VTB 24 issues its bonds

The bank issues its own profitable, government-backed bonds. These are special papers confirming the fact of investment. Among the main characteristics and conditions of circulation of securities, the following can be noted:

- Treatment time – 3 years;

- The general frequency of coupon payments is every six months;

- High level of profitability when compared with standard deposits;

- Possibility of repurchasing bonds before their maturity, but under special conditions;

- Automatic redemption of securities upon full expiration of time;

- The placement price is set by the issuer itself;

- The right to present OFZ-n bonds for redemption.

The financial institution's commission depends on the prices of the purchased securities. In this case, income is not taken into account.

Here are the basic rules for calculating it:

| up to 50 thousand | approximately 1.5% |

| 50-300 thousand | about 1% |

| more than 300 thousand | 0,5% |

As for the level of yield of securities to full maturity, it may change from time to time in direct dependence on existing market factors. The average yield is 8.5% per annum.

Who can issue perpetual bonds?

In Russia, the first perpetual bonds were issued by VTB Bank in 2012: it was an issue of dollar bonds worth $2.25 billion with an annual rate of 9.5%. Following VTB, Gazprombank, Alfa-Bank, Moscow Credit Bank, TKS Bank, Sovcombank and others placed their perpetual bonds. In all these cases, we were talking about dollar obligations.

Perpetual bonds of Rosselkhozbank: circulation among the people

Until 2021, there were no ruble perpetual bonds issued under Russian law on the local market. The pioneer was Rosselkhozbank, which was the first among Russian banks in 2021 to place three ruble issues of perpetual subordinated bonds with a total volume of 15 billion rubles. The perpetual issues of the Russian Agricultural Bank stood out against the general background not only because of the new ruble structure for this market, but also because of the composition of investors. It was RSHB that was the first among banks to organize active sales of its perpetual bonds among physicists. Commenting in October 2021 on the results of the placement of the RSHB issue, 08T1, worth 5 billion rubles, the bank’s management especially emphasized that the transaction was unique in terms of increased interest from investors - individuals. Based on the results of collecting applications, their share in the issue structure exceeded 15%.

Source: finanz.ru

Inspired by the success of their colleagues, in 2021, another large state bank, Sberbank, approved program for issuing ruble perpetual bonds The media, citing a source in the bank, then wrote that the financial institution plans to offer a new instrument, including to the population, through its network of branches, making the papers “public.” The program is valid for 5 years, but so far the release has not taken place.

Meanwhile, the desire of banks to actively diversify their investor base, attracting the population to invest in perpetual subordinated bonds, turned out to be not at all to the liking of the regulator. Representatives of the Central Bank have repeatedly emphasized that unqualified investors who are not highly financially literate may, in fact, simply not be aware of all the risks associated with investing in the eternal subordination of banks. At the same time, the name “bond” and the high coupon often simply mislead retail clients. In July 2018, the Central Bank even issued a draft instruction in which it recommended that banks place subordinated loans only among qualified investors .

True, this did not prevent Rosselkhozbank from repeating its popular “success” in December 2021, becoming the first issuer to place perpetual subordinated bonds in foreign currency on the local market. The issue of series 11B1 worth $50 million was also invested mainly by individuals: about 400 clients of the Russian Agricultural Bank, although they were qualified investors, bought 80% of the total volume of the issue. At the same time, more than half of the bonds were purchased by the bank's clients in the regions.

In total, over the past three years, Rosselkhozbank has placed 6 issues of ruble perpetual subordination with a total volume of 35 billion rubles. and one dollar issue for $50 million. This is the most outstanding result among Russian banks.

Source: Cbonds

Now, according to Cbonds, there are 26 issues of perpetual bonds circulating on the Russian market with a total volume of more than 6.9 billion in dollar equivalent - almost all of them are perpetual subordinated obligations of banks. According to Rostislav Kulak, this is explained by the fact that until recently the perpetual bond market in Russia was open only to banks due to legal restrictions:

— For financial institutions, the need to issue perpetual subordinated bonds is primarily related to the need to replenish capital and the lack of a normally functioning equity capital market: conducting an initial public offering transaction is very difficult for many banks today. And capital is needed to acquire competitors, to increase the loan portfolio, to regulate adequacy standards, and so on. For these purposes, they came up with the issue of perpetual subordinated bonds. Today, for banks, this is one of the few real opportunities to raise capital, and they will continue to use it, a Sovcombank representative is confident.

Banks may include funds received during the placement of perpetual subordinated bonds in first- or second-tier capital. Tier 1 capital is the bank's core capital, and Tier 2 capital is additional capital. Together they make up the total capital of the bank. To assess whether a bank is sufficiently capitalized, regulators use capital adequacy ratios .

“For banks, perpetual bonds are important primarily because of the ability to replenish capital without worsening debt indicators,” agrees Eduard Dzhabarov. — The bank attracts financing, which is actually debt, but with some amendments: the borrower pays an increased coupon (compared to senior debt), and the funds raised can be included in capital with a certain adjustment factor, while the par value is repaid only at the discretion of the issuer.

According to Dmitry Dorofeev, portfolio manager for bonds at Alfa Capital Management Company

, the trend in the coming years will most likely be the issuance of

ruble perpetual bonds by Russian banks:

- This is more profitable for banks: interest rates in dollars for perpetual bonds are now high, for them this is a rather expensive method of financing. At the same time, they can offer a lower premium for ruble instruments; in addition, they can attract a new class of investors, for example individuals, to invest in ruble instruments. At the same time, for investors, the ruble instrument itself is more risky than the dollar instrument, taking into account the volatility of the ruble, which, like any other currency of developing countries, tends to devalue.

By the way, starting from 2021, not only banks, but also corporates have the opportunity to issue perpetual bonds. On December 28, 2021, amendments to the law on the securities market came into force, allowing the issuance of perpetual bonds by corporate issuers, provided that they have the highest credit rating on the national scale and their bonds have been in circulation for at least 5 years. In addition, no significant violations of the fulfillment of obligations under such securities should have been identified during this period.

— Perpetual corporate bonds have long been actively used in foreign practice. In some countries, such securities are even included in the capital of companies. But compared to the eternal bonds of banks, these are rather one-time stories. I don’t think that this instrument will be widely used by companies on the Russian market, especially considering that only issuers with a high rating (at the sovereign level) will be able to place them,” says a representative of Alfa Capital Management Company.

“Corporations certainly have an interest in such tools,” Rostislav Kulak is convinced. — First of all, we are talking about large infrastructure companies, such as Russian Railways, which are implementing long-term infrastructure projects. We also received similar requests from issuers. However, it is hardly possible to talk about large volumes of production of such instruments. It's more of a niche story. In addition, the circle of potential buyers of such securities is quite limited, due to the fact that perpetual bonds are primarily aimed at long-term investors who have long-term money.

What are public and ordinary bonds VTB 24

After advertising and announcing a new profitable investment instrument, the organization set the task of developing and introducing something competitive with standard or ordinary deposit investments.

People's bonds are an alternative designed to securely store savings. This technique is available to all users, even those users with a lack of financial literacy. Among the positive factors are the following:

- Security – 100% complete safety of invested funds is guaranteed here;

- The rate of return on purchased bonds is higher than all current rates on conventional investments;

- Income transferred to the account is not subject to standard tax;

- Bonds can be easily purchased in one step by visiting a bank branch.

There are some important points that require attention before purchasing bonds.

It is worth knowing that during the process of opening an account with bonds you will not have to pay a commission, but when buying and selling bonds, the organization will take approximately 1.5% of the entire investment amount.

For the reason that the bank's commission can be reduced simultaneously with an increase in the total number of bonds purchased. It is much more profitable to buy a large number of financial products at once. It is more convenient to invest funds in parts, but it is not as profitable.

People's bonds cannot be transferred to another organization, they cannot be sold to another financial institution or used as standard collateral. At the same time, they can be left as an inheritance.

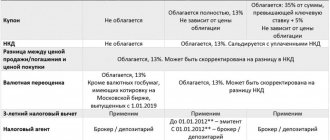

Features of taxation

Transactions with overnight bonds fall into the taxable base, and you will have to pay 13% personal income tax on profits between purchase and sale.

It would seem that one-day VTB bonds are corporate and fall under the benefits. Let me remind you that in accordance with Article 217 of the Tax Code of the Russian Federation, discount income received when redeeming corporate bonds is exempt from taxes.

However, Article 214 of the same Tax Code states that this rule (more precisely, the benefit) applies to securities for which the market quote is calculated - i.e. weighted average price for transactions carried out during one trading day. And for overnight VTB bonds, quotes are not calculated - there are no trades on the exchange for this instrument. Investors buy one-day shares directly from the issuer.

Therefore, overnight bonds are still subject to taxation.

Next are two options:

- if a broker transfers the amount from the redemption of a bond back to the brokerage account, then he is a tax agent and independently withholds all taxes and transfers them to the budget;

- if the money is transferred to a separate bank account, then the broker does NOT act as a tax agent, and you will need to calculate and remit the tax yourself.

And here is another interesting article: What types of bonds are there and what is better to buy

If there were several trading operations, taxes will have to be calculated for each of them.

Buy VTB 24 bonds for individuals

Anyone can buy papers, but they must meet certain conditions. Among them are:

- Age over 18 years;

- Official citizenship of the Russian Federation. The operation is also available to those living in other countries;

- You will need to bring your personal passport;

- You will need to be fully prepared to spend funds in the amount of at least 30 thousand and pay for the purchase from 0.5% to 1.5%.

The advantages of purchasing bonds from VTB have become the basis for the rapid growth in the popularity of bonds. During the first week of bond sales, the organization recorded more than 2,000 applications for 2 billion rubles.

How the price of a bond changes

Perpetual bonds may seem similar to a deposit in that they pay a constant income. For example, if you bought a bond for $100,000 with an 8.5% coupon, you would receive $8,500 annually. However, upon sale, the market price of the paper may be either lower or higher than the face value. Basically, the price of a bond depends on the key rate of the Central Bank. If inflation in the country slows down and the economy is doing well, the Central Bank will reduce the rate.

I also recommend reading:

What does investing in bond indices provide?

Bond indices: will they protect in a crisis?

As a result, the value of the bond increases, since a high coupon in a low interest rate environment will attract investors. This is good for the owner of a perpetual bond - he will be able to sell at a profit. If rates rise (as they are now), then the investment attractiveness of the bond will decrease and its price will fall. For the seller (owner of the paper) this state of affairs is unprofitable, but for the buyer it is the opposite. If you are looking for the moment to enter the market, it is better to do this when rates are rising.

VTB 24 bonds cost

It is possible to buy valuable products by opening a brokerage deposit or a special depot. For this purpose, it is enough to simply contact a financial institution and complete the registration there.

If you have any questions or complaints, please let us know

Ask a Question

Leave a complaint

The nominal value of one bond is 1000 (one thousand) rubles.

If you have a special brokerage account or depository, VTB 24 bonds for individuals can be purchased in two ways. This can be a remote acquisition of securities via the Internet, that is, using the personal account of an official investor. You can also submit an official order to conduct a financial transaction in the office itself, which provides standard investment services.

The exact value of the bonds can only be noted by the low threshold for entry. It is 30 thousand, which is enough to make a profit.

This is based on the fact that the level of return on investments is an order of magnitude higher than in the largest companies. The bank provides a refund guarantee. This does not take into account the commission paid, as well as the terms and conditions of the repurchase. Funds can be returned at any time if necessary.

At the moment, experts have noted that the average volume of applications for national federal loan bonds at VTB 24 does not fall below 300 thousand, and even more often amounts to one million rubles. Often lower bids are also observed, which indicates that an increasing number of investors are appearing among Russians with average income levels, as well as among those who do not have serious knowledge of the modern financial market.

The main advantage of modern government bonds is the ease of their acquisition. Bonds can be purchased at any nearby branch of VTB 24 Bank. You just need to open a personal brokerage account or depository. After opening it, you will need to deposit funds into the account and submit an official order to purchase securities.

Overnight yield

It is difficult to say anything unequivocally about the profitability of overnight bonds. The fact is that VTB assigns a discount depending on its needs, and its value is different every day. But on average the yield on overnight VTB bonds is 6-6.5%. At least as of 2021. We'll see what happens in 2021.

As you can see, the profitability of investments is even lower than the key rate of the Central Bank of the Russian Federation. And some deposits turn out to be more profitable, without the need to reinvest the money every time.

In addition, you will not receive all the profit, since taxes and commissions will eat it up.

Summing up

Bonds for individuals in 2021 are the best option for investing in the form of a profitable federal loan. VTB issues and provides the opportunity to purchase its government loan securities on the most favorable terms. To get a similar investment product and profit from it, you don’t have to spend time learning financial literacy; you just need to understand the question of what bonds are and how traditional and ordinary securities work.

Redemption of perpetual bonds

Although perpetual bonds do not have a specific maturity date, the issuer can redeem them at par. To do this, the company in the offer (public offering of a bond) declares the call option date on which it intends to repurchase the securities. Usually the redemption period is quite long - 10 years or more.

The second option to receive the bond's face value is to simply exit it, that is, sell the paper on the stock exchange, like any other asset. But here you need to take into account the nature of the paper. Most perpetual bonds are issued in the form of Eurobonds with a par value of $100,000. Due to high prices and low demand, their liquidity may be almost zero. You also need to take into account the brokerage commission, which can eat up potential profits.

Is it worth buying “perpetual” bonds?

At its core, Eurobonds are an investor’s instrument that differs from a supranational currency. The person who bought them took on currency and credit risks, since it is not known exactly what the final nominal price of the shares will be and how the Eurobond feature will affect it. But, on the other hand, this investment is also a way of exaggerating capital.

Now the market situation is more positive than negative. Specialists expect to receive a return that exceeds a deposit in the currency of a particular country. The risk level is minimal in the deposit categories from one and a half to two years . Debt obligations, if they belong to large companies, give the investor the opportunity to earn up to 30% in the deposit currency.

Strategies for Using Overnight Bonds

The most obvious strategy is to “park” funds overnight. It works especially effectively from Friday to Monday. The stock exchange is closed on weekends, and trading with other instruments will not be possible.

In addition, you can place your excess liquidity in one-day bonds while you are thinking about what else to buy. So that the money does not lie like a dead weight in the account.

One-day bonds are available for purchase on IIS. Therefore, you can use the Type B tax deduction to exempt your profits from tax. Consider, immediately + 13% to the amount of income.

You can also use deduction type A on IIS. But if your goal is simply to get a tax deduction for the amount of the contribution, then it is easier and more effective to use other conservative tools that do not need to be reinvested literally every day. For example, there are many bonds with a yield higher than the deposit. Or you can build a portfolio of undervalued stocks, especially if you plan to invest for several years and are willing to wait.

And here’s another interesting article: Gazprombank Mutual Fund Bonds Plus: profitability, cost, how to buy

In addition, if you want to make money on interbank rates, then use OFZs linked to the RUONIA value - this is more effective than overnight bonds and is not so confusing. Buy it and keep it.

Thus, overnight VTB bonds are a very interesting tool that allows you to earn money at night or on weekends, but you need to use it skillfully. Otherwise, you may overpay an extra commission or get bogged down in calculating the taxable base. There are different strategies for using such bonds - the most effective way is to “park” the funds for a couple of days while you look for the best use for the money. That's all, good luck, and may the money be with you!

Rate this article

[Total votes: Average rating: ]

Commissions

Each broker sets its own commissions for the purchase and sale of assets. Overnight bonds are traded on the stock section, so look at the fees for this particular class of instruments.

For example, for Sberbank it is 0.06% for the “Independent” tariff, for BCS it is from 0.0177% to 0.0531 for the “Professional” tariff depending on turnover, for Finam it is 0.0354% for the “Daily” plan ( prices are indicated everywhere for a turnover of up to 1 million rubles per day).

What’s interesting is that if you buy overnight bonds through a VTB broker, he offers a reduced commission - 0.00342% versus the standard 0.0513% at the Investor-Standard tariff. Those. There is a savings of 15 times!

Therefore, it is more profitable to buy overnight VTB bonds from a VTB broker. But you can do it with other brokers too, although it’s more expensive.

conclusions

Only a specialist who has carefully calculated the risks and returns can buy bonds with huge benefits for themselves. An ordinary bank client must answer the following questions before making a purchase:

- how much are you willing to invest;

- for how long;

- whether the funds will be reinvested;

- is it possible to purchase additional securities;

- Are you ready to independently study the features of the process?

Due to bank commissions, there is no point in investing money in Eurobonds of a stable company for a short term. Earnings depend on the interest rate, liquidity, and exchange rates.