The characteristics of depository operations involve a set of financial procedures aimed at retaining, managing and transferring ownership rights related to certificates of valuable documents.

At the same time, a market participant who carries out the mentioned processes at a qualified level receives the status of a depository, and people who constantly use these services act as depositors. The conditions for carrying out depository activities require an indispensable agreement for the participants, called a depository agreement or deed of depo account.

Types of depository

There are 5 types of depository:

- A professional participant in the securities market who provides services for storing certificates of these securities, and also keeps records of the transfer of ownership rights to them;

- A special room in a bank where deposit boxes are stored;

- Depository of an international treaty is a state or international organization that undertakes to store the text of an international treaty, documents on the ratification of such an agreement and other similar papers;

- The Central Depository is a financial institution of the securities market that performs the functions of settlements on securities;

- Depository bank is a banking institution that stores securities and other financial assets owned by clients, as well as provides management services for such securities.

What it is

Most of the securities (CS) on the stock exchange are in circulation in electronic form. When purchasing shares or bonds, you do not receive the securities themselves, but the right to them, which is recorded with a digital code.

A depository is a repository in which physical certificates for securities are located, and their owners are constantly changing. Simply make an electronic entry into the deposit account.

Types of depository activities

The depository performs various functions, including:

- Storage of securities certificates – the depository’s storage is used for this purpose. In addition, securities accounting can be maintained in intangible form using records entered into electronic registers;

- Accounting for rights to securities - transfer of securities to a depositary for safekeeping does not mean that the ownership rights to such assets are transferred to the depository;

- Settlements for transactions carried out with securities - conducting transactions on the exchange and over-the-counter markets;

- Payment of dividends – accrual of dividends, their actual payment with payment of income tax.

Depositories also provide some other services, for example, conducting repo transactions, lending with securities, providing information and others.

One of the key responsibilities of the depository is to ensure the safety of securities or rights to them, as well as to carry out any actions solely in the interests of the depositor. The depository is not granted the right to dispose of, manage securities, or carry out transactions with them. The securities are simply kept in the custody of the depository, but are not its property, therefore collection of its obligations does not apply to these assets.

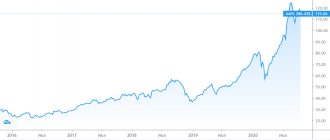

Traders and investors receive income (profit) from price changes (quotes - correlation and volatility) of financial instruments - index futures, common and preferred shares, currency pairs, CFDs, options, digital currencies, etc.

The depository is allowed to carry out its functions simultaneously with the conduct of other types of activities:

- Brokerage;

- Dealer;

- Securities management;

- Clearing (determination of mutual obligations).

Advantages of the Sberbank depository

The Sberbank Depository began providing services in 1997. As of 2021, there are 50 share programs under management here, as well as 29 issuers of the underlying asset of the Russian Federation. There are over 1.7 million securities accounts under service. For data transfer and remote transactions, the bank uses secure SWIFT or Online Sberbank channels.

The Sberbank Depository system complies with Russian Federation standards. It has proven a high degree of security and fault tolerance. Its activities are controlled directly by the Bank of Russia. Included in the TOP of global custodian banks in the Russian Federation and the world. For achievements in the field of depository services, she was awarded the Global Custodian Cup 5 times in a row from 2014 to 2021.

Remote control

The depositary works directly with clients when visiting offices and through remote control. The second method is preferable when it is inconvenient to come for operations in person every time. Clients use the SWIFT Connectivity system, which allows them to work simultaneously with several deposit accounts. Data transfer occurs according to the ISO020022 standard, which is approved throughout the world.

All document flow also occurs in electronic form, based on the EDI system. All electronic versions of stored documents correspond to the originals and allow transactions to be carried out online. Clients can create an electronic signature, which is stored on a flash drive or in special storage.

Russian issuers can order the Sberbank-Business service from the bank and conduct transactions with domestic securities on securities accounts through the Client-Bank system. You can access it in three ways:

- From the official website of Sberbank using your login and password.

- Through a personal computer or laptop on which special software from Sberbank is installed.

- From a mobile device after installing the application.

Sberbank's online systems for managing securities accounts have repeatedly won domestic and international awards for the implementation of advanced technologies. There are programs that are suitable only for working with Russian securities or only with foreign ones. But for clients who conduct transactions with the Central Bank in different currencies, universal software is provided.

Data Security

The Sberbank Depository ranks first among similar organizations in the Russian depositary services market. Data confidentiality is at the highest level. Data on transactions with the Central Bank and concluded transactions are not available to anyone except the account owner.

Encryption protocols meet the latest advances in this area. The largest companies in Russia trust Sberbank PJSC to handle their securities. These include Magnit, MTS, Rostelecom, Taftneft, Megafon, Lukoil, Gazprom Neft.

Versatility

Residents and non-residents of the Russian Federation, both individuals and legal entities, are serviced by the Sberbank Depository. The system works with securities accounts in Russian rubles and foreign currency.

The simplest transactions for the purchase and redemption of securities are available to individuals. And for corporate clients it is possible to carry out splitting, consolidation or other complex procedures with securities.

Regulation of depositories in Russia

To conduct depository activities in the Russian Federation, it is necessary to create a legal entity that must obtain a license from the Bank of Russia. The license for professional securities market participants to carry out depository activities does not have a validity period.

To obtain a license, several conditions must be met. For example, the company’s own funds must be at least 20 million rubles. In addition to financial requirements, you need appropriate technical support, an accounting system, and qualified personnel, for whom a special exam is required.

The activities of depositories in the Russian Federation are regulated by:

- Federal Law of April 22, 1996 N 39-FZ “On the Securities Market”;

- Bank of Russia Regulation 05/13/2016 N 542-P “Regulations on the requirements for the implementation of depository activities when creating records based on documents related to the maintenance of depository accounting, as well as documents related to the recording and transfer of rights to securities, and when storing these documents ";

- Bank of Russia Regulation No. 474-P dated June 10, 2015 “Regulations on the activities of specialized depositories.”

Prospects for the development of depository activities in Russia

Let us consider the prospects for the development of the depository system from the point of view of fulfilling the functional responsibilities of depositories in the context of the transition to a centralized-distributed structure. The basis for the legal regulation of depository activities in Russia is the Federal Law “On the Securities Market”, the Regulations on Depository Activities in the Russian Federation, approved by Resolution of the Federal Securities Commission of the Russian Federation No. 36 of October 16, 1997, and Instruction of the Central Bank of the Russian Federation of July 25, 1996 No. 44, determining the features of the work of depositories of credit institutions. The main directions and approaches to the development of the Russian depository system are formulated in the “Report on conceptual approaches to the place and role of depository activities in the modern securities market”, approved by the Government of the Russian Federation (decision No. BN-P13-21918 dated July 9, 1997), Presidential Decree RF dated September 16, 1997 No. 1034 “On ensuring the rights of investors and shareholders to securities in the Russian Federation”, State program for the protection of investors for 1998-1999, approved by Government Decree of the Russian Federation dated 06.17.98 No. 785 and Government Decree No. 741 dated 10 July 1998 “On measures to create a national depository system.” From the above documents it follows that the ways of further development must be considered from the point of view of the functions it performs: settlement or custodial.

Settlement depository is an organization of centralized depository services for transactions with securities concluded between professional participants in the securities market on stock exchanges or with other organizers of trading in the securities market, carrying out transfers of securities to the depository accounts of professional participants in the securities market based on the results of such transactions.

The main direction of the functional development of settlement depositories is their integration into a single information and technological space for the prompt implementation of transfers and the opportunity for a client of one of the settlement depositories to be a member of the trading system serviced by another settlement depository. This requires improvement of clearing, netting and settlement mechanisms. Improving the interaction of settlement depositories with counterparties, for example, with custodial depositories, is important for the effective functioning of the depository system. As part of this direction, it is necessary to introduce uniform forms and formats for data transfer and document flow. On the other hand, since the creation is aimed at increasing the level of service for professional participants in the securities market and maximizing the satisfaction of their needs, one of the directions of development should be the expansion of remote access capabilities using various methods of information security. The issue of remote access is relevant primarily from the point of view of providing regional market participants with the opportunity to quickly and reliably conduct transactions with settlement depositories.

Unlike settlement depositories, custodial depositories specialize in providing additional services for securities holders. Basically, they are aimed at private and institutional investors who are not professional participants in the securities market.

Prospects for the functional development of custodial depositories are aimed, first of all, at expanding the range of personalized services, an individual approach to servicing depositors and providing a full range of services. Simultaneously with improving the functions of storage and accounting of securities, custodial depositories must ensure cash settlements for transactions with securities. They need to provide additional security of ownership for their clients. An important component should be the provision of securities lending. A separate direction in the development of custodial depositories is the guaranteed provision of a full range of services to clients, regardless of the region and branch that serves the depositor (globalization of access). To solve this problem, the depositary must ensure the collection, storage and exchange of information coming from branches and counterparties. The proposed approach of a single space of Depot accounts greatly simplifies the provision of such services as re-registration of property rights. Registrars maintaining Registers are often located far from the place of the transaction, they have different requirements for the composition of documents for opening a personal account and re-registration of the Central Bank, and often require prepayment for their services. Thus, working directly with Registrars is quite difficult. Therefore, the task of the depositary is to provide a solution to these types of problems. With the scheme of work under consideration, due to the single space of Depo accounts, the client deals only with his Depository, which works according to uniform rules. Once enters into an agreement with him, provides documents for opening an account, and gives orders in the form of established depository forms.

Considering the need to integrate Russia into the global financial system and attract foreign investment, the custodial depository must provide its clients with the opportunity to work in the global depository system Global Custody. To meet this requirement, the depositary system of accounting and ensuring the rights of investors must comply not only with the requirements of Russian legislation, but also with Western formal and informal standards.

In addition to improving functionality, there is an objective need to improve the technologies of depositories and change the relevant rules and standards. Russian depositories must be able to operate in accordance with the International Organization for Standardization (ISO) standards for document flow for securities transactions (standard ISO 7775) and use the ISIN security numbering system, in accordance with ISO 6166. Characteristics of stock markets, especially the system the conclusion, clearing and execution of transactions differ from country to country as they reflect historical traditions and national legislation. Therefore, it seems appropriate to further develop cooperation in developing uniform standards and procedures acceptable to all depositories operating in the market. In this case, it is necessary to achieve the following goals: reconciliation of transactions the next day after conclusion (day T+1); execution of the transaction on a continuous and daily basis on day T+3; carrying out settlements on uniform principles and increasing efficiency through the wider possible use of depositories, offset mechanisms and standard numbering of securities.

The main problems that require solutions to minimize risks associated with deficiencies in clearing and settlement systems for securities transactions are the following:

lack of unified systems for reconciling the terms of concluded transactions;

different deadlines for execution of transactions;

non-compliance with the principle of delivery of securities against payment;

lack of standardized guarantees for transaction execution;

the absence in many markets of a system of non-cash accounts for the execution of securities transactions.

To solve them, the following conditions must be met:

Reconciliation of the parameters of transactions between all direct participants in the securities market (brokers, dealers and other members of the exchange) must be carried out no later than the next business day after the conclusion of the transaction, i.e. on day T+1. It is possible to implement two main types of reconciliation systems: two-way and one-way. The main difference between them is that in a two-way system, both parties to the transaction enter information about the transaction into the system, while in a one-way system only one party does this entry. T+1 reconciliation provides the parties with the opportunity to resolve any discrepancies or conflicts, which reduces the risk of non-execution of the transaction and helps ensure timely execution of the transaction. Institutional investors or other transaction participants other than brokers or dealers must also become members of the trade matching system.

All markets must adopt a system of daily execution of transactions, that is, execution of transactions must occur two business days after conclusion, on day T+3. In a daily execution system, final settlements of trades occur on all business days of the week. This process serves to reduce the number of trades entered into but not executed, thereby reducing market vulnerability.

Introduction of a trade settlement and clearing system. This issue is of particular relevance in the context of increasing transaction volumes and increasing intensity of interaction between participants. There are three main types of clearing clearing systems: bilateral clearing, multilateral clearing and continuous clearing. For each of these alternatives, the relationship between the cost of establishing and maintaining an offset system and the cost of executing trades without such a system must be analyzed.

Use of the “delivery versus payment” (DVP) principle in settlement and depository systems. A significant risk in the execution of securities transactions arises in cases where the delivery of securities occurs without the simultaneous receipt by the supplying party of the corresponding amount of money. The simultaneous exchange of values avoids the risk associated with price changes and the inability to act in accordance with obligations. The implementation of the PPP principle can be ensured by joining a cash payment system, a bank guarantee system or a financial guarantee system.

Making cash payments related to the execution of securities transactions must be carried out using a single technology for all financial instruments and markets on the basis of a same-day deposit agreement, subject to automation of the payment system.

The implementation of the above measures will help reduce risks in the securities market, increase guarantees of property rights and integrate Russia into international clearing, settlement and custodial systems. Based on this, the further development of the depository system in our country should take place in close cooperation and expansion of contacts with depository organizations of other countries, their international associations and other international infrastructure organizations.

Conclusion.

Depositories can exist as independent organizations or as structural divisions of banks. Bank depositories in Russia are not the largest; most securities are accounted for in specialized depositories. However, bank depositories, whose activities represent an important part of the market, while clients, especially in the regions, more often deal with their bank when trading securities than with specialized depositories.

As a result of the activities of any depository, a certain amount of information is formed, which must be processed and stored according to certain rules.

Clients of a particular bank at least once face the problem of choosing a depository in which they will store and account for their securities.

Further development of the depository system in our country should take place in close cooperation and expansion of contacts with depository organizations of other countries, their international associations and other international infrastructure organizations.

The following main directions of development of the depository system can be named from the point of view of guaranteeing the rights of owners of securities.

The development of each link of the depository system according to its individual characteristics, but taking into account interaction with other elements of the system and with the goal of increasing the guarantees of investors' property rights to securities.

Reducing the risks of depository activities by establishing an effective risk management policy.

Creation of insurance and guarantee funds, insurance of depository companies.

Integration into global payment and depository systems.

Improving the regulatory framework for depository activities.

Increasing the level of control and supervision, reporting requirements at the level of the depository system as a whole.

Thus, there is a clear need to improve the institution of depositories, primarily from the point of view of increasing guarantees of the rights of investors. The most relevant for Russia are:

transition to a new level of functioning of depositories within the framework of a centrally distributed system with a single space of DEPO accounts;

minimizing risks through the use of additional technological capabilities of the system;

optimization of the administrative and legal framework.

The development of the depository system as a system for recording rights to securities in these areas will help improve reliability and liquidity in general.

As for the accounting system, it should strive to service the widest variety of securities traded on the market: shares, bonds, bills, warehouse receipts, etc. Transferring the circulation of the maximum possible number of securities from cash to non-cash form will significantly reduce the costs of ensuring turnover, reduce the risks of falsification, loss and, ultimately, increase market efficiency. These goals are unattainable without a developed accounting system and without the development of a depository system.

This course work examined the work of the depository, the attitude of Russian banks to the depository system and the accounting system. The fact is that in Russia most securities are issued in book-entry form, which is why the role of depositories in organizing securities trading is so great. The functioning of the stock market and the costs of securities owners when carrying out transactions with them greatly depend on the efficiency of depositories.

List of used literature.

I. Regulatory acts:

1. Federal Law of the Russian Federation “On the Securities Market” dated April 22, 1996 No. 39-FZ.

2. Temporary regulations on depository activities on the securities market of the Russian Federation and the procedure for its licensing. Approved by the Federal Commission for Securities on October 2, 1996.

3. Instruction of the Central Bank of the Russian Federation dated July 25, 1996 No. 44 “On the peculiarities of the work of depositories of credit institutions”

4. Decree of the President of the Russian Federation of September 16, 1997 No. 1034 “On ensuring the rights of investors and shareholders to securities in the Russian Federation.”

5. State program for the protection of investors for 1998-1999, approved by Decree of the Government of the Russian Federation of June 17, 1998 No. 785.

6. Government Decree No. 741 of July 10, 1998 “On measures to create a national depository system.”

7. Instruction No. 292-U dated July 15, 1998 “On the temporary procedure for conducting depository operations with non-issued securities”

II. Articles :

1.N.G. Volkov. New rules for accounting for securities./Glavbukh.1998. №№2,3

2.O.V. Gutnikov. “Civil liability of an accountant. /Glavbukh.1998. No. 4

3.O.K. Kolesnikova, G.A. Bezruchenko. Accounting for securities by professional participants in the securities market/Glavbukh.1998. No. 14.

III Websites and articles on the Internet:

1. K. Ivanova “Fried ice or the issue of depository accounting of bills” - www. bankir.ru/analytics 09/25/2002

2. E. Demushkina - Advisor to JSCB Investment Banking Corporation, B. Cherkassky - National Depository Center - questions and answers on www. bankir.ru/analytics 09/25/2002

3. M. Matovnikov “Moskovskaya Pravda” - The largest depositories of Russian banks - https:// matov.narod.ru/publ/ 08/20/2002

4. K. Lysak, leading economist of the Securities Department of the Central Bank of the Russian Federation in Moscow, B. Cherkassky - National Depository Center - Accounting for depository operations - www.bdm.ru/arhiv/1998/01/50-53.html

5. B. Cherkassky - National Depository – www.bankir.ru/analytics/classic 09.24.2002

6. B. Cherkassky - National Depository Center - Report on the construction of the Accounting system - www.bankir.ru/analytics/classic 09.24.2002

7. A. Barshchevsky - head of the depository OPERU-1 at the Central Bank of the Russian Federation, M. Khabibulin - economist of the 1st category OPERU-1 at the Central Bank of the Russian Federation “Depositarium” No. 1(20) - “The problem of processing and interpreting depository accounting data” - www.bankir .ru/ analytics/classic 09/24/2002

N. Mazurin “Vedomosti” - “Depositories for our own” - https://matov.narod.ru/cite/ved200701.htm 07/20/2001

Appendix No. 1.

Comparative analysis of depository systems

| Centralized depository system | Decentralized depository system | Centrally distributed depository system | |

| Construction Features | It is the only depository. The depository's back-office is located in the central office (the central node of the network), maintains securities accounts, stores primary documents, and performs the full range of settlement, clearing, depositary, and custodial services. The depository's branches house the depository's front-office, which performs the functions of receiving primary documents from depositors and issuing them reporting documents prepared by the depository's back-office. In this case, the depository can also perform functions of servicing issuers. The second option is that these functions are transferred to registrars (also as centralized as possible). Unified management and control. | There is a network of independent depositories. The range of services provided is individual for each depository. Between individual depositories it is possible to establish correspondent relations or relations of the depository-subdepository type (a “one-to-one” relationship). Each depository has its own internal structure depending on the volume of operations, the number of clients and the range of services provided. There is a system of licensing, state regulation and control, but due to decentralization, full-scale control of the depository system is difficult. | It may have the largest number of possible options for system construction schemes compared to centralized and decentralized ones; There is a central depository and a network of depositories subordinate to it, connected with the central contractual relationship and a single technology (communication of the “one by all” type). As an option, some type of connection between equally subordinate depositories is possible, as well as several levels of subordination (regional centers), etc. The powers and functions of the central depository may vary depending on the level of development of the stock market and many other conditions. In the depository system, netting of securities can be carried out; in the case of combining depository functions with clearing functions, clearing of funds can be carried out. At least a two-level management system, a fairly high degree of unification of standards and requirements. Flexible control system. There is a licensing system. State regulation and control, in the presence of a central depository, effective control, prompt collection of consolidated reporting is possible, a sufficiently high level of centralization contributes to the coordination of actions. |

| Document flow | High level of unification. Unified rules and procedures for document flow, unified forms of paper documents, unified formats of electronic documents. A high level of centralization requires maximum use of electronic document management (this should not contradict the law). Electronic document management requires a high level of information security (electronic signature, cryptographic protection, etc.), as well as the ability to authorize the depository client. A very large amount of information and high complexity of the internal document flow of the depository, minimal external document flow. | Low level of unification. Each depository has different rules and procedures for document flow, different forms of paper documents (minimum uniform requirements). Electronic document management is practically not used, since there is no objective need for its widespread use. Large external document flow of depositories when interacting with counterparties (additional difficulties arise with low unification), the complexity of internal document flow is low, the volume depends on the size and structure of the client base. | There are two possible options for organizing document flow (paper, electronic) or a combination of them, depending on the specific structure used. Unified procedure and formats for interaction with the central depository. The external and internal document flow of depositories is comparable in volume and complexity. In this case, the greatest efficiency is achieved with maximum unification. |

| Features of the technology | Single database, single storage, real-time operation. It is possible for the client to carry out operations from any front office. The most optimal scheme for solving such problems as dematerialization and immobilization of securities. In fact, this is a monostructure of a depository and there are no special features in terms of technology, since it is a depository with a remote front office. Implementation of any schemes for the supply of securities. It is necessary to implement remote access systems and complex telecommunication systems. | Distributed databases that are not connected to each other, individual storage facilities for each depository, intra-depository operating technologies can be the simplest. Complications occur due to the need to implement chains of interdepository transfers and re-registrations in registers. Long period of operations. | Depending on the implemented scheme, many technology options can be implemented, combining the features of a centralized and decentralized system, as well as individual characteristics. |

| Degree of guarantees for the rights of security holders | High. Securities of all depositors are stored and accounted for in a single depository. A centralized risk monitoring and control system and the use of a single technology can reduce operational and technological risks. Low risk of interaction with third parties. Due to the widespread use of remote access and telecommunication systems, the issue of information security requires special attention. Due to the existence of a single client base, client risk is significantly reduced. Low complexity of organizing state regulation. | Low. The high level of operational and technical risk and the high share of paper document flow have a greater impact. High risk when the depository interacts with third parties. The difficulty is in organizing full-scale control and ensuring transparency of the activities of all companies. The complexity of state regulation of many independent and diverse depositories in specialization and other parameters. | Given all the possible risks associated with depository activities and the risks arising from the implementation of technology features, there are many possible ways to increase the reliability of a depository company. The degree of guarantee of property rights especially depends on the completeness, consistency and elaboration of legislation in this area. |

| Service cost | High. The high cost is due to complex software and hardware, the need for maintenance and support of telecommunication systems, information security systems. Unified tariff policy, almost monopoly pricing. In the absence of registrars, the need to pay for re-registration and transfer agency services disappears, and overhead costs are reduced. If registrars are present in the registration system, the cost of transfer agency services is reduced due to an increase in the number of clients. | Quite low cost of direct storage and recording of property rights services. But the cost of service increases due to additional costs for re-registration, transfer agency services, etc. It is possible to implement a flexible system of payment for services. The cost of services for an individual depository can vary widely. | The cost of services depends on the implemented scheme and the degree of personalization of services. |

[1] In Russian banks, about 10 percent is accounted for by the securities of the depository itself, and slightly less than 30 percent is accounted for by the funds of clients of correspondent depositories. Another 6-7 percent comes from securities encumbered with obligations. On the one hand, securities in the leading depository account for a dominant share of the securities recorded, more than 97 percent. On the other hand, only 1.4 percent of the total volume of accounted securities is physically stored in bank depositories.

[2] NDC is the settlement depository of the Moscow Interbank Currency Exchange

2 It is assumed that document flow will be electronic, but in the jargon of developers such an order is called “an order with a red stripe.

3 This is precisely the drawback of the scheme currently used by some banks, when the borrower’s securities are in the depository of the creditor bank.

Responsibilities of the depositary

The law imposes a number of responsibilities on the depositary:

- Maintaining client accounts, displaying information on each transaction, including the date and time of its execution;

- Registration of client securities, their encumbrances, obligations;

- Informing clients about securities received from issuers or former owners;

- Conducting transactions with securities at the request and on behalf of the client;

- Maintaining confidentiality - when a shareholder enters into a depo agreement, the remaining shareholders are not provided with information about who owns the shares. The depository will be able to carry out all necessary transactions with securities on behalf of the client. In this case, the depositary is responsible for the actions taken, and in case of significant violations, its license may be revoked and its personnel disqualified.

The depository also provides advice on legal issues, makes statements on depo accounts, and places and removes encumbrances. Clients can instruct the depositary to pay income from holding securities, exchange one paper for another, sell or redeem valuables, or combine several issues.

Tariffs for use

Tariffs for legal entities and individuals for depository services at Sberbank differ. The bank carries out some transactions for clients free of charge under service agreements.

Tariffs for individuals

| No. | Service | Tariff in Russian rubles |

| 1 | Opening, closing, re-issuing an account due to changes in passport or other personal data on the securities account | For free |

| 2 | Registration of a nominee account in the register of securities holders | 10,000 rubles |

| 3 | Storage and accounting of emission securities | For free |

| 4 | Accounting and storage of non-issue securities | 0.12% per annum, but minimum 10 rubles per day |

| 5 | Storing an integer number of investment fund units | For free |

| 6 | Encumbrance and removal of encumbrances from bills of exchange issued by Sberbank | 0.05% of the transaction amount, but minimum 400 rubles, maximum 15,000 rubles |

| 7 | Execution of an order valid on a permanent basis | 150 rubles + correspondent rate for each transaction |

Tariffs for legal entities and individual entrepreneurs

| No. | Service | Tariff in Russian rubles |

| 1 | Opening a securities account | 3,000 rubles at a time |

| 2 | Closing | For free |

| 3 | Accounting for shares and their storage in the issue account | 1,000 rub. per month for each issue |

| 4 | Accounting and storage of bonds | Up to 50 million 0.04%, but minimum 700 rubles Over 50 million on a contractual basis |

| 5 | Storing an integer number of investment fund units | 0.8% per annum, but minimum 100 rubles per month |

| 6 | Maintaining electronic document management | 1,000 rubles per month |

| 7 | Execution of an order valid on a permanent basis | 200 rubles + correspondent’s rate |

| 8 | Opening a nominee account in the register of securities holders | 10,000 rubles |

Starting from April 2021, tariffs for entrepreneurs are equal to tariffs for legal entities.

All bank clients who work with mutual funds or other investment programs cooperate with the Sberbank Depository. Brobank talks about how to make money from investing in his articles. Here you can also get acquainted with the rating of mutual funds and what you should rely on when choosing a fund.

about the author

Klavdiya Treskova - higher education with qualification “Economist”, with specializations “Economics and Management” and “Computer Technologies” at PSU. She worked in a bank in positions from operator to acting. Head of the Department for servicing private and corporate clients. Every year she successfully passed certifications, education and training in banking services. Total work experience in the bank is more than 15 years. [email protected]

Is this article useful? Not really

Help us find out how much this article helped you. If something is missing or the information is not accurate, please report it below in the comments or write to us by email

Websites of the largest depositories in Russia and the world

There are more than 400 depositories in Russia. They are divided into 4 groups: brokerage, specialized, custodians and centralized.

Not only depositories, brokers, management companies and clients participate in trading on the Moscow Exchange, but also the National Settlement Depository, which serves all procedural participants in the securities market.

NSD carries out storage of global certificates, depository accounting of federal loan bonds, and 99% of corporate and regional bond issues. The custodian holds over 15 thousand issues of securities with a total value of about 40 trillion rubles. The owner of NSD is the Moscow Exchange; the correspondent network includes the Central Depositories of the CIS countries and the largest centralized structures in Europe.

The largest depositories in Russia include:

- ING Bank (Eurasia) - www.ing.ru/ru/home

- National Depository Center (NDC) - www.nsd.ru/

- Gazprombank - www.gazprombank.ru/

- Depository Clearing Company (DCC) - www.dcc.ru/

- Vnesheconombank - https://web.rf/

- Settlement and depository company - sdco.ru/

- "Garant SDK" - www.sdkgarant.ru/index.php/ru/

- Sberbank of Russia - www.sberbank.ru/ru/person/investments/depository

- "Uralsib" (depository) - depository.uralsib.ru/article.wbp?id=821c6d55-df74-4138-a109-3138dbca6e06

- Citibank - www.citibank.ru/russia/main/rus/home.htm

- Central Moscow Depository (LLC) - www.mcd.ru/

In most countries of the world there are Central Depositories - commercial organizations that are created by large trading participants. Some of them provide settlements for transactions in international securities, including Eurobonds. Many work with internal assets.

The world's largest depositories are:

- Euroclear Bank - www.euroclear.com/en.html

- Clearstream Banking Luxembourg, CBL - www.clearstream.com/clearstream-en/

- SIX SIS - www.six-group.com/en/products-services/the-swiss-stock-exchange/post-trade.html

- globeSettle - www.lseg.com/markets-products-and-services/post-trade-services/monte-titoli

- Asia Pacific Central Securities Depository Group - www.acgcsd.org/

- European Central Securities Depositories Association - ecsda.eu/

- America's Central Securities Depositories Association - www.acsda.org/en/

- Association of Eurasian Central Securities Depositories - www.aecsd.com/

- Africa & Middle East Depositories Association - www.ameda.org/

- Australian CSD for equities and corporate bonds - www.asx.com.au/

- Austrian CSD - www.oekb-csd.at/en/

- Belgian CSD - www.euroclear.com/en.html

- Canadian CSD - www.cds.ca/

- Chinese CSD – www.chinaclear.cn/

- French CSD - www.euroclear.com/site/public/ef

- German CSD - www.clearstream.com/

- New Zealand CSD - www.vps.no/

- South African CSD (GraniteCSD) - www.granitecsd.co.za/

- Swiss CSD - www.six-securities-services.com/

- UK CSD - www.euroclear.com/site/public/eui

- US CSD - www.dtcc.com/

- Japanese CSD - www.jasdec.com/en/

Share buyback

The issuer may announce a repurchase of shares - buyback. The shareholder has the right to accept the offer or refuse it. To sell company shares, the client contacts his depository and submits an online redemption application. The papers are automatically debited from his account in exchange for money, but sometimes a paper application is also required. As a rule, repurchases are made at average market prices.

You can sell securities directly to the buyer, but to do this they need to be transferred from the depository account to the account of the new owner. The cost of translation is about 2000 rubles.

Pros and cons of depository banks

One of the disadvantages is the lack of flexibility in work, since they strictly follow the rules established by law. Pros:

- works directly with the shareholder;

- the company ensures and protects the rights of shareholders;

- control the receipt of dividends on the Central Bank according to equity participation.

By conducting activities specifically with the owners of securities, the depository not only confirms the rights of the holders, but also takes them into account. In addition, clients are provided with protection from unlawful actions of organizations issuing shares and registrars.

Leasing of securities

The depository has the right to deliver the client's securities to the broker. The latter makes money from exchange rate differences or from transferring assets to investment companies. Banks and other trading participants. Recently, many brokers have eliminated transaction fees, and income from securities lending plays an important role in terms of profitability.

The guarantee of the return of securities to the account is the conclusion by the broker of an over-the-counter repo transaction, i.e. carries out an operation to sell a security with an obligation to repurchase it. REPO transactions are recorded by a repository - a professional participant in the securities market.

How to reduce commission?

Now let's get to the fun part: how can you reduce your brokerage commission without reducing your trading volume and thus reducing your opportunities? It’s very simple - you can return part of the commission through special rebate services. How much commission can you get back? Typically, the service allows you to return from 7 to 50% of the commission on turnover, depending on the broker. Let's calculate how much it comes out to. Let's return to the example we looked at above. For example, reimbursement by one of the Alor+ services is 15% commission on turnover. A little higher, we calculated the broker’s commission at 9,240 rubles per month. 15 percent of this amount is 1,386 rubles per month or 16,632 rubles per year. Those. from an initial deposit of 100 thousand - this is more than 16.5% per annum! Now try to find a stock that consistently pays 16.5%. But you can find a broker with a large percentage of compensation, for example, 25 or even 50%! That is, every fourth or even second transaction will be free for you

How to choose a depository

The practice of recent years confirms that brokers are superior in reliability compared to banks, whose bankruptcies are no longer rare. However, since 2000, only a few brokers have gone bankrupt. This is due to the peculiarities of storing securities: it is very difficult to sell them without the client’s knowledge and withdraw money, including due to the work of depositories.

At the moment, the lowest risks of bankruptcy are with Finam, BCS and Sberbank brokers. A list of all operators is posted on the Moscow Exchange website. However, if the Central Bank revokes a broker’s license, you should immediately contact its depository with an application to transfer your securities to the depository of another company. The list of depositories is on the Bank of Russia website.

Other professional securities market participants

Main article: Professional securities market participants are... opinion of Masterforex-V

Depositories are professional participants in the securities market, along with:

- Brokers – intermediaries in concluding transactions with securities;

- Underwriters are large market makers specializing in conducting IPOs, helping new issuers of securities to get listed on the stock exchange;

- Dealers and market makers are large bank brokers who buy and sell exclusively at their own expense securities and derivatives of the exchange (stocks - blue chips, ordinary shares, bonds, options, preferred shares, warrants, stock (exchange) indices, forward contracts , depository receipts, index futures, etc.;

- Private traders and investors who trade financial instruments exclusively for their own account through one of the exchange's licensed brokers, who provides them with leverage and provides margin trading for trading large lots on the market;

- Investment funds are large investors who manage other people's financial assets (money of banks, corporations and individuals). These are trust management funds (TD), exchange-traded funds (ETFs), investment funds, PAMM accounts, hedge funds, etc.;

- Clearing companies ensure mutual settlements between professional participants in the securities market;

- Registrars specializing in maintaining registers of registered securities;

- The organizers of the stock exchange (owners are major shareholders and their executive management), who provide premises (trading floor during the trading session) and an electronic trading platform to ensure uninterrupted transactions for the sale or purchase of securities.

Sincerely, wiki Masterforex-V, free (school) and professional training courses Masterforex-V.

Comments: 34

Your comment (question) If you have questions about this article, you can tell us. Our team consists of only experienced experts and specialists with specialized education. We will try to help you in this topic:

Author of the article: Klavdiya Treskova

Consultant, author Popovich Anna

Financial author Olga Pikhotskaya

- Alexander

05/13/2021 at 17:44 I read the article and all the comments, but I still don’t understand. If I buy shares on a long-term basis using a brokerage account, do I need to register a nominee holder account in the register of securities holders?

Reply ↓ Anna Popovich

05/14/2021 at 01:35Dear Alexander, no, if the personal account (depository account) does not take into account the rights to securities owned by other persons.

Reply ↓

03/03/2021 at 21:38

Hello! I need to notify the tax office about investment income on which I need to pay tax. What certificates do I need to request from the depository?

Reply ↓

- Anna Popovich

03/03/2021 at 23:55

Dear Tatyana, you must report and pay taxes on your own based on confirmed income from operations.

Reply ↓

01/27/2021 at 07:20

A private organization acquired a share in Sberbank for 50,000 Soviet rubles; when the enterprise was closed, I (the owner of the enterprise) transferred the share to myself. its cost at that time was 50 rubles. Unfortunately, I don’t remember the dates. After that, I was not interested in the fate of the action. Today I decided to find out where my shares and dividends are? JSC Status found out that I had an account last ....734816 to which dividends were transferred, but today it is closed. Depository 8(495)6655600-1-10717 lattice, reported that dividends for the entire period including 2021 were transferred to account .....4816. There was no such account in the local branch of Sberbank. How can I find a stock and dividends? Where else to go?

Reply ↓

- Anna Popovich

01/27/2021 at 22:15

Dear client, contact the bank’s hotline at 900. A specialist will tell you how and where to send an application requesting to find an account.

Reply ↓

01/12/2021 at 12:02

Good afternoon A message was received about the accrual of dividends for Sberbank, sent to the depository. Where can I see this? I didn’t open a deposit account.

Reply ↓

- Anna Popovich

01/12/2021 at 14:46

Dear Natalya, contact the bank’s support service at number 900 from a mobile phone: free of charge, available in Russia for subscribers of MTS, Beeline, Megafon, Tele2, Yota, Motiv. The operator will advise you.

Reply ↓

25.11.2020 at 15:57

Good afternoon!

When opening a brokerage account with Sberbank, do you need to open a securities account for 10,000 thousand if you don’t plan to buy shares?

Reply ↓

- Anna Popovich

25.11.2020 at 23:39

Dear Elena, you need to check with a bank specialist whether a depository account is opened automatically for the client. This can be done by calling the short number 900 from a mobile phone: free of charge, available in Russia for subscribers of MTS, Beeline, Megafon, Tele2, Yota, Motiv.

Reply ↓

10.23.2020 at 15:44

Hello, how long after the purchase of securities does information appear on the depository?

Reply ↓

- Anna Popovich

03.11.2020 at 15:20

Dear Denis, usually within three working days.

Reply ↓

10/23/2020 at 10:19

Hello, I buy shares through Sber Invest, do I automatically have depositories open, or not? If not, then the shares are stored there?

Reply ↓

- Anna Popovich

10/23/2020 at 11:25

Dear Denis, no, you work with a brokerage account.

Reply ↓

Anonymous

03/18/2021 at 03:46

You don't answer questions at all.

Reply ↓

Anna Popovich

03.18.2021 at 17:17

Dear client, please duplicate your question, we try to process incoming comments promptly.

Reply ↓

10/22/2020 at 11:16 pm

Hello, if I don’t open a depository, can I also buy and sell securities? Or is it needed for security purposes, and I can decide for myself whether I need it or not?

Reply ↓

- Anna Popovich

10/23/2020 at 11:33

Dear Denis, yes, you can work through the application and if you have a brokerage account.

Reply ↓

10/13/2020 at 09:10

Hello! Great article, learned a lot from it. I have another question about the depository: in 1994 the shares were acquired and inherited to me, how can I find out about their existence, is there a depository certificate for a securities account?

Reply ↓

- Anna Popovich

13.10.2020 at 13:21

Dear Maya, you should contact the Federal Fund for the Protection of the Rights of Depositors and Shareholders, which is a government agency. They will provide full information about whether you have shares and whether you are entitled to compensation for them.

Reply ↓

03.10.2020 at 18:11

Is it necessary to connect a depository? I don’t have it connected, but I have a small amount of shares in Sberbank. Do I need it?

Reply ↓

- Anna Popovich

03.10.2020 at 22:02

Dear Ruslan, if you plan to make transactions with securities, then you need such an account.

Reply ↓

09.29.2020 at 19:19

What is a nominee account? what is it for?

Reply ↓

- Anna Popovich

09.29.2020 at 20:01

Dear Pavel, a nominee account is an account of an entity that holds securities on its own behalf and on behalf of other persons, but is not their owner. It is needed to represent the interests of security owners.

Reply ↓

09.16.2020 at 11:45

Hello. I have a question: do I need to open a custody account to transfer money from a bank abroad in the Russian Federation and pay tax on this transfer?

Reply ↓

- Anna Popovich

09.16.2020 at 15:57

Dear Lyudmila, a securities account is opened in the Sberbank Depository to record securities; in order to transfer funds from a foreign bank, its opening is not necessary.

Reply ↓

05/21/2020 at 08:59

Hello, the depository refers to the removal of encumbrances on real estate purchased at the expense of a bank (mortgage). I have a question, will the depository remove the encumbrance on real estate if I refinance the mortgage with a consumer loan within one bank??

Reply ↓

- Anna Popovich

05/21/2020 at 20:48

Dear Alexander, you cannot be given consent to dispose of the property that constitutes the mortgage cover. If you are planning to refinance with the same bank, we recommend that you clarify this issue directly with a lending specialist, since the bank’s practice may involve additional refinancing options or their absence at all.

Reply ↓

05/13/2020 at 13:05

The instruction contains the clause: “accounted for in the Securities Account No. as of the Recording Date.” How is the fixation date determined, for example, for Rosneft? Why is the payment for the service 1,500 rubles, and does not depend on the number of shares? With a small number of shares, this is too much money!

Reply ↓

- Anna Popovich

05/13/2020 at 13:37

Dear Artemy, the recording date is determined in advance. In domestic companies, this is usually the period from March to July. This calendar is publicly available in the form of a table with dates, ex-dividend period and data on the planned volume of payments. In particular, it is available on the website of the Moscow Exchange and similar financial portals, including on brokers’ websites.

Reply ↓

04/27/2020 at 12:40

And yet, is it mandatory to register a nominee holder account in the register of holders of the Central Bank when purchasing shares through the Sberbank Investor application? Is this account opened separately for the shares of each company? for example, Rosneft has one nominal holder account in the register of holders of the Central Bank, and Lukoil has a second account?

Reply ↓

- Anna Popovich

04/27/2020 at 14:02

Dear Olga, in fact, the brokerage account from which you plan to conduct investment activities and invest in securities and other financial instruments, in general, is a wallet where your finances and acquired assets are located. There may be one, but the legislator does not prohibit an investor from opening several brokerage accounts - therefore, their number depends on your desire and convenience.

Reply ↓

03/09/2020 at 21:06

“Registration of a nominal holder account in the register of holders of the Central Bank of 10,000 rubles” can this moment be covered? What does it mean?

Reply ↓

- Anna Popovich

03/10/2020 at 14:54

Dear Konstantin, depository services at Sberbank are paid and the cost of opening an account is 10,000 rubles.

Reply ↓