We have already talked many times about trading in the securities market and investing, giving advice on how to do it right and what not to do.

Here's another concept from the world of finance that will make you a better participant: liquidity. Liquidity is the ability to buy/sell an asset as quickly as possible with minimal losses.

Money has absolute liquidity, because... You can use them to immediately buy any product. But today we are talking about securities. The liquidity of an instrument is affected by both trading volume and the size of the company itself. The more liquid a particular instrument is, the better it is for the investor, and vice versa.

Why greater liquidity is a great boon for investors and traders:

— if your funds amount to more than 1 million rubles, then it will be very difficult to invest in completely unknown companies, because in order to collect the necessary package of securities, you will have to raise the price very much;

— if you purchase low-liquidity shares, you will spend quite a lot of financial resources due to the large spread (see below);

— if you are a scalper, you will under no circumstances be able to scalp on low-liquidity instruments;

— only two strategies work on securities with low liquidity: investing for a very long period, as well as working with corporate news;

- etc.

If securities are low-liquid, you need to do the following:

— improve the company’s image in the eyes of market participants, the most important thing for them is the company’s reliability;

— improve the company’s financial performance;

— improve the quality of information about your company to all market participants;

— as an option, reduce the controlling shareholder’s part of its share and sell these securities on the market;

— attract professional stock market participants (brokers) to work as market makers;

- etc.

These measures will certainly lead to an increase in the liquidity of securities on the market.

What is liquidity

Before defining what liquidity is in the securities market, let's consider the concept of liquidity in a general sense. In simple terms, liquidity answers the question “How quickly can I sell this or that asset?” Essentially, it is the rate at which an asset can be “transformed” into cash, and the costs that this “conversion” will entail. In another way, liquidity can be called the cost of error. For example, if you bought an asset and need to sell it, then liquid assets can be sold at almost the same price, while illiquid assets can be sold at a lower price. Thus, when purchasing illiquid assets, the investor immediately receives a virtual loss.

Therefore, liquidity

– this is a characteristic inherent to all assets and showing the likelihood of prompt sale of an asset, i.e. speed of conversion into cash. Liquidity is inherent in absolutely all assets - money, enterprises, banks, markets, real estate, securities, bank deposits, debts, etc.

There are several levels of asset liquidity - highly liquid, low liquid and illiquid assets. Only cash is considered absolutely liquid. Real estate can be classified as low-liquidity, since the sale of a particular property at a market price is not a quick process and takes a significant amount of time. An example of illiquid assets can be overdue debts, etc.

As mentioned above, liquidity is also inherent in securities that are traded on stock markets. Thus, liquidity in the securities market is a characteristic of financial assets listed on stock markets, which shows the ability to quickly convert into cash at a price close to the market.

Advantages of liquid investments

Liquid investments actually have the same advantages over illiquid ones. Let's list them:

- Flexibility. More opportunity in managing the funds. The ability to quickly transfer money from one asset to another.

- Small spread (commission, difference between purchase and sale prices).

- Opportunity to trade/speculate with big money.

- The ability to quickly withdraw money without loss.

Watch also the video “Asset Liquidity”:

Related posts:

- Global financial market - what it is and how it works

- What is a stock split (crushing) - why is it needed?

- COBR - what it is and how it works

- Free Float coefficient for stocks - what is it and why is it needed?

- What are the differences between the exchange and over-the-counter markets -...

- Money supply - what it is and what it includes

- Solvency and efficiency ratios…

- Assets and liabilities - what are they, examples

Liquidity levels in the securities market

The level of liquidity is the degree of popularity of an asset, which is ensured mainly by a large number of speculative market participants. The higher this popularity, the higher the liquidity of the asset will be. There are several levels of securities liquidity:

- Liquid securities

or highly liquid - these are financial assets for which investors on stock markets actively carry out purchase and sale transactions at the market price or close to it. Buying or selling such assets at market prices is not difficult.

- Illiquid securities

– these are financial assets presented on stock markets, for which there is no demand from investors due to a variety of reasons. Transactions on such securities are not concluded or are concluded, but rarely. It is very difficult to sell or buy such assets.

Let's consider the structure of financial assets of the Moscow and St. Petersburg exchanges by liquidity levels. To do this, we will focus on the trading volume of a particular asset, since this is the main indicator of liquidity.

At the time of writing, the Moscow Stock Exchange included more than 2,200 bond issues, of which only 905 (41%) were liquid. (see articles “Russian Bond Market”, “How to Buy Bonds”). This indicator suggests that more than half of the Russian bond market is illiquid.

Examples of illiquid bonds can be default bonds (see the article “Default of bonds”), bonds of the Central Bank of the Russian Federation (KOBR-40, KOBR-41, KOBR-42), OFZ 26231, OFZ 29019, OFZ 46012 (see article “How to buy OFZ"), structured bonds of VTB PJSC or Gazprombank PJSC (see the article “Structural bonds”), etc. The most liquid bonds in terms of trading volume per session are OFZ 26234, OFZ 24021, OFZ 26232 (see article “Best Bonds 2021”) .

As for shares on the Moscow Exchange, at the time of writing, out of 282 shares of Russian companies are liquid, i.e. 257 issues (91%) were in demand among investors. This result indicates a very liquid stock market in the Russian Federation.

An example of illiquid corporate shares can be Khimprom JSC (Khimprom PJSC), TransK JSC (TransContainer PJSC), Morion JSC (Morion PJSC), etc. Among bank shares, illiquid ones are MosOblBank (Moscow Regional Bank PJSC), Derzhava ap (Derzhava AKB), etc. .

Also, the absence of purchase and sale transactions may be due to the suspension of trading by the exchange due to the mandatory repurchase of its shares by the issuing company (“Share buyback”). For example, trading was suspended, but shares such as Megafon, Ruspolimet, Uralkali, etc. were not excluded from the quotation list.

According to the average monthly turnover of Russian shares, the most liquid shares in terms of trading volume on the Moscow Exchange are shares of such issuers as Sberbank PJSC, MMC Norilsk Nickel PJSC, Gazprom PJSC, Lukoil PJSC, Yandex NV (Yandex), NK Rosneft PJSC, etc. (see article “ Best stocks 2021"). An investor will never have a problem with the lack of buyers or sellers of these shares. Transactions on them are carried out daily, shares are among the leaders in trading turnover. Below is data on the TOP-25 shares of the Moscow Exchange in terms of average daily trading turnover (the review period is taken from February 8 to March 12, 2021):

The undisputed leader in trading turnover on the Moscow Exchange is Sberbank, the average monthly number of transactions on shares of which in one trading session reaches 102 thousand in the amount of 17.7 billion rubles.

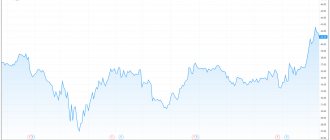

Investors themselves also create liquidity in the securities market. It depends on supply and demand, which can be affected by various market or internal events. So, for example, the event that happened with the shares of MMC Norilsk Nickel - an accident at two key production facilities and Taimyr). The chart below clearly shows a surge in trading activity in GMKNorNik shares, which was caused by negative news about the suspension of work at the mines.

A significant increase in trading volumes occurred after the accident, when investors actively closed their positions in shares of MMC Norilsk Nickel.

Next, we will consider the structure of financial assets of the St. Petersburg Exchange by liquidity levels. Here, of course, we are interested in shares of foreign issuers. At the time of writing this article, more than 1,450 shares of foreign companies were traded in St. Petersburg - shares of the USA, Germany, China, etc. Of these, 1,230 (84%) were liquid, i.e. they are actively traded by investors at market prices or close to them. (See the article “Best US Stocks”).

Illiquid assets include shares of companies such as The Boston Beer Company, Inc., SINA Corporation, Materion Corporation, China Telecom Corporation Limited, AutoZone, Inc. and etc.

In addition to liquid and illiquid securities, in practice, investors distinguish such assets based on the level of liquidity as conditionally liquid and weakly liquid financial assets.

Conditionally liquid securities

– these are financial assets that are quoted on over-the-counter markets, but have a certain attractiveness for investors. Conditionally liquid instruments may include various financial instruments - most often bills of exchange (see the article “Debt Securities”), as well as shares, bonds, shares, etc. In order to purchase such assets, investors will have to look for a seller, for example, with through advertisements or resellers. Examples of conditionally liquid assets can be bills of exchange of large companies such as Sberbank PJSC, MMC Norilsk Nickel, etc.

Poorly liquid (low liquidity)

– these are financial assets that are listed on stock markets, but have low demand from investors. The speed of converting such assets into cash at market prices can reach more than 1 month. Most often, low liquidity is inherent in assets whose issuers are little-known small companies.

Thus, the level of liquidity is one of the most important indicators on the stock exchange for investors. Neglecting it may result in the inability to sell any asset at a market price in the future, which will lead to loss of profits and significant losses.

Real estate liquidity: how is it determined?

Real estate itself has low liquidity. However, if we consider, for example, an elite luxury home and a new building in the budget segment on the outskirts of a large city, the new building will have much greater liquidity, since many more people can buy apartments in it, and it will be easier to sell them.

In the sale of real estate, the same rules apply to determine liquidity - the easier it is to sell, the higher the liquidity.

Methods for assessing liquidity in the securities market

The liquidity of an asset can be assessed using indicators such as trading volume (turnover) and spread. Let's take a closer look at each of them.

Trading volume or exchange turnover

is the volume of transactions with financial instruments in monetary terms made by investors during one trading session. Defined as the amount of completed transactions. The higher the turnover of an asset, the more liquid it will be considered for investors. The amount of transactions completed over a certain period is measured in the currency in which the asset is quoted. On the Moscow Exchange it is most often rubles, on St. Petersburg for foreign shares - dollars or euros.

In the Quik trading terminal, this indicator can be displayed for each asset by adding the “Turnover in money” parameter to the current trading table from the available parameters.

On asset charts, trading turnover is presented at the bottom of the chart in the form of columns of varying heights - a histogram. The turnover indicator on the chart is designated as Volume

.

The chart shows an example for MMK shares. Since the end of 2021, turnover on them has increased significantly and reached a maximum point of 51.3 million rubles. per trading session.

Spread

– is also the main indicator of liquidity in the securities market and shows the difference between the purchase price and sale price of a particular asset in the exchange book. The higher the value of this indicator, the less liquid the security is considered. Ideally, the spread value should be tenths or even hundredths of a percent. Calculated using the formula below.

Let's consider, using the example of the shares of Gazprom JSC (Gazprom PJSC) and Saratov Refinery PJSC, the calculation and interpretation of spread values. To do this, we will use the order books of these shares.

The spread of Gazprom JSC shares is equal to 1 kopeck (220.61 - 220.6 = 0.01) or 0.004% (0.01 / 220.61 * 100%). The spread on SaratNPZ shares, according to the order book, is 400 rubles. (14,200 – 13,800 = 400) or 2.8% (400 / 14,200 * 100% = 2.8%). This suggests that, having bought a share of Gazprom JSC, the investor virtually lost 1 kopeck, if he had to sell it immediately, and having bought a share of SaratNPZ, he immediately lost 400 rubles. or 2.8%. Thus, the purchase of illiquid assets immediately means guaranteed losses for the investor.

According to the data obtained on the size of the spread, we can conclude that Gazprom shares are highly liquid, unlike shares of the Saratov Refinery. In practice, it is worth considering both indicators (turnover and spread) together, which will give the most accurate result on the level of asset liquidity.

CALCULATION OF SHARES LIQUIDITY RATIO

This coefficient is calculated using the formula:

Where:

Median(V) – median daily trading volume in rubles, calculated for the stock over the previous three months;

WorkDays – number of trading days per year;

Average(P × (Q - Qn)) – average stock capitalization, calculated for three months preceding the calculation date, where:

P – closing price;

Q – total number of shares;

Qn is the total number of shares not outstanding.

How to find liquid assets

Finding liquid assets and avoiding illiquidity in the securities market is not difficult. To do this, in the Quik program you need to set up a filter by trading volume (turnover), sorting securities in descending order of turnover for one trading session.

After you have sorted the assets by trading turnover, before making a transaction, it is necessary, firstly, to conduct a fundamental analysis of the issuer, and secondly, to analyze the exchange book and calculate the spread indicator in order to assess its liquidity and estimate the size of slippage in the case of a market transactions for your volume. An example was discussed above. If the spread between the purchase and sale prices is no more than tenths of a percent, then such a security can be called liquid.

Our Fin-Plan Radar service has a special filter “Remove shares with no turnover from the list.” This filter allows you to remove from the issuance illiquid and low-liquidity securities that are not in demand among investors on the stock exchange.

This filter in the Fin-Plan Radar service is always enabled by default. You can see this for yourself by going to the “BONDS” or “RUSSIA SHARES” section.

If you need to disable this filter, you can use the switch next to the name or select the “Reset all” strategy.

What is the relationship between liquidity and volatility

It is worth noting that liquidity is related to volatility, but do not think that liquidity determines volatility. The market can be both high liquidity and low volatility, or low liquidity and high volatility.

High volatility and low liquidity are observed at the time of publication of important economic news, when large banks have to hedge against risks by reducing liquidity. This explains the long spiers of candles during the release of important news, when the price can jump by 50-100 pips in a matter of seconds.

Liquidity can be compared to a buffer that absorbs small spikes. This statement is clearly shown in the following diagram.

How investors should deal with liquid and illiquid securities

First, let's look at how investors with liquid assets should act. At first glance, everything is simple - if the asset is liquid, then take it and buy/sell. But in the case when an investor is ready to purchase or sell a large package of assets on the market, before the transaction it is first necessary to estimate the volume of supply/demand at the best price and determine the amount of slippage. Let's look at these actions in more detail.

The volume of supply or demand at the best price is the number of lots in orders that are presented in the exchange order book at the best supply/demand price. For example, for the shares of Gazprom JSC, the volume of supply at the best price is 23 lots, the volume of demand at the best price is 41 lots.

In the case when the required volume for purchase/sale is higher than the market volume at the best price, there is a need to complete a transaction and replenish the required volume at the next available price (you should focus on the “Best Amount” column in the order book). As a result, the average price of such transactions will be less profitable than the market price. In such a situation, the “Slippage Effect” occurs. For example, if you need to buy 200 lots of Gazprom JSC shares, then using a market order, 23 lots will be purchased at a price of 232.46 rubles, 85 at 232.47 rubles. and 92 for 232.49 rubles. The average price is 23 * 232.46 + 85 * 232.47 + 92 * 232.49) / 200 = 232.48 rubles. The amount of slippage in this case will be (232.46 - 232.48) * 200 = (-3.61 rubles). This suggests that this transaction will be executed at a price less favorable by 3.61 rubles.

Thus, the amount of slippage

– these are direct losses for the investor. The lower the liquidity of a security, the greater the amount of slippage or loss on the transaction. The higher the liquidity, the lower the slippage. In order to minimize such losses on transactions, it is necessary to choose more liquid assets.

To avoid the “Slippage Effect” when purchasing a large volume of assets, you should use limit orders

, and not market ones (for more details, see the article “Exchange Orders”).

In the case of low-liquid assets, everything is much more complicated. If the amount of funds for investment is small and the investor buys/sells 1-3 lots, then such a transaction will be executed even on a low-liquidity security. If you need to sell/buy a large package of financial instruments, then you can recommend that investors use a step entry, an iceberg order, or trading inside a spread. Let's take a closer look at all three options.

If you buy low-liquidity shares at market prices, you can “collect” the entire stock market book. So, for example, to buy 10 lots of the Sarat Refinery, you will need to make transactions at 7 different prices. You shouldn’t do this with low-liquid assets.

In such situations, you can use a stepped entry (order grid)

– this is a breakdown of a position into several limit orders, for example 3-6 pieces. with a price difference of 1-2%. This mechanism will allow you to buy or sell a significant amount of asset positions during natural market fluctuations.

Since prices for low-liquidity assets are more sensitive to changes in the balance of supply and demand, it is worth using an iceberg order.

It allows investors to hide the real order volume in the order book. If one part of the order is executed, another part appears. This mechanism makes it possible to “not alarm” other market participants and make transactions for a larger volume of funds in several stages, without creating large demand and increasing the price (for more details, see the article “Exchange Orders”).

Trading inside the spread

– allows you to reduce the spread and increases the likelihood of a limit order being executed.

For example, for the Sarat Refinery share the spread is 350 rubles. (2.4%). If an investor places a limit order at a price level of RUB 14,450, then the spread will be reduced to RUB 250. (1.7%). If an order at a price within the spread is not executed, it is necessary to increase the price and further reduce the spread, for example, make an order at a price of 14,500 rubles. and so on, gradually reducing the spread until the order is executed.

Where highly liquid securities are operated

Such transactions are made on the exchange market. Its main difference is absolute transparency in the calculation of completed transactions. It is also more technologically advanced and has clear and predictable pricing mechanisms.

Securities are traded on the stock exchange. Every country with a developed economy has its own national stock exchange. The largest by capitalization in 2021 are NYSE Euronext, NASDAQ and the Tokyo Stock Exchange. According to the results of the first quarter of this year, the Moscow Exchange was only in 22nd place.

How shares work

Shares give the owner the right to manage the activities of the enterprise and receive a portion of the profits commensurate with his share. The issue is carried out only by joint stock companies (JSC), the acquirer can be an individual or legal entity, including professional investors.

The scheme of shares in simple words looks like this:

- The joint stock company needs additional financing.

- Some of the assets are sold as shares of the company.

- The investor acquires a full package or part of the assets and becomes the full owner of the company or a co-owner.

- The JSC uses the money received to develop its activities and generate income.

- Shareholders receive a percentage of the enterprise's profits in the form of dividends equal to the share of purchased securities (more precisely, the percentage is equal to the part of the enterprise owned by the investor).

A joint stock company can have an unlimited number of participants. One share represents a share of the enterprise, for example 1% or 0.0001%.

Profits are distributed in a similar proportion. Participation in the management of the joint-stock company is formally given to all shareholders.

In practice, the owner of 0.0001% is unlikely to change the direction of activity, but is forced to participate in the life of the company. The minimum amount of a controlling stake is 50% + 1 share.

Choosing stocks for a portfolio: what you need to consider

The risk of investing in securities must be balanced with profitability and liquidity. To do this, it is important to distribute finances between different assets. The investment portfolio should include different types of securities, taking into account liquidity.

When forming a portfolio, it is also necessary to take into account the purposes for which it is created. Highly profitable, and therefore high-risk, portfolios are suitable for those who want to make money. But you need to take into account that the result may be the opposite. To preserve savings, it is better to give preference to securities with low yields but good liquidity.