Investment greetings, friends! In order to make smart investments, you need to understand what real return you can expect. This way you can understand whether the financial instrument offered to you will be profitable, what its risks are, what share to allocate to it in your portfolio, etc. Otherwise, it may turn out that all the money will be invested in a “super profitable” instrument, which in the end will not be so profitable, or it will have high risks that no one told you about, or there will be scammers behind it.

Algorithm for calculating the yield of the Central Bank

When calculating profitability, do not forget about time - the reporting period during which the trading result was recorded. For example, 50% of the profit could be earned in a week, month, quarter or year.

It is best to calculate the statistics of your exchange activities in relation to a universal time unit - the calendar year. On the one hand, this allows you to smooth out abnormal fluctuations in profits (or losses) on individual transactions. On the other hand, a novice investor who has been in the market for a year has passed some kind of test, and his results are trustworthy.

Stock returns: can you beat the index?

Investors in an era of falling rates usually shift from bonds and deposits to stocks or corporate bonds. This is where an exciting game begins called “beat the index and show what a cool investor you are.” But is it possible to beat the index over the long term?

In short, no. There are several reasons:

- trading is a game with a negative mathematical expectation due to commissions and taxes;

- indices are more resistant to crises due to their competent diversification;

- The index includes the most liquid, stable and promising stocks, which generally grow along with the market (and traders will trade on them in any case).

But in general, you can compare your investing success with an index. For example, the historical average annual return of the S&P500 index over the past 50 years is about 9.7% - i.e. That's about how much American stocks grow per year. Taking into account crises and reinvestment of dividends.

The return on the MICEX index (Moscow Exchange) is approximately 16% per year. These are data taking into account crises, when returns were negative, and taking into account the reinvestment of dividends, i.e. taking into account compound interest.

Therefore, when investing in American stocks, it is fair to expect a return of 9-10%, and in Russian ones - 16%. In the European market, the average return on the stock market is 8-12% depending on the country, i.e. approximately at a level slightly higher than the American one.

But these are broad market indices. Narrower indices, such as the Dow 30, which takes into account the quotations of 30 US industrial giants, or the Euro Stoxx 50, which includes the 50 largest companies in Europe, can show both higher and lower values.

However, the returns of hedge and mutual funds, as well as individual investors, are still usually compared with the broad market index. If the fund is highly specialized, then its benchmark is the corresponding index, and here its profitability should be compared not with the broad market, but with part of it.

Thus, understanding how much you can actually earn on the stock market will protect you from scammers who promise returns of 25-50% per annum in rubles or 20% in foreign currency.

But some exceptional individuals can outperform these indicators.

Types of yield of the Central Bank

The most widespread in the market are 3 types of security returns:

- speculative income (the result of the purchase and sale of an asset);

- dividend;

- coupon (typical for bondholders).

Bonds can be issued without coupon payments. In this case, the investor's profit consists of a discount - the difference between the nominal value and the actual price at which the financial asset was purchased.

The types are listed in descending order of potential profit and risk.

How scammers take advantage of the gullibility of novice investors

But I want to earn above the market. After all, no one wants to receive a pitiful 4-5% per annum on the US stock market or 3-4% on the European market. Give us 20% in foreign currency! Or better yet, 50%! And it’s better not per year, but per month, so that you can triple or quintuple your investments in a year!

Fraudsters take advantage of this by offering “investments” in various dubious projects. In fact, they do not invest money either in the stock market, or in cryptocurrency, or in startups, or in any “unique” bonds - but operate according to a banal financial pyramid scheme, when payments to previous “investors” come from contributions from outside newcomers.

Financial pyramids can be distinguished from real investment projects by the following aggregate characteristics:

- the promise of unrealistic returns - from 15-20% in foreign currency and from 30-35% in rubles per year, or even per month;

- lack of real documents on the company’s activities on the company’s websites – audit reports, charter, investment declaration, etc.;

- presenting colorful presentations and videos instead of real reports;

- lack of information about the fund’s infrastructure, its founders, key figures, shareholders, etc.;

- offshore registration;

- aggressive marketing.

The creators of financial pyramids play on people's fear and greed. On their websites they promise huge returns “without any risk” and encourage people to invest – they say, such a chance only comes once in a lifetime.

In fact, such scammers rely on people’s illiteracy and count on extorting small amounts, because of which no one will chase them. But the chicken pecks every grain... Read more about how to distinguish a real investment company from a hype company here.

If you encounter such a company, then ask yourself a few questions:

- If these investors have found such a “Grail,” then why don’t they take out loans from a bank at a lower interest rate and spend money according to this scheme on their own, but look for some private investors who also need to be paid a reward?

- Why don’t the names of these “experts” appear in the Forbes column and in the business press in general - after all, if some fund consistently makes even a “measly” 10-15% per annum in dollars, then this is a very cool fund?

- Why is the fund manager looking for private investors, and not offering his scheme to banks and large funds, because with their capital it is much easier to “raise money”?

If some project or some company offers you a return that is more than 3 times higher than the risk-free rate of return, then you have either a very risky instrument without diversification that may default, or outright scammers who are attracting money to the pyramid.

So, if you came to the stock market expecting to outperform the index and outshine Buffett, I will disappoint you. Only real professionals can make more than 20% per annum in Russian and more than 10-12% per annum in foreign ones. Beginners can count on returns 1.5-2 times higher than risk-free, i.e. 12-16% on the Russian and 5-8% on the Western market. It is more than possible to achieve these figures even with a small capital through proper selection of assets and proper diversification. And everything else is from the evil one. Good luck, and may the money be with you!

Rate this article

[Total votes: 1 Average rating: 5]

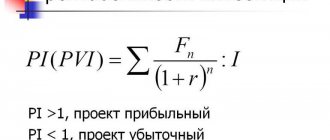

Calculation formula

Let's assume that on January 1, 2021, the investor had 100,000 rubles. During the year, he invested in various trading instruments, closed transactions, recording local profits and losses on them. As of December 31, 2021, his deposit amounted to 134,000 rubles. The profitability of our lucky player is calculated as follows: (134,000 – 100,000)/100,000 = 0.34, or 34 percent per annum!

If on December 31, part of his funds is “in papers,” that is, he bought, but did not sell at the end of the reporting period, then the profitability can be calculated taking into account the current market prices of these instruments.

How much do investment gurus earn?

We are talking about real gurus in the world of investments - experienced players in the stock market, whose actions have earned respect and respect from other participants. First of all, about Warren Buffett, who currently ranks 3rd in Forbes and is the first dollar billionaire who made his fortune solely on investments (and not an industrialist, like, for example, Bill Gates or Elon Musk).

And here’s another interesting article: What is a stock ticker: definition and examples

Buffett has been repeatedly recognized as the best investor of the 20th century, and for good reason. The average annual return of his company, Berkshire Hathaway, is 20.5% per annum. In dollars, guys. This is the best indicator in the entire history of mankind. It is 2 times faster than the S&P500 index.

You need to understand that Buffett does not carry out all the transactions himself - the best analysts and traders work in his fund, he receives insider information from all over the world, has the ability to buy companies with small capitalization and resell them after “pumping up”. All these opportunities are not available not only to private investors, but also to most large hedge fund managers. Do you want to overtake the index yourself, from home? It doesn't happen that way