Gold Price Analysis 2021: Times of Uncertainty Propel Stellar Growth

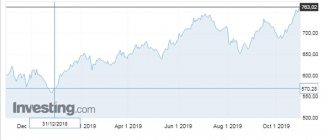

After losing much of its shine and falling below $1,200 an ounce in 2021, gold has rebounded sharply in 2021, rising nearly 20 percent to end the year at $1,519 USD. The growth continued this year, and by February 24, the price of gold rose to $1.672 USD/OZ.

In mid-March, a sell-off in the broader market sent the gold price down to $1.477 an ounce. The metal then quickly climbed above the $1,700 mark as low interest rates and unprecedented economic stimulus boosted investor interest in safe-haven assets.

The gold market sank in early June, but has broken through to record highs this summer. On August 6, the price of the metal was $2,070 per ounce, up 35% since the start of 2021 and 40% from its March lows. The rise was driven by a weakening US dollar and a number of significant geopolitical and economic developments on the global stage, such as the EU agreement on a €750bn (£670bn, $890bn) recovery fund for coronavirus damage and the closure of the Chinese consulate to Houston, USA.

When the dollar began to rise, the price of the metal fell to $1,900–$1,950 per ounce in September. After falling to $1.865 per ounce in the last days of October amid the turmoil in the US presidential election, gold prices have seen a steady rise. The price peaked at $1,960 on November 9. However, Pfizer's soon-to-be-announced Covid-19 vaccine brought the market down initially to $1,900, and by the end of November the price of gold had fallen below $1,800 an ounce.

At the time of writing the forecast, the precious metal was trading at $1.879 dollars per ounce, which means an increase of almost 25% since the beginning of the year. But will the price of gold rise before the end of this year? And what will determine the direction of gold prices?

When can we expect a reduction in prices for rolled metal products?

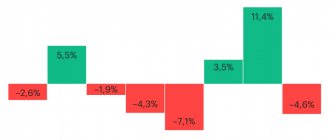

Prices for rolled metal products gradually increased throughout 2020, and the growth reached its peak in October-December. Compared to the beginning of the year, the cost of almost all long products, rolled pipes, rolled sheets, as well as most of the shaped rolled products increased by 30-65%. There has probably never been such a sharp rise in prices. And, naturally, it cannot please anyone, not even manufacturers, because the demand for metal at such prices a priori cannot be high. But the price increase was not limited to the end of the year; another increase occurred at the beginning of January 2021. So what to expect next? Will there be a reduction in the cost of the entire range of rolled metal products, or is it time to get used to such prices? Let's try to figure it out.

First of all, once again, let us remind you that the very increase in prices on the domestic Russian market (and it is this that is important to us now) occurred due to rising prices on foreign markets, which, in turn, was largely caused by a shortage in the production of semi-finished products, as well as an increase in demand and higher prices for scrap metal. As a result, we find that it has become much more profitable for domestic producers to sell semi-finished metal products in foreign markets than for domestic consumers. In order to equalize profitability, manufacturers raised prices. In turn, distributors also began to raise prices, and end consumers purchased as much rolled metal as they could, at prices that were not yet maximum, creating some local shortages of the most popular items of long, sheet and pipe products.

From the above, we can conclude that selling prices on the domestic rolled metal market at the beginning of 2021 are highly dependent on prices on foreign markets, in particular Chinese, European and Turkish, as well as on the availability of semi-finished products in distributors’ warehouses in different regions of Russia.

Some analysts at the end of 2021 predicted an imminent decline in prices for rolled metal products abroad. Some even talked about a sharp collapse in prices in February 2021, or at most in March. And there are some prerequisites for this: in the last week (at the beginning of the 20th of January), prices for reinforcement and sheet metal began to decline in the Chinese, Turkish and American markets. But for the domestic consumer, no positive trends are yet noticeable: the ruble exchange rate is slowly declining and levels out the entire difference in the cost of rolled metal. However, certain items of the ferrous metal product range began to lose price in the domestic market.

But the main question is, will the trend towards a decrease in the cost of rolled metal in foreign markets continue in the future? Chances are not. And the current decline is only a temporary decline due to decreased demand. The fact is that the production of raw materials in China will decrease in 2021 compared to 2021. And demand will increase due to increased production rates in China itself and greater openness of the American market (which is also expected in the coming months). All this should lead to a shortage of semi-finished metal products on a global scale and to a continued rise in prices, at least for long and sheet metal products.

On the other hand, the situation on the domestic Russian market may be a little more positive: metallurgists do not hide the fact that the cost of raw materials has decreased somewhat, and the government is trying to take control of the situation and force manufacturers to create quotas for the domestic market at prices lower than the world market arena. The only question is to what extent these quotas can satisfy the interests of the domestic market.

Let's try to summarize. Making forecasts now on the situation on the domestic, and global, metal market is a thankless task. But some things can be said for sure:

- prices in different world markets will vary greatly in the next 2-3 months;

- preliminary February selling prices of domestic manufacturing plants are 5-10% higher than in January;

- the cost of Russian rentals abroad decreased slightly in the second half of January.

This may mean that a real, sensitive reduction in prices for all major types of rolled metal should not be expected before March 2021. But a serious price increase is not expected in the near future.

Why gold is more promising than other metals: analysis

Buying gold has been a promising investment option for many years. It does not lose its relevance today. No matter how the economic and political situation develops in the world, entire states continue to invest in gold. Naturally, this has a positive effect on its quotes and demand for this metal.

Of course, when the pandemic just started, many investors, afraid of losing money, began to sell it intensively. But gradually the rate leveled off and now also promises to become very profitable.

On a note! Maternity payments in 2021

An important property of gold is that it does not depend on industrial demand for it. This is its advantage over other metals, about which the same cannot be said. Once incredibly promising, platinum and palladium are overly dependent on the automotive industry.

Previously, there was an unprecedented demand for palladium, and this was explained by the fact that catalysts for diesel engines were purchased all over the world. After this, the automotive industry began to get rid of such a component. Diesel engines have become unpopular. Therefore, there is now a decline in sales of this precious metal around the world.

Platinum has also already experienced its period of demand. Perhaps someday it will show good growth rates, but so far it has not shown significant progress.

This is interesting! Stock market professionals insist on the need to invest in gold today. Experts expect profitability rates in the range of 20-100% in 2021.

LBMA. Precious metals price forecasts for 2021

Source: MSK.MONETAINVEST.RU

Author: Roman Otlivanchik

In January of this year, the LBMA surveyed 38 analysts from 21 financial centers around the world regarding average prices for precious metals in 2021.

The mood is generally calm, the pre-election rush and Covid depression have passed.

Unlike last year, many are now betting on silver (+8% compared to January, 28.5 $/oz), only then on gold (+4.6%, 1973.8 $/oz), then on platinum (+ 4.1%, 1131.5 $/oz) and at the end of the list - for palladium (+1.4%, 2439.1 $/oz).

At the same time, the range of prices from minimum to maximum among different analysts is off scale:

— in gold from 1488 to 2680 $/oz (or price range of 1192 $/oz),

— in silver from 16.51 to 55 $/oz (or — 38.49 $/oz),

— in platinum from 774 to 1827 $/oz (or — 1053 $/oz),

— in palladium from 1500 to 3000 $/oz (or — 1500 $/oz).

Analysts point to negative or falling interest rates, US monetary and fiscal policy and dollar weakness in their assessments of the stock's rise.

In turn, the wide spread in forecast prices is associated with different assessments of geopolitical factors, COVID-19 and the pace of global economic recovery.

To clarify the picture of the future, we will find out the opinions of the LBMA winners for 2021. Each of them received 1 kg of gold from the sponsor MKS PAMP Group for the best forecast for gold, silver, platinum and palladium, respectively.

This is what independent analyst Ross Norman (Metals Daily), winner of last year in two categories, gold and silver, writes.

About gold

We expect gold to perform well in 2021, albeit a little more modestly than in the past.

Let's say right away that we see a continuation of the theme of a weak dollar, lower negative rates in the US government debt market and a significant increase in bad debts, as the Democrats plan to flood the economy with budget money. Given the fall in GDP in Q1, we expect economic growth in the second half of the year, thanks to the vaccination program, which will normalize business relations. The economic recovery is accompanied by a boost in demand, rising costs and an increase in the velocity of money, hence the expectation of higher inflation, despite the weakness of the labor market.

As in 2008, central banks are now doing everything in their power to save their economies, but the consequences of such policies weigh on the market. And if so, then investors’ views will move from problems with COVID-19 to the solvency of states as reliable borrowers.

Financial markets remain very dangerous and we believe that investors will continue to see gold as a life-saver. In short, the bullish trend (since mid-2018) is still in force and we see good chances for further growth, but at a calmer pace than in 2021.

About silver

As one of the best assets of 2021, we expect the same success from silver in the coming 2021.

Investment demand for coins, bars, and silver fund shares (already over 1 billion ounces) will likely continue to grow at a similar pace, implying strong demand for safe haven assets in such troubling times. As silver's bullish trend continues, we see further declines in the GSR, reflecting silver's higher rate of appreciation relative to gold. Demand for silver will mainly be concentrated in the US and Germany, with interest falling in India (due to the price factor).

The improvement in investment demand will, however, be accompanied by a decrease in industrial consumption due to the introduction of higher technologies in the automotive industry and photovoltaics.

Kieran Clancy (Capital Economics) platinum winner did not give his forecast for 2021. In this regard, we again turn to the opinion of Ross Norman (Metals Daily).

About platinum

We forecast a good chance of price gains for all commodities in 2021, but we are highlighting platinum.

In the post-Covid economy, we predict strong demand in the car market. Taking into account the introduction of stricter carbon dioxide regulations in Europe and China for light trucks, we see an increase in demand in China by 23% to 27 million vehicles and in the United States by 14% to 16.3 million units.

In addition, it is especially important to note the momentum generated by investors in platinum funds, the coin and bullion markets (especially in Japan) and associated with the recognition of the key role of platinum in the hydrogen economy.

The platinum market will remain in deficit in 2021, marking the third year in a row that demand will exceed supply by 240 thousand ounces. Even though the deficit will be smaller than in 2021, the cumulative effect will play a role. The general rise in commodity markets will spur demand for platinum, as well as for similar metals such as rhodium.

And in conclusion, we will find out the position of the last LBMA winner Zhexing Wang (Bank of China), who presented the most pessimistic forecast for the palladium market for 2021.

About palladium

Palladium still looks very uncertain. It is more expensive than platinum. It is likely that palladium will be replaced by platinum in industry and prices will thus continue to converge.

In addition, I will say the following. The recovery in demand for cars will support demand for palladium and this is due to successes in the fight against the pandemic, growth in employment and consumption.

Palladium prices are likely to fall initially and then rise, but the platinum factor cannot be discounted.

Gold price forecast for tomorrow, week and month.

| date | Day of the week | Min. | Max. | Price |

| 16.03 | Tuesday | 1698 | 1750 | 1724 |

| 17.03 | Wednesday | 1694 | 1746 | 1720 |

| 18.03 | Thursday | 1704 | 1756 | 1730 |

| 19.03 | Friday | 1740 | 1794 | 1767 |

| 22.03 | Monday | 1723 | 1775 | 1749 |

| 23.03 | Tuesday | 1702 | 1754 | 1728 |

| 24.03 | Wednesday | 1701 | 1753 | 1727 |

| 25.03 | Thursday | 1687 | 1739 | 1713 |

| 26.03 | Friday | 1698 | 1750 | 1724 |

| 29.03 | Monday | 1692 | 1744 | 1718 |

| 30.03 | Tuesday | 1652 | 1702 | 1677 |

| 31.03 | Wednesday | 1625 | 1675 | 1650 |

| 01.04 | Thursday | 1619 | 1669 | 1644 |

| 02.04 | Friday | 1619 | 1669 | 1644 |

| 05.04 | Monday | 1646 | 1696 | 1671 |

| 06.04 | Tuesday | 1652 | 1702 | 1677 |

| 07.04 | Wednesday | 1653 | 1703 | 1678 |

| 08.04 | Thursday | 1633 | 1683 | 1658 |

| 09.04 | Friday | 1610 | 1660 | 1635 |

| 12.04 | Monday | 1606 | 1654 | 1630 |

| 13.04 | Tuesday | 1605 | 1653 | 1629 |

| 14.04 | Wednesday | 1591 | 1639 | 1615 |

| 15.04 | Thursday | 1596 | 1644 | 1620 |

| 16.04 | Friday | 1601 | 1649 | 1625 |

Gold price forecast for Tuesday, March 16th: $1724, maximum 1750, minimum 1698. Gold price forecast for Wednesday, March 17th: $1720, maximum 1746, minimum 1694. Gold price forecast for Thursday, March 18th March 1st: $1730, maximum 1756, minimum 1704. Gold price on Friday, March 19th: $1767, maximum 1794, minimum 1740.

A week later. Gold price forecast for Monday, March 22nd: $1749, maximum 1775, minimum 1723. Gold price forecast for Tuesday, March 23rd: $1728, maximum 1754, minimum 1702. Gold price forecast for Wednesday, March 24th March 8th: $1727, maximum 1753, minimum 1701. Gold price for Thursday, March 25th: $1713, maximum 1739, minimum 1687. Gold price forecast for Friday, March 26th: $1724, maximum 1750, minimum 1698.

Silver price forecast for 2021-2024.

In 2 weeks. Gold price for Monday, March 29th: $1718, maximum 1744, minimum 1692. Gold price forecast for Tuesday, March 30th: $1677, maximum 1702, minimum 1652. Gold price for Wednesday, 31st March: $1650, maximum 1675, minimum 1625. Gold price forecast for Thursday, April 1st: $1644, maximum 1669, minimum 1619. Gold price for Friday, April 2nd: $1644, maximum 1669, minimum 1619.

In 3 weeks. Gold price forecast for Monday, April 5th: $1671, maximum 1696, minimum 1646. Gold price forecast for Tuesday, April 6th: $1677, maximum 1702, minimum 1652. Gold price forecast for Wednesday, 7th April 8th: $1678, maximum 1703, minimum 1653. Gold price for Thursday, April 8th: $1658, maximum 1683, minimum 1633. Gold price forecast for Friday, April 9th: $1635, maximum 1660, minimum 1610.

A month later. Gold price for Monday, April 12th: $1630, maximum 1654, minimum 1606. Gold price forecast for Tuesday, April 13th: $1629, maximum 1653, minimum 1605. Gold price for Wednesday, 14th April: 1615 dollars, maximum 1639, minimum 1591.

The importance of precious metals in the global economy

Historically, the development of trade relations spontaneously assigned the function of world money to gold and silver. The Parisian monetary system, established in 1867, elevated the first specified metal above the second. Gold reserves became the only world currency until the 70s. 20th century.

The First World War moved the financial center from Europe to the United States. After World War II, the United States launched demonetization of gold currency under the slogan “the dollar is better than gold” and gradually replaced the precious metal from its leading position.

In 1949, the United States used 75% of its official gold reserves to support the dollar.

Having lost the function of world money, gold remains the most important precious metal and performs new tasks:

- Emergency world money that is needed during economic crises.

- A kind of insurance fund of the state - the volume of the country's gold reserves reflects monetary and financial positions and serves as one of the main indicators of creditworthiness.

- Gold reserve is the materialization of public wealth.

The importance of the precious metal is emphasized by the fact that changes in the value rate are monitored all over the world. The price is volatile and depends on a number of factors, both predictable and completely unexpected.

Factors and events affecting the gold rate

The dynamics of gold prices is the most important economic indicator. The first trading on the American Stock Exchange began in 1972, at $19.35 per ounce.

In the modern world, international gold markets are located in Zurich, Hong Kong, London, New York and Dubai. The largest gold and foreign exchange turnover is in London and Zurich.

The table shows changes in gold prices over the past 10 years (data from the London Stock Exchange):

| Year | Minimum price / $ | Average price/$ | Maximum price / $ |

| 2010 | 1058 | 1224,53 | 1421 |

| 2011 | 1319 | 1571,52 | 1920 |

| 2012 | 1540 | 1668,98 | 1791,75 |

| 2013 | 1192 | 1409,24 | 1693,75 |

| 2014 | 1142 | 1266,40 | 1385 |

| 2015 | 1050,60 | 1158,66 | 1301,55 |

| 2016 | 1062,07 | 1253,51 | 1374,10 |

| 2017 | 1151,05 | 1257,53 | 1356,26 |

| 2018 | 1164,30 | 1262,43 | 1364,20 |

| 2019 | 1266,30 | 1383,40 | 1555,20 |

The price peaked at $1,920 a troy ounce in 2011 due to increased demand, record buying by China and fears of a debt crisis in the eurozone, according to a report by the World Gold Council.

In 2021, the main drivers of growth in gold and foreign exchange quotations were the following events:

- global economic slowdown;

- US-China trade conflict;

- UK's difficulties with Brexit.

Thus, the value is influenced by market factors and events occurring in the world:

- gold and foreign exchange transactions of countries;

- speculation by participants in foreign exchange markets;

- changes in the value of shares of gold mining enterprises;

- investor expectations;

- US dollar price;

- volumes of precious metal production;

- production cost;

- quantity of consumption;

- interest of the jewelry industry;

- natural disasters;

- political crises;

- seasonality.

All of the above is taken into account by analysts when making a forecast for the price of gold.

ADL's monthly gold chart suggests a range of $2,250 to $2,350

Let's start with the monthly gold chart according to the ADL system below. It shows a broad upward price trend starting in late 2021 or early 2021. It is highly likely that the gold price will remain flat in December before attempting to reach $2,250 or higher by April or May 2021 (possibly earlier). It looks like the real uptrend will start in early 2021 and continue through July 2021.

Monthly gold chart according to ADL

Note that according to the ADL system, gold prices will settle around or above the $2,100 mark after July 2021. It is very likely that some economic recovery can be expected during this period, which will draw attention away from metals. The ADL DNA marker for this future price forecast was composed of 17 unique DNA markers, resulting in a range of price levels with a probability of 92% to 99%. Given the high probability based on 17 unique ADL DNA mapping results, we are of the opinion that gold will move in line with this price forecast over the next 12+ months.

XAU USD forecast for Gold

In our XAU USD Gold forecast , we offer traders an up-to-date XAU/USD trading forecast, a unique analysis and forecast of Gold prices for today as part of an analysis of the current situation on the FOREX market using simple tools. The XAU/USD forecast section is updated every day.

Gold price forecast for today

The XAU/USD trading instrument represents the value of an ounce of Gold expressed in terms of the value of the US dollar on FOREX. The financial instrument XAU/USD is very popular and arouses interest among traders and investors around the world due to its technology; it is considered one of the most volatile instruments on Forex.

Technical analysis of XAU/USD

As part of our Gold price forecast, we offer daily free technical analysis of XAU/USD on FOREX. The simplest tools of technical analysis are used here: trend lines, graphical models, as well as modern approaches in the form of patterns, due to this we obtain a high-quality technical analysis of XAU/USD.

XAU/USD forecast for today

As part of the publication of XAU/USD forecasts, we also offer traders trading recommendations and signals for Gold from the experts of our portal. If you constantly follow the updates of the XAU/USD forecast section for today, you have already noticed that movements often occur immediately after the publication of forecasts for the pair XAU/USD.

XAU/USD forecast for tomorrow

Thanks to the analysis of the four-hour chart of the price of Gold against the US dollar, we make a forecast for the XAU/USD exchange rate for tomorrow, which is also relevant at this point in time. As a rule, the XAU/USD forecast for tomorrow is published in the afternoon, taking into account the morning trading session and right before the most aggressive American one.

What to do if you need materials?

If you need building materials made of thin sheet steel (metal tiles, corrugated sheets, drainage, etc.) at reasonable prices, then there are several options:

- Select the optimal products . If you need a material that will last as long as possible, it is best not to skimp on quality. But if you need a budget solution like a temporary fence, then there is no point in overpaying. For example, we have steel products in Premium, Premier, Standard and simply galvanized (without coating) coatings. Their thickness varies from 0.4 mm to 1 mm. There are often profitable promotions.

- Trust big companies . Perhaps some small companies will try to supply the market with goods made from cheap raw materials of low quality in an effort to save money. Therefore, we can say for sure: you should only purchase products like metal tiles and corrugated sheets from trusted large companies. Only such manufacturers will be able to provide constant quality control of materials. Not to mention the trained staff who help the client understand the selection of the right material from a large assortment.

Gold forecast: factors that will move the market in the coming weeks

Before we dive into the gold forecast for 2021, we want to quickly summarize the latest trends that could impact the value of the metal in the future.

It's no secret that gold prices tend to benefit from increasing uncertainty, whether in the economic or political arena. This year was no exception. To hedge their portfolios, investors have turned to the metal, adding it to their holdings in all shapes and forms, from gold coins and bars to gold stocks and exchange-traded funds, pushing the value higher and higher.

Among many issues, inflation has emerged as one of the market's worst concerns in 2021. As governments around the world scrambled to undo the damage caused by Covid-19, trillions of dollars were pumped into the global economy through fiscal stimulus and quantitative easing. McKinsey research

, this year's stimulus has already exceeded the measures taken during the global crisis of 2008-2009.

During monetary easing, investors tend to switch from the US dollar to gold as a hedge against inflation, which also increases the value of the precious metal.

Another important factor that will determine gold prices in the future, at least in the short term, is the coronavirus itself. The second wave has already hit the world, the number of cases is growing every day, and many countries are reinstating quarantine; this in turn has a negative impact on an already struggling economy. If governments decide on a fresh dose of fiscal and monetary stimulus, the yellow metal could continue to be a big beneficiary of the Covid-19 crisis.

So, will gold rise? Well, if the global economy continues to stagnate due to the pandemic and rising geopolitical tensions have already disrupted international trade, we could see the price of gold rise higher and even break its previous records.

Now let's move on to analysts' forecasts for 2021.

Gold price forecast for 2021 from analysts of the world's largest gold exchange-traded fund

George Milling-Stanley, lead analyst for the SPDR gold exchange-traded fund, along with senior analysts Maxwell Gold and Diego Andrade, provide their perspective on the yellow metal's prospects for the next year.

The coronavirus pandemic has been in the spotlight throughout 2020. It became the main factor in the growth of the gold rate to a record level of $2,067 per ounce. This was also influenced by increased uncertainty and risks, both economic and geopolitical, in a low interest rate environment. Unsurprisingly, inflows into gold ETFs have been increasing for most of 2021. Precious metals provide investors with the opportunity to diversify their portfolio, helping to preserve capital in times of market volatility and satisfying the need for liquid assets. The coming year will be no less successful for the precious metal.

The resolution of the political crisis in the United States thanks to Joe Biden's victory in the presidential election partially reduced the degree of political instability that investors had to reckon with throughout 2021. At the same time, news of coronavirus vaccines has increased the popularity of risk assets, raising hopes in markets that the economy will recover soon. Will this news be enough to completely reassure investors? How will stock markets react to other risks?

Sources of instability in 2021 and gold price dynamics

Ahead of the US presidential election, some speculators took long positions in gold futures, fearing that a Democratic victory in the presidential race and a majority in the Senate and House of Representatives would lead to the rollout of large-scale progressive reforms. Investors have resorted to preemptive actions to protect portfolios ahead of the election. They poured $1.4 billion into gold exchange-traded funds in October, bringing their total investments in 2021 to $57.1 billion.

When news emerged about the effectiveness of coronavirus vaccines and the election results became known, it became obvious that Democrats would not have a majority in the House of Representatives. This led to the liquidation of $6.8 billion in gold exchange-traded fund units in November. The post-election outflow from these funds was the largest since the April 2013 high of $8 billion. Changing investor sentiment in the market led to the gold rate briefly falling below $1,800 by the end of November.

However, the lion's share of the sources of instability have not disappeared. Therefore, gold has every chance to grow again. It should not be forgotten that it was in the general atmosphere of political and economic instability that in the summer of 2021 the gold rate broke through the upper limit of the trading range that had been in force for the previous six years, limiting the rate's advance above $1,350 per ounce.

Let us recall that in February 2021, the gold rate exceeded $1,600 per ounce. At that time, no one could have foreseen the global quarantine and enormous economic damage due to the pandemic.

As you know, the Biden administration has promised to focus its activities on four main tasks. Clearly, fighting the pandemic and economic incentives aimed at infrastructure projects are top priorities. In addition, health care reform will be implemented and important steps will be taken to prevent climate change. Solving all these problems is expensive. The result is likely to increase the deficit, the dollar will fall, and the inflation rate will rise.

The place and role of gold in the new world

The Biden administration will begin its work under challenging conditions: the number of daily cases of illness and death from coronavirus is growing every day; there is a need for new quarantine restrictions in the southwest and there is a high probability of a renewed lockdown in the northeast. Will hopes for a vaccine come true? Will producers cope with the logistical challenges to achieve herd immunity as quickly as possible? In short, the situation with the pandemic is extremely uncertain, to say the least.

In addition, the economy is still far from recovering from the pandemic shock, despite some encouraging statistics for the third quarter. A second wave of lockdowns could delay the recovery process, deepening the recession. Thus, Moody's Analytics predicts a deepening of the recession in the first and second quarters of 2021, and the unemployment rate in the United States will rise from the current 6.9% to 10% by the summer of next year. In such conditions, volatility in financial markets will increase and even a second collapse on them is possible. For the next two years, at a minimum, interest rates will remain near zero. Investors are bracing for the Fed to push Treasury yields into negative territory. Gold prices will benefit from low interest rates. The stock of global negative-yielding debt will rise to record highs and further reduce the opportunity cost of holding precious metals relative to fixed (now low) yield asset classes.

The new presidential administration will still have to solve trade and social problems. The need for increased government spending will not diminish given the unstable economic situation. Janet Yellen will take over as Treasury Secretary, and Jerome Powell will continue to head the Fed. This means that the two proponents of growing deficits will have the opportunity to do whatever is necessary to implement their views.

We have created three hypothetical scenarios and a corresponding number of gold price forecasts for 2021, taking into account these sources of instability. We have outlined trading ranges, likelihood of scenarios occurring and relevant factors for each. Forecasts represent possible trading ranges for the gold rate for the entire period, not at the end of the year.

Scenario one: pessimistic. Trading range: $1600-1800 per ounce. Probability: 20%.

What needs to happen to make this scenario a reality? This hypothetical scenario involves a sudden reversal of positive economic trends in China and the rest of the developing world. New waves of the pandemic may hit them, so the authorities will have to introduce large-scale quarantine restrictions. Economic recovery will stall. Jewelry demand for gold will not grow.

At the same time, the development of safe and effective vaccines will accelerate in the United States and Western Europe. Effective mechanisms for their distribution will appear. Vaccines will become available in industrialized countries, leading to the rapid establishment of herd immunity. In these regions, quarantine restrictions will be lifted, and economic activity will recover. Stock market indices will reach new record highs as economic recovery accelerates in developed countries. There will be a sharp rise in the yield curve coupled with a rebound in the dollar's appreciation.

In a pessimistic scenario, the gold rate may decline due to a decrease in investment demand and the demand for protective assets in the West. In Asia and other emerging markets, jewelry demand will not recover. Steady GDP growth in the West is offsetting declining investment demand thanks to rising jewelry sales. However, without the restoration of jewelry demand in developing countries, its global volume will be below average, which will reduce the exchange rate of gold.

Scenario two: basic. Trading range: $1800-2000 per ounce. Probability: 40%.

This scenario does not imply significant changes compared to current conditions and trends. The pace of economic recovery in developing countries will be slow. Jewelry demand for gold will be low. Emerging market central banks may end their 10-year bullion buying trend as the US currency becomes less likely to depreciate.

Quarantine and mask regime will only partially help stop the spread of coronavirus in the United States and Western Europe. According to a recent Pew Research poll, nearly half of US respondents would refrain from getting vaccinated even if vaccines are available. Therefore, herd immunity will not appear quickly.

Thus, the economic recovery in industrialized countries, signs of which appeared in the third quarter, will be slow. Consequently, a significant increase in jewelry demand is not expected. The American currency will remain at the same level or weaken slightly. The real yield on Treasuries will be negative because the inflation rate will exceed its nominal yield. Investment demand for gold may suffer as the economy recovers.

Scenario three: optimistic. Trading range: $2000-2300 per ounce. Probability: 40%

This hypothetical scenario implies geographical unevenness in the global economic recovery. Continuation of current positive trends in developing countries could lead to a significant recovery in economic activity in several regions, with China leading the way. As a result of rising prosperity, jewelry demand will increase. Emerging market central banks may resume their 10-year bullion buying trend despite net sales in the third quarter of 2021.

It is expected that the US and Western Europe will have problems resuming economic activity due to the need to introduce new quarantine restrictions. The Biden administration's policies (better fight against the pandemic, economic stimulus, universal health care, combating climate change) will increase the budget deficit, weaken the dollar and increase fears of soaring inflation. Demand for gold will increase under this scenario.

Forecast for 2021

The likelihood of the pessimistic scenario being realized is low, given the current circumstances. Most likely, we should expect something in between the base and optimistic scenarios. The economy will slowly recover, but at the same time a “new normal” will emerge with greater volatility in all financial markets. The yellow metal functions as a diversification tool, which means it will help investors preserve capital in unstable conditions.

So, based on the above probability indicators, gold has a better chance of rising in price.

Opinions of various experts

Jason Hamlin, an analyst representing Goldstockbull, believes that the gold price could reach $3,000 in 2021. The expert is confident that this is a completely expected and healthy movement. In his calculations, the analyst cites graphs of gold price growth over the past years.

If you look at them, you can see that in the period from 2006, in just 10 years, the price of gold was able to increase from 250 to 1,920 dollars. Thus, the price increase was as much as 660%. The increase in quotations occurred despite not the most favorable events in Russia and around the world over these years. The crises also did not have a significant impact on the price of the precious metal.

Analysts at the Golden Reserve portal consider Hamlin’s forecast to be somewhat aggressive and overly optimistic. But they are also positive and are looking at the $1,900 level in 2021.

Citi Research analysts are confident that gold may exceed its maximum over the next year and a half. They consider such a scenario possible, since investors will try in every possible way to reinsure themselves against risks. Actions taken by central banks will also contribute to strengthening the price of gold. Experts call the price at $2,000 per ounce in 2021.

On a note! Benefit for the birth of a child in 2021

Key reasons for the optimistic forecast

Financial markets are not experiencing the best of times right now. It is not yet clear what the prospects for the global economy will be, but the central banks of many countries have already lowered key deposit rates. This forces investors to look for safer assets, and they pay attention, first of all, to gold. All events taking place in the global economy today promise an increase in gold prices in the future.

On a note! In times of economic turmoil, gold is almost always perceived as the most reliable means of saving available money.

Bond yields have already fallen as interest rates have fallen. All this makes us wonder whether inflation will increase in the foreseeable future. If this happens, which is likely, the value of all other assets will decline, while gold will become attractive to buy.

The basis for strengthening the potential of gold is the financial policy of the Federal Reserve. Data have already been published, according to which supporting measures regarding the precious metal have been announced.

The average price of gold, according to experts at Citi Research, may be $1,640-1,660 per ounce in 2021. In 2021, average gold prices could reach $1,925 per ounce. It turns out that the precious metal can break through its historical maximum, recorded in 2011. All this information is reflected in the table:

| Forecast in 2021 | Gold price per ounce, in dollars |

| Optimistic | 3,000 or more |

| Neutral | 2 000 |

| Average prices | 1 925 |

Gold price forecast for 2021, 2022, 2023, 2024 and 2025

| Month | Start | Min-Max | End | Months,% | Total,% |

| 2021 | |||||

| Mar | 1722 | 1625-1738 | 1650 | -4.2% | -4.2% |

| Apr | 1650 | 1557-1650 | 1581 | -4.2% | -8.2% |

| May | 1581 | 1461-1581 | 1483 | -6.2% | -13.9% |

| Jun | 1483 | 1438-1483 | 1460 | -1.6% | -15.2% |

| Jul | 1460 | 1460-1546 | 1523 | 4.3% | -11.6% |

| Aug | 1523 | 1448-1523 | 1470 | -3.5% | -14.6% |

| Sep | 1470 | 1427-1471 | 1449 | -1.4% | -15.9% |

| Oct | 1449 | 1380-1449 | 1401 | -3.3% | -18.6% |

| But I | 1401 | 1379-1421 | 1400 | -0.1% | -18.7% |

| Dec | 1400 | 1400-1509 | 1487 | 6.2% | -13.6% |

| 2022 | |||||

| Jan | 1487 | 1487-1546 | 1523 | 2.4% | -11.6% |

| Feb | 1523 | 1523-1581 | 1558 | 2.3% | -9.5% |

| Mar | 1558 | 1558-1680 | 1655 | 6.2% | -3.9% |

| Apr | 1655 | 1632-1682 | 1657 | 0.1% | -3.8% |

| May | 1657 | 1631-1681 | 1656 | -0.1% | -3.8% |

| Jun | 1656 | 1656-1760 | 1734 | 4.7% | 0.7% |

| Jul | 1734 | 1734-1813 | 1786 | 3.0% | 3.7% |

| Aug | 1786 | 1702-1786 | 1728 | -3.2% | 0.3% |

| Sep | 1728 | 1728-1804 | 1777 | 2.8% | 3.2% |

| Oct | 1777 | 1702-1777 | 1728 | -2.8% | 0.3% |

| But I | 1728 | 1728-1863 | 1835 | 6.2% | 6.6% |

| Dec | 1835 | 1835-1914 | 1886 | 2.8% | 9.5% |

| 2023 | |||||

| Jan | 1886 | 1886-2030 | 2000 | 6.0% | 16.1% |

| Feb | 2000 | 2000-2066 | 2035 | 1.8% | 18.2% |

| Mar | 2035 | 2001-2061 | 2031 | -0.2% | 17.9% |

| Month | Start | Min-Max | End | Months,% | Total,% |

| 2023 Continued | |||||

| Apr | 2031 | 1992-2052 | 2022 | -0.4% | 17.4% |

| May | 2022 | 1952-2022 | 1982 | -2.0% | 15.1% |

| Jun | 1982 | 1982-2072 | 2041 | 3.0% | 18.5% |

| Jul | 2041 | 2041-2169 | 2137 | 4.7% | 24.1% |

| Aug | 2137 | 2089-2153 | 2121 | -0.7% | 23.2% |

| Sep | 2121 | 2121-2233 | 2200 | 3.7% | 27.8% |

| Oct | 2200 | 2143-2209 | 2176 | -1.1% | 26.4% |

| But I | 2176 | 2055-2176 | 2086 | -4.1% | 21.1% |

| Dec | 2086 | 1969-2086 | 1999 | -4.2% | 16.1% |

| 2024 | |||||

| Jan | 1999 | 1940-2000 | 1970 | -1.5% | 14.4% |

| Feb | 1970 | 1931-1989 | 1960 | -0.5% | 13.8% |

| Mar | 1960 | 1918-1976 | 1947 | -0.7% | 13.1% |

| Apr | 1947 | 1947-2035 | 2005 | 3.0% | 16.4% |

| May | 2005 | 2005-2084 | 2053 | 2.4% | 19.2% |

| Jun | 2053 | 2012-2074 | 2043 | -0.5% | 18.6% |

| Jul | 2043 | 2016-2078 | 2047 | 0.2% | 18.9% |

| Aug | 2047 | 1941-2047 | 1971 | -3.7% | 14.5% |

| Sep | 1971 | 1971-2091 | 2060 | 4.5% | 19.6% |

| Oct | 2060 | 2060-2139 | 2107 | 2.3% | 22.4% |

| But I | 2107 | 2033-2107 | 2064 | -2.0% | 19.9% |

| Dec | 2064 | 2047-2109 | 2078 | 0.7% | 20.7% |

| 2025 | |||||

| Jan | 2078 | 2064-2126 | 2095 | 0.8% | 21.7% |

| Feb | 2095 | 2064-2126 | 2095 | 0.0% | 21.7% |

| Mar | 2095 | 2095-2187 | 2155 | 2.9% | 25.1% |

| Apr | 2155 | 2155-2303 | 2269 | 5.3% | 31.8% |

Gold price for March 2021 . At the beginning of the month, $1,722. The maximum price is 1738, the minimum is 1625. The average price for the month is 1684. The gold price forecast for the end of the month is 1650, change for March -4.2%.

Gold price forecast for April 2021 . At the beginning of the month $1650. The maximum price is 1650, the minimum is 1557. The average price for the month is 1610. The gold price forecast for the end of the month is 1581, change for April -4.2%.

Gold price for May 2021 . At the beginning of the month, $1,581. The maximum price is 1581, the minimum is 1461. The average price for the month is 1527. The gold price forecast for the end of the month is 1483, change for May -6.2%.

Gold price forecast for June 2021 . At the beginning of the month, $1,483. The maximum price is 1483, the minimum is 1438. The average price for the month is 1466. The gold price forecast for the end of the month is 1460, change for June -1.6%.

Gold price for July 2021 . At the beginning of the month, $1,460. Maximum price 1546, minimum 1460. Average price for the month 1497. Gold price forecast at the end of the month 1523, change for July 4.3%.

Euro exchange rate forecast for the month and 2021-2024.

Gold price forecast for August 2021 . At the beginning of the month, $1,523. The maximum price is 1523, the minimum is 1448. The average price for the month is 1491. The gold price forecast for the end of the month is 1470, change for August -3.5%.

Gold price for September 2021 . At the beginning of the month, $1,470. The maximum price is 1471, the minimum is 1427. The average price for the month is 1454. The gold price forecast for the end of the month is 1449, change for September -1.4%.

Gold price forecast for October 2021 . At the beginning of the month, $1,449. The maximum price is 1449, the minimum is 1380. The average price for the month is 1420. The gold price forecast for the end of the month is 1401, change for October -3.3%.

Gold price for November 2021 . At the beginning of the month 1401 dollars. The maximum price is 1421, the minimum is 1379. The average price for the month is 1400. The gold price forecast at the end of the month is 1400, change for November -0.1%.

Gold price forecast for December 2021 . At the beginning of the month, $1,400. Maximum price 1509, minimum 1400. Average price for the month 1449. Gold price forecast at the end of the month 1487, change for December 6.2%.

Gold price for January 2022 . At the beginning of the month, $1,487. Maximum price 1546, minimum 1487. Average price for the month 1511. Gold price forecast at the end of the month 1523, change for January 2.4%.

Gold price forecast for February 2022 . At the beginning of the month, $1,523. The maximum price is 1581, the minimum is 1523. The average price for the month is 1546. The gold price forecast for the end of the month is 1558, change for February 2.3%.

Gold price for March 2022 . At the beginning of the month, $1,558. The maximum price is 1680, the minimum is 1558. The average price for the month is 1613. The gold price forecast for the end of the month is 1655, the change for March is 6.2%.

Gold price forecast until 2025

Gold quotes are rising in value not only because of the weak economic situation in the world and geopolitical events, according to the analytical company SNL Metals & Mining. In 2021, in their opinion, the peak of the discovery of new deposits will be reached. From now on, global production will decline. SNL Metals & Mining analysts are confident that the production of the precious metal will decrease by 1/3 times until 2025. This will undoubtedly raise the price of gold.

The largest gold mining company in Russia. Dividends for the first half of 2021 amounted to 21.7 billion rubles or 163.55 rubles. for an ordinary share, follows from the financial report of the organization.

The next crisis could be triggered by high levels of corporate debt and latent trade conflicts that have become open, says Jason Hamlin. The expert believes that if the bull cycle brings gold the same growth as from the low in 2015, then by 2025 the price per troy ounce will be $7,980.

Even if we only estimate a move that is half the size of the last major cycle, we are targeting a price of $4,000 by the end of 2025.

Jason Hamlin

Leading specialists in the gold and foreign exchange market believe that the time has come to invest in gold. This applies not only to big players, but also to ordinary people.

What other events could affect the precious metal?

Compensation for the increase in demand for gold as a protective asset may occur due to the strengthening of the dollar. As a result, the precious metal will become more expensive for buyers who have other national currencies. At the same time, demand for jewelry and metal may decrease. First of all, this will affect countries, such as China and India, where the most stringent quarantine measures are observed.

In the event of another fall in financial markets, prices may decline. This will force investors to re-sell the most liquid assets, such as gold, to avoid running out of money. If this happens, there may be a short-term decline in gold prices to $1,500 per ounce. But if such a phenomenon occurs, it will not be for more than a few blocks. Further, precious metals will rise in price again even in this situation.

If you study the latest news from the precious metals market, gold is now at the stage of a slight decline, which changes to a period of leveling off and slight growth. Meanwhile, around the world there is a frantic increase in purchases of gold coins, although they are now far from cheap.

However, experts recommend paying attention specifically to bullion and unallocated metal accounts, as they find them to be a universal investment tool.

TIAA Bank expert K. Gaffney says that regardless of the pace of economic recovery after the crisis, he is confident that gold prices will rise. The demand for this precious metal will continue during those periods when we can talk about a gradual restoration of the economies of states.

Results

- Most experts and financial analysts unanimously say that gold prices will rise.

- In the current crisis conditions, they find the national currencies of states to be a more vulnerable asset than the precious metal.

- Experts indicate different values for the cost of gold per ounce, but the average figure is about $1,900-2,000 per ounce.

The preciousness of the metal: are we in for an “eternal” rise in prices for raw materials?

The increase in prices on the world market for all types of raw materials, including oil, metals and food, has become impossible to ignore. Analysts around the world are warning of the onset of a “super cycle”, when raw materials of almost all types will become more expensive for many years, perhaps even decades. For Russia, this means accelerated economic growth and increased budget revenues - but also the problem of inflation, which is becoming increasingly noticeable. On the other hand, there are suspicions that this time there are no fundamental factors behind the rise in prices for all raw materials and they will soon begin to collapse. Is there a period of commodity growth awaiting us? - in the material of Izvestia.

This week it became known that inflation in the United States reached a record level for almost a decade and a half - 4.2% on an annualized basis. The reasons for the price increase were varied, from bottlenecks in the production of a number of goods to the rebound of some industries (for example, air travel) after falling during the coronavirus crisis and the corresponding fall in prices. However, consumer inflation was, among other things, directly related to a much faster rise in commodity prices, which affected all sectors of the economy. Which once again confirmed the hypothesis about the formation of a new raw materials supercycle in the early 2020s.

What is a supercycle? The term was coined at the end of the last decade by researchers Bilge Erten and José Antonio Ocampo, who tracked the phenomenon of prolonged and powerful increases in metal prices in the 1990s and 2000s. They came to the conclusion that such periods had already happened in the past and they were subject to certain general patterns. As a rule, supercycles were launched during periods of rapid economic growth, when a growing industry and consumer sector demanded more and more resources.

Jewel

Photo: IZVESTIA/Konstantin Kokoshkin

The drain is almost counted: the United States is ready to cede global leadership to China

Will the Biden administration be able to stop the economic crisis?

The first such period began in the 1890s following widespread industrialization in the United States. For several years, commodity prices have risen by more than 10% annually. The peak came in 1917 against the backdrop of an extreme expansion of military orders. The second and third periods were associated with World War II, post-war economic recovery, and the rapid economic growth of the 1960s and 1970s. At the end of this period, the overall growth in demand was also compounded by the oil crisis associated with the 1973 OPEC embargo.

Finally, the last period started towards the end of the 1990s. The main impetus for it was given by the economic growth of China, and then of India and other developing countries. By 2008, price records for oil, natural gas, iron ore, aluminum, wheat and many other commodity items had been updated. The crisis of that time only temporarily brought down all these prices, after which they remained at very high levels for several years. The fourth supercycle was brought to an end by the collapse of oil prices and general stagnation that began in 2014.

At the beginning of 2021, prices in the world collapsed on everything: almost all types of securities, real estate and any other assets. Of course, this collapse did not spare raw materials. Oil prices reached negative levels in certain regions last April. Almost all metals have rapidly fallen in price: aluminum lost more than 20% of its value from December 2019 to May 2021. Investors sold everything, preparing for a prolonged depression.

Despite harvests: why rising food prices have spread throughout the world

Excess liquidity and excessive hoarding have become the main causes of the food crisis

But it soon became clear that the decline in the economy, although extremely deep, did not last too long. China was the first to emerge from its “coma” by the middle of the year, and by the fall other major economies began to catch up. It turned out that trillions of helicopter dollars thrown into the financial system and the real sector could quite mitigate even the most severe collapse. To which, at the beginning of 2021, was added a relatively successful vaccination program.

As a result, prices soared throughout the commodity market. Oil prices have risen two and a half times, touching the $70 mark, which no one could have imagined a year ago. Iron ore has almost tripled, far exceeding the pre-crisis level and even breaking the seemingly eternal record of 2008 ($230 per ton versus 195). Aluminum has risen from $1,400 to $2,600 since May last year, setting a 10-year high.

The situation in the food market is even worse. Wheat prices rose by 50% over the year, corn by 130% (2.3 times), pork and poultry by 60–70%. Let us note that food products did not become much cheaper even at the height of the crisis (covid is covid, but you always want to eat), so there is no need to talk about the low base effect. Coffee, palm oil, sugar have risen in price significantly - it is extremely difficult to find a product where there has not been a colossal rise in prices.

A gift from overseas: how Biden's trillions will help the global economy

The short-term gain, however, threatens to turn into a severe hangover for both the US and the entire global market.

Thus, we are not talking about a rise in prices in any particular sector, which could be caused by industry conditions. Everything is becoming more expensive. This is what gave rise to some analysts, for example, at the world's largest investment bank Goldman Sachs, to talk about the beginning of a new super cycle.

The arguments in favor of this scenario are as follows. Firstly, numerous economic stimulus programs also imply an increase in infrastructure spending (see plans of US President Joe Biden, etc.). Secondly, the “green” program of “decarbonization” of the economy, that is, the replacement of traditional energy sources with renewable ones, is in full swing. And this requires trillions of dollars in investments in energy networks, generating capacity and other infrastructure. Storing renewable energy will likely require dozens of factories like Elon Musk's battery gigafactory. To do this, you need consumables and primarily metals like copper and aluminum.

Finally, more distributional economic policies in leading countries should lead to increased spending by poor households. And their consumption, as a rule, is more “resource-intensive,” according to economists. And this means that the demand for raw materials will inevitably continue to grow.

Jewel

Photo: IZVESTIA/Dmitry Korotaev

Paradoxically, in this case, the winners are countries that in some places were considered unpromising due to the raw material structure of the economy. For example, in Russia, the world’s transition to a “green” economy, in theory, threatened a drop in demand for oil and, accordingly, an economic recession. However, if the supercycle theory predicts events correctly, then the possible shortfall in oil revenues (which, by the way, is not going to fall anywhere yet) can be more than compensated for by other sectors. Now metals, wood and food make up almost a third of the country's exports. If prices continue to rise (and any supercycle is characterized by a prolonged rise in prices), then this share will increase further. Countries such as Australia, Canada and South Africa will also be big winners, while developing economies that rely on low- and medium-tech manufacturing without sufficient domestic natural resources, such as India, will lose out.

Get into the top five: analysts predicted inflation at the end of the year

It will be kept at the level of 4.85% by the Central Bank’s return to a neutral monetary policy

The negative side of this phenomenon will be inevitably high inflation. It will also affect the producers of raw materials themselves, as we see now in the example of the domestic food market. At the same time, export bans in the long term only risk destabilizing the industry, but not solving the problem of inflation once and for all.

At the same time, skeptics believe that it is too early to talk about the emergence of a supercycle. The last year has been a period of unprecedented pumping of money into the financial system around the world. In the United States alone, and only through fiscal policy, about $6 trillion was injected—a third of the country’s GDP. If we take into account monetary easing in Europe, Asia and other regions, the amount will increase significantly. It is not surprising that this was followed by a boom in the financial markets, which led to a rise in commodity futures - mostly speculative. However, sooner or later this policy will be at least partially curtailed, which will lead to a strong correction.

Secondly, the increase in prices for raw materials (as well as other products) can be explained, among other things, by difficulties in global trade, for example, a shortage of containers, or simply insufficient production volumes due to lockdowns and other problems. Until now, these difficulties have not been properly resolved, which may keep prices high for some time - but not forever.

Ultimately, the current supercycle lacks a clear growth engine. In the 1990s and 2000s, it was China, without which the world economy would have looked much paler. Now the PRC remains a major factor in global demand, but, firstly, its growth rate has slowed down significantly (to 5–6%, and probably even stronger in the future), and secondly, China’s growth is becoming more intense and less resource-intensive. Who can replace China in this role? India, according to the general belief, is not yet ready for such a role. As for the United States, even if large-scale infrastructure replacement plans are implemented, the effect on the global economy will still not be as powerful as it was 20 years ago in East Asia.