Options are the most flexible of the existing exchange instruments; in this parameter they are head and shoulders above futures. This type of contract allows you to build the most flexible trading strategies, reducing risk to a minimum. Options for beginners seem like a complex and confusing instrument, but this is a false impression. Spend 15-20 minutes reading this material and you will already know the theory in general terms. All that remains is to consolidate the knowledge in practice.

Important note: below we will talk about classic options , not binary ones. BO - instruments actively promoted by offshore brokers, do not belong to exchange-traded instruments and are not traded on classic stock exchanges.

What is an option

This term refers to a time-limited contract that gives the right to buy or sell any asset. This definition implies 2 key features of options:

- they give the right to buy or sell an asset, rather than an obligation . For example, the holder of a Call option to buy Apple shares may not exercise it if the price of the underlying asset (apple company securities) changes in a direction unfavorable for him.

- these contracts are limited in time , they have an expiration date - this is the time for which the conclusion of the transaction is postponed.

When it comes to the types of underlying assets, there are options contracts for all types of instruments. These can be precious metals, currencies, commodity market instruments, cryptocurrency, art objects. There are contracts for weather futures (traded including on the Chicago Mercantile Exchange), traders even make money on the correct weather forecast.

Options are traded on the same exchanges where traders trade futures contracts. If you are just starting to work in this direction, the article on what futures are will be useful; be sure to read it.

The video below provides a detailed analysis of the nature of options. I recommend checking it out.

Pricing in the options market

The theoretical price of an option is determined by the exchange, but this value is not final. As practice shows, the value of an option may change slightly during exchange trading.

The main parameters influencing the option price are:

- supply and demand;

- the value of the underlying asset;

- validity period of the option contract;

- volatility of the underlying asset;

- other parameters determined by the type of specific option.

When the value of the underlying asset changes, the theoretical price of the option is recalculated by the exchange, and the remaining limits are satisfied in order to equalize the indicators of the current and theoretical prices.

If the value of an option falls, the buyer is at a disadvantage because he will have to pay the option premium if the deal ends. In this case, the benefit will be on the seller's side.

But if the value of the option changes upward, the seller will not only return the entire premium, but will also have to cover the profit to the buyer of the option at his own expense.

The longer the term of the option contract, the greater the value of the option, and vice versa. It is worth noting that many options are fully vested at the end of the contract.

Types of options

The classification depends on the selected criterion.

Type:

- European . They are inconvenient because they allow the owner of the right to buy/sell to use it only during the expiration date . This reduces room for maneuver. For example, before the expiration date, the price of the BA changes in a favorable direction, but the trader cannot execute the contract ahead of schedule. He waits until the expiration date, during which time the chart may go in the unprofitable direction. By the expiration date, it may go out of the money.

- American ones are more flexible compared to European ones due to the fact that they can be executed on any day before expiration. The trader can exercise his right to sell or buy the underlying asset before expiration. This increases the chances of success; there is no reference to a specific date, control over the transaction is maintained throughout its entire life.

Let’s assume that at the end of May a Call option is purchased (the underlying asset is Aeroflot stock futures). The strike price of 8,000 rubles was selected, which means that in order to make money, the price must be above 8,000 rubles when the contract is executed.

The execution date is set for June 17, 2021. This example is shown for the Moscow Exchange, where American options are traded, so the trader can exercise it until 06/17/20.

Let's move on to the Aeroflot stock chart. The purchase was made when the price of the securities was slightly less than 80 rubles per share. At the moment their cost rose to 97.74 rubles. for 1 share, the maximum was reached on June 9, 2021. Since the work is carried out on the MICEX, the holder of the Call contract can execute it ahead of schedule, for example, at a price of 95.00.

the European was traded , the trader would have to wait for expiration. According to the regulations, it takes place on June 17, 2020. during evening clearing (18:45-19:05 Moscow time, usually the time is limited to 18:45-19:00 Moscow time, but on days when contracts expire, the time range increases by 5 minutes). At this point, the Call option becomes less profitable - Aeroflot stock quotes dropped to around 85 rubles. for 1 paper.

Executing the contract still makes a profit , but compared to closing early at a higher rate, the trader loses more than half of the potential profit. That is why the American is more popular .

As for fixing the result of a transaction, it can be done either by opening a counter position or directly by early execution of the current contract. The second option is used in the absence of a counterparty to conclude a counter transaction.

According to the method of organizing trade:

- Marginable (futures type). At the time of conclusion of the transaction, the premium is not transferred to the seller of the contract, but, as in the case of futures, the collateral is recorded in the accounts of the seller and the buyer. Another difference from the second type is the presence of variation margin , it is transferred at the end of each trading session.

- Non-margined – when purchasing a contract, the premium is transferred to the seller, and the GO for the option is recorded on his account. There is no variation margin; instead, when the price changes, the GO on the seller’s (subscriber’s) account changes. There are other differences in how these types of contracts work.

Deliverable options

This is the name of those contracts under which the underlying asset is delivered . At the same time, the trader is not forced to hold the contract until expiration (if it is an American type); positions can be closed with a reverse transaction - this is how the trading result is recorded. You can contact your broker for early execution.

As a rule, the underlying asset is a futures contract . Expiration of options (deliverable) occurs 2 days before the expiration of the corresponding futures during evening clearing on the MICEX.

Deliverable options and futures are widely used in real business to hedge risks.

This type of contract allows, for example, to hedge against unfavorable changes in the price of raw materials, equipment, currency and other categories of underlying assets.

Why real options are important

When calculating net present value (this indicator is a traditional valuation tool), the cost of such an element that is essential for making investment decisions as adaptability (i.e., the ability to adapt, adjust) is not taken into account. Accordingly, real options are especially important for strategic and financial analysis. Let's consider an example of another oil corporation's decision to purchase a five-year license for a field site, the expected production volume of which is estimated at approximately 50 million barrels of oil. Let's say the current price for a given grade of oil is $10 per barrel, and the current cost of developing the site reaches $600 million. The net present value of the investment option under consideration will be as follows:

$500 million - $600 million = - $100 million

Having received this result, the company's managers, naturally, will not buy a license. What if we evaluate using an option model that takes into account the importance of uncertainty?

The value of a site is affected by two main uncertainties: the level of production and the price of oil. The estimated production volume can be estimated by analyzing the statistics of the results of exploration of deposits in similar geological conditions. Information on fluctuations in oil prices is also quite accessible. Let's say that these two factors together produce a 30 percent standard deviation (-) in the growth rate of operating cash inflows. The company holding the option must incur annual fixed costs to maintain oil reserves in a state of readiness for production - say, they will be $15 million. This cash outflow is similar to dividend payments and is 3% (i.e. 15/500) of the value of the asset. We already know that the option duration (t) is five years and the interest rate on the risk-free asset (r) is 5%. Then the real option value (ROV) will be as follows:

Where did the difference of $200 million come from? Let's draw an analogy with a simple financial option. Suppose an option to buy a stock priced at $70 is offered at a time when the stock is priced at $83 and the option premium is $17. If the option buyer exercises it immediately, he will still receive a gain of $13 from buying the stock. , but will suffer a total loss of $4 (since he spent $17 to purchase the option). The four dollar difference represents the “adaptive cost” (the value of being able to make flexible decisions) due to the fact that the option owner does not have to immediately decide to invest the entire amount. It is this element that is ignored in the net present value calculation. In the example discussed above, $200 million is the equivalent of the indicated $4.

Therefore, ultimately, the option valuation takes into account the “learning cost” (i.e., the value of the opportunity to acquire new information). This is very important because strategic decisions are rarely made overnight, especially in capital-intensive industries. It is for this reason that net present value, based on all-or-nothing or yes-or-no decisions, is often an inadequate valuation tool, and this deficiency is not even quantifiable. While the real option model takes into account six variables, the net present value model takes into account only two (the present value of expected cash flows and the present value of fixed costs). Option valuation provides complete coverage of cost elements, including both net present value and “adaptability cost”, i.e. the expected change in net present value over the life of the investment opportunity (Fig. 2).

Adaptability lever: changing the value of real options

Some characteristics of the considered cost element (adaptability) are inherent in both financial and real options. In both cases, the option owner can decide whether to invest and realize the winnings; if it is worth doing, then when exactly (setting such a time is very important, since the winnings will be optimal at a precisely defined moment). This adaptability is reactive: the owner of the option, seeking to maximize his income, makes decisions based on external factors.

In discussing the responsive adaptability of a real option, we ultimately consider only the benefits of using it as a valuation tool. However, a much more significant benefit can come from proactive adaptability, which increases the value of an option already purchased. This possibility arises from the following circumstances. Unlike financial options, which are purchased and exercised in an active, transparent market, real sector industries typically have a fairly limited number of market participants interacting with each other. Each of them is capable of influencing a number of specific specific levers on which the value of real options depends. Thus, managers can use their knowledge and skills to increase the value of an option before the option is exercised (i.e., make the new value exceed the amount that was paid at the time it was purchased or created).

Lever 1. Increase in the present value of expected operating cash inflows. This is achieved by increasing income through higher prices, expanding production of the relevant product, or creating a series of sequential business opportunities that create a so-called compound option.

Lever 2. Reduce the present value of expected operating cash outflows. Costs can be reduced by taking advantage of “economies of scale” (decrease in unit costs as production volumes increase) and “economies of variety” (expansion of the range of products at the same costs). For a company that is not able to implement these methods on its own, organizing cooperation with any partner is not excluded.

Lever 3. Increased uncertainty in expected cash flows. High uncertainty leads to an increase in the “cost of adaptability”, resulting in an increase in the price of the option. This is the fundamental difference between option analysis and analysis using the net present value method. When all of a corporation's raised cash has already been invested (as assumed in the net present value model), uncertainty has a negative impact because the expected returns are then symmetrical (i.e., a total loss of the investment is as likely as a return of double the amount). If the option is purchased, the company does not risk completely losing its investment - it can only win or remain in its previous position. As a result, the owner of the option tries in every possible way to increase the uncertainty of the expected income, and then either exercise the option (when its maximum is reached) or refuse to do so. This point is extremely important: it entails a number of consequences that conflict with intuition.

Let us give an example to illustrate the above considerations. North Sea gas corporations tend to create value by accelerating their competitive positions and quickly exploiting the areas they hold licenses for. Some companies, however, follow a different, options strategy. It is based on the fact that the gas market, unlike the oil market, is usually local and much less transparent (due to difficulties with storing and transporting gas). Such firms encourage competitors to enter nearby areas and do not begin making capital investments until the activity of rivals reaches a maximum (as a result, it becomes possible to clarify what the productivity of the areas is. - Ed.)

The higher the uncertainty of future investment (and with them production) plans, the stronger the price fluctuations and the stronger the incentives for buyers to agree to enter into long-term contracts for gas supplies at high prices. Consequently, the option value of the licensed area increases. Corporations must compare, on the one hand, the value created by waiting, and on the other, the value lost due to the delay in starting work on the field and the subsequent delay in gas supplies. The real options strategy provides companies using it with two important advantages. First, they use the lever of reactive adaptability to make smarter investment decisions based on new information about competitors' performance. Secondly, they use the lever of proactive adaptability to get their customers, nervous about the uncertainty of the future gas supply regime, to agree to prices that are more favorable to producers.

Lever 4. Extending the validity period of an investment opportunity. This increases option value as a result of increased overall uncertainty.

Lever 5. Reducing the value lost during the option exercise period. For financial options, the lost value is embodied in the cost of waiting until the dividends become payable (at which point the stock price declines and, therefore, the option payout falls). In the real sector, the cost of waiting will be high if the early entrant to the market seizes the initiative and realizes the significant benefits gained by paying increased dividends. Accordingly, the option value created by the expectation will decrease. The amount of value lost due to the actions of competitors can be reduced by discouraging them from exercising their options (for example, by closing access to key customers or lobbying for the introduction of certain legal restrictions).

Lever 6. Increase in the interest rate on risk-free assets. This, of course, is not a subject for discussion from the point of view of proactive adaptability, since none of the market participants is able to influence the level of this rate. However, it is worth noting that during periods of expectation that the rate will rise, the option value generally increases (despite the negative impact of these expectations on the net present value) as the present value of the strike price decreases.

Lever selection

What levers can and should the company press? A simple sensitivity analysis can answer these questions.

Let's return to the example of a license area, which is valued at plus $100 million using the real option method and minus $100 million using the net present value method. Let's say that each of the six factors that appear in the Black-Scholes formula changes by 10%. We will immediately see that the license term, the interest rate on the risk-free asset and the annual license cost (i.e. the value lost over the life of the option, or "dividends") have much less impact on the option value than the present value of the expected inflows. cash outflows and the level of uncertainty. A ten percent change in the value of each of the last three factors adds 26, 16, and 11% to the option value, respectively (Figure 3).

Consequently, corporations are better off focusing their efforts on increasing revenue rather than cutting costs—a finding that appears key to managing option value. However, there are external limiters to income growth, such as competition and market regulation. If it turns out that the more powerful levers are more difficult to press, you can turn to the most accessible ones. Indeed, the analysis shows that improving the situation in terms of term and dividends also brings noticeable benefits.

The problem of choosing leverage is a problem of internal and external constraints under which the company operates. They can be very different - technical or related to marketing, negotiations, managing relationships with contractors and, finally, investment (acting in the form of factors such as lengthening the payback period of investments and restrictions imposed on additional capital investments).

How to change a leader's logic

Perhaps the most important benefit that comes from adopting options thinking is the transformation of the way you think. The systematic use of the options model alone begins to change the thought process of managers. The benefits of the new situation can best be seen by contrasting it with the traditional NPV approach (which involves a fixed investment model over many years and fixed annual return expectations). The practice of making one-time decisions based on static investment plans leads to a narrowing of the horizons of managers. As a result, managers may find it difficult to let go of forecasts they have made several years in advance, even when the opportunity arises to change course or abandon a failed long-term project.

Strategies based on the real options model differ from conventional approaches primarily in their sensitivity to uncertainty. There is a change in principles: instead of the usual “beware of uncertainty and minimize capital investments,” a new one is beginning to be applied: “use uncertainty and learn to learn.” This opens up a wide range of options and is key to unlocking the value of real options as a strategic rather than a valuation model (see sidebar, “Best Practices for Managing Real Options”). Later steps taken within options thinking often seem self-evident, which is precisely a sign of the effectiveness of the model.

How options trading differs from futures

If we describe what options and futures are in simple words, the key difference is flexibility :

- When dealing with options, the buyer acquires the right to buy and sell the underlying asset in the future.

- When dealing with futures, the parties agree on a deal that is delayed in time. The buyer has no choice regarding the execution of the transaction at expiration.

Both types of instruments can be seen as a dispute between 2 parties about what the price will be after a certain time. When purchasing a deliverable futures contract, for example, on Gazprom shares, the buyer actually purchases the securities of this company, but with a time delay. At expiration, he will receive shares at a price agreed in advance.

Example with Gazprom futures

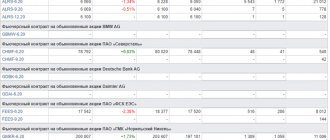

The figure below shows September futures for Gazprom shares. Let's assume that the purchase of 1 contract is completed on July 17, 2021. at a price of RUB 18,596. (1 futures implies the purchase of 100 securities). If you do not close the contract with a counter position and do not extend it, then in September there are 2 options:

- The price of the underlying asset will increase , for example, to 250 rubles. per security, then the buyer will still be able to buy shares at 185.96 rubles.

- The price will drop , for example, to 150 rubles. for 1 security, the trader still buys them for 185.96 rubles. for one. In fact, he loses 35.96 rubles. on every share. But usually futures are used for speculative transactions and rarely held until expiration. For them, the result is either fixed by counter positions, or the contract is transferred to the next month.

When working with options in the same situation, the trader could exercise the contract if was favorable for him. If the stock price is falling, there is no point in doing it. It is more profitable to lose the premium paid when purchasing the contract and not exercise the right to purchase Gazprom securities. This is the key difference between futures and options.

If we are talking about the margined type, the difference is no longer so obvious. the guarantee collateral is blocked on the account . During clearing, variation margin is paid, positions are constantly revalued. During expiration, the corresponding futures instead of the option.

Options thinking

There is another argument in favor of corporate executives adopting the basic principles of real options theory. Along with the high advantages of the Black-Scholes model as a method of determining value, one should also pay attention to the possibility of using real options as a strategy tool. We believe that the true power of real options lies in their strategic application: they can become a fundamental pillar of corporate strategy. This article will attempt to demonstrate how such a foundation is created by looking at six option levers.

The financial option price (option premium) is determined according to the modified Black-Scholes formula[4]:

S - share price (at the time of issue of the option - Ed.), X - option exercise price, δ - dividends, r - interest rate on risk-free assets, σ - uncertainty, t - option expiration date, N(d) - integral function of normal distribution [5]. (This formula also includes the number e, which is the base of natural logarithms. - Ed.). In the real sector, the equivalents of these six factors are determined as follows.

- Share price (S) is the current value of cash flows expected from the implementation of the investment opportunity for the right to exercise which the option was purchased.

- The exercise price (X ) is the present value of all fixed costs that are expected to be incurred during the period of implementation of the investment opportunity.

- Uncertainty (σ) is the impossibility of accurately determining the size of future cash flows associated with a given asset. More strictly stated, it is the standard deviation of the growth rate of future cash inflows.

- The option expiration date (t) is the period during which the investment opportunity remains open (valid). It depends on technology (duration of the product life cycle), competitive advantages (intensity of competition) and contract terms (patent, leasing, licensing).

- Dividend (δ) is the value lost over the life of the option. These may be expenses incurred in order to preserve the option (by pushing out competitors or creating the necessary conditions to support the investment opportunity), as well as the loss of part of the cash flows in favor of competitors who began to implement the investment opportunity earlier (the formula in question does not use the absolute value of dividends , and the dividend rate is in the form of a decimal fraction. - Ed.)

- The risk-free interest rate (r) is the yield on risk-free securities that have the same maturity as the option.

The price of an option increases as a result of increases in parameters such as the stock price, uncertainty, the expiration date of the option, and the interest rate on risk-free assets. It decreases due to an increase in the execution price and dividends (Fig. 1).

Understanding the terminology

Making money on various options involves using specific terminology. Let's look at the most common concepts:

- A call is a contract, the buyer of which can purchase the underlying asset (BA) in the future at a previously fixed price. It does not matter what the cost of BA will be at expiration.

- Put - its buyer receives the right to sell the BA at a pre-agreed price. The second party does not have the opportunity to refuse to purchase the underlying asset.

- Strike – the cost of the BA at which the asset can be bought or sold at expiration. On the options board there is a whole series of strikes for everyone. Depending on them, the cost of the contract and the likelihood of receiving income change.

- Volume – position size, measured in the number of contracts.

- Open Interest – shows the number of open contracts. At the moment of “entry” of new players, deals are concluded between sellers and buyers, and OI increases. Depending on further actions, it can either fall or rise.

| Seller (subscriber) | Buyer | Open Interest | Direction |

| New | New | +1 + 1 = 2 | OI is growing |

| New | The current buyer has left the market (sold) | +1 — 1 = 0 | OI remains the same |

| A former subscriber buys and exits the market | New | -1 + 1 = 0 | OI does not change |

| Exit | Exit | -1 — 1 = -2 | Open Interest is declining |

- Pro-trading levels - near them the forces of sellers and buyers are temporarily equalized. The chart is moving in a narrow price range; the trade breakdown indicates a more likely direction of movement in the future. Some trading systems are built on this phenomenon. I will tell you more about trading methods later in a post about options analysis and strategies.

- Premium is the amount paid to the seller when purchasing an option contract. This is a kind of payment for the risk that the holder of the right will not use it in the future and will not purchase BA from the subscriber. The premium remains with the seller even if the buyer does not exercise the option to purchase the underlying asset. In the case of margined contracts, the subscriber does not receive a premium to the account immediately; instead, an amount equal to the margin is blocked for both parties to the transaction.

- Expiration date is the time when settlement occurs between the parties. If actual delivery of BA is provided, the buyer can exercise the right to purchase it. More often than not, everything is limited to adjusting the account balances of the subscriber and buyer of the option contract. The specification indicates the expiration day, the process takes place from 18:45 to 19:05 Moscow time, this period is reserved for evening clearing (it is extended by 5 minutes on expiration days).

There are other “narrow” terms used when working with these tools. Very soon I will publish an article on how to trade options and, as part of it, I will explain a number of expressions that are used directly in trading.

Options trading and possible contract states

When trading, all transactions can be conditionally divided into “opening” ones and those that liquidate current positions. Traders most often work with American options and ahead of schedule when the BA price moves in a favorable direction.

| Entering the market | Liquidation of positions | ||||

| Emerging obligations | Emerging obligations | ||||

| Buyer | Salesman | Buyer | Salesman | ||

| Call | Right to purchase BA | Obligation to sell BA | Call | Elimination of the obligation to sell BA | Liquidation of the right to purchase BA |

| Put | Right to sell BA | Obligation to buy BA | Put | Liquidation of the obligation to buy BA | Liquidation of the right to sell BA |

Depending on the position of the price relative to the strike, the transaction can be in several states :

- In money . For Call contracts, the execution price must be higher than the strike, for Put contracts – lower. It is more profitable for the holder of the right to buy (Call) or sell (Put) BA to execute the contract.

- Out of money. For Call contracts, the BA price is lower than the strike, for Put contracts it is higher, and it is unprofitable to execute it. In this scenario, a loss occurs, but it does not exceed the premium.

- About money. The cost of BA is approximately in the strike area and it is impossible to predict what the outcome will be.

- Deep in money . Similar to the first item in this list, but the BA price has moved so far from the strike in a profitable direction that the probability of a change in the contract state is near zero. By the same principle, the type “Deeply out of money” .

Contract states

Now, based on these conditions, let’s look at examples of different states of option contracts:

- Buying Contract Call for June stock futures Rosneft. Strike – 36 000As long as the chart remains above this price level, it is “in the money”. The trader can hold it until expiration or liquidate it with a counter trade before that date. At the expiration date the trade is still profitable.

- The same asset (security futures Rosneft), but the deal is riskier, concluded in early June with a strike 40 000. The risk did not pay off, the price briefly reached the “in the money” state and the subsequent collapse made the execution of the contract financially unprofitable.

- Let's move on to options Put, BA we will leave the same. Suppose a Put with a strike is purchased 40 000, the forecast is fulfilled, and soon the price falls below this level. As soon as Rosneft shares begin to cost less than 400 rubles. for one security, the transaction goes into the state "in the money";

- A less fortunate trader could have bought the contract Put at the end of May with a strike 36 500. The forecast did not work out, the cost of BA began to rise, but the loss in any case is limited only by the premium. At expiration, the price never entered the state "in the money", so the contract remains unfulfilled.

It does not matter whether options are traded on stocks, precious metals, commodities or other categories of underlying assets. Events always develop according to one of the above scenarios.

Why sell options

The buyer is at a somewhat disadvantageous position. When opening a deal, a premium is paid. To gain profit, the increase in the price of BA must cover the payment to the seller.

Suppose a Call option was sold (BA - futures on Rosneft ) with a strike price of 36,000 , the premium on it was 500 rubles . During expiration, the price of securities increased to 362 rubles , which means that when the holder exercises the right to purchase BA, he will earn 200 rubles. , which partially covers the loss due to the premium. The seller in the same situation earned 500 – 200 = 300 rubles .

The relationship between the profits of participants in a Call option transaction is illustrated in the graph below. As soon as the price of the BA exceeds the strike , the buyer’s profit begins to increase, while the opposite side’s loss increases.

For Put contracts, the type of chart changes.

The condition of sellers of Put and Call options critically depends on the price of the underlying asset . At the moment the deal is concluded, he is in a more advantageous position, but over time the situation can quickly change.

Greeks

So-called “Greeks” are used to estimate the sensitivity of an option's value to a change in one of the parameters, while the remaining parameters remain unchanged. They are used by traders and financial institutions to assess and manage risks. Under the boundary conditions of the Black-Scholes model, the formulas for calculating the Greeks of European style call and put options are given below.

Delta

Delta _

) is considered the most important of the "Greeks" because it evaluates the sensitivity of the option price to changes in the price of the underlying asset. For example, if the delta of a call option is 0.75 and the price of the underlying stock increases by $1, then the price of that option will increase by $0.75. To calculate the value of this coefficient, the following formulas are used.

δCALL = N(d1)

δPUT = -N(-d1) = N(d1) - 1

Gamma

Gamma _

) is the first derivative of the option delta and estimates the rate at which it changes when the price of the underlying asset changes by 1 point (usually $0.01). For example, if the option gamma is 2, then if the price of the underlying asset increases by 1 point, the option delta will increase by 2 points.

Based on put-call parity, the gamma is the same for the call option and the corresponding put option:

| γ = | N'(d1) |

| Stσ√Tt |

where N'(x) is the probability density function.

Vega

Vega _

) is used to assess the sensitivity of the option price to changes in the standard deviation of the return of the underlying asset. This coefficient shows how much the option price will change if the standard deviation changes by 1%. For example, if vega is 0.5, then if the standard deviation changes from 11% to 12%, the option price will increase by $0.5.

Based on put-call parity, vega is the same for the call option and the corresponding put option.

ν = StN'(d1)√Tt

Theta

Theta _

) is a coefficient that characterizes the change in the price of an option as its expiration date approaches. For example, if the theta of an option is 0.75, then the next day its price should decrease by $0.75.

The following formulas are used to calculate the theta of a call option and the corresponding put option:

| θCALL = | StN'(d1)σ | — rKe-r(Tt)N(d2) |

| 2√Tt |

| θCALL = | StN'(d1)σ | + rKe-r(Tt)N(-d2) |

| 2√Tt |

It should also be noted that the gamma and theta of an option always have opposite signs. Theta is also characterized by an increase as the expiration date approaches.

Ro

Rho _

) is used as a measure of the sensitivity of an option to changes in the risk-free interest rate, which is usually the rate on US Treasury bills (

English Treasury Bill, T-bill

). The formula for calculating it is as follows:

ρCALL = K(Tt)er(Tt)N(d2)

ρPUT = -K(Tt)er(Tt)N(-d2)

This coefficient shows how much the option price will change if the risk-free interest rate changes by 1%. Assume the rho of a call option is 0.35 and -0.25 for the corresponding put option. If the Treasury bill rate increases from 2.50% to 3.50%, the call option price will increase by $0.35 and the put option price will decrease by $0.25. If interest rates fall, the price of a call option will decrease and the price of a put option will increase.

Can Beginners Make Money Trading Options?

The very concept of “no money” is somewhat arbitrary; it refers to newcomers with relatively small deposits. With zero capital it is impossible to make money in any of the markets.

The financial requirements for beginners are relatively small. Deposit of 10-15 thousand rubles . more than enough for experiments in trading.

When it comes to income, we recommend not viewing options as a holy grail. This instrument can indeed provide high returns in some cases, but it is better not to take risks and use conservative strategies. At the starting stage, remember the basic rule - never make “naked” option sales . For such positions, the loss is not limited; you can not only lose your deposit, but also go into the red.

Where and how can you buy options

This type of instruments is available on the MICEX , and on the CBOE (Chicago Board Options Exchange), and on other trading platforms around the world. However, it is impossible to directly register on the site and start trading. All operations are done through a broker who has access to the relevant exchange.

That is, the process looks like this:

- Find a broker who has access to the relevant exchanges.

- Register with him, open an account and top it up.

- Download the software.

- You start trading.

BCS one of the best brokers for beginners . It has a lot of tariffs, this will come in handy later when you reach a trajectory of sustainable growth. At all tariffs, it gives access to the MICEX derivatives market; the conditions for the starting tariff are given in the table below.

BKS | ||

| Minimum deposit | from 30,000 rub. | |

| Transaction fee | At the “Investor” tariff – 0.1% of the transaction amount | On the “Investor PRO” tariff – 0.035% of the transaction amount, with a deposit amount of 900,000 rubles or more |

| Additional charges | If the account has less than 30,000 rubles. 300 rub./month. for access to QUIK and 200 rub./month. for access to the mobile version of QUIK, Maintaining a Depo account is free. Deposit/withdrawal of rubles - free | |

| Account maintenance cost | 0 rub./month . on the “Investor” tariff, on other tariffs, funds are debited only if there was activity on the account this month. | 299 rub./month . on the “Investor PRO” tariff, if there were no transactions in the month - free |

| Leverage | Calculated for each share, within the range of 1 to 2 – 1 to 5 | |

| Margin call | Calculated based on the risk for each security | |

| Trading terminals | My broker, QUIK, WebQUIK, mobile QUIK, MetaTrader5 | |

| Available markets for trading | Foreign exchange, stock, commodity markets, it is possible to connect US platforms (Nyse and Nasdaq) - $1/month | |

| License | TSB RF | |

| Open an account in BCS | Open an account in BCS | |

Definition

The traditional methodology for evaluating an investment project based on discounted cash flows does not imply that during its implementation management will take managerial actions in order to influence cash flows. As we already know, real options represent opportunities that management can use to change the parameters of a project in response to changing market conditions during its life.

The presence of such management capabilities certainly changes the assessment of the investment project obtained on the basis of discounted cash flow analysis. However, the evaluation of real options requires the development of an individual approach for each project, starting from the stage of formulating the model and assessing the input variables. And although obtaining an accurate estimate of their cost may not be possible due to a number of objective reasons, building such a model provides a better understanding of the risks associated with the project. Port Bronka.

Pros and cons of working with options for beginners

Let's start with the strengths of this type of trading:

- The Put and Call option is an extremely simple instrument. It is enough to understand its nature, and after a couple of weeks of work you will master all the nuances.

- Low requirements for the starting deposit .

- Possibility of flexible risk management , profit and loss . This is the most flexible financial instrument.

- Thousands of assets , even weather contracts available.

drawback - the misperception of this tool by beginners. Due to a lack of understanding of its nature at the initial stage, traders can lose all their money and even take the account balance into the negative.

Alternative assets for investment

Among the analogues I will highlight:

- ETF funds are the simplest method of portfolio investment. For example, an ETF with the ticker symbol SPY replicates the entire S&P 500 index and is rock-solid.

- Mutual funds are similar to ETFs, but with a higher commission.

- Investing in securities directly, the investment portfolio is created manually. If you are just starting to work in this direction, the article “How to invest in stocks for a beginner” will be useful.

- Working with bonds – they provide coupon income and stable profits over the long term. I recommend them primarily as a highly profitable analogue of a foreign currency deposit in a bank.

- Futures are a less flexible instrument compared to options, but this does not make them less profitable.

- Forex is a riskier type of trading compared to the stock market.

- Binary options are the maximum risk, it is difficult to make money here. This is analogous to financial betting.

- PAMM (as well as RAMM, LAMM, MAM accounts). This is earnings through trading in passive mode, a subtype of trust management.

Open an account with BCS for investing

Nobody forces you to concentrate on one direction. You can work with options and at the same time form a long-term investment portfolio, and invest some of your money in cryptocurrency.

Summary

Put and Call options can become a source of income for any trader. The external complexity of working with this tool is an illusion. Once you understand the logic behind options contracts, master the terminology, and try a couple of strategies in action, you will be surprised at how simple trading can be.

At the same time, I caution you against taking a frivolous approach to options trading. Negligence in trading can lead to financial disaster .

This concludes the introduction to working with options; I will definitely continue this topic in the future. If you have any questions, ask them in the comments. Write your wishes and comments, I promise to answer everyone.

To receive the latest information about new blog articles, I recommend subscribing to my telegram channel . This is interesting news, polls and reviews of the situation in financial markets. With this I say goodbye to you. All the best and see you soon!

If you find an error in the text, please select a piece of text and press Ctrl+Enter. Thanks for helping my blog get better!

Introduction

The option pricing model was first introduced to the public in 1973 by two scientists: Fisher Black

) and Myron

Scholes

.

It is now widely known as the Black-Scholes Option Pricing Model

. The authors proposed a mathematical model describing the financial derivatives market. The practical result of the model was the Black-Scholes formula, which made it possible to calculate the price of a European-style call option. Its appearance led to a boom in options trading, and it itself became widely used among market participants. Like any mathematical model, it has its advantages and disadvantages, which we will now try to understand.