The Hong Kong Stock Exchange (HKEx) is the second largest in Asia and the sixth largest among all international stock exchanges in the world.

The HSI Index (HKG50) contains shares of the 34 largest companies and is calculated by the weighted average capitalization of large companies. The index is considered the most important on Asian exchanges and accounts for more than 65% of the total capital of the Hong Kong exchange.

Inside, the indicator is divided into 4 subcategories - financial industry, industrial enterprises, energy and real estate sectors.

Initially, after its creation in 1964, the HKEx had a level of 100 points. Since the index was created to reflect the performance of Hong Kong's largest companies on the stock exchange, it is considered the main indicator of market development.

What is an index

The index includes shares of a certain group of companies. Knowing how much the shares of the largest companies cost, you can determine the state of the market.

If the shares of ten large producers fell in price at once, then there is probably a crisis in the economy. If you have grown, on the contrary, there is reason to rejoice. But such sharp fluctuations rarely occur - we will talk about this later.

To make it more convenient, the indicator is expressed not in currency, but in points. The total price of shares is also not so simple to calculate: a multi-story formula is used. Thus, the indicator will be accurate and useful for everyone: investors, funds and analysts.

What is HSI

HSI is an abbreviation for Hang Seng Index. This is the name of the Hong Kong Stock Exchange Index. This is one of the most popular indexes in the world. The capitalization of companies from Hang Seng accounts for 57.4% of the total capitalization of the exchange. Therefore, the HSI can be used to judge the general situation in the Asian market.

About the asset

The Hang Seng Index is an index of the Hong Kong stock exchange, which is the second largest Asian stock exchange and, accordingly, one of the largest global exchanges. The instrument reflects the state of affairs in the Chinese economy; its quotes are calculated based on the value of shares of fifty powerful and financially stable companies.

In addition to Hong Kong, the index is also traded on the stock exchanges of Johannesburg and Bombay, but the most significant trading volumes take place, nevertheless, on the Hong Kong stock market. In general, the Hang Seng Future is a composite index, a group of four indices that unite companies in different segments of the economy, and each of these indices can be traded separately.

In addition to the Hang Seng Index, financial markets also offer derivative instruments - futures and options. The most popular investment method for private traders is binary options - long-term trading or intraday speculation provides greater profitability than trading the index itself or futures on it.

Which companies are included in the index?

The HSI database currently includes 50 companies and 30 issuers. Newcomers in 2018 were digital technology manufacturer Lenovo and Chinese pharmaceutical brand CSPC.

The composition of the HSI is reviewed every quarter. For today it is:

| Banks and funds | Housing Services | Real estate | Trade and industrial companies | |

| HSBC conglomerate | CLP HOLDINGS | CK ASSET | CHINA MOBILE | WH GROUP |

| AIA | HK & CHINA GAS | SHK PPT | HOLDINGS | MENGNIU DAIRY |

| CCB | POWER ASSETS | LINK REIT | CNOOC | CITIC |

| 1398 ICBC | CKI HOLDINGS | COUNTRY GARDEN | SINOPEC CORP. | MTR CORPORATION |

| PING AN | CHINA RES POWER | CHINA OVERSEAS | GALAXY ENT | CHINA SHENHUA |

| BANK OF CHINA | CHINA RES LAND | PETROCHINA | HENGAN INT'L | |

| HKEX | WHARF REIC | GEELY AUTO | WANT WANT CHINA | |

| CHINA LIFE | NEW WORLD DEV | SANDS CHINA LTD | SWIRE PACIFIC | |

| HANG SENG BANK | HENDERSON LAND | SUNNY OPTICAL | CHINA MER PORT | |

| BOC HONG KONG | SINO LAND | CSPC PHARMA | LENOVO GROUP | |

| BANKCOMM | HANG LUNG PPT | CHINA UNICOM | ||

| BANK OF E ASIA | AAC TECH | |||

So, HSI - what is it? These are 50 Hang Seng companies distributed across 30 holdings:

Hang Seng Index Futures: Investing in the Hong Kong Stock Market

Hang Seng Index (HSI)

— a stock indicator calculated based on the results of trading on the Hong Kong Stock Exchange (the second most important trading platform in Asia after Tokyo and one of the ten most capitalized in the world) and covering about 65% of its capitalization. The Hang Seng has been published by HSI Services Limited since late 1969 and measures investor sentiment in the Asian stock market.

Other articles from the master class “Expanding the range of trading financial assets”

- VIX volatility index futures: trading stock market sentiment

HSI index is calculated

in accordance with the capitalization of the 34 largest companies whose shares are traded on the Hong Kong SEHK Stock Exchange. In this regard, it is considered an indicator of “blue chips” - securities of the most reliable corporations. In addition, there are Hang Seng industry indices, of which the most popular are indicators of capitalization of shares of financial, energy and industrial companies. For example, the HSI index basket includes shares of HSBC, Bank of China (banking sector), Sinopec, PetroChina (energy), China Mobile, China Unicom (communications) and several other well-known corporations.

index

is a convenient tool for investing in the Hong Kong stock market

, which, by the way, is one of the main financial centers not only in Asia, but also in the world. Hong Kong, in turn, having the status of a special administrative territory of China, has the second largest economy in the world. In addition, the Hong Kong Stock Exchange indicator allows investors to invest in the Chinese economy, which is among the fastest growing in the world. Finally, the high liquidity of the HSI index allows it to be used for speculative trading.

How to trade HSI futures?

Traders can trade the Hang Seng Index through a variety of financial instruments, including exchange-traded funds (ETFs), contracts for difference, options and futures.

Futures contracts are among the most convenient and liquid ways to implement medium- and long-term index strategies, as well as speculative trading.

Investors have the opportunity to trade the following HSI futures:

- Standard Hang Seng Index futures contracts

traded on HKEx under the ticker symbol HSI. The price of this futures contract is HKD 50 per HSI index point. The minimum price change is 1 index point or HKD 50 per contract. Trading of the HSI contract is carried out from 09:15 to 12:00 and from 13:00 to 16:15 HKT (Hong Kong time). - Mini Hang Seng Index futures

are traded on the SEHK under the ticker MHI. The contract price is HKD 10 per index point, the minimum price change is one point or HKD 10 per contract. The trading hours of the HSI and MHI contracts are the same.

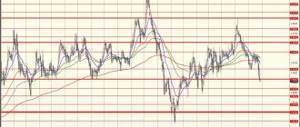

Rice.

1. Mini futures quote for the Hang Seng Index. Source: SaxoTrader trading platform In addition to the Hong Kong Stock Exchange, futures for the Hang Seng Index are traded on the

FORTS derivatives market of OJSC MICEX-RTS

, the Bombay Stock Exchange and the Johannesburg Stock Exchange. However, it is the contracts presented at HKEx that have the most significant trading volumes. On average, traders buy and sell more than 90,000 standard HSI derivatives per day and more than 40,000 mini HSI futures per day. The popularity of the latter is explained by the lower cost of entering a position, which makes it possible to implement a trading strategy even with a large deposit.

The maximum value of futures quotes for the Hang Seng index was demonstrated in the second half of 2007. This was due to the fact that the indicator value crossed the psychological threshold of 30,000 points in January of the same year, when the number of companies included in the HSI index basket was increased. A sharp rise in futures quotes in the form of a doubling was followed by an equally spectacular fall in 2008 below the 11,000 mark. The situation of the last five years, judging by the graph, displays a wave-like rally without such significant collapses or jumps.

Hang Seng Index Futures: Current Market Situation

The downward trend, which began in mid-December 2013 and continued until the end of January 2014, is explained by China's consumer price index, which continues to fall, thereby discouraging investors from actively buying shares. In addition, the expected relaxation of supervision over IPOs of Chinese companies provokes a large influx of new issuers. However, several Chinese firms withdrew their applications for public offerings on the eve of the event, citing the continued strict supervision of the Chinese Securities Commission. Obviously, the system for liberalizing the entry of companies to the stock exchange in practice turned out to be flawed and will require improvement. Although massive IPOs still put significant pressure on the growth of the Hong Kong indicator. As a result, during trading on January 30, 2014, the quote rose by about 200 points.

Rice. 2. Dynamics of Hang Seng Index futures (expiration date: February 2014). Source: official website of the Hong Kong Stock Exchange

The Hang Seng Index, being an emerging market instrument, is highly dependent on the release of reports from advanced economies. In particular, the instability of the situation in the United States is fully reflected in the indicators of Asian indicators, which also cannot finally decide on their direction, either instilling hope for recovery or disappointing the market with an unexpected decline. Today, one can hardly find uniformity in the dynamics of indices of Asian countries: most of them are moving in different directions under the influence of similar factors.

The Chinese market (and Hong Kong in particular), like the financial markets of Latin America, is highly sensitive to speculation related to the winding down/continuation of the quantitative easing program of the American Federal Reserve. At the same time, this issue is raised in printed and electronic publications almost as a permanent column. Plus, recent performance of the US economy gives reason to worry and even be wary: although job growth was much lower than expected, unemployment figures are at five-year lows. This back-and-forth movement within countries once again underscores the uncertainty of America's current economic situation and makes it much more difficult to accurately predict even the immediate future. Ben Bernanke, in turn, is trying to create an optimistic mood with his statements about a gradual recovery from the crisis, thereby restraining the aggressive pressure of the Fed news on world markets.

Considering the direct and very close correlation of Hong Kong stock exchanges with the “epic” of American problems, Hang Seng Index futures traders should pay attention to the release of US statistical data and the nature of the statements of the Fed leadership

as much attention as the dynamics of Chinese companies. In addition, it is important to consider the HSI as a composite indicator that combines financial corporations (they have the largest weight in the index), industrial enterprises, oil companies and real estate market players.

The article was prepared by Sergey Krasikov, senior financial consultant at Saxo Bank

Index history

Hang Seng was invented by a World War II hero named Stanley Kwan.

In 1969, the chairman and general manager of Hang Seng Bank commissioned him to develop an analogue of Dow Jones for the Hong Kong market. Thanks to the efforts of officials, statisticians and economists, the Hang Seng Index debuted that same year.

Kwan was a banker before the war and returned to business after it. He worked for the Hong Kong government for 10 years and then migrated. In England he received the Order of the British Empire.

Today, HSI is managed by a subsidiary of the Hong Kong bank, research firm Hang Seng Indexes. Since its inception, the index has grown 300 times.

Interesting facts about the Hang Seng Index

The Hang Seng Index was first released on November 24, 1969 and is still the largest indicator of the Hong Kong economy. The Hang Seng Index includes many more “fractional” stock indexes, including the Hang Seng China Enterprises Index, Hang Seng China AH Index Series, Hang Seng China H-Financials Index, Hang Seng Composite Index Series, Hang Seng China A Industry Top Index, Hang Seng Corporate Sustainability Index Series and Hang Seng Total Return Index Series.

The chairman of the board of directors of Hang Seng Bank, Ho Xing Han, conceived the Hang Seng Index as “Hong Kong's Dow Jones.”

The base value of the index (100 points) was established on July 31, 1964 as the total value of all shares. The index's record low occurred on August 31, 1967: then the Hang Seng fell to 58.61 points. On October 18, 2007, the Hang Seng crossed 10,000 and an all-time high was set soon after, with the index soaring to 31,958.41 on October 30 of the same year. 5 largest companies in the Hang Seng Index

| Company | Industry | Weight (%) |

| HSBC Holdings | Finance | 10.29 |

| Tencent | Information Technology | 9.59 |

| AIA | Finance | 8.51 |

| CCB | Finance | 8.24 |

| China Mobile | Telecommunications | 5.15 |

HSI by sector

| Sector | Weight (%) |

| Finance | 48.71% |

| Construction and real estate | 11.49% |

| Information Technology | 10.96% |

| Telecommunications | 5.95% |

| Energy | 5.61% |

Types of index

In total, the Hang Seng family includes 400 indices, each of which is calculated in real time. The indicators are intended to reflect the market situation in mainland China and Hong Kong.

Hang Seng Indexes offers the following grouping of their products:

- Groups of companies with the largest capitalization (Market Cap-weighted Indexes).

- Indexes focused on specific factors or strategies (Factor & Strategy Indexes).

- Sector Indexes.

- Sustainability Indexes.

- Fixed Income Indexes.

The following subtypes of the index can be considered key in Hang Seng:

| HS Finance Sub-index | 12 largest banks and insurance companies |

| HS Utilities Sub-index | 4 energy companies |

| HS Commerce & Industry Sub-index | 25 industrial and trading companies |

The company regularly expands its product line. The formula for industrial indices and real estate indices is constantly being improved. And on May 28, the launch of a group of indexes for hedged funds (Hang Seng Currency Hedged Index Series) was announced.

Dynamics and price for all time

Useful articles

What is an ETF and how does it work?

How to choose the right instruments and fill a passive investment portfolio?

What ETFs can you buy in Russia and how to do it?

TOP 3 ideas where to invest 500,000 rubles to earn money

In 1971, the Hang Seng collapsed to 150 points. This is due to the outbreak of the oil crisis and dollar devaluations.

It wasn't until 1993 that the HSI reached 10,000 points. Then the US Federal Reserve interest rates remained at the record low of 1973 for a year. This stimulated market growth, despite rising prices for gold and oil.

In 1997, Thailand declared itself bankrupt. A wave of shocks covered the whole of East Asia. Hong Kong's external debt has significantly outpaced GDP, but the region has stabilized since rising lending rates.

Ten years later, in 2007, Chinese companies lost hundreds of billions of dollars. The “Chinese bubble”, inflated by speculative trading, burst. The government decided to raise interest rates and take out foreign loans to curb inflation. In November, the HSI hovered around 26,500 points.

A new crisis for HSI came in 2015. In February, the HSI fell into the hole of 18,300 points. The yuan has surpassed the Canadian and Australian dollars in popularity to become one of the world's five largest currencies. Foreign investors began to buy shares of the Chinese stock exchange, often with borrowed funds.

In response, the government began devaluing the yuan, dropping the exchange rate to a historic low. When the bubble burst, investors began selling stocks. These events devalued the assets of 1,400 Chinese companies and deepened the crisis.

In January 2021, China's GDP grew by 7%, and in September the Hang Seng was already approaching 24,000 points. And in the first weeks of 2018, the index showed growth records.

This was due to the attraction of foreign capital through Shanghai-Hong Kong Connect. This is a government program that allows you to directly trade the same securities on the Shanghai and Hong Kong stock exchanges.

Factors influencing the HSI index value

As with other stock indices, the value of the Hang Seng is influenced by various micro and macroeconomic factors. First of all, the close connection of the index with the Chinese economy has an impact. Thus, a good example is the abolition of the rigid peg of the yuan to the dollar and the subsequent devaluation of the Chinese currency.

The devaluation of the yuan, which was carried out by the People's Bank of China in 2015, ultimately led to a decrease in the Renminbi by 30%, which could not but affect the stock market.

During such periods, experts become confident in the country's future economic growth, which is reflected accordingly in both its market and the stock index - in this case, the Hang Seng.

Politics also plays a significant role, although political events do not always directly affect the index. The best example in this regard is the Brexit announcement, which caused the Hang Seng to decline by 1,000 points.

Index calculation method

Hang Seng is calculated as an average, but not the arithmetic mean that we are familiar with from school. If we complicate the formula a little, we get a more accurate “weighted average”.

With this formula, larger companies matter more, even if small companies have higher shares. It is very comfortable. For this reason, semester grades at a university, for example, are calculated using a weighted average.

The complete Hang Seng formula looks like this:

- HSI (t) is the current calculated index value.

- P (t)—the current value of the company's share price.

- P (t-1) — stock price at the close of trading on the previous day.

- IS is the number of outstanding shares of the company.

- FAF is a coefficient that takes into account the number of shares in free float (English Freefloat), value from 0 to 1.

- CF is a coefficient based on the company’s capitalization, value from 0 to 1.

- HSI (t-1) - HSI value at market close on the previous day.

Pros and cons of the index

The disadvantage of Hang Seng is that it is not synchronized with other indexes. This is because HSI includes a unique range of companies. Their reporting may be worse or better than the results shown by the base of other indices - SSE Composite or China A50.

Seng's undoubted advantage lies in his formula. It takes into account a wide range of factors, making the Hang Seng calculation a reliable economic indicator.

And finally, the Hong Kong exchange does not have the main disadvantage of the mainland Chinese economy. The Hong Kong administration does not engage in aggressive price regulation. In China, on the contrary, the government seeks to demonstrate incredible economic indicators by distorting them.

What affects the price

The answer to this question comes down to general factors:

- Dollar exchange rate. Many Hang Seng companies are focused on the Western market and do better when the dollar rises in value.

- State of the American market. Some Chinese shares are owned by Western investors. Therefore, the more optimistic the US shareholder, the higher the HSI.

- "Economic Bubbles". This expression means economic growth that has no real basis. Today, these include the cryptocurrency market and the rise of the American market. If these bubbles burst, the Hang Seng index will go down.

But these are long-term factors.

Today the Hang Seng index is influenced by:

- US-China trade war;

- conflict with a major oil exporter, Iran.

Carbon prices are changing the dynamics of the Hang Seng, with about a dozen fuel and energy companies regularly included in the index.

Benefits of Trading HSI on AvaTrade

By trading on the website of a reliable accredited Forex and CFD broker AvaTrade, you receive the following benefits:

- low spread and leverage up to ;

- free trading training to gain complete confidence;

- wide selection of trading platforms;

- innovative AvaTradeGO application that will allow you to trade HSI anywhere.

You are ready? Start trading today by funding your account with just USD and a welcome bonus of up to $10,000 will be yours!

RegistrationDemo account

Forecast, analytics and prospects

The new government program opened the way to the entire stock market in the region. Although the program started in 2014, it is only now gaining momentum.

My optimism is also supported by the numbers: ETFs based on HSI brought more profit to investors than portfolios of Western companies. FinEx talks about a 70% return on the Chinese portfolio.

Local startups attract funds from Western investors and grow rapidly, boosting the region's economy. The index itself regularly includes high-tech companies in its base. China Mobile and Tencent Holdings performed well during the crisis. These two companies significantly impact Hang Seng's portfolio returns.

Similar indexes

Indices similar to HSI differ in that they repeat its dynamics. These include the S&P, DJIA and MSCI indices. Behind these abbreviations are leading analytical agencies that develop indices for regional needs:

- Standard&Poor.

- Dow Jones.

- Morgan Stanley Capital International.

Their difference from Hang Seng is in the factors that are taken into account in the formula. The choice is determined by the needs of the Western investor. But to one degree or another, the dynamics of HSI and its foreign analogues coincide.