Lazy Investor Blog > Stock Exchange

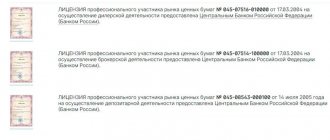

Despite the fact that Gazprombank is one of the largest systemically important banks in Russia, its importance as a stock broker is very small. Thus, the number of its active clients is less than 4 thousand people, and the turnover on the stock market in February 2021 amounted to 17 billion rubles. There must be good reasons for such modest figures. In this traditional review of the Gazprombank broker, we’ll try to figure out what’s wrong.

Markets

Gazprombank broker provides access to the markets of the Moscow Exchange, the London Stock Exchange (LSE), as well as a wide range of foreign stock and ETF markets. Foreign markets are available only to qualified investors. Taking into account the fact that the broker does not work with the instruments of the St. Petersburg Exchange, unqualified investors are deprived of access to foreign securities. For trading on all markets, the QUIK trading terminal is used, as well as mobile applications PocketQUIK, iQUIK, connected to the GBP-i-Trade information and trading system. To carry out any trading operations, you must open a personal account in rubles (by default) or in dollars (for access to foreign markets). Before this, depositary accounts of the trading section for the Moscow Exchange and the LSE brokerage section for the London Stock Exchange must be opened, respectively.

Settlements on the LSE are carried out in dollars, which requires opening a dollar personal account. The procedure for preparing to trade on the foreign exchange market is even more complicated. Available currencies: dollar, euro, franc, pound and yuan. For conversion between currencies, appropriate personal accounts are opened. When opening an account, you must provide a passport and a notarized copy of the certificate of registration with the local tax authority. There is no minimum deposit amount specified in any of the markets. Traditionally, an investor can open an individual investment account (IIA) for trading to receive a tax deduction.

I also recommend reading:

How to distinguish between value stocks and growth stocks

Value Stocks vs. Growth Stocks: Which is Better?

Software and mobile trading

After registering as a trader and opening a trading account, the broker offers to download a program for operation. It is represented by the Quik trading platform. On the website you can download one of two versions:

- for a computer or laptop;

- for a mobile device.

These versions have full functionality, incl. access to viewing stock quotes and the ability to conclude transactions.

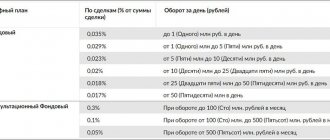

GPB tariffs

Stock market of the Moscow Exchange

| Tariff name | Trade turnover per day, rubles | Commission, % |

| Standard | up to 1000 000 | 0,085 |

| from 1000 000 to 5000 000 | 0,03 | |

| from 5,000,000 to 15,000,000 | 0,025 | |

| from 15,000,000 to 30,000,000 | 0,017 | |

| from 30,000,000 to 60,000,000 | 0,011 | |

| from 60,000,000 | 0,008 | |

| Investment ideas | up to 1000 000 | 0,17 |

| from 1000 000 to 5000 000 | 0,17 | |

| from 5,000,000 to 15,000,000 | 0,1 | |

| from 15,000,000 to 30,000,000 | 0,05 | |

| from 30,000,000 to 60,000,000 | 0,0275 | |

| from 60,000,000 | 0,02 | |

| Premium | up to 1000 000 | 0,2 |

| from 1000 000 to 5000 000 | 0,2 | |

| from 5,000,000 to 15,000,000 | 0,12 | |

| from 15,000,000 to 30,000,000 | 0,06 | |

| from 30,000,000 to 60,000,000 | 0,035 | |

| from 60,000,000 | 0,025 |

Foreign stock markets and ETFs

| Tariff name | Transaction amount, rubles | Commission, % |

| Standard | up to 10,000,000 | 0.17, but not less than 5000 rub. |

| from 10,000,000 | 0,09 | |

| Investment ideas | up to 10,000,000 | 0.2, but not less than 5000 rub. |

| from 10,000,000 | 0,12 | |

| Premium | up to 10,000,000 | 0.15, but not less than 5000 rub. |

| from 10,000,000 | 0,15 |

Trading of depositary receipts ADR and GDR on the London Stock Exchange is charged at a flat rate of 0.05% of the transaction amount, but not less than $50, which is equivalent to $100 thousand for 1 transaction.

Investing in open-end mutual funds

The management company Gazprombank - Asset Management offers investing in mutual funds. Among the 9 currently available offers, not all funds have attractive returns. The leader for the last 5 years - Open Investment Fund "Gazprombank-Shares" has an average annual return of more than 16%. At the same time, investment conditions are less attractive than those of a number of competitors’ offers on the market:

- the minimum down payment amount is 50 thousand rubles (later from 1000 rubles);

- discount on redemption 1% if the holding period was from 182 to 1096 days;

- management company remuneration 2% of the average annual value of net assets.

I also recommend reading:

What is premarket and postmarket on the stock exchange?

Premarket: be in time before others

However, it must be taken into account that when holding shares for more than 3 years, the investor is entitled to tax benefits for long-term ownership of the asset. Along with mutual funds, the management company offers trust capital management services. The recommended minimum for investment is 15 million rubles.

Opening an account

Although Gazprombank is one of the largest banks in Russia, among brokers for Individual Investment Accounts (IIA), the credit institution is not among the leaders.

One of the reasons for this situation is the difficulty of opening an individual investment account.

A personal visit to a bank branch to draw up an agreement is mandatory for all investors, regardless of whether they are already clients of a credit institution or not. Compared to other professional market participants who open IIS online to everyone, Gazprombank is clearly losing.

To formalize an agreement to open and maintain an individual investment account, the future investor submits:

- Application for brokerage services in the established form

- Powers of attorney for authorized persons, if any. Powers of attorney are signed under the supervision of a bank employee or certified by a notary.

- Documents and information within the framework of the survey to identify the client, his beneficiaries, beneficiaries.

Russian citizens prove their identity with the following documents:

- a Russian passport or a document replacing a passport;

- TIN;

- SNILS.

If a Russian citizen permanently resides abroad, you must submit a foreign passport with information about permanent residence or another document indicating permanent registration abroad.

Foreigners and stateless persons provide:

- national passport or other identification document;

- migration card;

- temporary residence permit or residence permit, or visa.

After receiving the package of documents, a Gazprombank employee will mark the application with the number of the personal account opened for the client and the registration code. The second copy of the application is returned to the investor with marks. The agreement comes into force after registration of the application.

Analytics

Gazprombank's analytics are quite unique. It is presented in the form of a model portfolio consisting of short-term transactions in securities and derivatives, as well as promising assets. A significant portion of the portfolio consists of cash. The main rule is that no asset should be more than 20% of the portfolio value. All trades are clearly supported by technical analysis and fundamental data. This approach is useful for developing inexperienced investors a “sense” for smart deals.

Agreement conditions

The agreement is drawn up in the form of accession to the Conditions for the provision of brokerage services by GPB (JSC) Bank with the opening and maintenance of an individual investment account.

As part of the agreement, Gazprombank opens an IIS and a personal account (l/s), registers the participant on the Moscow Exchange (in the stock section). To store securities, the user opens depo accounts: trading and brokerage. The procedure for service in the depository is regulated by a separate agreement.

The IIS reflects information about the investor’s transactions:

- by bank account;

- on trading and brokerage depot accounts.

Only funds can be credited to an investment account, except in cases of transfer of an individual investment account from another professional participant. Upon termination of an agreement with another broker or manager, assets are transferred to Gazprombank in compliance with the following requirements:

- providing information from the previous broker or trustee about the investment account being transferred;

- compliance of the amount of money, quantity and type of securities received from another professional participant with the data specified in the information.

Property from IIS is transferred within a month. The client has 35 days to provide information from the professional participant.

The client indicates information about the absence of other individual investment accounts or the presence of an investment account in the application for accession. The previous contract must be terminated within a month. To maintain the right to tax deductions, the client should not have more than one account at the same time, except in cases of transfer of assets from one IIS to another.

The personal account for accounting money is in rubles.

The account holder can enter into transactions under the agreement in the trading system of the main (stock) platform of the Moscow Exchange (MB) and on the over-the-counter market. Orders for the purchase and sale of securities on the International Bank are carried out from a trading depot account, and outside the exchange - from a brokerage account.

An investor can give orders for transactions:

- by providing paper orders;

- via a dedicated telephone line;

- through the GPB-I-Trade system;

- through the Broker-Client system.

Paper orders are sent to the broker by registered mail or courier.

To identify an investor during telephone messages, a code word or Token is used. Telephone orders must be confirmed by transmission of paper orders within a month. The client can block the submission of voice orders. The use of trading platforms in the interaction between the broker and the investor is governed by separate agreements.

When submitting orders for the purchase and sale of securities on the over-the-counter market, automated electronic systems are not used. Contact a broker by phone or on paper. If Gazprombank acts on behalf of the client in these transactions, its authority must be confirmed by a notarized power of attorney.

Money is transferred to personal accounts by bank transfer from client accounts opened with Gazprombank or other credit institutions. The total amount of funds credited during the calendar year should not exceed the amount established by law - 1 million rubles.

Money from the sale of securities and income from financial instruments are credited to the IIS. The agreement does not provide for the receipt of dividends and coupon interest on bonds to other accounts (bank, brokerage).

However, the conditions stipulate that when funds are sent to another account, Gazprombank is not responsible to the client for the loss of the right to deduct. Money from third parties is not credited to IIS. They are returned to the sender in full.

You can withdraw money from l/s or securities from deposit accounts only with the simultaneous completion of the agreement. Funds are transferred to the investor’s bank account or to an IIS from another professional participant. Transfers to other persons are not made. If an investment account is closed before three years, the right to personal income tax benefits is lost.

Reviews about Gazprombank Broker

There are practically no reviews of Gazprombank’s brokerage services online. This may be due to the lack of access for unqualified investors not only to foreign markets, but also to the St. Petersburg Stock Exchange. Thus, the set of assets is limited only to Russian securities and, as a broker, the bank has nothing to interest an unqualified investor. In addition, the information on the site is extremely poorly structured. Investors note that there are many nuances in the GPB regulations that are not spelled out in the documents, and which they do not learn about immediately, but only in the process of work.

Here we are talking about the fact that IIS must have at least 400 thousand rubles in order to be able to make transactions. In this case, the transaction amount does not matter.

There are complaints about organizational and technical inconsistencies.

As for trading conditions, judging by the reviews, the main problem is high tariffs. Gazprombank is clearly in no hurry to increase the number of investor clients, since it considers purely banking services to be its main focus.

However, there are clients for whom the size of the assets and the reliability of the GPB outweigh the limitations and disadvantages.

I also recommend reading:

What does the P/B multiple say about the company's value?

P/B multiple is another way to look for undervalued companies

Pros and cons of the company

Each brokerage company offers clients its own list of services, service rates and additional features. All these indicators affect the level of convenience in the work of traders. To determine whether it is worth opening a brokerage account with Gazprombank, you should study the advantages and disadvantages of cooperation.

Among the first are:

- Availability of our own structural products.

- Posting analytical materials and the opportunity to use the help of professional consultants.

- Downloading mobile and desktop versions of the trading platform. This maximizes the range of users and increases mobility.

- Gain access to multiple trading platforms and a wide selection of trading tools.

There are also several disadvantages:

- The broker focuses on corporate clients and traders with large volumes of trading transactions.

- No demo account. Such conditions are not suitable for beginners. In addition, to practice new strategies, you need to look for a demo account on the side.

- One active technical support channel.

- No seminars or training. Thus, you need to start trading with a broker with an already good knowledge base.