Securities data

| Ticker | G.E. |

| Trading platforms and trading times | New York Stock Exchange 17.30 – 00.00 Moscow time |

| Name | General Electric Company |

| Number of securities in circulation | 8 720 808 000 |

| Denomination | $1 |

| Dividends | Eat |

| Year of foundation | 1878 |

| Founded by | Thomas Alva Edison |

| Headquarters | USA: Boston, Massachusetts |

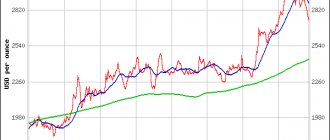

Exchange rate dynamics for all time

Quotes from TradingView

The shares were issued by General Electric in 1968. For the first 15 years, there were no special jumps in their rate; there was a slight increase of no more than 1–2% per year. The first takeoff was recorded in September 1987, when shares rose to $4.77.

The biggest rise was in August 2000, when the stock reached almost $60. Then the decline began again, lasting until January 2003, when the price reached $20.47.

A new peak occurred in 2007 ($39.77), and another drop in quotes in 2009. Over the past 10 years, General Electric shares have shown strong growth, but from 2021 to the present day there has been a decline to the 2009 level.

Time of the underdogs: General Electric began to grow

In June and early July, the share price of a longtime stock market underdog, the international conglomerate General Electric, suddenly began to show growth spurts. The last such surge occurred on July 2/July 3. Note that General Electric, once one of the companies that formed the backbone of corporate America, has been losing capitalization since 2021. It was in 2021 that Warren Buffett dumped shares of the conglomerate. At that time, they paid about $30 per share.

In 2021, General Electric shares received additional impetus to fall amid the pandemic. After all, the company belongs to the industrial sector of the economy, which has not been the focus of attention of investors who have focused on investing in the digital sector for a long time. Moreover, digital products turned out to be especially in demand during the period of restrictions due to coronavirus. At the time of the economic shutdown, General Electric shares were trading at around $13. and currently the price of one share fluctuates around $7 per share.

The main reason for the growth of shares of the industrial giant, according to some analysts, is the search for new opportunities in the market, which is gradually reviving following the gradual “opening” of the economy. And here purely opportunistic considerations played a role. General Electric shares are very cheap after a long decline. And the low base, according to investors’ calculations, in itself gives a chance for securities to grow, as a consequence of the well-known “buy low” rule. There is a chance that shares will return to the pre-crisis “natural” level of $13.

Perhaps investors were given hope by reports of the resumption of passenger traffic. They appear to have been impressed by data recently reported by the Washington Post: The publication, citing the Transportation Security Service, reported that passenger air travel was up 400% by mid-June compared to the “bottom” of the coronavirus crisis. And as you know, General Electric is one of the leading manufacturers of aircraft engines in the world. However, statistics can be presented in different ways: the same Security Service calculated that the number of air passengers transported during the same period was only 23% of the same period last year.

In general, consultants are very skeptical about the prospects of General Electric, not seeing the fundamental factors for the growth of the company's shares. They recommend selling them as soon as they rise a little.

However, there is a more optimistic view of General Electric's future. The fact is that at the end of last year, the conglomerate suddenly came to the attention of a new generation of investors belonging to the next wave of young professionals - like some other large industrial companies. And in the months leading up to the pandemic, General Electric shares rose from $8 in August to $13 in February.

The fact is that the problems that the conglomerate faced several years ago are typical for large companies, that is, sooner or later the business accumulates excessive costs and loses efficiency. However, by mid-2021, there was evidence that the conglomerate’s management was successfully optimizing and reducing costs, actively implementing the principles of lean management (lean production). Due to this, for example, it was possible to reduce losses by 60% in the division producing aircraft engines.

Business restructuring was also carried out - abandonment of ineffective activities and strengthening of effective areas. Note that the conglomerate began in 2021 by getting rid of the division from which its history began: the production of light bulbs.

The cleanup of unpromising areas continued until 2021. Thus, the company separated the biopharmaceutical division from the GE Healthcare division and sold it, focusing on what it had accumulated unique competencies in - the development and production of digital medical equipment.

On the other hand, young investors saw prospects in the remaining activities of the conglomerate. Without discounting General Electric's still main cash cow: the production of aircraft engines. Investors are confident that in the future the “cash cow” will be the production of engines that are being developed by the conglomerate for electric vehicles.

Investors are buying into predictions that there will be 125 million electric vehicles on the road by 2030, up from 6 million currently, and the vast majority of these vehicles will be powered by General Electric engines. And most of the new investors are young enough to wait these 10 years.

An additional consideration for purchasing General Electric stock is that the company has a turbine in its arsenal for use in wind energy. It is assumed that wind energy is the energy of the future, along with other industry sectors based on renewable energy sources.

And we must not forget that the conglomerate includes a division of high-tech medical equipment. It develops products based on breakthrough technologies, such as artificial intelligence, aimed at personalizing and increasing the efficiency of healthcare delivery.

About company

Founded in 1878, General Electric, which was created by the famous inventor Thomas Edison, initially specialized in the production of incandescent lamps with tungsten filament. But at the beginning of the 20s of the 20th century it switched to the production of household appliances, in particular refrigerators. GE also took the lead in creating the first broadcast television.

In the 1930s, General Electric improved incandescent lamps, released fluorescent lamps, and began using them in car headlights.

During World War II, General Electric begins producing weapons. And then he included patents related to nuclear energy, aircraft engines and astronautics among his inventions. In the seventies, he was engaged in oil and gas production, which significantly increased revenue.

Later, the restructuring of General Electric begins. The company sells part of its unprofitable enterprises, creates a training center, fires careless employees, which brings it tangible profits.

In the early 90s, the holding was actively involved in creating an international corporation, acquiring European and Asian companies. At the same time, financial and medical areas, as well as the diamond industry, are actively developing.

In the 2000s, General Electric turned to developments in the field of wind energy.

Production of the company

The main direction of General Electric's work is supporting the operation of global electrical networks, for which various electrical equipment is created. The company's products include various inventions that ensure the operation of power plants, not only hydro, but also gas and nuclear.

Most aircraft engines are produced by General Electric. The holding creates household and lighting equipment, and is developing new technologies for the production of plastics and sealants.

But a fifth of General Electric's income comes from sales from developments in the field of weapons, where a whole range of products is presented, from small arms and armored vehicles to space technologies.

Main shareholders

More than 20% of General Electric shares are distributed among the following companies (see table).

| Company | Number of shares (%) |

| The Vanguard Group, Inc. | 6,25 |

| State Street Corporation | 3,73 |

| BlackRock Institutional Trust Company | 2,59 |

| Capital World Investors | 1,73 |

| FMR, LLC | 1,63 |

| Bank Of America Corporation | 1,4 |

| T. Rowe Price Associates | 1,37 |

| Northern Trust Investments | 1,31 |

| BlackRock Fund Advisors | 1,2 |

| State Street Global Advisors Ltd | 1,1 |

| The Bank Of New York Mellon | 1,03 |

Key figure and her role

As of 2021, General Electric's Chairman and Chief Executive Officer is Henry Lawrence Culp Jr.

He became a member of the board of directors in April 2021, before which he headed Danaher Corporation for 14 years, which he is now trying to sell in order to cover debt obligations with the proceeds. Under his leadership, Danair increased revenues by $30 billion and entered international sales.

Affiliated companies

Today, General Electric has subsidiaries throughout the world, employing nearly 300,000 employees. GE has representative offices in New Zealand, Israel, Italy, Austria, Switzerland, and Argentina.

Various areas in the energy sector are being developed by Wind Energy, Energy, ScanWind. Radio and television broadcasting is carried out by Radio Corporation of America, NBC.

Company plans for the future

General Electric is trying to generate revenue by divesting some of its subsidiaries. Its plans include the sale in the near future of part of the enterprises involved in the creation of lighting devices, which will raise $5 billion, plus the same amount GE can receive by getting rid of part of the oil business.

General Electric plans to merge railroad agencies with Wabtec. Expected to receive $11 billion.

The part of the holding that deals with medical equipment will be reorganized into a separate division and put up for sale.

After the change in structure, General Electric will have only 4 divisions.

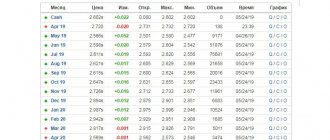

Dividend statistics

| Year | Stock quotes | Dividends ($) | Changes (%) |

| 2020 | 20 | n/a | n/a |

| 2019 | 9,57 | 0,01 | 0 |

| 2018 | 7,51 | 0,01 | -12 |

| 2017 | 17,45 | 0,12 | -50 |

| 2016 | 31,6 | 0,24 | 4 |

| 2015 | 31,15 | 0,23 | 0 |

| 2014 | 25,27 | 0,23 | 10 |

| 2013 | 28,03 | 0,22 | 16 |

| 2012 | 20,99 | 0,19 | 12 |

| 2011 | 17,91 | 0,17 | 21 |

| 2010 | 18,29 | 0,14 | 14 |

| 2009 | 15,13 | 0,1 | -31 |

| 2008 | 16,2 | 0,31 | 0 |

| 2007 | 37,07 | 0,31 | 11 |

| 2006 | 37,21 | 0,28 | 12 |

| 2005 | 35,05 | 0,25 | 14 |

| 2004 | 36,5 | 0,22 | 11 |

| 2003 | 30,98 | 0,2 | 11 |

| 2002 | 24,35 | 0,19 | 06 |

| 2001 | 40,08 | 0,18 | 13 |

| 2000 | 4,94 | 0,16 | n/a |

Interesting facts about the company

General Electric products power more than 90% of the world's electrical grid.

The company has 7 thousand gas turbines and 6 thousand turbo engines for wind, nuclear and hydroelectric power plants.

During its existence, the company produced 70 thousand aircraft engines.

GE's 4,000,000 units of medical equipment conduct more than 16,000 human health studies every minute.

Issuer analysis. General Electric - is it worth investing in shares?

General Electric is an American industrial conglomerate with a 127-year history and a capitalization of $86 billion.

The company's shares are traded on the NYSE and the St. Petersburg Stock Exchange under the ticker symbol GE. Since February, the papers have been moving sideways. Should you invest in GE? This review will provide an answer to this question.

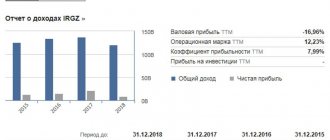

Financial indicators

The company operates in several segments: Energy, Oil and Gas, Aviation, Healthcare, Transportation, Instruments and Lighting, GE Capital (financial division). At the same time, over the past couple of years, part of the assets was separated in connection with the restructuring of the enterprise.

On April 30, GE presented its report for the first quarter. In January-March, the company received a net profit of $3.55 billion against a loss of $1.18 billion for the same period last year. Adjusted earnings per share (EPS excluding non-recurring factors) decreased from $0.15 to $0.14, but exceeded analysts' consensus estimates of $0.09. The return to profit is a positive factor. However, the graph of the indicator clearly shows that it is too early to talk about a stable trend.

Dynamics of quarterly net profit, million dollars.

Hereinafter source Reuters

Quarterly revenue decreased by 2%, to $27.29 billion, but was also higher than expected at $26.93 billion. The company's revenue in the most problematic energy segment decreased by 22%, to $5.66 billion, against the forecast of $5.33 billion. This is the main factor that allowed us to exceed market expectations. The energy segment accounted for 21% of the company's revenue. In 2015, GE acquired the energy business of the French company Alstom for $10 billion. This direction was one of the reasons for the financial difficulties of the conglomerate, which forced it to restructure and reduce dividends.

Dynamics of quarterly revenue, million dollars.

Adjusted free cash flow (FCF, operating flow minus capital expenditures) improved by 31% compared to the same period a year earlier and amounted to minus $1.22 billion. Operating flow was close to zero, and there was an outflow of FCF due to capital expenditures. If you look at the overall structure of the flow from investment activities over the past three years, you will notice a trend toward the sale of assets, which somewhat softens the cash situation.

Dynamics of quarterly FCF, million dollars.

The company confirmed its weak financial forecast for 2021. This year, FCF may be minus $2 billion. The outflow will end in 2021, the situation will improve in 2021. According to top management, the operating environment remains weak for the energy segment due to excess capacity in the industry, difficulties in emerging markets, the spread of renewable energy sources.

Conclusion 1: GE's financial situation improved in the first quarter. However, this cannot yet be called a stable trend. The stock's rise after the earnings was due to fact exceeding consensus. The company predicts a noticeable change in the situation only in 2021. If the global economy continues to slow down, the forecast may not materialize.

Financial stability and dividends

Compared to the end of 2015, GE’s reserves of cash and equivalents on its balance sheet decreased noticeably - $34.91 billion versus $70.48 billion.

Dynamics of “cache” and short-term investments, million dollars.

The debt burden is being actively reduced. At the same time, the debt/equity ratio is still about 350%, with a conditionally borderline value of 70% and 71% median for the group of comparable companies. There are $109 billion of GE bonds on the market. At the same time, $13 billion is planned to be repaid in 2021. If the situation in the financial system worsens and problems arise in the market for short-term instruments, GE may have problems. In the first quarter, Fitch downgraded the company's credit rating outlook to negative. In general, GE bonds now have the status of “junk”.

Dynamics of total debt, million dollars.

Problems in the business led to the abandonment of buybacks and a revision of the dividend policy in 2021. GE was once considered a “dividend story,” but in the fall of 2021, quarterly payments were cut in half. In 2021, they were reduced from $0.12 to $0.01 per share. Now the yield is 0.4% per annum. According to a Reuters forecast, no positive changes are expected in the next couple of years.

Where and how to buy/sell shares today

The main flow of General Electric shares today passes through the New York Stock Exchange, but they are also traded by others, for example, London, Paris, Frankfurt. In Russia, you can purchase shares in St. Petersburg.

Through a foreign broker

Representatives of brokerage firms abroad successfully open accounts for Russian buyers of shares, which is not always possible to do in Russia. Many of them are Russian-speaking. Using this method, you directly access the American stock exchange or European trading.

Verified foreign brokers

| Name | Rating | pros | Minuses |

| Interactive Brokers | 8/10 | They speak Russian | Subscription fee 10$\month |

| CapTrader | 8/10 | No monthly fee | They only speak English |

| Lightspeed | 7/10 | Low minimum deposit | Imposing services |

| TD Ameritrade | 6.5/10 | Low commissions | Not everyone gets an account |

Through a Russian broker

Before concluding an agreement with Russian brokers, you need to check whether the company has access to foreign markets. In our country, trading of American shares is carried out on the St. Petersburg stock exchange.

Reliable Russian brokers

| Name | Rating | pros | Minuses |

| Finam | 8/10 | The most reliable | Commissions |

| Opening | 7/10 | Low commissions | Imposing services |

| BKS | 7/10 | The most technologically advanced | Imposing services |

| Kit-Finance | 6.5/10 | Low commissions | Outdated software and user interface |

Through a foreign subsidiary of a Russian broker

Some Russian brokerage houses have branches abroad, for example in Cyprus. And they open your account independently through their representative office. Among the disadvantages of this approach is that the amounts that the client must have are quite large.

Directly from a company, individual or firm

General Electric shares cannot be purchased directly from the company; it lists them on the New York Stock Exchange.

Buy General Electric Company Stock Today

Buy General Electric Company shares

Today it has become quite easy to immerse yourself in the world of investments and purchase securities. One of the main tasks of a beginner is to choose the right investment object. If a person is just starting to get acquainted with the stock market, there is a high probability that the first thing he will pay attention to is the securities of companies popular all over the world - Apple, McDonald's, Google, etc. But this market is attractive because it contains a huge number of options, each of which can be profitable. There is no universal recipe for success that would suit absolutely everyone. People set different goals for themselves and prefer to go towards them in different ways. While some are willing to take risks in the hope of a quick, impressive result, others prefer a cautious approach that will bring a small, but almost guaranteed profit. Therefore, some choose inexperienced startups with unlimited potential, counting on significant growth in a short time, while others invest in corporations that have demonstrated good financial performance for years.

If you want to buy shares of General Electric Company, try to gather as much information about the organization as possible. Today, everyone has the opportunity to obtain detailed information about issuers from open sources, although in the past this was the privilege of brokers and financiers. Study analytical articles, pay attention to the opinions of experts. View current stock quotes. What are the characteristics of professional investors? They try to make decisions that arise from analyzing as much data as possible. But beginners tend to act based on their own emotions. Although only attention to detail allows you to consistently achieve the desired results.

Instructions

Before starting trading operations, the investor must understand what exactly will bring him income and what stages must be completed in order to purchase securities. Profit is generated in two cases:

- When acquired assets increase in value.

- When the owner of the securities receives dividends. To do this, they must be specified in the dividend policy of the joint-stock company. Payments are made once or twice a year. For these purposes, the company allocates part of its profits.

How to buy

Before making a purchase, you must complete the following steps:

- Determine the organization providing brokerage services. There is an important nuance to consider here. If your plans, in addition to investing in domestic organizations, are to invest in securities of foreign companies, choose a broker who has access to international exchanges. Don't forget to read the proposed terms of cooperation.

- Conclude an agreement and gain access to a personal account used to carry out purchases and sales. To start trading, you need to top it up.

- Two main methods are used directly for purchasing: personal instructions to the broker and the use of a special program that allows you to monitor stock quotes and independently perform any necessary actions. In both cases, you can do everything remotely without leaving your home.

The first method will free you from the need to waste time and make efforts to master the capabilities of the program. You simply tell the broker that you want to buy shares of General Electric Company, and he will do the rest. To evaluate the advantages of the second method, you first need to study the nuances of working with the program. But after the introductory stage, you will get a convenient tool with a large number of functions for plotting charts and analyzing financial indicators. To delve deeper into the issue and study useful information, you can visit the banki.ru portal, which always provides analytics, information about companies, quotes, etc.

Analysts and experts of the Investments section:

- Alexey Novikov, Head of Investments at Banki.ru, has been in the investment field for more than 15 years.

- Vladislav Kovalenko, editor-in-chief of the Banki.ru portal, in business and financial journalism since 2000

- Elena Smirnova, head of investment content, has been working in business and financial journalism since 2006.

- Daria Petrova, insurance and investment analyst, has been leading the content of the Investments section since 2021, email: [email protected] ,

Company prospects

General Electric is trying to improve its financial performance and aims to raise its share price to $20 by the end of 2021. In the future, the sale of the assets of the BioPharma division, which will generate $21 billion.

GE Transportation has begun developing and manufacturing 3D parts for locomotives, which will allow it to increase production volumes. This line has been developed until 2025. Electric power and aviation remain promising areas, which can provide profits of more than $50 billion.

GE plans to restore its level by conducting additional research in the field of marketing and changing the management of the company.

Analytics and forecast for the security

GE stock statistics are volatile. The value of shares has recently dropped by half, and the market capitalization has decreased by 100 billion.

General Electric operates in quite promising industries: energy and aviation.

At the end of the first quarter of 2021, the corporation made a profit of $3.5 billion.

According to analysts' forecasts, the share price should have decreased, but this did not happen; on the contrary, the price increased by 9 cents. In general, the prognosis is positive.

By the end of the year, earnings per share are expected to be 59 cents, with a dividend yield of 0.38%.

In the next few years, one should not expect a rapid improvement in the situation, since now the main cash flows are going towards restructuring the company.

Annual revenue through 2022 will be between $116 billion and $131 billion. In addition to investing and paying taxes, General Electric will try to minimize its debt, which in 2021 is more than $39 billion.

Alternative in this industry

The main competitors in the securities market for General Electric are the German Siemens and the South Korean Samsung.

Siemens shares are worth more than 100 euros. Dividends are close to 4€, which is more than GE today.