Mutual investment funds (UIF)

is a simple and affordable way to invest money with the help of professional managers in securities or real estate with the possibility of receiving more income than on deposits. Investments in mutual funds are convenient for those who are not ready to make investment decisions on their own due to lack of time or experience.

The purpose of creating a mutual fund

— making a profit on the assets pooled into the fund and distributing the resulting profit among investors (shareholders) in proportion to the number of shares.

Investment share

- this is a registered security certifying the right of its owner to part of the fund’s property, as well as the redemption (redemption) of the owned share in accordance with the rules of the fund. Investment units thus certify the investor's share in the fund's property and the investor's right to receive funds from the mutual fund corresponding to this share, that is, to redeem the units at their current value.

List of all funds of the management company

The table shows the characteristics of all Sberbank AM funds.

| Name | Ilya Muromets | Prospective bonds | Balanced | Monetary | Consumer sector | Eurobonds | Global debt market | Nikitich | Electric power industry | Natural resources | Global Internet | Financial sector | |||

| Ticker ISIN | RU000A0EQ3Q5 | RU000A0EQ3T9 | RU000A0EQ3P7 | RU000A1002D0 | RU000A0JP7D0 | RU000A0JU054 | RU000A0EQ3R3 | RU000A0JP4P1 | RU000A0JP4R7 | RU000A0JV8N9 | RU000A0JPFK1 | ||||

| Registration number | 0007-45141428 | 0327-76077399 | 0051-56530197 | 3428 | 0757-94127221 | 2569 | 1991-94172500 | 0011-46360962 | 0598-94120851 | 0597-94120779 | 2161-94175705 | 0913-94127681 | |||

| Registration date | 18.12.1996 | 02.03.2005 | 21.03.2000 | 23.11.2017 | 01.03.2007 | 26.03.2013 | 30.11.2010 | 14.04.1997 | 31.08.2006 | 31.08.2006 | 28.06.2011 | 16.08.2007 | |||

| Type | Open | Open | Open | Open | Open | Open | Open | Open | Open | Open | Open | Open | |||

| Strategy | Investing in a portfolio of bonds of Russian issuers denominated in rubles | Investing in a portfolio of bonds of Russian issuers denominated in rubles | Investing in a diversified portfolio of stocks and bonds | Investing in deposits and short-term bonds | Investing in a diversified portfolio of consumer stocks | Investing in a portfolio of government and corporate bonds | Investing in dollar bonds and debt securities in local currencies | Investing in a diversified portfolio of Russian stocks | Investing in a diversified portfolio of electric utility stocks | Investing in a diversified portfolio of shares of companies in the mining and manufacturing industries | Investing in a diversified portfolio of shares, ADRs/GDRs of liquid companies, ETF units for the Internet sector and telecommunications | Investing in a diversified portfolio of global financial sector stocks | |||

| Risk | Short | Short | Average | Short | High | Short | Short | High | High | High | High | High | |||

| Commission | 2,8–5,8 % | 2,8–5,8 % | 4,9–6,4 % | 1,8 % | 5–7 % | 2,3–5,3 % | 2,3–5,3 % | 4–7 % | 4–7 % | 4–7 % | 4–7 % | 4–7 % | |||

| Profitability for 3 years | 30,78 % | 30,62 % | 36,94 % | 6.24% (1 year) | 36,94 % | 16,92 % | 16,76 % | 55,19 % | 22,91 % | 89,02 % | 65,97 % | 11,13 % | |||

| Minimum initial deposit | 1000 rubles | ||||||||||||||

| Subsequent contributions | 1000 rubles | ||||||||||||||

| Number of shareholders | 19,483 people | 13,598 people | 10,700 people | 1105 people | 4165 people | 3065 people | 1143 people | 17,444 people | 4318 people | 15,232 people | 10,362 people | 2430 people | |||

| Buy online | Yes | ||||||||||||||

| Minimum investment period | 1 year | 1 year | 1 year | 1 year | 1 year | 1 year | 1 year | 1 year | 3 years | 3 years | 3 years | 3 years | |||

| Early withdrawal | Yes | ||||||||||||||

| Name | America | Europe | Developing markets | Biotechnology | Gold | Commercial real estate | Residential property 3 | Rental business | Rental business 2 | Rental business 3 | Rental business 5 | Moscow Exchange total return index “gross” (SBMX) | S&P 500 Index | Moscow Exchange index of ruble corporate bonds | Moscow Exchange government bond index | Moscow Exchange Index of Russian Liquid Eurobonds | ||

| Ticker ISIN | RU000A0JP4S5 | RU000A0JRLD0 | RU000A0JVLK7 | RU000A0JTRF8 | RU000A0ERGA7 | RU000A0JVRF4 | RU000A0JWAW3 | RU000A0ZYC64 | RU000A100HV5 | SBMX | SBSP | SBRB | SBGB | SBCB | ||||

| Registration number | 0716-94122086 | 2058-94172687 | 1924-94168958 | 2974 | 2168-94176260 | 0252-74113866 | 3030 | 3120 | 3219 | 3445 | 3747 | 3555 | 3692 | 3785 | 3629 | 3636 | ||

| Registration date | 26.12.2006 | 17.02.2011 | 28.09.2010 | 23.04.2015 | 14.07.2011 | 25.08.2004 | 27.08.2015 | 25.02.2016 | 29.09.2016 | 23.01.2018 | 18.06.2019 | 15.08.2018 | 19.03.2019 | 25.07.2019 | 24.12.2018 | 28.12.2018 | ||

| Type | Open | Open | Open | Open | Open | Closed | Closed | Closed | Closed | Closed | Closed | Exchange | Exchange | Exchange | Exchange | Exchange | ||

| Strategy | Investing in SPDR S&P 500 ETF Trust | Investing in the Euro Stoxx 50® UCITS ETF (DR) | Investing in iShares Core MSCI Emerging Markets ETF | Investing in the iShares Nasdaq Biotechnology ETF | Investing in SPDR Gold Trust shares | Investing in commercial real estate | Investing in real estate in Moscow and Moscow Region | Investing in Class A warehouse real estate | Investing in commercial real estate | Purchase of shares and depositary receipts included in the Moscow Exchange index | Investing in stocks proportional to the index | Investing in corporate bonds in proportion to the index | Investing in OFZs is proportional to the index | Investing in government and corporate Eurobonds | ||||

| Risk | High | High | High | High | Average | Average | Average | Average | Average | Average | Average | Average | Short | Short | ||||

| Commission | 2,8–5,8 % | 2,7–5,7 % | 2,7–5,7 % | 2,8–5,8 % | 2,7–5,7 % | 12.5% +15% income | 52,4 % | 1–1,1 % | 1 % | 0,8 % | 0,8 % | 0,8 % | ||||||

| Profitability for 3 years | 50,29 % | 22,77 % | 24,25 % | 30,22 % | 19,13 % | -16,96 % | -14,82 % | -4,93 % | 2,01 % | 38.96% (12 months) | 11.74% (6 months) | 1.11% (<1 month) | 9.52% (6 months) | 3.92% (6 months) | ||||

| Minimum initial deposit | 1000 rubles | 5,800,000 rubles | 300,000 rubles | 1000 rubles | 1,000,000 rubles | 1,000,000 rubles | 10,000,000 rubles | 1,000,000 rubles | ||||||||||

| Subsequent contributions | 1000 rubles | 100,000 rubles | 300,000 rubles | 1000 rubles | 1,000,000 rubles | 10,000,000 rubles | 1,000,000 rubles | |||||||||||

| Number of shareholders | 2357 people | 561 people | 1087 people | 3951 people | 2113 people | 1474 people | 787 people | 1683 people | 927 people | 10,481 people | 3,279 people | 442 people | 3154 people | 2296 people | ||||

| Buy online | Yes | Yes | Yes | Yes | Yes | No | No | No | No | Yes | ||||||||

| Minimum investment period, years | 3 | 5 | 1 | |||||||||||||||

| Early withdrawal | Yes | Yes | Yes | Yes | Yes | No | No | No | No | No | No | Yes | ||||||

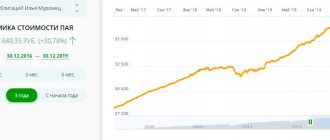

Dynamics of share value and NAV

Sberbank AM mutual funds have two characteristics: the price of the share and the value of net assets (assets-liabilities). I will look at the profitability graphs of mutual funds managed by Sberbank Asset Management.

The Natural Resources fund showed the highest return with a result of 89%. The smooth dynamics of the instrument was facilitated by an increase in the NAV of Sberbank AM Mutual Fund by 1104%.

Sberbank AM closed-end mutual funds show only losses. I don’t recommend investing in them: you won’t be able to quickly withdraw money from Sberbank AM.

Sberbank's exchange-traded investment fund AM "Moscow Exchange Index" has been growing for 12 months. The reason is the increase in NAV of the Sberbank AM mutual fund.

Profitability

Over the past three years, the mutual fund has shown a return of 78.13%. However, such high growth comes with an increased level of risk. In February 2021, the mutual fund showed negative dynamics - 4.15%. It is possible that the optimal moment to enter the industry has already passed. Accordingly, according to forecasts, there is a risk of entering at the maximum. The easiest way to evaluate the growth in profitability is on a chart.

Advantages and disadvantages

Why is Sberbank AM preferred by thousands of investors?

Now let me look at the advantages of the company:

- reliability. Sberbank AM was issued state licenses;

- profitability. Some funds give up to 75% in 3 years;

- simplicity. You can buy a share on the website sberbank-am.ru or at the Sberbank AM office.

The downside is the Sberbank AM commission of up to 7% for open mutual funds and 50% for closed mutual funds, which eats up profits. Let's do some simple calculations on a calculator. If the instrument gave a 30% profit, a 7% commission will reduce the net income by a quarter. And this does not include taxes. Over the past 3 years, closed mutual funds have brought only losses. Subtract the commission, and there will be almost nothing left from the original bill.

Why Sberbank broker clients are dissatisfied

How Sberbank deceives customers

The largest number of complaints is against the product “Accumulative life insurance”. It relates to the investment field and allows you to accumulate a certain amount for a specific event. For example, a child entering university. At the same time, the life and health of the client making contributions is insured. Most negative reviews are due to the fact that customers do not understand the essence of this product at all. And managers do not consider it necessary to explain clearly, apparently having their own plan for meeting KPIs.

The reason for imposing endowment life insurance on elderly people is especially unclear. Apparently the younger generation understands that there are more attractive investment products with high returns and there are very few clients in this area. Therefore, they attract whoever they can.

By the way, regular brokerage accounts and IIS are also offered to pensioners without any explanation. Elderly people are confused, scared and don’t know what to do next. This leads to subsequent termination of the contract.

As follows from this review, it is not clear why the bank manager, instead of making a deposit, “convinced” the pensioner to sign papers to open a brokerage account. The idea of starting an investment activity by opening an account and buying bonds is not bad. But its implementation let us down. In our opinion, first it is necessary to improve the financial literacy of this category of clients.

The bank’s response to this review looks even stranger: “to fill out an application for closure, you must contact the brokerage service office.” That is, “where you issued the card, go there” is still relevant. And this is in the 21st century, when almost everything can already be done online.

On other sites there are also many complaints about the substitution of concepts, when instead of deposits they offer to open an IIS. Or, even worse, involve trust management without really explaining how these investment products work.

Of course, this behavior of the First Bank of the Country cannot but outrage customers.

As for existing investors, there are also many complaints.

Technical glitches

All the “pain” is collected in one review. Yes, access to the Investor is closed at a time when there is no trading on the Moscow Exchange. During this time, you cannot view recent stock prices or evaluate your portfolio.

There are indeed frequent technical glitches in the application when it is impossible to log in. The reasons may be very different, but the result is the same - clients experience inconvenience.

A fairly common reason for the inability to work with one’s savings is the replacement of passports by clients. Changing personal data in the Sberbank Investor system leads to the “loss” of information about accounts. Technical support resolves these issues. But it does this very slowly, which entails financial losses for investors.

There are generally a lot of problems with passport data at the bank. Incorrect filling of information by employees leads to the inability to open an account. Moreover, no one is in a hurry to make corrections, but make do with standard unsubscribes.

In some cases, clients did not receive any documentary evidence of the account they opened.

Incorrect tax calculation occurs.

And again, a strange response from the financial institution about the need for the client to contact the bank with an application for a refund of the overly withheld tax. That is, they admit the mistake, but correcting it requires additional actions from the investor and waiting for a return within 3 months.

Technical failures sometimes lead to the “loss” of clients’ money in the system. Similar cases occurred, for example, among Tinkoff Bank clients. But there the issue was resolved within a few hours, a maximum of one day. Sberbank Investor is a more clumsy system.

Here, it takes weeks to resolve the issue, and the “customer care” service does not consider it necessary to notify about the outcome and apologize.

Problems with transactions on foreign currency accounts

This is the most numerous block of problems with this broker. Some of them stem from technical failures. Others impose restrictions on the transfer of funds between their own accounts within the same Sberbank system.

Essentially, clients are not given the opportunity to transfer funds in currencies other than rubles. If you want to replenish your brokerage account, for example, with dollars, then this can only be done at the bank’s office or by external transfer from another financial company. And this is quite strange, considering that other brokers have long implemented replenishment from their accounts in foreign currency.

IIS

Despite the growing popularity of individual investment accounts among the population, Sberbank Investor imposes many restrictions on this financial instrument.

Moreover, most of the limits apply to instruments of the Moscow Exchange. Despite the fact that other brokers have no problems with access to them.

How to invest

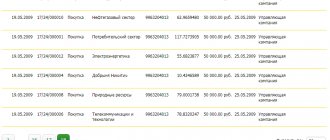

Log in to your personal account on the Sberbank AM website via ID or through government services. If you don't have an account, please register.

Expand the "Mutual Funds" menu. In the list of mutual funds, select the one you need (for example, “Balanced”).

"Buy online". Click on the button (don't forget to check the documentation!).

It's just a small matter: all that remains is to confirm the data in the Sberbank AM account and wait a week.

Feedback from investors

Private investors talk about the discrepancy between the profitability declared by Sberbank AM and the real one. Most reviews about mutual funds are negative. Investors do not advise investing in mutual funds of Sberbank AM.

Investments in global Internet companies from Sberbank

The manager controls the activities of a number of funds that invest in securities of foreign and Russian companies. The open mutual fund “Global Internet” places its bets on shares of strong IT companies engaged in online trading and the development of new technologies. The Internet economy sector has made many unknown people into billionaires and public figures. You won’t be able to join their number with the help of Sberbank’s mutual fund, but it’s quite possible to earn an increase in your salary or pension.

The principle of operation of the fund, from the point of view of investors, is as transparent as possible. An investor purchases shares for a certain amount, and his capital becomes part of a large mechanism, headed by the main “gear” - a reputable management company.

The activities of the mutual fund are controlled by a special depository and the Central Bank of the Russian Federation. The main goal is to get maximum profit in the long term. The Global Internet is not suitable for short-term investments, since the project’s potential will not be revealed within a few months. Although during the pandemic this fund showed good results. At the moment, on an annualized basis, it has returned 46.46% to investors. And over three years, the value of the share increased by 66.91%.

The Global Internet Fund invests in shares of Russian and foreign technology, that is, large corporations such as Apple and Google are also part of the “portfolio”. The Internet technology market, according to analysts from the management company, is an excellent investment tool for the next 3–5 years.

The structure of the fund is thought out to the smallest detail and is distributed between different instruments. The "Global Internet" has invested in software manufacturers, online media, telecommunications entities, etc.

Mutual Fund "Global Internet" was founded in 2011 and for 9 years now it has been a source of passive income for enterprising citizens of the Russian Federation who purchased shares, and with them became part of the IT ecosystem. Thus, investors do not need to monitor the dynamics of shares of specific technology companies, but only periodically monitor how the value of the acquired share changes. The entry threshold is low, so anyone can join the number of shareholders. Next, we will dwell in detail on the investment conditions and determine the rating of the mutual fund according to generally accepted coefficients.

Newbie

What are the advantages of the Sberbank AM mutual fund over a deposit? How risky are investments in Sberbank AM? Below I will answer the questions in accessible words.

What is a mutual fund and why is it needed?

This is managing your capital. Sberbank AM receives part of the investor's income - a commission. The management company uses the money of its shareholders to create a portfolio of bonds, shares, and depositary receipts. The company successfully placed funds - the price of the share increased - the investor received income.

Advantages and disadvantages of mutual funds

The advantages of mutual funds include:

- saving time: management is handled by the management company. All the troubles at Sberbank AM;

- minimum investment from 1000 rubles;

- profitability up to 75%. A deposit will not provide such profit.

But Sberbank AM commissions of up to 7% make mutual funds meaningless for experienced Russian investors.

Risks

Now I will consider factors that increase the riskiness of investments in Sberbank AM mutual funds.

What affects the risk level of a mutual fund

- Assets. A bond fund is safer than ETFs and stocks.

- Sberbank AM strategy. If the management company uses an aggressive strategy, the profit potential is unlimited (as is the risk).

- Age of the organization. You should not transfer money to little-known companies, because there is a risk of fraud.

What can be done to reduce risks

Buy a share in more than one mutual fund of Sberbank AM, but diversify your portfolio into several assets. In this case, the chance of losing your entire investment is minimized.

Investment conditions

Mutual Fund is a professional participant in the stock market. The company's resources and the experience of analysts make it possible for the population to receive income by simply investing money. But the fund establishes certain conditions on which cooperation and joint investment activities are based:

- The minimum investment size, if a share is purchased in a personal online profile or through an application for mobile devices, is 1 thousand rubles, and if in a branch of Sberbank or a Management Company - 15 thousand rubles.

- The acquisition of a share is accompanied by the collection of a commission (surcharge) of 0.5% for amounts over 3 million rubles. and 1% up to 3 million rubles.

- Redemption of a share is accompanied by a deduction of a commission (discount) of 0% if the investor owns the share for more than 732 days, 1% - from 181 to 731 days, 2% - from 0 to 180 days.

- The maximum investment period is not limited.

- The function of replenishing the share at any time and using it as a piggy bank is available.

- It is allowed to withdraw funds (redeem shares) without losing accumulated income.

If the client subsequently wants to invest money for the next purchase of shares, then the minimum amount for this is set at 1 thousand rubles. In addition, he can exchange a share of one fund for another without paying a commission.

Investors who bought a share after January 1, 2014 and sold it at a higher price after three or more years of ownership are exempt from paying personal income tax on the profit received. This rule applies to amounts not exceeding 3 million rubles.