Lazy Investor Blog > Trading

The Internet is full of advertisements for courses teaching the basics of technical analysis. I quite often receive questions from subscribers: does a long-term investor need to understand support lines, patterns, etc. Today we will discuss whether technical analysis of stocks works. At the same time, I’ll tell you how I use it myself.

Moscow Exchange: history

Exchange business in Russia has a rich history and traditions. The first mentions of Novgorod merchant associations are found in chronicles of the 12th-13th centuries.

The recent history of the exchange begins with the return of a market economy to the country.

The nineties were marked by a real stock exchange boom - at some point throughout Russia there were more than 1,000 exclusively commodity exchanges.

On these exchanges they traded anything and everything. Timber, sugar, electronics, paper, building materials, bread, cars, computers and many other goods were in use.

And since 1993, surrogate securities began to be actively traded on stock exchanges, including the infamous MMM tickets

It is noteworthy that in those years, trading in shares of Mavrodi’s company accounted for approximately 40–50% of the turnover of all Russian stock exchanges.

In 1992, the Moscow Interbank Currency Exchange (MICEX) was established, which became the center of organized currency trading, and in 1995, the Russian Trading System (RTS) began operating, on which shares of the first privatized Russian enterprises were traded.

The Moscow Exchange, as we know it now, was formed as a result of the merger of these two platforms - MICEX and RTS in 2011.

Dotcom bubble bi like

Less than a year has passed since the outbreak of the coronavirus pandemic and the collapse of stock exchange prices. The NASDAQ index, which reached 9817.18 units on February 19, 2021, collapsed to 6860.67 units by March 23. However, although the number of people infected with coronavirus only increased and increased, the decline was quickly recouped. Already at the beginning of summer, the index reached another historical high and, without stopping there, continued to go up. On the evening of January 12, 2021, it reached 13036.4 points.

The situation seems to be not very logical. Many industries (such as tourism and aviation) have not yet fully begun to recover. A more contagious strain of coronavirus has been discovered in the UK, increasing the burden on the healthcare system. The vaccination process is still at the very beginning, and the formation of collective immunity, which everyone hopes for, is still far away. But at the same time, financial market indicators are so high, as if the pandemic is a long-gone past.

Experts recall previous “financial bubbles,” in particular, the dot-com bubble (from the English “.com”), which burst with a deafening explosion in 2000.

The NASDAQ Composite index of high-tech companies peaked in March 2000, followed by a collapse.

The reason was the behavior of investors who, in the second half of the 90s, invested too actively in Internet companies, overestimating their capabilities. And often without really understanding the topic. As a result, companies became worth much more than they could have earned under the best circumstances. And many startupers, having received easy money from investors, began to happily spend it, without even trying to worry about the sustainability of their companies.

And thunder will strike: experts say when the IT bubble will burst

Moscow Exchange: business structure

The main functions of the exchange are to provide trading participants with liquidity and guarantee the safety of transactions and the safety of investor funds.

This is achieved thanks to controlled organizations - NCC (National Clearing Center) and NSD (National Settlement Depository)

NCC acts as a seller for each buyer and a buyer for each seller and, accordingly, assumes all risks for concluded transactions.

NSD provides accounting and storage of securities and money of trading participants and transfers them between accounts.

As you see, all these operations are nothing more than mediation. The exchange simply takes its commission for providing the above services and receives income regardless of whether its clients lose or earn money. That's the beauty of the business model.

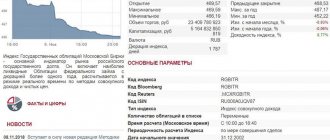

To make sure of this, let's look at the data for the first quarter of 2021:

Rice. 1 Quarterly group revenue. We are seeing significant growth due to increased trading volumes amid the coronavirus crisis

While there was panic in the markets, indices were flying up and down, turnover on the stock exchange was growing, and therefore revenue (income from operations) was also growing.

In the first quarter of 2021, the figure increased by 7.2% compared to the previous quarter and by 16.6% compared to 1Q19.

Commission income consists of commissions on the stock, bond, derivatives, foreign exchange and money markets. Based on the results of the first quarter, there was an increase in income on all platforms, with the exception of the money market, which does not depend on volatility and is an interbank lending market.

The exchange also takes a commission for the above-mentioned settlement and depository services and IT services, listing and other operations:

Rice. 2 Structure of the group’s commission income. The money market and settlement and depository services generate the most revenue.

As you may have noticed, in addition to the commission, the exchange also receives interest income, which amounts to 33% of the operating profit structure, which, in principle, is not small.

Moscow Exchange receives this interest income primarily from client funds:

Rice. 3 Group investment capital structure

How it works? Obviously, trading participants do not always keep their funds in shares. Long-term investors can simply keep rubles or foreign currency in an account, and short-term traders when trading futures pay the so-called GO or initial margin, which the company places on deposits in banks or other financial institutions. instruments.

In addition, there is a common practice in the interbank environment called overnight deposits. The point is that a bank or other organization with a reserve of funds can place its assets in another bank for just one night and receive a small interest on them.

As you understand, it would be a sin for Moscow Exchange not to take advantage of the opportunity and by placing client funds in this way, the company receives income even on holidays and weekends.

It is worth noting that interest income is and will continue to be under pressure as long as the central bank continues to cut rates. At the end of the first quarter, the exchange managed to increase net interest income by 2.1% due to the growth of client balances and realized income from the revaluation of the investment portfolio, but at the end of the whole year we will probably not see any growth here.

Moreover, the exchange does not incur enormous costs in order to maintain its activities. The largest expense item is personnel costs and based on the results of the 1st quarter. 2021 operating expenses were even lower than 1Q. 2021:

Rice. 4 Group operating expenses. The decrease in the first quarter is due to the transition to remote work

Thus, the exchange business is not only stable, but also high-margin. ROS (profit to revenue ratio) for the first quarter was 49%

Does a long-term investor need technical analysis?

The extent to which you need technical analysis depends on the strategy you choose. It’s one thing if you send a fixed amount to your account twice a month on the day of your advance and salary and buy a certain set of shares. And it’s completely different if you invest capital once every quarter or six months.

I use exclusively fundamental analysis 95% of the time. The only reason I take or add to a position is because I have confidence in the stock's long-term outlook. But some technical analysis tools that I find useful for my strategy fall into the simplest basic set:

- support levels;

- resistance levels;

- trend lines.

An example of such a picture on the graph. The blue line indicates a downward trend. It passes through several local maxima, each of which was smaller than the previous one. The red line is the nearest resistance. It will be possible to talk about a trend reversal only after the chart rises higher. Green line – support level. If it breaks through, most likely the price will go sharply down due to traders opening short positions and triggering stop loss orders, and not due to fundamental factors.

For example, I have decided that the price of a company has fallen below its fair price, and I believe that this is a good time to buy on the drawdown. In this case, I will assess the situation from the point of view of technical analysis. If I see that quotes have broken through a strong support level, I will postpone the purchase and monitor the situation.

Of course, if we are talking about a horizon of 20–30 years, then there is not much difference whether to buy 3–5% more expensive or cheaper. But, if you have a horizon of 5-7 years, the ability to find a local minimum can be useful.

I also recommend reading:

Gaps on the stock exchange: what you need to know about them

Where do gaps come from on the stock exchange?

I believe that an investor should not put technical analysis ahead of fundamental analysis. If I consider the timing of entry to be optimal from a long-term perspective, I will buy shares even if there is no clear signal to enter a long trade.

MOEX Operating Performance and Prospects

Now let's take a closer look at the company's operating indicators and think about the prospects for the development of the sector and the Moscow Exchange itself.

The average revenue growth rate over the past 6 years was 7% per year:

Rice. 5 Operating income of the group by year. Average annual growth rate is 7%

But if we discard the data of 14 years, then some stagnation is striking. As you can see, back in 15 and 16, interest income prevailed in the revenue structure, which was due to the high key rate at that time. The subsequent reduction in the rate led to a reduction in income, but, as you understand, the exchange cannot control this part of the revenue. but commission income can. And we have observed their average annual growth rate at 10.2% over the last 5 years:

Rice. 6 Commission income of the group by year. Average annual growth rate is 10.2%

The growth occurs even against the backdrop of the fact that trading volumes on the markets have been declining over the past three years:

Rice. 7 Trading volumes on Moscow. stock exchange by year. The largest volumes are in the foreign exchange and money markets

But let's return to total operating income. Management expects the average annual growth rate to accelerate to 10% over the next 4 years, and for good reason.

At a minimum, the following graph indicates that the Russian market is an unplowed field:

Rice. 8 Where do residents of different countries keep their savings? Russia ranks last in terms of the number of funds invested in shares.

Even under their pillows, people keep more than they do in stocks.

The aggressive marketing policy to attract investors to the exchange, which banks have begun to implement over the past couple of years, will definitely continue to have a positive impact.

Other growth drivers include the planned expansion of tools, attracting corporate clients and foreign investors, as well as increasing liquidity on trading floors. For example, the exchange plans to implement a link with the Shanghai Gold Exchange and cross-listing of securities with the Shanghai Stock Exchange.

You can also note the upcoming launch of the evening session on the stock market, which is scheduled for the second quarter.

In the long term, all this can have a positive impact on the company's earnings.

If you move a little away from the Russian stock exchange market and look at how the largest foreign exchanges operate, the following is striking: a very large source of income is the Data segment, within which exchanges supply information on quotes, as well as various analytics for a separate price.

For Nasdaq, this segment brings in 30.7% of revenue, for the world's largest exchange, ICE, a little more than 34%, and for LSE, 39%.

As you understand, the direction of the Moscow Exchange is not developed at all, so the road here is open.

Let's summarize.

Conclusions:

Why should you take a closer look at the stock?

- The business is stable and marginal. The exchange always makes money, regardless of whether trading participants lose or receive money.

- The exchange pays good dividends. According to the policy, payments are at least 60% of net profit. For the last three years, they paid 89% of the share price, and at the end of 2021, the payment will be 7.93 rubles per share:

Rice. 9 Moscow Exchange - dividends. The Group is committed to paying all FCFE.

It’s true that you won’t be able to get the dividend anymore. The cutoff was May 14th.

- Over the long term, the exchange has growth prospects. Banks and brokers continue to bring new clients to the market, but it is more difficult to attract a foreign investor.

Weaknesses of Moscow Exchange shares:

- The not-so-attractive investment environment in our country can create barriers to the influx of new money into both the debt and stock markets.

- The stock exchange was set very high for the dividend cut-off. Now the shares are quite expensive.

- The exchange periodically has management incidents (remember the theft of grain worth 2.6 billion at the beginning of 2021), and now there is a threat of lawsuits related to negative prices for WTI and colossal losses of traders and brokers. So far, no reserves have been created for this matter, but the risk remains.

Be that as it may, the stock exchange business brings and will bring money. The buy and forget strategy is perhaps the best option for trading shares on the Moscow Exchange