Dividend policy

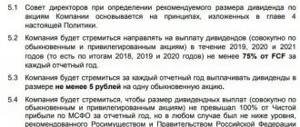

The corporate policy regarding the calculation of dividends at Lukoil establishes a minimum level of dividends in the amount of 25% of net profit under IFRS.

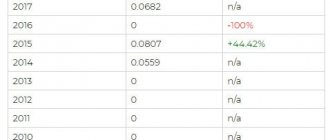

At the same time, Lukoil adheres to the idea of increasing dividends in each subsequent year by an amount exceeding ruble inflation in the reporting period. And the organization copes with this very well, continuously increasing dividend flows for 20 years.

And in recent years, Lukoil has been increasing payments by an amount that is several times higher than the inflation rate. Thus, in 2017, the amount of distributed profit increased by 10%, and in 2018 – by 16%.

The frequency of dividend payments is usually formed from two accruals, intermediate, for 9 months, and the final annual dividend.

About Lukoil

I’m sure that Lukoil doesn’t need any special introduction, but I’ll still tell you a little.

Lukoil is one of the largest Russian vertically integrated oil companies. It carries out exploration and development of oil and gas fields, produces and processes oil, sells oil products on the domestic market and exports oil products abroad.

The company arose in 1991 with the merger of three oil producing enterprises: Langepasneftegaz, Urayneftegaz and Kogalymneftegaz. From the first three letters of these (oil in English) the name Lukoil was formed.

The main headquarters of the company is located in Moscow, the North American headquarters is in the New York suburb of East Meadow.

The president and “face” of Lukoil is Vagit Alekperov.

The Lukoil company, in addition to oil production and gas stations, is known for 4 things:

- competent management (Lukoil has one of the best corporate companies on the Russian market);

- constantly growing profits;

- stable dividend history - Lukoil has been paying dividends for 20 years and has been constantly increasing their size, being one of the few Russian dividend aristocrats;

- a large-scale buyback program launched back in 2021 (according to Interfax, during this time about $2.5 billion was spent on buybacks, which is 4.32% of the securities.

Regular dividends, competent management actions (especially in difficult years), high share liquidity and constant support of quotes with the help of buyback have made Lukoil a favorite blue chip not only among Russian investors, but also foreign ones.

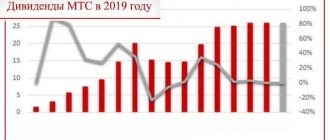

Look at how the size of Lukoil's dividends has changed over the years.

The main shareholder of Lukoil is its president Vagit Alekperov. After the redemption of shares purchased during the buyback, his share increased to 27.33%.

The second largest shareholder is Deputy President Leonid Fedun, he owns 10.26% of the shares.

Top management owns about 0.5% of shares.

Everything else – i.e. approximately 61.91% is in free circulation. Yes, Lukoil is one of the rare public Russian companies whose free float is more than 50%.

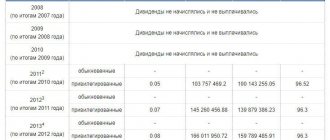

All company dividends for the last 10 years

| For what year | Period | Last day of purchase | Registry closing date | Size per share | Dividend yield | Closing share price | Payment date |

| 2019 | 1 Jul 2021 | 5 Jul 2021 | 12M 2020 | 213 ₽ | 3,56% | 19 Jul 2021 | |

| 2019 | 16 Dec 2020 | 18 Dec 2020 | 9M 2020 | 46 ₽ | 0,89% | 1 Jan 2021 | |

| 2018 | 8 Jul 2020 | 10 Jul 2020 | 12M 2019 | 350 ₽ | 6,41% | 24 Jul 2020 | |

| 2018 | 18 Dec 2019 | 20 Dec 2019 | 9M 2019 | 192 ₽ | 3,07% | 3 Jan 2020 | |

| 2017 | 5 Jul 2019 | 9 Jul 2019 | 12M 2018 | 155 ₽ | 2,84% | July 23, 2019 | |

| 2017 | 19 Dec 2018 | 21 Dec 2018 | 9M 2018 | 95 ₽ | 1,93% | 4 Jan 2019 | |

| 2016 | 9 Jul 2018 | 11 Jul 2018 | 12M 2017 | 130 ₽ | 2,92% | July 25, 2018 | |

| 2016 | 20 Dec 2017 | 22 Dec 2017 | 9M 2017 | 85 ₽ | 2,52% | 5 Jan 2018 | |

| 2015 | 6 Jul 2017 | 10 Jul 2017 | 12M 2016 | 120 ₽ | 4,02% | July 24, 2017 | |

| 2015 | 21 Dec 2016 | 23 Dec 2016 | 9M 2016 | 75 ₽ | 2,18% | 6 Jan 2017 | |

| 2014 | 8 Jul 2016 | 12 Jul 2016 | 12M 2015 | 112 ₽ | 4,02% | July 26, 2016 | |

| 2014 | 22 Dec 2015 | 24 Dec 2015 | 9M 2015 | 65 ₽ | 2,79% | 7 Jan 2016 | |

| 2013 | 10 Jul 2015 | 14 Jul 2015 | 12M 2014 | 94 ₽ | 3,81% | July 28, 2015 | |

| 2012 | 24 Dec 2014 | 26 Dec 2014 | 9M 2014 | 60 ₽ | 2,68% | 9 Jan 2015 | |

| 2012 | 11 Jul 2014 | 15 Jul 2014 | 12M 2013 | 60 ₽ | 2,85% | July 29, 2014 | |

| 2012 | 15 Aug 2013 | 15 Aug 2013 | 6M 2013 | 50 ₽ | 2,57% | 29 Aug 2013 | |

| 2011 | May 13, 2013 | May 13, 2013 | 12M 2012 | 50 ₽ | 2,44% | May 27, 2013 | |

| 2010 | 12 Nov 2012 | 12 Nov 2012 | 6M 2012 | 40 ₽ | 2,08% | 26 Nov 2012 | |

| 2009 | May 11, 2012 | May 11, 2012 | 12M 2011 | 75 ₽ | 4,32% | May 25, 2012 | |

| 2008 | May 6, 2011 | May 6, 2011 | 12M 2010 | 59 ₽ | 3,17% | May 20, 2011 | |

| 2007 | May 7, 2010 | May 7, 2010 | 12M 2009 | 52 ₽ | 3,25% | May 21, 2010 | |

| 2006 | May 8, 2009 | May 8, 2009 | 12M 2008 | 50 ₽ | 3,06% | May 22, 2009 | |

| 2005 | May 8, 2008 | May 8, 2008 | 12M 2007 | 42 ₽ | 1,76% | May 22, 2008 |

When will dividends be paid in 2021?

The register fixation date for inclusion in the list of shareholders claiming to receive dividend payments on Lukoil shares for the reporting year 2021 is set for 07/09/2019.

In fact, in order to receive funds into your account, you need to buy Lukoil Central Bank 2 business days before the due date, since the Moscow Exchange operates in the “T + 2” mode. That is, in order to receive dividends, you must be the owner of the securities as of the close of market trading, on the so-called cut-off date for dividends - 07/05/2019.

Estimated date of approval of the list of shareholders to receive dividends based on the results of 9 months. 2021 will likely be set for December 20-25, 2021.

Lukoil. We calculate dividends and evaluate prospects

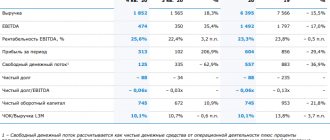

On October 16, Lukoil announced recommendations for interim dividends, announced its intention to redeem part of the shares, and also presented the principles of the new dividend policy. Let’s look at how these innovations have changed Lukoil’s investment case.

Dividend policy and interim dividends

Lukoil presented new principles of its dividend policy, according to which the company intends to allocate at least 100% of adjusted free cash flow to dividends.

Here are the principles of the new military policy:

The total amount of dividends on the company's outstanding shares, excluding shares owned by Lukoil group entities, is at least 100% of the company's adjusted free cash flow (FCF).

Adjusted free cash flow is calculated based on the consolidated financial statements prepared in accordance with IFRS and is defined as net cash provided by operating activities less capital expenditures, interest paid, repayment of lease obligations, and expenses for the acquisition of shares of Lukoil.

Dividends per ordinary share are rounded to a multiple of one Russian ruble.

Dividends are paid twice a year, with the amount of the interim dividend calculated based on the consolidated financial statements for 6 months.

The new dividend policy means linking the company's dividend base to free cash flow. This is a positive moment for shareholders, since Lukoil provides the highest FCF yield (this is FCF per share relative to the share price) among Russian oil companies. In a sense, this indicator reflects what the dividend yield would be for oil and gas companies if they paid 100% of FCF on dividends.

It is important to note that Lukoil uses adjusted cash flow . The biggest adjustment item is the ongoing buyback. At the end of 2018, the company spent 10.8% of FCF on buybacks, and for the first half of 2021, 18.6%. This means that the higher the volume of buyback, the lower the expected dividends and vice versa.

Another important change is that the company decided to completely abandon the previously existing division policy. This means that there is no talk of annual indexation of dividends to less than the inflation rate. That is, Lukoil’s position as a “dividend aristocrat” in the long run will now probably be under threat. However, this is not a negative point, since payments will increase this year, which pleases investors.

What dividends to expect at the end of 2021

Lukoil plans to pay the first dividends under the new dividend policy in December 2021. The Board of Directors proposed paying 192 rubles. per share as interim dividends. The closing date of the register for receiving payments is December 20, 2021.

The size of the payment, if approved by shareholders, will double compared to the dividend for 9 months 2021, raising the dividend yield on interim payments to approximately 3.4%. A total of RUB 133 billion will be allocated for dividends, which is 100% of adjusted free cash flow.

According to our estimates, dividends for the second half of 2021 could amount to about 290 rubles. per share. In this scenario, the company's total dividends for the entire 2021 will reach 482 rubles. on paper, and the dividend yield of Lukoil shares for 2021 could reach 8-8.5% by the end of the year.

It is worth considering here that the size of dividends for the second half of the year will greatly depend on the intensity of the buyback. If the buyback is ahead of schedule, the estimated dividends may be lower.

Thus, the company intends to distribute substantially all of its free cash flow through buybacks and dividends. At the end of the first half of 2021, Lukoil’s FCF amounted to 308 billion rubles, of which about 133.6 billion rubles were spent on the buyback program (which began last year) in the first half of 2021. Another 131.2 billion rubles. the company intends to pay in the form of interim dividends. This means that shareholders received about 387 rubles through buyback and dividends for the first half of the year. per share or 86% of FCF. That is, part is distributed directly in the form of payments, and part is due to the redemption of share capital, by increasing the actual weight of one share.

Simply put, if Lukoil had not carried out a buyback in the first half of the year, but had simply paid everything in dividends, then the shareholders would have received 387 rubles. per share.

About buyback

The company's management noted that now dividends will become a priority in the distribution of capital, and Lukoil intends to buy back shares only in a favorable market. However, there are no plans to pay dividends using borrowed funds. This suggests that the repurchase of shares from the market will not be carried out ahead of schedule, as was the case last time.

This also means that the company will not constantly spend money on buybacks, but will approach this issue more flexibly. For example, buyback activity can increase when quotes fall and slow down when they rise.

Another interesting feature that follows from management's statement is that market participants will understand when, in the company's opinion, the share price reaches fair levels.

For example, the company reports that last week it bought back shares at RUB 5,700. for paper, and the next week, when the price reached, for example, 5,800 rubles. the buyback was no longer carried out. This will be a signal to investors that Lukoil estimates the fair value of the securities to be somewhere between RUB 5,700. and 5,800 rub. In such a situation, volatility in stocks can decrease significantly. With a rise to 5800, traders can sell with greater activity.

Cancellation of shares

The Board of Directors recommended that the extraordinary general meeting of shareholders make a decision to reduce the authorized capital by purchasing part of the outstanding shares in order to reduce their total number.

A decrease in share capital is positive for the company's shareholders and means that the number of shares is reduced, leading to an increase in net profit or FCF per share. It follows that the company can increase the dividend even with a stable FCF.

Previously, Lukoil had already reduced capital using the same scheme. Then the company intended to repay the quasi-treasury stake and simultaneously issued an offer to shareholders. The only differences include a reduction in the size of the redeemable package from 35 million shares to 25 million now, as well as a change in the purchase price of the securities. If, based on the results of the previous cancellation, the company issued an offer of 5,450 rubles. per share (which turned out to be higher than the market value of the securities), now the repurchase is proposed to be carried out at 5,300 rubles. for paper. This price is below the market valuation of the shares, which means that if quotes do not drop to 5,300 rubles during the offer period, then the volume of supply will be formed mainly by quasi-treasury securities.

If we take into account that Lukoil does not pay dividends on the quasi-treasury stake, then, in fact, the redemption of shares seems to have already happened.

Summary

Lukoil's innovations should have a positive impact on the company's stock quotes in the medium and long term. The new dividend policy provides greater flexibility in dividends while increasing returns for shareholders. The company has indicated its intention to spend virtually all of its free cash flow on shareholders, either through buyback or dividends.

Lukoil's dividend yield at the end of 2021 may increase to 8-8.5% at a price of RUB 5,700. for paper. For 2021, the same indicator to the average annual price was about 5.8%. The increase is very large-scale, if we take into account that quotes have added more than 30% to the current moment.

All this gives grounds to believe that the company’s shares, given a favorable external background, are quite capable of rising above 6,000 rubles. in the medium term.

Read the best materials from BCS Express on Telegram

BCS Broker

Stock return

As a base value, I will take the estimated purchase price of Lukoil ordinary shares, equal to 5,200 rubles. Then the LTM yield (Last Twelve Months) for the last year is: (95 + 155)/5200 = 4.8% excluding taxes or 4.18% including withheld personal income tax.

If you calculate the profitability, taking into account the forecast dividend for 9 months. 2021, then the following figures will be obtained: (155 + 110)/5200 = 5.1% excluding taxes or 4.4% including personal income tax paid.

Payment terms

First, you need to determine when the company pays dividends.

It could be:

- Once a quarter;

- By half-year;

- Once a year.

Quarterly and semi-annual dividends are also called interim. The order in which interest on earnings is paid depends on the type of stock.

If these are preferred securities, then their holder has an advantage in receiving money over ordinary shares. But at the same time, owners of preferred shares also receive income in a certain sequence.

The payment procedure is as follows:

- The first to receive their interest on the profits are those owners who have full advantage in this;

- Next comes the payment for cumulative securities. That is, for those shares for which there were no payments or they were partial;

- Afterwards, interest is paid on shares for which the yield is specified in the company’s charter;

- The next to receive interest are holders of securities in which the amount of dividends is not determined;

- The last to receive income are the owners of common shares.

The deadlines for such payments are also established.

They can be:

- Registered in the organization's charter;

- Registered at the general meeting of shareholders;

- Legally established: no more than 10 days for a nominal holder and no more than 25 days for other persons from the register of securities owners.

How to buy shares and receive dividends

Lukoil shares are listed on the Moscow Exchange and have high liquidity, so it is best to purchase securities through one of the Russian brokers.

Best brokers

Reliable Russian brokers

| Name | Rating | pros | Minuses |

| Finam | 8/10 | The most reliable | Commissions |

| Opening | 7/10 | Low commissions | Imposing services |

| BKS | 7/10 | The most technologically advanced | Imposing services |

| Kit-Finance | 6.5/10 | Low commissions | Outdated software and user interface |

Here you can see a list of the best Russian brokers providing access to the stock market. These are the largest representatives who are distinguished by reasonable commissions, high service and excellent reliability.

Forecast

The outlook for Lukoil's profit is rather positive. An extensive increase is not guaranteed, but nevertheless, an increase in ruble dividends is no longer an unprecedented event in the oil and gas market.

In addition, the history of interest payments in Lukoil suggests that the principles of the dividend policy are being implemented in full. Although slowing inflation in Russia may limit the process of paying out profits from the profitability of the enterprise, many companies and current shareholders support Lukoil's policy of increasing the percentage of profits from securities.

An approximate forecast of payments and changes in dividends is presented here.

Warning about Forex and BO

Expert opinion

Vladimir Silchenko

Private investor, stock market expert and author of the Capitalist blog

Ask a Question

Binary options have nothing to do with the stock market. At its core, BOs are very similar to online casinos, where the client is invited to place a bet in a “make or break” style.

In fact, there are no real transactions taking place here, and representatives of binary traders strive to win against their clients, using the principles of setting unequal odds on assets, due to which they form a negative mathematical expectation on the side of the players in their bets.

Forex is an over-the-counter foreign exchange market. It also does not apply to the stock market, and you cannot buy shares through the services of a forex dealer.

What are the downsides?

Firstly, the fall in oil prices will not bypass Lukoil. Most likely, its revenue and net income will decline, and this will certainly affect the dividend. On the other hand, if Lukoil does not reduce its investment program (more precisely, it will use dividends from managers for this), then it may even receive good assets into ownership - and even a temporary decrease in revenue will not be perceived negatively.

Secondly, rumors persist that Lukoil wants to take over either Rosneft, Surgutneftegaz, or Gazprom. I don't think they are justified. But free-float above 50% gives a theoretical opportunity to take over the company by buying up all the shares from minority shareholders. And when someone buys a large block of shares, the corresponding rumors intensify.

Thirdly, in Lukoil a lot depends on the personalities of Fedun and Alekperov. If they leave the company, it may lose its leading position.

And here’s another interesting article: Review of the Moscow Exchange innovation and investment market: is it worth taking shares of high-tech companies

But the second and third minus is still an owl stretched over a globe. But the first minus is a very real negative factor. And how management copes with them will show how strong and competitive Lukoil really is.

Will you buy Lukoil shares?

- Yes, definitely 69%, 46 votes

46 votes 69%46 votes - 69% of all votes

- I’m holding it and gradually buying more 25%, 17 votes

17 votes 25%

17 votes - 25% of all votes

- No 4%, 3 votes

3 votes 4%

3 votes - 4% of all votes

- No, I'm gradually selling 1%, 1 vote

1 vote 1%

1 vote - 1% of all votes

Total votes: 67

21.05.2020

Thus, in my opinion, Lukoil is one of the most excellent shares of the Russian stock market, no matter how you look at it. The company is growing rapidly and paying generous dividends, reminiscent of both classic dividend aristocrats (such as Microsoft) and growth stocks (such as Apple or Google). The actions of management during a crisis show that they (management) really care about the company and will not abandon it in a difficult situation. This gives confidence to all minority shareholders.

Personally, I increased my positions in Lukoil, even before the company announced dividends for 2021. And, it seems, he was right. What do you think about this? Write in the comments! Good luck, and may the dividends be with you!

Rate this article

[Total votes: 1 Average rating: 5]