“By periodically investing in an index fund, an investor who knows nothing can actually outperform most investment professionals,” says Warren Buffett.

If you're looking for a safe way to bet on the growth of the overall US market while limiting downside risk, then the best advice is to take a closer look at the Vanguard S&P 500 ETF (VOO). Its goal is to closely track the performance of the S&P 500 Index, which is considered a measure of the overall performance of U.S. stocks, meaning if you invest in this fund, you are investing in the entire U.S. economy.

There are three main reasons why the Vanguard S&P 500 ETF is attractive.

- The fund consists of large-capitalization stocks. This is important because large-cap stocks are bigger ships, especially if the market has a tailwind. In addition, the stronger the storm in the market, the more resilient the big ships are during market corrections.

- Invests in stocks of the S&P 500 index, representing the 500 largest companies in the United States.

- A big reason why VOO is attractive is that it offers a 2.32% annual dividend yield and an expense ratio of just 0.03%!

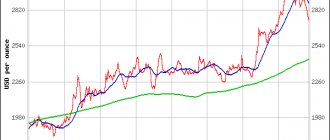

VOO was founded in September 2010. Unlike many exchange-traded funds (ETFs), it is up 187.25% since its inception, producing an average annual return of 11.7% before dividend reinvestment. In 2021 it grew by more than 32%. Its stable and impressive growth is driven not only by the growth of the market as a whole, but also by individual major US corporations, such as:

TOP 10 stocks from the VOO fund.

To get a broader idea of what you're getting when you invest in the Vanguard S&P 500 ETF, just look at the breakdown of the sectors that make up the fund.

History of The Vanguard Group

So, Vanguard is not a single fund, but a global financial services company operating in more than 170 countries and serving more than 20 million individual clients. In total, the corporation manages more than $4.6 trillion.

Vanguard's head office is located in the USA, in Pennsylvania, in the city of Valley Forge. The current executive director, following the death of John Bogle, is F. William McNabb III.

Vanguard currently manages more than 140 mutual funds, as well as about 75 ETFs (exchange-traded funds).

The founder of the company is John Bogle (below is his photo). The idea of establishing mutual funds with minimal management fees and passive index tracking came to him back in 1949, when he wrote his final student thesis, “The Economic Role of the Investment Company.” In it, he promoted the idea that there was no need to have a huge staff of analysts picking individual stocks when you could simply invest in the 500 largest companies in the S&P500 index and achieve similar results.

After graduating, Bogle took a job with Wellington Management, but was fired after a merger went wrong. And then he decided to start his own mutual fund. And not just one, but several, united by the idea of passive control.

Bogle was a fan of Admiral Nelson, so he named the newborn company Vanguard - after the admiral's flagship. So he wanted to emphasize that his company is at the forefront of new financial ideas.

In 1975, the first mutual fund, the Vanguard 500 Index Fund, appeared, which simply passively tracked the S&P 500 index. In fact, this is the prototype of modern ETFs.

Investors were initially skeptical of the idea of passive investing, but the fund's success and phenomenal returns, coupled with its negligible management costs, made the Vanguard 500 Index Fund popular—especially among investors who just wanted to put their money somewhere to grow without it. active participation.

Thus, since 1981, assets under management at Vanguard have doubled every three years:

- 1981 – $3 billion;

- 1983 – 6 billion;

- 1985 – 12 billion;

- 1987 – 24 billion;

- 1990 – $50 billion, etc.

From 1996 to 2005, assets increased from $200 billion to $800 billion. The line of mutual funds and full-fledged ETFs was rapidly expanding. Funds with leverage have appeared, designed for higher risk. Index funds for the broad market and individual countries have appeared.

In 1996, the Vanguard group entered the European and Australian markets, thus gaining a foothold on all continents of the planet.

The world's richest investor, Warren Buffett, once called John Bogle's ETF investment the best investment strategy of all time.

By the way, interestingly, despite the fact that Vanguard is actually the inventor of the ETF concept, the first full-fledged exchange-traded funds were issued by the group only in 2000-2001 - then Vanguard Calvert, Vanguard Total Stock Market ETF (VTI) and Extended Market ETF (VXF) began operating ). By that time, iShares had already issued 58 ETFs, State Street – 20 ETFs.

Vanguard, on the other hand, focused on the development of mutual funds, of which there are still much more in its portfolio than ETFs. However, Vanguard, along with State Street and iShares (Black Rock), is one of the big three ETF issuers with more than 85% of the market in assets. Vanguard's direct assets under management account for 25% of the total.

And here’s another interesting article: What is diversification: basic rules for allocating assets in a portfolio

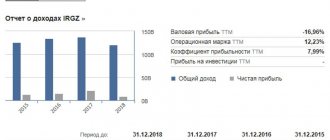

FXDM as an alternative to FXWO/FXRW

The situation is similar to FXDE. It is not clear what to do for those who have global funds from Finex? But what’s unclear here?

From my (purely subjective) point of view, global funds had (and still have) too high commissions . 1.36% versus an average of 0.9% for Finex. The difference is 1.5 times. For those who know how to count, in the long term this results in simply huge lost profits. And at one time (when they first appeared) I didn’t even consider them for my portfolio.

Global funds had only one advantage - they included shares in the markets of England, Japan and Australia. That is, something to which the investor did not have direct access.

This problem has now been resolved. There are all these markets within FXDM. And it makes no sense for investors to invest in more expensive global funds, when something similar can be done independently using a couple of separate ETFs (and in total reduce your commission costs by 1.5 times).

Vanguard Benefits

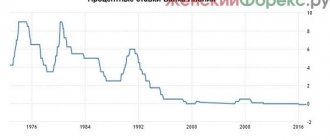

So, the main idea underlying all Vanguard ETFs is passive management . Funds do not need to employ a large staff of analysts; it is enough to simply follow the selected benchmark (index). The main thing is to set up the following correctly. Since the index itself already contains the ideas of diversification and rebalancing, the manager has an order of magnitude less work to do.

By saving on management costs, Vanguard charges clients far fewer fees than actively managed funds. All other things being equal, this is a weighty argument, because lower commissions over the long term contribute to greater capital growth.

Currently, Vanguard's average fund management fee is 0.2%, compared with more than 1% for the industry as a whole. Moreover, for many of the most popular ETFs, commissions are generally below 0.01%, i.e. actually free.

Another benefit of Vanguard is its reliability and credibility. John Bogle managed to achieve this by creating a unique company infrastructure with the connection of independent companies.

By investing in Vanguard funds, you can be confident in the safety of your funds, because client money is separated from the assets of the company itself. Even if a fund is dissolved, this will not affect client funds. Even if Vanguard is liquidated, all money will be returned to shareholders, since it does not constitute the capital of the organization.

By the way, such a separation of funds allows you to avoid conflicts of interest and eliminates the risk of the management company turning into a pyramid, living off the influx of new funds (as was the case with the Madoff Securities fund).

The third significant advantage is that the huge amount of management tools allows you to set up precise index tracking , which smaller providers cannot afford.

Therefore, the differences in the dynamics of growth in the value of Vanguard fund shares and the benchmark are minimal - hundredths of a percent (while the accuracy of tracking for many smaller companies is 95-98%).

Disadvantages of Vanguard

In essence, Vanguard’s business model is built in such a way that it has no particular disadvantages - all advantages