We are sure that sooner or later every person faces the question: “How to make money work and make a profit?” Moreover, in this case, abstract knowledge about the theoretical side of investing helps little. This requires real practice. A potential investor should not only clearly understand what investment instruments currently exist in the financial markets, but also have at least a general understanding of the fundamental principles of their use.

Without this, it is simply impossible to receive stable high profits from invested money. Playing blindly significantly increases the level of actual investment risks and threatens the investor with serious financial disaster. To prevent this from happening, I propose to study this topic in more detail.

Types of investment instruments

An investment instrument is an asset in which an investor invests money in order to receive benefits. All investment instruments can be divided into:

- Savings instruments are designed to protect capital from inflation and other risks. This category includes deposits, OFZs, and precious metals.

- Multiplication tools - aimed at generating potentially high income. These include shares, corporate bonds, real estate, mutual funds, and structured products.

The essence of the phenomenon

Investment instruments are specific ways to invest money. In other words, this is everything in which an investor can invest money and receive a certain level of income, which depends on the specific type of asset purchased.

In the understanding of most people, the category of investment instruments automatically includes bank deposits or profits from securities. Most often, this is where knowledge ends. However, in practice it is a much broader concept.

Criteria for evaluating investment instruments

Before you invest money in a particular instrument, you need to study it. Here are a few criteria to pay attention to:

- Risks and profitability. Any investment is associated with risk - the higher it is, the higher the potential return on investment. Before investing, complete risk profiling to determine your attitude to risk. The choice of financial instruments will largely depend on your willingness to take risks.

- Investment terms. For example, you can invest in shares for an unlimited time - at least as long as the company exists, but bonds and structured products have an expiration date (maturity).

- Frequency of payments. Income from investment instruments can be paid one time (for example, income from the sale of shares) or at a certain periodicity (for example, coupons on bonds are paid according to a predetermined schedule).

- Minimum entry threshold - for example, to purchase one OFZ you will need about 1000 rubles, and to purchase real estate - several million.

- Currency. There are investment instruments on the market both in rubles and in foreign currencies.

In most cases, the choice of investment instruments depends on the investor's attitude to risk. Those who are not going to take risks should choose assets with a low degree of risk - OFZs, deposits, precious metals. Investors who are willing to take risks for the sake of an increased rate can take a closer look at shares, mutual funds, currencies, and derivatives market instruments.

Let's look at the advantages and disadvantages of the most common investment instruments.

Main varieties

Currently, there are a huge number of investment instruments on the financial markets. Each of them will be analyzed separately. In this article, we will present only the best and most popular investment instruments.

Bank deposits

Bank deposits in Russia today are the most popular and at the same time the least risky ways of investing money. The last part of the statement applies to all deposits in the amount of up to 1 million 400 thousand rubles inclusive. This is their advantage.

The main disadvantage is the minimum profitability. Currently it ranges from 5 to 10% per annum. That is, depending on the bank chosen and the specific deposit, the income received under certain conditions may not even cover the annual inflation rate. Simply put, this means that with such an investment instrument we will not only not increase, but will not even preserve our own savings. However, in any case, this investment method is much better than storing money at home.

When choosing a deposit, you should remember the following points:

- the existence of the possibility of replenishing the deposit;

- the existence of the possibility of withdrawing part of the funds from the account without losing interest;

- the presence of monthly capitalization of interest or, in other words, the addition of interest to the deposit amount.

Company shares

Stocks are a type of security issued by a commercial company for the purpose of raising private money from investors. They can be ordinary and privileged. Only owners of ordinary shares can participate in the management of a joint stock company. However, holders of such securities do not have a guaranteed income. The decision on its payment is made at the end of the year at the general meeting of shareholders and depends on the actual performance of the company. The holder of preferred shares does not manage the company, but he is guaranteed to receive dividends. Moreover, their size is known in advance when purchasing these securities.

However, most private investors who play on the stock exchange do not prioritize dividends. They are primarily aimed at the income that they can receive from the resale of shares that have risen in price. It is clear that if, on the contrary, they become cheaper, then such an investment instrument will bring nothing but losses to its owner.

The easiest way to understand this is with a specific example. In 1999, one Gazprom share was bought and sold for 8 and a half rubles. Today its price is 155 rubles.

Currency operations

Such instruments are the focus of attention of investors playing on the foreign exchange market. The principle of their activity completely coincides with that described above. You need to buy currency cheaper and sell it more expensive. The difference between the two prices is precisely the investor's profit.

Naturally, in practice everything is much more complicated. First of all, you need to choose a national currency for trading. You can earn a lot in two ways. Firstly, the investor can operate with a large sum of money. In this case, even a small income from the resale of currency will bring a significant profit from the volume of the transaction. Secondly, you can choose a national currency that is expected to grow significantly in the near future.

Every successful player in the foreign exchange market understands that currency exchange rate fluctuations depend on many factors. For example, the value of the American dollar is affected by both events within the United States and far beyond its borders. The same applies to the euro, Russian ruble, Chinese yuan and so on.

Other tools

Now let's briefly mention other tools that an investor can use. These include:

- government bonds;

- shares in investment funds;

- futures and options;

- real estate objects;

- precious metals;

- art and antiques;

- information websites;

- investment programs of microfinance organizations;

- much more.

As you now understand, the right choice of investment instrument plays a decisive role. Without it, the investor will not be able to succeed.

Stock

Shares are securities that confirm ownership of a share in the capital of a company. They provide an opportunity to receive dividends in case of positive financial results of the enterprise, as well as to earn money on the difference between the purchase price and the sale price.

Features of investing in shares:

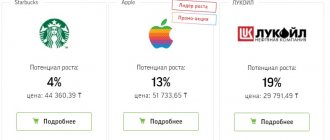

- low entry threshold (for example, shares of the Neftegaz company in October 2021 are trading at 40 rubles per share, and Sberbank - at 210 rubles);

- high liquidity (shares of most large companies are in demand and can be sold at any time);

- potentially high profitability;

- low predictability of quotes (the stock price is influenced by many factors - from events within the company to the state of the global economy).

Among investors who value reliability and stability, blue chip stocks are especially popular. In investment slang, “blue chips” are the shares of the largest and most reliable companies. As a rule, these are industry leaders who have stood the test of time.

Here are some basic signs of blue chips:

- the company is widely known in the market and has a stable income;

- it has a large capitalization;

- shares have high liquidity;

- quotes are influenced by business performance, not speculators;

- stocks are characterized by low volatility even during a crisis.

When choosing stocks, you should pay attention to the stock price chart, history of dividend payments, business development prospects, share capital structure and dividend policy. Review the financial results of the joint-stock company for past periods, study analysts' forecasts and draw your own conclusions.

Trading using robot advisors⠀

An excellent alternative to both earn and reinvest is trading with the WSB robot⠀ Wall Street Bot robot - can be configured both conservatively and more riskily. It all depends on your goals.⠀

Your benefits and what you will get: