Euro exchange rate forecast for tomorrow and the next few days of the month.

Updated 05/26/2021 16:20

What is the Euro exchange rate forecast for tomorrow?

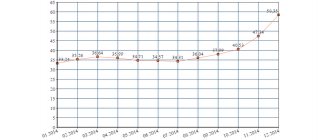

The Euro exchange rate forecast for tomorrow is 90.65 rubles, the minimum rate is 89.38, and the maximum is 91.92 rubles. The current exchange rate is Euro 90.05. Today the rate is down by 0.14% compared to yesterday’s close of the day at 90.18.

List of all forecasts.

Will the Euro rise or fall in a week?

Euro exchange rate forecast in a week 90.23 rubles, minimum 88.97, maximum 91.49 rubles. Thus, over the week the Euro exchange rate will increase by 0.18 rubles. relative to the current exchange rate of 90.05 rubles. For more detailed forecast by day for the week, see the table below.

What is the Euro exchange rate forecast for May?

Euro exchange rate forecast for May 87.88-92.01, at the end of May 90.74 rubles. At the beginning of May, the Euro exchange rate was 90.40, i.e. the change for the month will be +0.4%.

What Euro rate is forecast for June?

Euro exchange rate forecast for June - 91.31 rubles. at the end of June, the minimum rate during the month is 86.40, the maximum is 92.59. Monthly change +0.6%.

Dollar-Tenge exchange rate forecast for May, June and July 2021.

Euro exchange rate online and chart now.

Euro: a project that can still grow! Characteristics and history of the euro

The bank code of the famous currency is EUR and it applies to almost all of Europe. Today, you can buy and sell this currency at exchange offices around the world. About 340 million inhabitants of the “Old World” are included in the money circulation zone. There is more than 1 trillion euros in cash circulation, and this money supply continues to grow. The European currency has surpassed the US dollar in absolute number of banknotes.

The euro regulatory system is determined by common institutions for the entire EU. Regulatory organizations include:

- European System of Central Banks (ESCB);

- European Central Bank (ECB, governing body);

- National central banks of the EU countries (Interesting: The most reliable Russian banks according to Forbes rating).

The share of the euro in global turnover is 32% (dollar 42%, third place yuan - 1.47%).

The history of the euro and its name

The history of the euro begins with the creation of a “name”. The author of the elegant and succinct name of the new currency was the Belgian, Esperantist Germain Pirlo. The name itself on banknotes is usually indicated in the Latin alphabet (“euro”) and the Greek alphabet (Ευρώ). The peculiarity of the phonetics of the name is that it does not have a rigid framework and is determined individually in each language. The only condition is that the pronunciation of the name of the currency is identical to the pronunciation of the word “Europe” in each language. So the authors emphasized the unity of all countries. The history of the euro currency is based on its name.

Coins and banknotes

Like many monetary units of the world, the euro has banknotes and coins. The gradation is standard: 1 euro = 100 cents. All coins are created according to a single template: the front side (obverse) is the denomination against the background of the outline of Europe, the back side (reverse) is national images that determine the country of minting of the coin. A uniform design has been developed for the banknotes, regardless of the country of origin. Banknote denomination: 5, 10, 20, 50, 100, 200, 500 euros. The largest denominations (200 and 500) are not issued in all countries.

All coins are suitable for settlements within the eurozone, regardless of where they were minted. The following denominations are in circulation: 1 euro cent, 2, 5, 10, 20, 50 cents, 1 and 2 euros. Depending on national payment traditions, in some countries prices for goods are formed in multiples of 5 in order to avoid the circulation of small coins of 1 and 2 euro cents.

€ Symbol: History of the Euro Currency Sign

The symbol of the single European currency, which has become recognizable and famous, according to accepted standards, should be printed in yellow on blue. The combination of colors is at the heart of the design of the symbol, along with geometric shapes and lines. The choice of symbol took place in several stages. First, the commission selected 10 options from a huge number of proposals. Then three options were selected by voting among EU residents. The winner was determined by the European Commission.

According to official data, the winning project was developed by a group of 4 experts. The names of the authors are not disclosed, which prompted disputes over authorship. For example, Arthur Eisenmanger (former lead designer of the EEC) claims to be the creator of the symbol, which was originally used as a common sign for Europe. The history of the emergence of the euro has quite a few hidden pages.

When did the euro begin to function?

Euros have been around for a relatively long time, and it feels much longer. For non-cash transactions, the currency has been used since January 1, 1999. Exactly 3 years later it began to circulate in cash. For the first 2 months of the currency’s existence (until February 28, 2002), new signs circulated in the eurozone countries in parallel with the national currency.

The history of the euro as a currency stretches over time. So its introduction occurs constantly, which is expressed in the entry of new countries into the zone or the refusal of currency in countries existing in the zone. Read also: How to open an account in a foreign bank and why are accounts in the USA more reliable than in Switzerland?

In what year and when did the euro appear as a single and only currency?

On January 1, 2002, the currency became a single one, and from March 1, 2002, the only one in the eurozone.

In which countries is the official currency the euro?

As of 2021, the euro circulates throughout the EU, but is recognized as the official currency only in 19 countries: Austria, Belgium, Germany, Greece, Ireland, Spain, Italy, Cyprus, Latvia, Lithuania, Luxembourg, Malta, the Netherlands, Portugal, Slovenia, Slovakia , Finland, France, Estonia. And 9 more countries (7 of which are in Europe) have the euro as their official currency, but they cannot influence the banking aspects of circulation.

Euro sign location and separator type in different languages. Individual features of the one euro coin

Freedom of currency is expressed in many aspects. The location of the currency symbol may vary depending on the country. Each state reserves the right to write the amount and choose the separator. In the vast majority of cases, countries retained the spelling format that their national currency had - this makes it easier to get used to the new money.

According to ISO standards, the currency symbol should be written after the numbers, but about half of the countries left it in front of the amount. The basis of monetary circulation is the 1 euro coin. The obverse of the coin varies and is determined by the place of minting. The reverse is decorated with a general map of Europe. The coin is made of 2 metals (bimetallic) - 75% copper and 25% nickel. There are currently about 7 billion of these coins in circulation.

Euro exchange rate forecast for each day in the table

| date | Day | Min | Well | Max |

| 27.05 | even | 89.38 | 90.65 | 91.92 |

| 28.05 | heels | 89.40 | 90.67 | 91.94 |

| 31.05 | Mon | 89.47 | 90.74 | 92.01 |

| 01.06 | WTO | 89.32 | 90.59 | 91.86 |

| 02.06 | Wednesday | 88.97 | 90.23 | 91.49 |

| 03.06 | even | 89.30 | 90.57 | 91.84 |

| 04.06 | heels | 89.20 | 90.47 | 91.74 |

| 07.06 | Mon | 88.94 | 90.20 | 91.46 |

| 08.06 | WTO | 88.94 | 90.20 | 91.46 |

| 09.06 | Wednesday | 88.97 | 90.23 | 91.49 |

| 10.06 | even | 88.90 | 90.16 | 91.42 |

| 11.06 | heels | 89.33 | 90.60 | 91.87 |

| 14.06 | Mon | 89.47 | 90.74 | 92.01 |

| 15.06 | WTO | 89.26 | 90.53 | 91.80 |

| 16.06 | Wednesday | 89.20 | 90.47 | 91.74 |

| 17.06 | even | 88.84 | 90.10 | 91.36 |

| 18.06 | heels | 88.67 | 89.93 | 91.19 |

| 21.06 | Mon | 88.22 | 89.47 | 90.72 |

| 22.06 | WTO | 88.85 | 90.11 | 91.37 |

| 23.06 | Wednesday | 88.52 | 89.78 | 91.04 |

| 24.06 | even | 88.47 | 89.73 | 90.99 |

| 25.06 | heels | 88.65 | 89.91 | 91.17 |

| 28.06 | Mon | 88.35 | 89.60 | 90.85 |

| 29.06 | WTO | 86.40 | 87.63 | 88.86 |

What is the Euro forecast for July?

The Euro exchange rate forecast for July is in the range of 91.31-94.45, at the end of July 93.15 rubles. Monthly change +2.0%.

What is the Euro rate forecast for the rest of 2021?

Euro exchange rate forecast for 2021 : the rate will trade in the range of 86.40-94.45. Exchange rate forecast for the end of December 2021 89.27 rubles.

What will the Euro exchange rate be in 2022?

Euro exchange rate forecast for 2022 : exchange rate at the end of December 2022 - 104.56 rubles. And throughout the year the rate will fluctuate in the range of 89.27-109.13.

Where is the euro used?

The euro is the official currency of 19 EU countries (Germany, France, Italy, Spain, Portugal, Austria, Belgium, the Netherlands, Finland, Greece, Slovenia, Slovakia, Lithuania, Latvia, Estonia, Ireland, Luxembourg, Cyprus, Malta).

It is considered legal tender outside the European Union: in Andorra, Vatican City, Kosovo, Monaco, San Marino, Montenegro. However, representatives of these countries do not have the right to influence the policy of the European Central Bank.

Also in use in some overseas territories (among them Guadeloupe, French Guiana, Azores).

The euro as a currency has not been put into circulation in all EU countries. In the UK they remained loyal to the pound sterling, in Denmark - to the Danish krone, and the citizens of Sweden preferred to leave the Swedish krona.

Euro exchange rate forecast for 2021, 2022 and 2023

| Month | Min-Max | End | Total,% | |

| 2021 | ||||

| May | 87.88-92.01 | 90.74 | +0.4% | |

| Jun | 86.40-92.59 | 91.31 | +1.0% | |

| Jul | 91.31-94.45 | 93.15 | +3.0% | |

| Aug | 90.49-93.15 | 91.77 | +1.5% | |

| Sep | 88.54-91.77 | 89.80 | -0.7% | |

| Oct | 89.80-92.47 | 91.19 | +0.9% | |

| But I | 89.34-91.88 | 90.61 | +0.2% | |

| Dec | 88.02-90.61 | 89.27 | -1.3% | |

| 2022 | ||||

| Jan | 89.27-91.94 | 90.67 | +0.3% | |

| Feb | 90.67-94.29 | 92.99 | +2.9% | |

| Mar | 92.86-95.50 | 94.18 | +4.2% | |

| Apr | 94.18-103.13 | 101.71 | +12.5% | |

| May | 101.71-106.22 | 104.75 | +15.9% | |

| Jun | 98.57-104.75 | 99.97 | +10.6% | |

| Jul | 92.55-99.97 | 93.86 | +3.8% | |

| Aug | 93.86-102.79 | 101.37 | +12.1% | |

| Sep | 101.37-106.80 | 105.33 | +16.5% | |

| Oct | 105.33-109.13 | 107.62 | +19.0% | |

| But I | 103.90-107.62 | 105.38 | +16.6% | |

| Dec | 103.10-106.02 | 104.56 | +15.7% | |

| 2023 | ||||

| Jan | 103.81-106.75 | 105.28 | +16.5% | |

| Feb | 100.57-105.28 | 102.00 | +12.8% | |

| Mar | 102.00-107.60 | 106.11 | +17.4% | |

| Apr | 102.74-106.11 | 104.20 | +15.3% | |

| May | 100.51-104.20 | 101.94 | +12.8% | |

In a week, the Euro rate will rise to 90.23, and in two weeks the rate will be 90.23 rubles. Euro exchange rate forecast for tomorrow is 90.65 rubles, for the day after tomorrow 90.67. The rate over the next month will trade in the range of 87.63 - 90.74 rubles, with a slight downward trend towards 87.63 rubles. from the current level of 90.05.

By the end of this May, the Euro exchange rate on the stock exchange is expected to be 90.74 rubles, by the end of June 91.31, and on the last day of July 93.15 rubles. In the next six months, the Euro exchange rate will increase - in November 2021 we expect 90.61 rubles. In the future, the rate will rise and therefore in a year the target will be 104.75 rubles.

We expect the exchange rate to rise in the next two years. Within two years, the minimum rate will drop to 89.27, and the highest rate will touch 124.69 rubles. In two years, in May 2023, the predicted exchange rate will be 101.94 rubles.

The forecast is updated daily.

Sberbank shares forecast 2021, 2022

Bitcoin rate forecast 2021, 2022

History of the origin and introduction of the euro

The parallel circulation of national currencies and the newly introduced euro greatly simplified the introduction of the euro into circulation. It was possible to make a large-scale introduction of new banknotes in several countries, which in itself is a significant achievement. Those countries that became part of the eurozone after 2002 received 2 weeks of parallel treatment.

The history of the euro, as well as the history of its implementation, is a financial symbiosis of many economies. This led to close unification of the banking systems of many countries. We can say for sure that this has never happened in history. The history of the emergence of the euro in each country was strictly regulated by relevant legislative acts and represented a harmonious process. A large number of specialists worked on the history of the creation of the euro in each individual state.

The origins of the euro as a reserve currency

The entire history of the emergence of the euro is imbued with one question - whether this currency will be able to move the dollar from world dominance. Today it is the second reserve currency in the world. Initially relying on the strong franc and mark, the euro quickly entered the international market and every year more and more companies and investors strive to keep their resources in the single currency of Europe. Read also: Financial and investment instruments for a beginning investor. Warren Buffett's investment rules.

Effects of the creation of the euro and the history of currency adoption

The introduction of a new single currency led to many effects, both planned and completely unexpected.

Eliminate exchange rate risks

The euro made it possible to create a single financial field where each participating country could freely exchange funds, avoiding the risks that arose due to differences in exchange rates between countries. Working with another country's money, importing/exporting, investing abroad - these types of activities have huge potential, but had many difficulties when each EU country had its own money. The introduction of the euro eliminated these problems.

Elimination of costs associated with conversion transactions

One currency for all countries eliminated such expense items as conversion services. When transferring one currency to another, the bank necessarily charges a certain percentage for the transaction (see How to choose a bank to open an account?). If settlements take place between large companies and states, then the amount is more than significant. The introduction of the euro removed such problems.

More resilient financial markets

The history of the origin of the euro is the history of the formation of stability in a single economic space. The euro had a significant impact on the formation of stable market relations.

Price parity

Thanks to the introduction of the euro currency, it was possible to level out price ranges throughout Europe. The fact is that previously large-scale foreign exchange transactions could be found on the market based on the difference in exchange rates between countries. That is, the deal was concluded only in order to make a profit due to the difference in rates.

Competitive refinancing

The euro also made a splash on the securities market. Now companies could easily receive shares abroad without fear of losing profits.

Euro as a peg currency

Representatives of the region began to link their national currencies to the euro. This significantly accelerated and simplified the subsequent introduction of currency in new countries.