European Central Bank through monitoring of Masterforex-V traders

| National Bank through Masterforex-V monitoring | |||||

| 1. | countries | European Union (eurozone) | |||

| 2. | National currency | Euro | |||

| 3. | ISO 4217 code | 978 | |||

| 4. | Forex ticker | EUR | |||

| 5. | Change coin (1/100) | Cent (eurocent) | |||

| 6. | Currency banknotes | 5, 10, 20, 50, 100, 200 euros | |||

| 7. | Coin denomination | 1, 2, 5, 10, 20, 50 cents | |||

| 8. | Central Bank payment system | TARGET2, T2S, TIPS | |||

| 9. | Goals of the Central Bank | Maintaining price stability. Preserving the value of the euro. Implementation of the monetary policy of the Eurosystem – the central banking system of the euro area. Prudential supervision of credit institutions. Ensuring the stability of the financial system within the European Union. | |||

| 10. | Activities of the Central Bank | Issue of funds and securities. Maintenance of budget accounts. Management of gold and foreign exchange reserves. Forex currency regulation and control. Supervision of the activities of banks and regulation of the activities of financial companies: issuance of licenses and other permitting documents for dealing centers. Storing and managing euro area foreign exchange reserves. Promoting the smooth operation of payment systems. Determination of key interest rates. | |||

| 11. | Central Bank governing bodies | The governing bodies of the European Central Bank consist of a Management Board and a Governing Council, which includes members of the Directorate and governors of the national banks of the eurozone countries. | |||

| 12. | Chairman of the Central Bank | The European Central Bank is headed by a chairman who is elected for a term of 8 years. The candidacies of the chairman and his deputy are proposed by the Governing Council and approved by the European Parliament and the heads of state of the eurozone. The current chair of the ECB is Christine Lagarde. | |||

| Financial and economic state of the country, assets and liabilities of the Central Bank | |||||

| 13. | Gold reserves | 505 tons of gold and $913.9 billion (2019) | |||

| 14. | GDP | $18.292 trillion (2019) | |||

| 15. | GDP growth rate | 0,6% (2017), 1,8% (2018), 0,5% (2019) | |||

| 16. | GDP per capita | $44539 (2019) | |||

| 17. | Inflation | 1,52% (2018), 1,33% (2019) | |||

| 18. | External debt | $15.302 trillion. (2016) or 83.2% of GDP | |||

| 19. | Budget | €168.7 billion (2019) | |||

| 20. | Budget deficit | 0.8% of GDP (2019) | |||

| 21. | Average salary in the country | €35,000 per year (2016) | |||

| 22. | Unemployment rate | 6.2% (December 2019) | |||

| Credit policy of the Central Bank | |||||

| 23. | Central Bank key rate | 0% | |||

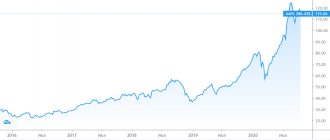

| 24. | Devaluation/revaluation | On the MN timeframe, there has been a long-term bearish trend since July 2008, i.e. weakening of the euro against the dollar. On the w1 chart from January 2021 there is also a bearish flat. | |||

| 25. | Basic deposit rate | 1,5% | |||

| 26. | Largest banks | Barclays, HSBC, Deutsche Bank, Commerzbank, KBC Group, Credit Agricole, BNP Paribas, ING Groep, UniCredit, CaixaBank, Dexia, Bank of Ireland, Bank of Greece, etc. | |||

| 27. | Interest on loans from commercial banks | Mortgage: in Iceland 6.56%, in Hungary 5.66%, in Greece 4.81%, in Poland 3.84%, in Cyprus 3.77%, in Sweden 2.91%, in Norway 2.66%, in France 1.78%, in Switzerland 1.54%, in Finland 1.47%. | |||

| 28. | Interest on deposits in commercial banks | Maximum 1-2% | |||

| 29. | Standard Poor's credit rating | Determined for each eurozone country separately | |||

| 30. | Moody's credit rating | Determined for each eurozone country separately | |||

| 31. | Payment systems | Mastercard, ELV, Sofort and GiroPay, Western Union, Visa, iDEAL, Scrill, Neteller, Google Checkout, Amazon Payments, SEPA, etc. | |||

| Central Bank policy on the country's stock and foreign exchange markets | |||||

| 32. | Stock Exchange | Euronext, FSE (Frankfurt Stock Exchange), BME (Madrid Stock Exchange), WBAG (Vienna Stock Exchange), GPW (Warsaw Stock Exchange), etc. | |||

| 33. | Stock indices | Euronext 100, CAC 40, BEL 20, AEX 25, PSI 20, ISEQ 20, DAX 30, Euro Stoxx 50, MDAX, TecDAX, IBEX 35, IGBM, ATX, WIG 20, WIG, etc. | |||

| 34. | Stock market | more than 1,600 ordinary shares, as well as stock indices, options, bonds, depositary receipts, investment funds, ETFs, currency pairs, warrants, certificates, derivatives, etc. | |||

| 35. | Common shares - blue chips | Siemens, Volkswagen, BASF, BMW, Adidas, Deutsche Bank, Daimler, Erste Bank, ENDESA, AENA, Raiffeisen Bank, AMADEUS, Vienna Insurance Group, Bank Polska Grupa Lotos, mBank, etc. | |||

| 36. | Commodity exchanges | — | |||

| 37. | Commodity futures | Export machinery, pharmaceuticals, benzene, ethylene, methanol, polypropylene, fuel, aircraft, iron ore, steel, pulp and paper products, alcoholic beverages, furniture, import oil, fuel oil, natural gas, liquefied gas, gasoline, machinery, vehicles , pharmaceuticals and other chemicals, gemstones, textiles, aircraft, plastics, silver, gold, aluminum, uranium, copper, lead, tin, cobalt, ships. | |||

| 38. | Investment funds | Dws Top Dividende Fd, Carmignac Patrimoine A Chf Acc Hdg, Anima Sforzesco A and others. | |||

| 39. | Famous traders | Bill Williams, Robert Prechter, Glenn Neely, Larry Williams, John Bollinger, Alexander Elder, William Gunn, Case Cynthia, Nick Leeson, Thomas Demark, Alexander Gerchik, Laura Pedersen, Steve Neeson | |||

| 40. | Famous investors | George Soros, Warren Buffett, Ken Griffin, John Douglas, James Simons, Paul Jones | |||

| 41. | Major Forex currency pairs | EUR USD (euro rate to US dollar), EUR RUB (euro rate to Russian ruble), EUR CHF (euro rate to Swiss franc), EUR JPY (euro rate to Japanese yen), EUR GBP - (euro to British pound), EUR NZD (euro to New Zealand dollar), as well as EUR AUD, EUR CAD, EUR NOK, EUR SEK, EUR PLN, EUR CZK, EUR KZT, EUR UAH, etc. | |||

| 42. | Forex brokers | FxPro, Swissquote, eToro (eToro), Oanda, FOREX.com, FXCM, GKFX, HYCM, ActivTrades, FXOpen, Interactive Brokers, NordFX, Admiral Markets, RoboForex, FIBO Group, etc. | |||

| 43. | Cryptocurrencies | there is no general law. The European Court classified transactions with Bitcoin as payment transactions on which VAT is not charged. Popular cryptos: Bitcoin Cash, Ethereum, Ripple, BTC, OmiseGO, Monero, Litecoin, EOS, Ethereum Classic, Binance Coin, Bitcoin Satoshi Vision, IOT, TRON, NEO, Zcash, Dashcoin, Stellar, Cardano, LINK, DASH, Tezos, NEM. | |||

| 44. | Binary options | — | |||

| 45. | Financial regulator | in the EU in general - MiFID, in France - ACPR, AMF, in Cyprus - CySEC, in Holland - AFM, in Germany - BaFin, in Belgium - FSMA, in Spain - CNMV, in Portugal - CMVM, in Italy - Consob, in Malta -MFSA, in Latvia - FCMC, in Estonia - FSAEE, in Poland - PFSA | |||

| Central Bank address | |||||

| 46. | Web site | www.ecb.europa.eu/ | |||

Central bank rates in Forex trading

The size of discount rates in the Forex market for a trader is important when calculating swaps and for determining the sentiment of a currency pair in the long term. How can you make money with this information?

Strategy for trading interest rate differences

When making a transaction on the Forex market, a trader exchanges one currency pair for another. To sell the euro-dollar, the trader needs to borrow European currency from the broker for American, which is the deposit currency. The trader receives funds in eurozone currency on credit at 0.05% per annum. When buying dollars for euros, a deposit interest rate on American currency is calculated in the amount of 0.375% per annum. The difference between the deposit and credit interest rates is 0.325% and is a positive swap. It is credited daily to open positions that the trader holds until the next calendar day.

Swap can be either positive or negative. There is no need to calculate it manually, since its value is indicated in the corresponding table on the website of any Forex broker. A simple strategy for trading interest rate differences is to open a position in the direction of a positive swap on a currency pair on one account and an opposite (hedging) position in the other direction, opened on the same currency pair on a swap-free account with another broker. Of course, you can’t count on big earnings with this approach, but the trading system is good for its simplicity.

Loans from commercial banks in the eurozone

Mortgage loans in Europe are considered a profitable investment tool due to favorable conditions and low rates . The easiest way to get such a loan is in Spain, Germany, France. The rate in each country is set separately, but it is always linked to the European interbank lending rate Euribor.

Foreigners have access to mortgage loans in Europe, but with an increased rate and an expanded package of necessary documentation. But the rate is fixed (2-2.5%). Banks are especially loyal to employees of European companies who have been working there for at least 3 years. The loan term is usually up to 20 years; in any case, the borrower will have to confirm his own solvency.

The main advantage of deposits in European banks is reliability. The EU deposit guarantee system promises a return of 200,000 euros. In some countries, the entire deposit will be returned, regardless of the amount. But such deposits also have a significant advantage - a low rate, not exceeding 1-2%.

Story

After the end of World War II, the unification of Europe began. Structuring was activated and the formation of a single market space began. In the period from 1947 to 1957, the period of integration of the states of the region was successfully completed with the parallel emergence of the European Payments Union. In 1957, the largest European states united into the European Economic Community. In 1979, fiat money - ECU - was introduced into the EEC for settlements that were immediately linked to a basket of European currencies. The memorandum on the formation of the European Monetary Area and the ECB was signed in 1988. LLC CB "Central European Bank" appeared after the signing of the international treaty on the creation of the EU in 1992 in Maachtricht, as well as after the formation of the European Monetary Institute, whose responsibilities included preparing for the transition to a single currency - the euro.

The best and largest banks in the European Union

The most reliable European banks are:

- Barclays is a large financial conglomerate with a large number of representative offices in Europe, the USA, and Asia. It is one of the globally systemically important banks. The bank works with investments, advises companies on acquisitions and mergers, opens private and corporate accounts, debit and credit cards. Website: home.barclays/

- HSBC is one of the world's largest financial conglomerates, with more than 3,900 branches in different countries. Offers a wide range of services to companies and private clients. Actively works in financial markets. It occupies a leading position in terms of assets and market capitalization. Website: www.hsbc.com/

- Deutsche Bank is Germany's largest conglomerate in terms of number of employees and total assets. It is one of the 30 most significant banks, owns commercial and mortgage, leasing and investment companies. It has representative offices in more than 70 countries. It is a major participant in the foreign exchange market and attaches great importance to investment activities and the issue of its own securities. Website: www.deutsche-bank.de/pk.html

Credit ratings from Standard Poor's and Moody's are assigned separately to each eurozone country.

Germany's credit rating from Standard Poor's

Germany's credit rating from Standard Poor's is AAA, like Australia, Canada, Switzerland, Denmark, Liechtenstein, Luxembourg, the Netherlands, Norway, Sweden, Singapore

- AAA is the maximum rating;

- Below AA are the UK, UAE, France.

The AAA rating is investment grade and means a very high ability to meet debt obligations.

Comparison of the 0% key rate of the European Central Bank with the Central Banks of other countries of the world

| Key rates of the Central Bank of the world on Forex currencies | |||||

| A country | central bank | Currency and its ticker | Central Bank key rate | Date of entry | Financial regulator |

| Australia | Reserve Bank of Australia | Australian dollar (AUD) | 0.75% | 01.10.2019 | ASIC |

| Great Britain | Bank of England | pound sterling (GBP) | 0.75% | 02.08.2018 | FCA |

| Hong Kong | Hong Kong Monetary Authority | Hong Kong dollar (HKD) | 2% | November 2019 | SFC |

| European Union | European Central Bank | euro (EUR) | 0% | 12.12.2019 | MiFID (EU requirements), ACPR and AMF (France), BaFin (Germany), Consob (Italy), CySEC (Cyprus), MFSA (Malta), AFM (Netherlands), FSAEE (Estonia), CMVM (Portugal), FSMA ( Belgium), CNMV (Spain), FCMC (Latvia) |

| Canada | Bank of Canada | Canadian dollar (CAD) | 1.75% | 4.12.2019 | IIROC |

| China | People's Bank of China | Yuan (CNY) | 4.15% | 20.11.2019 | CSRC, FinCom |

| New Zealand | Reserve Bank of New Zealand | New Zealand dollar (NZD) | 2% | 11.08.2016 | FSCL |

| Singapore | Monetary Authority of Singapore | Singapore dollar (SGD) | 1.63% | November 2019 | M.A.S. |

| USA | Federal Reserve System (FRS) | US dollar (USD) | 1.75% | 11.12.2019 | NFA, CFTC, SEC |

| Switzerland | National Library of Switzerland | Swiss franc (CHF) | -0.75% | 15.01.2015 | FINMA |

| Japan | Bank of Japan | Japanese yen (JPY) | -0.1% | 03.08.2016 | JFSA |

| Other forex currencies in Europe | |||||

| Belarus | National Library of the Republic of Belarus | Belarusian ruble (BYN) | 9% | November 2019 | ARFIN |

| Bulgaria | Bulgarian People's Bank | Bulgarian Lev (BGN) | 0% | 2.12.2019 | FSC |

| Hungary | National Library of Hungary | Hungarian forint (HUF) | 0.9% | 17.12.2019 | HFSA Hungary |

| Denmark | National Bank of Denmark | Danish krone (DKK) | 0.05% | 19.01.2015 | DFSA Denmark |

| Moldova | National Bank of Moldova | Moldovan leu (MDL) | 5.5% | 11.12.2019 | Licensing Chamber |

| Norway | Norwegian bank | Norwegian krone (NOK) | 1.5% | 19.12.2019 | NFSA |

| Poland | National Bank of Poland | Polish zloty (PLN) | 1.5% | 4.12.2019 | PFSA/KNF |

| Russia | Bank of Russia | Russian ruble (RUB) | 6% | 07.02.2020 | Bank of Russia (until 2013 FSFM) |

| Romania | National Bank of Romania | Romanian leu (RON) | 2.5% | 07.02.2020 | A.S.F. |

| Ukraine | National Bank of Ukraine | Ukrainian hryvnia (UAH) | 11.0% | 30.01.2020 | NCCPF |

| Croatia | Croatian People's Bank | Croatian kuna (HRK) | 2.5% | October 2019 | HANFA |

| Czech | National Bank of the Czech Republic | Czech crown (CZK) | 2% | 18.12.2019 | CNB |

| Sweden | Bank of Sweden | Swedish krona (SEK) | 0% | 19.12.2019 | (FSA Sweden) |

| Forex currencies in Asia | |||||

| Azerbaijan | Central Bank of the Azerbaijan Republic | Azerbaijani manat (AZN) | 7.5% | December 2019 | MBA |

| Armenia | Central Bank of the Republic of Armenia | Armenian dram (AMD) | 5.5% | 10.12.2019 | Ministry of Finance |

| Vietnam | GB of Vietnam | Vietnamese dong (VND) | 6% | October 2019 | SSC |

| Georgia | National Library of Georgia | Georgian lari (GEL) | 9% | 11.12.2019 | National Library of Georgia |

| Israel | Bank of Israel | Israeli shekel (ILS) | 0.25% | 10.12.2019 | ISA |

| India | Reserve Bank of India | Indian Rupee (INR) | 5.15% | 04.10.2019 | SEBI |

| Kazakhstan | National Bank of the Republic of Kazakhstan | Kazakhstan tenge (KZT) | 9.25% | December 2019 | AFSA |

| Korea | Bank of Korea | won (KRW) | 1.25% | 29.11.2019 | FSC |

| UAE | Central Bank of the UAE | Arabic dirham | 2% | November 2019 | Dubai? FSA |

| Thailand | Bank of Thailand | Thai baht (THB) | 1.25% | 18.12.2019 | Bank of Thailand |

| Türkiye | Central Bank of Turkey | Turkish lira (TRY) | 12% | 12.12.2019 | C.M.B. |

| Uzbekistan | Central Bank of the Republic of Uzbekistan | soum (UZS) | 16% | December 2019 | Central Bank of the Republic of Uzbekistan |

| Forex currencies in Africa | |||||

| Egypt | Central Bank of Egypt | Egyptian pound (EGP) | 12.25% | 14.11.2019 | EFSA |

| Tunisia | Central Bank of Tunisia | Tunisian dinar (TND) | 7.75% | October 2019 | Central Bank of Tunisia |

| South Africa | South African Reserve Bank | South African rand (ZAR) | 6.50% | 18.07.2019 / | FSCA |

| Forex currencies in Latin America | |||||

| Argentina | Central Bank of the Argentine Republic | Argentine Peso (ARS) | 63% | December 2019 | CNV |

| Brazil | Central Bank of Brazil | Brazilian real (BRL) | 4.5% | 11.12.2019 | CVM |

| Mexico | Bank of Mexico | Mexican Peso (MXN) | 7.25% | 19.12.2019 | CNBV |

| Chile | Central Bank of Chile | Chilean peso (CLP) | 1.75% | 5.12.2019 | SBIF |

The table shows that the European Central Bank's key interest rate of 0% is higher than in Switzerland (-0.75%) and Japan (-0.1%), but lower than in the UK (0.75%).

What does the ECB do?

The Central European Bank simultaneously performs several dominant functions:

- Development and implementation of monetary policy in the euro area.

- Providing, developing and managing exchange reserves of countries from the euro area of an official nature.

- Euro issue.

- Setting interest rates.

- Ensuring price stability in the European zone.

The ECB's indicators are the consumer price index for consumers throughout the EU and the size of the money supply, the growth of which during the year should not exceed 4.5%.