The current economic situation is such that global inflation is interdependent. The age of globalization has had an impact on the economic system: external factors directly affect the situation within a single state.

The term “inflation” first appeared during the North American Civil War. It characterized the excessive growth of the money supply in circulation. This term became widely used in the 20th century in different countries, denoting complex economic processes associated with the depreciation of national currencies and the increase in the cost of goods and services. Read more: about the concept of inflation and its types.

Modern inflation is characterized by an all-encompassing and chronic nature. Statistics show that in the past it was characterized by episodic activity, with periods of growth followed by falling prices and stability of money circulation. Today there is a tendency to increase prices at all phases of industrial production.

The growth rate is influenced by both internal and external factors, acting with varying degrees of intensity.

Internal factors:

- increasing the share of government spending;

- money supply growth;

- budget deficit;

- high share of military expenditures;

- market monopolization;

- changes in tax legislation in the direction of increasing income taxes;

- trade union monopoly.

External factors:

- weakening of the national currency, which affects the cost of imported goods;

- global financial crisis;

- changes in price conditions on the foreign market, which affects domestic prices.

Based on growth rates, economists distinguish different types of inflation:

- moderate (creeping) – growth rate of no more than 10-20% per year;

- hyperinflation – inflation over 50%;

- galloping - high growth rates with periodic jumps ranging from 10 to 40% per year;

- deflation – lowering prices for goods and services, falling productivity, reducing consumer demand.

Inflation increases or decreases at rates of varying degrees of intensity. First of all, internal factors influence the speed of inflation processes, the impact of which can increase or decrease.

Over the past 10 years, despite different levels of development, the factor driving inflationary growth for all countries has been another jump in energy prices and increased demand for food. There was also an impact from food supply shortages due to periods of low yields, cuts in financial support in the form of subsidies in the agricultural sector and agricultural exports, which contributed to higher prices in this sector. This significantly affected the economic situation in countries where food products occupy a leading place in the consumer basket (China).

Peru (1990) – 5% daily growth

The stagnation of the Peruvian economy began in the first half of the 80s of the last century, when, as a result of the Latin American crisis, the IMF took tough measures against the state. At that time, the country's president, Belaunde Terry, tried to adhere to the reforms recommended by external creditors, which caused disapproval among the population. After the 1985 elections, Alan Garcia came to power with a populist program that only weakened the economy and led to a complete closure of access to external credit.

5 million Peruvian inti banknote

As a result of these actions, persistent inflation turned into hyperinflation. If in 1986 the maximum denomination of the national banknote corresponded to 1000 inti, then by 1990 a banknote with a denomination of 5 million inti was already in use.

It was in 1990 that the peak of price growth was recorded, when in August the monthly inflation rate reached 397%. The following year, the rate of devaluation of the national currency slowed down, but it was completely stopped only at the beginning of the 21st century, after replacing the inti with a new monetary unit - the salt.

Main causes of inflation

Economists usually identify 6 causal factors that cause inflation of money, but in reality there are many more.

- Monopolization of spheres and industries.

- Increased government spending. The result is the inevitable emission of money.

- A fall in the level of national production when the money supply remains the same.

- Growth of tax deductions with a stable volume of the national currency (money supply).

- An increase in the frequency of issuing loans, as well as the nature of partial reserves of money by banks. Lending growth is ensured by a currency without proper value.

- Monopoly of trade unions.

China (1949) – 14%

After the end of World War II, China plunged into civil strife between communists and nationalists. The monetary unit was chosen as the main mechanism of the struggle for power. To finance the conflict, both sides resorted to huge budget deficits.

In 1945, the printing press worked 300 times more energetically than in 1941. This policy could not pass without a trace and led to a colossal increase in prices, which by the mid-40s were already 1000 times higher than pre-war levels.

Inflation in China

The rapid devaluation of the monetary unit also occurred because in 1935 the Central Bank completely seized control of the national banknote and began to issue currency not backed by gold. All military costs were covered by printed money, which became more abundant in the country every day. Later, the Central Bank of Taiwan was involved in the “game,” which led to hyperinflation on the island.

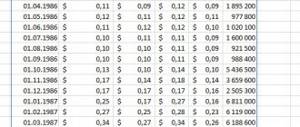

To assess the scale of the depreciation of the Chinese national unit, economists provide the following figures: in 1937, $1 was worth a little more than 3 yuan, while in 1949 the American currency was already valued at 23 million yuan.

Is it possible to simply freeze prices so that they do not rise?

It may seem that fixing prices at a certain level is a good solution. But such artificial intervention in the economy will lead to an increase in the imbalance between supply and demand. Manufacturers will not understand how much goods to produce, stores will not understand how much to purchase, and as a result, buyers will have to stand in lines at empty counters.

With frozen prices, there will be a shortage; some goods will have to be obtained rather than purchased. In addition, goods will become worse: in order to stay afloat and maintain unfavorable prices dictated from above, manufacturers will sacrifice quality.

It is for these reasons that in a market economy prices should be dictated by the market, not the state.

Greece (1944) – 18%

As a result of the occupation of Greece by the Hitlerite coalition in the period 1941-1944, the country's economy was destroyed. In addition to the fact that significant damage was caused to agriculture and foreign trade relations, the state regularly paid the costs of the occupation and provided financial support to the German army. If at the beginning of the war (1939) the Greek budget was 270 million drachmas, then a year later there was a deficit of 790 million drachmas.

5 million Greek drachma banknote

Since tax revenues decreased threefold - from 67 billion to 20 billion, the leadership of the Central Bank decided to turn on the printing press. This led to hyperinflation, which peaked in 1944, when the prices of goods and services doubled every 28 hours, and the denomination of the largest banknote increased from 25 thousand to 100 trillion.

In Greece, old money is thrown into the trash

The German occupation and subsequent hyperinflation led to famine in Greece, population stratification, the emergence of black markets and a significant hindrance to economic development. The post-war government was forced to take emergency measures, including two monetary reforms in 1944 and 1953. As a result, 1 new drachma was exchanged for 50 trillion old drachmas used in the country before 1944.

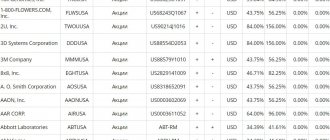

Top 10 Cases of the biggest inflations

Inflation is very simple: the prices of goods and services in your country are rising because... money loses its value. The cause of this economic “trouble”, leading the economy to collapse, today can be anything: wars, diseases, coups, cataclysms, mistakes of politicians (the most common reason), etc. The causes of inflation can be explained in this way. The level of production and exports in the country is falling, and accordingly the state earns less or nothing at all. Banks, the state’s currency, and the state itself, are less and less of interest to anyone as a business partner, and it begins to little by little waste its resources (gold and foreign exchange reserves), if any. Accordingly, a difficult time is coming for the people of this country, and they go to the store for groceries not with “change,” as before, but with paper bills, if the people have any. Which countries experienced the most powerful, “galloping” inflation?

1 Zimbabwe (2000-2009)

“The talk of the town” among all economists and bankers of our time is precisely Zimbabwe. This predominantly agricultural country grew and exported tobacco, cotton, tea and sugar cane. In 2000, Zimbabwean authorities began illegally confiscating land from European farmers in order to give it to local “businessmen,” most of them veterans of the civil war of the 70s. As a result, production and exports almost completely ceased. The country suffered huge losses because... foreign investors simply stopped investing in the country's economy and imposed numerous sanctions and trade embargoes. In 2008, inflation in Zimbabwe amounted to 231,000,000% per year! Those. prices doubled every 1.5 hours!!! All these years, the authorities did nothing but print new banknotes with more and more zeros. In July 2008, three chicken eggs in a store cost 100 billion Zimbabwean dollars. In 2009, the country’s president (who, in fact, started this mess) “had an epiphany,” and the country abandoned its own currency in favor of the US dollar. The situation has improved a little, but the land that was forcibly taken from farmers remains empty.

2 Hungary (1945-1946)

Devastated by the Second World War, Hungary was left without production and, as a “Hitler accomplice,” became economically dependent on the USSR. Having paid huge reparations to the participating countries, Hungary became bankrupt with huge debts and devastation in the country. Inflation did not have to wait long. At the time of its inception in 1945, the largest denomination in the country was the ten-thousandth pengo (the currency of Hungary before the forint). A couple of months later, a bill of 10 million “pengyō” was printed, a little later - 100 million, and then 1 billion. At that time, inflation reached 400% per day - prices doubled every 15 hours! Banknotes of 1 trillion, 1 quadrillion and 1 sextillion appeared... The National Bank of Hungary might have continued the search for the largest number, but in August 1946 it all ended with the introduction of a new currency - the forint.

3 Greece (1944)

In 1941, Germany, together with Italian troops, occupied Greece. Before that, the Greeks successfully repelled the attacks of the Italians. By forcing Greece to pay a huge sum for “occupation costs,” Germany paralyzed the country’s entire economy. Agriculture, the main artery of the economy, and foreign trade completely disappeared. Hunger began. Back in 1943, the largest denomination was 25,000 drachmas, and a year later a denomination of 100 billion drachmas appeared. Prices doubled every 28 hours. The population survived only thanks to barter and natural exchange. Only thanks to the competent actions of the Greek authorities, the country’s economy got out of the “debt hole.” This happened after 7 long years.

4 Yugoslavia (1992-1994)

After the collapse of the USSR, Yugoslavia also began to disintegrate.

The process was actively supported by the West, and the negative result was not long in coming. Serbia, Croatia and, in fact, Yugoslavia itself appeared. Civil war began, and the UN imposed all possible sanctions and embargoes against Yugoslavia. Production and trade, even within the country, virtually stopped. Prices rose every 34 hours, and the government began to print money... From the largest banknote in 1992 of 5,000 dinars, Yugoslavia reached a denomination of 500 billion dinars in two years. The economy has completely withered, despite the visible efforts of the government. Only the German mark, introduced into circulation in 1994, was able to revive it. 5 Germany (1922-1923)

After defeat in the First World War, Germany also experienced all the “delights” of poverty. Having paid huge reparations to the winners, the authorities did their best to restrain the rise in prices for some time, but to no avail. Every 49 hours people saw new price tags, and every month they looked in surprise at new bills of even higher denominations. The largest bill was a bill of 100 trillion marks, which actually cost less than 25 dollars. In November 1923, a new currency was introduced - the “rent mark”. At that time, it saved the economy, which later became one of the strongest in the world.

6 France (1795-1796)

The French Revolution (1789-1799) occurred at a time when France's debt reached 4 billion livres! The colossal sum was formed mainly due to the reign of the most wasteful king in history - Louis XV. The revolutionary government chose the nationalization of church lands under a bond issue as the main means of combating such debts - of course, with subsequent sale. In a “revolutionary impulse” they printed as many bonds as there had never been land in France. At the peak of inflation, prices rose every 5-10 days, and a pair of boots, which once cost 200 paper livres, had a price of 20,000. The coin, the franc, saved the situation. The authorities publicly burned all the paper notes in the treasury (about 1 billion livres) and all the machines for their production on Place Vendôme. Having thus begun the wholesale exchange of “paper” for “metal,” by the end of 1797 the French made the franc a stable currency for many years.

7 Peru (1984-1990)

In the distant past, the great Inca Empire, the Republic of Peru already in the twentieth century learned the disadvantages of economic progress. Due to problems in production and foreign trade, Peru's currency, “salt,” began to rapidly depreciate. In 1984, the largest bill of 50 thousand soles became 500 thousand. The authorities carried out a monetary reform and introduced a new currency - “inti”. But this move is nothing without resuscitating production and trade relations. By 1990, a bill of 1 thousand inti had become a bill of 5 million of the same long-suffering inti. In 1991, through many reforms, it was possible to stabilize the situation and at that time the “new salt” was equal to 1 billion salts of the 1984 model.

8 Ukraine (1993-1995)

Ukraine experienced one of the worst inflations in the post-Soviet space. Within 2 years, inflation reached 1400% per month. The reasons are the same as in other cases - a drop in production and export profits. The largest denomination after the declaration of independence was 1000 coupons. By 1995 it was already 1 million coupons. Without reinventing the wheel, the National Bank withdraws coupons from circulation and introduces hryvnia, changing at the rate of 1:100,000. At that time, this was equal to approximately 20 American cents. At that time, amazing stories happened: people who took out loans to buy a car or a home, after a while paid off these loans from their monthly salary.

9 Nicaragua (1986-1991)

After the 1979 revolution, Nicaragua's new authorities nationalized much of the economy. Given the country's huge foreign debts, this caused an economic crisis and inflation. The largest bill of 1 thousand cordobas became a bill of 500 thousand in less than a year. In 1988 the old cordoba was replaced by a new one. This, of course, didn't help. In mid-1990, the “golden cordoba” was introduced, equal to 5 million new cordobas. It turned out that 1 gold cordoba was equal to 5 billion cordobas issued before 1987. This “cordo fermentation” slowed down a little, and later almost stopped when it was possible to resume the agricultural sector of the economy.

10 Krajina (Serbian) (1993)

Krajina is an unrecognized country, annexed to Croatia in 1998. But while still independent, it suffered an economic decline, because was unable to establish either its own production or trade with neighbors. In just a year, 50,000 dinars turned into 50 billion! Gradually, with battles and negotiations, Krajina was returned to Croatia, however, many Serbs left... Inflation as a result of the illiteracy of the authorities can be easily defeated, but provided that these same authorities look at things realistically. By borrowing money from other countries, a country can live without troubles, but for a very short time. Only by setting up production and establishing trade in your own goods, accumulating resources along the way, can you not only not be afraid of this phenomenon, but also successfully help others. Of course, with benefit for yourself. These are the market relations that man invented.

Germany (1923) – 21%

As you know, during the First World War, Germany financed its military machine through external loans. Confident of its victory, the German government expected that all loans would be repaid by the losing side.

In addition to external debts, after the war Germany was faced with the need to pay huge reparations. In total, the debts exceeded the GDP of the country, whose leadership began to print money, gradually increasing its denomination.

Inflation in Germany

Since the new banknotes depreciated very quickly, and prices doubled in 3 days, people were forced to leave their entire salary in the store in order to purchase at least some food. The peak of inflation was observed in November 1923, when one dollar was worth 4.2 trillion marks (for comparison, in 1920, $1 was worth 50 marks).

DM 100 billion banknote from 1924

The situation was saved by introducing the Rentenmark, which was equivalent to 1 trillion papermarks that had been in circulation before. After the Rentenmark was replaced by the Reichmark in 1924, confidence in the national currency was restored to pre-war levels.