Stimulating investment activity is one of the most important tasks of the state. State investment policy includes multifaceted activities of government bodies related to the development and implementation of measures in the field of stimulating investment activity.

Investment public policy can be implemented at the following levels of government:

- federal;

- regional;

- local.

State investment policy

The essence of the state's investment policy is to create favorable conditions for investment activity. The investment policy of the state in a crisis becomes of great importance, since it is during a crisis that the influx of investments is reduced, and the need for them increases significantly.

In general, the components of such a policy are:

- public investment;

- government regulation.

The main directions of state investment policy include:

- systematic improvement of the regulatory framework;

- creation of a system of guarantees and benefits for priority projects;

- formation of institutions for promoting investment activity;

- creation of a system for coordinating subjects of investment activity;

- development of investment cooperation;

- determination of criteria for selecting investment projects;

- improvement of the general political situation.

The state's investment policy and its directions must be revised, as the situation in the economy is changing and it is necessary to set priorities correctly.

The state investment policy and its objectives are closely interconnected with other types of policies:

- innovative;

- tax;

- foreign economic, etc.

The investment policy of the state in modern conditions should be aimed at:

- to formulate a country development plan;

- to assess the need for investment in each sector of the economy;

- to choose the most effective ways of economic development of the country, etc.

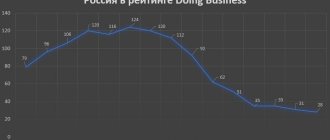

The main directions of the investment policy of the Russian state in accordance with international standards should be aimed at:

- maintaining socio-political stability;

- stimulating economic growth;

- increasing the level of openness of the economy;

- formation of a developed industrial and social infrastructure;

- enhancing a competitive banking system;

- training of qualified labor, etc.

Advice! Before making investments, it is necessary to familiarize yourself not only with the socio-economic indicators of the country or region, but also with the assessment of the investment climate by specialized rating agencies.

Regional Development Fund and Regional Investment Fund

Financial assistance to regions from the federal treasury is allocated through the following structures:

- Regional Development Fund, the purpose of which is to consolidate funds dispersed across many disparate federal and local investment programs. Subsequently, social infrastructure facilities are subsidized with this money. The Regional Development Fund is created at the expense of the federal treasury.

- The investment fund of a constituent entity of the Russian Federation (regional investment fund) operates on a PPP basis and is intended, first of all, to support transport, energy, construction and other capital-intensive sectors of the economy.

Cash receipts from these sources are provided within the framework of the national investment policy.

Register of participants in regional investment projects

A regional investment project is an investment project with the following characteristics:

- The goal of the project is commercial production. Services cannot be the subject of a regional investment project.

- The planned work is being carried out on the territory under the jurisdiction of the constituent entity of the Russian Federation.

- There are no restrictions on the type of project activity.

- Property objects on used lands belong to an authorized person.

- The project owner invests at least 50 million rubles.

- Each object is maintained by one participant.

In order for an organization to receive regional investments, it must be included in the appropriate register of participants in regional investment projects - a special list that includes the following:

- information about the organization (full name, IIN, checkpoint, address);

- details of the legal act on the inclusion of the organization in the register;

- information about the investment project (name, purpose, amount of funds required with directions of financing, amount of costs, deadlines, etc.).

The tax services are responsible for maintaining the register. Organizations are included in the list based on a decision of the authorized body of a constituent entity of the Russian Federation.

Investment Policy Models

There are the following models of investment public policy:

- tax incentives for investment activities;

- public private partnership;

- mixed model based on public-private partnership in coordinating investment decisions.

Tax incentives

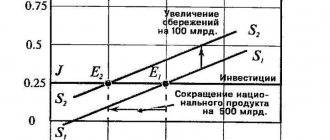

This model assumes that investment stimulation must be carried out through the regulation of tax instruments. For the successful functioning of this model, an important factor is the development of the stock market.

The distribution of investments is carried out through the stock exchange. The disadvantages of the model are the lack of incentives for active savings, as well as the inability to quickly increase savings.

Public private partnership

This model involves active interaction between the state and private investors. The state accumulates the population's funds in banks and provides them to companies in exchange for their fulfillment of certain obligations.

Under this model, investments in infrastructure are made based on the need for each facility to belong to a specific private structure. To implement this model, a strong private sector and a state with an effective management apparatus are required.

The advantage of the model is the ability to accumulate large funds and use them with maximum efficiency. The disadvantage is corruption in the selection of investment objects.

Mixed model

In this case, the opportunity is used for the state to create a private mechanism for coordinating investment decisions. The task of the state in this model is to support the innovative activities of companies by financing the developments they need. Investments are mainly directed to solving the problems of exporting firms, since they are the ones who are most ready to adopt innovations.

Advice! Try to invest in economies that use a mixed approach, as it is usually innovation that brings big profits.

Company, center and regional development corporation

The following special institutions provide other material, organizational, methodological, and consulting support to regions in the implementation of investment projects:

- A regional development corporation, as a rule, is a government agency whose purpose is to search for and attract investments and coordinate the work of the project. The Regional Development Corporation is created in the form of a joint-stock company, where the local government is the shareholder.

- A regional investment company established within the framework of PPP on a concession basis and carrying out operational management of projects for the implementation period.

- The Center for Investment and Regional Development, created as an institution under the regional administration and engaged in supporting investment projects, studying problems of regional significance, etc. Currently operates in the territory of Crimea.

The project participant has the right to resort to the help of any of the above organizations represented in his region.

Mechanisms for the formation and implementation of investment policy

The mechanism for forming the state's investment policy is to focus the investment strategy on creating an investment environment favorable for private investors.

Mechanisms for implementing the state’s investment policy include the definition of:

- reliable sources of investment financing;

- investment financing methods;

- timing of implementation of investment decisions;

- responsibility of government bodies for the implementation of investment policy;

- formation of the regulatory framework of the investment market;

- creating comfortable conditions for attracting investments, etc.

The mechanism of state investment policy also includes rules for the use of public resources, such as:

- budget resources;

- land resources;

- state property.

The importance of the state's investment policy for Russia is very great.

In modern conditions, it is relevant to correctly set strategic goals in the field of investment policy, including:

- organizing structural reform of the economy;

- creating comfortable conditions for the development of small and medium-sized businesses;

- creating conditions for the influx of private investment into the economy;

- creation of new, high-tech jobs for young specialists;

- creating conditions conducive to attracting investment into the economy;

- encouraging the attraction of cash savings of the population for investment purposes;

- development of mortgage lending, contributing to an increase in economic growth;

- development of modern forms of leasing in investment activities;

- development of incentives for the effective implementation of the investment process;

- creating conditions to encourage investment in venture capital.

The state's investment policy and the mechanism for its implementation allow the country to effectively use available resources and improve the socio-economic situation.

In Russia, the state's investment policy and its features are mainly related to regional differences. Russia is a very large country, and the socio-economic situation in each region differs, and often very strongly.

Advice! It is worth investing money in those regions where the authorities take care of entrepreneurs and create favorable conditions for them. Investing in regions with a low investment climate is also possible, but in this case there will be more difficulties on the investor’s path, and how much greater the profit will be is unknown.

Regional aspect

The size of the state has a very big impact on the methodology of its investment policy. Russia is the largest country in the world, so for it this specificity takes on a special scope. When developing and implementing federal investment policy, the specifics of individual subjects of the federation must be taken into account. Things to take into account:

- features of the geographical location;

- available natural resources;

- level of development of transport infrastructure;

- immediate proximity to foreign countries;

- investment attractiveness;

- state of ecology.

Ideally, the Government of the Russian Federation should combine the investment potentials of all subjects of the federation as competently and effectively as possible. On the basis of such cooperation, a favorable business climate should be created throughout the country.

Types of investments by region

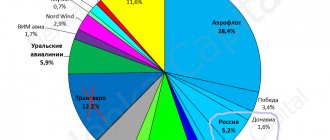

There are a large number of criteria for dividing investments into types. In particular, on a regional basis, types of investments are distinguished abroad, within the country and regional. The classification is based on the territorial affiliation of the objects subject to investment.

In addition, according to their regional nature, investments are divided into domestic (the capital of country residents is transferred) and foreign (funds of foreign citizens are involved).