Currencies are quite a complex substance for human perception, but in fact, everything is easy and simple.

If you try to answer the question simply and quickly, then the dollar is not more expensive than the ruble. And although at first glance it may seem strange. But we have fingers, and on our fingers you will now find out why this is so.

Why exchange rubles for dollars and euros?

In Russia, all payments are made in rubles, so there would seem to be no need to transfer your savings into foreign currencies. However, there are certain reasons for the public to convert. There may be several goals, depending on this, it is worth deciding when and what currency to buy.

Before traveling abroad

As a rule, when going on vacation, few people take rubles with them; people prefer to exchange money for euros or dollars and then exchange them again for the national currency. Let’s say right away that such double conversion is unprofitable, because we pay commissions and remuneration to banks for transactions twice.

You can consider this option: do not change money, but pay with a card everywhere. Then the conversion to the currency of the host country will be automatic. But this method is not suitable for all countries; in some places they still prefer to deal with cash.

If you need currency to travel abroad, it is better to worry about this issue in advance. Since the exchange rate is not constant, you can guess the moment when it is most profitable to make an exchange. On the Internet you can find information about which banks offer the most favorable rates. If you plan to buy from a thousand dollars or euros, then you will be offered more favorable conditions.

Another interesting option that banks offer today for traveling clients is the issuance of multi-currency debit cards.

For example, Tinkoff Bank offers such a service. Its essence is that the client can open several accounts in different currencies (up to 30) and link his card to them. Abroad, you can immediately pay in the country’s currency without losing on conversion.

The downside of the card is that linking to a foreign account is done manually through your personal account. This requires access to the Internet, which can be expensive abroad. And in order to return unspent money into rubles, conversion will be applied.

For investment purposes

There may be high-risk transactions for the sale and purchase of currencies and less risky ones. The first includes playing on the international Forex market. But this method is only suitable for professionals and those who understand the global economy. If this does not apply to you, it is better to entrust your money to an experienced trader. But in this case we are talking about free amounts that you, as an investor, are willing to risk.

If you are interested in guarantees, it is best to choose less risky methods. It is best to buy currencies for a long time. The thing is that the exchange rate of the euro and dollar to the ruble changes every day. But if we consider the long-term perspective, over the past 10 years both currencies have consistently strengthened against the ruble. Therefore, such an investment will be profitable if we consider the prospects for years to come.

All these years the account can be replenished. In this case, it is not so important what currency you store your money in, since the exchange rate of the ruble against it changes in one direction, but with different intensity.

In order to save money

If you have no desire to take risks, but want to protect your money from inflation, then it is best to do as experts advise, namely: diversify your capital. That is, divide all savings into three parts and store them in different currencies. The proportion could be as follows: 40% - rubles, 30% - dollars, 30% - euros.

Why does this method work? It will save you a lot of money. If one currency falls, the other will rise in value, and you will not suffer significant losses. It is best to keep all your money in a bank in deposits or savings accounts.

Why has the ruble become so cheap relative to other world currencies?

2020 has become a critical year for many world economies, including Russia. The already not very stable ruble could not withstand the quarantine load, causing a real currency swing.

The exchange rate depends on many factors, and unfortunately, today all of them are not in favor of the ruble.

Russia simultaneously faced difficulties in the external and internal arena, which were aggravated by the global pandemic. As a result, it became impossible to maintain a floating course in a certain corridor.

Currently, the ruble exchange rate is negatively affected by several factors:

- complex geopolitical situation and a wide list of sanctions, which continues to expand;

- decline in oil prices (Brent alone has fallen by 11% over the past year);

- falling demand for government bonds;

- deficit of the reserve fund after the crisis of 2014 – 2021;

- The coronavirus pandemic, which stopped many productions and reduced tax revenues to the treasury;

- decreased interest of foreign investors against the backdrop of general instability;

- a sharp strengthening of the dollar due to increased demand, creating a shortage of currency.

The ruble is now in an acute phase of decline, which may last for several more months.

As soon as the current situation becomes unfavorable for the Central Bank, the financial authorities will direct all their efforts to curb the exchange rate. In the meantime, due to the sharp weakening, the Ministry of Finance is intensively replenishing assets.

When is the best time to buy euros and dollars?

There is no definite answer to this question, because the exchange rate is constantly fluctuating. Buy when you have the opportunity. It is better to make a purchase transaction of 1000 euros or dollars, because in this case the exchange rate will be more profitable.

Analysts are noticing some seasonal fluctuations. Currencies begin to rise in price at the beginning of the holiday season; as a rule, from May to August it is less profitable to buy them. But after the New Year, rates go down a little, this is due to the payment of New Year bonuses to employees and dividends on shares to the owners of the largest companies.

Import-export ratio

In addition to the fact that the Russian currency has always had a low price, the ratio of imports and exports in our country has always been incomparable. It is known that the country that produces more goods and sells them for export is more attractive to investors; its products and currency are in demand.

Russia, on the contrary, sells practically nothing except hydrocarbons. But imports occur almost everywhere, from food to high technology. Since there is no demand for Russian goods, it means that there is no attractiveness for investing in the Russian economy and currency.

Loan without refusal Loan with arrearsUrgently with your passportLoans at 0%Work in Yandex.TaxiYandex.Food courier up to 3,400 rubles/day!

If a country imports goods and services, it accordingly buys the currency of the importing country, and thereby creates demand for it. At the same time, the exchange rate of own money weakens. Thus, if export volumes are less than import volumes, then the currency weakens, and if vice versa, it strengthens.

What affects exchange rates?

There are a lot of different economic factors that can bring down currency markets, these include the publication of various data by the central banks of countries, reports of international companies and speeches of top officials of countries. But if you do not understand the economic situation in the world, then it is almost impossible to predict your actions under the influence of this news.

Speaking about the Russian ruble, it is worth noting that it is most dependent on the following factors:

- prices for raw materials

, oil, gas and others - our country sells them abroad, and therefore Russia benefits when the ruble becomes cheaper relative to the dollar and euro; - the policy of the Central Bank of the Russian Federation

, which can establish a so-called currency corridor; it artificially keeps the ruble exchange rate within a certain range; - refinancing rate

, which is also set by the Central Bank. With it, he regulates the number of rubles in free circulation. The higher the rate, the more expensive Russian money becomes. It is more profitable for people to place free funds on deposits, and loans, on the contrary, become less profitable. The exchange rate of the ruble against other currencies is growing; - foreign trade balance

- the more foreign goods enter our country, the more foreign currency and the lower the ruble exchange rate. Due to the introduction of sanctions, the number of transactions with foreign goods has decreased.

Predicting the ruble exchange rate in Russia is very difficult, since it largely depends on the actions of the regulator - the Central Bank. This is partly why it is recommended to divide your savings and store them in different currencies.

Why does the dollar rise and fall?

We continue to explain the relationship between the dollar and the ruble. At the beginning of the article, we talked about why the dollar is more expensive than the ruble and found out that this is not so.

After all, if you look at life in Russia through the eyes of a Russian, and at life in the USA through the eyes of an American, then the citizens of both countries have approximately the same standard of living, because the salary is just enough to pay for housing, utilities, buy clothes, medicine, pay for school, etc. .d.

However, when salaries in Russia are compared with salaries in the United States, they do not take into account the costs of all this. Then, of course, it turns out that the salary is $3,000, which in Russia is the salary level of a deputy. Therefore, you can't compare like that. The money ratio is only beneficial if you have a business in the USA and live in Russia. If you live in the USA, receive a salary and spend it there, then the dollar becomes less attractive.

Well, let's move on to the question, why does the dollar rise and fall? In simple terms, the price per dollar reflects the quantity of goods that are brought to Russia for dollars. For example, many goods in Russia are imported from China: clothing, household appliances, tools, household chemicals, etc. If dollars are rising, then there are a lot of goods in Russia from abroad.

Can the dollar fall to 30 rubles?

Currently, the country is actively pursuing a trend toward import substitution. Over time, this can lower the price of the dollar, devaluing it altogether. Therefore, if you, for example, are betting on the development of the Russian economy, it is better to get rid of the dollar, otherwise it will damage your savings. Although the dollar may still rise for some time. Read also what will happen to the ruble exchange rate in the near future.

It all depends on the activity of citizens. If people work for the benefit of the State, stop freeloading, and stop thinking about how to get their hands on something somewhere and take it home, then there will be growth in the country.

By the way, precisely because in Russia people strive to get more than they can do, this leads the economy into decline and makes the country dependent on goods from other countries. And if the population were ready to work hard, then everything would flourish here. But it’s easier for everyone to fold their hands and wait until they get an exorbitantly expensive hamburger instead of Russian dumplings or borscht. So far this is the mentality. Although lately there has been a certain rise:

- In the store you can often find products made in Russia.

- Many cotton products are already made in Russia, in St. Petersburg and Moscow factories, as well as in other regions.

- The automobile industry is gradually replacing imported cars. People are switching to domestic ones.

- People are starting to choose holidays on their coast. They stop traveling abroad, leaving their money there, sponsoring the economies of other states.

- Education is also expanding its boundaries. Foreigners from different countries are already coming to our universities, giving preference to our education.

- Housing construction is rising to the top. A lot of apartments and commercial real estate are being built in Russia, especially in big cities. This is an indicator of a growing economy. In countries where belts really need to be tightened, there is no housing construction at all.

- Vast territories make it possible to build new factories and factories in Russia. In addition, in Russia there are programs under which in the Far East you can receive a free hectare of land from the State.

And, by the way, a lot of things grow in this territory too. All that distinguishes these territories from the European part of Russia is cold, snowy winters, yes, but not much. But summer, most surprisingly, is approaching other regions. It is also warm from June to August. Therefore, you just need to lift your butt off the couch and start doing something.

Really do something, and then everything will prosper. After all, whoever asks less questions and does something, the better the life around him becomes.

Can the dollar rise to 100 rubles?

Continuing the topic of why the dollar rises and falls, we can say that it depends only on the activity of people whether the dollar will be expensive or its influence will fade away. Nevertheless, there is a tendency that a dollar can cost 100 rubles. Everything is possible. But you need to look at everything with real eyes.

The more domestic production there is in Russia, the faster the country's economy will grow, and the ruble will become a world currency, because other countries will turn to Russia for financial support and lending.

And the price of the dollar jumps because every day on the world market the prices in dollars for those goods that are purchased abroad change. The more goods in a country that cost dollars, the more closely you have to monitor their prices.

A dollar may cost 100 rubles if trade turnover in Russia changes completely towards imported products. When even the bread on the store shelves will be from abroad. But so far no turn of events is expected. And in general, this is unlikely. Russia, like any country, strives for independence, which is quite natural. Therefore, it is more likely that a dollar will cost 65 rubles than 100. However, if the issue of savings is relevant for you, then you should definitely monitor any changes and think for yourself.

What conditions do banks offer for deposits in currencies?

If you decide to open deposits in different currencies, it is better to choose reliable, proven banks. Today the state insures household deposits in the amount of up to 1.4 million, but unfortunately, the rule only applies to savings in rubles. That is why the bank must be as reliable as possible. It is best to opt for those that have government. capital, such as Sberbank, VTB, RosAgrikhozBank and some others.

In general, our state is not interested in the population keeping money in foreign currency; this policy is pursued by the Central Bank of the Russian Federation. Therefore, today the interest rate on deposits in euros and dollars is much lower than on ruble deposits. It is only 1.5-2% per annum, while rubles can be invested at 7-9%.

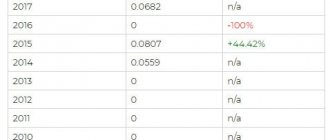

Today, investing in dollars is more profitable than investing in euros. If the rate on the first one can reach 1.8-2%, then the euro can be deposited in a bank at less than 0.5%. But do not forget that with dollars and euros you can get additional income from the exchange rate difference.