Those who are just getting acquainted with binary options from the Binomo broker will benefit from a promising and effective strategy for making a profit. It was created by experienced traders who have been engaged in such activities not only on Binomo, but with many other brokers for a long time.

profitable trading can be carried out while minimizing losses and risks of deposits. The basis of this strategy is indicator technical analysis, according to which 92% of operations are profitable.

This simplified step-by-step instruction is suitable not only for pros, but also for beginners. To create a strategy, standard technical indicators are used from the available stock of the Binomo trading broker, which makes it possible to simplify activities in the first stages of trading.

Go to the official Binomo website

Cubic RSI

Trading short-term options is a quick way to make big money. But at the same time, this method of trading is one of the most capricious in the financial market. To make money, you need to choose trading strategies on Binomo that will show the most accurate signals for opening transactions. If a trader starts playing the market at random, he will quickly lose all his money.

The Cubic RSI trading system is a simple and profitable strategy. Its main working tool is the leading RSI indicator.

Be sure to read our review of Binomo.

Higher levels

At higher levels, traders are able to adapt technical analysis to binary options trading and apply fundamental analysis. To do this, they learn from videos and books:

- Dow theory,

- Japanese “candles” (there are different models of such “candles”),

- become thoroughly familiar with the concepts of “support and resistance”, “moving averages”, “trend lines”, “pivot point”, “Fibonacci levels”, “harmonious patterns”, “Gann swings”, “Elliott waves”, etc.

That is, a trader must comprehend two types of “art”:

- technical analysis – graphical forecasting, in which the chart itself becomes a source of significant information,

- fundamental analysis is a scientific forecast based on economic data.

But the knowledge listed above is also not the limit of training for a BO trader. You need to master (and not just from YouTube videos) news trading, banking currency analytics, and understand currency correlations and indices.

However, right away, already in the first stages of training, it is important to understand that the evolution of a trader does not come down to learning the basics, moving on to a successful strategy and honing it in practice. The listed types of analysis (and with them also indicator and non-indicator, volumetric, statistical, complex, etc.) are needed precisely in order not to rely on some mythical “unconditionally successful” strategy, but to learn how to work with a “live” market, where there is a stable Only one own individual trading system will work, based on in-depth knowledge of the subject and honed skills.

The essence of the strategy

To understand how to make money on Binomo using Cubic RSI, you need to understand the principle of its operation. RSI or relative strength index is an oscillator that was created by one of the world's most successful traders, W. Wilder. The mechanism of operation of the indicator is an algorithm that determines the speed and amplitude of changes in price movement. In simple terms, the trader will be able to see the force with which prices change.

In the Cubic RSI system, 3 variants of this indicator are used for options trading, which need to be configured according to the specified parameters. This trading method helps to determine the moments of trend reversal in the market and open a deal at the stage of the emergence of a new price movement.

Below, using the example of the Binomo brokerage company terminal, we will consider an example of using the Cubic RSI trading system.

Login to Binomo

Average level

At the next level of trader training, learning to trade binary options involves becoming familiar with and taking into account the main factors influencing the success of trading. At first glance, everything is simple: you select an asset, expiration time, bet size and expected direction of the trend. If a trader predicted growth (or fall) and this forecast came true after the time specified by the trader, then the trader receives a fixed and expected percentage of winnings. If the forecast does not come true, he loses the bet. But when is the best time to bet, for what time to make a forecast and what should be taken into account when forecasting?

What to predict?

There are several types of forecasts available:

forecast of the direction of price movement, which illustrates the relationship between the price position at the time of purchase and its position at the time of closing the transaction (at the expiration time, which the trader chooses independently).

Call/Put options (up/down) –- One Touch\No options are a forecast of a price reaching or not reaching a certain level. If before the specified point in time the price was able to reach the predicted limit, the trader makes money, and how the price behaves further is no longer important.

- In\Out options – forecast of price retention (or non-retention) in a given corridor.

Since any type of forecast requires the same knowledge, each trader decides for himself which types of forecast he is typologically more comfortable making.

Trading time

Despite the 24-hour availability of BO on weekdays, there are times of exchange rate activity. Currency activity correlates with real exchange activity, and it occurs at the intersection of sessions of the world's leading exchanges. So the intersection of sessions:

- Tokyo and London stock exchanges are from 11 a.m. to 12 p.m. Moscow time.

- London and New York - from 16 to 19 hours Moscow time.

- Sydney and Tokyo - from 3 to 9 am.

The experience of attentive traders shows that maximum trading activity occurs during the European session and at 16:30, after the publication of significant economic indicators in the United States.

Key indicators that always influence the exchange rate include, for example, data on the number of employees in the non-agricultural sector NFP - Nonfarm payrolls, updated on the first Friday of each month. As this indicator rises, the dollar rises. When it decreases, the rate falls.

When choosing days of the week for trading, experienced traders advise the period from the second half of Monday to Wednesday inclusive. And Friday in the range of intersection of American and European trading hours - from 16 to 19 (Moscow time).

Expiration time

The time of completion of the transaction is expiration - the period for which the forecast is made. This time should not be confused with the time interval on the real price chart (time frame).

- Expiration time of 60 seconds is too unpredictable. They play on such short expirations, testing their luck, and not their ability to make a conscious forecast. For this expiration, the live chart timeframe is set to 1 minute.

- 10-15 minute expiration. Fluctuations remain quite unpredictable with possible price reversals. The timeframe for analysis is set to 5 minutes.

- 30 minutes for conscious trading is considered the optimal expiration. Such a period requires taking into account economic news and analyzing the time frame at 5-15 minutes and at the hour.

Already at an intermediate level, it is important to have a detailed familiarity with technical analysis, which makes it possible to read and understand charts.

How to use the RSI oscillator

The principle of operation of the indicator can be seen in a separate window under the quote chart. Externally it looks like a curved line – a smoothed moving average. It has 2 scales with values of 0 and 100 (horizontal edges of the window).

The oscillator formula is as follows – RSI=100-100/(1+RS), where RS is the average increase or decrease. The closer the average line comes to the scale with an indicator of 100, the weaker the price rises on the market, and vice versa, the closer it is to level 0, the slower it decreases.

The levels to look out for when trading options are 70 and 30 or 80 and 20. If the oscillator line reaches the 70 level, then this means that the market is overbought. At such moments, a reversal and price fall most often occur. And, conversely, when it reaches level 30 - the market is oversold - the price turns in the other direction - it rises.

Section 4. Indicators

As we have already said, there are practically no strategies in binary options that do not require the use of indicators for technical analysis. There are a very large number of them. However, there is no need to be afraid of this.

For beginners, we can advise you to first get acquainted with several of the most popular indicators. They are:

- Bollinger Bands;

- Moving average;

- Stochastic;

- MACD;

- RSI.

Remember a simple thing: you do not need to understand the algorithm of a specific indicator. Its operation is carried out automatically. All attention should be paid to the meaning of the information received and those trading signals that allow traders to open trading positions.

How the system works

Now let's take a closer look at this strategy. First, a template is set up on the chart. Proceed as follows:

- The chart timeframe switches to minute – M1.

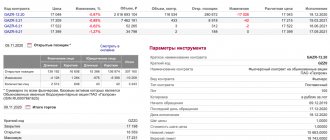

- From the list of indicators in the Binomo trading platform, the RSI oscillator is installed three times with periods of 5, 14 and 21. The scale level is 20 and 80.

If everything was done correctly, the graph will look like this:

Why do you need to install 3 indicators in your strategy for trading binary options in Binomo? Very simply, one oscillator cannot give accurate signals. In financial markets there are always so-called noises - short-term moments in which the price moves unpredictably. Looking at these movements, it is impossible to see any pattern or compliance with the rules. Using 3 indicators for options trading in Binomo allows you to make the strategy almost win-win, since false signals are discarded.

Section 2. General trading rules

Learning to trade binary options involves becoming familiar with several important principles. If an investor does not follow these recommendations, then the likelihood that he will achieve success is extremely low.

- Apply risk management in trading. The size of each bet should not exceed 2–5% of the amount in the client account.

- High-risk trading methods should not be used. A striking example of this approach is the use of the Martingale technique.

- Remember, binary options are not a casino where you need to rely on luck and chance. To get a stable income, you should devote enough time to training. Both theory and practice.

- Before implementing any strategy in practice, you need to work it out in a demo account on the platform of the selected broker.

- Keeping a trader's diary helps you achieve success. For a beginner, it is an extremely useful tool. Without its use, the learning process can take a long time. In such a diary, the trader should record data on each of the completed transactions. Their subsequent analysis will help identify imperfections and weaknesses in the trading strategy used.

Additional terms

When the indicator lines move into the overbought or oversold zone, the probability of a trend reversal is extremely high. Moreover, the beginning of a change in price direction is considered to be the moment at which the oscillator lines cross back the level of 80 or 20, that is, they return to the range between the two levels. The signal is further confirmed if a candle appears on the quote chart confirming the reversal (when buying an Up option it is green, Down option is red).

It is not recommended to trade using this strategy in Binomo if the trend is in a sideways channel or important news is expected to be released. At this time, no indicator can give a correct forecast.

You need to open a trade when each of the RSI indicators confirms a market reversal. In this case, the probability of concluding a profitable transaction is 87%.

Expiration and money management

To trade the Cubic RSI system on Binomo, a minute timeframe is used, so the expiration period is chosen to be 5 minutes, as it is the most optimal. But you can trade it on a second timeframe, then the expiration date is set to 1-2 minutes.

The transaction amount should not exceed 3% of the deposit volume, that is, you must follow the rules of money management so as not to lose your money. If the balance on the trading account is minimal, then the smallest lot size is selected. On the Binomo options broker website, the smallest lot is 1 USD.

To protect yourself from rashly opening many short-term transactions, you need to activate the single-threaded trading function on the official Binomo website in your personal account. It will not allow you to open a new trade until the previous one is completed, so you can protect your trading account.

Go to the official Binomo website

Money management when trading on Binomo

When answering the question of how to trade on Binomo correctly, one cannot fail to mention one very important point that many novice traders overlook. This is capital management, or money management, risk management. A successful trader is not one who can make effective forecasts (this is just a good analyst), but one who knows how to competently manage and manage his trading capital.

Money management teaches traders to correctly distribute their trading deposit when trading. This significantly reduces the risk of losing your money even during bad periods, when most of the forecasts do not come true. Money management is a whole science. However, in the context of options trading, it is worth noting the main rule, which strictly prohibits using more than 5% of the current account balance in one trading operation. The recommended investment amount is 1% or less.