The modern financial market cannot exist without the ability to carry out transactions for the purchase and sale of securities, derivatives instruments, currencies and other assets. National markets are being created to create conditions and provide a platform where trading will take place on a regular basis. Like the currency and stock exchange of the Republic of Belarus.

About the exchange

| Country and site | Belarus, Minsk |

| Year founded Owners (founders) | 2004 Republic of Belarus "Belresursy" "Eximgarant of Belarus" "Belarusbank" |

| Number of goods traded | Metal products Forest products Agricultural products Industrial and consumer goods |

| Capitalization Annual trading volume | 1.6 billion euros |

| Indexes | Formed upon request |

| Official site | www.butb.by |

| Work schedule Session duration time Moscow time | From 11-00 to 14-30 3.5 hours |

How the auction works

Trading takes place on an online electronic platform through accredited brokers:

- An application is placed for the purchase or sale of goods that are allowed for trading.

- If the application meets the conditions, then the exchange deposit must be transferred.

- After the transaction is completed and all obligations are fulfilled, the deposit will be returned to the owner.

Such measures provide for liability to counterparties and BUCE guarantees to all participants.

Trading in each section of the Belarusian Universal Commodity Exchange is conducted separately and does not exceed one hour. In fact, you can place an order and wait for it to be executed, since all of them must fit within a certain price corridor.

Here the desire to control prices and not let them out of state control is manifested. This is the Belarusian zest in the overall market pie.

Search for purchases

To start searching for tenders, go to the “Purchases” section.

You will be presented with a long, detailed list of trades, including information about:

- registration number and subject of each purchase;

- form of conduct and initial cost in the national currency of Belarus;

- customer and type of transaction financing;

- publication date and deadline for submitting proposals from performers;

- the number of proposals received and the state of the procurement.

To make your search easier, use the built-in filter located in front of the list of purchases.

Thanks to it, you can select auctions for a specific item, customer, region, start date, or other parameters that suit your situation. After the search settings have been adjusted, click on “Search”. The service will compile a selection of purchases based on the parameters you entered.

Participants

You can work on the Belarusian platform through brokers or independently by concluding a direct agreement with the exchange.

To trade directly, you need to prepare a package of documents, which includes:

- agreement with the Belarusian Universal Commodity Exchange;

- electronic digital signature, endorsed by the management of the trading platform;

- programs for working remotely from computers.

Most enterprises that trade constantly prepare traders on their own using the platform in a few days. Since the trading process on the Belarusian Universal Commodity Exchange is specific, brokers are not financial figures, but producers or buyers of specific products.

How to list on the stock exchange

If there is a product from the assortment traded on a universal platform, or a desire to buy it, then conducting a transaction is not difficult. The set of documents is small, registration is simple, and the transactions themselves can be single, irregular or permanent. The main condition is the presence of a real product or interest in purchasing it. There is no place for speculators and speculative transactions at BUCE: everything is aimed at the real economy.

The main participants of the universal commodity exchange are enterprises of the Republic of Belarus, which find here raw materials for production and a market for their goods.

What are fb for?

Exchanges, being a secondary market for securities, ensure the redistribution of rights to ownership shares and debts of companies issuing them. Thanks to the presence of a sufficient number of private investors, the state's economy functions effectively.

Being a guarantor of the legal execution of transactions, the exchange allows the investor not to contact the counterparty. The exchange platform ensures the liquidity of securities and the ability to carry out transactions supported by the market maker on preferential terms.

By monitoring the market, the exchange prevents price manipulation and fraud with stocks and bonds.

Advantages and disadvantages

There are many advantages to trading on the Belarusian Universal Commodity Exchange:

- First of all, the buyer and seller have confidence that they will find the right product or consumer.

- Solid guarantees of execution of all transactions. In this case, BUCE acts not only as an intermediary, but also as a guarantor for all trade agreements.

- On the Belarusian Universal Commodity Exchange, price jumps under the influence of emotions or speculation are impossible, since there are no opportunities for speculative transactions, and emotions are controlled by a price corridor, beyond which placing orders is also impossible.

But this is still not a universal market platform in the full sense of the word. Limitations from advantages smoothly flow into disadvantages, since prices for goods are not quite market prices. This kind of trade is only possible on a closed market like the Belarusian one, where all purchases are made between their own enterprises.

The most famous brokerage companies - review of the TOP 3 popular ones

If you choose one of the three companies we offer as a bidding intermediary, you will receive good (and often free) training, the best trading conditions, reliability and quality guarantees.

Study, choose and decide.

1) Alpari

Almost all my knowledge about the Forex market was obtained from ]Alpari[/anchor]. First, I watched webinars on the basic course from different authors (Alexey Kuznetsov, Eduard Sungatullin, Alexander Volverin), then I studied specific trading strategies: indicator analysis, patterns, Elliott waves (though I don’t trade with them).

Classes are divided into free (most), paid and conditionally paid. In the case of the latter, you need to top up your account with a certain amount. The money is not going anywhere, the broker will withdraw it back as soon as necessary.

Most of the conditionally paid seminars require a deposit of $100, the most luxurious courses require $1000 (for example, “Scalping with Marat Gazizov” or “System based on A. Elder’s three screens”), but they are already for the pros.

2) Finam

Finam, like Alpari, is licensed by the Central Bank of the Russian Federation. In addition to trading on the foreign exchange market, the broker offers traders to speculate in securities of Russian and foreign companies.

To cooperate with Finam you need large sums of money; if you don’t have any, it’s better to choose another broker. Most of the training here is paid, but it is in-depth and of high quality.

3) BCS Broker

The company works similarly with currencies and securities. BKS Broker began its journey in 1995, and within five years it became a leader. If you don’t want to trade yourself, you have the opportunity to invest money in investment products with the condition of protecting 100% of your capital.

I suggest watching a short video about the benefits of BCS.

For the most successful trading, BCS offers traders the services of a financial consultant who will help them not make mistakes even in the most difficult market situations.

Goods allowed for trade

Trading on the Belarusian Universal Commodity Exchange is conducted for the following groups of goods:

- metal products;

- forest products;

- agricultural products;

- manufactured goods and consumer goods;

- government procurement and property trade.

The basis consists of those categories of goods that are produced in the republic. In essence, the Belarusian Commodity Platform is focused on the national manufacturer, and there is a division between products intended for the domestic market and supplies for export.

Binary options and Forex

Useful articles

Review of the Ukrainian Stock Exchange: prospects + how to enter trading

Everything about the Kazakhstan stock exchange KASE: overview of the site + market prospects

For Belarus, such establishments look out of place. Forex is important for the currency and stock exchange. But currency trading on the BVSE takes place under the vigilant control of government agencies and creates a rate that is very far from the market one. Currency control in the republic is not an empty phrase.

But binary options in Belarus can create a criminal offense for participants in commodity relations. Which, however, is for the best - it will scare away amateurs and will not allow the scammers who organize this attraction to turn around, attracting people with incredible profits. Although it all ends in defrauding gullible citizens.

What hinders development?

- Confusion of laws.

- Lack of various mutual funds and other financial institutions.

- Managing the economy using old command-administrative methods.

- Very strict conditions for issuing securities. To issue bonds, a legal entity must have net assets worth at least 1 million euros and a positive financial result from its main activity.

- Lack of clear operating rules (at the legislative level) for investors.

- Lack of a mechanism for the exchange to create its own index.

- Insufficient education of the country's citizens in the field of the stock market.

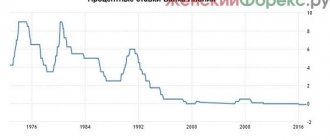

Trading indices

The originality of the Belarusian Universal Commodity Exchange is manifested in this. Indexes are calculated, but not in real time, but as a statistical indicator based on an individual request. They are calculated for each group of traded goods.

Prospects for investing in these indices

There are no prospects, since this is not a market indicator, but a simple economic conclusion from trading. All restrictions on market trading make the index not a universal commodity for speculation or investment, but an ordinary statistic of the Belarusian economy.

Brief description of the stock market of Belarus

Main market indicators

- BYR Composite and ITRBYR Composite - corporate bond market indices

- There is no special integrated index for the stock market, but there are statistics on the level of capitalization and trading volume, as, for example, can be seen in Table 1.

Table 1. Level of capitalization of the stock market of the Republic of Belarus:

| Indicator | Current value, BYR | Change to previous value |

| Share market capitalization at weighted average price | 2 587 231 283 195 | -31,39% |

| Share market capitalization at par | 909 264 454 176 | -10,70% |

Trading volumes by shares

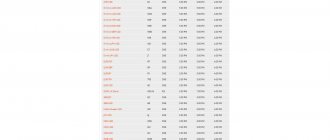

Table 2. Market trading volume for a period of 90 days:

| Ticker | Last trade date | Volume in rub. | Volume in pcs. | Price, in rubles | Change to previous price |

| Minskvodstroy A 1 | 28.10.2015 | 3.51 billion | 390 | 9 million | 497,64% |

| CentroEnergoMontazh A 3 | 02.11.2015 | 126.5 million | 575 | 220 thousand | 0,00% |

| Mozyrsol A 1 | 27.10.2015 | 125 million | 500 | 250 thousand | 0,00% |

| MinskZavodOtopObor A 3 | 02.11.2015 | 56.5 million | 689 | 76.91 thousand | 2,19% |

| Gomelkabel A 4 | 27.10.2015 | 21.46 million | 447 | 47.68 thousand | 1,41% |

As can be seen from Table 2 (trading results over the last 90 days), the level of liquidity of the stock market is at an extremely low level.

The only outsider of all the general negativity is the company Minskvodstroy A 1, where the level of growth looks quite impressive. According to some reports, this is due to the attraction of a reputable foreign investor to implement a large-scale project to reconstruct the water supply system of the capital region (since the times of the USSR, the deterioration of networks is more than 80%).

In general, the market looks quite thin, and the volume of shares in free float is clearly insufficient to talk about an attractive market for a large investor.

General stock market indicators

Even if we look at the data on the level of liquidity that was on the market for the entire 2015 (Table No. 3), we can draw the following and even some encouraging conclusions:

Table 3. Trading volume for December 2015 in US dollars

| Sector | Meaning | Change |

| Stock market | 570.98 million | -11,75% |

| Bonds, including: | 570.23 million | -11,72% |

| Government securities | 131.3 million | -58,28% |

| VGSB | 109.12 million | -42,81% |

| Exchange | 34.89 million | 34,68% |

| OMZ | 3.44 million | -59,92% |

| NB RB | 68 million | 12 076,77% |

| Corporate | 223.49 million | 112,18% |

| Stock | 746.52 thousand | -31,04% |

So:

- The greatest demand is for shares of the commercial sector of the economy, which, to a greater or lesser extent, can be integrated into the common European economic space. It is no coincidence that more than 90% of the total trading volume is in shares, since investors are already planning in advance for the inevitable processes of involving the Belarusian economy into the global one.

- The rather low volume of investments in government bonds is most likely due to the fact that investors and holders of these debts have reasonable fears about the possibility of the existing ruling regime fulfilling their obligations under them, mainly due to the declining subsidies to the Belarusian budget from Russia.