When buying dollars for rubles or selling euros, each time we pay a few additional percentages on top to the exchange office. For profitable currency exchange, buying or selling dollars or euros, there are several options. We will consider only official and reliable methods. When you can buy or sell currency at any time, without risks and with minimal losses.

Depending on the exchange option, you can save a lot. And buy dollars almost at the official rate, without extortionate markups from bank exchangers. The profitability of the exchange can be several percent of the amount.

When is the best time to buy dollars and euros?

The best time to buy currency is when the ruble is strengthening. As a rule, this happens when oil prices rise, and also during tax periods - when exporting companies (oil and gas, metallurgical and others) transfer foreign currency earnings into rubles to pay taxes. At such moments, the demand for the Russian currency increases, and its exchange rate increases accordingly. Tax periods occur every month - from the 19th to the 25th.

Related article Why do we need a currency exchange rate forecast until 2035?

Exchange at your bank

When comparing exchange rates, be sure to check the offers from your home bank. Not on the official website, but in your personal account.

For their clients, almost all banks set more favorable currency exchange rates. Compared to people on the street.

And it may turn out that the difference with the best rates in other banks, according to monitoring data, will not differ much from the rate set for you in your personal account.

Exchange rate in your personal account using the example of purchasing dollars.

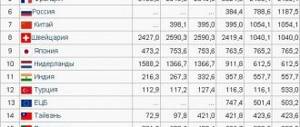

| Bank | Course on the official website | In your personal account |

| Sberbank | 64,41 | 63,94 |

| VTB | 64,05 | 63,80 |

| Opening | 63,70 | 63,30 |

| Alfa Bank | 63,72 | 63,30 |

It turns out that the rate for clients becomes 40-50 kopecks more profitable. A little more than half a percent - 0.6-08%.

And this is exactly what you need to compare with.

When is the best time to buy currency at the beginning of the month?

But, according to the head of the analytical department, Ekaterina Tumanova, there are exceptions when it is better to buy currency at the beginning of the month - August and December. The fact is that, historically, August is not the best month for the Russian economy: all the troubles began in this month.

“By the end of August, the exchange rate of the dollar or euro against the ruble sometimes goes through the roof, which means that purchasing foreign currency should only be considered at the end of July or beginning of August,” she explains.

As for December, the currency also rises in price in the last month of the year. This happens in connection with the peak of sales of trade organizations dedicated to Christmas and New Year, when many people decide to make expensive purchases. Most of these goods (electronics, household appliances, cars, etc.) are still purchased abroad, so when purchasing rubles, rubles are converted into foreign currency. Because of this, there is an increased demand for foreign currency and its exchange rate is rising.

What will happen to the dollar, ruble and euro by the end of the year? Currency forecast Read more

Terminals, ATMs

Special devices designed for currency exchange are not yet widely used by banks. However, they can already be found in branches of financial institutions, airports, and train stations. The principle of ATM operation is simple: you need to put money in a special compartment for exchange. And then pick up currency or rubles from another window.

When accessing ATMs, it is worth considering that they only accept banknotes with denominations divisible by 5 or 10. They issue money according to the same scheme. For example, at Sberbank ATMs you can exchange currency with denominations divisible by 100. However, currency exchange cannot be made in bills smaller than 100 rubles.

Therefore, if the amount to be issued is not “round,” the terminal will ask where to credit the difference: to a payment card (if available) or to top up your mobile phone account. The second important point when exchanging through an automatic device that you need to know about is the presence of a limitation: one exchange transaction cannot exceed the amount of 15,000 rubles.

When is it better not to buy currency?

You need to buy a currency when it becomes cheaper, and sell when it becomes more expensive. In Russia, this rule works exactly the opposite: as soon as the ruble exchange rate drops to critical levels, compatriots storm exchange offices with only one desire - to save their savings.

It is definitely not worth buying dollars or euros during periods of rising exchange rates, caused, for example, by factors such as the threat (or introduction) of another package of anti-Russian sanctions. As practice shows, over time the ruble wins back, and citizens who succumbed to panic and exchanged rubles for dollars/euros at a high rate do not win anything.

The place for the fall of the ruble and the rapid growth of the dollar and euro is between the announcement and the imposition of sanctions. To grasp this point, it is necessary to monitor the news about the statements of American politicians. Moreover, after the announcement, foreign currencies rise in price by 5-7 rubles, then they fall, but not so much.

Article on the topic

In what currency should you keep your money and should you take out loans now? Expert advice

What are the tariffs?

Now let's talk about the commission fees that Sberbank charges when performing transactions with money from other countries:

- The purchase or sale of foreign banknotes for cash rubles is free of charge at the rate announced by Sberbank at the time of the transaction.

- Selling the currency of one state for the money of another, i.e. Conversion is also free of commission fees.

- To exchange a large banknote for money from the same state, you will have to pay 5% of the amount.

- When replacing damaged, dirty or torn bills, you will be charged 10% of the value of the currency. In the same way, you can purchase damaged money with a 10% discount on the face value. The same commission applies when sending a banknote for collection.

- Checking the authenticity of money will cost the client 10 rubles for each banknote, but not less than 100 rubles for the entire operation.

Commission rates.pdf [241.74 Kb] (downloads: 412) View online file: Commission rates.pdf

On weekdays or on weekends?

It is better to exchange rubles for dollars or euros on weekdays: on weekends the exchange rate may be higher. The fact is that there is no trading on the Moscow Currency Exchange on weekends, while on Saturday or Sunday events may occur that could negatively affect the ruble exchange rate. Financial institutions factor this risk into weekend foreign exchange rates.

We've finished the game. State Duma deputy talks about how citizens are being fooled on the foreign exchange market Read more

Analysts told how the purchase of currency by the Central Bank of the Russian Federation will affect the ruble exchange rate

From January 15, the Bank of Russia plans to buy 7.1 billion rubles worth of currency on the market, which may lead to an adjustment in the Russian currency exchange rate. Experts from the financial analytics department of FBA Economy Today assured that the purchase of foreign currency will definitely not lead to a sharp weakening of the ruble.

After the collapse of oil in the spring of 2021, the Central Bank of the Russian Federation carried out only currency sales. At first, these actions were proactive in nature, and then became planned, calculated according to the budget rule.

The Russian Ministry of Finance forecasts the average exchange rate for 2021 at 72.4 rubles per dollar, and the price of oil at $45.3 per barrel. Taking this forecast into account, the department budgets a certain amount of oil and gas revenues. During the year, the price of oil and exchange rates may change significantly and differ from forecast values, so the Ministry of Finance may receive more or less planned oil and gas revenues.

Analysts explained that in case of income below the forecast, the Central Bank of the Russian Federation sells currency from the National Welfare Fund (NWF) to replenish the budget. If the income is higher, then the Central Bank buys currency on the market to replenish the National Welfare Fund.

FBA "Economy Today" /

In December 2021, the Russian budget received 32.7 billion rubles more from oil and gas revenues than predicted. In January 2021, the Russian Federation may also receive 73.5 billion rubles more than predicted. On this basis, the Russian Ministry of Finance plans to purchase foreign currency for 106.3 billion rubles in the period from January 15 to February 4.

Economists believe that the actions of the Ministry of Finance will not have a significant impact on the exchange rate of the Russian currency.

“With such high oil prices and with the reduction in the risk of new sanctions from the Biden administration, the ruble is likely to strengthen closer to 70-72 rubles. for a dollar. The effect of the fiscal rule and the purchase of foreign currency by the Ministry of Finance within the framework of this rule may slightly restrain the strengthening, but are unlikely to be able to stop this trend. At the same time, such purchases will definitely not lead to a sharp weakening of the ruble,” experts noted.

Analysts did not rule out a temporary market reaction to the purchase of foreign currency by the Russian Ministry of Finance. However, a weakening of the ruble exchange rate is possible subject to the introduction of new tough sanctions. Then the rate may reach 80 rubles per dollar.

“Currently the ruble is in the range of 73–75, while this level looks balanced for all market participants,” the experts concluded.

Analysts interviewed by journalists previously called the current situation a test for the global economy. However, the Russian currency has been strengthening since the beginning of the year.

Comments: 2

Your comment (question) If you have questions about this article, you can tell us. Our team consists of only experienced experts and specialists with specialized education. We will try to help you in this topic:

Author of the article Anatoly Darchiev

Consultant, author Popovich Anna

Financial author Olga Pikhotskaya

- Anonymous

03/01/2021 at 03:14 Hello _ I read your comments and answers_ how I realized that Belor.money needs to be changed only on the territory of Belarus!

Reply ↓ Anna Popovich

03/01/2021 at 03:18Dear client, old-style currency can only be exchanged at the National Bank of the Republic of Belarus. And from January 1, 2022, banknotes of the 2000 model will be considered invalid. The new type of currency can be exchanged on the territory of the Russian Federation without any difficulties.

Reply ↓

How is foreign exchange control exercised?

Not long ago, new currency exchange rules were introduced in the Russian Federation. In particular, the changes affected the procedure for purchasing banknotes in an amount exceeding 15,000 rubles. Now financial institutions must conduct verification of their clients and request the following documents and information:

- passport of a citizen of the country;

- a special form (issued and filled out on site);

- citizenship;

- TIN;

- contacts (telephone numbers, etc.);

- registration data;

- date, month, year of birth;

- etc.

All changes that should be made to the program are made by the bank employee according to the documentation provided by the client. Client data is stored electronically, which is very useful in situations where you need to serve a person who has previously interacted with the bank.

Note 1.

If the amount of money does not exceed 15,000 rubles, purchasing currency will only require a passport.

In addition to the points already listed, the following must be said: the banking company has the right to request the current financial situation of the citizen and the origin of the money

that need to be changed. The measure is aimed at counteracting the illegal receipt of funds and money laundering. It also helps to identify sources of financing for criminal communities, terrorism and protects the bank from fraud.

The questionnaire completed by the subject contains 17 items. A number of them are formulated by the financial institution independently.

Important! Bank employees bear a certain responsibility for the operation being carried out. These are risks, so the requirements for supporting currency exchange must be strictly observed.

Federal Law “On Combating the Legalization (Laundering) of Proceeds from Crime and the Financing of Terrorism” dated August 7, 2001, number 115-FZ

significantly expanded the ability of banking companies to request more detailed information from clients.

If financial institutions fully comply with the requirements of all articles of the law, limited requests for the acquisition of foreign banknotes by private individuals may be provoked. Failure to comply with existing requirements by citizens leads to only one result - refusal of the operation without explanation.

.

Important! Foreign money is legally property and is subject to a 13% tax.

Starting from 2021, purchases and sales of foreign currency must be included in the tax return.

The requirement is mandatory if the total income from transactions is more than 250,000.

How to book a hotel abroad profitably?

If you are going to pay for renting a home or car in advance, it will be most convenient to do this using a card.

You can pay with a ruble card. When you book a hotel or make a purchase, you immediately see a list of which cards you can pay with.

Pros:

- With this type of payment, the exchange rate will be more favorable;

- You do not need to do unnecessary manipulations in the form of currency exchange.

Minuses:

- In this case, a commission is provided. It will depend on the local bank through which the payment goes through.

Pay with a currency card

Pros:

- If the currency of your card matches the currency of the country, then there will be no commission;

- You can top up your account on a currency card at any time through an online bank.

Minuses:

- You will have to get a special card and pay for its service;

- It is not possible to withdraw cash from all ATMs.

Payment by multicurrency card

What it is? Such a card can have two or three accounts with different types of currency. You can change your account currency online yourself before traveling to a particular country.

Pros:

- You can connect additional accounts in a different currency to your regular card;

- Such cards can be topped up online with any type of currency you need.

Minuses:

- It is not possible to withdraw cash from this card at all ATMs;

- Money does not leave the multicurrency card immediately. So, if you want to pay for a hotel stay, the money in your account is first blocked and debited only after a few days.

Exchangers

Exchangers are special retail outlets established by banks, whose main task is foreign exchange transactions. You can also find out what rates of the main currencies in exchange offices and where to exchange currency more profitably using the Internet. All relevant information is posted on the websites of banks that own the exchanger, or on special websites that collect information about rates.

The main problem of the exchanger that clients encounter and which is actively discussed on the Internet is the discrepancy between the actual purchase and sale rates of currencies and those indicated on the information board.

Often, in order to attract customers, exchanger employees may place incorrect values on the sign and carry out the operation itself at the current rates. Therefore, before making an exchange, you need to ask the cashier about the transaction rate, or even better, check the information on the Internet.

From October 1, 2010, changes were introduced to the operation of exchange offices:

- exchangers must perform not only currency exchange operations, but also other banking services;

- they must be located in a permanent building;

- There must be detailed information on the stand about the bank: name, address, telephone number, list of operations performed.

I am looking for a currency exchange

Today, it is very difficult to say exactly where it is profitable to exchange currency. It all depends on the amount of the transaction, the level of risk that a person can take, the type of currency, its form.

Regarding electronic and cryptocurrencies, the situation here is slightly different. Domestic banks do not work with them, so they can be exchanged either in the electronic system itself in a special section or use one of the virtual exchangers on the Internet.

However, before initiating an exchange, it is recommended to check the exchanger’s website, it may be created by scammers. To do this, it is recommended to use special sites, for example, https://whois.domaintools.com/. Using the latter, you can determine when the exchanger was created. If it only “lives” for a few days, then it is better to look for another exchange site.

Alexander Babin