Economic science understands investment cash flow as actual current revenues that are directly related to the implementation of the project under consideration. This money should be distinguished from other payments received by the investor from other areas of his activity.

Thus, we can consider the investment flow as financial receipts from the implementation of an investment project per unit of time.

Let's look at all this with a specific example. An investor purchased a stake in an oil company. All securities generate annual income. That is, in the situation under consideration, the amount of cash flow that the investor will receive will be equal to the amount of dividends.

Cash flow concept

The very definition of cash flow came into the Russian language as a translation of the English phrase Cashflow, which can be literally translated as “cash flow.” That is, in other words, this is the movement of finances over a certain period of time. This is the difference between the amount of income and expenses. You can imagine this well using the example of a school math problem. There is a pool into which water (that is, financial resources) pours into it from pipe A, and pours out from pipe B. If more water poured into the pool, then we can talk about a positive cash flow, and if more water poured out, we can talk about a negative one.

In other words, this is the turnover of an enterprise’s money, on which its financial well-being directly depends. It is largely determined by the extent to which the company can fulfill its obligations, primarily of a financial nature. If there is a catastrophic lack of money, this indicates financial difficulties that do not add optimism about her future. On the other hand, an excess of financial resources may indicate that the company is suffering losses because these funds are used irrationally.

According to the time estimation method

5.1.

Present - NDP Characterizes the company's cash flow as a single comparable value, reduced by value to the current point in time.

5.2. Future - BJP

A single comparable amount of a firm's cash flow, reduced to its value at a specific future point in time. The concept of “future” cash flow determines its nominal identified value at a future point in time (or in terms of intervals of a future period), and serves as a discounting base for the purpose of bringing it to the present value.

Types of cash flow

When analyzing cash flow, you can get a lot of valuable information about exactly how the movement of funds occurs. This is especially true for money that is not taken into account when determining profit, for example, investment expenses, bank deposits, taxes, repayment of loan obligations, etc. That is why it is important to know the classification of cash flows, of which there are several, depending on the basis on which it is carried out. So, cash flows are classified:

By scale of economic processes:

- A flow that covers the entire enterprise and includes all its income and expenses;

- Flows of structural units;

- For business transactions, this is the very first object of control over the movement of financial funds.

By type of economic activity:

- Operating cash flows - related to payments for goods and services from suppliers and other contractors associated with production. These include staff salaries and tax deductions. The income item of the flow consists of income from the sale of goods and receipts from tax authorities in the event of recalculation of mandatory payments;

- Cash flows from investment activities are receipts and payments associated with investments, sales of intangible assets, excess fixed assets, transactions with the contents of the investment portfolio and similar transactions;

- Cash flows from financial activities are the flow associated with attracting loans and development loans, expanding share capital, as well as paying interest and dividends to shareholders.

By direction:

- Positive is the total influx of all the organization’s income from all types of activities;

- Negative - the sum of all payments of the enterprise for the period of time under study.

According to the method of calculating volume:

- Gross - shows all positive and negative flows;

- Net - the difference between receipts and expenses.

By level of sufficiency:

- Deficit flow - when an enterprise's income is lower than its real needs;

- Excess or surplus - the amount of incoming funds is greater than the needs of the enterprise.

According to the method of evaluation over time:

- Present - cash flow in the present tense;

- Future - planned flows, that is, related to the future time.

By continuity of formation:

- Regular - often associated with operational activities;

- Discrete - occurs during one-time business transactions, for example, purchasing a license, property rights, one-time assistance, etc.

According to the stability of the time intervals in which the cash flow is formed:

- At regular intervals - annuity;

- At irregular intervals - payments with a special payment schedule.

Cash flow statement

The statement of cash flows of an enterprise enables users of financial statements to assess the ability of an enterprise to generate cash and cash equivalents, as well as to assess the enterprise's needs for the use of those cash flows. The purpose of IFRS 7 is to standardize cash flow information by classifying cash flows by type of activity: operating, investing and financing.

Online course on treasury . Course program >>

An entity shall prepare a statement of cash flows in accordance with the requirements of this Standard and present it as an integral part of its financial statements for each period for which financial statements are presented.

Enterprises generate and use cash regardless of the nature of the activity and regardless of whether cash can be considered as a product of the enterprise (for example, banks and other financial institutions). Enterprises need cash for the same reasons, no matter how different their activities are. All enterprises need cash to conduct operations, to pay off liabilities, and to pay dividends. Accordingly, IFRS 7 requires the presentation of a statement of cash flows from all entities.

Seminar “Treasury: cash flow management” >>>

Benefits of a Cash Flow Statement

The statement of cash flows, when used in conjunction with other financial statements, allows users to evaluate changes in an entity's net assets, its financial structure (including liquidity and solvency), and its ability to influence the amount and timing of cash flows. The statement of cash flows is useful in assessing a business's ability to generate cash, and also in modeling, estimating, and comparing the present value of future cash flows with other businesses. The report allows you to compare data on the operating performance of different enterprises, since it eliminates the consequences of applying different accounting methods to similar transactions and events.

Historical cash flow data is often used to estimate the amount, timing and likelihood of future cash flows. They are also useful in examining the accuracy of previous estimates of future cash flows and in examining the relationship between profitability and net cash flows and the impact of price changes.

IFRS 7 Definitions

Cash includes cash on hand and on hand and demand deposits.

Cash equivalents are short-term, highly liquid investments that are readily convertible into known amounts of cash and are subject to an insignificant risk of changes in value.

Cash flows are receipts and payments of cash and cash equivalents.

Operating activities are the principal income-generating activities of an enterprise and other activities other than investing and financing activities.

Investing activities are the acquisition and disposal of long-lived assets and other investments other than cash equivalents.

Financing activities are activities that lead to changes in the amount and composition of the enterprise's contributed capital and borrowings.

Cash and cash equivalents

Cash equivalents are intended to cover short-term cash obligations and not for investments or other purposes. For an investment to qualify as a cash equivalent, it must be readily convertible to a known amount of cash and be subject to an insignificant risk of changes in value. Thus, investments are generally classified as cash equivalents only when they have a short maturity, such as 3 months or less from the date of acquisition. Investments in the equity of other entities are not included in cash equivalents unless they are, in substance, cash equivalents (for example, preferred shares purchased shortly before their maturity date and having a specified maturity date).

Bank loans are generally considered to be a financing activity. However, in some countries, bank overdrafts, repayable on demand, form an integral part of a company's cash management. In this case, bank overdrafts are included in the composition of cash and cash equivalents. A characteristic feature of such agreements with banks is that the bank account balance changes from positive to negative.

Cash flow does not include turnover between cash and cash equivalents items because these components are part of an enterprise's cash management and not part of its operating, investing, or financing activities. Cash management involves investing excess cash in acquiring cash equivalents.

Presentation of the Cash Flow Statement

The cash flow statement must contain information about cash flows for the reporting period, broken down into flows from operating, investing or financing activities.

An entity presents cash flows from operating, investing or financing activities in a form that best fits the nature of its activities. Classification by activity provides information that allows users to assess the impact of those activities on the financial position of an enterprise and the amount of its cash and equivalents. This information can also be used to assess the relationships between these activities.

The same transaction may involve cash flows classified differently. For example, loan payments may include both interest and principal. The interest portion may be classified as an operating activity and the principal portion as a financing activity.

Operating activities

The amount of cash flows from operating activities is a key indicator of how enterprises generate sufficient cash flows to maintain the enterprise's operating capabilities, repay loans, pay dividends and make other investments without resorting to external sources of financing. Information about specific components of cash flows from operating activities for prior periods, in combination with other information, will be useful in forecasting future cash flows from operating activities.

Cash flows from operating activities are primarily related to the core activities of the entity. These flows typically result from transactions included in the definition of profit or loss. Examples of cash flows from operating activities:

- Cash receipts from the sale of goods and provision of services;

- Cash receipts in the form of royalties, fees, commissions and other revenue;

- Cash payments to suppliers for goods and services;

- Cash payments to and on behalf of employees;

- Cash receipts and payments to an insurance company for premiums, claims, annuities and other insurance benefits;

- Cash payments or income tax refunds if they cannot be directly related to financing or investing activities;

- Cash receipts and payments from contracts entered into for commercial or trading purposes.

Some transactions, such as the sale of equipment, may result in a gain or loss. Cash flows from such transactions are classified as cash flows from investing activities. However, cash payments made to produce or acquire assets for rental to others and their subsequent sale in accordance with paragraph 68A of IAS 16 Property, Plant and Equipment are classified as cash flows from operating activities. Cash receipts from leases and subsequent sales of such assets are also cash flows from operating activities.

An entity may hold securities and loans held for business or trading purposes, in which case they may amount to inventory acquired specifically for resale. Therefore, cash flows arising from the purchase or sale of these securities are classified as operating activities. Similarly, advances and loans provided by financial institutions are generally classified as operating activities because they relate to the principal activities of the institution.

Investment activities

Separate disclosure of cash flows from investing activities is important because it shows what expenses have been incurred to acquire resources intended to generate future earnings and future cash flows. Examples of cash flows from investing activities:

- Cash payments for the acquisition of fixed assets, intangible and other long-term assets. These include payments related to capitalized development costs and independently produced fixed assets;

- Cash proceeds from the sale of fixed assets, intangible assets and other long-term assets;

- Cash payments for the acquisition of equity or debt instruments of other enterprises and interests in joint ventures (other than payments for instruments considered to be cash equivalents or held for business or trading purposes);

- Cash proceeds from the sale of equity or debt instruments of other enterprises and interests in joint ventures;

- Advances and loans provided to other persons (except for advances and loans provided by financial institutions);

- Cash receipts from the return of advances and loans provided to other persons;

- Cash payments or receipts under futures or forward contracts, options and swap agreements, unless the contracts are entered into for trading or trading purposes or the payments or receipts are classified as financing activities;

When a contract is accounted for as a hedge, the cash flows from the contract are classified in the same way as the cash flows from the hedged position.

Financial activities

Separate disclosure of cash flows from financing activities is important because this information is useful in forecasting the entity's future cash flows from those who finance it. Examples of cash flows from financing activities:

- Cash proceeds from the issue of shares or other equity instruments;

- Cash payments to owners for the acquisition or redemption of company shares;

- Cash receipts from the issue of debentures, loans, bills, bonds, mortgages and other short-term and long-term borrowings;

- Cash payments on borrowed funds;

- Cash payments made by a tenant to reduce the outstanding balance of a finance lease.

Reflection of cash flows from operating activities

An entity must report cash flows from operating activities using either:

Direct method, which discloses information about the main types of gross cash receipts and payments;

An indirect method in which profit or loss is adjusted by taking into account the results of non-cash transactions, any deferred or accrued past or future cash receipts or payments arising from operating activities, and items of income or expense related to cash receipts or disbursements. investment or financial activities.

An entity is encouraged to use the direct method of presenting cash flows from operating activities. The direct method provides information useful for estimating future cash flows that is not available with the indirect method. When using the direct method, information on the main types of gross cash and payments can be obtained:

- From enterprise accounts; or

- By adjusting sales, cost of sales (interest and other similar income and expenses for financial institutions) and other items in the statement of comprehensive income, taking into account the following factors:

- o Changes in inventories and accounts receivable and payable from operating activities during the period;

- o Other non-monetary items; And

- o Other items that give rise to cash flows from operating or financing activities.

When using the indirect method, net cash flow from operating activities is determined by adjusting profit or loss for the following factors:

Changes in inventories and accounts receivable and payable from operating activities during the period;

Non-cash items such as depreciation, amortization, valuation reserves, deferred taxes, unrealized foreign exchange gains or losses, retained earnings of associates and minority interest; And

Other items that give rise to cash flows from investing or financing activities.

Alternatively, net cash flow from operating activities may be presented indirectly by reflecting revenues and expenses disclosed in the statement of comprehensive income and changes in inventories and accounts receivable and payable from operating activities during the period.

Reflection of cash flows from investing and financing activities

An entity must report its principal gross cash receipts and gross cash payments arising from investing and financing activities separately, except for cash flows, which are reported on a net basis.

Reflection of cash flows on a net basis

Cash flows from the following operating, investing or financing activities may be reported on a net basis:

- Cash receipts and payments on behalf of clients when the cash flow reflects the activities of the client rather than the activities of the enterprise; And

- Cash receipts and payments for items characterized by rapid turnover, large amounts, and short maturities.

Examples of cash receipts and payments on behalf of clients:

- Acceptance and payment of bank demand deposits;

- Investment company client funds; And

- Rent collected on behalf of property owners and passed on to them.

- Examples of cash receipts and payments on behalf of clients:

Examples of cash receipts and payments of fast turnover:

- By the amount of debt of credit card holders;

- Purchases and sales of investments; And

- Other short-term loans, for example, with a repayment period of up to 3 months.

Cash flows arising from each of the following activities of a financial institution may be reported on a net basis:

- Cash receipts and disbursements for accepting and disbursing fixed maturity deposits;

- Placement and withdrawal of deposits in other financial institutions; And

- Advances and loans to customers and repayment of these advances and loans.

Cash flow in foreign currency

Cash flows arising from foreign currency transactions must be reported in the entity's functional currency by applying to the foreign currency amount the exchange rate between the functional and foreign currencies at the date of the cash flows.

Cash flows of a foreign subsidiary must be translated at the appropriate exchange rate between the functional currency and the foreign currency at the date of the cash flows.

Cash flows denominated in foreign currencies are reported in accordance with IAS 21 The Effects of Changes in Foreign Exchange Rates. This allows you to use an exchange rate that is approximately equal to the actual rate.

Unrealized gains and losses resulting from changes in foreign exchange rates are not cash flows. However, the effect of changes in currency exchange rates on cash and cash equivalents available or expected to be received in foreign currencies is presented in the statement of cash flows to reconcile cash and cash equivalents at the beginning and end of the reporting period. This amount is presented separately from cash flows from operating, investing and financing activities and includes any differences that would have arisen had the cash flows been reported at period-end exchange rates.

Interest and dividends

Cash receipts and payments related to the receipt and payment of interest and dividends must be disclosed separately. Each such receipt or payment must be qualified on a consistent basis from period to period as a cash flow from operating, investing or financing activities.

The total amount of interest paid during the period is disclosed in the statement of cash flows, whether it is recognized as an expense in the income statement or capitalized in accordance with the permitted alternative treatment in IAS 23 Costs on loans."

For financial institutions, interest paid and interest and dividends received are classified as cash flows from operating activities. However, for other enterprises there is no consensus on how to qualify these payments and receipts. They may be classified as cash flows from operating activities because they are included in the definition of profit or loss. And at the same time, they can be classified as cash flows from financial and investment activities, since they represent financing costs or investment income.

Dividends paid may be classified as cash flows from financing activities because they are a financing cost. However, they may be classified as an element of cash flows from operating activities to help users assess the entity's ability to pay dividends from cash flows from operating activities.

Income tax

Payments of income taxes are disclosed separately and classified as cash flows from operating activities unless they can be directly attributed to financing or investing activities.

While tax expenses may be readily attributable to investing or financing activities, it is not practical to attribute the corresponding tax cash flows, and such cash flows may relate to a period different from the cash flow in the underlying transaction. . Therefore, taxes paid are generally classified as cash flows from operating activities. When it is practicable to attribute tax cash flows to a specific transaction classified as an investing or financing activity, those flows are classified accordingly.

When tax cash flows relate to more than one activity, the total amount of taxes is disclosed.

Investments in subsidiaries, associates and joint ventures

When accounting for investments in subsidiaries and associates accounted for using the equity or cost method, the statement of cash flows limits the investor to information about the cash flows between it and the investee, such as information about dividends and advances.

An entity that reports its interest in a jointly controlled entity (see IAS 31 Interests in Joint Ventures) using the proportionate consolidation method includes in its consolidated statement of cash flows its proportionate share of the cash flows jointly controlled enterprise. And an entity that reports its share using the equity method includes in the statement of cash flows information about the cash flows associated with investments in the jointly controlled entity, distributions of profits, and other payments or receipts between it and the jointly controlled entity.

Changes in direct ownership interests in subsidiaries and other business units

Aggregate cash flows arising from acquisitions and losses of control of subsidiaries and other business units must be presented separately and classified as investing activities.

An entity must disclose the following aggregate information relating to both acquisitions and losses of control over subsidiaries during the period:

- Total compensation paid or received;

- The share of compensation represented by cash or cash equivalents;

- The amount of cash and cash equivalents held by subsidiaries or other business units over which control is gained or lost; And

- The amounts of assets and liabilities, other than cash and cash equivalents, in subsidiaries or other business units over which control is gained or lost, summarized by major category.

Presenting in one line the cash flow impact of acquisitions or losses of control of subsidiaries or other business units, and separately disclosing the amounts of assets and liabilities acquired or disposed of, helps separate such flows from other flows arising from other operating, investing or financial activities.

The aggregate amount of cash paid or received as consideration upon gaining or losing control of a subsidiary or business unit is reported in the statement of cash flows less any cash and cash equivalents acquired or disposed of in such transactions or events.

Cash flows arising from changes in direct ownership interests in a subsidiary that do not result in a loss of control must qualify as cash flows from financing activities.

Changes in direct ownership interests in a subsidiary that do not result in a loss of control (for example, a parent's purchase or sale of equity interests in a subsidiary) are accounted for as equity transactions.

Non-monetary transactions

Investment and financing transactions that do not require the use of cash and cash equivalents should be excluded from the statement of cash flows. Such transactions must be disclosed in other forms of financial statements in a manner that provides all necessary information about such financing or investing activities.

A significant part of investment and financing activities does not have a direct impact on current cash flows, but at the same time affects the structure of capital and assets of the enterprise.

Components of cash and cash equivalents

An entity must disclose the components of cash and cash equivalents and provide a reconciliation of the amounts contained in the statement of cash flows with similar items presented in the statement of financial position.

Given the diversity of cash management practices and banking arrangements around the world, and in order to comply with IAS 1 Presentation of Financial Statements, an entity is required to disclose the policies it has adopted for determining the structure of cash and cash equivalents.

The effect of any change in the policy for determining the components of cash and cash equivalents, for example a change in the classification of financial instruments previously considered to be part of an entity's investment portfolio, is reported in accordance with IAS 8 Accounting Policies, Changes in Accounting Estimates and Errors.

Other disclosures

An entity must disclose, together with management's commentary, the amount of significant cash and cash equivalents held by the entity that is not available for use by the group.

There are various circumstances in which cash and cash equivalent balances may not be available for use by the group. For example, a foreign exchange control measure or other legal restrictions that prevent the use of these funds in the general manner by a parent or subsidiary.

Additional information may be relevant to users' understanding of the financial position and liquidity of the entity. Disclosure of this information, along with management comments, is encouraged and may include:

Amounts of unused loan funds that can be used to finance future operating activities and to repay investment obligations, indicating restrictions on the use of these funds;

Aggregated amounts of cash flows by operating, investing and financing activities related to interests in joint ventures, data on which are presented using the proportionate consolidation method;

Aggregate amounts of cash flows representing increases in operating capability, separate from the cash flows required to maintain operating capability; And

The amount of cash flows arising from the operating, investing and financing activities of each reportable segment (see IFRS 8 Operating Segments).

Separate disclosure of cash flows representing increases in operating capabilities and cash flows required to maintain operating capabilities allows users to determine whether the entity is providing sufficient funds to maintain its operating capabilities. An enterprise that does not allocate sufficient funds to maintain its operating capabilities may be sacrificing its future profitability in the name of maintaining current liquidity and distributing profits to owners.

Disclosure of cash flows by segment allows users to better understand the relationship between cash flows at the enterprise level as a whole and at the level of its individual components, as well as monitor the availability and variability of cash flows by segment.

Read the interview with the teacher of the treasury management seminar, director of the Alfa Business School A.A. Uvarova. in the magazine “I am number one” >>>

View the seminar “Treasury: cash flow management >>>

Cash flow analysis

Being able to analyze cash flows is a necessary skill when studying the financial condition of a company. It is this that allows us to determine how well the company manages this instrument, in other words, whether the required amount of money is always available and whether it will be necessary to raise money from outside.

Typically, cash flow analysis is carried out using a report on the flow of financial resources, which is generated by the company’s areas of activity - current, investment and financial. It is this report that provides the most complete information for analyzing the cash flow of an enterprise.

Such a report allows you to clearly see how the organization’s various activities affect its financial condition and explain the reason for its change for the better or for the worse. In addition, this document will be useful not only for the head of the company, but also for its creditors and investors. Management from it will gain information about the liquidity of the enterprise and will allow them to plan the financing of certain programs - payment of dividends, bonuses to employees, settlements with suppliers, etc. Creditors and investors will glean information from the report about the financial health of the organization and draw conclusions regarding the ability of management to ensure competent management of it.

As we remember, the cash flow statement consists of three components. It's time to look at them in more detail. This will make it possible to understand which areas are the most profitable and which activities should be given additional attention.

Current activity

This is usually the longest part of the report. Current activities include all calculations that ensure the overall profit of the company. This includes expense transactions - the purchase of goods and services from suppliers that are necessary for the organization’s production activities, tax deductions, repayment of credit obligations, for example, bank overdraft, payment of wages to employees, etc. Profit consists of funds received from the sale of goods or services.

Investment activities

Investment activity is a necessary area of any enterprise that can bring profit, both in the future and in the present. The expenses of this industry consist of the acquisition of patents, securities, issuing loans to other organizations and the purchase of fixed assets, that is, a kind of money magnet for the future.

The profit of this area is the repayment of loans and interest on them, expansion of share capital through the issue of new shares, sale of fixed assets, implementation of the right to use unique technologies, the rights to which belong to the company.

Financial activities

The financial sector is mainly transactions related to the owners of the company. If the owners, for example, increase the authorized capital, this will be reflected in the “profit” column. And vice versa, if money is withdrawn from the business for any reason, this will be reflected in the “losses” column.

According to the continuity of formation in the period under review

6.1.

Regular - RDP Characterizes the flow of receipts or expenditures of funds for individual business transactions (cash flows of one type), which in the period under review is carried out continuously at separate intervals of this period.

Most types of cash (financial) flows generated by the operating activities of the company are regular: flows associated with servicing a financial loan in all its forms; cash flows ensuring the implementation of long-term real investment projects, etc. Within the life cycle of a company, the majority of its cash flows are regular.

6.2. Discrete - DDP

Reflects the receipt or expenditure of funds associated with the implementation of individual business transactions of the enterprise in the period of time under review. Characterized by a one-time expenditure of funds associated with the enterprise’s acquisition of an entire property complex; purchasing a franchising license; receipt of financial resources in the form of gratuitous assistance. Given a certain minimum time interval, all cash flows of the company can be considered discrete.

Net cash flow

One of the main indicators when assessing the financial condition of an enterprise is net cash flow. In practice, it shows the difference between positive cash flow (receipts) and negative cash flow (expenses). This indicator allows you not only to assess the financial balance, but also to see the growth rate of the company’s market value. Experts suggest not only calculating this indicator as needed, for example, when drawing up business plans, but also upon expiration of reporting periods. This will allow you to constantly monitor the cash channel and make timely changes to the financial policy of the enterprise.

According to the level of volume sufficiency

4.1.

Excessive - IDP It is characterized by the fact that cash receipts significantly exceed the company’s real need for targeted spending. A sign of this flow is a high positive value of net cash flow that is not used in the process of carrying out the business activities of the company.

4.2. Scarce - DFDP

It is characterized by the fact that cash receipts are significantly lower than the real needs of the company for their targeted spending. Even if the amount of net financial flow is positive, it can be characterized as deficit if this amount does not meet the planned need for spending funds in all planned areas of the company’s economic activity. A negative value of the amount of net financial flow automatically makes this flow scarce.

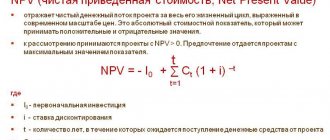

Cash flow discounting

Cash flow discounting is used when it is necessary to reduce current payments to their value in the future. This approach allows you to evaluate a business and determine the economic efficiency of investments. This process is based on the fact that the amount of financial resources that an organization owns today in real terms is worth more than an equal amount that it can receive in the future. There are several reasons for this: inflation, lost profits, risks of non-receipt of profit, etc.

To bring future financial receipts and expenses to their present equivalent, a discount rate is used. In order to determine it, several methods are used. Among them, the most accurate, and therefore giving the most reliable results, is the discounted cash flow (DCF) method.

DCF calculation method

This calculation method is used for enterprises that have a certain history of profitable activity. That is, steadily developing for some time. In addition, it is usually used to assess the investment attractiveness of a company, although this method should be approached with caution when assessing young enterprises looking for where to get money. The method consists of several stages:

- Selecting a cash flow model—for equity or for total invested capital.

- Determining the duration of the forecast period.

- Cash flow retrospective analysis and forecast of gross income from sales of goods or services of the company.

- Analysis of expenses and forecast for them.

- Income analysis and forecast

- Cash flow calculation for each forecast period.

- Determining the discount rate.

- Calculation of the company's value in the post-forecast period.

- Calculation of cash flow in the post-forecast period

- Making final edits.

Cost classification

When analyzing and predicting future expenses, it is necessary to classify costs. Depending on the basis on which this is done, there are several classifications:

By composition:

- Planned expenses;

- Actual expenses;

- Projected expenses.

In relation to production:

- Variables;

- Permanent;

- Conditionally permanent.

In relation to cost:

- Indirect;

- Direct.

By control function:

- Administrative;

- Production;

- Commercial.

For assessing cash flow, the second and third types are most important. Fixed costs will include management costs, rent, property taxes, depreciation, etc. That is, these costs do not directly depend on production volumes. At that time, the variable delays will be greater than the production volume. These include wages for personnel involved in production, payment for raw materials, energy and fuel. This classification helps determine the break-even point and optimize the product structure.

A simplified scheme for calculating cash flows from the implementation of an investment project:

Thus, the cash flow of the project can be simplified by the following algorithm:

- Investments;

- Revenue growth;

- Increase/decrease in operating expenses (without depreciation);

- Changes in depreciation charges;

- Change in income before tax (clause 2 – clause 3 – clause 4);

- Change in income tax (item 5 * 20%);

- Change in net profit (clause 5 – clause 6);

- Changes in depreciation charges;

- Net income from the implementation of the investment project (cash flow from operating activities) (item 7+item 8).

It should be noted that it is the change in indicators that appears in the algorithm. This is due to the fact that only indicators for the new project should be taken into account.

For example : If you decide to open another direction within an existing business, then investments, revenue, current costs, etc., must be taken only for this new business.

That is, if you, for example, had a confectionery shop that produced cakes, and you decided to launch a line for the production of cakes, then both revenue and costs to assess the effectiveness of the project must be taken in this direction.

This is understandable, because the company already received revenue from the sale of the cake. From a business point of view, the effectiveness of the new project is interesting.

Cash Flow Quadrant

Such a purely financial term, cash flow, can easily be adapted to personal finance. This was done by the American investor, teacher, entrepreneur and writer Robert Kiyosaki, who published the book “Cash Flow Quadrant”. In it, he clearly showed what role each person plays in the distribution of capital, and also gave guidance for action to those who want to create the most favorable financial conditions for themselves, forever forgetting what a consumer loan is, and independently generate cash flow.

So for those who are constantly dependent on a lack of money, the book is a must read. Within the framework of this article, I will only briefly dwell on its theses.

According to the author, all a person’s profit can come from one or several sectors, of which there are only 4:

- Hired workers - the salary of people working for hire. This sector is the most vulnerable and unstable.

- Working for yourself - profit comes from being self-employed. This includes entrepreneurs, freelancers, and narrow specialists with their own practice. It is also not a very protected sector, since as soon as a person gets sick or stops working, the cash flow will be greatly reduced.

- Business is profit from a large business that operates by hiring hired workers and brings tangible profits even without the direct participation of the owner.

- Investments - Profits come from successful investments. Real passive income that does not require human participation.

The quadrant principle is based on the fact that 70% of successful millionaires get their income from investing and only 30% from activities in the other three sectors. You can learn more about the author’s ideas in the books he wrote, the number of which exceeds two dozen. And the game “Cash Flow”, which was also invented by Robert Kiyosaki, will help you practically apply your knowledge. In it, in a playful way, you can consolidate skills that will help you achieve financial success in real life.

In the article we looked at such a financial term as cash flow or cashflow. This indicator is very important not only for business owners, but also for potential investors. It helps to understand the financial condition of the company and predict its future. And based on this data, make a decision about the possibility of investing in it.

Author Ganesa K.

A professional investor with 5 years of experience working with various financial instruments, runs his own blog and advises investors. Own effective methods and information support for investments.