Have you ever caught yourself wanting to make money quickly and a lot? Probably, every trader secretly dreams of an exchange jackpot, but professionals know how to live in reality and choose calm, systemic trading, not forgetting to place restrictive orders. But for beginners and traders with an adventurous streak, dreams and hopes of a fat jackpot often break free and... break the strategy, violate the system, and provoke mistakes.

Two typical mistakes that an uncontrollable thirst for quick enrichment leads to are “the last car” and “the oncoming locomotive”. Another analogy is sometimes used: “sailing ships” and “catching knives.”

In the first case, the trader, having noticed an increasing market trend late, hopes to have time to make extra money on it. In the second, he decides that he is already late and begins to play against the market.

The vectors are multidirectional, the errors are antipodes of each other, and the result is usually the same: losing money, losing a significant part of the deposit, or even complete ruin. Well, the root of evil is greed and lack of forward thinking. In other words, greedy stupidity, for which the market severely punishes.

Is it possible to trade against the trend? And if so, how to do it correctly?

Hello ladies and gentlemen. In this lesson we will talk about trading against the trend. Trading against the trend is dangerous; it very often leads to losses. But there are situations when you really want to enter a trade, even though it is against the trend.

In general, I will not recommend that you trade against the prevailing movement. But if a situation arises where you really want to enter a trade, then at least do it correctly.

And we’ll talk about how to do it correctly later.

Why is trading against the trend so dangerous?

The fact is that when we look at history on a chart that has already happened, has already been “drawn”, and not at prices that exist in real time, we pay attention to extremes, but do not pay attention to what preceded them.

And we see that there was a setup at the top, and it was possible to enter and take a good profit.

It seems that entering against the trend will be very, very profitable. But the fact is that we lose sight of the moments when the price had been moving up for some time, drew some kind of setup, but as a result continued to move in the same direction. And if we had entered against the trend, we would have lost many points. And, accordingly, real money.

Finding the right keys

How to find keywords that are “out of phase” with the current semantics? Regularly studying Yandex bid data and analyzing user behavior. For example, in one of the campaigns before balancing we had the following auction profile:

The graph shows clusters of keys with information and purchase intents, which originally consisted of semantics. We discovered that the opposite price dynamics were observed for requests with installment intent (“buy in installments,” “buy on credit,” etc.) By adding them to the campaign, we balanced it.

Having implemented the approach in practice, we were able to use the client’s budget more rationally . With the same expenses, targeted traffic in different campaigns increased by 5-15% .

What helped us in this situation was that the purchase and installment keys relate to successive stages of the user’s thinking. Having a need for a product, people first think about purchasing it - and only after comparing prices for relevant requests do they decide on a loan.

Unfortunately, there is no universal scheme for selecting balancing keywords. However, when searching for them on your own, you need to remember two points:

- The main thing is the meaning of the keys, and not the dynamics of their prices;

- Sometimes there are no such keys.

The second point is less pleasant - let's see what can be done in this case.

Why do you need to be very careful here?

Many traders lose their deposit in such situations. Because what happens next is not at all the movement that they were counting on... We have a downward doji. If you entered using a pending order, i.e. placed a pending order to sell just below the low point of our pin bar, then sales would be activated. So you're in the market. But what awaits you: profit or loss? The price went up a little. But the stop loss, which, as we remember, according to the rules of the pin bar, must be placed above its tail, in this case - the top - has not yet been knocked out. We wait. Another neutral candle has appeared. And behind it is another pinbar. He hit our stop loss.

If there is no balance

If all the necessary keywords have the same search activity peaks, this does not mean that it is impossible to use the approach. Economic theory will help us apply it in such a situation.

Let us recall the theories of international trade by Adam Smith and David Ricardo. Smith believed that profitable trade is possible only between countries that have an absolute advantage in the production of different goods. This is quite consistent with the balanced campaigns we looked at above. The out-of-phase keys alternately have an absolute advantage in the auction, so they can exchange traffic efficiently.

Ricardo argued that an absolute advantage is not at all necessary - a relative advantage is enough for successful trading. Let's take a look at one of the bid peaks of an unbalanced campaign:

As we see, it has a pronounced character only in one cluster of keys - in the other two it is more gentle. Consequently, we can avoid entering a too “overheated” auction, compensating for the decrease in traffic by participating in less busy ones.

The tactic only makes sense if the value of the traffic received from the new clusters exceeds the value of the traffic we missed by abandoning the first one. This condition can be written as follows:

elasticity allows you to determine to what level it is profitable to increase the bid for certain keywords . Its formula is as follows:

Elasticity shows how much you need to increase your bid to get an additional unit of traffic. At different traffic levels for different keys, its value changes. Let's take a look at this graph, for example:

Here you can see that for an increase in traffic from 65 to 75 for Key 1, you will have to pay twice as much as for Key 0.

At higher traffic levels, the elasticity of all keys increases tens and hundreds of times.

Elasticity makes it easy to distribute funds between keywords. As we have already said, it tells you how much traffic it makes sense to reach for each of them.

What could have happened if we had entered on the previous pinbar?

What would happen if we decided: now everything is 100% possible to enter. Some increase the lot, confident that now there will definitely be a strong downward movement. After all, the price cannot rise indefinitely? And one more pinbar. The next day - a bullish candle. The price rises by another 120 points. Then another pinbar is drawn. Well, now that’s it for sure, with a 1000% probability the price will go down! Because as long as you can draw pinbars, now there will definitely be a powerful pullback! That's it, the price is bound to collapse. Let's say that you are now entering sales. The price went down a little. If we entered with a pending order, it would be activated now. Next comes the neutral bar. AND…

Our stop loss is hit again! And a doji is drawn.

The role of speculators in the stock market and the need for its state regulation

The term "speculation" comes from the Latin word "speculatio", which means stalking, looking out. In the modern dictionary of foreign words, the term speculation is defined as:

1) Purchase and resale of various goods at increased prices with the goal of profit.

2) Purchase - sale of exchange-traded assets (shares, bonds, bills, etc.) with the goal of obtaining speculative profit from the difference between the purchase and sale prices (rate) when reselling these assets.

3) A calculation based on something, an intention aimed at using something for selfish purposes.

In economics, the concept of speculation is defined as making a profit by using price differences over time.

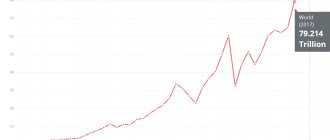

Speculators are the largest but least successful group of participants in the futures market. Although there are no official statistics on the successes and failures of speculators in the futures markets, however, some expert assessments have been made. According to these estimates, only 10 to 30% of the total number of speculators had a net profit in each year of their activity. But this does not prevent new groups of futures market participants from trying their hand at speculative operations.

The subject of speculative transactions is the trading of the deferred right to make and accept delivery under a contract in order to extract a “price difference” in connection with changing business conditions. Speculators, unlike hedgers who seek to protect transactions from risk, take risks in an effort to obtain a certain profit.

In market conditions, speculation is an integral element of purchase and sale transactions, since regardless of the will and desire of the parties, one of them, as a result of continuous price changes, ultimately receives additional gains, while the other incurs losses.

Exchange speculation is usually carried out by members of the exchange and those who wish (usually private individuals) to play on the difference in the price dynamics of futures contracts, but large corporations and banks can also participate in speculation, acting through the same speculators.

In practice, there is no strict distinction between entities engaged in hedging and entities whose activities are related to exchange speculation, since participants in the real goods market are also engaged in exchange speculation, because in a market economy the main thing is to make a profit, regardless of through what exchange transactions this goal is achieved.

In textbooks on stock trading, for stock speculators :

§ Increasing market liquidity;

§ Relative smoothing of price fluctuations.

§ Taking part of the risk of investors or hedgers depending on the market;

§ Competition.

There are two main types of speculators in futures markets: short sellers and long sellers.

Bearing is carried out by speculators selling futures contracts with the aim of subsequently buying them back at a lower price. Speculators who engage in these transactions are called "bears."

The bullish game is carried out by purchasing futures contracts with the aim of subsequently selling them at a higher price. Speculators of this type are called "bulls".

Speculative profit is possible both when playing for an increase and when playing for a decrease. At the same time, in speculative operations losses are also possible, often quite significant. A speculator usually carries out short-term operations. When he starts an operation, they say: he opens a position, when he closes, he closes the position. If a speculator buys securities, he opens a long position, if he sells, he opens a short position. (6)

Stock speculation, as a rule, is carefully planned and carried out according to pre-prepared scenarios, through careful preliminary measures, stretched over quite long periods. Moreover, the excitement on the stock exchange is not necessarily organized by large stockbrokers. This role is usually assigned to small and medium-sized investors, who essentially prepare the ground for large-scale stock market speculation. But, as a rule, large corporations, banks, primarily investment banks, and other financial institutions already participate in them. An increase in interest in general in certain securities or in shares and bonds of a certain company may be due to information about a merger with a larger partner, upcoming scientific and technical discoveries in a particular company, false information about business negotiations between companies on various issues ( on the distribution of government orders for large sums). The dissemination of such information can ultimately give a powerful impetus to an increase in the exchange rate, which may seem unpredictable. In this case, it is important to carry out a transaction a few minutes before the end of the exchange, since the established rate becomes decisive for the next day or two.(8)

On the modern stock exchange, not only stocks, but also bonds of private companies and corporations have become the object of stock speculation. They are used for all kinds of fraud and fraud to make speculative profits. For the purpose of speculation in bonds, special companies are created that build their business on fluctuations in interest levels. Commercial banks play a huge role in the organization and financing of such shell companies, which make additional profits in transactions related to the provision of bonds on credit. Together with banks, other credit and financial institutions with solid financial resources also participate. In this regard, insurance companies have a special place. When transacting in securities, market participants can conduct real, speculative or arbitrage transactions. Stock speculation is a phenomenon as old as the stock exchange itself. Before explaining why speculators are attracted to the stock market, we should briefly discuss why people speculate. There are two main motives in speculation: the possibility of profit and pleasure. Every speculator will agree with the first motive, but the second is often of greater importance. Some people like risk, and stock speculation is inherently risky.

This raises the question: is speculation different from gambling? Those who love speculative operations usually point out that in a game, risk is created for the sake of risk, while speculation is a mechanism for taking risk that already exists. For example, no one needs to lose or gain money depending on which card is dealt. Everyone can just give up on the game. However, someone must lose or gain money depending on whether the prices of stocks or bonds fall or rise, that is, whether the risk falls on the issuers of these securities or on one of the speculators.

The psychological motives of speculators do not differ significantly from the motives of gamblers. However, stock speculation does transfer risk from those who do not want it to those who do. In other words, speculation in financial assets directs the desire to take risk in an economically productive direction.

Stock trading has great appeal for those who are interested in a combination of excitement and the possibility of big, quick profits. First, it represents extraordinary profit opportunities. Secondly, stock trading is technically simple. You just need to call your account executor and within a few minutes your order will be executed. There are thousands of brokerage houses and many brokers ready to assist clients in their trading. Thirdly, stock transactions stimulate intellectual activity; they make it possible to analyze the market and anticipate its changes. (11) Exchange markets themselves are interesting and informative. One of the first things speculators discover is that very few events in the world do not affect stock or currency prices. Stock speculation makes those who just want to make a profit more aware of the world in which they live.

Most speculators are attracted by the hope of quick profits rather than concern for the welfare of the economy, however, they perform several vital functions in the stock markets that facilitate trading in stocks and financial instruments.

The presence of a large group of speculators in stock markets benefits both the stock exchange and the economy as a whole. The main functions that stock speculators took on: increasing market liquidity, relative smoothing of price fluctuations.

Increasing market liquidity. Speculators are an important source of market liquidity. The constant influx of orders from stock speculators into the trading floor can significantly reduce the time for counter orders to buy and sell to appear. In a liquid market with a large number of buyers and sellers, transactions can be carried out on any scale with little change in prices. At the same time, the arrival of speculators, increasing the number of participants in operations, promotes competition, and ultimately more effective identification of an objective exchange rate. Relative smoothing of price fluctuations. The activities of stock speculators contribute to the relative stability of the market and generally eliminate price fluctuations, since the operations of speculators are often directed against the market, that is, against the main price trend at the moment. By purchasing assets at low prices, speculators help increase demand, which leads to higher prices. Speculators selling assets at high prices reduces demand and therefore prices.

Regulation of an exchange market or exchange activity is the regulation of the work of its participants and transactions between them by organizations authorized by society for these actions. An exchange can have both external and internal regulation. Internal regulation is the subordination of its activities to its own regulatory documents: the Charter, Rules and other internal regulatory documents that determine the activities of this exchange as a whole, its divisions and employees. External regulation is the subordination of the exchange’s activities to regulations of the state, other organizations, and international agreements. Regulation of exchange activities is carried out by bodies or organizations authorized to perform regulatory functions. From these positions they distinguish:

— state regulation of exchange activities, which is carried out by government bodies whose competence includes performing certain regulatory functions;

— regulation by professional participants in the securities market, or self-regulation of the market. There are two possible options here. On the one hand, the state can delegate part of its market regulation functions to authorized or selected organizations of professional participants in the exchange market. On the other hand, the latter can themselves agree that the organization they created receives from themselves certain regulatory rights in relation to all founders or participants of a given exchange or all exchanges;

— public regulation or regulation through public opinion; Ultimately, it is the reaction of broad sections of society as a whole to some actions on the stock market that is the primary reason why certain regulatory actions of the state or market professionals begin.

Regulation of the exchange market has the following goals:

— maintaining order in the exchange market, creating normal conditions for the work of all market participants;

— protection of market participants from dishonesty and fraud of individuals or organizations, from criminal organizations and criminals in general;

— ensuring a free and open process of exchange pricing based on the concentration of supply and demand;

— creation of an efficient market in which there are always incentives for entrepreneurial activity and every risk is adequately rewarded;

— creation of new exchange markets, support of exchange structures, initiatives and innovations, etc.; influencing the stock market in order to achieve some social goals (For example, lowering stock prices).

The regulation process in the exchange market includes:

— creation of a regulatory framework for its functioning, i.e. development of laws, regulations, instructions, rules, methodological provisions and other regulations that place the functioning of the market on a generally recognized and respected basis;

— selection of professional participants of the exchange market; a modern exchange market is impossible without professional intermediaries, who must meet certain requirements for knowledge, experience and capital established by authorized regulatory organizations or bodies;

— control over compliance by all market participants with the norms and rules of market functioning; this control is carried out by the relevant control bodies;

— a system of sanctions for deviations from the norms and rules established on the stock exchange; Such sanctions may be: oral and written warnings, fines, criminal penalties, exclusion from members of the exchange.

The principles of regulation of the exchange market reflect time-tested global practice of the exchange market.

The main principles mentioned are:

— separation of approaches to regulation in relation to over-the-counter market participants, on the one hand, and to professional participants of the exchange market, on the other.

— the maximum possible disclosure of information about everything that is happening on the exchange market. This ensures not only the opportunity for market participants to obtain information necessary for making business decisions, but also increases the degree of trust in the exchange and its members;

— ensuring competition as a mechanism for objectively improving the quality of services and reducing their costs;

— preventing the combination of rule-making and rule-enforcement in one management or regulatory body;

— ensuring transparency of rule-making, public discussion of market problems;

— principles of continuity of world experience with the Russian system of regulation of the exchange market;

— optimal distribution of functions for regulating exchange activities between state and non-state governing bodies.

The system of state regulation of the exchange market includes:

— state and other regulations;

— state regulatory and control bodies.

Forms of government market management, which include:

direct, or administrative, control;

indirect, or economic, control.

Direct, or administrative, control is carried out by:

— adoption by the state of relevant legislative acts;

— registration of market participants;

— licensing of professional activities on the exchange market;

— ensuring transparency and equal awareness of all market participants;

— maintaining law and order in the market.

Indirect, or economic, management of the exchange market is carried out by the state through the economic levers and capital at its disposal:

— taxation system (tax rates, benefits and exemptions);

— monetary policy (interest rates, minimum wage, etc.);

— state capital (state budget, extra-budgetary funds of financial resources, etc.);

— state property and resources (state enterprises, natural resources and lands).

The main government bodies directly regulating exchange activities:

— Federal Commission on Securities and Stock Market;

— Federal Commodity Exchange Commission;

— Ministry of Finance of the Russian Federation;

— Central Bank of the Russian Federation.

The Federal Securities and Exchange Commission directly regulates the activities of stock exchanges. The Federal Commodity Exchange Commission regulates commodity exchanges and futures trading. The Central Bank regulates the activities of currency exchanges.

The Ministry of Finance sets accounting rules, issues government securities and regulates their circulation on stock exchanges.

Now do you understand why counter-trend entries are very dangerous?

Because when we look at history on a chart that has already passed, we only pay attention to the extremes. Only on them. And all setups on them, since they are extremes, naturally turn out to be profitable.

After the doji the price really went down. It is not yet clear whether it will go further down or reverse and continue the upward trend. But the point is that the price can rise for a very, very long time. Moreover, and without kickbacks.

also distinguish between trading against the trend, when there is a clear trend and you are trading against it, trying to enter the market against the trend from trading in the range

. That is, when there is no clear movement, no general trend up or down, but there are zigzag movements. Well, like here, for example:

A situation where the trend is unclear, when it is not clear whether bulls or bears now prevail, we trade as usual, as if we were trading with the trend, but we set more modest goals. That is, we trade from level to level, since in the case of a range it is not known where the price will go. Whether it will bounce back from the level or move further, forming a new trend, we don’t know.

Therefore, acting in conditions of uncertainty, we set small goals: we entered into a trade, the goal is the nearest level. We trade as carefully as possible from level to level, and do not hold a position for a large amount of time.

Range trading is more dangerous than trading with the trend, but less dangerous than trading against the trend.

Signals in sports betting that cannot be ignored

“Damn, why did I read all this?”

Let's get to the heart of the matter. A trend break (end of a trend) is identical to the formation of a trend and always has a foundation. To make it easier to understand, we created a table of all possible signals for a trend break. Each signal was assigned a degree of danger for the trend and for the player from 1 to 10 points, where 1 means this needs to be further assessed, and 10 is the red stop market marker. The assessment of the degree of danger is the author’s, but such conclusions were made based on numerous observations of similar situations.

| Market signal | Danger level |

| Change of head coach | 10 |

| Injury/disqualification of a key player | 8 |

| Injuries/disqualifications of an entire group of players from one line | 8 |

| Motivation at the end of the season | 9 |

| Start of a new season | 10 |

| Fatigue/accumulated fatigue | 8 |

| History of personal meetings | 6 |

| Abrupt change in gaming philosophy/tactical scheme | 7 |

| Inconsistency between xG statistics and real results | 6 |

| Changes in weather conditions * | 5 |

| General motivation to play | 5 |

| Deteriorating atmosphere in the locker room | 6 |

| Playing in front of empty stands** | 8 |

*Particularly critical for RPL

**The pandemic has made adjustments to the table

The table, of course, does not contain absolutely all the signals that could warn a player about a trend break. Firstly, many additions are actually a consequence of the already announced beacons. Secondly, trends are often interrupted due to unique factors specific to an individual team or player.

Supplement the table with your data and regularly conduct trend watching if you play according to trends.

What are the signs of a good counter-trend setup?

Firstly

, our entry must be preceded by a strong movement, as in the example with USDCAD. That is, there must be a long and strong trend up or down.

In this case, the candles should be large, larger in size compared to the previous ones. Compared to the average candle size of this chart, this time frame and this currency pair. That is, the candles should stand out on the chart. For example, like this candle:

Secondly

, there should be space on the left. What is meant?

If there is some movement that you think is a trend, and you are about to enter it, but you see other candles on the left, then most likely this is not a trend, but a range. But if these candles are far enough from your potential entry, then the trend here is not very strong and the entry is not justified. It turns out that this is not a range, and not against the trend, but it is not clear what. As they say, the market decides where to go. In such situations, it is better to refrain from entering and wait until the movement manifests itself.

Third

, you can consider entering a trade if a double top is present. If the previous top was not so far away, or it was far away, but in this case it will no longer be a double top, but a stop at the level.

See a separate lesson about the double top; we discussed this pattern not long ago.

Also

, if the price has run somewhere far away, and at the same time it hangs in the air, and there is no support for the level, that is, when you zoom out on the chart, this top has not been encountered before, or has been encountered, but a very, very long time ago.

Let's say, as in the example. I rewinded the daily chart to 2009, and this top did not occur.

This price was previously for this currency pair, but this price did not form any extremes anywhere nearby. Therefore, there is no reliance on the level here. And if there is no support for the level, then it is dangerous to enter.

Are there times when entry is more reasonable?

Yes. If the price reaches any level. Often, especially for those who trade intraday, it is useful to move to a higher time frame and see what is happening there. Here we have daily charts. Let's mark our top with a level.

Let's say we're going to enter here and now let's go to the weekly chart. Let's see what kind of level this is and what is happening on the weekly charts? On the weekly charts we have long candles, there is space to the left, a clear uptrend, and a pin bar. If we move our graph out a little, what do we see? Has this peak been seen before?

I haven’t met, the entrance is dangerous. And there is no level on the weekly charts. If the level we noted was on the weekly charts, the entry would be more justified. But we don’t have a level on the weekly charts, so we work with what we have. However, do not forget to look at the higher time frame when in doubt.

So, I have listed for you a few signs of a good counter-trend entry. But even these signs are sometimes not enough, because such signs as long candles, space on the left, the presence of some kind of setup that is natural for entry - all this does not give us complete confidence, since the price may well continue to move.

And yet, if you need to enter the market against the trend... When is the best time to do this?

Firstly, you should wait for all the signs that I talked about earlier. And besides, wait for the price to reach a high at approximately the same level at least two times in a row. In this case, we can see it on the graph. The price hits almost the same level.

The price at which they were selling was 1.1121. The price does not have to hit point for point, it is enough to break within narrow limits. Plus or minus two or three points. And when you see that from one point they are selling for several days in a row, that is, the price is not allowed to go higher, this is a sign that you can enter into sales. This is a sign that the trend has at least slowed down and there will at least be a correction.

Because on daily charts, in order to keep the price below a certain level and sell from this level over and over again, you need a lot of assets and a lot of resources. This means that there is a strong player in the market.

Therefore, in the case of a strong long-term trend, we wait until the price breaks away from the same price level at least twice, and only then enter. Moreover, it is best to enter close to this level. And, of course, you need to enter with a pending order.

The Secret of Balance

The basis of our approach to optimization is the creation of a balanced auction profile of the campaign. Let us now explain what this means.

Different keywords may experience bid peaks at different times (after analyzing 40,000 customer keywords, we were convinced of this). In other words, when for some requests the auction “heats up” and bids go up, for others it can, on the contrary, “cool down”, reducing bids. The point of balancing is to use keys with alternating peaks in campaigns. It turns out like a game against the market for traders: when everyone enters the auction, we leave it, and vice versa.

Here is the auction profile of the campaign that we managed to balance:

In this form, the graph is not very clear; let’s leave in it only two clusters that differ most in gap dynamics.

To make the picture completely clear, we center the graphs relative to their average value.

Now it is easy to notice that the dynamics of the gap, corresponding to the peaks of rates, are opposite for the keys. This means that you can successfully “transfer” the budget between them when the trend changes. As soon as the auction for cluster 2 begins to “overheat,” funds are redistributed to the keys of cluster 3, where competition has subsided and rates have returned to normal - and vice versa.

In this case, where is the best place to do this?

Here we have a candlestick and it breaks away from the price of approximately 1.1120. And another candle appeared and bounced off the same price, a couple of points lower. Let's set the level. What does it mean? This means that we are building a new level from which they sell.

After our second candle has closed, which bounced off the same point with a high, we place a pending sell limit order not far from the level. Let's note where we would place a pending order? Let me remind you that our price has bounced off the level of 1.1120, so we set it at 1.1105. We place a pending sell limit order, since the price at the closing of the Dodge is lower than the price at which we want to enter. And the stop loss is slightly above the level. At approximately the same distance at which we entered below the level, we place a stop loss at the same distance above the level.

What goal should you set?

If you enter against the trend, you shouldn’t set any big goals, so our goal is the nearest level. In this case, the nearest explicit level is far away. Therefore, you can hold, or you can play it safe and simply increase the stop loss by 4 times. In this case, we have a stop loss of 40-45 points. Let's multiply by 4. It turns out 160 points. But as you can see, the price has already reached this level. Our take profit would have already been taken in this case. And the trade would be closed with a profit four times greater than the given stop loss.

This is how you should enter against the trend.

If we had a level here, we could enter easier: using the setup, using the pinbar, which would be with the reference level. If there is no level, we wait for it to form, that is, when the price pushes off a certain price mark twice.

These bars may not necessarily be consecutive. There may be one or two candles between them. But don’t expect too many candles either: five bars have passed, you can look for some new setups.

If we had purchases, we would wait for the price to bounce twice from the same price. We would wait until the lows of two candles became approximately at the same level. This would mean that a large seller is buying from this level. Also, if we entered using a setup from a level against the trend, then the stop loss would be according to the rules of the setup.

Is it bad to be a speculator?

It's not bad to be a speculator. Another question is that he doesn’t do anything good either. Such players create volatility on exchanges and also add liquidity. Thanks to this, exchange commissions are reduced; the market is always within a slight fluctuation from the average value. Therefore, for any exchange, speculators are indispensable assistants and liquidity providers.

They are an excellent source of income for brokers. After all, they have a large turnover, which means the broker’s commissions will also be higher.

Speculators subsequently either leave the exchange or become investors or medium-term traders. This is due to the growth of the stock market. Why actively trade when you can simply invest in stocks and earn handsome interest. This principle is called buy and hold. At the same time, it doesn’t take up any time at all.

- Stock return - what does it consist of;

- The truth about trading;

- Is it possible to live on earnings from trading?

- How much can you earn from stocks?

A couple of tips for those who trade intraday

You can enter from the level of the previous day. Take the high point or low point of the previous daily candle as the level when you are trading intraday, monitor the daily levels, and take the average daily range as a goal, or simply close at the end of the American session, that is, in the evening. What do I mean when I say target the average daily range?

This is the average candle size from high to low of a given currency pair. That is, if the average size of a candle from high to low is, say, 100 points, and the price has already passed 80, then it is naturally better to exit, since the probability that it will pass any large number of points is very, very small. How to find out the average daily range?

The average daily range can be viewed using the ATR indicator, as well as on the website www.forexticket.ru:

- Visit this site.

- Find the Forex volatility section.

- Select the desired currency pair from the list, for example GBPUSD.

There is an average candlestick range from high to low, even hourly, for those who like extreme trading - starting from M1.

There is an average daily high to low range on various days of the week. Here on Wednesday we had an average of 113 points over the past 10 weeks. This is how much the average price goes from high to low. On Thursday the average was 91 points, 110 on Friday, and on Tuesday – 84 points. On average we can say 90 is the average daily range for the pound dollar.

Accordingly, if the price has already passed 80 points since the beginning of the day, then opening some new positions and going in the direction in which the price was moving is pointless. And it is also pointless to expect any super-profits. Better get out. When trading intraday, take these data into account.

Let's look at some more examples

Here is an interesting example: such a strong collapse began on H4 and a pinbar with a long tail appeared. By the way, here we also had support for the level. It would seem that you can enter. But if we entered here, then the closest target, the closest level, would be this one.

And as we see, the price did not reach him. If you did enter here and saw the tails when the price did not reach the target a little, this means you need to exit earlier. If you saw the price almost reaching your goal and drew a tail - get out.

Therefore, when trading against the trend in general, and especially intraday, it is worth monitoring the price behavior very carefully. The slightest sign that the trend will continue, and you entered against it, exit. It’s better to have some penny profit or small loss, but treat counter-trend entries like some kind of flammable substance.

Taking the temperature of the auction

To begin with, we introduced a new value characterizing the degree of overheating of the auction. An analysis of bids for keywords from a number of large clients helped us arrive at it.

Using the Direct API, we downloaded recommended bids and write-off prices for all keys from our customers’ advertisements. Over time they behaved in similar ways. For example, the dynamics of the recommended bid for different volumes of traffic for one of the keys looked like this:

The next chart shows its write-off price.

Considering each key separately, especially when there are thousands of them in campaigns, is too labor-intensive and simply irrational. Therefore, we combined keys with similar price behavior into clusters - this made it possible to represent the entire campaign on one graph. This is, for example, how the dynamics of the recommended rate across all semantics began to look:

Nothing supernatural: periodic peaks of search activity within working days on weekends are replaced by an almost stable plateau. However, we were interested in something slightly different.

Although the recommended bid and write-off prices are related, their meaning is different. The first shows at what rate, according to Yandex forecasts, you can win the auction, and the second shows how much, according to the same forecasts, you will actually have to pay for the click. Therefore, the difference between them characterizes the uncertainty of the auction, which increases during peak periods and decreases when the rush subsides.

The more bidders competing for an impression, the more likely it is that some of them will go beyond the suggested bids - and the more the price charged will differ from the recommended bid. In an ideal world, where all players know about the actions of their opponents, the difference between them would tend to zero - but in reality it increases with the number of players.

This difference became our new metric, which we conventionally called gap (from the English gap - gap, interval):

gap = recommended bid - write-off price

For example, for one of the campaigns the dynamics of the gap took the following form:

We began to call such graphs for the recommended bid, write-off price and gap the auction profile of the campaign.

Now that we have some useful new terminology, we just need to figure out how to use it to optimize our advertising.

One interesting moment of a successful entry against the trend

Sometimes on daily and intraday bars there are such long tails as here.

This is a good time to enter. When a candle with such a long tail has closed, you can enter immediately. Because this means that they are buying or selling very intensely, and there will be a downward impulse. After such candles, this usually always happens. In such a deal, you can sit longer. Not even to the next level, but to the next level. And make a very, very good profit.

It's like free treats from the market. Because everyone will come here. Don’t forget about the feet – place them either by the tail or near the end of the tail, otherwise there’s no other way. Because there are still outbursts when they try to knock out those who entered on this tail. This is also normal. Here you need to place a large stop, but the profit is often also very large.