For novice investors who have entered into a brokerage service agreement with Sberbank, it can be quite difficult to understand all the intricacies of working on the stock market and the interface of trading platforms. In particular, quite often the question arises as to how to see whether dividends on shares have been credited, to which account they are paid, and whether income tax has been paid.

Read the article further and you will find out where dividends from shares come to Sberbank Investor, how to view the report on accrued payments, where the money came from, how to set up a withdrawal to the card that is convenient for you.

Dividend policy

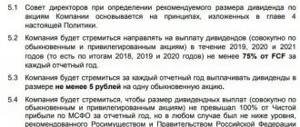

Sberbank's dividend policy assumes a minimum level of net profit allocated to dividends according to IFRS in the amount of 20%.

Since Sberbank is a state-owned company, it strives to comply with the directive and to establish the level of dividend payments in the amount of 50% of the state of emergency.

However, the issuer is moving progressively towards this goal and intends to achieve a similar level of payments by 2021, gradually increasing the percentage of allocated profit for each reporting period.

Thus, for 2021, 25% of net profit according to IFRS was paid, for 2017 - 36%, and for 2018 - 43.5%.

How to set up dividend payments?

To set up the most convenient payment option, follow these steps:

- Log in to your Sberbank@Online account.

- Go to the “Other” - “Brokerage” tab.

- Click on the “Manage Accounts” link.

- Click on the “More details” button.

- In the “Receiving Income and Broker Reports” section, you will see an option where the money goes.

To configure this setting, click on the “Change” button.

Check the box next to the desired item and click on the “Continue” button. - After this, an application to change service parameters will be generated. To confirm the operation, you must click on the green “send application” button.

Only after this review will the changes take effect. - If you select the “to current account” option, then dividends and other payments will be credited to the card or deposit that was specified in the brokerage agreement for withdrawing funds. To check which bank card is linked to your agreement, return to account management and look at the “Account in rubles” section. Change it if necessary.

All company dividends for the last 10 years

| For what year | Period | Last day of purchase | Registry closing date | Size per share | Dividend yield | Closing share price | Payment date |

| 2019 | year | May 10, 2021 | May 12, 2021 | 12M 2020 | 18,7 ₽ | 5,84% | May 26, 2021 |

| 2018 | year | 1 Oct 2020 | 5 Oct 2020 | 12M 2019 | 18,7 ₽ | 8,23% | 19 Oct 2020 |

| 2017 | year | June 10, 2019 | June 13, 2019 | 12M 2018 | 16,00 ₽ | 6,43% | June 27, 2019 |

| 2016 | year | June 22, 2018 | June 26, 2018 | 12M 2017 | 12,00 ₽ | 5,6% | 10 Jul 2018 |

| 2015 | June 9, 2017 | June 14, 2017 | 12M 2016 | 6,00 ₽ | 4% | June 28, 2017 | |

| 2014 | June 9, 2016 | June 14, 2016 | 12M 2015 | 1,97 ₽ | 1,41% | June 28, 2016 | |

| 2013 | June 10, 2015 | June 15, 2015 | 12M 2014 | 0,45 ₽ | 0,63% | June 29, 2015 | |

| 2012 | June 11, 2014 | June 17, 2014 | 12M 2013 | 3,20 ₽ | 3,6% | 1 Jul 2014 | |

| 2011 | April 11, 2013 | April 11, 2013 | 12M 2012 | 2,57 ₽ | 2,51% | April 25, 2013 | |

| 2010 | April 12, 2012 | April 12, 2012 | 12M 2011 | 2,08 ₽ | 2,18% | April 26, 2012 | |

| 2009 | April 15, 2011 | April 15, 2011 | 12M 2010 | 0,92 ₽ | 0,87% | April 29, 2011 | |

| 2008 | April 16, 2010 | April 16, 2010 | 12M 2009 | 0,08 ₽ | 0,09% | April 30, 2010 | |

| 2007 | May 8, 2009 | May 8, 2009 | 12M 2008 | 0,48 ₽ | 1,49% | May 22, 2009 | |

| 2006 | May 8, 2008 | May 8, 2008 | 12M 2007 | 0,51 ₽ | 0,63% | May 22, 2008 |

Preference shares

| For what year | Period | Last day of purchase | Registry closing date | Size per share | Dividend yield | Closing share price | Payment date |

| 2019 | May 10, 2021 | May 12, 2021 | 12M 2020 | 18,7 ₽ | 6,25% | May 26, 2021 | |

| 2018 | 1 Oct 2020 | 5 Oct 2020 | 12M 2019 | 18,7 ₽ | 8,5% | 19 Oct 2020 | |

| 2017 | June 10, 2019 | June 13, 2019 | 12M 2018 | 16,00 ₽ | 7,27% | June 27, 2019 | |

| 2016 | June 22, 2018 | June 26, 2018 | 12M 2017 | 12,00 ₽ | 6,27% | 10 Jul 2018 | |

| 2015 | June 9, 2017 | June 14, 2017 | 12M 2016 | 6,00 ₽ | 4,91% | June 28, 2017 | |

| 2014 | June 9, 2016 | June 14, 2016 | 12M 2015 | 1,97 ₽ | 2,01% | June 28, 2016 | |

| 2013 | June 10, 2015 | June 15, 2015 | 12M 2014 | 0,45 ₽ | 0,93% | June 29, 2015 | |

| 2012 | June 11, 2014 | June 17, 2014 | 12M 2013 | 3,20 ₽ | 4,34% | 1 Jul 2014 | |

| 2011 | April 11, 2013 | April 11, 2013 | 12M 2012 | 3,20 ₽ | 4,41% | April 25, 2013 | |

| 2010 | April 12, 2012 | April 12, 2012 | 12M 2011 | 2,59 ₽ | 3,32% | April 26, 2012 | |

| 2009 | April 15, 2011 | April 15, 2011 | 12M 2010 | 1,15 ₽ | 1,58% | April 29, 2011 | |

| 2008 | April 16, 2010 | April 16, 2010 | 12M 2009 | 0,45 ₽ | 0,68% | April 30, 2010 | |

| 2007 | May 8, 2009 | May 8, 2009 | 12M 2008 | 0,63 ₽ | 3,31% | May 22, 2009 | |

| 2006 | May 8, 2008 | May 8, 2008 | 12M 2007 | 0,65 ₽ | 1,27% | May 22, 2008 |

Investment idea

Sberbank is the largest Russian bank by assets. The share in the SME lending market is 35%, in the retail deposit market - 44%, credit cards - 45%, mortgages - 54%.

We increase our recommendation for Sberbank shares to “Buy” and the target price to RUB 252. for ordinary shares and 227 rubles. according to privileged ones. Potential profitability taking into account dividends over a 11-month period. is 25% and 24% respectively.

* We believe that the bank has passed the crisis levels in terms of profit, and we predict an improvement in profitability in the second half of the year. Monthly reports under RAS reflect a trend towards a decrease in the volume of contributions to reserves and the restoration of commissions.

* Stable capital adequacy ratios allow the payment of dividends for 2021 of ~420 billion rubles. We also believe it is possible that annual profit will be higher than the current Reuters consensus of RUB 606 billion. and will amount to about 633 billion rubles. Support will come from reducing interest expenses and optimizing costs.

* Dividend forecast for 2021 - 14 rubles. Thus, taking into account DPS 2019E 18.7 rub. investors can receive a total of ~33 rubles. in the fall of 2020 and May-June 2021, which means a yield of 14.4% on ordinary shares and 15.6% on preferred shares.

* Sberbank receives a significant advantage from a large customer base, a high level of digitalization of business, a safety margin for capital and a low cost of interest obligations. The issuer remains our favorite in the banking industry. The downturn will provide an opportunity to increase market share.

Stock return

If we take as a base value the cost of ordinary shares of Sberbank at 230 rubles. per piece, then the annual dividend yield will be: 16/230 = 6.96% excluding taxes or 6.05% taking into account the payment of personal income tax (13%).

An interesting point is that this yield is not inferior to and is close to the rates on deposits at Sberbank.

Where is the money deposited?

By default, dividends to Sberbank Investor clients are transferred to a brokerage account, unless the client has previously submitted a corresponding application for payment to a current account.

Thus, the crediting of profit to the investor in the form of dividends from shares and coupons on bonds in Sberbank can be carried out in 2 ways:

- to a brokerage account (suitable for those who want to reinvest their profits in the purchase of new assets);

- to a bank account.

According to Law No. 208-FZ “On Joint-Stock Companies,” dividends are credited to the investor’s deposit within 25 business days from the date of formation and closure of the register. To qualify for dividends, a shareholder must purchase securities at least 2 days before the cut-off date. If securities were purchased with borrowed funds, the terms for crediting funds can be increased to 1-2 months.

Information about where the broker transfers money and whether accruals have been made can be obtained in your Sberbank Online personal account. The information is located in the broker's reports in the “Brokerage Services” section. Since the Sberbank Investor mobile application is a simplified version of the trading terminal, information about accrued dividends is not displayed there.

In addition, information about payments made is sent to Sberbank clients in the form of SMS notifications. Messages come from number 900.

How to buy shares and receive dividends

Sberbank shares are traded on the Moscow Exchange today, so the easiest and most convenient way to purchase them is to open a trading account with one of the Russian licensed brokers.

Best brokers

Reliable Russian brokers

| Name | Rating | pros | Minuses |

| Finam | 8/10 | The most reliable | Commissions |

| Opening | 7/10 | Low commissions | Imposing services |

| BKS | 7/10 | The most technologically advanced | Imposing services |

| Kit-Finance | 6.5/10 | Low commissions | Outdated software and user interface |

Above you can see the leaders of the brokerage business in Russia. These companies have very competitive commissions, provide excellent quality of service and high reliability.

Financial indicators

* Profit to shareholders decreased in the 2nd quarter by 33%, to 167 billion rubles, return on equity was 15%. The deterioration in results is mainly due to a 14-fold increase in reservations and low dynamics of commissions (+3% y/y) due to a decline in transaction volumes during quarantine. The effect was mitigated by a 22% reduction in interest expenses. Net interest margin increased by 20 bps. p., up to 5.61%, due to a reduction in deposit rates.

* Reporting came out better than expected. We believe that the bank has passed the crisis levels in terms of profit, and we predict an improvement in profitability in the second half of the year. Monthly reports under RAS reflect a trend towards a decrease in the volume of contributions to reserves and the restoration of commissions:

Source: company data

* The gross loan portfolio (according to IFRS) reflects good dynamics for a recession: +1.6% for the 2nd quarter without taking into account currency revaluation. Credit risk has increased, but not much: problem assets amounted to 5.0% of the portfolio compared to 4.3% at the beginning of the year.

Main financial indicators

| Indicator, billion rubles, unless otherwise indicated | 2K 2020 | 2K 2019 | Change, % | 6m 2020 | 6m 2019 | Change, % |

| Net percentage income before reserves | 398,2 | 353,1 | 12,8% | 770,1 | 690,6 | 11,5% |

| Reservation | 126,5 | 9,2 | 1275,0% | 264,5 | 26,5 | 898,1% |

| Net percentage income including reserves | 271,7 | 343,9 | -21,0% | 505,6 | 664,1 | -23,9% |

| Net commission income | 120,0 | 116,7 | 2,8% | 246,4 | 219,6 | 12,2% |

| Net profit of shareholders | 167,0 | 250,1 | -33,2% | 287,2 | 477,1 | -39,8% |

| CIR | 33,50% | 34,60% | -1,10% | 33,40% | 33,20% | 0,2% |

| Net interest margin | 5,61% | 5,41% | 0,20% | 5,56% | 5,34% | 0,22% |

| COR | 2,25% | 0,14% | 2,11% | 2,58% | 0,55% | 2,03% |

| Balance sheet indicators | 2K 2020 | 1Q 2020 | 4K 2019 | Meas., c/c | Meas., YTD | |

| Deposits | 23 312 | 23 062 | 21 574 | 1,1% | 8,1% | |

| Loans gross | 22 852,1 | 23 166,0 | 21 749 | -1,4% | 5,1% | |

| — Corporate | 14 582,1 | 14 972,0 | 13 865 | -2,6% | 5,2% | |

| — Consumer | 8 270,0 | 8 194,0 | 7 884 | 0,9% | 4,9% | |

| Share of non-performing loans (NPLs) | 5,00% | 4,37% | 4,31% | 0,63% | 0,69% | |

| Assets | 32 383 | 32 069 | 29 959 | 1,0% | 8,1% | |

| ROE, % | 15,0% | 11,0% | 20,9% | 3,9% | -5,9% |

Source: data

- Sberbank's forecast for the growth of commissions in 2021 by 4–6% implies a decrease in 2H by 0.7% y/y, which we see as a conservative forecast, taking into account the fact that in the problematic 2Q, commissions increased by 3% y/y according to IFRS and in June showed an increase of 26% y/y according to RAS.

- In general, the report indicates the stability of the bank, and stable capital adequacy ratios allow dividend payments for 2021 to be made at about 420 billion rubles. We also believe it is possible that annual profit will be higher than the current Reuters consensus of RUB 606 billion. and will amount to about 633 billion rubles. Support will come from reducing interest expenses and optimizing operating costs (previously it was reported about plans to save about 80 billion rubles on managerial salaries).

Forecast for key financial indicators

| Indicator, billion rubles, unless otherwise indicated | 2017 | 2018 | 2019 | 2020P |

| Net profit of shareholders | 750 | 833 | 845 | 633 |

| Accor. profit | 717 | 832 | 915 | 633 |

| ROE | 24% | 23% | 20% | 13% |

| Dividends | 271,0 | 361,4 | 422,5 | 316,7 |

| Payout rate | 36% | 43% | 50% | 50% |

| DPS, rub. | 12,0 | 16,0 | 18,7 | 14,0 |

Source: data

- We add that the recession will provide an opportunity to increase market share, since the crisis will provoke a reduction in the number of lenders and strengthen consolidation around the largest players. The beneficiaries will be banks with a high level of digitalization.

Warning about Forex and BO

Expert opinion

Vladimir Silchenko

Private investor, stock market expert and author of the Capitalist blog

Ask a Question

Binary options are bets on a decrease or increase in the price of an asset within a limited period of time. These offices are analogues of online casinos and sweepstakes.

There are no real transactions on the transfer of ownership rights, and clients are doomed to lose money in the long term.

Forex is an over-the-counter market where currency pairs of different countries are mainly traded. In this market it is not possible to make transactions to purchase securities of issuers.

Grade

We are raising our recommendation for Sberbank shares from “Hold” to “Buy” amid expectations that indicators will recover from crisis levels and record dividends will be announced. Target price for ordinary shares is 252 rubles. assumes an upside of 11% and 25%, taking into account the total dividend of 33 rubles. for 2019–2020 Target for preferred shares - 227 rubles. implies a full return of 24% over an 11-month horizon.

At current multiples, ordinary shares are undervalued by an average of 18% relative to foreign and Russian peers, with a target price of RUB 269. Cost analysis based on target dividend yield (DY) assumes a target of 273 rubles. with an average forecast DPS of 2019–2020E of 16.4 rubles. and target DY 6%. Valuation based on own historical multiples of 6.3x P/E LTM, 6.3x P/E Y1, 1.2x P/B implies a valuation of RUB 214. Aggregated target price - 252 rubles.

Below are the basic data on multipliers:

| Issuer name | P/ E 2020E | P/ D 2019E | P/ D 2020E |

| Sberbank | 7,7 | 11,8 | 15,2 |

| VTB | 6,7 | 16,6 | 45,5 |

| TCS Group | 12,8 | 70,4 | 54,9 |

| Bank "Saint-Petersburg | 4,2 | 21,2 | 14,4 |

| Russian analogues, median | 7,2 | 18,9 | 30,3 |

| Developing countries, median | 11,5 | 15,0 | 25,4 |

Source: Thomson Reuters, calculations by FINAM Group of Companies

When does Sberbank pay dividends?

The bank is distinguished by stable dividend payments to shareholders. After a sharp drop in 2014, the dividend yield of the organization’s securities is growing, and the amount of money that goes towards payments is increasing.

There are 2 types of shares available for free sale:

- ordinary. The shareholder has the right to receive dividend profit and to participate in voting when making management decisions. Ticker SBER (MICEX);

- privileged. Earnings on them are calculated first, but the holders of these securities cannot vote. Ticker SBERP (MICEX).

Table 1. Timing and amount of dividend payments of Sberbank in 2017. Source: investfuture.ru

| The period for which income is paid | Amount of dividend per 1 ordinary share (rubles) | Amount of dividend per 1 preferred share (rubles) | Total amount of payments (billion rubles) | Register closing date (dividend cut-off) | Payment schedule |

| 2016 | 6 | 6 | 135,5 | 14.06.2017 | 01.07.2017 – 01.08.2017 |

According to the company's policy, dividends are paid once a year.

Table 2. Forecast for the timing and amount of dividend payments of Sberbank in 2021. Source: investfuture.ru

| The period for which income is paid | Amount of dividend per 1 ordinary share (rubles) | Amount of dividend per 1 preferred share (rubles) | Total amount of payments (billion rubles) | Register closing date (dividend cut-off) | Payment schedule |

| 2017 | 12,00 | 12,00 | 271 | 26.06.2018 | 27.06.2018 – 21.07.2018 |

Download “Regulations on Dividend Policy” (pdf format).

More information about Sberbank can be found in the article: “All about Sberbank”.

Income approach

In the income approach, I assume a moderate growth rate of the bank's interest-bearing assets. Due to uncertainty regarding the impact of the key rate increase, I expect a slight decline in net interest margin in 2022 and a subsequent recovery.

As for reserves, they should definitely be reduced. It is quite possible that a bank will reach a critical point and begin to dissolve them, as large international banks have been doing for a long time.

Fee income will continue to grow, but the growth rate will gradually fade. The bank is too big to consistently produce double-digit growth rates.

Based on the above arguments, by 2025 I predict net profit of 1.17 trillion rubles. P/E, taking into account the bank's current capitalization, will be 5.14.

The fair price of shares will be 370 rubles, prefok - 310 rubles. Growth potential for the first is 34%, for the second 22%

| Name | IDF | API |

| Estimated share price, rub. | 368 | 307 |

| Current price, rub. | 275.44 | 251.52 |

| Potential, % | 33.95 | 22.32 |

Table of percentages of Sberbank's net profit allocated for payment of dividends, 2001 - 2019

| year | % |

| 2001 | 6 |

| 2002 | 7 |

| 2003 | 8 |

| 2004 | 8 |

| 2005 | 8,5 |

| 2006 | 10 |

| 2007 | 10 |

| 2008 | 10 |

| 2009 | 10 |

| 2010 | 12 |

| 2011 | 15,3 |

| 2012 | 17 |

| 2013 | 20 |

| 2014 | 3,5 |

| 2015 | 20 |

| 2016 | 25 |

| 2017 | 36 |

| 2018 | 43,5 |

| 2019 | 50 |

Technical picture

On the weekly chart of common stocks, a short-term growing trend has formed within the long-term triangle. The target is the upper border of the figure ~260 rubles.

for preferred shares . When breaking through local resistance of 210 rubles. there will be an opportunity to increase to historical highs of ~235–240 rubles.

Source: Thomson Reuters

0

PFC at 08/12/2020 / Trading - financial market news / Leave a comment

Summary

Sberbank is one of the most efficient banks in Russia. He worries not only about his shareholders, but also about his future as the largest company in Russia. If you think that Sber is just a bank, then the maximum upside you can count on is 90 rubles from the increase in share price + 140 rubles dividend. If you think that Sber’s IT areas are very promising and there is a place for them in the future, then your maximum upside is 260 rubles from the increase in share price + 140 rubles dividend.

Depending on your opinion, the forecast price in the first case may be 370 rubles per share, in the second - 540 rubles.

I believe that in Russia, IT companies with a Sber wallet can achieve anything, so in the final forecast my fair price is 540 rubles per share.

Sberbank, dividend payment tables, 2002 - 2007, rub.

By law, payments on preferred shares must be greater than or equal to the yield on ordinary shares. Actually, preferences should always be paid at all, because... the essence of preference shares is to receive income in exchange for refusing to participate in the management of the company (shareholder meetings)

However, in the period from 2002 to 2007, a strange anomaly is visible (payouts for ordinary shares are higher than for preferred ones):

| Year of payment | Ordinary | Prefs |

| 2002 | 52,85 | 1,14 |

| 2003 | 109 | 2,32 |

| 2004 | 134,5 | 2,88 |

| 2005 | 173,9 | 3,79 |

| 2006 | 266 | 5,9 |

| 2007 | 385,5 | 9,3 |

Perhaps there were exceptions in the legislation of that time that made it possible to pay more according to custom than according to preferences. According to the regulations on Sberbank's dividend policy, they undertake to pay at least 15% of the par value of preferred shares. Since 2008, the nominal value of the pref is 3 rubles. Accordingly, Sberbank undertakes to pay at least 3 * 0.15 = 0.45 rubles / preferred share.

What dividends will be paid in 2020?

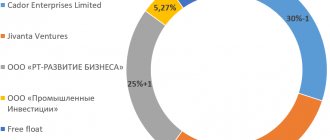

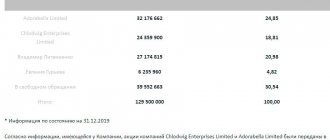

The main holder of Sberbank shares is the Bank of Russia: it owns 50% plus one voting share. The remaining shares are distributed among numerous Russian and international investors. Information on how many dividends Sberbank pays is freely available. It is available on the official portal of the credit institution and leading financial websites.

Stock payouts have grown steadily over the past five years. As a result, the dividend yield of the shares was:

- 2019 – 6.43%;

- 2018 – 5.6%;

- 2017 – 4.0%;

- 2016 – 1.41%;

- 2015 – 0.63%.

The outlook for 2021 is optimistic: analysts believe the dividend yield could reach 7.89%. This means that at current quotes of 254 rubles. expected payments per share will be 19.89 rubles.

Closing stock price in the last trading session of the year, 2008 - 2021

Table

| year | custom | Prefs |

| 2008 | 22,79 | 9,06 |

| 2009 | 82,94 | 69 |

| 2010 | 104,18 | 75,1 |

| 2011 | 79,4 | 59,24 |

| 2012 | 92,94 | 67,3 |

| 2013 | 101,17 | 80,21 |

| 2014 | 54,9 | 37,7 |

| 2015 | 101,26 | 76,5 |

| 2016 | 173,25 | 129,75 |

| 2017 | 225,2 | 189 |

| 2018 | 186,34 | 166,18 |

| 2019 | 254,75 | 228,3 |