For most people, investment in construction involves investing money in apartments and studios located in houses and residential complexes under construction. This state of affairs is due to several factors. The main one among them, of course, is financial.

Indeed, investing in the construction of commercial real estate requires much more capital. At the same time, many investors can afford to invest in the construction of a new building. In addition, the mechanisms for such investments in Russia have long been established.

What is investing in construction and what are its advantages?

Investments in the construction of residential real estate are investments in the purchase of housing (apartment or cottage) at the stage of their construction with the aim of making a profit in the future . This method of making money “work” has become very popular, along with bank deposits and buying shares. Let's figure out why investing in housing construction is so loved by many.

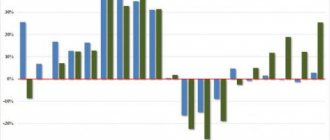

- High profitability. Construction investments, with the proper approach to business, can pay off in 2-3 years and bring you a profit of 25-50% of the invested amount. And during the construction boom of the mid-2000s, buying an apartment in Moscow at the stage of its construction brought investors superprofits, expressed in hundreds of percent and millions of rubles.

- Comparative simplicity. Investing in housing construction will not require you to daily monitor stock quotes on the stock exchange or the need to understand and understand all the intricacies of a particular production area. Even the simplest scheme “bought an apartment at the foundation stage - sold it in a ready-made house” can bring in a profit, and quite a considerable one.

- Reliability. Despite the severe crisis, housing in Russia remains in price. By investing in new buildings, you are guaranteed to be able to return your capital without loss, even with negative developments in the economy. And losing such an investment object is possible only in the event of insurmountable situations, such as war or natural disasters.

Secondary housing

The scenario for investing in secondary housing is similar to the story with the primary market. Here you also need to choose an investment strategy, take into account the location of the property, nearby infrastructure and existing repairs. the founder of the rental property management platform Doubleyourrentalprofit.com, Farid Gazizov buying this or that profitable property right now: “Due to the coronavirus pandemic, there is unrest and stress everywhere. And in the secondary market there are many small and isolated players who may misinterpret the situation and sell their properties at a reduced cost. This gives you more opportunities for a bargain. Therefore, it is important to carefully monitor proposals here.”

As for the risks when buying an apartment on the secondary market, the main ones are the incapacity of the seller, sale of housing by proxy, multiple resale, illegal privatization, unauthorized sale (if the apartment has several owners), debts on contributions for major repairs. Regardless of whether you are buying a home for your own residence or as an investment, all these points need to be checked before concluding a transaction.

Investments and construction - possible risks

This way of managing your funds also has a downside. Like any investment, investing in housing construction has its risks, which are useful to know about:

- Delays and missed deadlines. The main headache for those who decide to invest in a new building may be the delay in its commissioning. Construction itself requires a high degree of organization, and is very dependent on the human factor. Errors by workers, breakdowns, accidents, disruption of the supply of materials - all this can delay the delivery date of the finished house. It is calculated that each week of delay reduces profitability by 0.01%.

- Bankruptcy of a construction company and freezing of construction.

- Fraud – not so long ago, it was not uncommon for criminals to disappear after receiving money from investors. At best, deceived investors received only the foundation of a failed new building, and at worst, the construction site existed only on paper.

- House demolition. Some companies begin to attract investment in construction without having a complete package of documents for the construction of housing or simply building it illegally. In this case, the demolition of the building by court order is quite possible.

- Defects and poor quality work. It was already mentioned above that construction is highly dependent on the human factor. And if control over the activities of workers and foremen was insufficient, then investors may find that the quality of housing does not meet their expectations. This leads to a drop in its value and loss of profitability.

- Unseen circumstances. The investment object can be lost in the event of hostilities, earthquakes or other natural disasters.

Investments in new buildings - how to get income

So, you have decided to invest in one of the housing projects. How can you make a profit from your future apartment or cottage? The most popular way is resale.

The action plan is very simple, even primitive:

- You take part in shared construction and invest money at the stage when the house is only a foundation pit or foundation.

- We are waiting 2-3 years until everything is ready.

- We sell an apartment in a new building at a market price and that’s it, the construction investment has paid off, and you get a good profit.

An alternative way to earn money can be renting out living space. The profitability in this case is significantly lower, but the money can literally flow for decades. There are two ways to improve the efficiency of such an investment:

- Daily housing rental. It is not necessary to rent an apartment for a long time; renting it for a couple of days can bring you significantly more income. But there are also risks here: the living space may remain idle for some time, or a careless tenant may wreak havoc on it and leave.

- Monitoring the real estate market. Let's say you invested in the purchase of an apartment and receive a small income by renting it out. However, you always have the opportunity to sell your home at any time. And if you follow the trends of the real estate market and “catch” the moment when the cost per square meter increases significantly, the apartment can be sold at a good profit.

Investing in new buildings can also bring less obvious benefits. By investing money in housing construction, you can live in it yourself and get an apartment at a price significantly lower than the market price. And saving money, in a sense, is also income.

Now it's time to decide on an investment object. These can be either high-rise apartment buildings, or low-rise cottages or townhouses.

Bankruptcy auctions

Another possible option for purchasing residential real estate as an investment is collateral or seized property, bankrupt property. “This category mainly includes housing for which mortgage obligations could not be repaid. The sale of this property is carried out at prices below market prices, which already initially gives a chance to make money on resale. The liquidity of such objects is high, and the payback period is less than a year,” says Evgeny Gudkov.

Trade-in housing exchange – is it worth getting involved with?

Why is the bankruptcy of the seller dangerous for a secondary buyer?

Investing in high-rise new buildings

For many years now, apartment buildings have been the main type of housing in medium-sized and large cities, and especially in megacities. It was high-rise new buildings that became the object of the construction boom of the mid-2000s. Why are they so attractive both for life and for investment?

- High comfort of life. A high-quality “high-rise” can offer its residents comfortable apartments, a garbage disposal, good parking, an attractive appearance, a reliable roof and much more, which will allow an apartment in such a building to be sold for good money and justify investments in housing construction .

- Life time. A well-designed and constructed apartment building can last for decades.

- Infrastructure. Most high-rise buildings are built within the city, and many are built on the site of previously demolished old and dilapidated buildings. This means that next to them there are already roads, schools, kindergartens, shops, clinics and other necessary civil infrastructure.

To increase profitability, a construction investment agreement should be concluded as early as possible, preferably immediately after the start of sales. At this stage, prices will be minimal, which means that the return on investment in the future will be higher.

But it is much more important to choose the right investment object in order to end up with housing that is attractive to buyers and has a good cost per square meter. Remember that the price of an apartment consists not only of its area, but also of many different factors. How not to make a mistake at this stage and choose the most worthy investment option?

Explore the construction site and surrounding areas. Imagine yourself in the place of a potential buyer, what would be important to you? Is there a school, kindergarten, good department store nearby, how far is it to the clinic, will there be parking at the house or a garage cooperative nearby, how long does it take to walk to a public transport stop or metro station? All these factors must be taken into account.

Find out what's planned for construction in the area. If it is a shopping center, then good; proximity to it can give a small plus to the price per square meter. And if it’s a factory, then the opposite is true; it’s unlikely that anyone will be willing to pay good money for housing in a place with a bad environment.

Before investing in new buildings with a particular construction company, experienced investors study its past projects. The best way to do this is to interview their residents; they will tell you exactly and without embellishment about all the pros and cons of their houses.

By the way, about experience. If construction investments are new to you, it would be a good idea to use the help of an agency or friends and acquaintances who have already worked with this . Extra hassle and expense in this matter can save you from problems in the future.

Apartments

Apartments are, on average, 10–20% cheaper than apartments with similar characteristics. The difference is due to the legal status of the apartments: purely formally, these are non-residential premises. Therefore, the developer, on the one hand, should not change the purpose of the land plot for the construction of housing, and on the other, is not obliged to build internal infrastructure. This is partly a drawback of apartment complexes, but today developers are increasingly providing social facilities even in such projects.

“Buyers of apartments in mixed-type complexes where both formats of real estate are sold are in the most advantageous position: they will have access to the entire infrastructure. Such apartments can be rented out at the same price as apartments, but entry into the project (lot price – editor’s note) will be noticeably lower,” notes Igor Kozeltsev, General Director of Management Company “Razvitie” .

The growing popularity of apartments among investors is now influenced by the active discussion of their “legal amnesty” at the level of the Government of the Russian Federation: since the beginning of the year, the demand for this type of real estate has already increased by 15%. These figures are cited by AFI Development Director of Residential Real Estate Sales Fedor Ushakov , who also emphasizes that if the law equating apartments with residential premises is nevertheless adopted, the demand for them in the short term will increase by another 30–40%. “The consequence will be an increase in the price of these lots, including due to the “washing out” of the cheapest options from the market. As a result, their cost may increase by 25–30%,” adds Ushakov.

Investments in low-rise construction

An alternative to multi-storey high-rise buildings today are cottage communities and townhouses built within the city or near it. The main advantage of investing in low-rise construction is the acquisition of high-quality and comfortable individual housing in an area with good environmental conditions. And right now, many people strive to live in their own homes and breathe clean air, not poisoned by the exhaust of cars and factories.

Here, when choosing an investment property, the criteria are slightly different from those that exist for high-rise buildings within the city.

- Firstly, for cottage villages and townhouses, the ecological situation and picturesque surroundings are of high importance. A house on the river bank will cost significantly more.

- Secondly, the transport issue is especially acute - the faster and more comfortable the trip from the cottage village to the city, the better. And this depends on the road situation at the entrance, traffic jams and the presence of highways and transport interchanges.

- Thirdly, it is worth finding out whether the future residential complex will be protected, whether, in addition to housing, there will be other facilities there, such as a kindergarten or shops.

But, as with investments in new buildings, before investing in the construction of cottages, it will be useful to find out more about the past projects of the developer and, if possible, use the help of qualified specialists or experienced people.

Commercial real estate

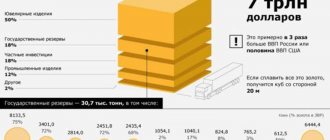

Commercial real estate was seriously affected by the crisis, which largely undermined its investment potential. However, some of its segments are still capable of generating stable income. The key to their sustainability is that they are linked to the pressing needs of both businesses and consumers.

“During the pandemic, the demand for warehouse space has increased sharply due to the expansion of the delivery industry. Coworking and hybrid workspaces have gotten their chance. This was facilitated by the transfer of a significant part of office employees to remote work. Accordingly, if it is necessary to organize a meeting with partners or quickly mobilize a team, renting a coworking space has become the most suitable option. However, a certain category of classic offices remains attractive to investors - compact multifunctional premises in centers with good transport accessibility,” comments Olga Khasanova, head of the Urban Awards .

It is also possible to invest in commercial properties in new buildings. Regardless of the economic situation, residents of new neighborhoods will need shops, beauty salons and personal services.

We reduce investment risks

How to avoid falling for scammers or unscrupulous developers? There are several things to consider before signing a construction investment agreement. By paying attention to them, you will protect yourself from scammers.

- The company's past. The more houses and cottages it has built before, the more reliable your investment in housing construction will be . At the same time, it is worth investing in something in which the company already has experience. If it specializes in cottage communities, then investing in a new high-rise building from the same company can be risky.

- Reputation. Investments and construction are a responsible matter, and no one wants to entrust their money to someone unknown. Therefore, first find out whether this developer has had any scandals or problems with the law. The fastest way to do this is through the Internet - if the name of this company appeared in the news in a negative light, then finding this news will not be too difficult. It wouldn’t hurt to interview knowledgeable people to see if they are aware of something that is unknown to the general public.

- Be sure to ask whether the developer has a justification for investment in construction - a package of documents containing investment goals, expected profitability and economic effect, basic construction decisions and justification for choosing the location and design of a residential building.

- How is your work going. Don't forget to visit the construction site - you, as an investor, have every right to do so. When visiting it, be attentive and note the details - what is the pace of work, whether there is equipment at the construction site and whether materials are being unloaded. Also make sure that there is no flight of investors trying to sell the property at any possible price just to get their money back.

What is justification for investment in construction?

The task of any developer is to find an investor for construction. The investor’s task is to calculate all the risks, make sure that the project promises benefits and invest in it. And for everything to work out well in the end, the developer must explain why it is necessary to invest in its enterprise, what effects it promises (both financial and social) and why construction should be carried out in the chosen location and according to the chosen project.

Without this, attracting investment in construction is simply impossible. And therefore there is a package of documents called “Justification of investments in construction”. Its importance should be assessed by the fact that its development and content is regulated by the state using the set of rules SP 11-101-95.

The creation of these documents is the responsibility of the developer company, and its development begins even before the draft is drawn up. Justification for investment in construction includes:

- purpose of investment;

- explanation of the choice of site for construction;

- overview of basic construction solutions;

- work plan and deadlines by which the building will be put into operation;

- economic and social effect of investing in construction;

- assessment of the profitability of investments and their feasibility.

Since this document is very important, any potential investor should study it in detail and assess the possible risks before making a decision to invest funds.

In conclusion, it is worth saying that with a competent approach to business and taking into account all the nuances and risks, investing in housing construction is extremely profitable. And if you are new to investing, then first of all you should pay attention to the real estate market.