Investment greetings, friends! Bonds are one of the simplest instruments on the stock market, and therefore quite popular. Using bonds allows you to receive a stable cash flow through coupons. But, naturally, you want to maximize profits. Next, I compiled a list of the highest-yielding bonds in 2021. I've divided the bonds into categories so you can find what's right for you.

- State and quasi-state companies

MAIN SELECTION CRITERIA

Profitability

Therefore, first of all, it is worth excluding high-yield bonds, since high yields directly indicate high investment risks, based on the “Risk-return” concept (see the article “Risk-return concept”). Moreover, risk should be understood as both the likelihood of a violation of the coupon income payment schedule and a complete loss of invested funds. Therefore, extremely high yields on debt securities may be an indicator of problems with the financial stability of the issuer, which in the future may cause one of the main risks of investing in bonds - the risk of bond default (see the article “Bond Default”). those. when the issuer is unable to pay its debt obligations.

- Currently, about 30% of all bonds on the market (or about 550 bonds) have negative, zero, or potential yields greater than 20%.

Maturity

Another important point when choosing bonds is the maturity date of the securities. The bond market also has a large selection of bonds, depending on the maturities of the bonds, up to 2057. However, it is worth remembering that, firstly, the maturity dates of bonds should not exceed investment horizons, since bonds work as an instrument with a fixed value only at the time of redemption or offer, since prices are unpredictable. Secondly, the higher the maturity period, the higher the uncertainty regarding future periods and, accordingly, the investment risks.

Based on this, we will consider the most attractive securities at the moment and medium-term investment horizons - up to 3 years.

- According to current data, about 1000 bonds have a maturity of up to 3 years.

Liquidity

Liquidity means how quickly and efficiently you can buy or sell a particular asset on the stock market, i.e. The smaller the “spread” between the bid and ask prices, the higher the liquidity of the security. In other words, this security is of interest to most investors. You can understand how liquid a particular asset is by looking at the turnover of transactions per day. Of course, highly liquid instruments are of investment interest, since, if necessary, they can be effectively implemented.

- At the time of writing, about 50% of bonds on the market have low liquidity (transaction turnover is 0). Traditionally, the most liquid securities in the debt market are government bonds.

What to look for when analyzing an issuer

So, you have selected a certain pool of bonds in accordance with your criteria. For example, corporate bonds without an offer and without amortization, not subordinated, non-convertible, with constant income and good liquidity. How can you now choose which companies to entrust your money to?

To do this, we evaluate the issuer itself. First, let's find information about him. The easiest way to do this is to go to the company’s website, find the “Investors” or “Information” section and download the report for the last year (or better yet, three to see it over time).

This is what this section looks like on the Sberbank website.

Now let's start analyzing the reports. What parameters should you pay attention to in order to select corporate bonds with high income and low risk of default?

Profit dynamics

The company must generate profit. Moreover, there should be an increase annually and quarterly. Even if each subsequent cycle must be higher than the previous one - otherwise it is not a cycle, but a vicious circle or even a funnel to hell.

An increase at a level above the coupon rate is considered normal. Or better yet, 2-3 times higher than it. So, if a company promises to pay 15% per annum, then its profits should grow by at least 20-30% per year.

But you need to understand that every company’s business is different. I have already written about cyclicality. You should not expect constant and equal capital gains from such companies. Other companies, for example, in the IT sector, may be in a development stage and are not yet generating profits, but only destroying the cache. From large companies such as Sberbank, VTB, Lukoil, Gazprom, etc. also, one should not always expect a double increase in profitability.

In short, when analyzing the dynamics of profit, you need to understand where the profit comes from and what its size and growth depend on.

Amount of debt

This is a very important parameter. If a company is overly leveraged, then a significant part of the profit will be eaten up by interest. The normal level of debt is considered to be 50-60%. If this level is above 80%, then such a bond is not worth taking.

Also look at the multiples. It is optimal if the net debt / EBITDA ratio is below 4, and the debt / profit is no more than 6-7. If the values are higher than these parameters, it means that the company is borrowing more than it earns.

Also look at the dynamics and structure of debts. If a company has only one source of borrowing, for example, only bonds, then this serves as a negative signal. Perhaps banks do not give her loans because they know something that private investors do not know?

But a high level of loans provided to the parent company can be assessed positively, because if something happens, these debts can easily be restructured or written off.

In general, look at the situation.

Asset-liability ratio

Ideally, the ratio of assets to liabilities should be approximately equal, with a slight predominance of assets. The latter is important, since in the event of any financial problems, the company must have enough assets to fully pay off creditors.

The almost complete absence of liabilities or the presence of a small part of them can be interpreted as a minus. After all, it turns out that the business is not using its capabilities to the fullest - by borrowing money, it could generate more profit.

Have there been defaults on bonds in the past?

When choosing which bonds to buy, be sure to look at the issuer's history. If he has already made defaults before (albeit technical ones, when the payment was eventually made later), then the likelihood of a similar situation repeating is high.

And here is another interesting article: What is an offshore and an offshore zone

If the issuer often does not fulfill its obligations to investors, then it is better not to take its bonds.

Number of issues in circulation

This allows you to indirectly assess the debt burden (the full debt structure can be viewed in the financial statements). It’s one thing that Sberbank has two dozen issues worth billions of rubles. And if a small office constantly issues bonds, then this is a reason to think about it.

Also check out past episodes. Some companies practice this scheme:

- issue a bond for a certain period, for example, 3 years;

- after 2 years the second issue will be issued;

- the funds collected for the second issue are paid as repayment of the first issue;

- after 2 years they issue the third issue, etc.

This is both good and bad. Good - the company will have money to pay off the debt + there will always be money in circulation. Bad - if something goes wrong, the scheme will fall apart like a house of cards. Here again you need to look at the size and turnover of the issuer. If Sberbank does this, that’s one thing, but if some woodworking plant from Sosnovsk is a reason to think about it and more carefully analyze the company’s reporting.

MAIN TYPES OF BONDS

We identify three main classes of instruments that should be included in an investment portfolio in order to diversify assets and effectively minimize risks:

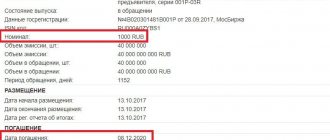

- Federal loan bonds (OFZ) (see the article “How to buy OFZ”) are bonds with the maximum degree of reliability on the Russian market, since the state represented by the Ministry of Finance of the Russian Federation acts as the borrower.

- Currently, the average yield on OFZ is 5-7%. As a rule, the yield on federal loan securities is considered to be the risk-free rate of return or, in other words, a measure of the most reliable assets in the financial market, by which the investment performance of other asset classes is measured.

- Municipal bonds or bonds of federal subjects (see the article “Bonds of federal subjects”) - this type of securities is also one of the most reliable at the moment, just like government bonds of a federal loan. Various municipalities and federal subjects can act as issuers of such assets in order to attract investment into the region and replenish the budget.

- The average yield on bonds of the constituent entities of the federation is 0.5% - 1% higher than the yield on OFZ, and the risks are almost at the level of government securities. Moreover, as a rule, the higher the region's debt burden, the higher the bond yield.

- Reliable corporate bonds are “blue chip” bonds of the Russian market; these are large and highly liquid companies, the financial stability and efficiency of which is beyond doubt.

- Blue chips include the largest Russian issuers. For example, Gazprom, Lukoil, Rosneft, Gazprom Neft, Transneft, etc. These companies occupy leading positions in the industry and are backbone companies of the Russian economy, i.e. the reliability of these companies is identified with the reliability of the state itself.

Further, if you look in more detail at the corporate sector, you can find companies that meet the criteria of reliability and efficiency, which have a sufficient level of financial strength for the timely fulfillment of loan obligations. To assess the level of solvency of a company, it is necessary to carefully analyze the financial statements of the issuer. The result of careful analysis can be returns above market averages and at the same time an acceptable level of reliability for a reasonable investment.

- Corporate bonds are one of the largest and most diverse groups of financial instruments. There are currently about 750 bonds traded on the Moscow Exchange, the issuers of which are companies from different industries with specific features inherent in a particular field of activity. Profitability in the corporate sector has a wide range. The yield on bonds of the so-called “blue chips” is currently in the range of 6-9%. A thorough financial analysis of corporate sector assets can lead to higher returns at acceptable levels of risk.

Issuer classification

The classification of issuers issuing securities allows for a basic assessment of their reliability.

In the classic format they are divided into three echelons:

- Highly liquid enterprises and federal networks. A stable financial position is confirmed not only by its image, but by many years of activity, profitability, liquidity and economic capacity. These include Sberbank, Gazprom, Rostelecom, MTS and other enterprises that are not subject to sudden bankruptcy. Corporate bonds from blue chip companies are virtually risk-free.

- Representatives of regional enterprises occupying leading positions in the local market.

- Commercial firms and low credit ratings, weak financial and production planning.

As a rule, these are small organizations that can set a high pace for the market, but its stability is questionable. For example, a retail chain sells popular goods of temporary demand - a cheap alternative appears and the company loses its position. Bankruptcy is also possible within a few months.

HOW TO FIND THE BEST BONDS?

So, to quickly and efficiently search for the best assets, we will use the Fin-Plan Radar service. This service allows you to screen the entire Russian market based on the main parameters of bonds, as well as the estimated financial indicators of issuers.

How to set up basic filters:

For the purposes of this study, in the main filters we will exclude bonds for which there is no turnover and leave only liquid securities that in practice will not be difficult to buy, since there are orders for sale on them. Next, we will turn up the filters by terms and profitability to the maximum and in the advanced filters we will refine these parameters, taking into account the characteristics of each type of financial instrument.

The best information web platforms for analytics

You can find bonds and get acquainted with their main parameters on specialized web sites.

Here is a small list of reputable resources:

- rusbonds.ru. To use the site you need to go through a simple registration. The portal is easy to use and informative.

- cbonds.ru. Provides up-to-date information on all types of bonds with yield and quotes. There are detailed instructions for using the site.

- moex.com. Official website of the Moscow Exchange. It presents not only the corporate bond index, but all securities and their quotes, currency and precious metals rates.

Registration is required to use any site. However, this procedure is very simple and does not require the provision of personal data. The only thing you need is a mobile phone and e-mail.

The best Federal Loan bonds for 2021

OFZs are the most reliable and low-risk securities on the Russian market. Therefore, when searching for the best OFZs, first of all, you should focus on the repayment terms and parameters for determining the coupon (fixed/floating).

In addition, it is necessary to exclude assets available for acquisition only to commercial banks (COBR class bonds issued by the Central Bank of the Russian Federation) or other financial funds or institutions.

How to set up advanced filters:

- The maturity date of the bond is up to 3 years, i.e. until 01/01/2023

- Type of bond - federal.

- Coupon type - everything. Next, you can refine the selection - fixed and floating coupon.

11 OFZs on the Russian market meet the above criteria for selecting securities (we excluded bonds of another state - the Republic of Belarus).

The bonds OFZ 29012 and OFZ 25083 have the highest level of yield among Russian government securities. Let's look at the selected bonds in more detail.

Tax issue

It is known that coupon income from bonds is taxed at 13%. Corporate bonds issued after January 1, 2021 are exempt from tax if their yield does not exceed the Central Bank refinancing rate by 5%. When purchasing OFZs, coupon income tax is not charged.

An example of calculating benefits on OFZs and corporate bonds, taking into account tax

Suppose the yield on OFZ is 6%, and on corporate bonds – 6.8%. The amount available for investment is 150 thousand rubles. Which bonds are more profitable for investors?

Income from OFZ: 150 * 0.06 = 9 thousand rubles.

Income from corporate bonds: 150*0.068*0.87 = 8.874 thousand rubles.

Thus, if the interest rate on corporate bonds differs slightly from the OFZ coupon yield, it is more profitable to purchase government loan bonds, since they are not subject to income tax.

OFZ 29012 – floating coupon

This bond matures in November 2022. The bond has a floating coupon, the size of which directly depends on the RUONIA rate and is paid twice a year. Currently, the estimated annual yield on this bond is 6.45%. You can find out the yield on this bond in the “Bond Calculator” service (see the article “Online Bond Calculator”).

Bonds whose coupon depends on specific economic indicators play a kind of additional protective role against various market and economic risks. You can read more about how to properly use bonds of this type in our article “Bonds with a variable coupon.”

Next, we will highlight OFZs with already known coupons and maximum potential yield. To do this, in the “Coupon Type” filter, select the item “Fixed”.

Where to open an account?

I wrote a separate article about where it is better to open an individual investment account. In short - either at the bank or at the broker . It is better to start working with bonds in a large bank such as VTB or Sberbank - they charge a commission for every sneeze, but they have minimal risk of default and lengthy litigation in an attempt to return the deposit. Personally, I worked through Promsvyazbank , which still offers low commissions and convenient conditions.

You can also work through brokers. A little more commission, a little more ways to extract money from the client - in exchange, we are offered more ways to earn money . For example, PSB’s IIS does not have access to the currency section. You also cannot enter the futures securities market - experienced traders will say that without these high-risk instruments you cannot make money. But we are still learning, so even the absence of leverage will benefit us.

Among the best brokers with virtually no shortcomings, I would like to highlight:

- BCS – there are no restrictions on trading platforms; you can work with Russian shares on the MICEX and St. Petersburg Stock Exchange, and with shares of foreign issuers. If active trading is expected, you can choose the “Trader” tariff plan with a commission reduced to 0.0155%; on the “Investor” tariff it reaches 0.3%.

- Tinkoff Investments - I would call this option ideal for passive investors . There is no convenient terminal here, but you can buy from 1 share and store them for as long as you like. The process itself is no more complicated than purchasing a product in an online store. Here you do not need to pay for account maintenance (the “ Investor ” tariff) and the depository. The commission on the starting tariff plan is 0.3%.

I will provide a detailed comparison of conditions in tabular form.

| Company | Tinkoff investments | |

| Minimum deposit | Unlimited, you can even buy 1 share, they recommend starting from RUB 30,000. | |

| Transaction fee | 0.3% for the “Investor” tariff | 0.05% for the “Trader” tariff |

| Opening, replenishing, closing an account, withdrawing money, service in the depository and exchange commission | For free | For free |

| Account maintenance cost | Free for the "Investor" tariff | 0 ₽ when not trading 0 ₽ if you have a Tinkoff Premium card 0 ₽, if the turnover for the last billing period exceeded 5 million ₽ 0 ₽ for portfolios from 2 million ₽ 290 ₽ in other cases |

| Leverage | Calculated for different instruments, the calculation is linked to the risk rate | |

| Margin call | Depends on the asset | |

| Trading terminals | The purchase of shares is implemented like an online store, professional software is not used | |

| Available markets for trading | American and Russian stock markets | |

| License | TSB RF | |

| Open a Tinkoff account | Open a Tinkoff account | |

The best bonds of the federal subjects for 2021

To search for the best bonds among federal subjects and municipalities, almost the same criteria and filters will be used as for selecting OFZs, with the exception of a filter by coupon type, since there are currently no municipal bonds with a floating coupon on the market.

It is worth noting that the bonds of the constituent entities of the federation are mainly bonds with depreciation of the nominal value, which are capable of generating additional cash flow. Therefore, if we take into account the reinvestment of coupons and amortization payments, the potential yield on such securities may be higher than the calculated values.

How to set up advanced filters:

- The maturity date of the bond is up to 3 years, i.e. until 01/01/2023

- Type of bond: municipal.

- Depreciation is everything.

A group of 37 municipal bonds meets these selection criteria.

We exclude the Karelia 17 bond from the leaders of the list, since the bond matures in April of this year; therefore, it is incorrect to compare the annual yield of a bond that will mature in a couple of months. Currently, the total yield (i.e., yield to maturity) on this bond is 1.62%.

We explain in the most accessible way what bonds are and how to make money on them

Bonds (in foreign sources you can find the term Bonds) are a conservative instrument, making money with which is quite simple and which is often compared to a bank deposit, noting numerous advantages over the latter.

In practice, when working with bonds, a novice investor is faced with a large number of nuances and specific terms that significantly complicate the investment process and sometimes lead to painful mistakes.

Our “Training” section contains a large amount of useful materials on the subject of bonds, but they all require a basic understanding of how they work and knowledge of the terminology. This review is intended for those who need to master this basic level. Here we will analyze what bonds are using simple and understandable examples, and also define the key concepts of the debt market.

What are bonds

A bond is a debt security for which the borrower (the one who issues the bonds) must return to the creditor (investor) the cost of the bond (par value) and interest on the use of funds (coupon income) within a specified period.

Example. A friend comes to you and asks you to borrow 90,000 rubles - it’s not enough to buy a car. He will be able to return the money only in a year, and as a thank you he is ready to give not 90,000, but 100,000 rubles. You agree, and to record the agreement you make a receipt. This receipt states that on a certain date your friend will return you 100,000 rubles. Your friend receives the money, and you have a receipt in your hands. This receipt is essentially a bond. And the deal you entered into is a bond placement.

In the above example, RUB 100,000. is the face value of the bond. The amount that your friend (borrower) will return to you (investor). The date on which the debt will be repaid is called the maturity date.

The 90,000 you paid for the note is the issue price of the bond. The income on this security will be the difference between the redemption price and the placement price: 100,000 - 90,000 = 10,000 rubles. Bonds for which income is generated in this way are called discount or zero-coupon bonds.

Bond coupon is the percentage of the face value that the bond issuer pays to the investor for the use of funds. The coupon can be paid on a semi-annual basis, annually, quarterly or monthly.

In the example above, we will compose the receipt a little differently. After a year, your friend returns you not 100,000, but 90,000, as he borrowed, but once every three months he will pay you 2,500 as a reward for using the funds. That is, after 3, 6 and 9 months you will receive 2,500 rubles each, and after a year your friend will return your 90,000 rubles. and the last payment is 2,500 rubles. This quarterly payment will be called a coupon or coupon income.

To make it easier to compare bonds, the coupon is measured as a percentage per annum. In this example, you will receive 2,500 * 4 = 10,000 rubles as income. On the invested amount this will be 10,000/90,000 = 11.11% per year. In this case, it is customary to say that the coupon on this bond is 11.11% per annum.

Why is the yield on a bond called a coupon? Previously, bonds were held by investors in paper form. When the holder received payment from the issuer, a paper coupon was torn off the bond. Now bonds mostly exist in electronic form, but the term coupon is firmly entrenched in the lexicon of market participants. The vast majority of bonds on the Russian market are coupon bonds. Discount papers are quite rare.

Thus, we figured out that, in essence, a bond is a promissory note with certain conditions, the main ones of which are the maturity date, par value, size and frequency of coupon payment, and, of course, who is the issuer of this paper. The only point is that this receipt is a non-documentary security.

Basic parameters of bonds in the “Current trading” window of the QUIK terminal. The first column indicates the name of the issue, which usually includes the name of the issuer. Top to bottom: Sberbank, Rosneft, PIK Group, AFK Sistema, etc. “Coupon duration” - the period after which the next coupon is paid - is measured in days. The coupon size is indicated in rubles, and the bond price is indicated in%. The “Yield” column indicates the effective yield to maturity, the meaning of which will be described below.

Everyone is familiar with a simple economic law: The higher the risk, the higher the return, and vice versa.

This rule also applies to the bond market. The more reliable a bond issuer is, the lower the return it offers its investors. Conversely, if the risk of problems with the solvency of the issuer is high, then it has to pay a higher coupon on its debt securities in order to interest market participants.

The reliability of the issuer is also called credit quality - the higher it is, the lower the probability of bankruptcy. In Russia, the most reliable securities are considered to be federal loan bonds (OFZ), issued by the state represented by the Ministry of Finance. They are a kind of benchmark in the debt market.

To assess credit quality, issuers and individual bond issues are assigned credit ratings. This is done by special rating agencies that evaluate the financial performance of issuers, their debt load, legal risks, the state of the industry as a whole and many other factors.

The ratings of the three largest international agencies are considered to be the most authoritative in the world: Standard & Poor's, Moody's and Fitch. Read more about rating agencies in the special material What you need to know about ratings and rating agencies

Also, the yield of a bond depends on the period to maturity. The shorter the term to maturity, the lower, other things being equal, its profitability*, since the risk of problems for the issuer in a short period of time is lower than in a longer period.

*In fact, there are exceptional cases when this rule is violated. Read more in the article What does the OFZ yield curve say?

Start investing

Features of bond circulation

Bonds are traded on the exchange and over-the-counter markets. If you are a bond holder and need to quickly return your investment, you can sell it to another investor and get money.

Since bond prices are determined by supply and demand, the market price often differs from the par value. For convenience, it is measured as a percentage of the nominal value. For example, if the market price of a bond is 101.53 and the face value is 1000 rubles, this means that the paper can currently be bought or sold for 101.53% * 1000 rubles. = 1015.3 rub.

If a bond is trading above par, it is said to be trading at a premium. If it is lower, the bond is said to be trading at a discount. Most bonds on the Russian market have a nominal value of 1000 rubles.

Market price of the bond

The market price of a bond is formed based on the level of required market yield for issuers of the appropriate credit quality.

The point is this. An investor will not buy bonds with a yield of 6% if there are alternatives on the market at 8% with the same level of reliability. In order for the holder to sell such a security, he will have to sell it at a discount, which will compensate the buyer for the difference in the yield of 2% per year until maturity.

Example: A bond was issued in early 2011 due in 2021 with a coupon of 8%. At the beginning of 2015, the level of interest rates increased and for bonds of comparable credit quality the yield is 10% per year. Accordingly, for a bond to be of interest to investors, it must provide a similar return. But since the coupon was previously fixed at 8%, such a yield can only be achieved by reducing the cost of purchasing the bond.

To offset 2% per year for 2015 and 2021. the denomination should be reduced by approximately 2*2%=4%. Thus, the market price will be 96% of the face value. This example is very simplified, but allows you to understand the principle of pricing in the bond market.

Read more about this in Duration’s special material. What is it and why is it important

Bond yield

Another issue that can cause confusion for a beginner is the concept of bond yield. There are several types of returns that are worth knowing.

Coupon yield

In essence, this is simply the value of the coupon. If the coupon on a bond is 8%, then the coupon yield will be similar. It is worth noting that regardless of the frequency of the coupon payment (quarterly, monthly, etc.), the investor can receive interest income on the bond for each day it is held.

When selling, investors include in the price the amount of interest accumulated during the period of ownership of the security since the last coupon. For securities of the same issue, the premium on the same day is always the same, so for convenience, in modern trading systems this value is calculated automatically and immediately taken into account in transactions. This premium is called accumulated coupon income (ACI), which you can read more about in a separate review: What is ACI, why is it needed and how is it taxed.

Current yield

This is a simplified yield indicator that shows the coupon yield relative to the specific current market price of a bond. The assumption here is that the price of the bond will not change over time. Current yield is convenient to use if you buy a bond for a short period (up to six months) and plan to sell it long before maturity

Simple (nominal) yield to maturity

This yield includes not only the coupon income, but also the profit/loss from the difference between the redemption price and the market price at which the bond was purchased.

Effective yield to maturity - YTM

Effective yield to maturity is the most popular and most accurate for comparing bonds. In most resources, the concept of profitability means exactly that. Unlike the previous indicator, it takes into account the reinvestment of coupons - it is assumed that the received coupons can be immediately invested in bonds at the same yield.

The effective yield formula is quite cumbersome, and the average investor does not need to know it - it can be viewed in QUIK, on the Moscow Exchange website or on specialized resources such as cbonds or rusbonds, where it is calculated automatically.

Bond classification

By type of issuer, bonds are government, corporate and municipal.

By maturity, bonds are divided into short-term (up to 1 year), medium-term (1 to 5 years) and long-term (more than 5 years).

Depending on the type of income, bonds can be either discount or coupon. There are also securities with a variable coupon, floating coupon, indexed par value, etc.

By par currency, bonds can be denominated in rubles and quoted in other currencies, most often in US dollars. Bonds that are quoted in other currencies are called Eurobonds.

Read more: Types of bonds on the Russian market

Risks of investing in bonds

Credit risk is the risk of deterioration in the issuer's solvency. If the risk that the issuer may default on its debt increases, the price of the bond may decline. If the issuer's credit rating has been downgraded, the price will drop slightly, but if there is a serious risk of bankruptcy, the value of the bonds may fall significantly.

Interest rate risk is the risk that the value of a bond will decline due to changes in interest rates. The further the maturity date and the lower the coupon on the bond, the higher this risk. It can be assessed by the duration indicator.

Liquidity risk - Most of some bond issues are concentrated in the hands of large investors who plan to hold them for the long term. In this case, the trading turnover of these securities on the exchange will be very low and selling/buying a more or less large volume at the desired price may be problematic.

The risk of exercising embedded options - read more about this in the material: Let's remember the offer .

Inflation risk - when purchasing bonds with a constant coupon, there is a risk that inflation will rise and begin to overtake the income on the portfolio. To protect against this risk, you can form part of the portfolio from bonds with a floating coupon linked to the inflation rate.

What to look for first when choosing a bond for your portfolio

— Assess the level of required return and acceptable risk. Based on this, it is already possible to consider the securities of certain issuers. As a rule, the more the yield of a bond exceeds the yield of the corresponding OFZ, the higher the risk.

— Give preference to large issuers whose solvency does not raise questions.

— Assess your investment horizon and select securities whose maturity date approximately coincides with your goals.

— Assess the liquidity of the bonds you are considering purchasing. Are daily trading volumes sufficient? How often do transactions take place? How quickly can you sell securities if necessary without loss in price?

— If, in your opinion, interest rates on the market will rise, you should give preference to short-term issues or securities with floating rates. If you think interest rates in the market will fall, you can allocate part of your portfolio to longer-term securities in order to receive additional income due to their rising prices.

— When trading bonds, keep in mind that coupon income on corporate securities issued after January 1, 2021 is not taxed. Also, income from coupon income on OFZs and municipal bonds is not taxed.

— Don’t forget to take into account the costs of exchange and brokerage commissions.

— Do not try to use technical analysis to trade bonds. This tool doesn't work here.

Start investing

BCS Broker

IrkObl2016

The issuer of this bond is the Government of the Irkutsk Region. Currently, the Irkutsk region has a surplus budget and the share of debt in GRP is about 1%. Among the largest taxpayers in the region are well-known public companies - NK Rosneft, RUSAL, Transneft, Polyus, etc.

This bond matures at the end of 2021, there is no offer. The coupon is paid 4 times a year, which is about 8.89% compared to current prices. Until the end of the bond's circulation period, two amortization payments are provided at par - in December 2021 and 2021. Thus, the current annual yield of the bond is 7.03%.

We also draw your attention to the fact that the frequency of coupon payments and the amount of depreciation of the face value allows you to further increase the efficiency of investments by reinvesting the received payments on this security.

Advantages and disadvantages

Advantages of corporate securities:

- Bonds typically offer more guaranteed returns than stocks.

- Payments on coupons are known in advance and are structured.

- Corporate bond prices tend to be stable.

- Corporate bonds generally have better yields than other bonds.

Disadvantages of corporate securities:

- Corporate bonds do not have the same growth potential as stocks.

- Not all bonds can be freely resold on the stock exchange.

- Higher interest rates may make corporate securities less profitable.

Mordovia03

The issuer of this bond is the Republic of Mordovia represented by the regional Government. According to the latest data, the region remains subsidized and has a budget deficit of about 17%, and the debt level is about 23.5% of GRP, which is slightly higher than the average debt level for the regions, but does not exceed the threshold of 40%. In addition, in the current political and economic conditions of the country, the probability of default is extremely low.

This bond matures in September 2021. The bond issue provides for 4 coupon payments, the coupon size is 10.89%. Currently, the bond is trading above the nominal price, based on this, the total annual yield on this issue is 6.46%, an offer is not provided.

The issue also provides for 2 amortization payments - in September 2021. and 2021

Also, the presence of frequent coupon payments and amortization can increase the potential return of securities when reinvesting received payments.

An example of calculating coupon yield on a bond

Let's assume that an investor purchased a bond with a 3-year validity period immediately after placement for 980 rubles. The nominal value of the bond is 1000 rubles. The promised income is 9% per annum. What will be the investor's income minus personal income tax?

Calculation

Coupon income: 1000*0.09*3 = 270 rubles.

Exchange rate income when the bond is redeemed: 1000-980 = 20 rubles.

Total income: 270+20 = 290 rubles.

Income minus personal income tax = 290 * 0.87 = 252.3 rubles.

Thus, the investor’s income for a long-term investment of 3 years after repayment of the par value amounted to 252.3 rubles or 8.3% per year.

Best Corporate Bonds for 2021

Corporate bonds are a broad segment of the stock market where choosing the best bonds is a little more complicated than the above bond types. The main criteria for selecting assets in this segment are the financial stability and efficiency of the issuers, as well as the stable and fixed cash flow of the selected assets.

So, we determine the financial position of the company based on the company’s reporting. Companies with a good financial position have the following indicators: revenue growth of more than 5%, the presence of a positive financial result in the form of profit, which can provide a return on equity of more than 8%, and the company’s equity must exceed the size of the company’s total debts, i.e. the share of equity capital in the company's assets is more than 50%. We discuss in more detail the methodology for selecting bonds, as well as the nuances and features of the criteria in the course “School of the Intelligent Investor”.

In addition, additional criteria for selecting asset releases must be specified. First of all, we are interested in securities that have a minimal degree of uncertainty regarding future coupon payments. Thus, we are interested in issues with a fixed coupon or, if the security has an offer (see the article “Offer of bonds”), then we consider securities with redemption dates for the offer, since at the time of the offer the issuer can change the current coupon yield rate, which, in in turn, can fundamentally change the value of the current potential yield until the end of the bond's term.

How to set up advanced filters:

- The maturity date of the bond is up to 3 years, i.e. until 01/01/2023

- Type of bonds: corporate.

- Bond offer – No offer. You can further clarify this point.

- Financial Analysis: Corporate Bonds

Period: 3rd quarter 2021 (last reporting period)

- Revenue growth rate more than: 5%

- Return on equity, more than: 8%

- Share of equity in assets more than: 50%

So, at the time of writing, 11 bonds on the Russian stock market meet this selection criterion.

We exclude bonds of the First Collection Bureau from the list due to the risky nature of the business.

What bonds can you buy in the Russian Federation?

The first bonds in Russian history were issued after the Crimean War. Military operations were carried out with the money of creditors; loans were going to be repaid with indemnity. After the peace treaty, it was necessary to give more financial freedom to entrepreneurs and allow the construction of private railways. The government printed government securities (hereinafter referred to as Securities) for British banks, and railway magnates issued corporate bonds. A few years later, the city authorities also began to sell their own bonds - municipal, the proceeds went to the improvement of cities and infrastructure development. The following types are currently in use:

- State - issued by the state to cover the budget deficit. The redemption of bonds is guaranteed by the state. The most reliable type of securities, and therefore the least profitable.

- Municipal - issued by local authorities, income from them is not taxed.

- Corporate - issued by banks such as Sberbank, VTB or commercial companies to finance projects. High risk, high reward if successful.

Here is a good video about Russian government bonds.

Differences between bonds by yield

- Discount (Zero Coupon) - fully repaid by the issuer on time. Sold at a price below par, redeemed at par. Due to the difference, the holder makes a profit.

- With a fixed rate, coupon profit is paid regularly as a percentage of the face value. The Central Bank does not lose its nominal value.

- With a floating rate - profit is paid regularly, but the interest is tied to agreed economic indicators. Most often - to loan rates.

The specific profit depends only on the conditions under which the security is issued. For example, government ones for a period of one year can bring up to 6% profit. And some UTair will offer 968% per annum. The chance of getting money from government bonds is 99.9% versus 1% for UTair. Choosing bonds is a search for a middle ground with good reliability and the best return.

BelugaBP1

These bonds belong to ]Beluga PJSC[/anchor]. The company has fixed coupon payments until the end of the repayment period - until 06/07/2022, accordingly, no offer is provided. The coupon size is 47.37 rubles. and are paid 2 times a year, which corresponds to 9.01% coupon yield at the moment. The compound annual return based on current value is 6.71%.

Next, let’s change the advanced filter for “Bond Quality” and select a top reliable corporate bond by selecting the item in the “Blue chips only” filter.

What it is

In general terms, it is a debt obligation that a business company sells to an investor. The basis of cash security is the profit that will be received as a result of future transactions. In many cases, an additional guarantee for the investor is the obligation to repay the deposit through the sale of company property in the event of default.

Why are they released?

Corporate bonds are a form of debt financing. They can become the main source of capital for many businesses, along with shares or bank loans. A company must have some earnings potential to offer debt securities at a favorable coupon rate.

More often, bonds are issued when corporations need to quickly raise capital to implement their strategies. In this case, they can sell commercial paper with a maturity of one year or less.

Emission

The issue of securities is carried out in the form and sequence established by law. The decision to issue corporate bonds is made and approved by the board of directors or the body performing its functions in accordance with the law. When they are issued, one or more liquidity providers (financial institutions or intermediary banks) buy the entire pool and resell them to investors through the exchange.

Bashneft04

This is the largest oil and gas company ANK Bashneft PJSC and a blue chip in the Russian market.

The security matures in 2 years – in February 2022. Despite the fact that the coupon of this bond is floating, all coupons are already known until the end of the term. The coupon size is 34.9 rubles. and payment period 2 times a year. The bond's compound annual yield is 6.77%.

Despite the fact that the bond has a floating coupon, all coupons are already known until the end of the maturity period, which makes it possible to calculate a stable cash flow for this asset.

Taxes on profits from bonds

If you have an IIS , and the deposit made does not exceed 400,000 per year, you do not have to pay taxes on the profit received of any size. You can open an IIS from any broker with a license to trade securities. We select a broker we like, read the account servicing agreement, look for any problem areas (like a commission of 100 rubles for each transaction). We agree if the conditions suit you. We read the instructions for opening an account in a specific company, follow all the steps, wait several days for the application to be processed and the account to be opened. Have you opened it? Then read on.

Conclusions:

Bonds are an essential and integral part of a smart investor's balanced portfolio. In addition, at current levels of market returns, fixed-value instruments should not only be present in the portfolio, but form a large part of it in order to provide effective protection against potential investment risks. A novice investor may mistakenly think that bonds are a simple and understandable instrument with a fixed income, however, in practice it turns out that bonds have many “pitfalls” and nuances that are not visible at first glance, but can significantly affect the final profitability of your investments.

In our “School of the Smart Investor” we tell you how to avoid pitfalls in investing and use effective methods for selecting high-quality and reliable assets. We invite you to start learning how to invest in bonds and stocks with our free webinars. You can sign up via the link - https://mk.fin-plan.org

Limitation of liability:

This article is not a guide to action, but represents the opinion of the author. The security analysis stated in the post is the opinion of the author and does not constitute a personal investment recommendation. Always do your own analysis before making any trades.

If the article was useful to you, like it and share it with your friends! Have a profitable investment!

Where to see the list

There are many sites for monitoring, collecting analytics, and selecting corporate securities. They provide:

- charts, quotes;

- financial news;

- comparison, analysis;

- calculations, forecasts.

A good option is to get information from the primary source (Moscow Exchange listing). There you can find out the history of quotes for any period, current conditions and other details.

I myself also use screeners from Rusbonds, Cbonds, Smartlab.

IIS

You can invest in bonds through an individual investment account (IIA). It is opened through a broker and gives the right to receive a tax deduction in the amount of 13% (no more than 52 thousand rubles per year). You can top up your account and apply for deductions annually, provided you have official taxable income.

Features of IIS:

- maximum contribution amount – up to 1 million rubles per year;

- annually, if you choose deduction type “A”, you can receive a deduction of up to 52,000 rubles;

- Type “B” deduction allows you to avoid paying tax on investment income;

- The minimum period for using IIS is 3 years;

- a citizen can open only one account.

If you urgently need money and want to withdraw it from your account, be prepared for the fact that you will have to return the tax deduction you received.