PJSC "Territorial Generating" is engaged in the production and supply of electrical and thermal energy in the North-West region of Russia. Power plants are located in St. Petersburg, the Leningrad region, the Republic of Karelia and the Murmansk region.

The total installed electrical capacity of all power plants is 6.9 GW, thermal capacity is 13.5 thousand Gcal/hour. 42% comes from hydroelectric generation - 40 hydroelectric power plants with a total installed capacity of 2.9 GW. The company also has 12 thermal power plants with a total installed capacity of 4 GW, operating mainly on gas fuel.

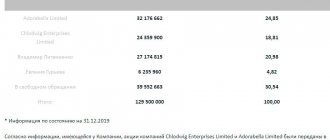

Share capital structure of PJSC "TGC-1"

A controlling stake of 51.79% of PJSC TGC-1 is owned by Gazprom Energoholding LLC, 100% of which belongs to PJSC Gazprom. The structure of Gazprom Energoholding also includes such energy companies as PJSC OGK-2 and PJSC MOEK.

The Fortum Corporation is a Finnish state-owned energy company, which in Russia, in addition to PJSC TGC-1, also owns an energy company (formerly OJSC TGC-10), formed as a result of the reform of RAO UES of Russia.

Production figures

Power generation

The volume of electricity production by PJSC TGC-1, taking into account its subsidiary PJSC Murmanskaya CHPP, has been within the range of 28-29 billion kWh for the last 5 years. No significant changes in electricity production are expected in the near future, so output will remain at the same level.

Electricity production is influenced by the water level in the regions where the company operates, because About half of the installed capacity is hydroelectric generation.

Thermal energy production

Thermal energy production also remains in the range of 24-26 thousand Gcal without any significant fluctuations. However, in recent years there has been a slight downward trend.

The supply of thermal energy depends on the outside air temperature during the heating period.

It is also worth switching from the investment program of CSA (capacity supply agreements) to COMMOD (competitive selection of power for modernization). This is a new payment mechanism for modernized thermal power plant capacities. You can read more in the article about the DPM and COMMOD programs in the electric power industry.

In modernization projects for 2022-2024. a project for the reconstruction of two turbine units at the Avtovskaya CHPP with a capacity of 236 MW was included.

Financial indicators

Let's move on to consider the financial performance of the company. The graphs below show the dynamics of revenue and net profit, as well as the structure of revenue in more detail.

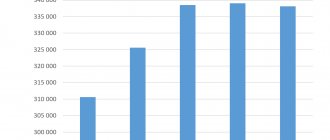

Revenue dynamics, million rubles.

Revenue dynamics tend to grow despite fairly stable electricity generation indicators, which is associated with rising prices for the average estimated tariff.

Dynamics of net profit, million rubles.

Revenue structure, million rubles.

In the revenue structure, there is an increasing predominance of income from the sale of thermal energy. For 2021, 44% of revenue comes from income from the sale of thermal energy, 34% from income from the sale of electricity and 21% from income from the sale of power.

Debt load

TGC-1 has no problems with its debt load; the Net Debt/EBITDA ratio is less than one and does not have a tendency to grow.

The leverage ratio, the ratio of liabilities to equity, is 0.37. This means that the company’s activities are financed to a greater extent by equity capital rather than borrowed funds, and characterizes TGC-1 as a financially stable company.

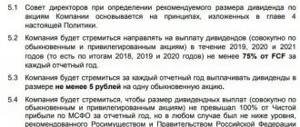

TGC-1 this year switched to paying 50% of net profit under IFRS in the form of dividends to its shareholders.

Since 2010, the organization has been regularly paying dividends, and the growth rate of payments, taking into account those expected for 2021, exceeds 40%. Over 10 years, the average dividend yield on shares was about 3%, while in the last 3 years there has been a multiple increase in the indicator.

The closing date of the register of shareholders to receive dividends for 2019 will be July 7, 2021. Taking into account the T+2 trading regime, the last day to purchase shares to be included in the list of persons to receive payments is July 3 (Friday), 2021. Dividend amount will be 0.001036523 rub. per share.

The dividend yield based on stock quotes as of July 2 (RUB 0.013) is about 8%, the net dividend yield taking into account the tax factor (13% personal income tax) is estimated at 6.9%.

Dividend gap closure statistics

The average length of time to close a dividend gap in stocks is 7 trading days, and in 60% of cases the gap closes within 1 session. The increasing rate of dividend payments from year to year and the low liquidity of the instrument (average daily trading volumes do not exceed 100 million rubles) determine the rapid decline of securities.

The depth of the dividend gap usually corresponds to the size of the dividend. The average maximum drawdown is only 1.5 percentage points. higher than average historical dividends. A more than two-fold increase in the dividend for 2012 and favorable market conditions ensured an upward gap of 2.5% in early May 2013.

The DSI indicator (Dividend Stability Index, dividend stability index) of TGK-1 shares, demonstrating the regularity of dividend payments and the rate of their growth, is the maximum value - 1.

DSI= (C+U)/14,

The index is calculated based on historical data as the difference in the number of periods from the last seven years when dividends were paid (C) and the number of consecutive years when dividend payments were not lower than previous payments (U). The denominator is a constant, the number 14 (2 times 7 years).

The issuer regularly pays dividends with a constantly increasing growth rate of payments. Thus, according to the DSI indicator, TGK-1 shares are included in the “rating” of the best securities in terms of dividend attractiveness.

What will happen to the gap in July 2020

On Monday, July 6, TGK-1 shares will open with a downward gap of around 7%. The size of the technical gap may be less than the declared dividend (0.001036523 rubles) by the tax rate - 13% of personal income tax.

Using a historical modeling approach, one would expect the stock to take less than 7 sessions to close the gap. However, it is difficult to count on such an optimistic scenario. Considering that the peak of payments under CSA has passed, the growth rate of payments next year may slow down. Therefore, even with a stable external background, the period for closing the price gap may be extended for several weeks.

BCS Broker

Dividends

| Dividend period | Amount of dividends per share, rub. | Net profit, million rubles. | Share of dividends in net profit, % |

| 2020 | 0.0011 | 8 253 | 50% |

| 2019 | 0.0010 | 7 990 | 50.02% |

| 2018 | 0.0006 | 10 421 | 23.86% |

| 2017 | 0.0005 | 7 927 | 23.83% |

| 2016 | 0.0003 | 5 324 | 24.98% |

PJSC "TGC-1" consistently pays dividends. At the end of 2021, according to the level of payments established by the parent company, dividend payments are expected in the amount of 50% of net profit under IFRS, which is 0.0011 rubles. per share and corresponds to a dividend yield of 9.6% of the current price.

Forecast of TGK-1 results according to IFRS: reduction of subsidies also reduces profits

On November 11, TGK-1 will publish financial statements for 9m20 under IFRS. Our forecast for the main indicators is presented below. Our comment: Operating conditions for hydro generation in 2021 are extremely favorable, but TGK-1 is unlikely to benefit from this factor, although hydro power plants account for 41% of the company's generation structure.

The fact is that the transfer and reduction of subsidies in the thermal energy segment will lead to a drop in comparison with the increased financial indicators of recent years, including due to this factor. At the same time, according to our forecasts, TGK-1 at the end of 2020 will provide a dividend yield of 8.2% if write-offs are reduced in 4Q20 compared to last year. Our calculated forecast price for 12 months is 0.014 rubles. per share, implying an expected total return of 38%. We confirm our Buy recommendation for TGK-1 securities. The 9m20 results will not receive support from the 3q20 results. The volume of generation at hydroelectric power plants in 9m20 increased by 12.8% y/y compared to 17.8% y/y in 1h20, and the volume of generation at thermal power plants decreased by 12.1% y/y versus 11.7% y/y at 1p20. At the same time, prices on the DAM in 3Q20 were better than in 1H20. Meanwhile, according to our calculations, subsidies for 9M20 will decrease by 63% YoY (due to a decrease in 1H20 and a transfer from 2H20 to 2021). Taking into account all factors, revenue will decrease by 11% YoY, to RUB 62,287 million, despite support from capacity payments; Adjusted EBITDA may fall by 24% YoY, to RUB 16,816 million, despite a significant decrease in fuel costs due to a reduction in generation volumes at thermal power plants. In terms of net profit, we forecast a decline of 36% YoY, to RUB 6,973 million, since TGK-1 has been significantly dependent on subsidies in recent years. Dividend yield remains supportive.

TKG-1's profit figures are unlikely to exceed expectations - which can be said about other generating companies, especially with thermal plants - given the warm weather and the impact of the pandemic. On the other hand, a reduction in write-offs and support from delta-cash payments will allow the company to provide a dividend yield on its shares of 8.2% for 2021, compared to the sector average of 7.4%. In addition, TKG-1 is valued very inexpensively - at 1.9x based on the EV/EBITDA 2021 ratio versus 3.2x on average for Russian generating companies. Our calculated forecast price for 12 months is 0.014 rubles. per share, implying an expected total return of 38%. We confirm our Buy recommendation for TGK-1 securities

Fundamental Analysis

Cost-effective approach

Based on the net asset value of 138,958 million rubles, the cost of a TGC-1 share according to the cost approach is 0.0361 rubles.

PJSC "TGC-1" strives to develop and increase production capacity, consistently shows good financial results and liquidation, in which the company will be forced to sell its assets, is unlikely, so the cost approach will have little weight in the final assessment.

Comparative analysis

| "Inter RAO" | "RusHydro" | "Unipro" | Mosenergo | "OGK-2" | "TGK-1" | Enel Russia | Average | |

| price, rub. | 5,3125 | 0,7822 | 2,791 | 2,0665 | 0,73 | 0,01119 | 0,900 | |

| Number of shares, million pieces | 104 400 | 439 289 | 63 049 | 39 749 | 110 441 | 3 854 341 | 35 372 | |

| Capitalization, million rubles. | 554 625 | 343 612 | 175 969 | 82 142 | 80 622 | 43 130 | 31 835 | |

| Revenue, million rubles | 986 292 | 382 845 | 75 317 | 180 908 | 120 687 | 88 889 | 44 037 | |

| Profit, million rubles | 75 465 | 46 607 | 13 750 | 8 045 | 13 265 | 8 253 | 3 625 | |

| EBITDA, million rubles | 122 300 | 120 268 | 26 413 | 30 472 | 31 569 | 21 935 | 9 017 | |

| BV, million rub. | 616 097 | 125 709 | 120 544 | 329 791 | 144 645 | 138 958 | 40 276 | |

| EV, RUB million | 376 560 | 491 311 | 176 411 | 89 574 | 125 557 | 44 524 | 42 612 | |

| P/S | 0,56 | 0,90 | 2,34 | 0,45 | 0,67 | 0,49 | 0,72 | 0,88 |

| P/E | 7,35 | 7,37 | 12,80 | 10,21 | 6,08 | 5,23 | 8,78 | 8,33 |

| P/BV | 0,90 | 2,73 | 1,46 | 0,25 | 0,56 | 0,31 | 0,79 | 1,00 |

| EV/S | 0,38 | 1,28 | 2,34 | 0,50 | 1,04 | 0,50 | 0,97 | 1,00 |

| EV/EBITDA | 3,08 | 4,09 | 6,68 | 2,94 | 3,98 | 2,03 | 4,73 | 3,93 |

| EPS | 0,7228 | 0,1061 | 0,2181 | 0,2024 | 0,1201 | 0,0021 | 0,1025 | 0,2106 |

| ROE | 12,25% | 37,08% | 11,41% | 2,44% | 9,17% | 5,94% | 9,00% | 12,47% |

| ROA | 8,72% | 4,95% | 10,16% | 1,98% | 5,91% | 4,33% | 4,80% | 5,84% |

PJSC "TGC-1" carries out similar activities with other generating companies in the electric power industry and has similar indicators.

Generating companies in the industry have shown stable revenue and profit dynamics over a fairly long period, so the P/S and P/E multipliers will be used as the main indicator for the final calculation of the fair value of a share.

The estimated fair value of a share of PJSC TGC-1, according to a comparative analysis, is 0.019 rubles.

Income approach

As part of the income approach, a graph is presented with the dynamics of operating profit and forecast values for 2021-2025. in million rubles:

According to the DCF model, PJSC TGC-1 is capable of generating positive cash flow. Therefore, this method of company evaluation is quite representative.

The estimated fair value of a share of PJSC "TGC-1" according to the income approach to analysis is 0.0187 rubles.

Dividends on shares of TGC-1 JSC in 2021 - size and date of closure of the register

Home → Dividends→ TGK-1 shares - forecast, payment history

A table with the complete history of dividends of the company TGK-1 JSC indicating the amount of payment, the date of closure of the register and the forecast:

| Payment, rub. | Registry closing date | Last day of purchase |

| 0.00107055 (forecast) | July 7, 2021 | 05.07.2021 |

| 0.0010365 | July 7, 2020 | 03.07.2020 |

| 0.0006446 | June 26, 2019 | 24.06.2019 |

| 0.0004898 | June 25, 2018 | 21.06.2018 |

| 0.0003453 | July 7, 2017 | 05.07.2017 |

| 0.000243 | July 7, 2016 | 05.07.2016 |

| 0.0002254 | July 10, 2015 | 08.07.2015 |

| 0.000167 | July 4, 2014 | 02.07.2014 |

| 0.0001218 | April 30, 2013 | 30.04.2013 |

| 0.0000487 | May 2, 2012 | 02.05.2012 |

| 0.0000468 | May 12, 2011 | 12.05.2011 |

| 0.0000437 | May 12, 2010 | 12.05.2010 |

| 0.0001034 | May 7, 2007 | 07.05.2007 |

| 0.0000284 | May 7, 2007 | 07.05.2007 |

*Note 1: The Moscow Exchange operates on the T+2 trading system. This means that settlements for buying and selling shares occur within 2 business days. Therefore, to be included in the register of shareholders and receive dividends, you must be a shareholder 2 days before the cutoff.

*Note 2: Exact payout date varies by broker and issuer. The predicted nearest date for receipt of dividends to the brokerage account for the TGK-1 company: July 20, 2021.

Total dividends of TGK-1 shares by year and changes in their size compared to the previous year:

| Year | Amount for the year, rub. | Change, % |

| 2021 | 0.0010706 (forecast) | +3.29% |

| 2020 | 0.0010365 | +60.8% |

| 2019 | 0.0006446 | +31.6% |

| 2018 | 0.0004898 | +41.85% |

| 2017 | 0.0003453 | +42.1% |

| 2016 | 0.000243 | +7.81% |

| 2015 | 0.0002254 | +34.97% |

| 2014 | 0.000167 | +37.11% |

| 2013 | 0.0001218 | +150.1% |

| 2012 | 0 | +4.06% |

| 2011 | 0 | +7.09% |

| 2010 | 0 | n/a |

| 2009 | 0 | n/a |

| 2008 | 0 | -100% |

| 2007 | 0.0001318 | n/a |

| Total = 0.0044758 |

The amount of dividends paid by TGK-1 for the entire period is 0.0044758 rubles.

Average amount for 3 years: 0.00092 rubles, for 5 years: 0.00072 rubles.

DSI indicator: 0.21.

You can buy TGK-1 shares with minimal commissions from stock brokers: Finam and BCS. Free deposits and withdrawals. Online registration.

Brief information about the issuer PJSC TGC-1 JSC

| Sector | Energy |

| Issuer's full name | PJSC "TGC-1" JSC |

| Issuer's name is short | TGK-1 |

| Ticker on the stock exchange | TGKA |

| Number of shares in lot | 32767 |

| Number of shares | 3 854 341 416 571 |

| TIN | 7841310000 |

| Free float, % | 19 |

Other companies from the Energy sector

| # | Company | Div. profitability for the year, % | The nearest registry closing date | Buy before |

| 1. | Unipro JSC | 15,08% | 22.06.2021 | 18.06.2021 |

| 2. | IDGC CPU | 10,35% | 15.06.2021 | 11.06.2021 |

| 3. | RyazEnSb | 10,10% | 03.06.2021 | 01.06.2021 |

| 4. | Lenenerg-p | 10,05% | 29.06.2021 | 25.06.2021 |

| 5. | IDGC Center | 8,78% | 11.06.2021 | 09.06.2021 |

Calendar with upcoming and past dividend payments

| Immediate | Past | ||||

| Company Sector | Size, rub. | Registry closing date | Company Sector | Size, rub. | Registry closing date |

| RusAqua JSC Foodstuff | 5 | 27.05.2021 | MDMG-gdr Miscellaneous | 19 ✓ | 25.05.2021 |

| FGC UES JSC Energy | 0.016 | 29.05.2021 | TransK JSC Logistics | 403.88 ✓ | 24.05.2021 |

| SevSt-ao Metals and mining | 46.77 | 01.06.2021 | M.video Retail trade | 38 ✓ | 18.05.2021 |

| Tattel. JSC Telecoms | 0.0393 | 01.06.2021 | PIK JSC Construction | 22.51 ✓ | 17.05.2021 |

| SevSt-ao Metals and mining | 36.27 | 01.06.2021 | PIK JSC Construction | 22.92 ✓ | 17.05.2021 |

| GMKNorNik Metals and mining | 1021.2 | 01.06.2021 | Moscow Exchange Finance and Banking | 9.45 ✓ | 14.05.2021 |

| MOESK Energy | 0.0493 | 01.06.2021 | Sberbank Finance and Banking | 18.7 ✓ | 12.05.2021 |

View full calendar for 2021 »

7 Best Dividend Stocks for 2021

| # | Company | Sector | Dividend yield for the year, % | The nearest registry closing date | Buy before |

| 1. | Surgnfgz-p | Oil Gas | 16,84% | 20.07.2021 | 16.07.2021 |

| 2. | iMMTSB JSC | Miscellaneous | 15,24% | 09.06.2021 | 07.06.2021 |

| 3. | Unipro JSC | Energy | 15,08% | 22.06.2021 | 18.06.2021 |

| 4. | ALROSA JSC | Metals and mining | 14,99% | 04.07.2021 | 30.06.2021 |

| 5. | NLMK JSC | Metals and mining | 14,91% | 09.06.2021 | 07.06.2021 |

| 6. | Rusagro | Food | 11,85% | 18.09.2021 | 15.09.2021 |

| 7. | MMK | Metals and mining | 11,80% | 17.06.2021 | 15.06.2021 |

View the full company rating for 2021 »

Interesting read:

- How to buy shares for an ordinary person - a complete guide;

- How to trade on the stock exchange from scratch - step-by-step plan;

- Investing in securities is a simple matter of complexity;

- How to create an investment portfolio - instructions and tips;

- How much money is needed for dividends to be 50,000 rubles per month;

- How to buy Sberbank shares;

- What is the average profit of stocks;

- Investments in Russian shares - full review;

← Return to main catalog