Currency of income

When considering where to store your savings, we advise you to listen to experts who say that where you receive income is better to keep your money. For example, if you make profits in rubles, there is little point in converting them into dollars. First you will spend money on the initial conversion, then you will pay more when you convert the currency back into rubles.

But it all depends on the situation. For example, if the purpose of savings is to further spend them on the purchase of foreign real estate, it makes sense to open a foreign currency deposit and convert your rubles there. Euros and dollars are currencies that have shown their stability and can be invested in.

When deciding to store money in dollars, euros or another currency, a person must be aware of the risks of currency fluctuations. Sometimes it is impossible to predict how the situation will develop in the future, especially now, when the global financial crisis looms ahead.

If you receive money in rubles and spend it mainly in the same currency, then it is better to keep your savings in rubles, using investment instruments.

Where to invest money to receive income in 2021?

Anton Polishkis, General Director:

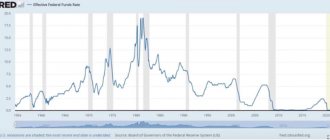

From a macroeconomic point of view, 2021 will most likely be very different from previous years, because we are entering a period of low inflation: for the current year, accumulated inflation is at the level of 2% per annum, and by December 31 it will rise to a maximum of 4%. These are very unusual numbers that have not been seen in recent history. Only the period 2011-2013. was comparable in terms of inflation, which at that time was equal to 6.1-6.6% per annum.

Low inflation means low returns on a wide range of investment instruments, from bank deposits, which can now earn about 7% per annum, to real estate, which is subject to decent taxes and brings from 3-4% per annum net income in the case of residential real estate and up to 6-7% per annum - with commercial. I’ll say right away that to operate with real estate you need to be a fairly qualified investor; this tool is not suitable for a wide audience. Plus, there is a risk of a decline in real estate values until 2021.

From the point of view of a conservative approach, I would give the following recommendation to individuals: it makes sense to buy a dollar at a rate of up to 60 rubles

This approach is based on the fact that the ruble is now close to local highs, and in February new financial sanctions may be adopted in the United States prohibiting investments in Russian OFZs (federal loan bonds - ed.), which will deal a blow to ruble financial instruments. The currency can then be deposited at approximately 1% per annum.

If we ignore the topic of money itself, then we can talk about investing in our own education, advanced training, and even better, in the education of our children. The way such investments are returned in the end surpasses any speculative instruments many times over.

What the experts say

The question of which currency is best to keep savings in practice is not simple; it is impossible to give an unambiguous answer. It depends on the currency in which income is received, in which expenses are incurred, on the volume of savings, and on the period of savings.

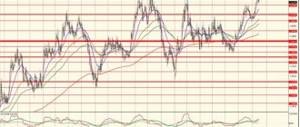

Now it is difficult to predict how the rates, which have recently been unstable, will behave. External circumstances can “scare away” a stable situation, as was the case at the beginning of 2021. Due to oil transactions, the exchange rate of the ruble against the euro and dollars has fallen significantly. This is an external circumstance that was difficult to predict.

As a result, those who previously decided to store money in euros or dollars benefited significantly. The exchange rate of the same dollar increased from 62-63 rubles to 75-80. The capital of Russians' foreign currency investments has grown significantly; some have decided to convert funds back into rubles while the exchange rate allows this to be done with a good profit.

Situation as of April 21, 2021:

But still, when analyzing which currency to store your savings in, you should start from the period for which the investment is made:

- for the short term. For example, you need to save up for a vacation or to buy a car. It is better to opt for rubles. Inflation will not have time to eat up capital, plus there will be no losses on conversion. In addition, in the short term, significant changes in the exchange rate can be observed, which can reduce capital;

- medium term perspective. If you do not plan to touch your capital for the next 3-5 years, consider the option of saving money in foreign currency. Experts advise choosing dollars, since today it is the most stable currency that is always growing;

- long-term perspective. If investments are made for a long period exceeding 5-7 years, financial experts advise using diversification, that is, “putting your eggs in different baskets,” making the capital multi-currency.

If you don’t have enough experience in this area, you can contact investment consultants who will give you the right vector depending on the situation.

Caution doesn't hurt

Is it possible to insure yourself against the risks of using cash dollars on a large scale? To some extent, yes, but please don’t expect universal advice here. They do not exist and cannot exist! This method of storing capital is unnatural in the modern world and must be abandoned step by step. This is difficult and painstaking work, just like effective management of your personal capital in general.

Financial advisors often encounter wealthy people who hold large amounts of cash in dollars or euros. Many of them are simply forced to do this. Here is a typical example: for one reason or another, a person closed his foreign accounts and transferred the money to his homeland. Then he distributes them among large banks, invests something in real estate and deposits a significant part in cash in safes and/or safe deposit boxes. This is his emergency fund, money for a rainy day. And here, it would seem, our nameless hero has nothing to reproach.

However, this is not quite true. The fundamental mistake is that, due to circumstances, a person concentrated capital in one country. Even if you had to transfer all your money to Russia, this does not mean giving up the search for new opportunities for country diversification. There are such ways, although they require a lot of effort in the current situation.

There are cases when an average businessman fundamentally does not keep his savings in the bank, preferring real banknotes. I will honestly say that, despite all the inconveniences of such storage of money and possible problems, these people rarely succumb to the conviction that it is better to do things differently. Many of them have been burned more than once in Russian banks and do not want to experiment anymore. In such cases, we can only recommend diversifying your investments a little, meaning reliable bonds, precious metals, works of art and other similar assets.

Particular attention should be paid to people who are saving money to educate their children abroad, buy real estate for them, etc. After 3-5 years, they may find themselves in a difficult situation when it will be almost impossible to use cash dollars or euros for these purposes. There are several acceptable and well-known recipes that can be used in such a situation: for example, open savings accounts in Russian state banks or find something similar abroad. As an option, I would not rule out purchasing special policies for children from European insurance companies. For large amounts, a certain combination of these approaches is possible.

Due to current circumstances, it is now easier to open an account with a reliable brokerage company than with a foreign bank. True, this is not entirely correct from the point of view of the classical theory of organizing personal finance. But life makes its own adjustments for Russians, many of whom have no access to banks. True, one significant caveat is needed here. A brokerage account for savings purposes for children must be opened and managed exclusively under the wing of a smart and reliable professional. Otherwise, it is better to forget about this opportunity.

Overall, if you are an active bet on cash dollars in your life, then you have something to think about, and it is better to do it now, before the threats described here come knocking on your door.

Currency distribution

Most often, questions about storing money are asked by people who want to preserve capital in the long term. And most experts say that in this case, storing money in foreign currency should be carried out in parallel with investing in rubles. That is, choose several investment options at once.

Approximate spread of the savings basket:

- 50% - in dollars. It is recommended to keep most of your savings in American dollars, because today it is the most stable currency. Central Banks of various countries store capital in it because of stability and low inflation;

- 25% - in euros. Also a stable currency. But in light of the exit of some countries from the European Union and various unrest in it, everything may change. So far, the exchange rate is stable, but it is still better to allocate a small part of your savings to the euro;

- 25% - in rubles. If income comes in rubles, and spending is also done in this currency, it makes sense to leave a quarter of the currency basket in rubles. In addition, when storing in Russia, the rates on ruble deposits are the highest.

Most experts, based on the current situation with the near crisis, recommend holding a third in euros, a third in dollars, and a third in cash rubles.

The 50/25/25 ratio is ideal in a normal, stable world situation. But now, when the pandemic is raging, it is better to divide the basket into three equal parts. It is impossible to give a guaranteed forecast of what will happen to the global foreign exchange market next. If one depreciates, two others will remain, which will support capital.

Currency deposits

Interest on foreign currency deposits has always been inferior to interest on ruble deposits. The weighted average rate on dollar deposits, according to the Central Bank of the Russian Federation, in domestic financial organizations is 1.37%, in euros it is even less - 0.19%.

The most profitable deposit in dollars that AiF.ru was able to find is 3.3% per annum, but with the condition: you must conclude an investment/accumulative life insurance agreement with the bank. With the euro the same conditions, and 1.4% per annum. Without additional costs - maximum 2.6% in dollars, and 1.1% in euros. For comparison: you can now open a deposit in rubles at 9%, and without any additional costs.

However, the share of deposits in foreign currency (in the total volume of deposits - ed.) is steadily growing - in August the figure increased from 21.1% to 21.5%, according to the materials of the Central Bank of the Russian Federation.

As Alexey Okhorzin, director of retail products at Moscow Credit Bank , the benefit of any bank from a foreign currency deposit is determined by the size of the interest margin. Simply put, a financial institution cannot give a depositor more than it earns itself. For the euro, this margin is now extremely low, which is why the rates are such.

Article on the topic: What will happen to the dollar, ruble and euro in October?

Currency forecast “It is not profitable for banks to attract liabilities in euros. This is due to the ultra-soft monetary policy of the European Central Bank (ECB), which is trying to support the economy of the European Union through low rates. The ECB's base rate has been at zero since 2016. And the ECB deposit rate, which is already in negative territory, was recently reduced from minus 0.4% to minus 0.5%,” explains financial investment consultant Jan Melnyczuk.

In addition, there is currently no demand for loans in euros in Russia, and it turns out that banks simply have nowhere to place the attracted euro money. “In the current situation, a financial organization may suffer losses even by maintaining accounts in euros, and not just by paying the minimum interest on the deposit. Therefore, banks either remove deposits in euros from their line of offers, or begin to charge a certain commission for clients placing large amounts in this currency,” notes Melnichuk.

In Europe, the practice of deposits with negative rates is common. In Russia, the issue of introducing such deposits for legal entities is currently being discussed. We emphasize that the measure will not affect private individuals in any way.

When it comes to foreign currency savings, experts recommend deposits in dollars - the rates are higher. “Deposits in dollars look more interesting, the yield on them is about 2% per annum. And from a risk point of view, the potential for a weakening of the euro is higher than that of the currencies of other developed countries. This is due to the slowdown in the growth rates of key European economies - German and French, as well as risks associated with the upcoming exit of Great Britain from the European Union. The ruble will weaken less against the euro than against the American currency,” predicts Yan Melnichuk.

“For ordinary citizens, the benefit from a foreign currency deposit depends not only on the interest rate, but also on the dynamics of the exchange rate of the currency itself. So, even with low rates, it is still better to keep currency in the bank than “under your pillow,” adds Alexey Okhorzin.

However, when opening a foreign currency deposit, one important point must be taken into account. If the bank where you have a deposit in dollars or euros has its license revoked, an insured event will occur and the money will be returned in national currency at the exchange rate on the day the license was revoked. That is, in rubles. It may happen that the dollar or euro exchange rate on the day the license is revoked will be worse than on the day the deposit was opened. In this case, you will lose some money.

Where to store currency

If you decide to store in dollars or euros, it is important to choose quality investment instruments. It is clear that keeping money under your pillow at home is not the best option. These include the risks of theft and the impact of inflation. But, still, if we consider inflation, then for euros and dollars it is small, the losses will not be high.

Where to store dollars:

- currency debit card. If you plan to store money in different baskets, you can choose a multi-currency one. Choose cards that accrue interest on the balance of client funds. This will be a kind of contribution, the funds of which are always at hand;

- investments in shares, securities, bonds. If you have little personal experience in this matter, it is better to resort to the services of investment companies or brokers;

- bank deposits. The most popular option. But here you need to take into account that rates on foreign currency deposits are extremely low. For example, these are the rates on dollar deposits at Sberbank for the second quarter of 2021:

The most important thing is how to save your savings. Choose reliable investment instruments. Yes, the yield on them will be small, not exceeding 1-2% per annum, but this will already protect your foreign currency capital from inflation. The greatest profit comes from investing in securities, but you cannot do without risks. The most reliable are deposits, but the profitability will be minimal.

Alternative ways to store savings

Investing in precious metals . Those who choose this option need to decide whether to buy metal in physical form or purchase an impersonal metal account. At the same time, no one guarantees a constant stable increase in the price of precious metals.

Investing in stocks, bonds . These investments do cover the growth of inflation, but are quite risky. It takes a certain level of financial literacy to invest this way.

Keeping money at home . Plus - the funds are always available, nearby. Disadvantages - the risk that you will simply be robbed.

Buying a property . By the way, investing in real estate is considered the most profitable by about 20% of the working population (based on surveys).

Bank deposit . More than a third of our fellow citizens prefer to make deposits in banks. The confidence of potential clients increased with the introduction of the state deposit insurance system.

How best to save rubles

Most Russians prefer to open bank deposits for this. The rates on such deposits are several times higher than on foreign currency deposits, but in general the yield barely covers inflation. Today, rates of 4-5% on ruble deposits are a normal situation, although once they reached 7-8% and even higher.

Also, when considering where to store rubles, one cannot help but mention investments in securities and shares. Some banks even create special tools and applications for this, for example, Sberbank Investor. At Sberbank you can also use the services of investment consultants who will help you make a smart investment.

Promising industries for investment

When deciding where to invest money profitably in 2021, you should not limit yourself only to the choice of investment instruments. It is equally important to try to analyze the world economy to find promising industries for investment. For example, the media and entertainment industry looks generally favorable. Difficulties and discrepancies arise even when choosing specific companies. Who will be more successful: The Walt Disney Company with its large-budget projects or the American television networks CBS and FOX? If independent analysis of companies is beyond your capabilities, it is better not to risk your money and use the services of professional analysts.

The biotechnology sector is no less attractive to investors, but it has been recommended for several years now, and it has not yet produced explosive growth. On the one hand, there is the possibility of such growth in the next year or two, but on the other hand, such growth may occur in a more distant future or not occur at all. In addition, shares of biotechnology companies are quite volatile, so detailed analysis is not possible here.

Internet giants Facebook and Amazon, the American and European banking sectors (JPMorgan, Bank of America, Credit Agricole), as well as the automotive industry (Ford, General Motors) have potential for good growth.

Questions and answers

In what currency should you keep your money in 2021?

The final recommendation from experts is to divide the basket into three equal parts. These are euros, rubles and dollars. This way, the risks of capital loss will be minimized: there is a global economic crisis ahead, you can expect anything.

Is it profitable to keep money in dollars?

The dollar is the most reliable currency in the world, so investing in it is safe. In addition, the dollar is least susceptible to inflation. It is profitable to hold funds in them in the long term, but in the short term there are risks of losses due to currency fluctuations.

Which bank should I store my currency in?

Many banks allow you to keep money in foreign currency and service deposits in euros and dollars. It is better to choose large and reliable banks for this: Sberbank, Gazprombank, Rosselkhozbank, VTB.

How to store cash dollars?

Storing it under your pillow at home is not the best option, but it is suitable if you are talking about a small amount. If the amount is large and there is a need to store cash, consider placing it in a safe deposit box or safe. Many banks provide this service.

Should you keep your money in euros?

For now, the euro is a stable currency, but everything can change. Experts do not advise holding capital only in euros; it is better to make baskets of them, dollars and rubles. Many Russian banks have stopped servicing deposits in euros altogether.

about the author

Irina Rusanova - higher education at the International East European University in the direction of "Banking". Graduated with honors from the Russian Economic Institute named after G.V. Plekhanov with a major in Finance and Credit. Ten years of experience in leading Russian banks: Alfa-Bank, Renaissance Credit, Home Credit Bank, Delta Credit, ATB, Svyaznoy (closed). He is an analyst and expert of the Brobank service on banking and financial stability. [email protected]

Is this article useful? Not really

Help us find out how much this article helped you. If something is missing or the information is not accurate, please report it below in the comments or write to us by email

Basics of investing

Having decided to increase their wealth, inexperienced investors neglect a number of tips that can lead to a number of negative consequences.

First rule : you can only invest free funds! In no case should you invest in long-term or even short-term projects the money that you currently need. The money with which you ensure the daily needs of yourself and your loved ones.

Second rule : Never invest in long-term projects with borrowed funds whose repayment period is less than the expected period of profit/dividends.

Rule three : Assess the risk of losing your investment. Investments can bring profit or be unprofitable. When assessing risk, you should always adhere to the rule: the higher the planned profit, the higher the risk of losing invested funds in the event of an erroneous calculation, force majeure or fraud on the part of the recipient of the investment (recipient).

Rule four : Never invest all your free money in one project! Investments should be more or less freely distributed between various projects. Some should be investments with low returns, but a high guarantee of return (about 50%), some should be medium-risk investments with high incomes and difficult to calculate risks (about 30%), the smallest part is invested in high-risk projects that promise hyper-profits, but also carry the most high risk of non-return (about 20%).

Comments: 0

Your comment (question) If you have questions about this article, you can tell us. Our team consists of only experienced experts and specialists with specialized education. We will try to help you in this topic:

Author of the article Irina Rusanova

Consultant, author Popovich Anna

Financial author Olga Pikhotskaya

Eurobonds

As an alternative to deposits, Jan Melnychuk recommends Eurobonds as an investment in foreign currency. The average rate on them is 3.55 per annum (this is the yield in dollars).

“The yield in euros now reaches about 3.9% per annum. A wide selection of Eurobonds on the market allows each investor to select the instrument required in terms of risk and return. Government bonds denominated in foreign currency are considered the most reliable. In this case, the guarantor of payment is the state, and not a separate company.

For example, the debt of the Russian Federation can now be purchased on the stock market and receive high interest income, which is not taxed. Regular Eurobonds are taxed, but their yield is higher. For those who want to consider more profitable stories, it is worth taking a closer look at corporate Eurobonds, but even here it is better to choose an issuer with participation in the share capital of the state in which the company was founded and operates,” the expert emphasizes.

Structured Products

This type of investment vehicle is offered by some banks and brokers. In short, the essence of structured products is as follows:

- most of the funds (up to 95%) are invested in reliable instruments such as deposits and OFZs;

- a smaller part of the funds (usually about 5%) goes into risky instruments for a specific investment idea, for example, the growth of Coca-Cola shares or the dollar against the euro.

The risk part is usually options and futures. If the risk part pays off, the investor will receive increased income. If not, then the minimum agreed remuneration, ensured by the growth of the conservative part.

An example of such instruments is structured bonds.

Some structured products are offered in euros. The entry threshold is from several hundred, or even thousands of euros. The commission is high - usually the management company takes from 1% to 5%.

In my opinion, this is a rather complex instrument, especially for novice investors. But for professionals with significant capital, structured products are not so interesting, since they can themselves assemble a portfolio of hedged assets in such a way as to neutralize most of the risks.

Prepare to save money

The strategy for saving money depends on many variables: the amount of money, our plans - whether we are going to invest once or whether we intend to gradually collect the required amount, as well as the calculation of profitability. All methods have one key feature - there is no way to invest with zero risk. Therefore, it is worth preparing to save money.

Create a financial cushion

This is a conditional start for any strategy. When we have a supply of money for two to three months of life, it helps us make decisions more calmly. It is worth keeping such funds either in cash or on deposit in a reliable bank, from where you can always withdraw them.

The owner of the Zalog 24 Group of Companies, a private investor, Jan Marchinsky, does not advise investing for those who do not have a financial cushion. “With a high degree of probability, such a person will sell shares due to need and at a low price,” he clarifies. “We must understand that investing is not a quick and easy get rich, but a long process that requires diligence and discipline.”

Divide the airbag into three currencies

Divide into rubles, dollars and euros. In the future, try to adhere to the same principle. This will help preserve your fixed capital, because if one currency falls sharply, another is likely to rise.

Different experts speak differently about the proportions of the “basket” of savings. For example, the author of the book “Investing is Easy” Vladimir Savenuk recommends keeping a fifth of your capital in rubles, and dividing the rest of the money exactly between dollars and euros. If you think that the ruble can sharply “win back” upward, change the proportions.

Pay off all loans

Loans work well only in one situation - when the income from them exceeds interest payments. For example, if you took out a loan from one bank at 5% per annum and deposited this money in another bank at 10% per annum, without risks and with insurance. Then this is a smart financial decision. As a rule, there are practically no such situations in the world of small money.

If the loan needs to be repaid, and the loan money does not earn anything, it needs to be closed as soon as possible.