EUR/GBP News

GV Gold plans to announce IPO next week Russian gold mining company GV Gold plans to announce next week its intention to conduct an initial public offering in Moscow.

March 12, 2021

Stock market

Oil hits 14-month high On Friday, March 5, oil prices jumped more than $1 a barrel, reaching their highest level in nearly 14 months.

March 5, 2021

FOREX

Moscow Exchange seeks to attract Asian investors The Moscow Exchange is seeking to attract Asian investors with extended trading hours and is also betting on increasing the number of retail clients and companies listed on the exchange, a spokesman for Russia's largest exchange said.

February 26, 2021

FOREXStock market

Russian ruble falls ahead of central bank rate decision The growing prospect of new European Union sanctions against Russia has sent the ruble down to ₽90 per euro for the first time in a week ahead of a central bank board meeting that is expected to keep interest rates unchanged.

February 12, 2021

FOREX

All news

Eurozone economy

The Eurozone ranks second in the world in terms of GDP share, imports and exports of goods. The economic model uniting 27 countries has a developed internal market and a common economic, international and monetary policy.

The EU area covers 27 countries, 19 of which have a common currency, but monetary policy is determined by a supranational body, the European Central Bank. The euro is the second largest global currency in terms of Forex trading volume (after the US dollar).

Popular couples

| Tool | Bid | Ask | Opening price | Changing pips | Change % | Time |

| AUD/USD | 0.74041 | 0.74058 | 0.73424 | +0.00617 | +0.833% | 05:54:05 |

| EUR/CAD | 1.53842 | 1.53849 | 1.5149 | +0.02352 | +1.529% | 05:54:06 |

| EUR/CHF | 1.16392 | 1.16418 | 0 | +1.16392 | 0% | 18:08:22 |

| EUR/GBP | 0.88482 | 0.88485 | 0.90563 | -0.02081 | -2.352% | 05:54:07 |

| EUR/JPY | 130.464 | 130.482 | 129.605 | +0.859 | +0.658% | 05:54:08 |

| EUR/RUB | 72.4856 | 72.5124 | 78.1597 | -5.6741 | -7.828% | 05:54:09 |

| EUR/USD | 1.17248 | 1.1725 | 1.16452 | +0.00796 | +0.679% | 05:54:09 |

| GBP/CHF | 1.31541 | 1.3158 | 0 | +1.31541 | 0% | 18:08:22 |

| GBP/JPY | 147.456 | 147.458 | 143.104 | +4.352 | +2.951% | 05:54:10 |

| GBP/USD | 1.32507 | 1.32511 | 1.28586 | +0.03921 | +2.959% | 05:54:10 |

| NZD/USD | 0.67931 | 0.67966 | 0.67 | +0.00931 | +1.371% | 05:54:11 |

| USD/CAD | 1.31218 | 1.31223 | 1.30092 | +0.01126 | +0.858% | 05:54:12 |

| USD/JPY | 111.277 | 111.278 | 111.271 | +0.006 | +0.005% | 05:54:13 |

| USD/RUB | 61.8327 | 61.8377 | 67.1275 | -5.2948 | -8.563% | 05:54:13 |

The latest changes in the quotation of the EUR/GBP currency pair on the Forex market are presented on the Analytics Online website.

Watch EUR/GBP fluctuations online and don't miss out on profit opportunities by bookmarking the page in your browser.

Hunting for traders' stops in the majors

Just as theater begins with a coat rack, trading on the Forex market begins with the choice of tools. With a high degree of probability, it can be said that the EURUSD pair is the most popular among traders. The rest of the rankings are occupied by other major pairs, but the dollar is present in each of them.

The reasons for this choice are liquidity, the best trading conditions with brokers, and even the technicality or predictability of trends compared to other instruments. The irony of the last statement is that any pair containing the USD ticker is an unpredictable bomb for the trader’s stops.

Many analysts and brokers prefer to hush up the fact that a trader who has entered a dollar position is already to some extent dependent on Donald Trump’s Twitter. The American president has proven in 2021 and 2021 that his messages can lead to unforeseen fluctuations that can even reverse trends. On our website there is an article devoted to how the not always considered words of an American leader can affect the exchange rate of a currency pair.

Liquidity is another pitfall for beginners and professional traders, especially day traders. It is ensured by the presence of large banks that spend money hunting for stops or manipulating the rates of major currency pairs in the Forex market.

The level of pending orders is information that is publicly available or sold by brokers. Large players put on the market a volume of currency capable of collecting a book of orders in order to reach the level of stop loss accumulation. Activation of a mass of such orders serves as a catalyst for a manipulative trend.

The hunt for stop losses does not lend itself to any technical analysis forecast, as does the desire of large banks to end the session with a certain rate of dollar pairs. Previously, such proposals seemed fantastic until an investigation was carried out into fraud with the LIBOR rate. Regulators discovered related contract trading on the Forex currency market. Those who are not in the know can read a selection of articles in the Vedomosti newspaper.

How to protect yourself from this? Stop trading in pairs with the USD prefix. In all of the above cases, the manipulators used EURUSD or other liquid dollar pairs. The choice is obvious - trade crosses.

Pulse

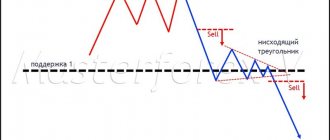

Wave analysis, with the right approach, has great prognostic significance. Let's take the wedge above as an example. The wedge is always the first wave of the impulse and after its formation, a significant price movement begins in the direction of the formed wedge. This is precisely the development of events that we see in the graph below. The intersection of waves is also clearly visible here.

Corrections to global growth EURGBP

From 2010 to 2021, the EURGBP chart shows a significant correction zone, which is due to the consequences of the global crisis of 2008. Like many developed countries, the ECB launched quantitative easing programs (QE): purchasing government bonds and distributing preferential loans through repo markets. This is believed to have led to a slowdown in economic growth, necessitating a rate cut.

The Bank of England faced the same problem, but the decline in consumer price growth in the UK was several percentage points higher than in the EU, as can be seen from the six-year summary statistics.

The downward trend of EURGBP acquired a stable direction in the period 2013-2016. At this time, the inflation imbalance was added to by the reduction of rates by the ECB, while this indicator was kept at a stable level by the Bank of England.

Now the level of Eurozone rates has gone into negative territory, the Bank of England has reduced this parameter to virtually zero, which makes it impossible to make money on the carry trade. Our website has a special functionality for this calculation – “Swaps Calculator”.

As can be seen from the resulting table, leading brokers will charge EURGBP overnight when transferring positions:

- For longs - negative swap;

- There is a zero swap for shorts.

Simple Zigzag

A simple zigzag is the main “material” for complex corrective forms. For example, a double zigzag consists of two, a triple zigzag, respectively, of three simple zigzags. These complex corrective patterns are designed to deepen the correction after a very powerful impulse movement. In such cases, a simple zigzag is not enough. An example of a double zigzag is also shown on the chart with an impulse; here a double zigzag formed in the 4th wave and is indicated by the letters W, X, Y.

Complex correction models also include horizontal and oblique triangles. An example of a horizontal triangle is shown below. The peculiarity of this model is that it is the penultimate wave in the impulse, that is, it is always the 4th wave of the impulse, and after its formation the final stage of the impulse movement will begin, the trend change is already close.

UK economy

The UK ranks 10th in world exports and 11th in world imports of goods. The main income in foreign trade comes from cars, in second place are medical products, and the third item is oil and gold.

Unlike the Eurozone and many other countries, the monetary policy of the Regulator - the Bank of England (BoE) - is coordinated with the UK government and parliament. Meetings on the rate are held by the Monetary Policy Committee; its members are not employees of the Central Bank, which is represented there only by the head of the BoE.

What is the best time to trade the EURGBP pair?

According to our currency volatility service, you can observe an active trading phase in the European session. A unique property of EURGBP is a decrease in trading activity in the American session, which is explained by the absence of USD in the instrument.

A day trader can afford not to sit around waiting for the Fed minutes to be released and not to increase the stop loss before the NFP release.

How exactly to trade and what strategies to use?

The EURGBP pair is little dependent on American news, which is reflected in the lowest ATR among highly liquid instruments. This means a much lower percentage of stops getting hit due to unexpected volatility spikes.

It will be convenient for a trader to use classic trend strategies with the placement and adjustment of the size of stops using the ATR indicator, which allows taking into account the growing range of candles within the day. The risk of a large loss is reduced by a short period of active trading, the reasons for which are described above.

- Price Action, support/resistance levels, trend lines and other elements of classical technical analysis also work;

- There is no point in going below H1 due to low volatility;

- Despite minor movements overall, this currency pair may have some nasty spikes, which is worth taking into account when setting stops.

Night scalping

The EURGBP cross-pair, due to the lack of a strong reaction to the American session and relatively low volatility, has advantages over other pairs in the “night scalping” strategy. As has already been shown above, the pair is inactive from 19-00 to 9-00 - this period is three times longer than that of Asian currencies traditional for night trading.

Unlike the "Asians", EURGBP has no problems with news related to the Central Bank of Japan or the People's Bank of China. A trader can “calmly” determine the boundaries of a flat in order to sell near resistance or buy at support.

If it is difficult for a trader to trade manually, there are articles on our website that describe robots for night scalping both with the Martingale option and without position averaging. A separate topic describes the methodology for programming your own advisor for night trading.

Traffic from 10:00 to 19:00

As we found out above, the most active trading time for EURGBP is from 10 to 19 Moscow time. And if you open the hourly chart of this pair, you will see that the movement is most often unidirectional. That is, having taken the right side of the transaction, you can safely hold it until the evening or set a take profit of 70 old points (average daily volatility of EURGBP at the time of writing).

Unfortunately, the first impulse at 9~10 am does not always occur in the true direction of the subsequent movement; there are days with false breakouts of the night range:

A later entry, for example, at 12 or 1 pm, when a false breakout has already occurred and the pair has decided on the direction of the day, will help to partially weed out such signals.

In any case, the strategy can be interesting, it is worth thinking in this direction.

Trends in D1 after Brexit

Take a look at the daily D1 chart of EURGBP.

What do you see? After Brexit, the pair gives very clear and understandable trends. Earn money - I don’t want to. You can even open good trades using a simple moving average.

The graph is literally “just like in the textbooks.” It is unknown how long such a “freebie” will last. Perhaps a couple of years, maybe longer. But while there is such an easy opportunity to make money, why not pay attention to it?