Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

+7 (499) 938-81-90 (Moscow)

+7 (812) 467-32-77 (Saint Petersburg)

8 (800) 301-79-36 (Regions)

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

In the modern economic world, various types of available lending coexist. One of them is a bonded loan, which, when conducting a professional comparison, is many times more effective and profitable than other types.

In this article, we will consider what this type of borrowing is, who can act as each party, we will determine the main differences from loans from financial institutions, as well as the main pros and cons from the point of view of the source of financing.

Features of a bond loan

The essence of a bond issue is to attract investors. This is done by issuing bonds, which are then purchased by investors - thereby the company receives new cash injections. Selling securities to an investor means that the money he spent on the purchase will be returned within the agreed period. In the future, the buyer of bonds receives back either his money or valuable property for a similar amount.

In order for a bonded loan to materialize, the presence of three parties is necessary:

- The issuer, that is, the company that will provide the issue of securities.

- An investor who is ready to purchase bonds.

- An underwriter is a person whose signature can increase the value of the issued securities and make them as attractive as possible for investors. Banks can act as underwriters, and insurance companies are a kind of guarantors. It is understood that if problems arise with the issuer, they will undertake to reimburse investors for financial losses.

Government bond loan

The governments of many countries, as well as private organizations, need an influx of financial resources. This is mainly due to the implementation of any investment projects that are attractive from a financial point of view.

In the Russian Federation, existing federal bonded loans have the status of state borrowing.

In addition to the implementation of large government projects, funds from government bonded loans can be raised for the following purposes:

| To replenish the state budget | in case of stagnation or temporary shortage of budget funds, the Government may resort to medium-term and long-term loans in order to be able to stabilize the financial situation and reach the level of budget surplus |

| Refinancing | sometimes, in the absence of the necessary amount of cash to fulfill its financial obligations on other securities, it may be necessary to raise capital from private investors |

Municipal type

Municipal bond issues represent the issue of securities by individual representative offices of the country (regions, regions, municipalities, districts, etc.). A distinctive feature is the mandatory repayment guarantee.

In the Russian Federation, when issuing municipal bonds, such a guarantee is municipal property.

That is, in the event of its financial insolvency and inability to repay issued and sold bonds, the municipality will have to put up individual real estate objects for auction to pay off debts.

The goals that municipalities pursue when issuing bonds are the same as in the case of government bonds, only on a smaller scale. Therefore, the profitability from them is almost on the same level as government ones.

An important feature of a municipal loan in the Russian Federation is that the investor’s coupon income on such securities is not taxed.

Commercial

Commercial loans are one of the instruments for financing legal entities. Naturally, small and medium-sized businesses do not issue bonds to attract investors' funds, for which the preparation of a bond issue and subsequent loan servicing will become an unbearable financial burden. Bond loans are affordable only for large companies and corporations.

The main purposes of using such borrowing are:

- replenishment of working capital deficit;

- financing an attractive investment project;

- carrying out modernization;

- refinancing existing debt;

- development of a new direction of activity.

It is important to understand that in most cases, the use of a bonded loan is much more profitable for companies than the use of credit funds.

The bank's interest rate is fixed and non-negotiable, and when issuing bonds, a legal entity has the opportunity to independently set the amount of remuneration for investors.

Where it is possible to get an urgent loan without collateral, read the article: loan without collateral in 2020. How to correctly fill out a notice of unilateral termination of a loan agreement, read here.

Domestic

Domestic bond issues are all bonds issued in the territory of one state, regardless of their form, type of issuer, etc.

Bonds issued for domestic use invite domestic investors to invest their capital in Russian enterprises, municipalities or financial support from the state itself.

External

External bond loans, so-called Eurobonds or Eurobonds, are the issue of securities in foreign currencies aimed at the international financial market.

They have the goal of attracting foreign capital for the implementation of investment projects on a national scale (for example, the construction of international pipelines, etc.).

Eurobonds can be issued in any currency (euro, dollar, yen, yuan, pound, franc, etc.). The prefix “euro” only indicates the international nature of such a financial instrument.

An external bond loan is a form of international lending and, depending on the purpose of use, can be:

| Export | The main purpose of receiving funds from foreign investors is the purchase of certain products |

| Foreign exchange | used to settle the balance of payments in the country |

| Financial | effective when there is an urgent need for funds in the state for the purchase of goods or construction of real estate |

Difference from loan

In fact, a regular loan and a bond loan have many differences:

- When registering a bonded loan, there is no need to provide collateral.

- The loan term is longer than with conventional lending.

- The interest rate is not set by the lender, as in any other loan product, but by the issuer himself.

- In most cases, several investors are attracted at the same time, this greatly reduces the importance of each of them individually.

- Through a private subscription, the issuer has the right to issue small amounts of bond issues. This step helps to select local investors operating in the same region.

- A bond loan is an excellent chance to raise serious funds with minimal risks. Investors, despite having the company's securities, cannot participate in its management and, moreover, dictate their own rules.

This type of loans has gained enormous popularity in Russia. This is due to a large number of advantages specifically for the issuer (the company that issues securities).

Advantages and disadvantages

The advantages of such loans include:

- The management of the Central Bank cannot interfere with the financial and economic activities of the issuing company.

- The issuer independently sets all the parameters of the loan: the number of bonds issued, their cost, interest rate, credit period, repayment, etc.

- A bond loan balances the level of yield of bonds for investors and the costs borne by the issuing company.

- Also, a bond loan allows you to achieve the best system of mutual settlements and structure of the issuer's debt.

- Impressive amounts of funds are attracted to the company for a long period.

- The loan gives the right to use the preferential tax system.

- The credit history of a bond loan becomes public, thereby increasing the credit rating of the issuing company.

There are also disadvantages:

- The main disadvantage is the presence of risks for the issuer itself, since there is always a possibility that the costs will exceed the benefits received.

- Difficulties with the emission itself. In order to issue and sell its securities, the issuer must have an organizer, access to the trading platform, and an agreement with investors. In addition, the development of many related documents is required.

- The long period of time required to issue the required number of bonds. Moreover, the issuer itself will not be able to speed up this process, since this is the responsibility of the organizer.

Important! Bond loans are used only by large companies, authorities at various levels and the state itself.

What are the benefits for the issuer

From the point of view of financial analysts, they have a number of competitive advantages not only for investors, but also for the issuer itself.

Let's define the main ones:

| No risk of outside interference in the process of enterprise management or its activities | the purchase of bonds guarantees the investor the right to return the invested funds and receive a certain reward in cash or in kind. But this does not give any rights to interfere in internal management. |

| Ability to independently determine parameters | in all other borrowing options, the client “plays on someone else’s field,” that is, the terms of the transaction are dictated by the lender. In the case of bonds, the issuer independently determines the main terms of the contract (interest rate, number of securities to be issued, maturity date, etc.) |

| The optimal combination of the degree of profitability for investors and the issuer’s costs for issue and maintenance | There are certain statistics showing that the feasibility of issuing bonds is present in the case of a total amount of 200-300 million rubles. If the state or enterprise has the required annual profit (about 2.5 billion rubles), then the efficiency of the bond issue will tend to 100%. |

| Possibility of financial accumulation of funds received from the sale of bonds | Due to the duration of loans (except for term bonds), the issuing enterprise has a good opportunity to “save” a sufficient amount of money on favorable terms for a fairly long period |

Read about the Russian Loan company in the article: Russian Loan in 2020. How to conclude a targeted loan agreement between individuals, read here.

Is it possible to secure a loan with maternity capital in 2021? Read here.

Bond loans are a mutually beneficial financial instrument that has certain advantages for both investors and the issuer-borrower itself.

Types of bonds

There are several classifications of this type of loans.

Types of securities by maturity:

- Term loans are issued for short periods of time, not exceeding 1 year.

- Medium-term loans with a maturity of 1-5 years are called coupons. If the period increases to 10 years, then these are already uncertificated coupon papers. They provide for payments every six months. Registration of a medium-term bond loan is most popular among portfolio mutual investment funds. The Ministry of Finance of the Russian Federation is responsible for issuing medium-term bonds.

- Long-term. The issue period is 20-30 years and the issuer in such cases is usually the state itself. Because of this, bonds are considered the most reliable of all.

Important! Early bonds are considered reliable in the United States, since the guarantor in this case is the state itself. Such bonds are called bonds.

Types of securities by purpose:

- Commercial. Such bonds can be issued by any legal entity that urgently needs to solve financial problems. The circulation period of such bonds is from 1 year. Repayment of debt on bonds can be carried out not necessarily with money, but with some valuable property.

- Domestic bonds. Their emission occurs strictly according to international standards. They are not available for free sale; they are only in circulation between organizations and clients of Vnesheconombank. Such securities are also good because they can improve the company’s reputation, and at the same time its credit history.

Types of bonds by issuer:

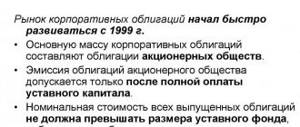

- Corporate are the most profitable types; they can quickly expand the capabilities of the issuing company.

- Municipal. Based on the name, it is easy to understand that the local government acts as the issuer. The security for such bonds is municipal property.

- State. These securities are commonly called government bonds; they are widely used to replenish the country's budget. The period for their implementation is always strictly limited; profitability is accrued on them. Not every state has the ability to issue such bonds. For example, countries that do not have a stable economy cannot do this.

- Federal. The issuer is the Ministry of Finance of the Russian Federation. Some bonds of this type provide depreciation and return in the form of interest.

- External. The issuer here is the same Ministry of Finance, such bonds have been issued only since 2013, their total volume today is $1.5 billion. One bond has a face value of $20,000. Such bonds can be held by individuals and legal entities.

Negative points

With all its undeniable advantages, there is also a downside. Let us define some negative aspects of this type of borrowing:

| Increased complexity of the procedure | in addition to strict adherence to Russian legislation, the issuer is required to conclude and sign many agreements with the obligatory participants of the bond issue (depository, issue organizers, representatives of the stock exchange for the subsequent sale of bonds, etc.) |

| Inability to plan time costs | In reality, the hired organizer is responsible for issuing securities and introducing them to the country's stock market. As a result, the borrower-issuer does not have the opportunity to influence the course of this process |

| Financial expenses | If we consider the costs of issuing securities in relation to a bank loan, then the latter clearly benefit. When applying for a loan, the client’s costs are determined only by the amount of interest required to be paid. The issue of bonds will require additional expenses in the amount of 2-3% of the total value of securities |

Cost of a bond loan

It is in the cost of the loan that there is another significant difference from a conventional loan. The specifics of the cost include:

- It is rare for a company to place its bonds on the open market. This involves some formalities and the possibility of losses.

- If the issuer does not have sufficient ability to ensure the protection of its rights in the event of difficulties with investors, then various unpleasant accidents may arise. Because this risk is always present, the issuer is forced to increase interest rates.

- There are always costs for intermediaries, which are inevitable when issuing and placing bonds.

Issuing bonds is a way to raise money

Any company moves to a stage of its development at which credit funds are required for further development. Management must choose the most appropriate way to attract creditors, weighing the pros and cons of all existing ways to achieve this goal.

Issuing bonds is one of the most promising options because:

- the borrower can receive an impressive amount of money to implement a large-scale investment project without the risk of other investors intruding into issues related to the management of the company;

- the borrower gets the opportunity to accumulate enough money received from a number of private investors and legal entities in order to use it on favorable terms in the financial market.

Source of financing

Abroad, this type of financing is extremely popular today. More than 50% of private investment comes from bond issues. The parties clearly know their direct responsibilities, despite the lack of clear rules for issuing and conducting such loans. Bonds as a source of financing for companies have the following positive aspects:

- When bonds are issued, access to large financial injections is automatically opened. No bank will give you that kind of money in the form of a loan.

- With the help of bonds, it becomes possible to attract funds from a vast economic sector.

- If the bonds do not have too high a value, this will attract not too large creditors.

- The issuer itself regulates the repayment terms of such loans.

- There is a unique opportunity to reduce the tax base by increasing the cost of goods. In many countries, all costs of such loans are included in the cost price and thereby increase it.

- Bonds are always cheaper to issue than shares. In addition, shareholders get a say in the management of the organization, but bondholders do not.

- For investors, this is also a very attractive deal; for them there are minimal risks.

Placement and purchase

Bond issues are placed on the primary market, where securities are sold.

If securities are sold, they may be traded on the secondary market. The sale of bonds on the secondary market explains the main advantage of such securities - their liquidity.

In accordance with the current legislation of the Russian Federation, the initial placement of bond issues can last from three months to one year.

No more than a year should pass after the bond is registered with the Federal Financial Markets Service. In practice, the initial placement of a security is carried out within a few days.

In order to buy a bond, you need to thoroughly understand the stock trading process.

The main volume of bonds is available on the Moscow Currency Exchange. To purchase a bond, you must register a brokerage account with access to the stock exchange.

Terms of bond loans

It is important to know the period during which the bonds will circulate on the securities market. In particular, the Russian market implies two such terms:

- Official, which is provided for in the terms of the bond issue.

- Application period taking into account the offer. With the help of the offer, companies can issue medium-term bonds while minimizing debt refinancing costs. Investors also benefit from the offer, since they provide good rates and at the same time low risks.

Release

The issue of a bonded loan makes it possible to best satisfy the medium- and long-term development plans of the enterprise and opens up new opportunities to attract financial resources on favorable terms.

This is due to increased recognition of the corporation and, as a result, attracting interest from investors.

The condition for issuing a bond issue is a special provision in the agreement on the issue of a security. There are positive and negative release conditions.

A positive condition requires certain actions, a negative condition limits them. The share of a bond issued in separate issues is called a tranche.

Interest rate

The following types of interest rates are distinguished:

- Variable, which is preferable for Russia, since it implies binding to a specific instrument. Another thing is that in Russia there are no such tools. Because of this, each issuer chooses the type of interest rate at its own discretion.

- Fixed - it is attractive to investors. With such a rate, they can make forecasts for their future income, while at the same time macroeconomic risks are reduced. In addition, fixed rate bonds have a much more active turnover, which is associated with their increased liquidity.