Hello, dear readers.

Surely most of you want to be confident in the future and your financial stability. But financial crises and rising inflation regularly threaten cash savings or bank deposits. The national currency does not maintain stability compared to the dollar; your hard-earned money depreciates in one moment.

However, there is an alternative to cash and bank accounts - investing in shares. Therefore, let's talk about a large investment platform - LSE (London Stock Exchange). Let's learn how to safely invest and increase them.

Features of listing on the LSE

Listing, in simple words, is the inclusion of the shares of a corporation, after careful verification and audit, on the register of the stock exchange to begin trading on them.

To be listed on the London Stock Exchange (PLM - Premium Listed Main Market), a company must disclose commercial, financial and management information in the prescribed form, and also meet the following requirements:

- The value of the fixed capital is at least £700,000.

- An agreement with a market maker who is ready to satisfy any volume of purchases/sales of its shares at the current market price of the exchange.

- At least 25% of the shares must be owned by shareholders who are not directors of the organization.

- No shareholder should have more than 30% of the votes.

- FCA check.

- External audit of a licensed consulting company (99% of FTSE-100 companies choose an audit from one of the “Big Four” of the world’s most reputable consulting corporations - KPMG, EY, PwC or Deloitte, to remove any doubts among investors.

Currently, shares of more than 1.5 thousand companies are traded in this segment, incl. included in the FTSE-100 and FTSE-250 stock indices.

Markets PLM AIM SFM PS

In order to streamline the activities of companies whose capital is different on the London Mercantile Exchange, 4 markets have been identified.

Selection criterion - in investment:

- Premium Listing Market (PLM) - the market includes 1.5 thousand companies with large capitalization from 65 countries.

- Alternative Investment Market (AIM) - 3 thousand small capitalization companies are represented on the London Stock Exchange Group.

- Specialist Fund Market (SFM) is positioned as a professional stock market for institutional investors.

- Professional Securities Market (PSM) - specialized for working with debt securities and depositary receipts.

The characteristics of each type of domestic market determine the listing conditions for participating companies. For example, to work in London PLM, you need to have a stable profit for 3 years and a capital of 700 thousand pounds sterling.

Shares of which global corporations are listed on the London Stock Exchange

Traders and investors on the London Stock Exchange can buy shares of the following global giants

— Royal Dutch Shell (capitalization $192 billion) is the largest oil and gas company in the world, headquartered in The Hague (Netherlands). Its subsidiaries produce oil in the Gulf of Mexico, California (USA), Canada, Nigeria, Iraq, Oman, Egypt, Island. Sakhalin (RF), Arctic;

- HSBC Holdings plc (value $125 billion) led by the 7th bank in the world - HSBC, which has 3,900 branches in 67 countries of the European Union, Asia, Africa, North and South America, where more than 39 million of its clients.

— Unilever

($119 billion) - the 2nd largest (after Procter Gamble) manufacturer of consumer goods in the world, incl. tea (Lipton), soap (Lux and Dove), toothpastes (Close Up, Pepsodent), ice cream (Breyers and Magnum), etc.

— Diageo

($73 billion), the world's largest producer of elite alcohol, incl. such well-known brands as Smirnoff and Popov vodka, Johnnie Walker and White Horse whiskey, Gilbey's brandy, Don Julio tequila, Captain Morgan rum, Black Haus schnapps, Gordon's gin, etc.

— British American Tobacco ($70 billion), the 2nd (after Philip Morris) tobacco corporation in the world, controlling 17% of the market. Produces Kent, Pall Mall, Rothmans, Dunhill, Vogue, Lucky Strike, Viceroy, and in Russia, Java Golden cigarettes.

Table 1. Shares of which global corporations are listed on the London Stock Exchange

Shares of Russian corporations on the London Stock Exchange

More than 30 shares of Russian companies are presented in the form of depositary receipts on the London Stock Exchange. This

- in the financial sector - Sberbank of Russia, VTB Bank, Tinkoff Bank, AFK Sistema;

- in oil and gas production - Gazprom, Lukoil, Tatneft, Rosneft, Gazprom Neft, Integra, Novatek, Surgutneftegaz;

- in metallurgy and mechanical engineering - Severstal, Evraz plc, Magnitogorsk Iron and Steel Works, HMS Group, NLMK, TMK;

— in the food sector — Cherkizovo;

— fertilizers — Akron;

- mining and gold mining - Polymetal (included in the FTSE 250), Polyus, Petropavlovsk PLC (included in the FTSE 250 and FTSE Gold mining);

— construction — Hals-Development, LSR, PIK;

— energy — Rosseti, RusHydro, FGC UES;

— pharmaceuticals — Pharmstandard;

— telecommunications — MegaFon;

— IT sphere — Mail.Ru Group and Sitronics;

Table 2. Shares of Russian corporations listed on the London Stock Exchange

What did Russian companies gain from having their shares traded on the London Stock Exchange?

- direct investments. For example, AFK Sistema received an IPO in 2005. $1.3 billion;

— the image of a reliable and reputable international corporation, audited by the world's leading consulting firms, FCA and LSE;

— unlimited potential for receiving funds, both through the growth of the company’s share price and through the issuance of new securities.

How to access trading on the London Stock Exchange

This can be done with the help of foreign or domestic brokers.

There are three options for accessing the LSE directly:

- by concluding an agreement with one of their subsidiaries of a Russian broker in Europe or America (minimum deposit - $200);

- through a Russian broker, but with the status of a professional investor;

- through a foreign broker (minimum deposit - $5,000).

The best brokers for buying and investing in shares

As I mentioned above, it is possible to start trading on the London Stock Exchange only with the help of a domestic or foreign broker. Their choice must be taken seriously. After all, not only your money, but also your reputation in the financial market will suffer from an unscrupulous businessman.

Below I will present a list of reliable and proven brokers:

Verified foreign brokers

| Name | Rating | pros | Minuses |

| Interactive Brokers | 8/10 | They speak Russian | Subscription fee 10$\month |

| CapTrader | 8/10 | No monthly fee | They only speak English |

| Lightspeed | 7/10 | Low minimum deposit | Imposing services |

| TD Ameritrade | 6.5/10 | Low commissions | Not everyone gets an account |

London Stock Exchange indices

Stock index is the arithmetic average of the prices of shares of those enterprises that are included in this index. Let's highlight the five most popular stock indices of the London Stock Exchange.

The FTSE All- Share Index shows the price dynamics of all shares that are bought and sold on the LSE.

Rice. 1. Index FTSE All-Share on LSE

FTSE 100 is the most popular LSE stock index, formed from 100 shares of the largest companies on the London Stock Exchange by capitalization. It includes such giants as HSBC Holdings, Rolls-Royce plc, Marks Spencer, Royal Dutch Shell, British Petroleum, Coca-Cola HBC, British Airways, Lloyds Banking Group, Barclays, Air China, RSA (insurance group), Toshiba, etc. .

Rice. 2. FTSE 250 Index

FTSE 250: This index contains 250 mid-cap companies. Russian companies are also present, for example, Evraz Group.

Rice. 3. FTSE 250

The FTSE 350 combines companies from the first two indices.

Rice. 4. FTSE 350

FTSE Small Cap. It is calculated based on the quotes of shares of a company with a small capitalization that are not included in 100 and 250.

Rice. 5. FTSE Small Cap

The most famous stocks traded here

There are quite a lot of companies here. There are both foreign and Russian. For example, everyone knows Sberbank, which has been successfully operating for many years in a row, Tatneft, which is engaged in oil production.

| Foreign companies | Russian companies |

| VR | Gazprom |

| Marks&Spencer | Tatneft |

| AstraZeneca | Megaphone |

| Greggs | Rosneft |

| Hays | Lukoil |

| ThomasCookGroup | |

| HardyOilandGas | |

| Mothercare | |

| Coca-Cola | |

| Durex | |

| Bentley |

FTSE Indices: a joint product of the Financial Times and the London Stock Exchange

The FTSE 100 index stands for Financial Times Stock Exchange Index , i.e. was originally a joint product of the reputable Financial Times newspaper and the London Stock Exchange. Since 1995, this stock index brand has belonged to the FTSE Group, a subsidiary of the London Stock Exchange, which has its own Internet portal www.ftserussell.com on whose pages you can easily find dozens of other financial products of the FTSE index:

- FTSE AIM UK 50 Index (50 largest UK companies);

- FTSE/Athex Large Cap (25 companies on the Athens Stock Exchange);

- FTSE Bursa Malaysia Index - 30 (30 largest firms on the Malaysian stock exchange)

- FTSE Bursa Malaysia Index - 70 (respectively, 70 enterprises)

- FTSE Bursa Malaysia Index - 100 (respectively, 100 enterprises)

- FTSE China A50 Index (50 largest enterprises of the Shanghai Stock Exchange);

- FTSE China AH 50 (50 largest Chinese enterprises of the Hong Kong Stock Exchange);

- FTSE China B Share All Cap Index

- iShares FTSE A50 China Index ETF

- Bosera FTSE China A50 Index ETF

- Bosera FTSE China A50 Index ETF-R

- FTSE Fledgling Index

- FTSE Italia Mid Cap

- FTSE MIB

- FTSE SmallCap Index

- FTSE techMARK 100

- FTSE4Good Index

Masterforex-V comments:

1. why so many stock indices?? According to the F TSE Group, they are necessary for professional investors (?), “asset managers” (?), “institutional investors”, “advisers on choosing the best instruments for an investment portfolio”, “for scientists” (??), etc. .

2. we have listed... only a small part of these indices, the rest can be found on their website;

3. Masterforex-V traders only use FTSE-100 and 250. Believe me, this is enough to find the trend (explanation below)

Trading strategies for professional trading of the FTSE 100 index

Masterforex-V Academy recommends a number of trading strategies with MF modifications:

- when trading on small time frames m5 and m15 - Scalping: classics and strategies Masterforex-V;

- for MEDIUM-term trading on n1 - n4 - Swing trading: classics and know-how Masterforex-V

- for a comprehensive market analysis, it is advisable to install “3 Elder screens” - more details Three Elder screens: essence, criticism and modifications of Masterforex-V and study at least the basics of Elliott wave theory.

Features of investing in the FTSE 100 and FTSE 250 index of the London Stock Exchange

Wiki Masterforex-V for LONG-TERM investments in stock indices LSE strongly recommends paying attention

1. for approximately a ten-year growth algorithm of all stock indices of the London Stock Exchange from one global economic crisis to the next (1987 / 1998 / 2008 / 2019-1920?)

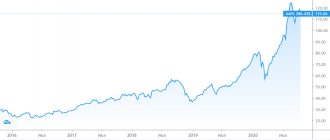

Rice. 6. FTSE 100 and FTSE 250

2. absolute similarity of trends on w1 FTSE 100 and 250 . Look at both graphs - there is no difference. Therefore, there is no need to buy MULTIPLE indices on the LSE, they are practically the same for an INVESTOR in the “decade” of a LONG-term bull market.

Rice. 7. Comparison of FTSE 100 and FTSE 250 trends

3. all stock indices in the world are similar to each other. Compare London's FTSE 100 with the US Dow Jones 30 Index. Again there are no major differences.

Rice. 8. Comparison of FTSE 100 and Dow Jones 30 trends

Comments wiki Masterforex-V : pay attention to the support and resistance levels that we give to our traders on the closed forum of the MF Academy. Is it easier to understand the market if you know the movement vector and the immediate goals?

— do you need a stop loss when working on buy?

— where will you set take profit and open a new buy after a downward correction?

— have you already realized WHERE to look for bullish trend continuation patterns from ascending triangles to flags, pennants, wedges?

— Do you need Pivot Points to search for opening a sell or buy order?

— should you be interested in bullish or bearish trend reversal patterns within 9-10 years?

If you answer these 5 questions correctly, you will understand more than what is covered in 90% of books, webinars and training courses on “working on the stock exchange”.

Recommended brokers for trading London Stock Exchange indices

Masterforex-V traders work on DIFFERENT markets, finding MEDIUM-term (from n8) and LONG-term (from d2) trends

— on Forex;

- on the stock market;

— in the cryptocurrency market;

— on CFD commodity futures of gold, silver, oil.

All these tools are available from the recommended brokers of the MF Academy. Half of our traders have opened trading accounts with NordFx with quotes for the FTSE-100, NASDAQ, Dow Jones, SP 500, DAX 30, Nikkei 225 indices, dozens of forex currency pairs and cryptocurrencies, as well as CFD futures of gold, silver, oil, crypto indices, etc.. This is enough to earn 300%-700% in foreign currency for several years, as can be seen from the online monitoring of MF traders’ accounts on our rebate autocopy service pro-rebate.com.

The second half of trading accounts of Masterforex-V traders is distributed between the British FxPro, the Swiss Dukascopy Bank SA and beginner cent accounts with Fort Financial Services.

Remember: what is important for successful trading is not the market (indices and shares of the London Stock Exchange, Forex, futures or cryptocurrencies), but finding a trend at the very beginning of its emergence.

Caution about BO and Forex

When talking about making money through buying shares, one cannot fail to mention binary options and the Forex market. Unfortunately, these ways to increase capital are ineffective and even dangerous for the well-being of your finances.

Binary options are securities traded by investors on the Chicago Stock Exchange. It is impossible to make money from them the way advertising presents it. Forex is an online casino that is not directly related to the stock markets. Earnings here are associated with significant risk. For you. Ready to be deceived - go ahead.

London Stock Exchange Innovation: Supporting the World's First Cryptocurrency Bonds

Unlike its competitors, the London Stock Exchange is very loyal to crypto projects and invests in them through its own company London Stock Exchange Group Plc (LSEG, operator of the London Stock Exchange LSE). Pay attention to what projects are being invested in.

1. London Stock Exchange Group Plc (LSEG) in February 2021 invested $20 million in bonds of the Nivaura crypto project to launch a blockchain that would significantly simplify the issuance of debt securities (bonds) based on cryptocurrency.

Nivaura is a digital platform for issuing and managing corporate bonds, loans and shares. According to Nivaura, head of international development at LSEG, issuing bonds now requires any stock exchange to take numerous steps over time. Using Nivaura blockchain technology, the time for this issue can be reduced by 80%, and the cost of raising capital will also be significantly reduced.

2. LSEG and HSBC invested in JP Morgan's crypto project of its own digital token, JPM Coin, linked to the dollar exchange rate, through which clients can instantly transfer funds to each other using the blockchain network. As a result, the bank's monthly expenses were reduced by 25%, and clients received a modern and secure currency exchange system.

3. Since 2021, LSEG has been collaborating with IBM to create a blockchain-based platform for issuing private shares to medium and small enterprises in Italy.

4. In 2021 The London Stock Exchange has registered the first cryptocurrency company, Argo Blockchain , associated with the mining of cryptocurrencies. The company offered remote mining with a monthly subscription for anyone. Argo Blockchain located its own mining facilities in the Canadian province of Quebec, which is quite attractive for cryptocurrency mining due to low temperatures and cheap electricity.

Argo Blockchain's IPO on the London Stock Exchange brought in £25 million. The company successfully passed the audit of the British Financial Conduct Authority (FCA) and began to successfully advertise services for mining Ethereum, Ethereum Classic, Bitcoin Gold and ZCash on its equipment. Users pay a monthly subscription and receive cryptocurrencies in proportion to the amount of money they deposit. Argo Blockchain CEO Jonathan Bixby said: “More than 90 percent of crypto mining is done on an industrial scale because doing it individually is technically very difficult... We want to be like Amazon Web, but in the crypto industry.”

About the exchange

The abbreviation LSE stands for London Stock Exchange. The volume of capital investments allows the stock exchange, geographically located in the English capital, to confidently occupy third place. The LSE determines quotations in the EU and remains independent from American trading platforms.

| Country and site | LSE, UK |

| Year founded and owner | 1801, London Stock Exchange Group |

| Number of shares traded | 2169 |

| Capitalization | $4.38 trillion. |

| Indexes | FTSE Indices |

| Official site | https://www.londonstockexchange.com/ |

| Work schedule and duration of the session according to MSK | Mon. -fri. from 10:00 to 18:30 |

London Stock Exchange shares and takeover attempts

Exchanges also have shares. The LSE is no exception, whose shares can be freely purchased on its own platform. It's easy to see that over the last decade they have risen in price by 750% from £610 to £4,600. Knowing this result, answer the question for yourself whether the founders of the London Stock Exchange were right or wrong when they rejected tempting offers to sell it four times.

According to the authoritative The Wall Street Journal and Financial Times

1. In 2004, the Deutsche Boerse stock exchange (Germany) offered 1.35 billion pounds for a large stake. It was not about a takeover, but rather a merger. The united exchange would have become a leader in the European market, but the deal did not take place. The LSE considered the proposal to be one that “does not reflect the real situation.”

2. A year later, in 2005, the Australian investment bank Macquarie bank wanted to buy LSE for 1.48 billion pounds ($2.62 billion). The British rejected this proposal as well.

NASDAQ exchange was more persistent in its desire to acquire the London Stock Exchange (this platform presents shares of companies in the high-tech sector, which is why it is called that). In 2006, the Americans made a generous offer to the British, but LSE considered it not at all generous and rejected it. Unlike the Germans and Australians, the Americans decided to take the plunge and began aggressively purchasing shares of the desired company. In a short time they managed to acquire a substantial stake of 28.75%.

4. In 2007, there was a second attempt by NASDAQ to buy the LSE. They had a substantial stake, but the Americans wanted to increase it to a controlling stake. At that time, they offered twice as much as the Germans two years earlier - 2.9 billion pounds, but were again refused with a similar explanation: “You underestimate us.” After this, the Americans refused to continue the fight for the LSE, reselling its shares, and in the meantime they themselves acquired another European exchange platform, but that’s another story.

Bidders

on the London Stock Exchange is very large. The fact is that all major brokers not only in the European region, but also American ones are usually connected to this trading platform. This creates such good trading conditions, because the more participants there are, the higher the liquidity not only for the main securities, but also for the secondary ones. There are investors who collect portfolios of young, but at the same time quite promising companies, in the hope that some of the investments can later be left and receive high dividends or take profit by selling shares. So, there are only two main groups:

- Individuals . That is, these are just traders, private investors. True, most of them are speculators, since popular stocks show good daily ranges, not to mention stock indices.

- Legal entities . Basically, these are investment funds. The London Stock Exchange allows you to place significant volumes of orders and at the same time there is enough liquidity, that is, there are no sharp price jumps or they are extremely rare. Along with the New York Stock Exchange, the LSE is one of the main platforms in terms of the number and volume of transactions per day in the stock sector.

Also, the large number of traders is due to the fact that the shares of the London Stock Exchange are represented by a huge number of foreign companies. Typically, trading platforms mainly trade shares of companies in their own country. In the case of London, we have several dozen countries whose legal entities are listed. In total, at the moment you can purchase 4 thousand different shares. They are divided into groups, which we will consider further.

I also recommend reading:

TOP 9 mistakes in investing. What are you doing wrong?

Beginners often make investing mistakes that cost them a lot (literally). To do your job […]

London Stock Exchange under Brexit

Due to Brexit, London may lose its position as a global financial center, thanks to which the London Stock Exchange has developed so successfully and rapidly in recent decades. Banks, insurance and investment companies are one after another moving part of their employees and capital to the European Union due to fear of losing access to the EU market - this is a negative forecast given by many financial analysts, incl. in the Z/Yen report.

Already, 33% of companies in the UK financial sector have publicly announced that they intend to move some operations or employees outside the UK due to Brexit, according to an EY report. We are talking about all the major banks, including Barclays and HSBC, as well as a branch of the CME group - BrokerTec - a subsidiary of CME, which moved its “European” headquarters from London to Amsterdam.

History of the exchange

The London Stock Exchange is one of the oldest on the Eurasian continent, more than two hundred years old. And although the official year of creation is considered to be 1801, in fact the LSE was founded back in 1570. It was during this period that securities markets emerged in European countries.

The 16th-century Royal Exchange in London was a place where rootless commoners were not allowed. What could they do? Gather in coffee shops. True, the trading took place in a unique way: standing on stools, brokers announced the price of shares.

Among the first goods were sheep's wool, paper, coal and coffee beans. Therefore, Thomas Gresham, as a financial adviser to the Queen of Great Britain, convinced Elizabeth I in 1571 to give the green light to the creation of a meeting place for businessmen.

Despite the opposition of Parliament and the king, the London Stock Exchange officially began to function on March 3, 1801. It has managed to establish itself well over its five-century existence. This explains its popularity and stability today. LSE continued its work even during the Second World War under shelling and bombing. And in subsequent years it increased trading volumes.

Today the London Stock Exchange is a joint stock company: LSE shares are traded on it, ensuring the safety and security of investments.

Interesting facts about the London Stock Exchange

1. According to historian E. Morgan, the stock exchange terms “bulls” and “bears” first appeared among traders on the London Stock Exchange.

- “bears” were those who tried to “lower the market” by selling shares, even those... that they did not own, in an attempt to sow panic on the stock exchange. They said about such people: “they share the skin of a bear that has not yet been killed”;

- the “bull” was the traditional rival of the bear in bloody fights in the center of the City on the Thames - a favorite pastime of the same stock exchange traders. So the bull began to be seen as an opponent of the bear, and these names of stock market players have been preserved to this day.

2. Outside the LSE building there is a dynamic sculpture by the Greyworld artist collective called "The Source". This is a cube of marbles placed on ropes in the atrium of the new London Stock Exchange building. The cube consists of 729 balls - 9 bases by 9 balls and 9 balls in height by 32 meters, up to the roof of the building. The balls are controlled by a computer system and can move independently of each other, creating different shapes and forms depending on the current situation on the stock market. The sculpture opens (the closed sculpture creates a simple cube) at 8 am, when active trading begins in the market.

At the end of the day, lights placed in each of the 729 balls show the closing price of the London Stock Exchange. The sculpture was unveiled on July 27, 2004 by Queen Elizabeth II, and a broadcast of the event was sent around the world. Interestingly, each sculpture is shown on TV every morning. The audience is estimated at 80 million people.

3. On April 5, 2000, trading in London was paralyzed for almost eight hours due to a failure in the electronic system. Losses amounted to several million pounds and the FTSE-100 fell just 0.74%.

4. In 2021, the Antimonopoly Committee of the European Commission blocked the decision of the London and Frankfurt stock exchanges to merge. The head of the committee, Margrethe Vestager, said that the European Commission took this decision because “a merger could lead to the formation of a de facto monopoly in a number of markets, and one of the commission’s goals is to ensure that the merger does not harm competition.”

Exchange functions

The London Stock Exchange (LSE) has the following functions:

- Ensuring the quotation of securities and providing access to trading to all participants. Now this happens in the form of pricing in an electronic system.

- Determination of the procedure for the functioning of tenders, compliance with regulations and control over the tendering process.

- Formation of a list of companies whose shares are listed on the stock exchange, as well as criteria for the placement of new trading instruments. Here it is worth going into more detail and indicating the requirements that a company must meet in order to be listed on the London Stock Exchange:

- Providing mechanisms to ensure the possibility of obtaining investments in one form or another.

- Separate from the administrative functions, there is also a fairly practical one, which is common to all large trading platforms, namely the formation of a stock index, which we will discuss later.

Rules for placing shares on the LSE exchange

You can also note the fact that not every company can choose to list on the LSE. The list of requirements is quite serious, and some of its items make placement impossible for some companies that, in principle, are large enough to have a placement. So the rules are:

- The capitalization of a company wishing to place its shares must exceed 0.7 million pounds . This, on the one hand, hinders the development of potentially successful enterprises; on the other hand, the London Stock Exchange is known for its quality; despite the impressive list of securities for trading, it eliminates many possible options due to its conditions. This is a definite plus, since only legal entities that have truly confirmed their solvency will trade on the market.

- The share of votes of each shareholder should not exceed 30% . It is for this reason that many cannot enter the market. If you look at large corporations, you will see that the key person usually has a package that is not at all what one would expect. This is partly due to these rules. But in general, this decision is correct, since centralizing a large number of shares in the hands of one person can lead to disastrous results.

- At least a quarter of all shares must be owned by persons not related to the board of directors . Also, shares must be available for purchase, that is, they must be tradable. This is done on the lse exchange in order to exclude options for price manipulation, strong movements, to provide access to shares and at the same time not to be in constant tension due to possible price jumps due to the actions of individuals with large blocks of shares. Unfortunately, this happens quite often on not very liquid securities, so even such conditions do not always guarantee the same trading stability as shares of large companies and corporations. However, all measures are aimed precisely at increasing liquidity and creating transparent conditions for everyone.