Elena Pazina

5578

0

Font

A.A.

No time to read?

According to statistics from the Central Bank of the Russian Federation, foreign currency deposits account for 21.6% of all deposits of individuals - this is about 5 trillion rubles. Conventional deposits in foreign currency - in euros and dollars - do not provide profitability: on average, the interest rates on them are about 1.5%. To assess whether it is profitable to invest in the currency of the Celestial Empire, we analyzed different points of view on the question: what exchange rate of the yuan is predicted for 2021.

What does the yuan exchange rate depend on?

The Chinese yuan is a fairly stable currency, but it cannot avoid the influence of the global economy. Let's highlight the main ones.

Oil

The price of “black gold” affects many currencies on the international financial market.

The turnover of oil futures on the Shanghai International Energy Exchange (INE) has led to Beijing, along with New York and London, becoming the third center that shapes world oil prices. Beijing has developed its own Shanghai Oil - a standard grade of oil with payments in yuan, in contrast to the English Brent and the American WTI.

Some traders are afraid of currency risks and do not participate in trading on INE, since prices are set in yuan. But the Chinese authorities have resolved the issue: yuan from sales can be converted into US dollars - the INE currency reserve, or into gold, which is not used on other exchanges.

China as part of the world economy

As of January 1, 2021, the yuan became sixth on the list of reserve currencies of the International Monetary Fund. China has joined international organizations: G20, APEC, SCO, UN Security Council.

At the end of 2021, the United States ranks first in global GDP with a share of 23.48%. China is second, with a share of 16.21%. These countries are the undisputed leaders among other economies of the world.

Relations with Russia

The weakening of Russia's ties with Europe and the United States due to foreign policy factors plays into China. China can afford to ignore isolation measures, receiving resources from the sanctioned country at reduced prices. Due to tensions between countries as a result of sanctions, the value of the yuan is increasing.

According to the Russian foreign trade website, which uses data from the Federal Customs Service of Russia, there is an increase in trade turnover between Russia and China. The data in the table below illustrates this turnover.

| 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | |

| Trade turnover, million dollars | 59 291 | 83 232 | 87 394 | 88 799 | 88 389 | 63 556 | 66 108 | 86 964 |

| Export, million dollars | 20 326 | 35 030 | 35 766 | 35 625 | 37 505 | 28 605 | 28 021 | 38 922 |

| Import, million dollars | 38 964 | 48 202 | 51 628 | 53 173 | 50 884 | 34 950 | 38 087 | 48 042 |

Policy of the Central Bank of China

In 1948, the People's Bank appeared in China. It is the central bank of China, which reports directly to the State Council of the People's Republic of China.

The People's Bank of China regulates the exchange rate of the yuan. According to a statement by Premier of the State Council of the People's Republic of China Li Keqiang at the annual session of parliament - the National People's Congress, the Chinese authorities intend to stabilize the yuan in 2021.

According to Bloomberg, the United States in trade negotiations with China is asking Beijing to maintain a stable yuan exchange rate - this issue was raised during several rounds of negotiations.

Dollar, euro, yuan, ruble, gold - what should investors bet on in 2021?

Dollar, euro, yuan, ruble, gold - what should investors bet on in 2021?

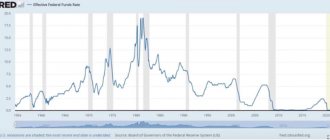

If you look at analysts’ forecasts made now, you can see that they are generally focused on the development of the “golden mean” scenario , in which recovery from the pandemic will proceed quite quickly in terms of economic growth, but not fast enough in terms of inflation and central bank rates .

Timecode on video: 11:55

The market will be saturated with excess liquidity .

There will be a strong growth in corporate profits as economies reopen following global vaccinations as early as the first half of 2021.

Indeed, the first year after the end of a recession is often very good for risky financial assets and not so good for risk-free bonds and the dollar.

However, this assumes the absence of negative surprises both from the epidemic (the vaccine may not be so effective, and most importantly, it will be difficult to produce and distribute in such volumes and in such a short time) and from economic risks: budget deficits will suck out free liquidity , the United States will tighten regulation and try to raise taxes, citizens will not return to their usual consumption patterns after quarantines are lifted, and inflation may be above 2%.

(Fig. Dynamics of main financial assets in 2010)

2021 will likely look like a repeat of 2010 (also the first year after the end of the recession): a generally good year, but with a lot of volatility.

A significant difference from 2010 will be a greater weakening of the dollar in the first half of the year , when Europe has already emerged from quarantine, Asia will begin to grow rapidly due to the revival of international trade, but the United States will be ahead of the rest in terms of the speed of the Fed’s printing press and fiscal incentives from President Biden .

Despite expectations of a strong decline in the dollar against the euro, the decline of the dollar requires an alternative in terms of all three functions of money: savings, measures of value and means of payment .

Neither the euro, nor the yuan, nor gold, nor bitcoin can provide all three of these functions at the level of the dollar. The euro could have done so if the eurozone economy had not been so structurally weak and torn apart by North-South contradictions.

The yuan will also someday be able to at least claim the role of the main regional currency (like the yen in the late 1980s), but institutional restrictions and political risks will not allow it to displace the dollar in the foreseeable future.

There is too little gold, and the transaction costs of its circulation are too high, and bitcoins are an excellent speculative instrument, but certainly not a measure of value and not a means of stable savings.

However, a weakening dollar could be an important investment theme next year , especially in the first half.

(Graph, Analysts’ expectations for the dynamics of the euro exchange rate for the next three years and distribution of forecasts for the exchange rate at the end of 2021)

This is based on the following six premises .

1. The US is behind the rest of the world in the coronavirus cycle . Moreover, historically, after a recession, a cycle of dollar weakening began.

2. The absence of a complete victory for the Democratic Party in the elections will not allow for a large-scale stimulus program with a compensating effect from increasing taxes on the rich - the budget deficit will set new records, and the Fed will have to print even more dollars to monetize it.

3. American assets are very overvalued and occupy an unreasonably high share in the portfolios of global investors due to:

a) a huge influx of funds into Treasuries and technology stocks and

b) a strong outflow of funds from European assets due to the initially more severe consequences of the pandemic.

Thus, according to Citi estimates, the share of American stocks in portfolios is now about 45% versus 11-13% of EU stocks and emerging markets; the share of American bonds is 41–42% versus 23–24% of European and 10% of emerging markets, respectively. These are the maximum differences since 2008 .

4. The dollar itself is overvalued by 6-11% based on various fundamental metrics from purchasing power parity to the real interest rate model.

5. Probability of incentives for carry trades in dollars . Already now the difference in real rates has ceased to be in favor of the dollar.

6. In February 2022, the mandate of Fed Chairman Powell ends, and therefore in 2021, either he will be as loyal to Biden as possible (and will print dollars to the maximum), or a new candidate for the head of the Fed “dove” will appear.

Therefore, you should count on an 8–10% drop in the dollar in the first half of the year : buy euros, precious metals and even ruble bonds.

What do you think about the dollar?

Expert opinion

The Chinese yuan is backed by gold and is considered very attractive for investment. Even the dollar does not have such stability.

TASS reports that the influence of external factors on fluctuations in the yuan exchange rate has decreased. The financial portal Dongfantsaifuwang quoted Xiao Lisheng, an employee of the Institute of World Economics and Politics at the Academy of Social Sciences of the People's Republic of China, as saying: “The influence of external uncertainty on the Chinese currency has decreased, however, the possibility of the renminbi’s dependence on the dollar index and the situation in the global economy cannot be completely excluded.”

Forecast of the yuan to ruble exchange rate

Most experts agree that the yuan exchange rate against the ruble will be stable in 2021. According to the Independent Bureau of Currency Rate Forecasting Prognozex.ru, prepared based on comments and statements by analysts of the largest banks in Russia, 10 yuan on December 31, 2021 will cost approximately 95.58 rubles. According to Rambler/Finance, the yuan exchange rate by the end of 2021 will be 9.22 rubles per 1 yuan.

Their data is based on forecasts from the following companies:

- FxPro - 9.72

- Libertex - 9.45

- InstaForex — 9.19

- IH Finam - 8.70

- Alpari - 9.05

Analysts of the Central Bank of the Russian Federation also share opinions about the stability of the yuan, which increased the share of yuan in Russia’s reserves back in 2021.

Don't mix politics with personal preferences

The Duchess of Sussex, who dragged her poor husband Prince Harry into the turmoil of the election campaign, said that the upcoming US presidential election will be the most important in history. She's probably right, but for a different reason. Meghan Markle believes that Biden's victory is the only way to save America, primarily because she can't stand Trump (which is mutual). However, it doesn't matter who wins, because this is about preventing the collapse of the United States economy and currency.

On the other hand, Biden's policies will bankrupt the country much faster than Trump's. Spending Democrats will forgive trillions in debt, increase spending, and cut taxes for the public.

The Chinese have been patiently waiting for this moment. They predicted the collapse of the “capitalist monetary system based on the dollar” half a century ago, and how right they were!

Yuan to dollar: forecast

In most cases, when it comes to the ordinary population, the exchange of one currency for another is carried out with the aim of enrichment or at least saving finances from inflation. It is very important to buy exactly the currency whose rate will rise, then it can later be sold at a higher price and the difference will cover all inflation risks.

Another thing is that no expert can predict the change in a particular currency 100%, but the use of forecasts in combination with proper risk distribution allows you to achieve stable profits. On the Sravni.ru website you can see the dynamics of changes in the yuan, on the basis of which you can make your forecast. Or you can read the forecasts of foreign exchange market experts and follow their advice.

End of an era

I realize this may all sound like the nostalgia of an older man with embellished memories. There may be some truth to this, but I am absolutely convinced that the era we are in is the end of a cycle

, which includes criteria such as quality of life, values, crime, honesty and integrity.

The current economy, built on debt, fake money and false values, is creating a very unhappy society.

This is why the current cycle must end soon. The world needs a real fire that will destroy debt and all asset bubbles financed by printed money and worthless debt.

The coming fall in global debt will be a relief to the world, but will obviously lead to a protracted period of suffering. However, only after this will humanity be able to begin a new cycle of growth

, based on a sound monetary and financial system and real values, both moral and material.

Half a century of dramatic changes

Over the past half century, the world has undergone significant metamorphoses. The table below shows how debt, the dollar, GDP and equities have changed over my 51 years in the financial markets, from 1969 to 2020. The federal debt of the United States has increased by 75 times, but GDP by only 20 times. There is no clearer evidence that the US economy is depleted and that increasing the GDP in nominal terms requires increasing the debt.

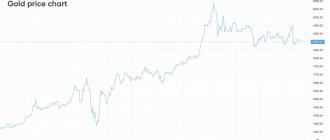

Chart and forecasts for the CNY/USD exchange rate

A convenient tool for financial analytics – chart and forecasts for the CNY/USD exchange rate. Short-, medium- and long-term forecasts allow us to predict with a high degree of probability future currency quotes in a certain period. They are compiled based on an analysis of the financial and economic situation, political situation, expert opinions and other data. Graphs display this data in the form of curves located along the time and data axes. The user can select the required period and view the information he is interested in to make a decision on the purchase or sale of funds.

Biden will worsen US economic downturn

And the reason for all this will be Biden's victory. Of course, she's not the only one. But just as the coronavirus accelerated the decline of the entire global economy, Biden will be the catalyst for an accelerated decline in the United States. Both events would have happened anyway, but probably not as dramatically as with the help of these powerful catalysts.

Regardless of who wins, the upcoming elections will have bitter consequences for all countries. Most likely, the aggressive struggle will continue not only until November 4, but also after the results are announced. People will begin to challenge and discuss this topic in forums, streets, homes, courts, the media and the ruling elite.

Coins and banknotes

Today, coins are issued in denominations of 1, 2 and 5 fen, 1 and 5 jiao, 1 yuan. Banknote denominations are 1, 5, 10, 20, 50, 100 yuan. The 1 yuan note depicts Xihu Lake in Hangzhou (eastern Zhejiang province), 5 yuan - Huangshan Mountains (eastern Anhui province), 10 - Three Gorges of the Yangtze River (southwestern Sichuan province), 20 - Guilin landscape of the Lijiang River (Guangxi) -Zhuang Autonomous Region in southern China), 50 - Potala Palace in Lhasa, the capital of Tibet (western China) and the Great Hall of the People in Beijing on the 100 yuan banknote. On the other side of all banknotes is a portrait of the first Chairman of the People's Republic of China, Mao Zedong. In addition to Chinese, the banknotes contain inscriptions in the languages of national minorities - Zhuang, Mongolian, Uighur and Tibetan.

Memories of better times

I have just entered my 52nd year of working life, but I remember well my life as a small boy in Sweden in the 1950s. It was a time when the family was considered the center of society and everyone respected law and order. Mothers looked after their children at home.

The father's salary was enough to support the family. Almost no one had any debt, and apparently there were no credit cards. Most things were paid for in cash.

The police were unarmed, and their authority was universally recognized. There were almost no immigrants living in Sweden at that time. There were very few crimes, and practically no serious ones. I remember visiting churches in rural areas and the doors would be thrown open and the church silver would sit on the shelves completely unprotected. Young children could move freely without parental protection. Very few people went on holiday abroad or owned cars or televisions.

The economy was strong, based on real money, and debt was low. The quality of life was much higher than today. I'm not talking about material things, but people were much happier with low stress levels and full respect for their fellow humans. Integrity was defined by strong moral and ethical values.

Periods of activity

If you look at the chart of the dollar/Japanese yen pair, you will notice that it is active from midnight to 13:00 GMT - this is the London and Asian trading hours.

It is recommended to trade this pair on time frames from H1, since strong price fluctuations are observed on shorter time intervals. In addition, the spread for intraday trading is very high.

It is also worth noting that closer to night the spread increases, which excludes those who like short-term trading at night. I would also like to draw your attention to the fact that the cost of one pip on this currency pair is much lower than on other pairs.

So, for example, when opening a deal with a 0.1 lot on the euro/dollar pair, 1 point will cost approximately 1 dollar, while on the dollar/yen pair its cost will be 10 cents. So if you usually open trades with a 0.1 lot, then here open a trade with 1 lot.

Another important point, especially for day trading enthusiasts, is swap. The fact is that on this pair it has an impressive size. So, if you plan to keep the deal open for a long time, be sure to pay attention to it.

Note that the current swap is 151.4 pips for long positions. If you keep the buy trade open for 2 days, your loss will be 252.8 pips, which, you will agree, is a significant loss.

But if you keep a sell trade open for 2 days, you can earn 43 points, even if the price remains the same.

If you trade at night or transfer orders to the next day, then you can act in two ways: create only sell trades on the pair or use accounts without swaps.

Churchill's call

The widespread conflict reminds me of Winston Churchill's speech to Parliament in June 1940 after the evacuation of Dunkirk:

...We will fight on the beaches, we will fight on the coast, we will fight in the fields and in the streets, we will fight on the hills...

Churchill's words were supposed to unite and prepare the nation for the upcoming large-scale war. But the fallout from the US election will be divisive and devastating, no matter who emerges victorious.

Thus, 2021 will mark the beginning of not only a severe and prolonged economic decline or collapse for the states, but also an extended period of extreme political and social disharmony.

CNY/USD exchange rate history

To make profitable currency exchanges, the history of the CNY/USD exchange rate is important. It shows the process of changes in currency quotes over time. Based on this data, the user can predict further exchange rate fluctuations and choose the right time to conduct currency exchange transactions. Up-to-date, accurate information is presented on the websites of state and commercial banks and aggregator resources. The data is presented in the form of tables, graphs, diagrams, provided with explanations and transcripts. It is possible to select a period (month, year, week), print a report, and save the results.

Exchange rate table

- by month

- by days

- on years

| Month | Average price, rub. |

| May 2021 | 114.856 |

| April 2021 | 116.628 |

| March 2021 | 114.074 |

| February 2021 | 114.566 |

| January 2021 | 114.439 |

| December 2020 | 112.973 |

| November 2020 | 116.037 |

| October 2020 | 115.05 |

| September 2020 | 110.967 |

| August 2020 | 105.982 |

| July 2020 | 101.475 |

| June 2020 | 97.698 |

| May 2020 | 102.22 |

| date | price, rub. |

| 26.05.2021 | 114.53 |

| 25.05.2021 | 114.353 |

| 22.05.2021 | 114.358 |

| 21.05.2021 | 114.356 |

| 20.05.2021 | 114.449 |

| 19.05.2021 | 114.714 |

| 18.05.2021 | 114.639 |

| 15.05.2021 | 114.989 |

| 14.05.2021 | 115.198 |

| 13.05.2021 | 114.933 |

| 12.05.2021 | 115.381 |

| 08.05.2021 | 114.78 |

| 07.05.2021 | 115.196 |

| 06.05.2021 | 115.643 |

| 05.05.2021 | 116.253 |

| 01.05.2021 | 115.657 |

| 30.04.2021 | 115.036 |

| 29.04.2021 | 115.559 |

| 28.04.2021 | 115.569 |

| 27.04.2021 | 115.24 |

| 24.04.2021 | 115.627 |

| 23.04.2021 | 117.764 |

| 22.04.2021 | 118.264 |

| 21.04.2021 | 117.023 |

| 20.04.2021 | 117.106 |

| 17.04.2021 | 115.833 |

| 16.04.2021 | 117.834 |

| 15.04.2021 | 115.832 |

| 14.04.2021 | 117.969 |

| 13.04.2021 | 118.308 |

| 10.04.2021 | 117.647 |

| 09.04.2021 | 117.728 |

| 08.04.2021 | 118.814 |

| 07.04.2021 | 116.606 |

| 06.04.2021 | 116.65 |

| 03.04.2021 | 115.95 |

| 02.04.2021 | 115.328 |

| 01.04.2021 | 115.385 |

| 31.03.2021 | 115.268 |

| 30.03.2021 | 115.536 |

| 27.03.2021 | 115.83 |

| 26.03.2021 | 116.578 |

| 25.03.2021 | 116.737 |

| 24.03.2021 | 115.756 |

| 23.03.2021 | 114.599 |

| 20.03.2021 | 113.988 |

| 19.03.2021 | 113.282 |

| 18.03.2021 | 112.413 |

| 17.03.2021 | 112.253 |

| 16.03.2021 | 112.612 |

| 13.03.2021 | 113.015 |

| 12.03.2021 | 113.2 |

| 11.03.2021 | 113.691 |

| 10.03.2021 | 113.935 |

| 06.03.2021 | 114.909 |

| 05.03.2021 | 114.074 |

| 04.03.2021 | 113.771 |

| 03.03.2021 | 115.271 |

| 02.03.2021 | 114.599 |

| 27.02.2021 | 115.232 |

| 26.02.2021 | 113.911 |

| 25.02.2021 | 114.304 |

| 21.02.2021 | 114.566 |

| 20.02.2021 | 114.523 |

| 19.02.2021 | 114.004 |

| 18.02.2021 | 114.222 |

| 17.02.2021 | 113.483 |

| 16.02.2021 | 113.513 |

| 13.02.2021 | 114.487 |

| 12.02.2021 | 114.208 |

| 11.02.2021 | 114.712 |

| 10.02.2021 | 114.935 |

| 09.02.2021 | 114.981 |

| 06.02.2021 | 115.919 |

| 05.02.2021 | 117.165 |

| 04.02.2021 | 117.813 |

| 03.02.2021 | 117.498 |

| 02.02.2021 | 116.787 |

| 30.01.2021 | 118.024 |

| 29.01.2021 | 117.637 |

| 28.01.2021 | 116.044 |

| 27.01.2021 | 116.797 |

| 26.01.2021 | 115.575 |

| 23.01.2021 | 114.789 |

| 22.01.2021 | 113.496 |

| 21.01.2021 | 113.416 |

| 20.01.2021 | 113.628 |

| 19.01.2021 | 113.907 |

| 16.01.2021 | 113.569 |

| 15.01.2021 | 114.089 |

| 14.01.2021 | 113.728 |

| 13.01.2021 | 114.83 |

| 12.01.2021 | 115.082 |

| 01.01.2021 | 112.956 |

| 31.12.2020 | 113.119 |

| 30.12.2020 | 112.787 |

| 29.12.2020 | 112.742 |

| 26.12.2020 | 112.973 |

| 25.12.2020 | 114.582 |

| 24.12.2020 | 115.41 |

| 23.12.2020 | 115.075 |

| 22.12.2020 | 114.015 |

| 19.12.2020 | 112.069 |

| 18.12.2020 | 111.693 |

| 17.12.2020 | 112.31 |

| 16.12.2020 | 112.219 |

| 15.12.2020 | 111.557 |

| 12.12.2020 | 111.778 |

| 11.12.2020 | 112.578 |

| 10.12.2020 | 112.126 |

| 09.12.2020 | 112.752 |

| 08.12.2020 | 113.566 |

| 05.12.2020 | 113.698 |

| 04.12.2020 | 114.651 |

| 03.12.2020 | 115.13 |

| 02.12.2020 | 116.138 |

| 01.12.2020 | 115.754 |

| 28.11.2020 | 115.245 |

| 27.11.2020 | 114.803 |

| 26.11.2020 | 114.714 |

| 25.11.2020 | 115.257 |

| 24.11.2020 | 115.326 |

| 21.11.2020 | 115.66 |

| 20.11.2020 | 115.807 |

| 19.11.2020 | 116.037 |

| 18.11.2020 | 116.269 |

| 17.11.2020 | 116.937 |

| 14.11.2020 | 116.893 |

| 13.11.2020 | 116.307 |

| 12.11.2020 | 115.124 |

| 11.11.2020 | 115.689 |

| 10.11.2020 | 117.11 |

| 07.11.2020 | 116.589 |

| 06.11.2020 | 118.146 |

| 04.11.2020 | 119.623 |

| 03.11.2020 | 120.259 |

| 31.10.2020 | 118.403 |

| 30.10.2020 | 117.523 |

| 29.10.2020 | 115.515 |

| 28.10.2020 | 113.841 |

| 27.10.2020 | 114.11 |

| 24.10.2020 | 114.662 |

| 23.10.2020 | 115.577 |

| 22.10.2020 | 115.7 |

| 21.10.2020 | 116.424 |

| 20.10.2020 | 116.409 |

| 17.10.2020 | 116.398 |

| 16.10.2020 | 115.803 |

| 15.10.2020 | 114.675 |

| 14.10.2020 | 114.672 |

| 13.10.2020 | 114.304 |

| 10.10.2020 | 114.728 |

| 09.10.2020 | 114.737 |

| 08.10.2020 | 114.997 |

| 07.10.2020 | 115.615 |

| 06.10.2020 | 115.05 |

| 03.10.2020 | 114.996 |

| 02.10.2020 | 113.797 |

| 01.10.2020 | 115.671 |

| 30.09.2020 | 116.798 |

| 29.09.2020 | 115.345 |

| 26.09.2020 | 112.65 |

| 25.09.2020 | 113.091 |

| 24.09.2020 | 112.423 |

| 23.09.2020 | 112.348 |

| 22.09.2020 | 112.268 |

| 19.09.2020 | 111.007 |

| 18.09.2020 | 111.13 |

| 17.09.2020 | 110.812 |

| 16.09.2020 | 110.928 |

| 15.09.2020 | 109.498 |

| 12.09.2020 | 109.544 |

| 11.09.2020 | 110.427 |

| 10.09.2020 | 111.118 |

| 09.09.2020 | 111.183 |

| 08.09.2020 | 110.664 |

| 05.09.2020 | 109.922 |

| 04.09.2020 | 110.401 |

| 03.09.2020 | 108.205 |

| 02.09.2020 | 107.842 |

| 01.09.2020 | 107.682 |

| 29.08.2020 | 108.713 |

| 28.08.2020 | 109.355 |

| 27.08.2020 | 109.601 |

| 26.08.2020 | 107.808 |

| 25.08.2020 | 107.661 |

| 22.08.2020 | 107.174 |

| 21.08.2020 | 106.57 |

| 20.08.2020 | 105.982 |

| 19.08.2020 | 106.024 |

| 18.08.2020 | 105.11 |

| 15.08.2020 | 105.34 |

| 14.08.2020 | 105.994 |

| 13.08.2020 | 105.439 |

| 12.08.2020 | 105.234 |

| 11.08.2020 | 105.848 |

| 08.08.2020 | 105.798 |

| 07.08.2020 | 105.176 |

| 06.08.2020 | 105.396 |

| 05.08.2020 | 105.091 |

| 04.08.2020 | 106.278 |

| 01.08.2020 | 105.204 |

| 31.07.2020 | 104.724 |

| 30.07.2020 | 103.191 |

| 29.07.2020 | 102.631 |

| 28.07.2020 | 102.244 |

| 25.07.2020 | 102.033 |

| 24.07.2020 | 101.424 |

| 23.07.2020 | 101.055 |

| 22.07.2020 | 101.475 |

| 21.07.2020 | 102.95 |

| 18.07.2020 | 102.443 |

| 17.07.2020 | 101.789 |

| 16.07.2020 | 101.292 |

| 15.07.2020 | 101.334 |

| 14.07.2020 | 101.016 |

| 11.07.2020 | 101.664 |

| 10.07.2020 | 101.451 |

| 09.07.2020 | 101.505 |

| 08.07.2020 | 102.742 |

| 07.07.2020 | 101.424 |

| 04.07.2020 | 99.7522 |

| 03.07.2020 | 99.8016 |

| 02.07.2020 | 99.7568 |

| 01.07.2020 | 99.5806 |

| 30.06.2020 | 98.8278 |

| 27.06.2020 | 97.6638 |

| 26.06.2020 | 98.1408 |

| 25.06.2020 | 97.3025 |

| 24.06.2020 | 97.4292 |

| 23.06.2020 | 98.178 |

| 20.06.2020 | 98.2898 |

| 19.06.2020 | 98.3166 |

| 18.06.2020 | 98.0639 |

| 17.06.2020 | 98.4911 |

| 16.06.2020 | 99.2248 |

| 12.06.2020 | 97.7624 |

| 11.06.2020 | 97.1023 |

| 10.06.2020 | 96.8802 |

| 09.06.2020 | 96.549 |

| 06.06.2020 | 96.8447 |

| 05.06.2020 | 96.9068 |

| 04.06.2020 | 96.1038 |

| 03.06.2020 | 97.0117 |

| 02.06.2020 | 97.7322 |

| 30.05.2020 | 99.0079 |

| 29.05.2020 | 99.3089 |

| 28.05.2020 | 99.3312 |

| 27.05.2020 | 99.6942 |

| 26.05.2020 | 100.28 |

| The table is too large to display on the screen. | |

| Year | Average price, rub. |

| 2021 | 115.012 |

| 2020 | 105.419 |

| 2019 | 92.8566 |

| 2018 | 95.6571 |

| 2017 | 87.0588 |

| 2016 | 97.7887 |

| 2015 | 99.3612 |

| 2014 | 58.3993 |

| 2013 | 52.6288 |

| 2012 | 49.6161 |

| 2011 | 44.6965 |

| 2010 | 45.0421 |

| 2009 | 45.9251 |

| 2008 | 34.2817 |

| 2007 | 33.6646 |

| 2006 | 33.6938 |

| 2005 | 34.2923 |

| 2004 | 35.0196 |

| 2003 | 37.0191 |

| 2002 | 37.9046 |

| 2001 | 35.16 |

| 2000 | 33.775 |

| 1999 | 29.265 |

| 1998 | 7.46645 |

| 1997 | 6 967.8 |

| 1996 | 5 889.75 |

| 1995 | 549.93 |

| 1994 | 234.0 |

| 1993 | 176.3 |

| 1992 | 9.93 |

What strategies should you use to trade Yuan?

In my opinion, it seems interesting to develop a special strategy exclusively for short positions. Where only sell trades are opened and left for several days. Naturally, they open for a reason, but according to the trading system. But for this you need to work through everything. The option is interesting because the swap for short positions is very large. The price will move quite a bit, but if you hold the position for a long time, you will be in the black.

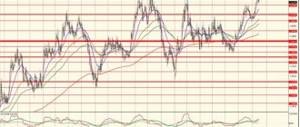

Also, a rather interesting option is to develop a breakout strategy for the yuan on hourly charts. When, around midnight GMT, some pending orders are placed or at the boundaries of channels, after breaking through which we enter the market and take some position. Depending on where the price went. Such situations happen often. Let's mark them with figures on the chart.

For example, when, after a period of calm, before the Asian session, a breakdown occurs and an active increase or decrease in price occurs.

In the picture above I have noted periods of calm in recent days. They just end around midnight GMT, and then there is a breakdown and some kind of movement. It's not always big. For example, in the photo below it is very small:

But it is quite possible to develop a strategy and work through options. Because on some days we can see false breakouts

You can, for example, create a variation not for a breakout of the box, but enter directly after the breakout candle. Place a pending order just above its high, if there is a breakout up, and just above its low, if there is a breakout downwards. And thus insure yourself against false breakouts. Add some more elements of technical analysis. But overall the idea seems very interesting and it is on the surface. So breakout strategies on H1 should work well on this pair.