Investment idea

RusHydro is one of the largest energy companies in Russia and the world with an installed capacity of 39.4 GW. Hydrogeneration accounts for about 77% of capacity.

We confirm our Buy recommendation and increase our target price from RUB 0.64 to RUB 0.85. Upside 20% in 12 months. The total return could be 20%.

- RusHydro has shown resilience to the crisis and warm winter. Output increased in 1Q 2021 by 19% y/y. Shareholder profit increased by 55% y/y, to RUB 24.7 billion, EBITDA by 27% y/y, to RUB 34.0 billion.

- According to our estimates, the company can achieve a profit of RUB 55 billion in 2021, which implies the payment of a record 2020E dividend of RUB 0.058. with a yield of 8%. Growth factors are an increase in output, including due to new capacities, the introduction of a new CSA facility (Zaramagskaya HPP-1), and improved profitability of thermal power plants. An increase in HYDR prices will also reflect financial income due to a decrease in the forward obligation.

- One of the key growth drivers from this year will be the Far Eastern segment. Large write-offs on fixed assets, which limited investor interest in the HYDR case, should decline this year with the completion of large investment projects in the Far Eastern Federal District. New 5-year tariff decisions for Far Eastern thermal power plants from July this year will improve the profitability of assets. In addition, consumption in the East, where the generating company is introducing new capacities, is growing at a faster pace than in other regions. Over the first 5 months, consumption in the Eastern Energy System increased by 3.5%.

| Stock Key Indicators | |

| Ticker | HYDR |

| ISIN | RU000A0JPKH7 |

| Market capitalization | RUB 321 billion |

| Qty. shares | 433 billion |

| Free float | 19% |

| Animators | |

| LTM P/E | 23,1 |

| P/E 2020E | 6,2 |

| EV/EBITDA LTM | 12,1 |

| EV/EBITDA 2020E | 4,9 |

| DY 2020E | 8% |

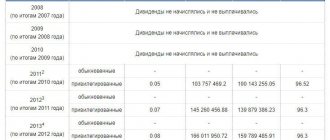

Dividends RusHydro

The company pays shareholders 50% of net profit under IFRS. Previously, there were reports in the press that RusHydro could revise its dividend policy and allocate 50% of its profits under IFRS to dividends, but not less than the average size for the last three years. This is an unofficial version and there is no certainty that this will materialize. Last year, changes in the dividend policy and linking payments to non-cash flows were already discussed. During the conference call, management did not set guidelines for the volume of payments in the next dividend season. We believe that changing the way dividends are calculated and excluding non-cash write-downs from the dividend base could provide more visibility into payouts and make HYDR shares less vulnerable to asset write-downs.

With the current version of the dividend policy DPS 2018E, according to our estimates, will be 0.0353 rubles. per share with a yield of 7.0% to the current price.

Source: data

Brief description of the issuer

RusHydro is one of the largest energy companies in Russia with a total installed capacity of ~39.4 GW, which is about 16% of the country's total installed capacity. Hydroelectric generation accounts for about 30 GW, or 77%, of installed capacity, the rest of the energy is generated mainly at thermal stations. The group also manages energy sales, research and construction companies.

In terms of power, the RusHydro hydroelectric power station is in third place in the world after HydroQuebec (38 GW) and Electrobras (36 GW). PJSC RusHydro owns the largest hydroelectric power station in Russia - the Sayano-Shushenskaya HPP with an installed capacity of 6.4 GW. In terms of production volume, 143 billion kWh in 2021, including the Boguchanskaya HPP, RusHydro is one of the largest generating companies in Russia.

Capital structure . The controlling stake, 61.2%, is owned by the state through the Federal Property Management Agency, VTB Bank owns 13.1% of the shares, mainly under a forward contract. Free float - 19%.

Growth factors

| Financial indicators, billion rubles. | ||||

| Index | 2019 | 2020P | ||

| Revenue | 406,6 | 428,5 | ||

| EBITDA | 36,8 | 90,2 | ||

| Clean share profit | 5,1 | 52,0 | ||

| Dividend, kop. | 3,62 | 5,8 | ||

| Financial ratios | ||||

| Index | 2018 | 2019 | ||

| EBITDA margin | 20,9% | 9,1% | ||

| ROE | 5,5% | 0,9% | ||

| Ch. debt / EBITDA adj. | 1,24 | 1,58 | ||

Commissioning of new capacity, about 1 GW in 2019–2020. Among the projects there is a facility under a CSA - the Zaramagskie HPP for 346 MW, which will bring payments for capacity in the amount of 10 billion rubles. in 2021 with very high EBITDA margins. It should be noted that the new capacities are more efficient and cost-effective.

Entry into a modernization program with 4 facilities with a total capacity of 1.3 GW. The company will implement these projects on payback terms with a base return of at least 14%. By 2027, RusHydro plans to optimize generating assets and will decommission 1.6 GW of old, inefficient thermal capacity.

The volume of write-offs should begin to decline from 2021, with the completion of projects in the Far East (the remaining ones are Sovganskaya CHPP, in Sovetskaya Gavan, with commissioning in September 2021, and the 4th hydroelectric unit of the Ust-Srednekanskaya HPP by 2023). The next large-scale investment program to modernize facilities involves a payback mechanism.

The introduction of long-term tariffs for thermal power plants in the Far East from July 2020 should improve the operating profitability of Far Eastern assets. These decisions involve the return of previously lost tariff revenue and the preservation of savings in tariffs. These factors will be the main drivers of profit and dividend growth from 2021. Profit in 2021, according to our estimates, will recover to RUB 52 billion, which will make it possible to pay a record dividend of RUB 0.058. (DY7.8%) next year.

RusHydro. What dividends to expect in 2021

RusHydro has been consistently paying dividends over the past 10 years. Payments grew, but after the peak of 4.7 kopecks. at the end of 2015, the indicator decreased and stagnated. The reason is write-offs for impairment of energy facilities put into operation in the Far East. Regulated tariffs lead to write-offs, due to which the introduced objects do not provide investment profitability, that is, they become economically unprofitable. The difference between capital costs and the property's valuation at current rates is deducted from profit. But the situation may soon change.

Dividend policy and profit write-offs

Earnings adjustments for paper losses have a significant impact on the company's dividend base. In 2021 and 2018 the amount of write-offs amounted to about 40 billion rubles, or 8-9 kopecks per share, and in 2021 - more than 50 billion rubles, or approximately 12 kopecks per share. The bulk of write-offs is due to economic depreciation of fixed assets.

In 2021, in order to stabilize dividend payments, RusHydro changed its dividend policy, adding to payments of 50% of profits under RAS or IFRS a condition according to which the minimum level of dividends cannot be lower than the average for the last three years. At the end of 2021, the company paid the minimum dividends within the limits of the new condition - 3.6 kopecks. per share.

Assessing the scale of write-offs is not an easy task. This is not always possible to do quickly, even by the company itself. In 2021, profits were expected to decline by 25%, to RUB 30.8 billion. taking into account write-offs for impairment of the commissioned Nizhne-Bureyskaya HPP with a capacity of 320 MW and Sakhalinskaya GRES-2 with a capacity of 120 MW. In fact, the profit amounted to only 643 million rubles.

Good news

In 2021, the head of RusHydro Nikolay Shulginov said that in 2020 the scale of impairment is expected to decrease. Of the large facilities for which the return on capital costs is not ensured by the DMP program, in 2021 it was planned to introduce a thermal power plant in the city of Sovetskaya Gavan with an installed capacity of 126 MW. The facility was successfully launched in September 2021. The costs of the project and the installed electrical capacity of the thermal power plant are similar to the Sakhalin State District Power Plant commissioned last year. According to our preliminary assessment, we can expect approximately the same scale of write-offs or a little higher due to the availability of heat generation capacity, that is, about RUB 25 billion.

Shulginov also said that from 2021 to 2023 there may be no large write-offs of profits until the Pevek-Bilibino power line and one hydraulic unit at the Ust-Srednekanskaya HPP are put into operation.

Strong results since the start of 2020

In the first half of 2021, the RusHydro group faced a sharp decrease in electricity generation due to natural factors. Low water content was observed in a number of reservoirs. Against this background, the company's financial performance showed a sharp decline.

This year the situation is reversed. In the central part of the Russian Federation and Siberia, there was an influx of water into reservoirs that significantly exceeded the long-term average values. Until May 2021, consumption in the Far East continued to grow above long-term averages. This led to an increase in group revenue for the first half of 2021 by 9% YoY. Net profit under IFRS for the first half of the year increased by 59.4%, to 46.8 billion rubles.

For the third quarter In 2021, the company slightly worsened its operating results in annual terms. Electricity generation across the group decreased by 3.5% y/y, heat supply remained almost unchanged. Forecasts for water content in the fourth quarter. generally neutral. The dynamics of financial indicators according to IFRS will become known on November 30.

To simplify the preliminary assessment, you can take the adjusted indicator of last year as the expected profit in the second half of 2021. As a result, taking into account the assumptions and simplifications made, after write-offs for impairment as a result of the commissioning of a thermal power plant in the city of Sovetskaya Gavan, net profit at the end of 2021 could amount to about 42 billion rubles.

Dividend forecast for 2020

The minimum possible dividends for 2021, according to the rule of averaging payments over the last 3 years, can be approximately 14 billion rubles, or 3.29 kopecks. per share. This conservative scenario could provide a 4.6% dividend yield at current prices.

In an optimistic scenario, taking into account the expected decrease in write-offs in 2020, we can assume payment of 50% of the projected profit, that is, 21 billion rubles, or 4.8 kopecks. per share. This could provide a forward yield of 6.6%. From 2021, according to management statements, write-offs for impairment of fixed assets may cease, and dividends may rise further.

Summary

Preliminary estimates show that in an optimistic scenario, dividends could grow by 30% YoY, with the potential for further growth in 2021-2022. and provide about 6.6% yield. This year, dividend payments were shifted in time due to the pandemic. Typically, the company makes payments in mid-July. Taking this factor into account, the expected annual dividend yield could be almost 9%. The stock has not yet closed the 2021 dividend gap. The expectation of higher payouts may speed up the process. According to the consensus forecast, the target price for RusHydro shares is set at RUB 0.84, which implies an upside of 16%. As there is clarity in the financial results and the volume of actual write-offs for the third and fourth quarters, the estimate may shift higher.

BCS World of Investments

Financial indicators and events

RusHydro significantly improved its operating and financial results in the 1st quarter: shareholder profits grew by 55% y/y to RUB 24.7 billion, EBITDA by 27% y/y to RUB 34.0 billion, with revenue increasing (excluding subsidies) by 7% YoY. The drivers of growth were high operating results, income from a new CSA facility, low dynamics of operating costs and growth in financial income as a result of forward revaluation.

Output increased by 19% y/y excluding Boguchanskaya HPP. The output of hydroelectric power plants, in particular, increased by 30%; a decrease of 3% was recorded for thermal power plants, which had a favorable effect on operating profitability. We expect that this year the generating company will update its production record due to high water content and new capacities.

Operating expenses increased by 1.9% YoY. The low inflation environment will support profitability.

The quarterly results confirm expectations for profit growth this year . According to our estimates, the company will be able to achieve a profit of about 52 billion rubles in 2021, which implies the payment of a record dividend for 2020E of 0.058 rubles. Factors that increased profits this year were increased production, including due to new capacities, lower impairments, payments for capacity under the CSA from Zaramagskaya HPP-1, and improved profitability of thermal power plants. An increase in HYDR prices will also reflect financial income due to a decrease in the forward obligation.

One of the main growth drivers from this year will be the Far Eastern segment . Large write-offs on fixed assets, which limited investor interest in the HYDR case, should decline this year with the completion of large investment projects in the Far Eastern Federal District. New 5-year tariff decisions for Far Eastern thermal power plants from July this year will improve the profitability of assets. The average tariff will be indexed to no less than the inflation rate (but not higher than +9.9%). In addition, consumption in the East, where the generating company is introducing new capacities, is growing at a faster pace than in other regions. Over the first 5 months, consumption in the Eastern Energy System increased by 3.5% y/y.

The investment program for the current year is planned in the amount of 109 billion rubles . with VAT , but in fact, most likely, it will come out significantly lower (according to our estimates, 73 billion rubles without VAT, which is comparable to last year).

Main financial indicators

| Indicator, million rubles, unless otherwise indicated | 1Q 2020 | 1K 2019 | Change, % | 2019 | 2018 | Change, % |

| Revenue | 106 214 | 99 237 | 7,0% | 366 642 | 358 770 | 2,2% |

| Subsidies | 11 470 | 10 223 | 12,2% | 39 983 | 41 648 | -4,0% |

| EBITDA | 34 059 | 26 823 | 27,0% | 36 842 | 83 730 | -56,0% |

| EBITDA margin | 28,9% | 24,5% | 4,4% | 9,1% | 20,9% | -11,9% |

| Net profit of shareholders | 24 656 | 15 909 | 55,0% | 5 126 | 31 229 | -83,6% |

| 1Q 2020 | 4K 2019 | Meas., c/c | ||||

| Net debt | 122 977 | 142 625 | -4% | |||

| Net debt / EBITDA | 2,79 | 3,87 |

Forecast for key financial indicators

| Indicator, billion rubles, unless otherwise indicated | 2016 | 2017 | 2018 | 2019 | 2020P |

| Revenue incl. subsidies | 391,3 | 380,9 | 400,4 | 406,6 | 428,5 |

| EBITDA | 71,7 | 72,0 | 83,7 | 36,8 | 90,2 |

| EBITDA adj. | 98,2 | 97,3 | 108,0 | 90,4 | 104,8 |

| Adjusted EBITDA margin | 25,1% | 25,5% | 27,0% | 22,2% | 24,5% |

| Net profit of shareholders | 40,2 | 26,4 | 31,2 | 5,1 | 52,0 |

| Accor. profit | 61,4 | 57,8 | 61,8 | 47,7 | 53,9 |

| CFO | 71,4 | 78,1 | 84,6 | 75,7 | 84,8 |

| CAPEX | 61,0 | 71,7 | 67,4 | 74,8 | 72,5 |

| FCFF | 10,4 | 6,4 | 17,1 | 0,9 | 25,7 |

| Net debt incl. forward | 199,8 | 189,5 | 133,3 | 142,6 | 117,6 |

| Ch. debt / EBITDA | 2,79 | 2,63 | 1,59 | 3,87 | 1,30 |

| Dividends | 19,9 | 11,2 | 15,9 | 15,7 | 25,1 |

| Payout rate | 50% | 50% | 50% | 2438% | 50% |

| DPS, rub. | 0,047 | 0,026 | 0,037 | 0,036 | 0,058 |

Source: data

Main financial indicators of RusHydro

| million rubles, unless otherwise indicated | 3K 2018 | 3K 2017 | Change, % | 9m 2018 | 9m 2017 | Change, % |

| Revenue | 77 619 | 67 738 | 14,6% | 258 472 | 248 604 | 4,0% |

| Subsidies | 9 591 | 13 350 | -28,2% | 29 615 | 20 138 | 47,1% |

| EBITDA | 19 268 | 19 151 | 0,6% | 80 549 | 66 600 | 20,9% |

| EBITDA margin | 24,8% | 28,3% | -3,4% | 31,2% | 26,8% | 4,4% |

| Net profit of shareholders | 8 983 | 10 537 | -14,7% | 44 643 | 32 589 | 37,0% |

| Accor. net profit | 9 973 | 8 557 | 16,5% | 48 405 | 40 855 | 18,5% |

| EPS, rub. | 0,0213 | 0,0249 | -14,5% | 0,1057 | 0,0823 | 28,4% |

| 3K 2018 | 2K 2018 | 4K 2017 | k/k | YTD | ||

| Net debt | 126 596 | 115 644 | 120 085 | 9,5% | 5,4% | |

| Net debt/EBITDA | 1,46 | 1,33 | 1,65 | 0,12 | -0,31 |

Source: data

Dividends

The company adjusted its dividend policy in 2021. According to the new rules, dividend payments are defined as 50% of profit according to IFRS, but not less than the average volume for the last 3 years. This calculation scheme, which will be valid for 3 years, will increase the predictability of dividend payments, as well as reduce sensitivity to impairment.

The dividend payment for 2021 may be 0.0362 rubles. per share with a yield of 4.9%.

Management expects significant payout growth in the medium term. According to our estimates, next year RusHydro will be able to offer shareholders a record dividend of RUB 0.058. (+60% y/y, DY 7.8%).

Source: data

The company reduces the impact of “paper” losses on payments

According to Kommersant, RusHydro intends to set the dividend payment level at 50% of annual profit under IFRS, but the figure should not be lower than the average for the three previous years. This will allow you to fix the amount of payments and neutralize the negative effect of “paper” write-offs.

RusHydro expects to approve a new dividend policy, sources in the energy market told Kommersant. The company wants to leave the payment rate at 50% of profits under IFRS, but introduce a condition that the volume of accruals to shareholders should not be lower than the average value for the last three years. According to Kommersant, the board of directors must approve the dividend policy by the end of November. This scheme, Kommersant’s interlocutors believe, will help level out the volatility of accruals to shareholders caused by “paper” losses.

In 2021, with RusHydro's revenue growing under RAS by 26%, to 144.7 billion rubles, and falling under IFRS by 2.7%, to 380.9 billion rubles, the company reduced its profit under IFRS by 43.5 %, to 22.5 billion rubles, due to taking into account non-cash write-offs (the profit cleared from them fell only by 2.6%, to 62.7 billion rubles). For 2015, RusHydro paid 50% of net profit under RAS - 15 billion rubles. (0.038 rubles per share), for 2021 - 50% of profit according to IFRS, or 19.8 billion rubles. (0.047 rubles on paper), but in 2021 50% of the profit under IFRS was only 0.026 rubles. per share, or 11.22 billion rubles. To reduce the dependence of dividends on non-cash write-offs, RusHydro has already proposed revising the accrual principles by linking dividends to free cash flow (FCF) or EBITDA, but these schemes were not approved.

How RusHydro decided to calculate dividends for 2021

RusHydro told Kommersant that management is constantly working on issues of increasing the company’s value, including improving the dividend policy, but now there are no decisions to change it. The Ministry of Energy does not comment on this.

The net profit of RusHydro in 2018 and in subsequent years, as well as the size of dividends, could be brought down by possible write-offs in connection with the postponement of the construction of the Sakhalinskaya GRES-2 from 2018 to 2019, the thermal power plant in Sovetskaya Gavan from 2019 to 2021 (this assessment of the transfer was given by the Accounts Chamber; RusHydro denied this). There is also a risk of overestimating the fair value of the non-deliverable forward on RusHydro shares with VTB and writing off the frozen Zagorskaya PSPP-2 project (up to 70 billion rubles were spent on construction in 2008–2013, the cost of completion was estimated by the head of RusHydro Nikolay Shulginov at 44 billion rub.).

Fedor Kornachev from Sberbank Investment Research reminds that the commissioning of new facilities without contracts with guaranteed profitability can lead to write-offs: in 2021, RusHydro recorded 24 billion rubles. loss from impairment of fixed assets at Yakutskaya GRES-2. According to his estimates, the average dividend of RusHydro over the past three years is 0.037 rubles. per share, or 6.8% dividend yield at the current share price. “On the one hand, such a measure can provide dividends even if a significant impairment is reflected in the reporting,” the analyst notes. “At the same time, such a level of dividend yield is unlikely to lead to a significant revaluation of shares and may act as a protection against further decline rather than a significant driver growth. The revaluation of fixed assets is poorly predictable, since it is quite difficult to predict RusHydro’s profit with 100% certainty, especially taking into account the shifts in the commissioning of facilities.”

Russian Energy Minister Alexander Novak: “We are not talking about the privatization of the RusHydro hydroelectric station”

According to ACRA forecasts, RusHydro's net profit under IFRS in 2021 will amount to 35.4 billion rubles, in 2021 46.9 billion rubles, in 2021 49.7 billion rubles. and 53.75 billion rubles. in 2021, and payments to shareholders for 2021 - RUB 17.7 billion. From 2012 to 2021, the company generated negative FCF, which was associated with high CAPEX and dividends, notes Anna Mikhailova from ACRA. In 2018–2020, RusHydro's FCF will remain negative and will reach breakeven no earlier than the end of 2021, “while the company is characterized by a strong liquidity position and a moderate debt burden, combined with strong debt servicing capabilities,” the analyst notes.

Tatiana Dyatel

Grade

We confirm our Buy recommendation and increase our target price from RUB 0.64 to RUB 0.85. We estimate the growth potential at 15% over the next year and 20% including dividends. The idea is being implemented as earnings, cash flow and dividends recover from 2020. Against the backdrop of expectations for growth in operational and financial performance from 2021, we consider RusHydro shares to be a defensive asset in a crisis.

Based on multiples, HYDR shares are valued on average at approximately the same level as peers with a target price of RUB 0.72. Cost analysis based on its own dividend yield implies a target price of RUB 1.16. with a forecast dividend for 2021 of 0.058 rubles. and a target return of 5.0%. The valuation based on its own historical multiples—forward P/E 1Y (6.4x) and forward EV/EBITDA 1Y (4.2x)—suggests a target of RUB 0.68. Aggregated target price: RUB 0.85.

Below are the basic data on multipliers:

| Company | P/E 2020E | EV / EBITDA 2020E _ | R/ D 2019 | R/ D 2 020E |

| RusHydro | 6,2 | 4,9 | 14,9 | 10,2 |

| Inter RAO | 6,6 | 2,4 | 25,7 | 21,9 |

| TGK-1 | 5,7 | 3,5 | 12,5 | 12,7 |

| OGK-2 | 6,9 | 3,8 | 12,7 | 13,2 |

| Unipro | 9,7 | 7,1 | 12,5 | 12,5 |

| Enel Russia | 6,5 | 4,0 | 11,7 | 16,5 |

| Mosenergo | 8,9 | 3,3 | 17,8 | 14,2 |

| Mediana, Russia | 6,6 | 3,8 | 12,7 | 13,2 |

| Median, developed. countries | 10,8 | 7,1 | 22,0 | 19,7 |

Source: Thomson Reuters, Bloomberg, calculations by FINAM Group of Companies

Forecast for key financial indicators of RusHydro

| billion rubles, unless otherwise indicated | 2 016 | 2 017 | 2018F | 2019F | 2020P |

| Revenue incl. subsidies | 391,3 | 380,9 | 396,4 | 409,3 | 424,4 |

| EBITDA | 71,7 | 72,8 | 80,0 | 71,8 | 82,4 |

| EBITDA adj. | 105,6 | 97,8 | 100,6 | 97,3 | 97,7 |

| Adjusted EBITDA margin | 27,0% | 25,7% | 25,4% | 23,8% | 23,0% |

| Net profit of shares | 40,2 | 24,0 | 32,0 | 36,4 | 46,1 |

| Height, % | 27,5% | -40,3% | 33,5% | 13,5% | 26,9% |

| Net profit adj. | 66,9 | 54,4 | 58,2 | 54,1 | 53,5 |

| CFO | 71,4 | 78,1 | 77,1 | 86,2 | 84,7 |

| CAPEX | 61,0 | 71,7 | 82,1 | 94,1 | 59,1 |

| FCFF | 10,4 | 6,4 | -8,4 | -7,6 | 26,5 |

| Net debt incl. forward | 132,4 | 120,1 | 126,4 | 138,4 | 124,6 |

| Ch.debt/EBITDA | 1,85 | 1,65 | 1,58 | 1,93 | 1,51 |

| Dividends | 19,9 | 11,2 | 15,5 | 17,7 | 22,6 |

| DPS, rub. | 0,047 | 0,026 | 0,035 | 0,040 | 0,051 |

| Height, % | 20,0% | -43,5% | 33,9% | 13,9% | 27,6% |

| DY | 5,7% | 3,8% | 7,0% | 8,0% | 10,2% |

Source: data

Technical picture

Stocks have broken the long-term downtrend. We accept the possibility of consolidation or a technical correction after a sharp rise from the 0.75 resistance, but overall the technical frame looks optimistic. After breaking through and consolidating above 0.75, the potential for an increase to 0.85–0.90 will open. Support level - 0.70.

Source: Thomson Reuters

0

PFC at 06/17/2020 / Trading - financial market news / Leave a comment