Due to the record influx of new investors in 2021, the demand for mutual funds (mutual investment funds) has increased, since independent investing requires certain knowledge and time. Mutual funds help an investor save time and rely on a professional manager to manage your funds.

You can learn more about what a mutual fund is by following this link.

Let us analyze in detail the profitability of the main mutual funds available to Russian investors and compare their success with indices. This will allow you to understand whether it is profitable to invest in mutual funds or not.

Let’s take, for example, mutual funds for the broad Russian stock market, the debt bond market and the market for foreign IT stocks. Since there are a large number of funds in each sector, we will take the leaders in terms of profitability over 5 years; for emerging markets this is the optimal investment period, and we will analyze them in detail. And also briefly compare with other similar funds.

About companies

Sberbank Asset Management

Sberbank Asset Management is a leader in the market of open mutual funds. The value of assets under management of the company is more than 1 trillion rubles. The analytical team was recognized as the best according to the Extel Pan-Europe Survey rating.

VTB Capital Asset Management

A management company with the highest reliability rating A++ according to Expert RA. Offers various investment instruments: hedge funds, closed mutual funds, venture and retail funds. You can purchase a share at one of 600 sales offices throughout the Russian Federation.

Alfa Capital

Part of the Alfa Group consortium, operating since 1992. Trust management company No. 1 according to NAUFOR 2021. Investment capital over 380 billion rubles. Received the highest reliability ratings according to the National Rating Agency (AAA) and Expert RA (A++).

What federal loan bonds is Sberbank currently selling?

Competent and profitable management of savings is entrusted to specialists of the bank organization, who are able to make informed decisions and have a fairly high level of professionalism. The general level of dynamics of the value of purchased shares in a financial organization offers several profitable directions in the field of unit management. They differ from each other in the overall composition of the portfolio, as well as the chosen strategy. Among the most important and profitable areas are the following:

- Closed-end mutual fund of any form of real estate;

- Open mutual fund of profitable shares;

- Open mutual fund of numerous funds;

- Open mutual fund of valuable bonds;

- Open mutual investment fund of mixed investments.

A special professional portfolio manager will choose the most understandable and profitable strategy, based on certain analytical information and mutual fund statistics. It is on these parameters that the manager and owner of the securities will build their profitable management.

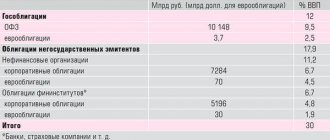

List of all bond mutual funds

In the table I have indicated the indicators of bond mutual funds managed by reliable companies.

| Name of the management company | Sberbank Asset Management | Sberbank Asset Management | Sberbank Asset Management | VTB Capital Asset Management | VTB Capital Asset Management | VTB Capital Asset Management | Alfa Capital | Alfa Capital | Alfa Capital |

| Name of mutual fund | Ilya Muromets | Prospective bonds | Eurobonds | Emerging Markets Eurobonds | Eurobonds | Treasury | Alfa Capital Reserve | Alfa Capital Bonds Plus | Alfa Capital Eurobonds |

| Ticker ISIN | RU000A0EQ3Q5 | RU000A0EQ3T9 | RU000A0JU054 | RU000A0JS9M4 | RU000A0JS9N2 | RU000A0JS9M4 | RU000A0ERNL0 | RU000A0HNSU2 | |

| Registration number | 0007-45141428 | 0327-76077399 | 2569 | 0958-94130789 | 0963-94130861 | 0958-94130789 | 0094-59893648 | 0095-59893492 | 0386-78483614 |

| Registration date | 18.12.1996 | 02.03.2005 | 26.03.2013 | 13.09.2007 | 13.09.2007 | 13.09.2007 | 21.03.2003 | 21.03.2003 | 18.08.2005 |

| Type | Open | Open | Open | Open | Open | Open | Open | Open | Open |

| Strategy | Investing in bonds of Russian issuers | Investing in bonds of Russian issuers denominated in rubles | Investing in corporate bonds of Russian issuers, Eurobonds | Investing in Eurobonds issued by developing countries | Investing in Eurobonds of Russian issuers | Investing in federal, municipal and corporate bonds with high credit ratings | Investing in federal and corporate bonds with high credit ratings | Investing in government, municipal and corporate bonds with high credit ratings | Investing primarily in foreign currency Eurobonds of states, Russian and foreign issuers |

| Risk | Short | Short | Short | Short | Short | Short | Short | Short | Short |

| Commission | 2,8–5,8 % | 2,8–5,8 % | 2,8–5,8 % | 4–8,5 % | 3,1–7,6 % | 4–8,5 % | 2,4–6,8 % | 2,4–6,8 % | 2,2–5,1 % |

| Profitability for 3 years | 30,78 % | 30,62 % | 13,56 % | 25,39 % | 18,49 % | 33,04 % | 31,82 % | 33,34 % | 25,48 % |

| Minimum initial deposit, RUB | 1000 | 1000 | 1000 | 5000 | 5000 | 5000 | 100 | 100 | 100 |

| Subsequent payments, RUB | 1000 | 1000 | 1000 | 1000 | 1000 | 1000 | 100 | 100 | 100 |

| Number of shareholders | 19 483 | 13 598 | 3065 | 1611 | 2848 | 26 074 | 5969 | 15494 | 6044 |

| Buy online | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Minimum investment period | 1 year | 1 year | 1 year | 1 year | 1 year | 1 year | 1 year | 1 year | 1 year |

| Early withdrawal | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

Summary

2020 was a year of boom in the ruble bond market. Since the beginning of the year, the market has increased by 7% and reached 11.32 trillion rubles. The Bank of Russia's soft monetary policy contributed to a decline in yields to historical lows for all categories of issuers - the most significant drop could be observed for the VDO segment, whose yields fell by 200 bps on average. n. for the last 12 months. At the same time, low deposit rates brought more than 5 million clients to the stock market, who brought brokers more than 1.5 trillion rubles.

In such conditions, first-tier borrowers were able to reduce the cost and lengthen their loan portfolios, including by replacing foreign currency debts. But, according to the agency, the activity of issuers from the sphere of small and medium-sized businesses (SME companies) deserves special attention. This sector has already served as a full-fledged growth point for the bond market since 2021; it is here that the majority of new issuers appeared in both 2020 and 2019.

The SME issuer segment must overcome a number of childhood illnesses that we believe could cut them off from retail investors' money and prevent companies from moving into the higher echelons of low-rate borrowers. Such key limitations now include low transparency of companies, an unsatisfactory situation with the quality of reporting and the lack of widespread use of IFRS standards, low rating coverage of small issuers, as well as distortions in risk assessment by investors associated with the classification of issuers in the VDO sector.

The Russian debt market has defeated the coronavirus. The Russian bond market greeted 2020 with positive dynamics, which could be observed throughout 2021 - the share of non-residents was at near-peak levels, amounting to 32%, the easing of the monetary policy of the Central Bank of the Russian Federation contributed to a progressive decrease in yield rates and an increase in placement volumes both from the outside Ministry of Finance, and from corporate issuers. All the prerequisites were formed for the continuation of positive dynamics, however, the global economic crisis caused by the outbreak of the Covid-19 epidemic served as a serious test for both the Russian bond market and world stock markets.

The main blow to world markets came in the period February–March 2020, when it became obvious to market participants that the coronavirus infection, and with it restrictive measures, would inevitably spread beyond China. Stock indices of developing and developed countries showed double-digit rates of decline during this period.

Over 30 days, the MSCI aggregate stock price index for Russia showed a decline of 41%, which is slightly higher than the decline for developed (-33%) and developing (-31%) countries. The drop in indices for Russia turned out to be especially significant due to stress in the oil and gas industry, where during this period the price of Brent oil fell to $27 per barrel. – the minimum level over the past 10 years.

The Russian OFZ segment also reacted strongly to the development of the epidemic - from the beginning of 2021 until the peak of the decline in March of this year, the yield curve showed an upward shift in all its sections. At the same time, the medium- and long-term sections of the curve were most actively sold off. If in the period up to 1 year yields increased by 70-137 bp, then in the period 3-7 years one could observe an increase in quotations by 190-200 bp. year to date.

The readiness of the Russian economy for a global recession turned out to be higher than in many other developed countries of the world. The peculiarities of the Russian economy played into its hands - the limited integration of the Russian Federation into the world economy against the backdrop of a high share of the public sector allowed it to be among the largest countries in the world whose economies suffered less during the first wave of coronavirus. Data on GDP growth rates in the second quarter of 2020 show that the fall in Russia's GDP was not as dramatic as in other countries of the world.

Table 1. The Russian economy demonstrated the least significant rate of decline in GDP among most developed and developing countries

| GDP growth rate in Q2. 2021 (annualized), % | Maximum Credit Rating from Moody's/S&P/Fitch | |

| USA | -9,1 | AAA |

| EU | -15,0 | AAA |

| Germany | -11,3 | AAA |

| Great Britain | -21,7 | A.A. |

| Brazil | -11,4 | BB |

| Russia | -8,5 | BBB |

| India | -24,1 | BBB- |

| Türkiye | -9,9 | BB- |

| Mexico | -18.7% | BBB+ |

| Colombia | -15.7% | BBB |

| China | +3.2% | A+ |

Source: Bank of Russia, Expert RA

At the time of the aggravation of coronavirus infection in March and at the end of October, the level of real interest rates in Russia looked high relative to the levels of developing countries.

In terms of the ratio of the credit quality of the Russian Federation, the proposed yield on government securities and the resilience of GDP to the current crisis, Russian bonds looked attractive in comparison with other countries with economies in transition. This made it possible to limit the outflow of foreign investors from the Russian debt market, and, accordingly, smooth out the decline in prices of Russian bonds, despite the general sentiment of global investors to move away from risky assets in favor of safe ones.

By April 2021, the share of non-residents in OFZs amounted to 32%, remaining at the level of the end of 2021, when the Russian debt market as a whole was experiencing upward dynamics. By October 2021, the share had dropped to 27% due to worsening geopolitical risks associated with EU sanctions and uncertainty around the US elections. Also, the decrease in the share of foreign investors was due to the nominal increase in the volume of OFZ in circulation, which was not kept up with the influx of foreign capital.

In response to the consequences of the coronavirus epidemic, in order to stabilize the situation on stock markets in 2021, the Bank of Russia began to more aggressively reduce the key rate. If for the entire 2021 the rate was reduced by 125 bp. p., then over the 10 months of 2020 the regulator lowered the rate by 200 bp. p. to a historical minimum for the entire history of modern Russia of 4.25%.

The implementation of an expansionary monetary policy has partly led to increased inflation risks, which, in terms of real interest rates, is gradually pushing real deposit yields into negative territory. This situation forced private investors to withdraw deposits and enter the stock market in search of profitability.

Over the past 12 months, by the end of September 2021, the number of registered clients on the Moscow Exchange more than doubled and exceeded 11 million people. The number of active clients also showed upward dynamics, more than tripling over this period, from 306 thousand to 1.059 million people. Average monthly transaction turnover among the top 10 market operators increased by 33% over the year, amounting to about 16 trillion rubles.

In the year to October 1, 2021, the number of investors in this category grew by the same amount as it grew in the 20 years from 1999 to 2021.

The reduction of the key rate of the Central Bank of the Russian Federation to historical lows, as well as an unprecedented influx of funds from individual investors, supported the growth of the corporate debt market and put pressure on interest rates. Over the 9 months of 2021, the growth in the number of new corporate bond issues was 25% higher compared to the 9 months of 2021.

After a surge in yields in March 2021, public debt rates have stabilized and continued to decline. At the same time, spreads to risk-free yield levels looked different for issuers of different quality categories.

Market conditions made it possible to significantly reduce the cost of funding for all market participants.

For issuers of the 1st and 2nd tiers, a downward trend could be observed throughout the year. This was especially pronounced for issuers with a rating of ruAA- and higher.

Since the end of June 2021, fluctuations in debt raising rates and OFZ spreads have been minimal for the selected categories of issuers. Some widening of credit spreads could be observed for issuers with ratings in the range 'ruA+' – 'ruBBB' from 100 bps. p. in January 2021 to 160 b. by the end of October. The widening of spreads is explained by the return of the geopolitical premium to the Russian market, as well as the desire of issuers to extend the duration and increase the volume of transactions, slightly increasing the premium to risk-free rates, but maintaining the cost of financing at record low levels.

A different picture can be observed for companies belonging to the high-yield bonds (HYB) segment, which mainly consists of representatives of small and medium-sized businesses.

The dynamics of VDO yields was similar to the dynamics of yields of securities of large issuers, however, the spread to OFZ for such categories of issuers showed a more active decline, which was facilitated by the influx of individual investors.

Today, the SME segment is formed by issuers without ratings, or by companies with ratings at the ruBBB level and below, while many companies in the segment raise funds at the level of rates issued by ruAA category issuers, which they paid two years ago.

We consider the SME sector to be key because this is where new names are emerging, where physical investors are most active, and where the foundation is being laid for increasing the diversification of the Russian bond market and its liquidity. According to our calculations, if in 2018 the issuers of the segment carried out 18 debut transactions, then in 2019 their number increased to 41; over the 10 months of 2021, about 30 debut transactions were carried out. According to the Moscow Exchange, as of 9 months of 2021, individuals already accounted for about 17% of the volume of placements of corporate and exchange-traded bonds and 11% of the volume of trading on the secondary market, respectively. If 2 years ago the order book contained about 2-3 applications from individuals with a share in the total placement of about 0.5-1%, then in 2021 it was possible to observe transactions where, with an placement of 5 billion rubles, demand from the outside individual investors amounted to more than 4 billion rubles, and the number of applications was measured in hundreds.

New retail investors are a big liability for the market, which in an unfavorable scenario can destroy it. VDO issuers bear high risks, which yesterday's depositors cannot fully assess and correlate with the profitability that should accompany the risk. At the same time, a situation where the coupon exceeds 2 or even 3 key rates reduces the motivation for critical thinking and a comprehensive risk assessment. Opinion leaders in this segment are either applications of the largest brokers with their recommendations, or ordinary users of thematic chats and telegram channels, who are not always objective in their judgments. The situation is improved by unlimited liquidity in the scale of issues and low refinancing risks even for the most problematic borrowers: by adding a couple of percent to the rate, money can almost certainly be raised, and in larger volumes compared to previous issues. Profitability as the key and only driver of the market has already laid down a number of “childhood diseases” in its development, without curing which the market will not reach a qualitatively new level with billion-dollar placements, lower rates and investor demand from financial institutions. The market risks getting stuck in its current position and, under pressure from the Bank of Russia, limiting the risks of unqualified investors, losing access to refinancing.

Dynamics of share value and NAV

The value of the share is the amount of the deposit. NAV is the value of net assets, calculated using the “assets – liabilities” formula. It directly affects the value of the share (the profitability of the mutual fund). I will look at graphs of NAV and the cost of deposits of the most profitable bond mutual funds.

Sberbank’s Ilya Muromets, despite the decline in NAV, has shown a stable increase in profitability over three years.

“Treasury” demonstrates an almost straight line of profitability, which indicates the reliability (growth without significant drawdowns) of the instrument. The increase in the value of the share is supported by the growth of NAV.

The most profitable mutual fund managed by Alfa Capital was Alfa Capital Bonds Plus. Yields of over 33% are shown against the backdrop of a temporary drawdown in NAV.

Feedback from investors

Most reviews about investing in Sberbank mutual funds are positive: depositors note higher profitability compared to deposits and ease of investment.

Alfa Capital’s instruments are recognized as simple and reliable investments, however, the purchase commission “eats up” part of the profit.

Shareholders of VTB Capital talk about low profitability compared to purchasing bonds independently.

Sometimes there is unfounded criticism of bond funds.

“Childhood diseases” of the new wave of issuers

Analyzing the placement practice of small and medium-sized issuers, in addition to the natural financial risks that are associated with the small size of companies and increased sensitivity to any shocks, we note extremely low information transparency, quality of reporting, corporate governance and systematic regular communication with investors. It is in this area, according to the agency, that a breakthrough is needed. It is worth noting that over the past year there has been noticeable progress in terms of ensuring greater transparency in the segment of small and medium-sized issuers thanks to the efforts of market infrastructure participants. Rating requirements for listing on the Moscow Exchange have been introduced, encouraging issuers to disclose even low ratings; placement organizers are promoting the expansion of the practice of preparing and disclosing reporting under IFRS; the Exchange's inspection procedures, as well as work with rating agencies, are pushing issuers to more clearly structure their business and increase transparency. Nevertheless, there is still significant room for improvement in all these areas, and distortions in the issuer’s demonstration of its risks and their assessment by investors are large.

Information transparency is still low. The minimum permissible disclosure of information in accordance with the law does not allow a full assessment of the issuer's risk. Without a complete understanding of the company, its business risks, financial risks and governance risks, investors may be asking for an unnecessarily high premium that could have been avoided. Many issuers are not mature enough for IFRS reporting and working with good auditing. Almost no one in the sector publishes non-financial operating indicators of their activities. In cases where the issuer operates in a group with one or more related legal entities and publishes only its own individual statements under RAS, investors do not have the ability to analyze the entire perimeter of the group and correctly assess the debt. Due to a lack of understanding of intragroup flows, an investor may demand a higher premium, but this level of analysis may not be available to retail investors, which means the issuer may not pay extra for the risk.

Difficulties in determining profitability. An analysis of the bond market map by credit quality categories shows that the segment of VDO issuers is a market without rules.

When analyzing the yield curve of first-tier issuers, you can see the normal slope of the curve, which runs parallel to the benchmark – the OFZ yield curve. Quotes are distributed evenly along the entire curve and are characterized by minor deviations from it. The level of interest rates of companies fluctuates slightly - at around 1 percentage point, depending on the specific company, term and level of credit rating. Using the yield map of 1st tier issuers, investors and issuers can easily understand what rate a particular company with a rating of ruAAA – ruAA+ can expect.

When analyzing the market map of the VDO segment, which is largely formed by small and medium-sized businesses, a different picture can be observed.

Chart 13 shows the bonds included in the Cbonds CBI High yield aggregate yield index, which includes the most liquid bonds of the VDO segment. The market map of the VDO segment and unrated bonds, in particular, are characterized by a lack of consistency in terms of the distribution of yields to maturity. Quotes are unevenly distributed, which makes it impossible to construct a representative yield curve for unrated bonds. Over a period of 1–1.5 years, the difference in yield reaches more than 600 bp. p. between issuers, or almost 1.5 key rates of the Central Bank of the Russian Federation. In the complete absence of a reliable benchmark, the investor has a very limited set of data to determine the fair levels of profitability of a particular unrated security, so he is left to make a decision only based on his own greed and a sense of acceptability of the rate.

Low rating coverage of SME issuers. The segment of securities of SME issuers is poorly covered by ratings: 41% of the market does not have credit ratings. Because of this, there is largely such a dispersion in the levels of interest rates for one sector with a fundamentally similar profile of issuers.

According to the agency, the problem of low rating coverage contributes to the underestimation of the risks of unrated issuers and the overestimation of issuers with ratings below the ruBBB+ level, but close to it. We consider the ruBBB+ level to be the starting point for securities in the “investment grade” category, since it is from here that issuers have access to a wide range of institutional investors, as well as the opportunity to get into a premium listing. At the same time, many bonds with ratings in the ruBBB category are traded at a level similar to other securities in the VDO segment without ratings. The same situation is observed for issuers of the ruBB category. We believe that this situation is formed by the fact that companies with ratings of the ruBB and ruBBB categories are in the VDO segment. Due to receiving the label “VDO issuer,” which includes unrated securities, issuers may be biased by investors with profitability requirements related not to credit risk, but to the average level of profitability familiar to the VDO sector. Securities with credit ratings included in the VDO segment are perceived by investors in the same way as securities of the same segment without a credit rating, in which there may be significantly more hidden risks.

Alternatives

Mutual funds can provide up to 25% net return over 3 years. For a beginner, this result is impressive, but for experienced investors it is more profitable to invest in securities themselves or use exchange-traded funds (ETFs).

Playing on the stock or derivatives market will give a higher percentage, but the risk will grow in proportion to the profit. If the goal is to save money from inflation, it is worth investing in OFZs. Bonds provide yields of up to 8.8% per annum with minimal risk.

Is it worth taking

Expert opinion

Vladimir Silchenko

Private investor, stock market expert and author of the Capitalist blog

Ask a Question

Yes, if you are a beginner in the field of investments and do not have enough time to manage assets yourself. The profitability of ruble funds is higher than that of a bank deposit, and the risk is minimal, since Sberbank Asset Management invests money in conservative securities.

For an experienced investor, I recommend the Dobrynya Nikitich exchange-traded fund, which yields more per annum (not taking into account the commission), but the degree of risk is noticeably higher.

Newbie

To ensure that a novice investor does not make mistakes when working with bond mutual funds, I will describe the operating principle of the investment instrument, indicate acceptable returns and possible risks.

What is a mutual fund and why is it needed?

A mutual fund is an investment fund whose funds are invested by a management company. If you have available funds (pension savings, savings), you buy a unit (share) of the fund. The management company invests shareholders' money in a diversified portfolio of securities. If the investment generates income, the value of the share increases. You can sell the share and make a profit.

Advantages and disadvantages of mutual funds

Compared to bank deposits, the return on mutual funds can reach up to 25% (over 3 years). For people who do not have investment experience, knowledge and time, this type of investment is a godsend.

Investment procedure: just register on the official website of the management company, select a mutual fund and transfer money.

The main disadvantage is the commission, reaching up to 5%. If the fund’s return is less than 13%, then the investment loses its meaning: government bonds with a fixed income of 8% per annum are safer.

Risks

To prevent a beginner from losing his savings, he must know the basic principles of risk management. I will describe the factors influencing the risk level of a mutual fund

What affects the risk level of a mutual fund

Manager's strategy. It is divided into aggressive (this behavior will give high profits, but the risk will be corresponding), conservative (lower profits with lower risks) and balanced.

Age of the fund. Confidence in a young fund is lower: perhaps the mutual fund’s profitability is ensured by one manager. His departure from the organization may jeopardize the investments of shareholders. In large organizations, management is handled by a team of analysts.

NAV value. The fund's profitability directly depends on the net asset value. If the stock market value of securities falls, the profitability of the mutual fund will also begin to fall.

What can be done to reduce risks

Divide investments into several assets. For example, buy a share not only in a bond mutual fund, but also in an exchange-traded fund (ETF), invest in real estate, precious metals, and the futures market.

A decrease in the price of one asset will not lead to significant drawdowns: the remaining investments will cover losses and increase the overall return on investment.

How to invest

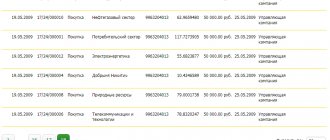

I will support the instructions with screenshots from the official Sberbank website.

Via PC

I will consider the process of investing in the ruble mutual fund “Prospective Bonds” through an online service. To do this, you need to register on the UK website and log into your personal account.

On the main page, open the “Mutual Funds” menu. Click on "Prospective Bond Fund".

On the mutual fund page, click “Buy online”.

After filling out your personal data and confirming payment, you just have to wait 5-7 days and you will become a shareholder.

Via mobile application

The smartphone allows you to carry out all operations with investments anywhere where there is Internet access. I will show you how to buy a share through the Sberbank mobile application.

- Download the Sberbank Asset Management application from Google Play or AppStore.

- Log in to your account (having previously gained access at a Sberbank branch or through State Services). The application displays statistics on current investments.

- In the menu on the left, click on “Mutual Funds”.

- Select the “Ilya Muromets” tool.

- Click on the “Buy” button and indicate the investment amount. Within a week you will become a shareholder.