Is it possible to make money on grain futures, what do you need to know for this and what data to use to analyze and predict market behavior? Managing Director of Invest Mikhail Khanov talks about the peculiarities of trading wheat and a number of other grain crops on electronic commodity exchanges .

Grain futures are among the traditional and quite popular exchange instruments. In English, all contracts for grain crops are called the term Grains. As a component they are included in the broader category Agriculture, which includes contracts for all agricultural products.

In its modern form, grain futures originated in the mid-19th century in the USA. Then they traded at the Chicago Board of Trade (CBOT). Then the Minneapolis Grain Exchange (MGEX) was created.

A radical revolution in the field of commodity futures trading occurred as a result of the transition to electronic trading. As a result of the innovation, both the potential and actual number of bidders has increased sharply through the use of remote access via the Internet. Against this background, the traditional form of trading on commodity exchanges (by the shouting method), although slowly but steadily, is dying out.

Unit of measurement of wheat on the stock exchange

On world exchanges, wheat and other bulk commodities are measured in bushels. This is a measure of volume equal to three buckets. Accordingly, the weight of the product (wheat, oats, rice and other grains) is different, only its volume is equal - 1 bushel.

1 bushel of wheat = 27 kg 216 g.

The minimum contract is 5,000 bushels (136.08 tons).

Wheat price on the stock exchange

The price of wheat, like other commodities, is subject to fluctuations. The cost is influenced by various factors - crop failure, economic situation, natural disasters, etc.

The price of wheat on the stock exchange is affected by:

- demand;

- productivity;

- speculative operations;

- Exchange Rates;

- Estimated delivery time;

- force majeure (fire, hurricane and other disasters, military actions, new taxes, etc.);

- world crises.

Wheat is traded in the currency of the country in which the exchange is located: rubles, Australian dollars, euros, yuan, rupees, South African rands, Hong Kong dollars, Swiss francs, US dollars, etc.

The conditions of the exchange stipulate what criteria the product must meet. Buyers know exactly what class of wheat they are buying, and often also from where.

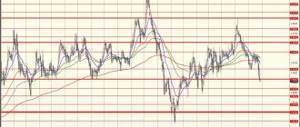

In the chart below, see the price dynamics of US wheat futures from 1990 to 2021. Prices are in cents per bushel. That is, 498.62 is $4.9862.

Wheat on the Moscow Exchange

Russia plays a significant role in the wheat market. The first trading in deliverable forward contracts took place in December 2015 at the National Commodity Exchange (owner - Moscow Exchange).

Since March 2021, the Moscow Exchange has launched a new instrument - grain swaps. This is the provision of a loan where a commodity, in this case wheat, acts as collateral for repayment of the loan.

Investing in wheat

People invest in wheat and other commodities on the stock exchange by buying or selling:

- options,

- futures;

- indexes;

- CFD (contract for difference),

- ETF,

- shares of producers on stock exchanges.

Large businesses come to the commodity markets and need a product, not a game on price fluctuations. This is how commodity markets differ from the securities market (stocks, bonds, units of mutual funds), which people come to for profit on exchange rate changes, to receive dividends, or out of a desire to enter the business by purchasing a large share of the issuer.

The exception is precious metals (gold, silver, palladium and platinum), they are also attractive for making money on exchange rate differences and long-term investment.

It is a mistake to rely only on luck if you want to receive a stable income on a long-term basis. Knowledge is needed, and it is better if it is obtained from qualified teachers. This way you will learn to catch trends, be able to distinguish a real breakout from a false one, learn the basic methods of market analysis (technical analysis, Elliott wave analysis and MasterForex-V know-how), etc.

Question from Masterforex-V Academy: Are you familiar with the trend resistance and support levels?

How to Trade Wheat in 3 Quick Steps

Do you want to start trading wheat right away? Follow these three steps to create a brokerage account and start trading.

Open a trading account.

Open a free trading account with our recommended broker. As part of the registration process, you will be required to provide your personal details for KYC.

Depositing funds

Once you have completed registration and your account has been approved, you can transfer funds to your account using one of the provided payment methods.

Demo and real trading

Start trading on a demo account. A demo account allows you to trade in real time and also learn about the mechanics of wheat trading and understand the basic terms.

Open a wheat trading account now

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to risk losing your money.

Once your account is funded, you are ready to start buying and selling wheat. We recommend that you start trading with a demo account so that you can learn the basics and develop a strategy.

Wheat production in the world

The big three wheat producers are China, India, Russia. They are noticeably ahead of other countries. The TOP 10 also includes Ukraine.

TOP 10 wheat producers:

- China – 134.34 million tons per year.

- India – 98.561 million

- Russia – 85.86 million

- USA – 47.37 million

- France – 36.92 million

- Australia – 31.82 million

- Canada – 29.98 million

- Pakistan – 26.67 million

- Ukraine – 26.21 million

- Germany – 24.48 million

Wheat import

The largest importers of wheat are countries where it is difficult to grow due to natural conditions. The exception is the presence in the list of the European Union. In fact, the EU is an export leader; it simply buys part of its wheat from other countries for economic reasons.

TOP 10 wheat importers (2016):

- Egypt - 11.5 million tons.

- Indonesia – 9.1 million

- Algeria – 8.1 million

- Türkiye – 7.3 million

- European Union – 6.7 million.

- Brazil – 5.8 million

- Japan – 5.7 million

- Iran – 5.5 million

- Mexico – 4.5 million

- Nigeria – 4.3 million

Processors have increased demand

Despite the lack of demand for grain from exporters due to current restrictions, prices for wheat, barley, and corn last week again increased by 50–250 rubles, to 13.6–15.25 thousand rubles. per ton. The reason may be increased purchases by livestock farmers due to low stocks in the center of the country and the restoration of meat production. The return of demand from exporters is expected in June, but their activity depends on buyers, some of whom have purchased for future use.

Sovecon reported in its review about the growing demand for grain from Russian processors, primarily livestock farmers. The reason may be relatively low reserves. In addition, a number of players could begin to worry about the late arrival of the new crop, analysts write. Against this background, the average price of wheat over the past week increased by 75–250 rubles, to 13.6–14.55 thousand rubles. per ton, depending on the class, of barley - by 50 rubles, up to 13.6 thousand rubles. per ton, corn - by 175 rubles, up to 15.25 thousand rubles. per ton. According to Sovecon director Andrei Sizov, in 2021 Rosstat switched from publishing monthly reports on the status of grain reserves to quarterly reports, which could have given a number of processors the wrong idea about the state of the market.

In April, it turned out that farmers had accumulated significant amounts of grain, and consumers’ stocks were at a record low for recent years, and they stepped up purchases, he says.

General Director of the National Union of Pig Breeders Yuri Kovalev confirms that grain prices have increased slightly, most likely due to low reserves, primarily in the center of the country, where the main production facilities are located. According to him, all free grain from the center was exported, and processors have to purchase raw materials in remote regions of the Volga region and Siberia, which, taking into account logistics, also slightly increases the cost compared to prices last month and the month before. But, Mr. Kovalev emphasizes, prices are still within reasonable limits due to duties. The head of the National Meat Association, Sergei Yushin, adds that the increase in demand for grain from processors could be caused by the restoration of egg and broiler production in recent months and the acceleration of the growth rate of the pig population by 4-5% year on year, as well as an increase in turkey production. As follows from the estimates of the National Union of Pig Breeders, in April the enterprises produced 18.12 thousand tons of this meat compared to 4.21 thousand tons in February. In May, pork production is expected to increase to 23.86 thousand tons, in June - to 27.63 thousand tons.

Demand for grain from traders, on the contrary, is weak, and some large exporters have suspended purchases, Sovecon writes.

According to Andrei Sizov, demand may recover in June, after the mechanism for applying the new, floating duty, which starts on June 2, becomes clear. Currently, there is a duty on the export of wheat of €50 per ton; from June 2, its size will be 70% of the difference between the indicative price and the base price of $200 per ton. According to Sovecon, last week average prices for Russian wheat in deep-sea ports decreased by $2, to $272 per ton. The stock exchange index is $240.4 per ton.

How the May holidays fueled demand for Russian wheat

According to preliminary calculations by the Chairman of the Board of the Union of Grain Exporters Eduard Zernin, the export duty on wheat from June 2 may be at $30. “This is less than the current size, so we can expect an increase in the purchasing activity of exporters,” he notes. But, Mr. Zernin continues, for a real increase in exports, an increase in demand from buyers is also required, most of whom had previously purchased for future use. The Egyptian GASC recently announced a tender for the supply of wheat in August, which eloquently indicates that the key buyer of wheat from the Russian Federation has sufficient reserves for the coming months, he points out. From the beginning of the season to May 20, Russia exported 40.4 million tons of grain, including 32.9 million tons of wheat.

Anatoly Kostyrev

Wheat export

The largest exporter of wheat is the countries of the European Union. Russia ranks second, but leads if EU countries are counted separately rather than together. Ukraine is also in the top ten, where agriculture is at a fairly high level, and the government’s immediate plans include opening the land market.

TOP 10 wheat exporters:

- European Union – 33 million tons.

- Russia – 24.5 million

- Canada – 22.5 million

- USA – 21.2 million

- Australia – 16.3 million

- Ukraine – 15.8 million

- Argentina – 8.8 million

- Kazakhstan – 7.5 million

- Türkiye – 5.5 million

- Mexico – 1.3 million

Features of speculative trading in grain futures

The entire group of grain futures is highly dependent on fundamental data on the US economy . This is primarily due to the fact that the majority of participants in grain futures trading are American producers, exporters, importers and speculators.

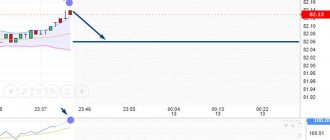

The most liquid contract from the group of grains is wheat. For speculators, this futures is primarily of interest due to its enormous liquidity and high level of volatility, comparable to the price volatility of the S&P500 index. When trading wheat futures, it is necessary to closely monitor the release of fundamental data on wheat reserves in various countries, yields in exporting countries, etc.

The best time to trade grain futures is the trading session on the Chicago Mercantile Exchange (from 18:30 to 22:30 Moscow time), when most of the major players enter the market. The rest of the time the market behaves very sluggishly and is of no interest to speculators.

Every Monday , important fundamental data affecting the grain market is published - the “Crop Progress Report” (Report on the progress of ripening of major crops and harvesting). On the 11th of each month, the USDA US and World Supply & Demand Report is published. Both of these regular events have a huge impact on the grain market, resulting in much higher volatility.

Grain futures traders should also be wary of trading heavily during the months when new grain crops are being delivered—July for wheat, September and November for soybeans, December for rye.

Largest wheat exporting companies

TOP wheat exporting companies (2017):

- Louis Dreyfus Group, international company. Production – 2.134 million tons. Head office in the Netherlands. The shares are not traded on the stock exchange; the key stake (90%) is owned by the Louis-Dreyfus family.

- NIBULON, Ukraine – 1.669 million tons. Main office in Nikolaev. The shares are not traded on an exchange.

- Kernel Trade, Ukraine – 1.534 million tons. Shares are traded on the Warsaw Stock Exchange.

- Cargill, USA – 1.460 million tons. The majority owner of the company (90%) is the Cargill family.

- Bunge, USA – 1.089 million tons. Shares on the New York Stock Exchange.

- Archer Daniels Midland (ADM), an international company – 909 thousand tons. Head office in Chicago. Shares on the NYSE.

- Glencore, Switzerland – 864 thousand tons. Shares on the London Stock Exchange.

- State Food and Grain Corporation of Ukraine, Ukraine – 833 thousand tons.

- Agroprosperis, Ukraine – 794 thousand tons.

- Engelhart, international company – 570 thousand tons.

The largest exchanges for the sale of wheat futures

Futures and options for wheat and other commodities are traded:

In Russia:

- St. Petersburg International Commodity and Raw Materials Exchange,

- MOEX (Moscow Exchange),

- FORTS (Moscow Exchange derivatives market).

In Europe:

- LME (London Metal Exchange),

- LIFFE (London Futures Exchange).

In Asia:

- Dalian Commodity Exchange (China),

- Multi Commodity Exchange (India),

- Tokyo Commodity Exchange (TOCOM),

- Zhengzhou Commodity Exchange, CZCE.

IN THE USA:

- Chicago Mercantile Exchange,

- NYMEX (New York Mercantile Exchange),

- ICE (Intercontinental Exchange).

Grain trading today

The North American holding CME Group Inc. is today the main organizer of trading in futures contracts for various grain crops. The formation of this structure occurred during the merger of several large commodity exchanges from New York and Chicago. In addition to the CBOT mentioned above, these also included the Chicago COMEX, CME and New York NYMEX. Trading of liquid grain futures is carried out within this holding on the CME Globex electronic platform. The single currency of trading held here is the American dollar.

The most popular grain crops actively traded via electronic futures are wheat, corn, rice and oats. This group of grain contracts traditionally includes soybean futures, as well as its processed products: soybeans, soybean flour, meal and oil. Another related group of futures are contracts for the supply of canola seeds, i.e. Canadian rapeseed varieties. However, this article will focus exclusively on wheat.

Wheat CFD

The best option for traders to make a profit on the commodity markets is CFD (Contract For Difference). This is a “contract for difference”, which does not involve the purchase of the product itself!

Details about CFDs from the No. 1 broker rating of the Masterforex-V Academy broker Nord FX.

The company provides leverage, with which exchange trading has become accessible to the general population, because there is no need to pay 100% of the lot.

Other brokers represented in the major leagues are also recommended for cooperation: FXPro, Dukascopy Bank SA, Swissquote Bank SA, FXCM, Finam, FIBO Group, OANDA, Fort Financial Services (FortFS), FOREX.com, Interactive Brokers , Alpari (Alpari), Saxo Bank.

The second league is in reserve. These companies have many negative ratings: FreshForex, GKFX, Forex Club, TeleTrade, RenesourceCapital, LiteForex, XM.com, AlfaForex, FXOpen, Forex4you, RoboForex, Admiral Markets, eToro, NPBFX, EXNESS, Xtreamforex, GrandCapital, MaxiMarkets, TurboForex, EsplanadeMarketSolutions , FinmaxFX, etc.

Commodity contracts in ancient Greece and Mesopotamia

The first prototypes of modern futures contracts appeared in ancient times, long before the era of the industrial revolution and the subsequent rapid development of international trade. At least in 1750 BC, the practice of concluding fixed-term contracts in ancient Mesopotamia was so widespread that this fact was reflected in the legislative documents of that time. In the famous code of the king of Babylon Hammurabi, a separate part was devoted to the rules for concluding contracts for the supply of goods in the future at pre-agreed prices.

Aristotle told the legend about the ancient Greek philosopher Thales. This sage was able to predict a record harvest of olives and earn a lot of money from timely concluded contracts. Thales entered into contracts in advance at low prices for the use of oil presses located in the immediate vicinity. When his forecast for the olive harvest came true, he was able to sell the rights to lease the oil mills at a high profit. In Japan, the rice exchange was opened in Osaka already in our era, but also quite a long time ago, in 1697.

Popular commodities market products

Energy: oil (URALS, Brent, WTI), gasoline, diesel, biodiesel, benzene, gas oil, fuel oil, natural gas, liquefied gas (propane), coal, electricity.

Industry: polypropylene, methanol, ethanol, ethylene.

Ferrous and non-ferrous metals: aluminum, nickel, zinc, copper, steel, cobalt, molybdenum, uranium, lead, brass, tin.

Precious metals: palladium, platinum, gold, silver.

Financial regulators for wheat futures and CFDs

Brokers, exchanges, market makers, brokers need a license from the state financial regulator to legally operate in the financial markets.

Bank of Russia, FFMS - in Russia, CySEC - in Cyprus, - in Sweden, BaFin - in Germany, FCA - Great Britain, FSAEE - in Estonia, ACPR and AMF - in France, CNMV in - Spain, FCMC - in Latvia, FINMA - in Switzerland, PFSA - in Poland, MiFID (for all EU countries), CSRC - in China, SEBI - in India, FSB - in South Africa, Botswana IFSC - in Botswana, ISA - in Israel, CMB - in Turkey, Dubai FSA - in Dubai, UAE, Tadawul - in Saudi Arabia, IFSC in Belize, FSC - in Mauritius, NCPFR - in Ukraine, AFSA - in Kazakhstan, FinCom - in China, MAS - in Singapore, SFC - in Hong Kong, SET - in Thailand, CFTC, NFA, SEC - in the USA, FSCL - in New Zealand, ASIC - in Australia.

How do you assess the prospects for investing in wheat? Please leave your feedback in the comments and share the article on social networks.

Sincerely, wiki Masterforex-V - free (school) and professional Masterforex-V training courses for working on Forex, stock, futures, commodity and cryptocurrency exchanges.

The Magna Carta is an attempt to emerge from the shadows

As an alternative tool for conducting a transparent and fair competitive business, taking into account the initiative of representatives of the Federal Tax Service of the Russian Federation, aimed at operational influence on the current situation, taking into account the current conditions in the Russian agricultural products market and the development trends of the economic situation in the country, the idea of creating a Charter in the field of turnover arose agricultural products. Its participants were companies operating in this market.

Those who signed the document confirm their intentions to work honestly and transparently

, without gaining a competitive advantage due to non-payment of tax payments or the use of illegal schemes to minimize them, they strive to purchase products from bona fide market participants and exercise due diligence when choosing a counterparty and cargo carrier.

The signing of the Charter, its supporters believe, can lead farmers to more transparent activities and significantly increase benefits for both agricultural producers and all participants in the grain market.

In turn, the Ministry of Agriculture will readily support producers who conduct honest and clean business within the framework of current legislation

.

“The idea of creating a Charter in the field of turnover of agricultural products arose after an analysis of the situation in this market carried out by the Federal Tax Service of Russia,” explains a specialist of the Federal Tax Service in the field of taxation of agricultural enterprises. – As a result, illegal taxation schemes used by participants in the grain market were identified, leading to the Russian budget incurring billions in losses.

The principle of constructing these schemes is very complex, it includes multi-stage documentary resale of agricultural products, through the creation of shell companies and forgery of documents, the inclusion of false information in the submitted reports - in general, the complete set. To solve this problem, at one time the service initiated a meeting in Moscow of the top 20 largest domestic grain processors and exporters. The result of the meeting was the understanding that business needs to be restructured, to abandon “gray” and even more so “black” schemes

.

The Charter, signed in different regions of Russia at different times - from two years ago to a year ago - seems to remain an instrument regulating the transparency of the process of buying and selling grain, but it seems to be gradually turning into one of healthy, reasonable, honest, but in reality of little useful initiatives, of which there are heaps in Russia. Unscrupulous market participants have always existed, and tax evasion schemes have always existed. This document was not signed by all grain producers, and those who signed it only declared their good intentions. What follows such declarations in our country - do we need to explain?