Tuition fee

Your first possible expense, in my opinion, should be spending on training. There are a huge number of free lectures on the Internet, but some of them are not relevant, do not contain information about changes in legislation, and miss important innovations. Therefore, you need to take elementary courses.

They will give you the direction in which you should move, teach you how to use the terminal, and tell you about your capabilities. If you took courses for beginners a long time ago (more than three years ago), but did not start trading during this time, you have lost money, since you will have to study again. The market does not stand still!

Ways to reduce commission:

- Find out about free classes from a broker,

- Ask for a discount

- Find out about bonuses after completing the course for existing account holders,

- Take homework from the coach,

- Schedule personal lessons after studying the materials yourself.

Account service fee

If you have money and securities in your account, even if you do not have trading operations, you may incur expenses in the form of account maintenance fees.

Are you on vacation and are being unfairly charged? While you are relaxing, a whole army of broker employees is working for you: someone is making your terminal better, someone is improving your personal account, someone is developing new services and strategies for you. Therefore, this waste is natural.

Ways to reduce commission:

- Make trades – often trading commissions reduce account maintenance fees,

- Check with the manager about the availability of tariffs without this fee,

- If you have rubles in your account, then buy OFZ (effectively combats costs if the position period is planned for at least 2 weeks).

Depository costs

Your securities - stocks and bonds - are stored in a depository. Not for free!

Ways to reduce fees:

- Always stay with the original number of papers overnight.

You have 100 lots of Gazprom shares, within a day you make 1000 transactions with them on the stock exchange, but at the end of the trading session you buy back exactly 100 lots again,

- Do not use the depository - always stay in the “cache” with cash at night.

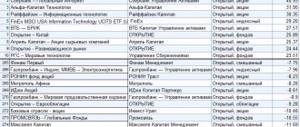

Top brokers with the lowest commissions

The top brokers with minimal commission fees were compiled by a popular online portal in the field of investments and are relevant at the time of writing:

- IT Invest;

- BKS;

- Finam;

- Veles Capital;

- Alfa Bank;

- VTB 24;

- Uralsib;

- Promsvyazbank;

- Tserich capital;

- Alor Broker;

- Opening Broker;

- Gazprombank;

- Solid;

- Sberbank;

- ATON.

Transaction fees

The fee for transactions can be fixed, or it can be in the form of a percentage of turnover. A combination of these two types of fees may be used: fixed fee + turnover fee. It is important that the “% of turnover” fee is charged only on completed transactions. Some brokers have a hidden commission that is charged as a fee for any order submitted. Regardless of whether the transaction went through according to this application or not.

Ways to reduce commission:

- Find a broker with live managers who are ready to receive you in the office or answer your questions by phone,

- Clearly formulate your trading plans to your manager - this will help him choose a tariff plan. For example: “I want to trade on my own, I don’t need advice or training. But my average transaction amount will be 50 thousand rubles.” Managers of our company will offer you a “Consultation” tariff. It includes an analytical newsletter as a nice bonus, even though you decide to trade on your own. The manager understood and heard you in this regard, but this tariff does not have a minimum transaction fee. And for your task, this is important!

- Monitor your spending according to your tariff monthly, or better yet weekly. Perhaps it is not as large as you think, and the fee is, for example, for your use of borrowed funds. We will talk about them in the next paragraph.

How to reduce commission

The easiest way to reduce the amount of duties is to simply increase trade turnover. All brokers accommodate large traders halfway and offer them reduced commissions.

If the capital is small, all that remains is to use rebate services. Their principle is completely similar to referral programs: you attract new clients to a broker company, a small percentage of their trading turnover goes towards your commission. The process will not be very profitable, but the trader does not risk anything, why not try?

Fee for the use of borrowed funds

The broker is ready to provide you with a loan, both for bullish and bearish games. Naturally, there is a certain fee for this service.

This fee is charged daily, regardless of weekends and holidays. The T+ mode can significantly increase this fee. This is a special settlement mode on the stock exchange, when after a transaction is completed, settlements are made only on the second business day. So, if you borrowed money during the week and closed a trade with borrowed funds on Friday, your broker will not receive the money until Tuesday, which means you will pay for the use of borrowed funds for two weekends and Monday. This does not mean that you need to say goodbye to debts on Wednesdays. This means that when entering a trade, you need to calculate whether the profit on it is sufficient to recoup this expense.

Speaking about such costs as fees for borrowed funds, I would like to ask you, do you know how fees are charged when playing for a short sale? With “long” everything is simple: I bought shares with my own money and borrowed some amount from a broker, for example 50,000 rubles. She will be charged daily for borrowed funds. It is worth considering that the calculation takes place daily, and tomorrow interest will be accrued on the principal portion of the debt and on the outstanding interest.

But what about the “short”? Am I borrowing shares from a broker? How much will the fee for this loan be? Answer my email. I’ll give the first three correct answers a month of free consultations! Even if you are not a client of my company (* the usual cost of the service for clients is from 5,000 rubles, for non-clients from 25,000 rubles). And whoever doesn’t know the answer will receive it in the “Beginner” course, which starts on June 26 at 19.00 Moscow time (in person, by correspondence, video archive).

Ways to reduce costs:

- Trade intraday (if there is no overnight transfer of debts, there is no charge for using borrowed funds). The method is too extreme; this strategy is not suitable for everyone.

- Remember about the T+2 mode, especially before the long weekend.

- When assessing the profitability of an operation, do not forget to take into account the fee for borrowed funds.

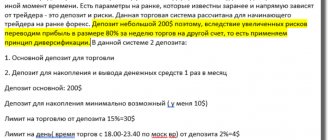

Tariffs of the Derivatives Market of PJSC Moscow Exchange

Fee for granting admission to participate in the Auction

| Name of contribution | Contribution amount | |

| 1. | Fee for admission to participate in Trading as a Category “O” Trading Participant | 5 000 000 |

| 2. | Fee for admission to participate in the Trading as a Trading Participant of category “F1” and/or “F2” | 3 000 000 |

| 3. | Fee for admission to participate in Trading as a Trading Participant of category “T1” and/or “T2” | 1 000 000 |

| 4. | Fee for admission to participate in Trading as a Trading Participant of category “D1” and/or “D2” | 1 000 000 |

| Categories | Stock section | Money section | Product section |

| ABOUT | + | + | + |

| F1/F2 | + | ||

| D1/D2 | + | ||

| T1/T2 | + |

For more information about the Categories of Trading Participants in the Derivatives Market - Rules for admission to participation in organized trading of PJSC Moscow Exchange, Part III. Derivatives market

Contribution to the Guarantee Fund

The minimum contribution to the Guarantee Fund of each Clearing Member is 10,000,000 .

Methodology for determining the amount of contribution to the Guarantee Fund.

Exchange and clearing commission of the derivatives market

3.1. Exchange and clearing commission for concluding futures contracts

The amount of the exchange fee for concluding futures contracts based on non-addressed or addressed orders is calculated using the following formula:

FutFee ≥ 0.01 RUR

Options:

| FutFee | the amount of the exchange fee for concluding a futures contract (in Russian rubles); |

| FutPrice | the futures price value determined in accordance with subclauses 3.4.2 – 3.4.3 of the Tariffs (in units of measurement in which the futures price is indicated in the application in accordance with the Specifications of the relevant futures); |

| W ( f ) | the cost of the minimum step of the futures price, determined in accordance with the Specifications of the corresponding futures (in Russian rubles); |

| R(f) | the minimum futures price step determined in accordance with the Specifications of the relevant futures; |

| Round | mathematical rounding function with a given accuracy; |

| abs | function for calculating absolute value (modulus); |

| BaseFutFee | the value of the base tariff rate for concluding a futures contract for the Group of Derivatives Contracts to which this futures belongs in accordance with clause 3.5 of the Tariffs (hereinafter referred to as the Group of Contracts) (in basis points). |

Groups of contracts by type of underlying asset

| Group of contracts | Subgroup of underlying asset* | Base exchange rate (BaseFutFee), in percent | Base clearing rate (BaseFutFee), percentage | Total base rate (BaseFutFee), in percent | |

| 1 | Currency contracts | foreign currency exchange rate to Russian ruble | 0,000885 | 0,000655 | 0,00154 |

| foreign exchange rate to US dollar | |||||

| US dollar to foreign currency exchange rate | |||||

| 2 | Interest contracts | interest rates | 0,003162 | 0,002338 | 0,00550 |

| federal loan bonds | |||||

| Eurobonds of the Russian Federation | |||||

| 3 | Stock contracts | shares of Russian issuers | 0,003795 | 0,002805 | 0,00660 |

| shares of foreign issuers | |||||

| depositary receipts | |||||

| investment units of investment funds | |||||

| 4 | Index contracts | stock and other indices (except for commodity indices) | 0,001265 | 0,000935 | 0,00220 |

| volatility of the Russian market | |||||

| 5 | Commodity contracts | energy raw materials | 0,002530 | 0,001870 | 0,00440 |

| metals | |||||

| agricultural raw materials |

* List of underlying futures assets

3.2. Exchange and clearing commission for concluding margined option contracts

The amount of the exchange commission for concluding margined option contracts based on non-addressed or addressed orders is calculated using the following formula: OptFee ≥ 0.01 rub

Options:

| OptFee | the amount of the exchange fee for concluding an option (in rubles); |

| FutFee | the amount of the exchange fee for concluding a futures contract, which is the underlying asset of the option (in rubles); |

| W(o) | cost of the minimum step of the option price (in rubles); |

| R(o) | minimum option price step; |

| Round | mathematical rounding function with a given accuracy; |

| K | additional coefficient; K=2 |

| Premium | the value of the option premium (in the units of measurement in which the option price (premium) is indicated in the application); |

| BaseOptFee | Value of the exchange base rate for concluding an option 0.06325 Value of the clearing base rate for concluding an option 0.04675 |

3.2.1. Exchange fee for scalping transactions

| Tool | Definition of Scalping Trades | Tariffication (discount amount) |

| Futures | Futures transactions executed on the basis of non-addressed orders, leading to the opening and closing of a futures position within one Trading day | 0.5 of the total exchange fees for scalping transactions |

| Options | Futures transactions executed on the basis of non-addressed orders, which can lead to the opening of opposite positions in the underlying asset of the option (futures) in the event of execution of the options (regardless of the exercise price (strike)) during one Trading day. Opening a long futures position can be achieved by buying a call option and selling a put option. Selling a CALL option and buying a PUT option can lead to opening a short position on futures. Scalper pairs for options (purchase of the underlying asset - sale of the underlying asset): • purchase of CALL - sale of CALL; • purchase CALL – purchase PUT; • selling PUT – buying PUT; • sale of PUT – sale of CALL. |

The full formula for calculating the amount of the exchange fee for making scalping transactions with options can be found in Tariffs of the derivatives market. The discount amount for scalping trades does not apply to calendar spreads.

Clearing commission and clearing rates

The clearing commission for the execution of derivatives contracts and clearing tariffs for services of NPO NCC (JSC) are established in accordance with the Tariffs of the Clearing Center (Sections II and V).

Transaction Fees

Fees for Transactions in favor of PJSC Moscow Exchange:

- Ineffective transaction fee

- Fee for erroneous transactions other than Flood Control errors

- Flood Control Error Transaction Fee

The algorithm for calculating fees is described in the document Additional fees and remunerations provided for in the agreement on the provision of an integrated technological service; coefficients for calculation are in the list of parameters.

Learn more about the fee for ineffective transactions Learn more about the fee for erroneous transactions Learn more about the fee for Flood Control errors

Calendar Spread Fee

Calendar spread – simultaneous purchase and sale of futures with one underlying asset and different execution dates based on “Calendar Spread” Orders.

More details - Trading rules on the derivatives market.

The fee for Calendar Spreads is determined each Trading Day for each section of the clearing registers based on the amount of fees for completing purchase transactions and sales transactions of each futures based on unaddressed or addressed “Calendar Spread” Orders.

Calculation of the fee for Calendar spreads in relation to futures concluded on the basis of non-addressed Orders “Calendar spread” is carried out according to the formula:

FeeCS = ΣFutFeeCS × (1-K)

| FeeCS | the amount of the fee for Calendar spreads based on unaddressed “Calendar Spread” Applications during the Trading Day (in Russian rubles); |

| K | discount rate equal to 0.2, valid during the marketing period. The marketing period is 6 (six) months from the first Trading Day, from which it is possible to conclude futures based on non-addressed “Calendar Spread” Orders. After the expiration of the marketing period, the discount rate is not applied (equal to zero); |

| ΣFutFeeCS | the amount of the exchange commission payable for concluding futures on the basis of a non-addressed “Calendar Spread” Order, calculated using the following formula (in rubles): FutFee CS = Round (( Round ( ( abs FutPrice 1) + abs(FutPrice2))× Round (W(f)/R(f);5));2)×BaseFutFee;2) Where: FutPrice1 – the value of the Settlement Price of a futures contract with a near expiration date, determined in accordance with the Trading Rules based on the results of the evening Settlement Period of the last Trading Day preceding the Trading Day of Calculation (in the units of measurement in which the futures price is indicated in the application in accordance with the Specifications of the corresponding futures); |

The calculation of the fee for Calendar spreads in relation to futures concluded on the basis of targeted Orders “Calendar spread” during the Trading day is carried out according to the formula:

FeeCS = ΣFutFeeCS

| FeeCS | the amount of the fee for Calendar spreads based on targeted “Calendar Spread” Applications during the Trading Day (in Russian rubles); |

| ∑FutFeeCS | the total amount of the exchange fee payable for concluding futures on the basis of a targeted “Calendar Spread” Order, calculated using the following formula (in Russian rubles): FutFeeCS=Round(Round ( abs(FutPrice1) + abs(FutPrice2)) × Round W(f) / R(f) ;5) ;2) × BaseFutFee ;2) Where: FutPrice1 – the value of the Settlement Price of a futures contract with a near expiration date, determined in accordance with the Trading Rules based on the results of the evening Settlement Period of the last Trading Day preceding the Trading Day of Calculation (in the units of measurement in which the futures price is indicated in the application in accordance with the Specifications of the corresponding futures); |

Costs of trash

These, in general, are the main costs for a trader when trading on a Russian stock exchange through Russian brokers. I did not consider such trash as a fee for using trading programs; at a minimum, a broker should have three free programs for trading via the Internet. Only professional programs for algorithmic trading or complex statistical research can be paid. Another trashy service is a fee for technical support. That is, when the broker even pays for assistance in installing the terminal. Fortunately, this is rare.

I did not include paid subscriptions to information resources and consulting support; working with a personal consultant is not an obligatory cost. And it’s up to everyone whether to use them or not. We focused on the most constant and frequently occurring costs. It is worth repeating only that in relation to minimizing costs, clear, coordinated work with your manager is important! Are your managers as good as mine?

Trading apps

Just a few years ago, the most popular terminal for individual investors was the QUIK platform. Many people still use it today, but broker mobile applications are becoming more and more widespread for making transactions on the stock exchange.

In an ideal situation, the client has maximum choice: he can trade both through the broker’s native application and through third-party terminals. Both a web version and applications for computers and mobile phones are available.

In the table below I show what our top brokers provide to their clients as software.

| Broker | Software |

| FG BKS | Quik, mobile version of Quik, Metatrader 5, mobile version of Metatrader 5, TSlab platform, etc. |

| Opening | XTick Extreme, MetaTrader 5, QUIK all types |

| Finam | just an overwhelming number of different software solutions for trading |

| Keith Finance | KIT Finance TWS (Trader Workstation) and mobile version of Handy Trader Quik and mobile version |

| Alor+ LLC | Quik and its varieties,Trading View, Alor Trade |

Here it is very difficult to remove someone from the list for the title of “best broker in Russia”. I only trade in the Quik terminal and I don’t need any, not even mobile versions of Quik. Therefore, it would be wrong to remove a broker with modest software from the list.

But for yourself, you can already note what you would like to use for your trading.

For now it's decided! We leave all brokers for further struggle.