The Australian Securities Exchange is the main stock market in Australia, created on the basis of Sydney Futures Exchange and SFE Corporation. The corporate merger that gave birth to the Australian Stock Exchange in its modern form took place in July 2006. Its current turnover reaches $4.685 billion and its capitalization is $1.4 trillion. Today it is ranked among the top 10 securities markets, and economists and financial experts rank it alongside the NYSE, London Stock Exchange and Deutsche Börse AG.

The ASX Group, to which ASX belongs, assumes the functions of trade organizer, clearing authority and settlement systems coordinator. The group's powers extend to control over compliance with the rules of financial transactions and standardization. She is also involved in building corporate relationships between companies and businesses that are listed on the Australian Securities Exchange.

Presentation of the Australian Stock Exchange and its main features

1. It is still difficult for the Australian exchange to compete with the leaders of the stock market , but it is included in the conventional “trillion” club, occupying a respectable 16th place, losing only mega grant

- New York Stock Exchange – $23.211 trillion.

- NASDAQ: No. 2 stock exchange in the world – $11.218 trillion.

- Tokyo Stock Exchange – $5.608 trillion.

- Shanghai Stock Exchange SSE – $5.013 trillion.

- Hong Kong Stock Exchange HKE – $4.307 trillion.

- Euronext exchange (Paris, Amsterdam, Brussels, Lisbon, Dublin) – $4.268 trillion.

- London Stock Exchange LSE – $3.965 trillion.

- Shenzhen Stock Exchange SZSE – $3.355 trillion.

- Toronto Stock Exchange – $2.216 trillion.

- Bombay Stock Exchange BSE – $2.179 trillion.

- National Stock Exchange of India – $2.156 trillion.

- Frankfurt Stock Exchange - $1.867 trillion.

- Swiss Stock Exchange - $1,603 billion;

- Korean Stock Exchange - $1,468 billion;

- OMX Group Nasdaq Nordic Exchange (Vilnius, Iceland, Copenhagen, Riga, Stockholm, Tallinn, Helsinki, Armenian stock exchanges) - $$1.432 trillion.

- Australian Stock Exchange ASX - $1.384 trillion.

- Taiwan TWSE - $1.041 trillion. =====================================================

- Johannesburg Stock Exchange (South Africa) - $950 billion;

- Sao Paulo Stock Exchange (Brazil) - $820 billion;

- Madrid Stock Exchange - $770 billion;

- Singapore Stock Exchange - $715 billion;

- Moscow Stock Exchange MOEX - $636 billion.

For comparison: the population of Australia is only 24.6 million people, the Russian Federation is 144.5 million, and Brazil is 209.3 million . Despite this, the Australian Securities Exchange has a capitalization that is 2 times larger than the united Moscow Exchange and 1.5 times larger in investment than the Sao Paulo Stock Exchange.

2. In terms of capitalization growth rates, the Australian Securities Exchange ranks only a modest 26th in the world (+2.42% for the 1st quarter of 2021), which is lower than the global average (5.01%) and worse than its closest competitors

- The Shenzhen Stock Exchange showed an increase of +33.94%.

- Shanghai Stock Exchange +19.55%.

- National Stock Exchange of India +9.80%.

- Bombay Stock Exchange +9.36%.

- Nasdaq Nordic Exchange +8.32%.

- Australian Securities Exchange +2.42%.

3. The Australian Securities Exchange has its own “charm” and many “pluses” that traders and investors like so much:

— the widest selection of liquid financial instruments of the stock, commodity and foreign exchange markets to create a full-fledged investment portfolio;

- the friendliness of the financial regulator - ASIC (Australian Securities and Investments Commission) with whom you can communicate on Twitter, LinkedIn and Facebook, ask for help in completing documentation, or consult online through the feedback form on the website. Read more about the amazing financial regulator in the main article ASIC - Australian Securities and Investments Commission;

- stability of the banking system;

- Australia's loyalty to Bitcoin and cryptocurrencies;

- generally stable AUDUSD exchange rate and much more.

Links

State symbols Flag • Coat of Arms • Anthem • Other flags Policy Citizenship • Constitution • Monarchy • Government • Parliament • Legal system • Political parties • Army • Law enforcement agencies • Electoral system • Elections • Foreign policy Geography States and Territories • Regions • Capitals • Cities • Ecology • Climate • Continent • Deserts • Flora • Fauna • Forests • Geology • Islands • Mountains • Protected Areas • Rivers • Lakes Economy Agriculture • Companies • Energy • Winemaking • Homeownership • Homeless • Manufacturing • Media • Mining • Poverty • Taxation • Communications • Tourism • Transport • Currency • Central Bank • Stock Exchange • States by GDP • Social Security • Pension Payments • Post Office Society Crime • Population • Education • Health • Human Rights • Immigration Culture Australians • Languages • Architecture • Art • Australian English • Cinema • Cuisine • Dance • Aboriginal • Literature • Music • Holidays • Religion • Television • Internet • Theater Sport Australian Football • Motorsport • Baseball • Basketball • Cricket • Golf • Athletics • Motorsports • Netball • Rugby League • Tennis • Football

Australian Securities Exchange listing conditions

To be listed on the Australian Securities Exchange , the issuer company must meet the following requirements. Have:

— from 300 non-affiliated investors, the share of each of which is at least 2 thousand dollars;

— from 20% of shares in free circulation on the stock exchange;

— at least 3 years on the market and a total profit of $1 million, plus at least $0.5 million of consolidated profit for the last year, or $4 million of net tangible assets, or $15 million of market capitalization.

— regularly publish semi-annual and annual financial statements;

— pay an initial fee and an annual subscription fee from 26.3 to 61.7 thousand dollars.

List of securities on the ASX stock exchange

The following are traded on the Australian stock exchange:

— shares of more than 2 thousand enterprises;

— dozens of stock indices of the S&P/ASX family (S&P/ASX -20, S&P/ASX -50, etc.);

— hundreds of bonds (state, municipal, bank, etc.);

— dozens of shares (shares) of exchange-traded funds ETF and ETP, Warrants, Options on securities;

— index derivatives: Mini SPI 200 Index Futures, S&P/ASX 200 A-REIT Index Futures, S&P/ASX 200 Financials-xA REIT Index Futures, S&P/ASX 200 Resources Index Futures; — interest rate derivatives and swaps: ASX 30 Day Interbank Cash Rate Futures, ASX 90 Day Bank Accepted Bill Futures, ASX Packs and Bundles on 90 Day Bank Bill Futures, Australian 3 Year and 10 Year Treasury Bond Options, Australian 20 Year Treasury Bond Futures ; — derivatives of the electricity market: Australian Electricity Futures and Options, Australian Gas Futures, New Zealand Electricity Futures and Options.

Services

Village

Security holders own shares in one of two forms, both of which operate as uncertificated ownership rather than through the issuance of physical share certificates:

- Electronic subregister system of the Information Chamber (CHESS). The investor's controlling participant (usually a broker) sponsors the client in CHESS. A security holder is assigned a "Holder Identification Number" (HIN) and monthly reports are sent to the security holder from the CHESS system when there is a movement in their holding that month.

- Sponsored by the issuer. The company's share registry manages the security holder's shareholding and issues the investor with a security reference number (SRN), which can be quoted at the time of sale.

Holdings can be moved from an issuer-sponsored holding to CHESS or between different brokers via electronic communication initiated by the controlling participant.

Options

Options on leading shares are traded on the ASX with standard sets of strike prices and expiration dates. Liquidity is provided by market makers, who are required to provide quotes. Each market maker is allocated two or more shares. A stock may have more than one market maker and they compete with each other. The market maker can choose one or both of the following options:

- Make the market continuous using a set of 18 options.

- Make the market in response to a quote request with any option up to 9 months.

In both cases, a minimum quantity (5 or 10 contracts depending on the stock) and a maximum spread are allowed.

Due to the higher risk of options, brokers must verify clients' suitability before allowing them to trade options. Clients can either write (i.e. buy) or write (i.e. sell) options. For written positions, the client must post a margin.

Debt securities

The ASX interest rate market is a collection of corporate bonds, floating rate notes and similar preference share bonds listed on the exchange. These securities are traded and settled in the same way as ordinary shares, but the ASX provides information such as their maturity date, effective interest rate, etc. to facilitate comparison.

Futures

The Sydney Futures Exchange (SFE) was the 10th largest derivatives exchange in the world, providing derivatives on interest rates, shares, currencies and commodities. SFE is now part of the ASX and its most active products are:

- SPI 200 Futures are futures contracts on an index representing the 200 largest shares on the Australian Securities Exchange by market capitalization.

- AU 90-day Bank Accepted Bill Futures are the Australian equivalent of Treasury Bill futures.

- 3-Year Bond Futures - Australian 3-Year Bond futures contracts.

- 10-Year Bond Futures are Australian 10-Year Bond futures contracts.

The ASX trades futures on the ASX 50, ASX 200 and ASX property indices, as well as grain, electricity and wool. Options on grain futures are also traded.

Short sale

Main article: Short (finance)

Short selling of shares is permitted on the ASX, but only among certain shares and under certain conditions:

- ASX trading participants (brokers) must report all daily gross short sales to the ASX. The report will aggregate the gross short sales reported by each bidder at the individual inventory level.

- The ASX publishes aggregate gross short sales to ASX members and the general public.

Many brokers do not offer short sales to small retail investors. LEPOs can serve as an equivalent, while Contracts for Difference (CFDs) offered by third party providers are another alternative.

In September 2008, ASIC suspended almost all forms of short selling due to concerns about market stability in the ongoing global financial crisis. The ban on private short selling was lifted in May 2009.

Additionally, the biggest change for the ASX in 15 years was the introduction of the ASTC 11/10/12 settlement rule, which requires the broker to deliver shares when settlement is due, otherwise the broker must buy shares from the market to cover the shortfall. The rule requires that if there is an unsuccessful payment on the second business day after the day on which the rescheduled batch instruction was originally scheduled for settlement (i.e., typically at T+5), the settlement participant must either:

- close the Settlement Deficiency on the next business day by purchasing a number of Financial Products of the relevant class equal to the deficit; or

- purchase, under a securities lending agreement, a quantity of Financial Products of the relevant class equal to the shortage, and deliver these Financial Products in a batch settlement in no more than two business days.

Australian Securities Exchange blue chips and their S&P/ASX 20 index

The most popular trading instrument on the Australian Securities Exchange (ASX) is the 20 blue chip shares. All of them are included in the S&P/ASX 20 stock index of Australia, so analysts never have discussions about which company shares should be included in this list. As of May 1, 2021, it included:

11 blue chips of the financial sector:

— Commonwealth Bank (abbreviated as CommBank), with a capitalization of $131.9 billion, is a multinational financial holding company with branches in New Zealand, Asia, the USA and the UK. It provides a variety of financial services including retail, commercial and institutional banking, fund management, pensions, insurance, investment and brokerage services. Commonwealth Bank is Australia's largest listed company on the Australian Securities Exchange as of August 2021, with brands including Bankwest, Colonial First State Investments, ASB Bank (New Zealand), Commonwealth Securities (CommSec) and Commonwealth Insurance (CommInsure). The bank is also the largest in the Southern Hemisphere.

- National Australia Bank (NAB) , with a capitalization of US$120 billion, is one of the largest financial institutions in Australia by capitalization, revenue and clients. NAB was ranked the 21st largest bank in the world. As of November 2021, NAB operated 1,590 branches; and 4,412 ATMs in Australia, New Zealand and Asia, serving 12.7 million customers. NAB has a long-term issuer rating of 'AA-' from Standard & Poor's.

- Westpac Banking Corp , capitalization $94.8 billion. Australian bank and financial services provider headquartered at Westpac Place in Sydney. It was founded in 1817 as the Bank of New South Wales and merged with the Commercial Bank of Australia (est. 1866) on 4 May 1982, becoming Westpac Banking Corporation in October of that year. It is one of Australia's Big Four banks and is the first and oldest banking institution in Australia. Its name is "Pacific".

- ANZ Banking Group Limited , capitalization $77.0 billion The Australian and New Zealand Banking Group, commonly referred to as ANZ, is an Australian multinational banking and financial services company headquartered in Melbourne, Australia. It is the second largest bank by assets and third largest bank by market capitalization in Australia.

- AMP Limited , capitalization US$14 billion, is a financial services company in Australia and New Zealand, providing pension and investment products, including loans and savings accounts. AMP shares are listed in the S&P/ASX 50 Index of the Australian Securities Exchange. The headquarters is located in Sydney, Australia.

- Insurance Australia Group Limited (IAG) capitalization US$14.7 billion is an insurance company headquartered in Sydney, Australia. IAG is listed on the Australian Securities Exchange and is a component of the S&P/ASX 20 Index.

— Macquarie Group Limited, capitalization $27 billion, is an Australian independent investment company and financial services company. Headquartered in Australia, Macquarie (ASX: MQG) employs more than 14,000 people in 25 countries, is the world's largest asset manager and Australia's top M&A advisor. Has more than $495 billion in assets under management. The company's operating groups include Macquarie Asset Management and Macquarie Capital.

— QBE Insurance Group Limited (capitalization $17.8 billion) is the largest global insurer in Australia. QBE provides insurance services primarily in Australia, America, Europe and Asia Pacific. QBE has 14,226 employees in 37 countries. As of August 2021, QBE is ranked among the world's largest insurers.

— Scentre Group Limited ($19 billion capitalization) is a retail company operating under the Westfield brand in Australia and New Zealand. The corporation owns and engages in development, design, construction, fund/asset management, property management, leasing and marketing for its centers. The group was created in June 2014 when Westfield Group separated its US and European businesses from its Australia and New Zealand operations. The company is listed on the Australian Securities Exchange and has a shopping center portfolio that includes investment interests in 43 shopping centers across Australia and New Zealand, covering approximately 12,544 retail locations and total assets under management in excess of $39.4 billion. .

- Suncorp Group Limited (capitalization $23 billion) is an Australian financial, insurance and banking corporation based in Brisbane, Queensland, Australia. It is one of Australia's mid-sized banks (measured by lending and deposits) and its largest general insurance group, formed on 1 December 1996 by the merger of Suncorp, Metway Bank and the Queensland Industrial Development Corporation (QIDC).

— Westfield Corporation ($37 billion capitalization) was an Australian commercial real estate company and shopping center operator. It was founded with the spin-off of Westfield Group in 2014, with assets in Australia and New Zealand forming Scentre Group and assets in the UK and US becoming Westfield Corporation. It was listed on the Australian Stock Exchange under the ticker symbol "WFD". On December 12, 2021, Westfield accepted a US$32.8 billion takeover bid for Unibail-Rodamco, excluding Westfield Labs. In June 2021, the takeover was completed and the parent company was renamed Unibail-Rodamco-Westfield.

The blue chips of the Australian Exchange include 2 energy companies:

— Origin Energy Limited (with a capitalization of $17 billion) is a public energy company registered in Australia with headquarters in Sydney. It is an Australian Stock Exchange listed stock.

— Woodside Energy (with a capitalization of $27 billion) is an Australian oil exploration and production company. Woodside is Australia's largest oil and gas operator and Australia's largest independent specialist oil and gas company. It is a public company listed on the Australian Securities Exchange and is headquartered in Perth, Western Australia.

Among Australia's blue chips are 3 industrial giants:

- BHP Billiton Limited (capitalization $196 billion) is the trading organization of BHP Group Limited and BHP Group plc, an Anglo-Australian multinational publicly traded metals and petroleum mining, processing and petroleum company headquartered in Melbourne, Victoria, Australia.

— Rio Tinto ($65 billion capitalization) is an Anglo-Australian multinational corporation and one of the world's largest metals and mining corporations. Rio Tinto is a dual-listed company traded on both the London Stock Exchange, where it is a component of the FTSE 100 index, and the Australian Securities Exchange, where it is a component of the S&P/ASX 200 index. In addition, American depositary shares of the UK subsidiary Rio Tinto is traded on the New York Stock Exchange, with listings on 3 major stock exchanges.

— Brambles Limited ($14 billion) is an Australian company that specializes in the production of pallets, boxes and containers. Listed on the Australian Securities Exchange. As of 30 June 2015, Brambles employed over 14,000 people and handled approximately 500 million pallets, cases and containers through a network of approximately 850 service centres.

2 companies from the consumer goods sector:

— Wesfarmers Limited ($12 billion capitalization) is an Australian conglomerate headquartered in Perth (Western Australia), with interests primarily in retail trade in Australia and New Zealand. It is engaged in trading of chemicals, fertilizers, coal mining, as well as industrial and safety products. At £65.98 billion, Wesfarmers is Australia's largest private employer, with approximately 220,000 employees.

- Woolworths Group Limited (capitalization $10.8 billion) is a large Australian company with extensive retail interests throughout Australia and New Zealand. It is Australia's second-largest company by revenue, behind Perth retail conglomerate Wesfarmers, and New Zealand's second-largest. In addition, Woolworths Group is the largest takeaway liquor retailer in Australia, the largest hotel and gaming poker operator in Australia, and the 19th largest retailer in the world in 2018.

One corporation in the telecommunications industry is Telstra Corporation Limited (capitalization $18 billion) - Australia's largest telecommunications company, which builds and operates telecommunications networks and markets voice, mobile communications, Internet access, pay television and other products and services.

One healthcare business: CSL Limited ($89.9 billion) is a global specialty biotechnology company that researches, develops, manufactures and markets products to treat and prevent serious diseases in humans. Applications of CSL include blood plasma derivatives, vaccines, antidotes and cell culture reagents used in a variety of medical and genetic research and manufacturing applications.

How are Australia's blue chips doing? Far from impressive for investors. The S&P/ASX 20 index (Australia's blue chips) has actually been in a flat for 13 years, unable to gain a foothold at the resistance level of October 3692, 2007, which indicates a clear recession in the Australian economy and stock market.

History of the exchange

The Australian Exchange has united spontaneous brokerage organizations throughout the country. There were six of them, and trade was carried out according to “house” rules. It was only between the First and Second World Wars that a platform with uniform rules for listing and trading appeared.

But the exchange was not stable: trading was slow, and quotes often became the result of speculation. And so, in 1987, the Australian Parliament stepped in and created what we call the Australian Securities Exchange, or ASX.

Today it is the leader in the Asia-Pacific region and one of the most progressive exchanges in the world.

Australian Securities Exchange stock indices

Australian Securities Exchange indices are supported by the reputable rating agency Standard & Poor's , which is reflected in their name

- The S&P/ASX 20 index is a typical blue chip index, which we have just described in detail;

- S&P/ASX 50 Index - an index of 50 shares of the largest ASX companies;

- S&P/ASX 100 Index;

- S&P/ASX 200 Index;

- S&P/ASX 300 Index;

- S&P/ASX 500 Index, etc.

Prospects for investing in these indices

To talk about investing in indexes, you need to understand two things. Firstly, what is an investment portfolio, and secondly, what is an index.

An index is a collection of shares of some companies. In our case, Australian indices collected “blue chips” - that is, large and profitable companies. Buying shares of companies from the ASX index is profitable for these reasons:

- Profitability never falls below the market average.

- Companies from the top 100 have proven that they can cope with any crisis, so the portfolio will not depreciate.

- The real state of affairs of any index company can be found out from the official website and the press.

To invest in the Australian index, you can buy shares one at a time or purchase securities of an ETF fund.

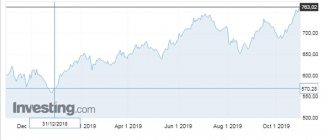

AU200AUD quotes provided by TradingView

S&P/ASX 200 is the main index of the Australian Securities Exchange

The S&P/ASX 200 includes shares of the 200 largest companies , which account for about 85% (March 2019) of the total capitalization of the exchange. These are not blue chips or a composite index, but the S&P/ASX 200 fully shows the state of the Australian market and its economy, which is developing at approximately the same pace (both the leaders included in the S&P/ASX 20 and the next 180 companies ), to do this, just put the S&P/ASX 20 and S&P/ASX 200 indices side by side.

On March 31, 2000, the S&P/ASX 200 Index was first introduced in its current form. It started at 3133.3 and doubled in the first 7 years, breaking the 6000 mark.

Features The S&P/ASX 200 is a capitalization-weighted index that moves based on share prices adjusted for company capitalization. If a company increases its capitalization by issuing additional shares, the formula does not allow it to influence the index.

Structure of Australian economic sectors represented in the S&P/ASX 200 stock index futures

The 5-year chart shows frequent and violent fluctuations in the S&P/ASX 200 Index. This offers opportunities for profit in the short term, but calls into question the rationale for investing in the expectation of long-term growth.

The most famous stocks traded here

Useful articles

Step-by-step instructions: how can an investor fill out a 3-NDFL declaration and pay taxes?

25 Habits That Separate Rich People From Poor People +12 Things That Are Keeping You From Getting Rich

The main step on the path to wealth: long-term investments

Is there a good non-state pension fund in Russia?

Franchises from Australia are unfamiliar to Russians because they trade with us as contractors for domestic brands. And yet I will tell you about the four largest companies in Australia. Funnily enough, none of them are located in the city of Sydney.

BHP Billiton is a mining company that sells fuel to half of the West. Another corporation, Wesfarmers, is almost as big as Billiton in terms of capitalization. She became rich selling coal and fertilizers.

Third place goes to Woolworths, a supermarket chain. By the way, Wesfarmers also has a national supermarket chain.

And among media companies, the leader was the Australian Associated Press, a national newspaper. There is a regional version of the publication in every state of Australia.

Exchange Traded Funds ETFs and Exchange Traded ETP Products in Australia

There are over 100 exchange traded ETPs, ETFs, managed funds and structured products available on the Australian Securities Exchange. The largest are

ETF funds

- Vanguard Global Multi-Factor Active ETF (Managed Fund) (ticker: VGMF)

- VanEck Vectors MSCI World Ex Australia Quality (Hedged) ETF (ticker: QHAL)

- VanEck Vectors FTSE International Property (Hedged) ETF (ticker: REIT)

mFund:

- Legg Mason Martin Currie Core Equity Fund – Class A (ticker LMA11)

- Legg Mason Martin Currie Emerging Markets Fund (ticker LMA12)

- Legg Mason Martin Currie Ethical Income Fund – Class A (ticker LMA13)

- Legg Mason Martin Currie Ethical Values with Income Fund – Class A (ticker LMA14)

- Legg Mason Martin Currie Global Long-Term Unconstrained Fund (ticker LMA15

Bonds on the Australian Securities Exchange

The difference between bonds (bonds) and shares does not give any right to a share of the company or to receive dividends. Bonds are a loan from the issuer under which the investor receives income guaranteed by the property of the state, local governments or commercial entities that issued the bond.

34 government bonds available on the Australian exchange

incl. 9 indexed), 4 corporate and several dozen bank bonds for every investor’s taste. For example, see government bonds (bonds) on the Australian Exchange with a coupon of 2.75% for six months or 4.5% for a year:

Australian government bonds

Corporate bonds have a high return for investors, as shown in the following screenshot:

To help traders, the Australian Securities Exchange offers on its official website asx.com.au/products/bonds/asx-bond-calculator.htm a bond calculator that will quickly calculate the yield of any security.

Content

- 1 Overview 1.1 Australian capital markets

- 1.2 Regulation

- 1.3 Products

- 2.1 Chronology of significant events

- 4.1 Calculation

Is there a connection between the trends of the ASX 200 stock index of the Australian Exchange and the AUDUSD rate?

Study two charts (ASX 200 and AUDUSD) and answer the question yourself. Answer from Masterforex-V: there is no connection between the AUDUSD rate on Forex and the ASX 200 on the stock market. The stock index and the currency pair have different market makers, therefore different trends.

Successful trading systems for making profits on the Australian stock exchange

If you have not studied at the Masterforex-V Academy, we suggest you carefully study several reliable trading systems with MF know-how:

— Scalping (Scalping: classics and strategies Masterforex-V) — for trading on timeframes m1 and m5; — Swing trading (Swing trading: classics and know-how Masterforex-V) — for trading on time frames on M30 - N4; — “3 Elder screens” (three Elder screens and Masterforex-V modifications) — for comprehensive market analysis; — What did Masterforex-V change in Bill Williams’ trading strategy to make it work?

We understand that studying successful trading systems in reality is always difficult. - “Simple” is a short way to losing (“buy an advisor and he will trade for you”), - “complicated and unusual” is the only road to a stable income among professionals.

Trading systems

The ASX Group has two trading platforms: ASX Trade, which facilitates trading of ASX equity securities, and ASX Trade24 for trading of derivatives.

All ASX equity securities are traded on the ASX Trade screen. ASX Trade is NASDAQ OMX's ultra-low latency trading platform based on the NASDAQ OMX Genium INET system, which is used by many exchanges around the world. It is one of the fastest and most capable multi-asset trading platforms in the world, offering latency up to ~250 microseconds.

ASX Trade24 is the ASX's global derivatives trading platform. It is distributed worldwide with network access points (gateways) located in Chicago, New York, London, Hong Kong, Singapore, Sydney and Melbourne. It also allows true 24-hour trading and supports two active trading days simultaneously, allowing products to be opened for trading on a new trading day in the same time zone while products are still trading during the previous day.

Opening time

ASX normal trading or business days are weekdays from Monday to Friday. The ASX does not trade on public holidays: New Year's Day (1 January), Australia Day (26 January and celebrated on that day or the first business day after that date), Good Friday (which changes each year), Easter Monday, Anzac Day ( 25 April), Queen's Birthday (June), Christmas Day (25 December) and Boxing Day (26 December).

Each trading day there is a pre-market session from 7:00 to 10:00 AEST and a regular trading session from 10:00 to 16:00 AEST. The market opens alphabetically in single-price auctions, in stages within the first ten minutes, with a little random timing built in to prevent accurate prediction of the first trades. A single price auction is also held between 16:10 and 16:11 to determine the daily closing prices.

Masterforex-V recommendations for trading the ASX 200 index of the Australian stock exchange

1. For investors. ASX 200 (like the Japanese NIKKEI 225, and the Chinese SSE Composite, SZSE Component Index, etc.) is one of those stock futures for which we do not recommend opening buy transactions for LONG-TERM investment, because Unlike the American indices Dow Jones 30 and S&P 500, the Canadian S&P/TSX 60, the British FTSE 100, their Australian counterpart in the favorable years 2009-2019. failed to update its historical highs and gain a foothold ABOVE them.

1. For traders. ASX 200 is a very interesting and volatile financial instrument for trading, if... you know the current strong and minor levels of order accumulation from the Masterforex-V Academy.

3. Professional traders work on different, and not on ONE market (Australian, Moscow, Swiss, London or New York exchange). What is important to a successful trader is not a specific market (stock, cryptocurrency, commodity, foreign exchange), but the trend, which varies by instrument in different months. So, in the current quarter the trend may be EUR USD

or GBP USD, the next for stocks and stock market indices, the third for Bitcoin and cryptocurrencies, the fourth for oil and gas futures and CFDs, etc. and so on.

It is by working in DIFFERENT markets that you can earn 300%-700% in a few years, like Masterforex-V traders according to the statistics of our Rebate - auto-copy service pro-rebate.com. Not a single bond, share, index, ETF or ETP fund can provide such a return for investors for any period in the history of their trading.

Choosing a broker for trading stock indices

The widest selection of financial instruments for working on DIFFERENT markets is presented by the English forex broker FxPro , which is one of the recommended brokers of our Rebate - autocopy service pro-rebate.com and the TOP rating of brokers of the Masterforex-V Academy.

The FxPro.com trading terminal contains:

- 85 US blue chips, 26 blue chips, 15 French shares, 15 German shares, etc.;

- 24 stock indices, incl. Australian S&P/ASX 200 (#AUS200), Canadian S&P/TSX 60 (#Canada60), Japanese NIKKEI 225 (Japan225), Euro Stoxx 50 (#Euro50), American Dow30, NASDAQ-100, and S&P 500, Hong Kong Hang Seng 50 (#HongKong50), German DAX 30 (#Germany30), IBEX 35 (#Spain35), Swiss SMI 20. British FTSE 100 (#UK100), Chinese SSE 50, Polish Poland20, South African South Africa40, etc.

The broker provides

- a trading platform familiar to all traders for Meta Trader 4 and Meta Trader 4 Mobile traders with the largest group of built-in indicators and oscillators for technical analysis of charts;

- minimum trading account from $100 (note: the minimum recommended deposit for money management MF is from $800-$1000 when trading 0.01 0 lot)

- leverage from 1:30 to 1:500;

- All types of trading strategies are allowed, from automated advisors to day trading, swing trading, scalping, etc.

- acceptable swaps when transferring positions to the next day, especially with highly profitable trading and earnings on global financial and economic crises; (for example, a positive swap when working on sell on WTI oil futures +$6.41 for 1 lot per day, +$5.83 on gold futures (Gold), Dow Jones stock indices, SP-500, NASDAQ-100, etc.)

- insurance payments up to 20,000 euros from the Investor Compensation Fund in case of bankruptcy of a company (compensation for non-trading risks)

When opening a real trading account from $3000 with FxPro, a trader receives the opportunity to study for free for 1 year at the Masterforex-V Academy.

Possible blockchain technology

In 2021, the ASX announced that it would become the first stock exchange in the world to build infrastructure based on blockchain technology. This will replace the existing clearinghouse infrastructure known as CHESS (Clearing House Electronic Subregistry System) to improve the reliability, efficiency and security of the system. On 27 April 2021, ASX released a consultation document detailing the target "day one" functional requirements of the new system, non-technical business requirements, blockchain architecture, connectivity options and implementation plan for the years leading up to the transition date.

As the ASX is tasked with maintaining the efficient operation of the Australian Stock Exchange, the replacement system also aims to meet high non-functional and technical requirements including:

- Availability and Resiliency:

ASX aims for the system to be reliably available 99.95% of the time during published operating hours, exceeding CHESS's current target of 99.8%. - Recoverability:

The new system must be restored without data loss to the backup site within no more than one hour. - Scalability: As

the network expands, the system must be able to handle the increasing daily market trading and number of users connected to the blockchain via a node. - Security:

All integration channels between ASX and users will be protected by strong authentication and encryption, as users will only receive data that they are entitled to receive. - Performance:

The initial implementation will be tested at 10 million trades per day (CHESS peak 5.4 million) or a sustained rate of 463 trades per second.

March 2021 - The multi-year CHESS replacement project suffers from further delays due to the impact of the COVID-19 pandemic, user feedback on timing, requested functional changes and the need for the ASX to finalize aspects of its own readiness. https://www.asx.com.au/documents/asx-news/asx-consults-on-timing-of-chess-replacement-project.pdf

ASX and cryptocurrency

Australia has a loyal attitude towards digital currencies - you can even buy crypto money at a newsstand! The Australian Securities Exchange does not directly trade cryptocurrency, but it does trade shares of companies that are in one way or another related to blockchain technology and cryptocurrencies. For example:

- Digitalx Ltd (ticker DCC);

- Yojee (YOJ);

- Kyckr (KYK);

- Fatfish Blockchain (FFG);

- Mobecom (MBM).

In 2021, the exchange announced plans to launch blockchain technology for registering shares and a number of other transactions. Tests have shown significant superiority over the current electronic CHESS system. The introduction of new technology will allow the exchange to develop new directions, reduce costs and become leaders in innovation in the global financial market. However, the transition to blockchain is not progressing as quickly as planned. If previously the exchange was going to launch the system before the end of 2021, it has now announced a delay until at least March or April 2021. This is due to the need for additional tests to alleviate some customers' concerns about its reliability.

Story

Sydney Stock Exchange Building in 1872 Sydney Stock Exchange Building in 1959.

The origins of stock exchanges in Australia go back to the mid-1800s, when six separate exchanges were established in the capital cities of the British colonies in Australia - Melbourne, Victoria (1861), Sydney, New South Wales (1871), Hobart and others. Tasmania (1882), Brisbane, Queensland (1884), Adelaide, South Australia (1887) and Perth, Western Australia (1889). A further exchange in Launceston, Tasmania merged with the Hobart exchange.

In November 1903, the first interstate conference was held to coincide with the Melbourne Cup. The exchanges then met on an informal basis until 1937, when the Australian Associated Stock Exchange (AASE) was created with representatives from each exchange. Over time, AASE established uniform listing rules, broker rules, and commission rates.

Trading was conducted using a bell system, where an exchange employee called out the names of each company and brokers bid or bid on each. In the 1960s this changed to a postal system. Exchange employees called "chalkies" wrote bids and offers with chalk on boards constantly and recorded transactions made.

ASX (Australian Stock Exchange Limited) was formed in 1987 by legislation of the Australian Parliament, which allowed the merger of six independent stock exchanges that previously operated in state capitals. Following demutualization, the ASX became the first exchange in the world to have its shares listed on its own market. The ASX was incorporated on 14 October 1998. On 7 July 2006, the Australian Securities Exchange merged with SFE Corporation, the holding company of the Sydney Futures Exchange.

Chronology of significant events

1861

: Ten years after the official start of the gold rush, Australia's first stock exchange was formed in Melbourne. In the 1850s, Victoria was the center of gold mining in Australia, with its population increasing from 80,000 in 1851 to 540,000 in 1861.

1871

: Thirty years after lighting Sydney's first gas street lamp, AGL has once again taken its place in history by becoming the second company to be listed on the Sydney Stock Exchange.

1885

: Two years after the Broken Hill Mining Company (a private company) was founded by a syndicate of seven men from the Mt Gipps sheep station, the company was incorporated and became the Broken Hill Proprietary Company Limited (BHP). In 1885, BHP listed on the Melbourne Stock Exchange.

1937

: The Australian Associated Stock Exchanges (AASE) were established in 1937.

Since 1903 the state stock exchanges had met on an informal basis, but in 1936 Sydney took the lead in formalizing the association. This initially concerned exchanges in Adelaide, Brisbane, Hobart and Sydney. Melbourne and Perth soon joined them. Through AASE, the exchanges gradually introduced common listing requirements for companies and uniform brokerage and other rules for brokerage firms. They also set the ground rules for fees and placement of government and semi-government loans. Sydney Exchange Square Entrance to Sydney Exchange Square

1938

: Publication of the first stock price index.

1939

: The Sydney Stock Exchange closed for the first time due to the declaration of World War II.

1960

: The Sydney Futures Exchange began trading as the Sydney Grease Wool Futures Exchange (SGWFE). The original purpose was to provide Australian wool traders with hedging opportunities in their own country. SGWFE offered one contract for greasy wool, which sold 19,042 lots by the end of the year.

1969–1970

: The Poseidon Bubble (a mining boom fueled by the discovery of nickel in Western Australia) led to a surge and then crash in Australian mining shares, prompting regulatory recommendations that eventually led to Australia's national company and securities legislation .

1976

: Australian Options Market created, trading call options.

1980

: The separate Melbourne and Sydney stock exchange indices have been replaced by the Australian Securities Exchange indices.

1984

: Broker commission rates have been abolished. Since then, commissions have gradually fallen, and today rates from discount online brokers are 0.12% or 0.05%.

1984

: The Sydney Stock Exchange closed due to heavy rain and flooding on Friday 9 November 1984, with 70 millimeters of rain falling in half an hour. All trading on the floor of the Sydney Exchange was suspended throughout Friday. Damage totaled $2 million and repairs took more than six months to install new carpeting and replace cables and computers.

Stockbrokers who took advantage of the shared access could trade on the Melbourne Stock Exchange. And with the Sydney trading floor closed by floodwaters, the Melbourne Exchange experienced its busiest trading day in a year. Following this episode, a backup site was established outside the Sydney CBD.

1987

: The Australian Securities Exchange Limited (ASX) was formed on 1 April 1987 by incorporation under the laws of the Australian Parliament. The formation of the national stock exchange involved the merger of six independent stock exchanges that operated in state capitals.

Launch of the Stock Exchange Automated Trading System (SEATS). This was a far cry from the original system, which is over 100 years old. At that time, there were three different forms of trading on the Australian stock exchanges. The earliest of these was an auction-based calling system, in which a stock exchange employee (the caller) called the name of each listed security in turn, while bidders bid, sold, or bought shares on each call. This system proved inadequate to handle the increased trading volume during the mining boom. This was replaced by the "postal" system in the early 1960s, where shares were listed on "posts" or "boards". "Chalks" were used by the Stock Exchange and their function was to record in chalk the bids and offers of operators (employees of stockbrokers) and the sales made. This system was in effect until 1991.

1990

: A market for warrants has been created.

1993

: Added fixed rate securities. Also in 1993, the FAST accelerated settlement system was created, and the following year the CHESS system was introduced (see Calculation below), replacing FAST.

1994

: The Sydney Futures Exchange has announced futures trading for selected ASX shares. The ASX responded with a low exercise price option or LEPO (see below). SFE went to court arguing that LEPOs were futures and therefore the ASX could not offer them. However, the court ruled that these were options and so LEPOs were introduced in 1995.

1995

: Stamp duty on share transactions has been halved from 0.3% to 0.15%. The ASX agreed with the Queensland government to base staff in Brisbane in exchange for a reduction in stamp duty, and other states followed suit to avoid losing brokerage business to Queensland. In 2000, stamp duty was abolished in all states as part of the introduction of GST.

1996

: Exchange members (brokers, etc.) voted for demutualization. The exchange was incorporated as ASX Limited and in 1998 the company was listed on the ASX itself, with the Australian Securities and Investments Commission enforcing listing rules for ASX Limited.

1997

: Electronic trading begins when the options market moves from floor to screen. A gradual transition to the electronic CLICK system for derivatives has begun.

1998

: The ASX has been converted to a listed company. It was the first exchange in the world to demutualize and list on its own market, a trend that has been imitated by several other exchanges over the years. The Australian Mutual Aid Society began in 1849 as an organization offering life insurance. Now known as AMP, it became a public company on the ASX in 1998.

2000

: In October, ASX acquires a 15% stake in trading and order management software company IRESS (formerly BridgeDFS Ltd).

2001

: Stamp duty on marketable securities has been abolished.

2006

: The ASX has announced a merger with the Sydney Futures Exchange, Australia's primary derivatives exchange.

2014

: mFund settlement service launched, allowing retail clients to trade unlisted managed funds in the same way they currently trade shares.