Did you know that in 1984 the Financial Times and the London Stock Exchange teamed up to create one of the most popular market indicators for investing in UK companies? A newly formed company, the FTSE Group (Financial Times and Stock Exchange Group), maintains one of the world's most popular indexes that tracks the performance of the UK stock market, called the FTSE100.

From this article you will learn:

➡️ What is the FTSE100 index and how is it calculated.

➡️ Who is part of the FTSE100?

➡️ What drives the FTSE100 market?

➡️ How to trade FTSE100 share prices and the index itself completely risk-free on a demo account.

➡️ Free trading strategy for FTSE100 that you can use right now!

What it is?

The reader will not be able to enjoy a conversation on the topic of the European economy if he does not know what the ftse 100 is, and what the index is in principle. The word is creepy, and behind it there are three layers of mathematical calculations. But the main thing is to know why analysts need this tool.

Index is the total value of shares of a group of companies. If this group is expensive, then investors and the economy are doing well. How do you figure out how much a stock is worth? Apply the equation. The result of this equation is expressed in points. More points means a richer company, and vice versa.

Which companies are included in the index?

About two companies leave the top 100 every quarter. Today, the main candidate for departure is MARKS & SPENCER, which has closed a quarter of its stores in the country. In addition to him, G4S (a security company) and Severn Trent (a water supply company) are getting poorer.

The requirements for companies to be included in the ftse index are quite general:

- Liquidity.

- Reliability.

- The shares are in free circulation.

- The companies are listed on the London Stock Exchange.

But this is not enough. The following parameters distinguish Footsie 100 from others:

- The companies passed the nationality test.

- Share prices are expressed in pounds or euros.

- Companies have the status of limited liability companies.

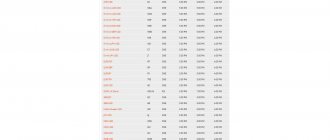

Here is the current list of FTSE 100 companies:

| Company | Ticker | FTSE sector |

| 3i | III | Financial services |

| Admiral Group | A.D.M. | Insurance Company |

| Anglo American plc | AAL | Food industry |

| Antofagasta | ANTO | Food |

| Ashtead Group | AHT | Food |

| Associated British Foods | ABF | Foodstuffs |

| AstraZeneca | AZN | Pharmaceuticals and biotechnology |

| Aviva | AV. | Insurance Company |

| BAE Systems | B.A. | Aerospace and defense industry |

| Barclays | BARC | Banking |

| Barratt Developments | BDEV | Household products |

| Berkeley Group Holdings | BKG | Household products |

| BHP | BLT | Food industry |

| B.P. | B.P. | Oil and gas companies |

| British American Tobacco | BATS | Tobacco company |

| British Land | BLND | Real estate investment trusts |

| BT Group | BT.A | Communications and telecommunications |

| Bunzl | BNZL | Food industry |

| Burberry | BRBY | Personal Items |

| Carnival Corporation & plc | CCL | Travel and leisure |

| Centrica | CNA | Housing and communal services |

| Coca-Cola HBC AG | CCH | Food |

| Compass Group | CPG | Food industry |

| CRH plc | CRH | Construction Materials |

| Croda International | CRDA | Pharmaceutical company |

| DCC plc | DCC | Food industry |

| Diageo | DGE | Food |

| Direct Line Group | DLG | Insurance Company |

| easyJet | EZJ | Travel and leisure |

| Evraz | EVR | Industrial metals |

| Experian | EXPN | Food industry |

| Ferguson plc | FERG | Food |

| Fresnillo plc | FRES | Food industry |

| GlaxoSmithKline | GSK | Pharmaceuticals and biotechnology |

| Glencore | GLEN | Food |

| GVC Holdings | G.V.C. | Travel and leisure |

| Halma | HLMA | Electronic and electrical equipment |

| Hargreaves Lansdown | H.L. | Financial services |

| HSBC | H.S.B.A. | Banking |

| Imperial Brands | IMB | Tobacco company |

| Information | INF | mass media |

| InterContinental Hotels Group | IHG | Travel and leisure |

| International Airlines Group | IAG | Travel and leisure |

| Intertek | ITRK | Food industry |

| ITV plc | ITV | mass media |

| Johnson Matthey | JMAT | Pharmaceutical company |

| Just Eat | J.E. | Retail |

| Kingfisher plc | KGF | Retail |

| Land Securities | LAND | Real estate investment trusts |

| Legal & General | LGEN | Insurance Company |

| Lloyds Banking Group | LLOY | Banking |

| London Stock Exchange Group | LSE | Financial services |

| Marks & Spencer | MKS | Retail |

| Melrose Industries | MRO | Cars and spare parts |

| Micro Focus | MCRO | Software |

| Mondi | MNDI | Forestry |

| Morrisons | MRW | Retail trade of food and medicine |

| National Grid plc | N.G. | Housing and communal services |

| Next plc | NXT | Retail |

| NMC Health | NMC | Medical equipment and services |

| Ocado | OCDO | Retail trade of food and medicine |

| Paddy Power Betfair | PPB | Travel and leisure |

| Pearson plc | PSON | mass media |

| Persimmon plc | PSN | Home & Home Products |

| Prudential plc | PRU | Insurance Company |

| Randgold Resources | RRS | Food industry |

| Reckitt Benckiser | R.B. | Home & Home Products |

| RELX Group | REL | mass media |

| Rentokil Initial | RTO | Food industry |

| Rio Tinto Group | RIO | Food |

| Rightmove | RMV | mass media |

| Rolls-Royce Holdings | R.R. | Aerospace and defense industry |

| Royal Bank of Scotland Group | RBS | Banking |

| Royal Dutch Shell | RDSA | Oil and gas companies |

| Royal Mail | R.M.G. | Industrial transport |

| RSA Insurance Group | RSA | Insurance Company |

| Sage Group | S.G.E. | Software |

| Sainsbury's | SBRY | Retail trade of food and medicine |

| Schroders | SDR | Financial services |

| Scottish Mortgage Investment Trust | SMT | Equity Investment Instruments |

| Segro | SGRO | Real estate investment trusts |

| Severn Trent | SVT | Housing and communal services |

| Shire plc | S.H.P. | Pharmaceuticals and biotechnology |

| Sky plc | SKY | mass media |

| Smith & Nephew | S.N. | Medical equipment and services |

| Smith, D.S. | SMDS | Engineering |

| Smiths Group | SMIN | Engineering |

| Smurfit Kappa | S.K.G. | Engineering |

| SSE plc | SSE | Electricity |

| Standard Chartered | STAN | Banking |

| Standard Life Aberdeen | SLA | Financial services |

| St. James's Place plc | STJ | Insurance Company |

| Taylor Wimpey | TW. | Home & Home Products |

| Tesco | TSCO | Retail trade of food and medicine |

| TUI Group | TUI | Travel and leisure |

| Unilever | ULVR | Personal Items |

| United Utilities | UU. | Housing and communal services |

| Vodafone Group | VOD | Mobile telecommunications |

| Whitbread | WTB | Hotel business |

| WPP plc | WPP | mass media |

Index history

The Financial Times Stock Exchange Index (FTSE) was created by the publishing house Pearson and the London Stock Exchange in 1986.

Today the FTSE 100 index is owned by the independent research company FTSE Group, a subsidiary of the London Stock Exchange. The publisher sold its stake in the company and now their newspaper Financial Times does not participate in the Footsie 100 calculations.

In addition to the newspaper, FTSE Group has previously collaborated with Chinese analysts. But in 2010, the company learned to obtain data on the Asian market independently, without the help of a foreign exchange. This is how the FTSE China A50 was born.

Annual profit

The following table shows the annual change in the FTSE 100 index calculated since 1969.

| Year | Closing level | Index change in points | Index change in % |

| 1969 | 313,16 | ||

| 1970 | 289,61 | -23,55 | −7,52 |

| 1971 | 411,03 | 121,42 | 41,93 |

| 1972 | 463,72 | 52,69 | 12,82 |

| 1973 | 318,30 | -145,42 | −31,36 |

| 1974 | 142,17 | -176,13 | -55,33 |

| 1975 | 335,98 | 193,81 | 136,32 |

| 1976 | 322,98 | -13,00 | −3,87 |

| 1977 | 455,96 | 132,98 | 41,17 |

| 1978 | 468,06 | 12.10 | 2,65 |

| 1979 | 488,40 | 20,34 | 4,35 |

| 1980 | 620,60 | 132,20 | 27.07 |

| 1981 | 665,50 | 44,90 | 7,23 |

| 1982 | 812,37 | 146,87 | 22.07 |

| 1983 | 1,000.00 | 187,63 | 23.10 |

| 1984 | 1 322,20 | 232,20 | 23,22 |

| 1985 | 1,412,60 | 180,40 | 14,64 |

| 1986 | 1,679,00 | 266,40 | 18,86 |

| 1987 | 1 712,70 | 33,70 | 2,01 |

| 1988 | 1,793,10 | 80,40 | 4,69 |

| 1989 | 2 422,70 | 629,60 | 35,11 |

| 1990 | 2 143,50 | −279,20 | -11,52 |

| 1991 | 2 493,10 | 349,60 | 16.31 |

| 1992 | 2 846,50 | 353,40 | 14,18 |

| 1993 | 3 418,40 | 571,90 | 20.09 |

| 1994 | 3 065,50 | -352,90 | -10,32 |

| 1995 | 3 689,30 | 623,80 | 20,35 |

| 1996 | 4 118,50 | 429,20 | 11,63 |

| 1997 | 5 135,50 | 1 017,00 | 24,69 |

| 1998 | 5,882,60 | 747,10 | 14,55 |

| 1999 | 6 930,20 | 1 047,60 | 17,81 |

| 2000 | 6 222,46 | -707,74 | -10,21 |

| 2001 | 5 217,35 | −1 005,11 | -16,15 |

| 2002 | 3 940,36 | -1 276,99 | -24,48 |

| 2003 | 4 476,87 | 536,49 | 13,62 |

| 2004 | 4 814,30 | 337,57 | 7,54 |

| 2005 | 5 618,76 | 804,46 | 16,71 |

| 2006 | 6 220,81 | 602,05 | 10,71 |

| 2007 | 6 456,91 | 236,10 | 3,80 |

| 2008 | 4 434,17 | −2 022,74 | −31,33 |

| 2009 | 5 412,88 | 978,71 | 22.07 |

| 2010 | 5 899,94 | 487,06 | 9.00 |

| 2011 | 5 572,28 | -327,66 | −5,55 |

| 2012 | 5 897,81 | 325,53 | 5,84 |

| 2013 | 6 749,09 | 851,29 | 14,43 |

| 2014 | 6 566,09 | -183,00 | −2,71 |

| 2015 | 6 274,05 | -292,04 | -4,45 |

| 2016 | 7 142,83 | 868,78 | 13,85 |

| 2017 | 7 687,77 | 544,94 | 7,63 |

| 2018 | 6 728,13 | -959,64 | -12,48 |

| 2019 | 7 542,44 | 814,31 | 12.10 |

| 2020 | 6 460,52 | −1 081,92 | -14,34 |

Types of index

To gauge the state of the market, analysts look at the Dow Jones, DAX 30 and FTSE 100. The British top 100 is very popular, but the FTSE Group has also come up with another 250 thousand stock indexes.

Why so many?

Analytical companies serve for:

- pension and ETF funds;

- real estate REITs;

- media companies;

- private and large investors;

- other analysts.

There is no formula to please everyone. Therefore, there are groups of indices, each with its own equation. They are divided according to the following criteria:

- Branch of the economy.

- Region.

- Economic indicator.

Specifically for the FTSE Group, they monitor the economies of 80 countries and provide real-time data on 600 indices.

For example, the FTSE 250 will say more about the British financial market than the top 100, which analyzes the European market. We will discuss why this happens later.

FTSE SmallCap looks at the state of affairs of small companies at the bottom of the ranking. It is part of the FTSE All Share, which includes all securities of the London Stock Exchange.

It is difficult for the average person to intuitively understand how this or that index will be useful.

For example, our current FTSE 100 index reflects the position of the European market, although its companies occupy 80% of the capitalization of the London Stock Exchange. And FTSE All Share, which seems to reflect the general situation in the British economy, actually copies the dynamics of the top 100.

To understand why each type of index is useful, you can visit the FTSE Group website. There are educational videos, booklets and blogs on the FTSE 100 and more.

How does it reflect the economic situation?

In the FTSE 100, the assets of all included companies account for about 80% of financial turnover on the London Stock Exchange. It effectively reflects the current economic situation in general throughout the country. With an increase in analogues, a sharp decrease in exports, it decreases; with an increase in the capitalization of companies, an increase in their profitability, it increases.

However, one of the key features of the FTSE 100 is that the index rarely experiences sharp ups and downs . Even during the global economic crisis of 2007, its fall to 3,500 points was smooth. And the then asset holders suffered minimal losses.

And during its entire existence, the FTSE 100 has never had deep drawdowns without subsequent growth. Therefore, as an investment instrument, it is a very durable asset that is owned by almost every major investor on the planet.

Cost and dynamics for all time

Since its launch, the ftse 100 index has grown 8-fold and is now approaching the 8,000 mark.

The last “hole” that the UK and the UK 100, along with the FTSE 100, fell into was the referendum on England’s exit from the EU. Brexit still affects the dynamics of the indicator, but not as much as in 2021.

To show erudition, it is enough to mention only three key points for the global economy of modern times:

- the advent of the Internet in 1995;

- terrorist attack of September 11, 2001;

- US mortgage crisis of 2008.

I suggest not stooping to such platitudes. We'll talk about how the UK's top 100 companies responded to other significant events in the world and country.

In March 2021, the FTSE 100 showed a strong fall for the first time since the crisis. In general, no index in the world showed such low results for the first quarter. But it's easy to explain.

At that moment, all indices were suffering from rumors of a trade war between the US and China. Inflation was predicted for the weakened dollar. But the FTSE 100 has fared the worst because all the companies in the index are focused on overseas trading and are heavily dependent on the dollar.

When the dollar weakens against the pound, it is bad for the top 100. Conversely, when the dollar shows growth (as in July 2021), the Footsie 100 climbs to the top.

But this is not the only combination of factors that regularly brings down the British stock market. In February 2021, the weakening of the Chinese economy coincided with a drop in oil prices. This alone would have been enough for the FTSE 100 quotes to be in the red zone, but then the country's banks announced the risk of recession.

As you understand, the combination of only five conditions explains the rise and fall of the Footsie 100 throughout the history of the index.

Historical giant

Being part of the European Union, Great Britain has a high influence on the entire market of the Old World. Today, it is the volumes of British transactions that make up a large part of the capitalization of local stock markets.

Britain, historically, occupies one of the leading roles in Europe. From the Middle Ages, when the English crown conquered lands, to the 1930s, a huge part of the earth's land was under its rule. England had colonies in Africa, the Middle East, Southeast Asia and, of course, India. Formally, at that time, India itself was part of Britain, along with Pakistan and Sri Lanka, and only after gaining independence did these states appear.

The huge amount of fertile land gave Great Britain enormous strategic power, both in terms of resources and in terms of military affairs. It is not surprising that the largest European stock exchange was eventually formed in London. London is also known for trading in non-ferrous metals. Today, it is here that the main capitalization of gold trading around the world is formed.

Index calculation method

All indexes come in two types:

- According to Paasche's formula.

- According to the Laspeyres formula.

I don't write about mathematics, so I'll only tell you the main thing about Footsie's calculation.

In the complex FTSE 100 formula, the number of shares that are in free float matters a lot. This number is in both the denominator and the numerator. The index is calculated as follows:

Σ * (Price of one share * Number of shares) * Free float factor / Index divisor = FTSE Index

Here free float means “free circulation”. In the future, the curious reader will encounter the expressions “free float capitalization” and “free float formula”. All these expressions refer to free shares of companies.

FT 30

The oldest continuous index in the UK is the FT 30, also known as the Financial Times Index or the FT Regular Index (FTOI). It was founded in 1935 and is now largely obsolete due to its redundancy. It is similar to the Dow Jones Industrial Average and represents companies in the industrial and commercial sectors. Financial sector companies and government stocks are excluded.

Of the original components, three are now in the FTSE 100: Tate & Lyle, Imperial Tobacco and Rolls-Royce, although Rolls-Royce was not consistently listed and Imperial Tobacco was a subsidiary of Hanson for a number of years, now renamed Imperial Brands. Only one of the original FT 30 companies is still in the index: Tate & Lyle (membership is not strictly based on market capitalization, so this does not mean they are necessarily among the thirty largest companies in the FTSE 100). The best performer from the original lineup was Imperial Tobacco.

Pros and cons of the index

In the formula y. This means that the largest members of the index (and the FTSE 100 is no exception) have more influence on the indicator, and this is a plus.

For example, for Dow Jones, the price of securities matters most, so it “promotes” small companies with expensive shares. Footsie 100 is more accurate here. In addition, the indicator does not take into account shares owned by insiders. Therefore, investors' understanding of the market situation becomes clearer.

What the index doesn't take into account is dividends. Although for some this is even a plus - it all depends on the goals of the analysis.

Speaking of which. If the task is to evaluate the British market, then the FTSE 100 is not suitable, no matter how paradoxical it may sound. I have already said that the indicator is tied to the dollar, and the top 100 companies are focused on the foreign market.

Trading strategy for FTSE 100

One of the easiest ways to start trading the FTSE100 is to use technical analysis models to identify turning points in the market and therefore areas to buy and sell.

A popular price action pattern is the engulfing candlestick pattern, which comes in two types: the bearish engulfing candlestick pattern and the bullish engulfing candlestick pattern.

An example of a bearish engulfing candle.

As shown above, the bearish engulfing candlestick pattern consists of two candlesticks. The most important candle is the second one, which covers the range (high to low) of the previous candle. On the second candle, buyers first push the market up, breaking the high of the previous candle. However, during the same candle, sellers step in and push it down, breaking the previous candle's low and closing lower. This represents a significant shift in momentum to the downside.

An example of a bullish engulfing candlestick pattern.

As shown above, the bullish engulfing candlestick pattern is based on two candles. The most important candle is the second one, which covers the range (high to low) of the previous candle. On the second candle, sellers push the market down, breaking the low of the previous candle. However, during that same candle, buyers step in and push it back up, breaking the previous candle's high and closing higher. This represents a significant upward shift in momentum.

Warning

Useful articles

What are portfolio investments Asset Allocation and why are they so popular?

What to invest in in 2021: from the most profitable to the most reliable investments

Step-by-step instructions: how can an investor fill out a 3-NDFL declaration and pay taxes?

How to save for retirement, and not rely on the country and beg for alms from the transition?

Regular readers already know my point of view on stock speculation. For the rest, I repeat - binary options and the Forex market are nothing other than a lottery. But I promise, as soon as something changes, I will start taking pictures with a fan of large bills, like all these scammers in advertising do.

The options themselves are binary, and this is a type of so-called exotic options. They cannot be purchased through the application by spending a nominal 2 thousand rubles.

Binary options require a special trading strategy. And that’s not in Russia: we don’t have platforms for such trading.

What the scammers are demonstrating is a virtual environment in which it is impossible to earn anything.

Forex is a different matter. It hides behind complex terms, and trading here takes time. But by and large it is still a scam, despite the fact that economic concepts are included in it.

Technical analysis is based on the Charles Dow theory, which is 80 years old. Once upon a time this was know-how, and those who used it were truly head and shoulders above everyone else (you read “Notes of a Stock Speculator” of 1923, right?). Today, indicators that suggest making a trade are calculated in milliseconds in hundreds of thousands of trading terminals around the world and appear too late, so that speculation is doomed to failure.

And fundamental analysis simply will not be useful to the average person: even the most venerable economist cannot keep track of all the news and analytical materials. Even more ridiculous are attempts to make a forecast of the economic calendar.

Why trade the FTSE 100 with Admiral Markets?

If you trade FTSE100 with Admiral Markets you can:

✅ Use leverage up to 1:20 for retail clients. This means that you can control a large position with a small deposit.

✅ Trade with a well-established and highly regulated company.

✅ Have access to the fastest and most popular MetaTrader trading platforms for PC, Mac, Android and iOS operating systems.

✅ Use the negative balance protection policy for your peace of mind.

✅ Trade FTSE100 without commission!

If you are itching to start trading, or this article has provided some additional information to add to your existing trading knowledge, you may be pleased to know that Admiral Markets provides the ability to trade Forex and CFDs on over 80 currencies, with the latest market updates and technical analysis provided FOR FREE!

To open your trading account, simply click on the banner below:

What affects the price

The index base includes many energy companies. Therefore, a decline in oil prices could drop the Footsie 100 by a couple of hundred points. But this is not an axiom: there were periods when oil prices rose, and the FTSE 100 was still in the hole.

Another misconception concerns the US Federal Reserve's increase in lending rates. Simple logic says that the harder it is for companies to borrow, the worse their business, the cheaper the shares and the lower the index (including the FTSE 100).

In fact, the lending rate and the dynamics of the Footsie 100 have no direct connection. The US tightens credit conditions when everything is very good in the country and the threat of inflation looms. And since everything is fine, investors feel optimistic and leave their funds on the stock exchange.

So it turns out that the interest rate has risen along with the FTSE, but there is no direct connection between these events.

But what always changes the state of the London Stock Exchange is the exchange rate of the dollar against the pound. Again, the top 100 companies do business outside the UK, so a strengthening of the national currency will only harm them.

Forecast, analytics and prospects

Loading …

All important economic events have had an impact on the FTSE. For the last two years, industry in England has been in decline. Analysts find it difficult to write a prescription for any specific medicine. If not for the recession, the Footsie 100 would have long ago broken through the ceiling of 8 thousand points.

Venezuela and Iran are suffering from sanctions from the US and other countries. They are large oil exporters and therefore influence FTSE 100 companies.

After the presidential elections in Iran, the government will have to close the issue of the nuclear program. When this happens, the price of oil will fall to an acceptable level.

In Venezuela, another problem is the claims of the Americans regarding the unfair nationalization of mining complexes. Many countries are working on the situation, including Russia, so my forecast is rather positive.