Task

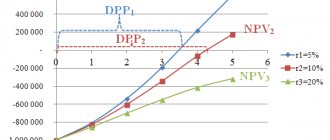

Determine the effective discount rate and the discount amount if it is known that a financial instrument worth RUR 5 million, due in five years, was sold at a discount with quarterly discounting at a nominal discount rate of 15%.

Solution

If you do not need paid help now, but may need it in the future, then in order not to lose contact, join the VK group.

We determine the discount amount using the formula:

where is the nominal discount rate

-number of discounts per year

- term in years

The effective discount rate characterizes the result of discounting for the year. It is found according to the formula:

Answer:

If you do not need paid help now, but may need it in the future, then in order not to lose contact, join the VK group.

The price is greatly influenced by the urgency of the decision (from a day to several hours). Online help with the exam/test (solution time 1.5 hours or less) is provided by appointment.

You can leave a request directly in the chat on VKontakte, WhatsApp or Telegram, having previously informed

you need for

solving

and dropping the conditions of the tasks.

Simple, complex and nominal discount rate[edit | edit code]

Simple discount rate[edit | edit code]

When accounting using simple

discount rate, the discount is charged in relation to the total amount of the obligation and represents the same amount each time. In other words,

P = S − S ∗ n ∗ d = S ( 1 − nd ) {displaystyle P=SS*n*d=S(1-nd)} ,

Where

Complex discount rate[edit | edit code]

When accounting for complex

discount rate, the payment amount P {displaystyle P} is calculated using the formula:

P = S ( 1 − d ) n {displaystyle P=S(1-d)^{n}}

(with the same notation).

Nominal discount rate[edit | edit code]

When accounting at nominal

discount rate f {displaystyle f}, which is calculated m {displaystyle m} once a year, the payment amount P {displaystyle P} after n {displaystyle n} years is calculated by the formula:

P = S ( 1 − fm ) mn {displaystyle P=S(1-{frac {f}{m}})^{mn}} .

Types of discount rates

In the economic literature, there are three main types of discount rates, which are calculated using individual formulas based on the calculation conditions.

Simple discount rate

This type of rate assumes the same amount of interest charged throughout the duration of the agreement. This means that the base for calculating interest always remains unchanged throughout the entire settlement period.

Simple discount rate formula:

P=SS*n*d=S(1-nd)

Where:

- P – payment amount;

- S – total amount of obligation (payment amount plus interest);

- n – discount rate expressed in shares;

- d – number of periods before payment.

Complex discount rate

A compound discount rate differs in that the base for calculating interest changes each time. The reason for the changes is the accrued interest over the past period. In other words, the accumulated interest on the deposit becomes part of the amount on which interest is calculated

Therefore, the amount issued by the bank when discounting a bill of exchange is calculated using the formula:

P=S(1-〖d)〗^n

Where:

- P – payment amount;

- S – total amount of obligation (payment amount plus interest);

- n – discount rate expressed in shares;

- d – number of periods before payment.

Nominal discount rate

Let the annual compound interest rate be f, and the number of compounding periods in a year m. Then each time interest is calculated at the rate f/m. The rate f is called the funeral rate.

Interest is calculated at the nominal rate according to the formula

P=S(1-〖f/m)〗^mn

Where:

- P – payment amount;

- S – total amount of obligation (payment amount plus interest);

- n – discount rate expressed in shares;

- m – number of periods in a year;

- f – nominal rate.

When deciding on the type of rate, the method of comparing rates from different countries is used. Thus, we can conclude that the decision on the discount rate in the state is made not only after an analysis of the economic situation in the country, but also on the world stage.

When making a deposit in foreign currency, the discount rate is the first thing you should pay attention to. It is this that, as an indicator, will help determine the stability of the national currency.

The rate of growth or decrease in the discount rate will indicate how committed the state is to fighting inflation (depreciation of money) in the country.

A comparison of the discount rates of several countries will help you decide between choosing a foreign currency for a deposit or a loan.

Risk-free interest rate

This is the name given to the interest rate on a financial instrument with a relatively low level of risk. For example, the coupon rate on government bonds, which are considered the most reliable securities. Or, the rate on a bank deposit can be considered risk-free, since all deposits of individuals are subject to the state insurance program**

Please note that the word “risk-free” in this case does not mean the complete absence of risk.

There is always risk in investments, and the greater their potential return, the higher the level of risk. This is why the profitability of financial instruments with a risk-free interest rate is at a minimum level (often it barely exceeds the inflation rate).

When investing even in the most reliable government bonds and bank deposits, you may encounter such risks as:

- Unfavorable interest rate change;

- Political changes;

- Risk of default;

- Other Unforeseen Liabilities.

Why was the concept of risk-free interest rate introduced? The fact is that everything in this world is relative and strongly depends on the specific starting point from which the assessment is made. So in this case, the risk-free rate serves as the starting point for calculating and assessing interest rates on other financial instruments.

The effectiveness of an investment can be assessed by the number of points by which its interest rate exceeds the risk-free level. For example, the interest rate on corporate bonds of 14% per annum looks very attractive compared to the 8% that is given on bank deposits.

The risk-free interest rate can be of two main types:

- Common noun;

- Real.

The nominal rate is understood as the interest rate on financial instruments with a maximum level of reliability and a minimum level of risk (as in the examples discussed above with government bonds and bank deposits). And the real one is the nominal risk-free rate minus the current inflation rate.

When assessing the attractiveness of an investment project, they look specifically at the real risk-free interest rate, which in this case acts as the risk premium that the investor will receive as a result of the successful implementation of the project in question.

** Up to a deposit amount not exceeding 1,400,000 rubles.

What it is

The term "discount rate" is used in several cases. This may be an additional fee charged by banks when bills are discounted or purchased by a financial institution before maturity.

Or is it the percentage at which the Central Bank lends to commercial banks. Then it is called the refinancing rate: “Center” received the finances and transferred them to “Eustace”.

This indicator is not just a number, it is a powerful tool for influencing the economy. It just seems that a small commercial bank in the outback is lending money to businesses using the public’s money.

Financial institution:

- Receives funds on loan from the Central Bank under certain conditions.

- Issues loans, and the interest rate will be higher than the discount rate (a commercial bank receives income from bank interest).

- Returns the increased amount of the CB.

The lower the number, the more attractive the loan terms for the end consumer. When the official figure rises, real inflation definitely rises.

Regulation of the discount rate

The formation of the discount rate is a strong lever of the Central Bank of the Russian Federation to control the activities of each commercial bank in the country. Changes in this indicator control the reserves of Russian banks.

There are two ways to control commercial banks:

- Reducing the discount rate. In the event that the discount rate loses its percentage, commercial banks begin to increase their reserves by reducing the cost of loans from the Central Bank of the Russian Federation, which leads to an increase in the amount of transactions with their clients.

- Increasing the discount rate. This procedure has the opposite effect. With an increase in the discount rate, it leads to a reduction in reserves and, accordingly, a reduction in amounts issued for transactions with clients of commercial banks.

By reducing banking operations for borrowing funds, the level of inflation decreases, when, as a decrease in the level of the discount rate, the level of inflation increases, which occurs due to greater access to loans from the state. However, a decrease in interest from the Central Bank of the Russian Federation brings economic stability in the country by increasing the income of the population through the acquisition of bank loans.

Thus, changes in the discount rate, both in one direction and the other, bring different economic effects, therefore any decisions regarding the discount rate are made after a thorough analysis of all economic indicators.

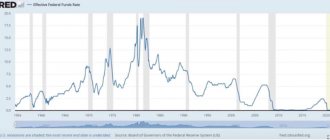

For example, in the USA in 1929-1933. (the first economic crisis in the USA), the discount rate decreased eight times, and in 1957-1958. (second economic crisis in the USA) – four times. In the post-crisis period, this same figure increased seven times, and by 1981 the discount rate had already increased seventeen times, compared to this percentage during the crisis.

In a detailed analysis of the world practice of economic regulation by countries, by regulating the interest rate, two directions of monetary policy are identified. And by choosing one of these directions, the government of the country determines its actions in relation to the state of the state’s economy.

- The first direction combines the following actions: The Central Bank promotes an increase in the number of banknotes in circulating banking operations and the number of loans issued by reducing the discount rate. However, the other side of this “coin” is an increase in prices of goods on the market, an increase in inflation of the national currency and, as a result, the depreciation of money. This direction of monetary policy is called “cheap money”.

- The second direction comes down to limiting the number of banknotes in circulation, helping to reduce the number of loans issued. As a result, there is a reduction in prices for goods and services, as well as control of inflation. In such a situation, there is an increase in the level of the national currency and the purchasing power of the country's population. However, this policy leads to an increase in the percentage of loans from commercial banks, so they become inaccessible. This direction is called “dear money”.

Due to the imperfection of this method of regulating the monetary policy of states in developed countries, they prefer not to use it. In such countries, regulation occurs through direct control of lending rates in commercial banks.

Your repost and rating of the article:

Chicken or egg?

From the fall of 2021 to April 2019, the NBU refinancing rate constantly increased. “The rate cut cycle that preceded the growth period turned out to be too rapid, so overly loose monetary policy resulted in a higher than planned inflation rate,” says Mikhail Demkiv, financial analyst at the ICU group. In his opinion, wanting to return this indicator to the target level, the National Bank had to return to a tighter monetary policy. The inflation rate in annual terms was reduced from 16.4% in September 2017 to 9.1% in July of this year.

In turn, Mikhail Vlasenko, Chairman of the Board of Idea Bank, recalls that in 2017–2018, pessimistic economic development scenarios included an increase in the dollar exchange rate to the level of 40 UAH/USD. “The regulator had to absorb excess liquidity from the market to reduce pressure on the exchange rate, and maintaining a lower discount rate could lead to the swinging of the hryvnia by currency speculators and an even greater increase in inflation in the country,” he says.

As Mikhail Demkiv notes, the real interest rate (the difference between the discount rate and inflation) in Ukraine remains one of the highest in the world. “The current level of the discount rate of 17% per annum corresponds to a real rate of about 9% per annum, which indicates a very tight monetary policy,” agrees with his colleague Alexey Blinov, chief economist at Alfa-Bank Ukraine. “He explains that, according to NBU estimates, the neutral level of the real discount rate is 3%, which would be equivalent to a nominal discount rate of about 10%.

Focus' interlocutor also draws attention to the trend of central banks lowering interest rates in order to increase the competitiveness of their economies in trade wars. For example, on August 7 of this year, three central banks reduced rates at once: India - to 5.4%, Thailand - to 1.5%, New Zealand - to 1%.

But the National Bank considers the current level of interest rates as a balanced, middle path. “A tight monetary policy could return inflation to the target of 5% back in 2021, but it would lead to additional losses for economic growth in Ukraine,” the NBU told Focus. “The current policy has made it possible, on the one hand, to significantly slow down inflation, and on the other, to prevent unreasonable losses in economic growth rates.”

Kinds

Everyone is familiar with the simple debt formula: take the amount - pay it back plus interest.

At the economic level, where numbers with 6 zeros and higher are used (for example, government contracts), the opposite situation is more common:

- the amount that needs to be paid after some time is known;

- but the amount of “help” received was not disclosed.

For “reverse” transactions a discount rate is also applied.

Simple

When a payment obligation, such as a bill of exchange, is purchased before it is due, its market value is less than that stated on the security (meaning "purchased at a discount").

If:

- discount rate – d;

- payment term, years – n;

- future payment – S;

- present value – P.

Then P = S – Snd = S (1 – nd)

It turns out that if the bill is repaid for a long time (for example, n = 5 years, d = 20%), the owner will not receive anything.

If you plan to purchase such securities, and the payment term is less than a year, convert the number of days until payment into a fraction. For example, 55 days until payment = 55/360.

Complex

If interest is not paid, but added to the amount of debt, it is called compound interest.

The current value formula with the same notation will look like this:

P = S(1 – d)n

Nominal

Inflation forces you to pay the added value several times a year (some foreign financial institutions practice daily interest accrual).

Then another formula works:

P = S (1 – f/m) mn, where m is the number of payments in 360 days, and f is the nominal discount rate.

Key rate of the Central Bank of the Russian Federation - table of changes from 2013 to 2021

Previously, another single standard was in force in Russia - the refinancing rate. Key – implemented on September 13, 2013. Received its significance in January 2021. At this moment it was equated to the refinancing rate.

| Board meeting date | The established level of the key rate | Start date of the new level |

| 07/24/2020 | 4.25 (current level) (down by 0.25%) | 07/27/2020 |

| 06/19/2020 | 4.5 (down 1.0%) | 06/22/2020 |

| 04/24/2020 | 5.5 (lowered by 0.50%) | 04/27/2020 |

| 02/07/2020 | 6.0 (down 0.25%) | 02/10/2020 |

| 12/13/2019 | 6.25 (down 0.25%) | 12/16/2019 |

| October 25, 2019 | 6.5 (down 0.50%) | October 28, 2019 |

| 09/06/2019 | 7.0 (down 0.25%) | 09.09.2019 |

| 07/26/2019 | 7.25 (down 0.25%) | 07/29/2019 |

| 06/14/2019 | 7.5 (down 0.25%) | 06/17/2019 |

| 12/14/2018 | 7.75 (increased by 0.25%) | 12/17/2018 |

| 09/14/2018 | 7.50 (increased by 0.25%) | 09/17/2018 |

| 03/23/2018 | 7.25 (down 0.25%) | 03/26/2018 |

| 02/09/2018 | 7.5 (down 0.25%) | 02/12/2018 |

| 12/15/2017 | 7.75 (down 0.50%) | 12/18/2017 |

| October 27, 2017 | 8.25 (down 0.25%) | 10/30/2017 |

| 09/15/2017 | 8.5 (down 0.50%) | 09/18/2017 |

| 06/16/2017 | 9.0 (down 0.25%) | 06/19/2017 |

| 04/28/2017 | 9.25 (down 0.50%) | 05/02/2017 |

| 03/24/2017 | 9.75 (down 0.25%) | 03/27/2017 |

| 09/16/2016 | 10.0 (down 0.50%) | 09/19/2016 |

| 06/10/2016 | 10.5 (down 0.50%) | 06/14/2016 |

| 07/31/2015 | 11.00 (decreased by 0.50%) | 08/03/2015 |

| 06/15/2015 | 11.50 (down 1.0%) | 06/16/2015 |

| 04/30/2015 | 12.5 (down 1.5%) | 05/05/2015 |

| 03/13/2015 | 14.0 (down 1.0%) | 03/16/2015 |

| 01/30/2015 | 15.0 (down 2.0%) | 02/02/2015 |

| 12/16/2014 | 17.0 (increased by 6.5%) | 12/16/2014 |

| 12/11/2014 | 10.5 (increased by 1.0%) | 12/12/2014 |

| 05.11.2014 | 9.5 (increased by 1.5%) | 05.11.2014 |

| 07/25/2014 | 8.0 (increased by 0.50%) | 07/28/2014 |

| 04/25/2014 | 7.5 (increased by 0.50%) | 04/28/2014 |

| 03/03/2014 | 7.0 (increased by 1.5%) | 03/03/2014 |

| 09/13/2013 | 5,5 | 09/13/2013 |

How is the refinancing rate set?

The size of the discount rate is set by the Council of the Central Bank, depending on various factors, such as: expectations regarding the level of inflation, acceleration or deceleration of GDP growth, trends in general economic development, macroeconomic and budgetary processes, the state of the monetary market, price stability, etc. This instrument is one of the levers for managing the financial and economic situation in the country; therefore, the rate cannot be raised or lowered without a reason: there must be compelling macroeconomic arguments for changes. By changing the discount rate, the Central Bank implements a discount foreign exchange policy to regulate capital flows and balance payment obligations. The discount rate is public information that must be made public through the media every time the rate changes. For example, as of 2014, the Board of Directors of the Bank of Russia announced the current refinancing rate equal to 8.25%.

How the decision to change is made

Changing the key rate is the main instrument of the Central Bank’s monetary policy. Monetary policy is also called monetary policy. With its help, the Central Bank creates conditions for economic development.

Monetary policy itself does not develop or slow down the country's economy , but it does affect demand. If demand increases, labor productivity increases and technology develops. If demand decreases, labor productivity decreases and there is not enough money for technology. Monetary policy can be expansionary, contractionary or neutral.

Expansionary monetary policy is used if the economy slows and inflation is below target. During the stimulus policy, the Central Bank lowers the key rate so that inflation rises and the economy revives.

Contractionary monetary policy is applied if the economy is “overheated” and inflation is above the target level . In this case, the Central Bank raises the key rate to reduce inflation.

With a neutral policy, the key rate is kept for a long time at the level that the Central Bank considers most suitable for the economy. The rate itself does not change so that the economy remains in equilibrium.

The Central Bank makes decisions on changing the key rate based on the macroeconomic forecast and takes into account many factors: changes in taxes and the economy, the situation on world markets, statistical data. The change in the key rate affects the economy gradually over several quarters.

The Central Bank publishes monetary policy reports on its website to explain why it is changing the key rate and what further actions it will take.

Its meetings are scheduled for all 12 months. That is, the schedule for 2021 has been developed in advance. You could see it above.

It is important to note that meetings of the Board of Directors do not always take place according to schedule. They may be unplanned.

In particular, such an exceptional case was recorded in 2014. When the key rate was urgently raised by 6.5 percentage points.

After this, a gradual decline has been observed since 2015. The regulator reduced it without sudden jerks. Mostly by 0.25-0.5%. Although with a slight fluctuation at the end of 2021, the downward trend in rates continued into 2021.

Regulation of the discount rate

By correctly adjusting the parameter (refinancing), you can:

- Change the value of the money supply, influencing inflation.

- Attract investors. There is a connection between the discount rate and securities quotes.

- Increase or decrease the demand for loans from commercial banks.

Who sets the discount rate?

The official indicator is a tool exclusively for banks. If we are talking about securities, then the amount of compensation is set by the drawer.

Discount rates of developed countries of the world

The Bank of England declares a discount rate of 0.75% (08/2/2018), in Canada - 1.75% (10/24/2018), the European Central Bank - 0% (03/10/2016).

And in Japan and Switzerland communism almost arrived:

- in the Land of the Rising Sun -0.1%;

- Switzerland states -0.75%.

In Russia, the discount rate for refinancing is gradually decreasing:

- January 24, 2000 - 45%;

- January 1, 2021 – 11.00%;

- July 29, 2021 – 7.25%;

- September 9, 2021 – 7.00%.

The goal of the Central Bank of the Russian Federation: to ensure price stability at a constant inflation rate of 4%.

Dynamics of the key rate of the Central Bank of the Russian Federation for 2013 – 2021 and beyond...

The key rate was declared as the main instrument of monetary policy from September 13, 2013. From this date until the end of 2013, it was 5.50% per annum, inflation at the end of 2013 was 6.45%. In 2014, the key rate changed 6 times, all in the direction of growth. Russia ended 2014 with the Central Bank key rate of 17.00%. A sharp increase in the key rate to 17.00% per annum occurred on December 16, 2014. The Board of Directors of the Bank of Russia noted that this decision was due to the need to limit devaluation and inflation risks that have significantly increased recently. Inflation at the end of 2014 was 11.36%. 2015, which began with a rate of 17% per annum, continued with its gradual decrease. During 2015, there were 5 changes in the key rate, and there were 6 rates during the year. The year ended with the key rate at 11.00%. Inflation at the end of 2015 was 12.90%. During January - June 2021, the Bank of Russia periodically decided to maintain the key rate in force since 2015 at 11.0% per annum, from June 14 - reduced it to 10.50%, and from 09/19/2016 reduced it to -10. 00%. At the end of 2021, the key rate was kept at 10.00%. Inflation at the end of 2021 was 5.4%. Since the beginning of 2017, the key rate by the Bank of Russia has been maintained at 10.00%, and from the second quarter it began to be systematically lowered. During 2021, the key rate changed 6 times and decreased from 10.00% to 7.75% by the end of the year. Inflation in Russia for 2021 amounted to 2.5%. At the beginning of 2018, the key rate of the Bank of Russia was 7.75% per annum, from 02/12/2018 it was reduced to 7.50%., from March 26, 2021 it was reduced to 7.25% per annum, and from 09/17/2018 it was increased to 7 ,50%. From December 17, 2018, the rate was again increased to 7.75% and returned to the rate in force at the beginning of the year. The key rate of 7.75% will be valid until March 22, 2021. From the beginning of 2021, the Bank of Russia rate was 7.75% per annum, from June 17, 2021 - 7.50%, from July 29, 2021 - 7.25%, from 09/09/2019 - 7.00%, from 10/28/2019 year - 6.50%, and from December 16, 2019 - 6.25% and which will still be valid until February 7, 2021. The dynamics of the Bank of Russia key rate in 2019 are impressive, since during the year it was changed for the sixth time. The overall decrease for the year was 1.50 percentage points. Since the beginning of 2020, the key rate of the Bank of Russia was 6.25% per annum, and from 02/10/2020 it is 6.00%, from 04/27/2020. – 5.50%, from 06/22/2020 – 4.50%, and from 07/27/2020 – 4.25%. This is the fifth and final rate change in a year. From the beginning of 2021, the key rate is 4.25%.