Definition and purpose of investments

I have been teaching subjects related to investments and investment activities at the university for 20 years. But only a couple of years ago I realized that the material I give will not help young people change their thinking towards the need to start creating personal capital from the first independent income.

Complete information about current strategies that have already brought millions of passive income to investors

In our classes, we discuss how important it is to invest for businesses that want to survive in market conditions, and we study the mechanism of investment. But when I talk to students about personal finance and investing, I see a complete lack of understanding of the process and skepticism. Why is this necessary? We need millions. It's too early for us to think about retirement. We want to live one day at a time. All the same, the state will take everything away, and so on and so forth.

Destructive thoughts for young people. She has every chance of gaining financial independence, because on the side of the young, one of the main success factors is time.

In short, I began to correct the situation, as far as the standards of the Ministry of Education allow me to do so. But within the framework of our blog, I am not limited by boundaries, so I am happy to share my knowledge and experience in investment activities. And today the very basics.

Investments in the general sense are investments in any objects in order to obtain an effect. The effect does not have to be commercial (profit making). If we are talking about public investments, then we can talk about social, environmental and other effects. Take, for example, a project to build a kindergarten or reconstruct a wastewater treatment plant.

But the article is not about the investment activities of enterprises, but about ours.

For a private investor, investment is the investment of money in assets with the aim of creating, maintaining and increasing personal capital.

I think everyone has the answer to the question why it is necessary to create capital. This is the purchase of expensive goods (car, apartment, house), the opportunity to travel or a regular vacation with the family at sea, education of children and, finally, a decent pension. The pinnacle of everything is financial independence, when you are not dependent on your employer and the salary you receive, when you have the opportunity to do what you have dreamed of all your life.

Tell me at least one normal person who would be against all this. Then why are there just over 2% of investors in Russia, and even fewer active ones? Because we love to make excuses for inaction. The most popular: “there is no money to invest,” “we don’t want to limit ourselves in anything, life is too short,” “investments were invented to take away the last.”

Dangerous misconceptions. Before talking like that, you first need to find out everything about the subject of the dispute and try it in practice. I did both. I have not found any confirmation of any of the above arguments. It's up to you.

A little history

The beginnings of investing can be traced back to the Code of Hammurabi

- legislative code of 1750 BC. It described a law that established the method of collateral in exchange for investment in a project and created the legal basis for investment. For example, a lender transferred part of his land for use in exchange for products grown on it.

Over time, such transactions began to be concluded between the owner of the ship and other persons for maritime trade, feudal lord and vassal, etc.

A more modern investment structure emerged in medieval Europe. The Amsterdam Stock Exchange is considered one of the first stock exchanges

, which connected potential investors with those who needed investment.

Since the 1850s, international investment has flourished, and the advent of the Internet has greatly influenced the speed of all processes. Now most investors operate online and most countries have their own stock markets. Meanwhile, international brokers are making it even easier to invest around the world.

Classification of investments for a private investor

In any economics textbook you will find an extensive classification of investments. But we will analyze only that part of it that relates to the private investor. And the first sign is investment objects. Depending on it, investments are:

- real – investments in real assets, for example, purchasing real estate, land, equipment;

- financial – investments in securities (stocks, bonds), currencies, derivative financial instruments (futures, options).

By investment period:

- short-term or speculative - this is a game on the difference in the price of an asset; several purchase and sale transactions can be carried out in a minute; this type is difficult to classify as an investment;

- medium-term - for a period of 1 to 5 years, the goal may be to buy a car, educate a child, take a vacation, etc.;

- long-term – investments for a period of 5 years, as a rule, the main goal is to create passive income from capital.

The strategy depends on the investment period: active or passive.

What types are there depending on the nature of the investor’s participation:

- direct, when an investor invests directly, without the participation of an intermediary (for example, in the development of a business, his or hers);

- indirect, when funds are invested through intermediaries (brokers).

By risk level:

- aggressive,

- moderate,

- conservative.

The choice of option depends on the investor’s individual attitude to risk.

Examples of successful investments

An acquaintance of mine learned that it was decided to demolish part of the city center and build new luxury housing. He bought up the most dilapidated housing and registered (for a fee) relatives. During the demolition, everyone was provided with new housing, which was successfully sold.

Another successful deal is leasing (rent with option to buy) of the plant. A loan with a one-year deferred payment was issued for this case. Taking into account the sharp jump in the dollar exchange rate, the obligations were repaid in 3 years.

Real investment failures

Oh. Although failures are inevitable, losing money is always a nuisance. Motor Sich shares. The political situation in Ukraine led to the fact that the walls of the plant remained. What can we say about dividends on securities.

Investment objects

We are looking for an answer to the question of where to invest money. I have already written about this; I will briefly discuss the options that are already available to private investors in Russia.

Option 1. Bank deposits.

A traditional instrument that is familiar to every Russian and for many still remains the only way to invest. The reduction of the Central Bank's key rate in 2021 led to a significant decrease in the yield on deposits (4 – 5% per annum). Such a rate can hardly be called acceptable for an investor who wants to create and increase capital.

Option 2. Stocks and bonds.

For beginners, these are risky instruments, except for OFZs and municipal bonds. But the profitability on them is higher than on deposits. I advise you to buy shares and bonds of individual issuers only after theoretical preparation. If you don’t want to take risks and decide to stick with OFZs and municipal bonds, get ready that the yield on them is only 1–2% higher than on bank deposits.

Option 3 : Index funds.

At the initial stage, it is better to invest in index funds that follow the stock index (BIIF or ETF). This will allow you to immediately fulfill the first rule of a competent investor - diversification. There are stock funds, bond funds and even gold funds. Invest in American, Chinese, German and other markets, in rubles, dollars or euros. A decrease in quotes for some shares included in the index is compensated by an increase in others.

Option 4. Currency.

It’s not the best advice to buy cash and save it at home. First of all, it's not safe. Secondly, no one has canceled inflation. The same bad advice is to put it in a foreign currency account at a bank. The rates there are indecently low. I won’t send beginners to Forex either. 99% that they will lose all their money there. As an option, study the topic of PAMM accounts and form a portfolio of several accounts with a conservative strategy and a long history.

Option 5. Real estate.

Suitable for people with large initial capital. And anyone who hopes to buy with a mortgage, rent out, repay the loan at its expense and earn something may be very disappointed. Calculations, calculations and more calculations. For those who do not have enough money to purchase real estate, an affordable option may be to purchase shares of real estate funds traded on the St. Petersburg Stock Exchange (REIT) or participate in a closed real estate mutual fund.

Option 6. Precious metals.

Experts call this option protective. There won't be much profit. Only if another global crisis breaks out, and all investors rush to buy gold instead of collapsed securities. It is for such cases that one invests in precious metals.

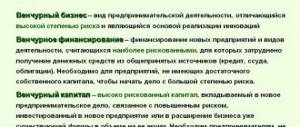

Option 7. Venture investment.

This is a highly profitable and at the same time high-risk option. Investing in something new and promising can bring thousands of percent return, or can turn capital into 0. Examples of successful venture projects: Facebook, Alibaba, Xiaomi.

It would be wrong if I don’t talk about one more type of investment. Each of us is already an investor because we have invested or continue to do so in our education, health, children, etc. The last object, by the way, puzzles me. Some parents invest in children so that they can support them later. I believe that we are obliged to do everything possible so that our children do not have to help us in our old age.

I presented all these investment options in order to show that without studying the operating mechanism of each instrument, beginners should not count on high income and quick enrichment. Most people's fear of taking risks comes from a lack of understanding of how investing works. That's why Russians invest their money in banks and apartments. And no one is born with understanding, not even Warren Buffett.

Factors influencing the volume of financial investments

Net cash flows can be influenced by a wide variety of factors. First of all, this is political or economic instability in the state, which undermines the successful activities of enterprises and deprives them of large amounts of profit. In addition, various legislative measures that affect the sphere of economics and investment have a great influence, including changes in taxation issues. The development of technology can also affect the size of such investment contributions, especially in the context of constant scientific progress.

Thus, net investments represent a special type of investment that, on a state scale, can influence national income. At a lower level, they characterize the production potential of the enterprise at a given point in time. That is why this type of investment has a special role in the economy of both organizations and the state as a whole. When developing your production, it is very important to ensure that the investment contributions in question are of the positive type, only then will all costs be fully recouped.

Step-by-step instructions for a novice investor

Several years ago, my husband and I were new investors. Today we have two brokerage accounts and a formed investment portfolio in which capital is created for various purposes. The return for 2021 was 19.8%. For a passive investor who spends 1 hour a month analyzing and replenishing accounts, a couple of hours at the end of the year on rebalancing, this is a good figure.

Only investors who have received more, but consistently over the past 10 years, can criticize the results obtained. I have a lot to learn from them, which is what I will do. I look forward to a long investment life.

I'll give you a little step-by-step instructions based on my personal experience.

Step 1. Self-education.

This is where I started. My track record includes books, paid and free webinars, conferences with the country's leading investors, courses on portfolio investments from professionals. All this gave me a great start and prevented me from making rookie mistakes and losing money.

Step 2. Assessing the family's financial situation.

I started keeping a family budget: income and expenses, assets and liabilities, plan and fact, savings and overspending. I compile tables, plan, optimize and identify sources for investment. I spend 1 minute on this every day and 10 – 15 minutes at the end of the month.

Step 3: Create an airbag.

I can’t afford to risk all the money in the family, because investing is always a risk. An airbag must be created without fail. We made it in the amount of 4 monthly family expenses. It is best to keep reserve money in instruments from which you can quickly withdraw it. For example, a deposit with the possibility of withdrawal without loss of interest, a debit card with interest on the balance, OFZ or money market funds on the Moscow Exchange.

Step 4. Determine investment goals.

Without this, you cannot form an investment portfolio. Its composition and distribution of assets within depend on the investment period. For example, one of our goals is the education of a child (our youngest daughter will graduate from school in 2024). The goal is medium-term, so asset allocation was made conservative. Another event is scheduled for 2027 - asset allocation has become more risky, but not aggressive.

Step 5. Selecting investment instruments.

At this stage, I recommend determining your risk profile. There are special tests offered by brokers and freely available on the Internet from the world's leading investment companies. Next, depending on your attitude to risk, investment goals and timing, we select instruments.

Step 6. Make your first investments and begin your path to financial independence.

Net Financing Value

Net investments are always additional financing, which has a positive effect on the growth of the company's capital. The key role of such financing is to be the basis for optimization, expansion of production, growth of its capacity, and increase in the volume of output. Such financing can be an investment in real estate, as well as in working and fixed capital.

Such real capital is extremely important for the creation of new equipment, the construction of new production buildings, and the expansion of space. Consequently, financing for the growth of real capital is a process of accumulation of funds.

Types of net investments

Types of net investments:

- zero: depreciation investments and gross financing turned out to be equal in volume, which led to a zero level of net investment, when they already talk about “zero growth” when the enterprise does not develop;

- positive: depreciation investments are less than gross financing, therefore there is an increase in investments and an increase in real production volume, an increase in net profit;

- negative ones arise in a critical situation, when gross investments are less than depreciation ones, as a result of which even lost capital is not reimbursed and the enterprise is on the verge of bankruptcy.

It is important to do everything to ensure a positive net investment. This is how the liquidity of the enterprise, the stability, the success of its development, and the stability of the company as a whole are confirmed.

The same criteria can be used to judge the economic situation in the country. These investments are constantly carefully analyzed, and detailed reports are provided to economists and the government. They are used to judge the level of economic development. Then certain measures are taken to ensure the growth of net investment.

Investment risks

We always say that investing is a risk. What types of risks can an investor face:

- country - a risk inherent in a particular country and associated with political, economic, legal and other factors;

- currency – when inflation and changes in exchange rates in one direction or the other reduce the return on assets or even lead to a decrease in capital;

- market – associated with fluctuations in stock and bond prices;

- individual company risk.

There are two extremes that must be avoided:

- Do not analyze risks at all and invest all your money in highly profitable projects, hoping that “maybe it will blow away.” The result is lost capital, disappointment in investments and the conviction of other people that it is all a scam, a lottery and a casino.

- Do not take risks at all, but, for example, keep money at home. The result is the same as in the first case. Only here you can no longer blame the government, the president, a neighbor or a friend.

Conclusion: you don’t need to be afraid of risks, you need to learn how to manage them. One of the most effective ways is diversification.

What if it doesn't work out?

Yes. It may not “take off”. There are always risks.

- Risk of problems in the country. Some politician will do something weird. Pass some kind of law. And hi!

- Currency risks. Well, you already know that.

Passed several times

Passed several times - Market risks. Well, for example, you decided to invest in an apartment. And the developer...

It is important to remember that you need to approach this matter wisely. And don't let fear take over. Just calculate everything and diversify your asset portfolio!

Operational phase

At the third stage, the enterprise is launched, which was put into operation at the end of the previous phase.

Most of the implementation period of the entire project falls on this stage. In order for this period to be most effective, and the entire campaign to be crowned with success, it is necessary to extend the operational stage for as long as possible.

The operational phase includes:

- obtaining certificates for product release (if necessary);

- Production Management;

- promotion of the manufactured product on the market;

- monitoring product quality;

- organization of service;

- determining the point of reduction in consumer interest in the product.

Formula

There is also a formula for private net investment. It is necessary for an objective analysis of the economic state: the formula is used in the process of determining key indicators of gross investment in various areas of the state and economy.

This is how net investment is defined:

HIt = BIt – At.

Let's decipher the formula:

- Аt – depreciation charges in year t;

- NIT – net investment in year t;

- VIt is the entire volume of gross investment in year t.

If we specify the formula, it will become clear that in this case the volume of gross investments is just net investments. They retain value. However, the statistics include gross investment, which also includes working capital financing. Working capital and fixed capital are growing. Of course, it’s easier to calculate the amount of net investment this way.

Such financing includes investments in real estate, working capital and fixed capital.

How to determine, calculate and find the payback period of a business project using a formula with examples

So, we have already examined the methodology and some nuances that must be taken into account during settlement operations when introducing technologies, modernizing and improving existing ones, or implementing a new initiative. However, it is necessary to highlight the presence of shortcomings: lack of proper consideration of a number of important factors, a relatively low degree of accuracy. The methods discussed above enable the investor to timely assess and analyze the risks present and calculate the return on investment of the business plan. However, to obtain more reliable and accurate results, it is necessary to use two methods: the discounted and simple approach. The techniques differ from each other in the degree of participation of the rate, which takes into account the cost of attracted capital in the formula and allows it to be discounted. Let's take a closer look at each of these techniques.

Simple method

Implies the use of the following expression:

PP= I/PR

In this case, the period during which the zero point (PP) is reached. Net investment income is denoted as PR, and the total amount of invested capital is I. As you can see, the calculation is as simple as possible, which determines the wide popularity of the described methodology.

Application

Let us take the following situation as an example: a company bought new modern equipment for 5,500,000 rubles. This made it possible to increase annual income by 1,200,000 rubles. Now we use the formulas and calculate:

PP= 5.5/1.2

It follows from this that in approximately 4 years and 7-8 months the company will be able to fully recoup the funds. Please note that the calculations assume a stable inflation rate, which is practically unrealistic in actual conditions. Plus, it is necessary to take into account that any investor, making an investment, not only fully compensates for the costs incurred, but also makes a profit. In addition, there is another drawback - the possibility of fluctuations in the flows of cash assets during the calculated time period is completely ignored, that is, it is assumed that all costs and expenses incurred will be repaid in installments.

Discounted method

As mentioned above, a simple expression does not take into account a number of characteristics and indicators, factors that are directly reflected in financial indicators. In this case, the inflationary process is considered the main or most important. The discounted method allows you to take into account jumps in the value of money supply through the use of more complex settlement operations. Let's look at how to calculate the payback period of a business project - a formula with an example of calculation.

First of all, let’s define what time period we are talking about. This is the time when the profit received covers the amount of funds used. In this case, the amount of profit and the total number of investments are calculated taking into account the established barrier rate, which is often called discounting.

In this situation, the discounted period (DPP), the received cash flow for a particular time period (CF), the initial investment made (IC), the number of stages (n), the number of the time period being studied (t) and the rate itself (r) are considered. .

The formula clearly shows that when calculating the payback of the discounted type, the volume of cash flows, taking into account a specialized reduction factor, is of paramount importance. As a result, the final indicator will in any case be higher than the simple method used.

Application

For greater convenience and ease of calculation manipulations, it is better to use tables that demonstrate at what time the discounted cash ratio leaves a negative value and becomes positive, that is, when the costs incurred are fully covered. For better understanding, let's look at an example.

A businessman wants to make an investment contribution to opening a cafe in the amount of 7.2 million rubles. The estimated profitability should be 2.76 million rubles. The barrier rate will remain at 21%. Let's create a table for indicators of the period or payback period of the project.

| Year | Cash flow (RUB million) | Bid (%) | Discounted Cash Flow | Discounted cash flow with cumulative result |

| 0 | 7.2 | 21 | 7.1 million | — 7.2 million |

| First | 2.76 | 21 | 2280990 | -4919008 |

| Second | 2.76 | 21 | 1890419 | -3028598 |

| Third | 2.76 | 21 | 1559321 | -1469276 |

| Fourth | 2.76 | 21 | 1289718 | -179587 |

| Fifth | 2.76 | 21 | 1065636 | +886048 |

The table shows that while the volume of profit remains unchanged, its true value decreases. This causes an increase in the duration of resource recovery; as a result, a positive result can be achieved only in the fifth year of doing business. If you calculate the DPP for a more accurate total, it will be 4 years and 2 months.

Efficiency

To assess the level of economic development of any state, enterprise, or company, it is enough to determine the growth dynamics of net financing. They, as the most objective indicator, reflect the effectiveness of work. As soon as investment growth begins to decline, we can talk about a recession in the economy. If there is no growth, this is an indicator of crisis .

Increasing such investments makes a huge difference. It immediately provokes an increase in the well-being of the population, an increase in employment, and an increase in the level of production. Net investments are growing in individual enterprises – the country’s economy is growing as a whole. When investments increase, related industries also begin to produce more consumer goods, products, materials, and build more housing.

Life cycle of an investment project - what is it?

Each investment program has a life cycle (investment cycle), that is, the period of time from the beginning of the idea to invest money until the liquidation of the investment program. It is divided into four phases, which follow one after another. The phases differ in goals, objectives, and duration.

Thus, it is customary to distinguish the following phases:

- Pre-investment (includes research and analysis);

- Investment (design with subsequent conclusion of contracts);

- Operational or production (economic activities);

- Liquidation.

Calculations using specialized online calculators and Excel tables

So, we looked at the estimated payback period of projects in months with examples and formulas. It is difficult to manually calculate the required indicator, since there is a high risk of errors. It is much more rational to use specialized software products to automate the process. For example, you can use traditional Excel tools. Even a table with 4 columns (month, investment amount, incoming cash flows, regular and cumulative) will significantly simplify the process. For better visualization, it is recommended to link the graph to fillable forms. An alternative, simpler and more convenient option is to use specialized online calculators, of which there are many in the public domain today.

For more complex operations that any entrepreneur faces when running his business, you can use the software offered by our company. With us you will find solutions for optimizing and automating processes in a store, warehouse or office.

Do you want to implement “Store 15”? Get all the necessary information from a specialist.

Thank you!

Thank you, your application has been accepted.

Reinvestment

This is the name given to the process in which funds received from investments are then put back into business. If income is not withdrawn, then capital growth will occur not in the form of an arithmetic progression, but in the form of a geometric one, that is, with acceleration. It's easiest to look at a specific example. Let us have a bank deposit of 100,000 rubles with a fixed rate of 5% net per annum:

- Every year we take our 5,000. In ten years we will receive an income of 50,000 rubles.

- We do not touch the income, but add it again to the deposit amount. In 10 years we will have 62,889 rubles.

That is, the difference is significant. And the higher the rate of return or the longer the investment period, the more noticeable the increase in income due to reinvestment will become. There is a rather interesting instrument - ETFs, which already provide for the direction of dividends for the purchase of new shares, that is, reinvestment occurs as if automatically.

I also recommend reading:

Minority shareholder and majority shareholder - who are they? Features of share owner statuses

The terms minority and majority shareholders refer to shareholders owning different shares of shares. The ability of the security holder […]

Passed several times

Passed several times