The banking system of the Russian Federation is a set of national banks and other credit institutions operating within the framework of a single financial and credit mechanism.

Banking infrastructure is a set of elements that ensure the functioning of banks:

- enterprises, agencies, various services, communications

- informational, methodological, scientific, personnel support

Functions of the Central Bank of the Russian Federation

- development and implementation of a unified monetary policy, protection and assurance of the stability of the ruble (this function is carried out jointly with the government of the Russian Federation)

- emission, that is, the release of money

- issuing loans to banks

- carrying out a refinancing policy (that is, repaying loans, securities)

- establishing rules for conducting banking operations, all types of bank reporting

- implementation of state registration of credit organizations (issuance and revocation of licenses)

- exercising control over the activities of banks

- registration of securities issue by banks

- carrying out banking operations

- implementation of currency regulation

- storage of the country's gold reserves

- storage of bank reserves

- determining the interest rate

- issue and redemption of government securities

- government accounts management

- execution of foreign financial transactions.

Regulator

The Central Bank of the Russian Federation was created in the form of a legal entity, but it does not have a charter and is not regulated by tax authorities. It can issue money, withdraw it, issue new banknotes. The profit of the institution is used to form reserves, funds, and is transferred to the budget. Sources of income:

- dividends on shares;

- interest income on loans and deposits;

- profit from transactions with precious metals, corporate rights, other securities, etc.

The objectives of the activity are:

- organization of the banking system;

- ensuring the stability of the national currency (purchasing power, exchange rate);

- ensuring the effective functioning of the system.

Tools:

- rates on Central Bank operations;

- reserve standards;

- refinancing;

- currency regulation;

- benchmarks for money supply growth.

According to the law, the authorized capital of the regulator and its other property are federal property. The Bank of Russia only manages them. The state and the Central Bank of the Russian Federation are responsible for each other’s obligations.

The supreme body of the Central Bank is the Board of Directors, which determines the directions of the institution’s activities. It consists of the chairman of the Central Bank and 12 members. Banks of the republics, which are territorial branches of the regulator, cannot issue guarantees, sureties, or obligations without the permission of the Council.

Banks are divided into two large groups: commercial organizations and non-bank credit institutions. This is how the country's banking system is structured at the first level.

Types of banks

By service sector

- international

- national

- regional

- interregional

By property type

- state

- private

By industries served

- diversified

- single-industry (industrial, agricultural, construction, etc.)

By range of banking services

- universal (carry out almost all types of banking operations)

- specialized (provide one or two types of services)

By function

- issuing bank - the Central Bank issues money and securities; commercial banks - securities.

- mortgage - provide long-term loans secured by real estate

- investment – provide financing and long-term lending

- deposit - carry out credit operations to attract temporarily free money:

- Trust - services in managing someone's property and capital.

- Clearing – implementation of non-cash payments

- Exchange - servicing exchange transactions

- Accounting – accounting of bills, etc.

- savings loans - attract small deposits for a certain period

- special - finance individual target, regional, state programs.

By terms of loans issued

- long-term

- short-term

By capital size

- large

- average

- small

By organizational structure

- single bank - single legal entity

- banking group – group of legal entities = parent bank + branches (legally independent, but managed by the parent bank)

- banking association - formed for the purpose of coordination and coordination of actions.

"Bankfall" 2015

The national banking system as of January 1, 2016 includes 681 credit institutions. A total of 947 organizations are registered, but 266 of them have had their license revoked. Compared to 2015, the number of banks decreased by 102 units. Analysts predict that in 2-3 years this figure will drop to 500.

Despite the crisis, the pace of “cleaning up” the sector has not slowed down. The loudest thing last year was the revocation of Transportny's license due to non-compliance with federal laws. The volume of DIA payments is estimated at a record 39 billion rubles.

The number of banks in the Russian Federation exceeds the needs of the state economy. Approximately 96% of the country's acts are consolidated among the 200 largest institutions. Another 481 small organizations account for 3.5% of assets. Until the economic situation improves, small banks will have problems with liquidity and meeting regulations. There are only two options to solve the problem: sell assets or go for rehabilitation.

Specialized credit and financial institutions

These are organizations that are not banks, but partially perform their functions. These include:

- pension funds

- Insurance companies

- pawnshops

- trust companies (semi-banks, trust operations, management of real estate, other property, acceptance of valuables for safekeeping, management of a minor’s property by a guardian, management of property by will, etc. Trust is an agreement on the management of property by other persons, can be by consent or by law)

- credit partnerships

- mutual credit societies

History of formation

It is impossible to give a comprehensive description of the current state of banking in Russia without a preliminary excursion into history.

The first financiers and banking organizations appeared in the Russian Empire under Elizabeth, in 1754. From this time until the beginning of the First World War, the number of banks increased from two to six hundred, and this does not count all the branches of each bank separately.

Since 1917, banks began to belong to the state. This situation remained until 1990, with a break due to the NEP, when the opening of private and mixed-ownership banks was allowed. In 1921, the State Bank of the RSFSR appeared, which in 1923 expanded to become the state bank of the entire USSR. The State Bank's charter appeared in 1929.

Since the collapse of the Soviet Union, banking has acquired a completely new scale: new laws began to be adopted, banks were able to attract private and even foreign capital; The Central Bank of the Russian Federation appeared, whose instructions currently most regulate the structure of the financial market of all legal documents within the Russian Federation.

Problems of the Russian banking system

- insufficient level of bank capital

- large volume of non-repayable loans

- high dependence of banks on the state of state and local budgets

- insufficient level of development of promising banking technologies

- high dependence of banks on large shareholders

- insufficiently high professional level of bank employees

- lack of current legislation for stricter control over the activities of banks, etc.

Material prepared by: Melnikova Vera Aleksandrovna

Operating principles

- Work within the limits of actually existing resources. Interest income on deposits and loans is the main, but not the only source of profit for banks. In conditions of inflation, the most profitable area is stock trading. Bank capital contributes to the growth of speculative transactions. In such conditions, planning is carried out on the basis of actually raised funds.

- Responsibility for performance results. The banking system in the economy performs an important task - it redistributes money between sectors. Credit institutions are free to choose clients and areas of investment. But banks are responsible for all their obligations with their own funds, which may be subject to penalties.

- Organizing relationships with clients based on market conditions. When issuing loans, the bank is guided by indicators of liquidity, profitability and risk.

- Regulation of activities is carried out exclusively by indirect methods. The state and legal acts form the basis for functioning, but cannot dictate the conditions and directions of activity.

Results 2015

Throughout last year, banks tried to maintain profitability. But not everyone succeeded. Even major market players showed record losses. While the population is considering whether to take deposits to the same Sberbank (after exchanging rubles for dollars), credit institutions are experiencing problems with liquidity.

Due to the collapse of the ruble, the volume of the loan portfolio in the first quarter of 2015 decreased by 0.7%, reserves - by 7.6%, profit amounted to only 6 billion rubles. A lifeline was thrown by the Central Bank, which introduced regulatory relaxations. As a result, the share of the regulator’s funds in banks’ liabilities at the end of April reached a record value of 10.4%. Institutions accrued reserves for restructured loans under a preferential scheme.

The second support measure is the additional capitalization of banks by 830 billion rubles. according to the OFZ scheme. The program started working only in the second half of the year, so its effectiveness can only be truly assessed by the end of 2016. But the injections allowed banks to maintain capital adequacy standards and replenish Tier 1 reserves. The payment for support was the obligation not to increase expenses for private entrepreneurs and to limit dividends for three years. The actions of the Central Bank made it possible to increase the share of loans by 0.7%, deposits by 10.9% and generate a profit of 265 billion rubles.

Difficult to find investors

There are many banks willing to stay on the market. As well as buyers. The problem is that the vision of value on both sides is different. Since the introduction of sanctions, the number of Western investors has been constantly decreasing. Partners are now being sought in the markets of the Middle and Far East.

The work of the Russian banking system may well be carried out at the expense of 300 institutions. Organizations in the fourth hundred in the ranking are captive and serve only a number of enterprises. In the literal sense, they are not engaged in banking activities.

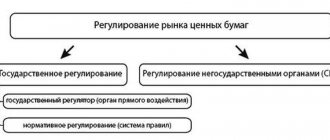

Legislative regulation

The activities of the Central Bank are regulated by the federal law “On the Central Bank of Russia” No. 86-FZ , as well as the Constitution of the Russian Federation (more precisely, Article 75). Banking activities, as well as banking infrastructure in a general sense, are regulated by the following documents:

- Civil Code of the Russian Federation;

- Federal Law “On Banks and Banking Activities” dated December 2, 1990 No. 395-1;

- Federal Law “On Deposit Insurance” No. 177-FZ;

- Federal Law “On microfinance activities and microfinance organizations” dated July 2, 2010 N 151-FZ;

- Federal Law “On Consumer Credit” No. 353-FZ;

- Federal Law “On the National Payment System” No. 161-FZ;

- Federal Law “On the Development Bank” dated May 17, 2007;

- Federal Law “On the insolvency (bankruptcy) of credit organizations” dated February 25, 1999.

Development

The course of development of the banking system is influenced by a number of macroeconomic and political factors. The following can be distinguished from them:

- degree of maturity of commodity-money relations;

- social and economic order, its purpose and social orientation;

- legislative framework and acts;

- a general idea of the essence and role of the bank in the economy.

The development of the banking system is influenced by the development of national international trade markets. The demand for banking services expands as production increases and the scale of exchange between commodity producers increases.

General ideas about the essence and role of the bank in the economy also have a huge impact. Social and economic order inevitably affects the nature of its activities. Political factors also affect its condition and current development. Here, first of all, the general political orientation of the state turns out to be important.

With the general progressive development of the banking industry, it can at the same time be restrained by wars that are associated with the destruction of material wealth and property. Protracted economic crises also have a negative impact on the banking system.

Legislative framework of the country. In some countries, banks are prohibited from performing certain transactions with securities and investing their capital in the capital of enterprises. In some countries, banks are not allowed to engage in insurance.

A noticeable factor determining the development of the banking system is interbank competition. The presence of a sufficiently large number of independent banks in the country and its individual regions creates a certain environment in which they are forced to compete for the client, improve the quality of service, expand services, and offer the market new products.

Development may be hampered by factors such as excessive tax pressure on banking profits, lack of sufficient resources for active banking operations, lack of qualified personnel, etc. In countries with economies in transition, it is often these factors that do not allow banks to take broader steps in their development .