From the history of the company

Founded in 1994 under the name “Finance-Analyst”, the company was one of the first in Russia to provide services related to work on the stock market. In the late 90s, it received the FINAM ticker and began providing brokerage services in the RTS trading system.

In 2002, the Finam holding was created, which today includes:

- investment company;

- Bank Finam;

- investment fund Finam Global;

- LLC "Finam.Ru";

- manager;

- ANO training center.

As of March 2021, the company's turnover on the stock market is 449 billion rubles, on the futures market - 2,922 billion and 529 billion on the foreign exchange market.

In 2021, Finam became the winner of the Grand Prix of the “Financial Elite of Russia” award, and the FinamTrade service became the best application according to the banki portal. ru.

The company has representative offices in 90 cities in more than 40 countries. Finam broker clients include more than 260 thousand people.

Official website - finam.ru.

Finam license from the Central Bank

The Finam company is one of the few forex brokers licensed by the Central Bank of the Russian Federation to carry out brokerage activities in Russia. The broker received a license from the Central Bank of the Russian Federation to conduct brokerage activities on November 9, 2000.

As practice at the beginning of 2021 has shown, not all brokers who previously received licenses pass inspections by the Central Bank of the Russian Federation. If Finam has consistently withstood the checks of the main bank for compliance with the conditions when working with clients for 19 years, this indirectly confirms the reliability and safety of the broker.

Finam holding companies also have licenses for:

- Banking services,

- Dealer activities,

- Depository activities,

- Securities management

- Investment fund management.

The presence of the above licenses indicates a serious approach to the company's work.

Brokerage services

Finam works with individuals and legal entities, offering a wide range of investment services.

The broker is focused on clients with different levels of capital and provides its full protection when conducting transactions with such instruments as:

- stock;

- bonds;

- options;

- mutual funds;

- ETF funds;

- futures, etc.

Traders who actively use brokerage leverage have access to margin trading and credit funds.

All users are provided with depository services. Storing funds in the account is free, but for its maintenance there is a monthly fee of 177 rubles (i.e., if there are movements on the account).

IIS reviews from investors

Most positive reviews about IIS are due to the fact that with a relatively low level of risk, the return is 3-4 times higher than bank interest on deposits.

The risk level of IIS is approximately at the level of a bank deposit, but with higher profitability and a more complex investment system. Unlike a deposit, where you simply put money in and forget about it for a while, IIS offers two ways to generate income:

- the first is a tax refund of 13%,

- the second is income from financial instruments , which requires greater participation of the investor. Most often they choose to invest in bonds - the yield on them will be 7-8% per year. Federal government bonds are considered the most reliable.

You can also conduct active trading and get higher profits by choosing stocks as a tool.

- How much can you earn from stocks?

- How many shares do you need to live comfortably on dividends?

- How to buy Gazprom shares and receive dividends

In the case of investing according to the formula “conservative bonds (corporate or government) + deduction”, in total we have 20-21% per annum, with minimal risks of losing money.

Conditions

When choosing an intermediary, an investor is most often guided by the trading conditions offered by the broker. In addition to the wide range of available tools and services, an important criterion is the size of commissions, which will directly affect future profitability.

For novice users who plan to practice with small amounts, the entry threshold is important. The minimum recommended deposit for opening a Single Account with Finam is 30 thousand rubles.

In 2021, the company launched the Free Trade service. This is a tariff plan that is completely free of brokerage commissions. It is available to those who open a new account remotely to make transactions on the Russian stock market through a mobile application.

By the way, broker Finam offers a fairly convenient online service that allows beginners to buy shares in just a couple of clicks. If you have never purchased shares before and do not know how to do it correctly, then the button below will allow you to quickly resolve this issue:

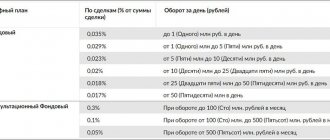

The fees for services provided are as follows:

When replenishing your account:

- by bank card in your personal account – 1% of the amount;

- through Internet banking or a cash desk at the Finam office - no commission. I top up my Finam brokerage account without commission from a Tinkoff Black debit card.

When withdrawing:

- in rubles – no commission;

- in dollars and other currencies – 0.07% (deducted in rubles at the Central Bank exchange rate).

Depository:

- if there are transactions on the account - 177 rubles per month;

- if there are no account transactions within a month – free of charge.

The amount of brokerage services depends on the chosen tariff.

IIS cons

Thus, we highlight the disadvantages of IIS:

- Availability of tax deductions only for a certain category of citizens with an official place of work.

- Lack of state insurance of invested funds.

- Discrepancy between declared and actual profitability. A tax deduction of 13% is paid on the deposited amount once, but not for the next 2 years.

- There is no opportunity to withdraw funds earlier than three years without loss of income. And without paying a deduction, income from an IIS looks completely unattractive. The opportunity to receive a tax deduction for many is the determining factor why they choose IIS.

- Brokerage commissions eat up part of your income. Moreover, brokers do not always act honestly. For example, one day you may change your tariff without warning, which will become known after detection of debits from your account.

All of the above is confirmed by the reviews and dissatisfaction of clients who opened an IIS.

Account types

Broker Finam offers its clients to open one of the following types of accounts.

IIS

An individual investment account is a type of brokerage account that provides tax benefits in the form of exemption from personal income tax or a deduction.

Features of IIS in Finam:

- Limits on the amount – 1 million rubles per year.

- Investment period – from 3 years.

- Profitability from 16.87%.

- The accrual on the account balance is 3.87% per annum.

- Consulting from managers.

- Opportunity to receive coupon income in dollars.

PAMM accounts

It involves investing funds into a general account with a Forex company and transferring your assets to them for management. The manager, using the capital in the account, trades on the financial market.

Depending on the success of the trade, the trader receives a profit or loss. Both are divided between the manager and all investors in proportion to the invested amounts and established conditions.

Single account

Since June 2021, the Single Trading Account service has become available to Russian traders. It allows you to perform transactions on several platforms within one brokerage account (with a single cash collateral).

What markets are available:

- Futures Moscow Exchange (futures).

- Stock Moscow Exchange.

- Currency Moscow Exchange.

- Foreign securities of the St. Petersburg Exchange.

Advantages and features of the Single Account:

- The minimum deposit is 30 thousand rubles. You can top up within 1 month from the date of opening.

- 1 agreement is concluded, and access is provided to 4 markets.

- Trading is carried out backed by securities.

- IIS.

- Flat rate for margin trading.

- Access to all trading platforms.

DEMO account

A free demo account is available to users for 3 months. You can open it on the broker's website. In this case, you can use any trading terminal for work.

Negative points

The disadvantages of opening an IIS in Alfa-Bank are:

- Lack of insurance of funds, as is the case with deposits.

- Annual contributions do not exceed 1 million rubles.

- Availability of only 1 investment account.

- Investing only in national currency.

- Receipt of income only after the expiration of the three-year period.

- Investing only in Russian companies; shares and bonds of foreign companies are not used for investments.

Opening an IIS at Alfa-Bank is suitable for those who want to make a profit in the long term. This is a good option for passive income, in which you do not need to waste time on market research, analysis and choice. All responsibility for the return on investment lies on the shoulders of the management company. But you need to take into account the negative aspects that you may encounter when using such a product.

Personal Area

To gain access to your personal account, you need to register:

- On the official website page finam.ru/open/order/russia, enter personal information - full name, email address, phone number.

- An SMS message with a login code will be sent to the specified phone number.

- To open online, the user will need passport data and TIN. You do not need a passport to open a demo account.

How to open and close an account

Let me remind you that the minimum deposit when opening a trading account is 30 thousand rubles. You can open an account online on the Finam broker website, as well as in the office (you need to have a passport, tax identification number and a USB flash drive with you).

To apply for opening, you must select the required account type:

- Single.

- IIS.

- Trust management.

- Forex with license.

To close a brokerage account, you will have to visit the broker's office. This cannot be done online.

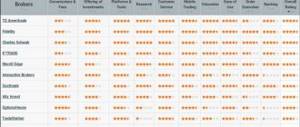

Finam broker rating

I determine the reliability rating of the bank and broker Finam according to the data of the verified rating agency “Exper RA”. In November 2021 experts assigned the company a BBB+ rating, meaning a moderate level of financial reliability and stability with a high probability of maintaining the position in the medium term.

According to the official rating agency as of July 2021. Finam's rating was withdrawn due to failure to provide data for its assessment. There is no need to be afraid of this. As can be seen from the history of rating assignments, this has already happened. I think in the near future the data will be provided and the rating will be restored.

According to financial statements for 2021. The company has seen a gradual increase in profits from brokerage activities throughout the year.

How to fund a brokerage account without commission

You can fund your trading account without commission in several ways:

- Bank transaction.

- Through the cash desk of Finam Bank.

Replenishment from a bank card will cost 1%. There is no fee charged to a Tinkoff Bank debit card.

Deadlines for crediting funds:

- Using a bank card - at 10.30 if the transfer application is signed before 10.00, and within 30 minutes if the application is submitted from 10.00 to 18.30 on weekdays. If you submit an application on non-working days, enrollment will occur in the morning of the next working day.

- By bank transfer – within 15-20 minutes.

- Transfer from a third-party bank – 30-40 minutes.

How to withdraw money from your account

You can only withdraw available funds up to the initial margin level.

The procedure for withdrawal through your personal account: Services – Transfer – Withdrawal of funds – Withdrawal from a brokerage account.

Finam registration

Registering your personal account takes a few minutes. To register, go to the official Finam website and fill out a simple registration form. You can fill it out faster by logging in through the social networks Fb or Vk.

Next, in your personal account you will need to fill in your personal information. To do this, prepare your passport data, INN, SNILS.

After filling out all the information in the form, the questionnaire will be sent for verification. They check quickly, usually within 1 business day. The next day after verification, your account will become active and you can begin to get acquainted with the broker’s personal account.

Advantages and disadvantages

Such conclusions will always be more subjective in nature, since each investor notes for himself the personal aspects of the broker’s work. What is important to one user is of secondary importance to another.

Taking into account various opinions and reviews, as well as available advertising and information data, I will try to list the pros and cons of the Finam broker.

Advantages:

- Successful experience in financial markets for more than 20 years.

- A large number of national and international awards.

- The highest reliability rating is A++.

- License of the Central Bank without expiration date.

- Huge turnover in all markets.

- Direct access to the largest exchanges.

- Wide selection of assets.

- Various ways to deposit and withdraw funds in a short time.

- Margin lending.

- Transaction insurance.

- In-house development of additional services for the convenience of clients - the automatic transaction repetition service common.ru, the social network whotrades.com, the auto-following service Trade Center.

- Free training materials and analytical data.

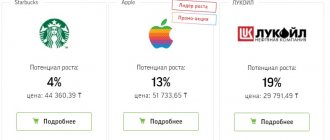

- Online store of shares.

- Free demo account for 3 months.

- New FreeTrade tariff without commissions.

- Huge selection of software.

Flaws:

- Limited number of input/output methods.

- The need to visit the office to terminate the contract.

- Frequent newsletters, but you can unsubscribe from them

Important additions!

You need to open an account after you determine:

- Investment strategy (how often to make transactions, how many years you plan to hold securities, whether you want to invest in foreign securities, investment amount, etc.)

- Do you want to expand the list of available securities in the future by obtaining the status of a qualified investor?

- How important is the convenience of receiving services to you?

- Are you planning to open an individual investment account (IIA)?

After answering the questions asked, you will be able to select brokers based on your personal requirements and needs. Feel free to ask questions in the comments and with bank/broker employees before making a final decision.

And keep in mind, they will forcefully impose “left-wing” services on you, so read carefully and go purposefully towards your goal. If something interests you, it is better to refuse and study the issue more thoroughly at home.

Tax deductions

You can receive a tax deduction using IIS in 3 years - I already wrote about this. There are two types of these deductions.

A - for replenishment. It works like this:

- you top up your account with a certain amount, say 100 thousand rubles;

- twist and turn, buy assets or just keep money in an account - it doesn’t matter;

- at the end of the year, write an application for a refund via IIS of 13% of the money deposited (i.e., from 100 thousand);

- you get your rightful 13 pieces.

It doesn’t matter whether your capital has increased or completely evaporated - 13% is yours. However, not all so simple. To receive this type of deduction, you must pay tax. Yes, with an IIS, personal income tax is returned - the money that the employer pays for you (or you yourself - out of the kindness of your heart). No personal income tax - no deduction for IIS. In other words, if you do not work and do not pay taxes, then, unfortunately, you will not be able to use this type of return.

Well, the maximum deduction is limited to two figures:

- 13% of 400 thousand is the state-established limit;

- 13% of your salary - more than you paid to the budget, will not be returned to you.

The second type of deduction is B. It’s simpler here. You do not need to pay tax on the income received from exchange rate differences. For example, if you bought a share for 150 rubles and sold it for 200, then in a normal situation you would have to pay tax - 13% of 50 rubles. If you have an IIS and deduction type B, then you do not need to pay this tax.

Here's another interesting article: 10 questions every investor should ask themselves

It is convenient to use this type of IIS when purchasing ETFs and mutual funds, where the main income is generated precisely due to exchange rate differences.

You can only use one type of IRA tax deduction - either A or B. Plan ahead if you open an individual investment account. If there is no salary and you want to earn millions, choose B. If you need an IIS to form a safety net, choose A.

Documents for opening

The terms of service at Finam are designed in such a way that only a legally capable citizen of the Russian Federation of adult age can take advantage of the offer. To open an account, you only need a passport and TIN number. Additionally, three documents of the investment company are completed:

- customer profile;

- application for adherence to the regulations;

- statement of choice of terms of service.

These three papers must be signed in the presence of a representative of the broker. If a positive decision is made, the company sends a notification to the client about the conclusion of the contract. It contains the number and date.

Promotions for training from Tinkoff

Open an account

What can you trade?

According to the director of the Kazan branch Arkady Rashchektaev, the client has the right to independently choose investment objects. This could be, for example, individual shares, bonds, a ready-made thematic “selection,” a structured product or a mutual fund. You can choose the most suitable product yourself, or you can consult with a brokerage company consultant.

“All instruments traded on the Moscow Exchange and the St. Petersburg Stock Exchange are available to IIS owners. You can buy currency, mutual funds and structured products. The only thing there are restrictions on is the purchase of securities on foreign markets. That is, you cannot buy Apple shares directly on the American stock exchange, but you can buy them on the St. Petersburg stock exchange,” explains the expert.

According to the Moscow Exchange, 87% of the turnover structure consists of transactions with shares, 10% with bonds, 4% with exchange-traded funds.

Financial instruments used

Finam provides its clients with access to all sections of the Moscow Exchange, as well as to the US stock and derivatives market. Funds credited to IIS can be invested:

- in bonds;

- in shares;

- in futures and options;

- in ETFs;

- in currency;

- in mortgage participation certificates;

- into depositary receipts.

The Moscow Exchange is the largest holding company in terms of trading volume and number of clients.