olegas Jan 21, 2021 / 118 Views

When a rush of demand for a particular asset arises in the market, leading to the fact that its price begins to rise rapidly, many times exceeding its true value, they say that an economic bubble is formed. Although, more precisely, people usually start talking about a bubble after it collapses. Then, when for everyone it became an obvious fait accompli. It is much more difficult to recognize a bubble at the stage of its formation (it can easily be confused with a strong bullish trend, for example).

An economic bubble is also called a market, speculative or financial bubble. The name, as they say, does not change the essence of the matter, and in any case, the bubble is a negative factor both for the people who invested their money in it and for the economy as a whole. The collapse of a bubble is a sharp collapse of hitherto soaring prices, and this collapse can be of an avalanche nature, that is, dragging along entire sectors of the economy.

What is a financial bubble

Remember what the Gold Standard is? This monetary system existed before the First World War. Its essence was that all money should be backed by gold and foreign exchange reserves. In other words, the currency was worth exactly as much as the money that was used to make it. With the advent of fiat money, the value of the national currency began to be determined by political and economic factors, both internal and external. This is discussed in detail in the article “Fiat Money”. The denomination of a banknote is many times higher than its cost, and this is normal - the main thing is that there is a sufficient amount of money supply on the market. A shortage of money leads to its rise in price, and an excess leads to depreciation.

Imagine an ancient coin found by archaeologists that was issued several centuries ago. In those days, you could only buy a loaf of bread or a bag of potatoes with it, and what its current value would be remains to be determined by experts. In any case, the value of such a coin is important only to a narrow circle of collectors who collect such things. Since it will be possible to resell the relic for a lot of money to a limited number of people, rush demand for it is unlikely to arise.

But there are many things that are valuable to most. First of all, these are housing, securities, currencies, consumer goods - that is, assets that are easy to sell. What generates increased demand for them depends on the specific situation. At some point, people begin to rapidly buy up a product, demand for it significantly exceeds supply, and the price skyrockets.

A financial bubble is a cyclical economic phenomenon when interested parties fuel interest in an asset. The goals and means for this can be very different. As a result, the price rises rapidly, but at some point a glut occurs, buyers begin to get rid of the product, realizing that its cost is greatly inflated and this investment is unlikely to pay off. Then there is a reverse reaction: supply exceeds demand and its value drops sharply. And those who invested a lot of money in the hope that the asset would continue to rise in price suffer losses.

Such phenomena have existed since the Middle Ages. Let's turn to history.

Definition of the concept

A financial bubble is also called a market, price, financial or speculative bubble. This phenomenon involves trading large volumes of goods or securities at a price that differs from the fair market price. As a rule, this situation arises when there is a rush of demand for a product, accompanied by an increase in market value, or due to unreliable statistical data.

Over time, the price is adjusted to a fair level, which is accompanied by investor panic. Sales intensify, causing the price to drop even further. Thus, the financial bubble collapses. This brings serious losses to both the owners of the goods and related parties. In some cases, the problem extends to an entire industry or financial system.

A financial bubble is an extremely harmful phenomenon for the economy. The collapse of prices leads to misallocation of resources, destruction of a significant amount of capital and economic recession.

History of the development of financial bubbles

In 1619-1623 A campaign was launched in Holy Rome to increase the money supply. This was necessary to finance the struggle for the dominance of the Roman Empire in Europe. The Thirty Years' War required a lot of money for weapons and armor. For this purpose, coins were minted everywhere, adding copper to their composition. As a result, there was an excess of money and it rapidly depreciated. Then the cheap coins were sold to other countries in exchange for high-grade coins. Such exchange existed among a variety of segments of the population. Its consequence was galloping inflation.

In 1711, the Earl of Oxford Robert Harley founded the South Sea Company in England. Its creation was dictated by a noble goal: to reduce the national debt of England accumulated during the war with Spain. Thus, the country's debt obligations were converted into shares of the Robert Harley company, and the government granted this company the right to a monopoly in trade with South American countries. As a result, the value of shares grew rapidly, but trading did not turn out to be profitable, because The Spanish fleet controlled most of the ports in South America.

What happened next? At some point, it became clear that the fabulous value of the securities was not supported by anything and their quotes collapsed. The South Sea Company declared itself bankrupt at the end of 1728.

Next, economic bubbles affected real estate. An example of this is the increased demand for land and houses in Florida that arose in the 20s of the 20th century. The bubble burst in 1926, when prices reached such a level that only the very wealthy could afford housing in Florida.

And, of course, everyone remembers the mortgage crisis of 2007-2008. in the USA, when banks began to lend even to insolvent citizens at low interest rates. As a result, the number of defaulters increased, and debt obligations were resold. The large bank Lehman Brothers declared bankruptcy, which provoked a real panic in the banking industry and in the mortgage market. Since the dollar is a global currency, the American crisis spread to other countries and affected almost the entire world.

And finally, the Bitcoin bubble, which formed from 2021 to 2017, when the value of this cryptocurrency began to grow rapidly, and in 2021 collapsed 5 times.

The reasons for the excitement are varied. Let's look at the main ones.

A bubble called "Overhaul"

Even the common man, who is far from the concept of financial pyramids, tickets, crises and bubbles, is directly affected by these problems. For example, major repairs.

In 2012, a law was passed in the Russian Federation, according to which residents of high-rise buildings are required to independently pay for future major repairs. The regulatory act came into force in 2014. From now on, residents pay monthly starting from 6.16 rubles. per sq. m, depending on the region. Transfers are made to the regional capital repair fund or to an individual house account.

Russians were skeptical about this initiative, as they are confident that major repairs are the responsibility of the state. In addition, this is a blow to the family budget. But economists see in this initiative signs of a financial pyramid or bubble. Firstly, citizens are required to continue paying contributions even after the completion of major repairs. Secondly, they cannot influence the timing and scope of repairs predetermined by officials. Thirdly, in case of insufficient funds, residents will be forced to make additional contributions. And given the fact that many refuse both the payments themselves and their indexation, this program will only be beneficial for those whose houses are scheduled for renovation in the near future. When will the financial overhaul bubble burst? When payers will be left with nothing.

In response to the complaint of the initiative group of deputies to the Prosecutor General's Office and the Constitutional Court, a response was received about the illegality of collecting payments for major repairs. Since payers cannot manage their own financial resources, this initiative is unconstitutional.

Causes of bubbles in financial markets according to Shiller

American economist Robert James Shiller identified the following reasons for the emergence of financial bubbles in the world economy:

- Increase in money supply.

- Available loans.

- Development of information technologies.

- The influx of investors arising as a result of certain political and cultural processes, access to foreign markets.

- Changing demographic situation. In general, older people consume less than younger people.

- General improvement in the well-being of the population.

Robinhood is giving money to the rich

But what Portnoy didn't know was that Robinhood makes money not from fees, but from sending order flows to mega-hedge funds like Citadel. This allowed Citadel to outpace Retail Bros with its high-speed trading technology. However, they also had close relationships with large hedge funds that lost billions by shorting GameStop.

Then on Thursday, January 28, Robinhood suddenly announced that customers could no longer buy GameStop. Other brokers followed suit. Retail Bros lost most of its profits when GameStop shares collapsed. The tailor declared war. He tweeted that Robinhood is a "fraud" and "should be behind bars." Portnoy may be well versed in sports, but his knowledge of how Wall Street works behind the scenes seems negligible.

Large banks, brokers and hedge funds know how to protect their interests. I saw this firsthand when I negotiated the buyout of Long-Term Capital Management (LTCM) in 1998.

In 1998, Wall Street didn't save the hedge fund, they saved themselves because they were on the other side of LTCM's trades. Something similar happened in 1980 when the COMEX changed the rules mid-day to stop the Hunt Brothers' efforts to corner the silver market.

Essentially, hedge funds, clearing houses, and Robinhood teamed up to crush the mob of retail traders who were bidding up stocks that hedge funds were shorting.

Robinhood was bailed out by loans from JPMorgan and Goldman Sachs, while mega-hedge fund Citadel pulled strings behind the scenes to force Robinhood to suspend trading.

For now, it appears the GameStop battle has ended in a draw. Hedge funds lost $5 billion, but Retail Bros also suffered billions of dollars in losses when GameStop collapsed.

Legal consequences were not long in coming. A class action lawsuit has been filed against Robinhood on behalf of all day traders who were disadvantaged by the partial shutdown of retail trading. The platform could be liable for billions of dollars in damages in a class-action lawsuit. Additionally, Robinhood may have missed out on a chance at a billion-dollar IPO in the near future.

But investors in other markets can learn an important lesson from this situation:

When you rely on exchanges and paper contracts to make a profit, remember that the rules of the game can suddenly change and you will lose all your positions and future income. Be careful.

Faber's picture of an economic bubble

Marc Faber, an investor and financial analyst from Switzerland, pays great attention to the topic of the emergence and formation of financial bubbles. This is what the picture of an economic bubble looks like in his understanding:

- information to the population about methods of profitable investment, which is of an advertising nature, gives rise to speculation;

- banks issue loans at low interest rates. The volume of loans increases sharply;

- The construction of housing and infrastructure facilities is rapidly developing;

- The media promises a “bright future.” Something like this: stocks will only rise in price, people will only get richer. And people tend to be optimistic, and as a result, even those who were far from it begin to become interested in trading on the stock exchange;

- a large number of transactions are financed using credit funds;

- before the financial bubble bursts, all of the above provides an opportunity to make good money for a limited number of people;

- At a certain point, consumer oversaturation occurs. Some of them, the most cautious ones, are beginning to slowly get rid of assets. And since such transactions are usually carried out on a large scale, the phenomenon quickly becomes widespread. Stocks, currencies or real estate fall sharply in price.

In Japan in the late 1980s, a huge percentage of the money supply was concentrated in citizens' savings accounts. As a result, real estate prices began to rise. In addition, the country's economy attracted investors, and stock index prices increased significantly. Society began to consume more, because... people felt financially free.

#4 Railway Mania (1840s)

The British railway bubble of the 1840s was a classic case of speculative frenzy and excess.

When the railroad was first invented, it was truly a revolutionary and life-changing thing, so much so that it created huge amounts of capital and allowed the Industrial Revolution to happen.

However, the success of the railway companies led to the creation of thousands of kilometers of unnecessary track in a clear sign of excessive optimism. Railroad stocks continued to rise higher and higher until prices fell and many of the same companies went out of business (bankruptcy).

How bubbles arise in financial markets

There is such a thing as the fundamental price of an asset. What does this mean? For example, you own a block of shares that you purchased by paying 75,000 rubles. ($1,000 or 29,000 UAH). By analyzing the price chart over recent years, you can get an idea of what the stock will be worth in a year. Let’s say the average price increase was 15% per year. Accordingly, if you decide to sell them in a year, you will receive 86,250 rubles. ($1,150 or 33,350 UAH). Plus dividends, which average 10% per annum. In total, the fundamental value of your package of securities in a year will be 93,750 rubles. ($1,250 or 36,250 UAH).

Of course, this is very conditional - a variety of factors can affect quotes. But we will not now take periods of recession and other unfavorable circumstances. You purchased this stake because you are confident that the shares will rise in price.

And in reality, this is what happens - shares rise in price, but not by the expected 15% per year, and not by 20, but, say, by 100%. Why is this happening? Well, okay, let’s say that at the end of the year the company showed very good results, and the amount of dividends exceeded the expectations of shareholders. Accordingly, the shares increased in price. But didn’t the profit double? And if so, then why do people buy securities at such an inflated price when just a few months ago the shares were much cheaper? And people buy, sometimes even borrow from friends or use the leverage of a broker. Why are they doing that?

Types of phenomenon

Economists divide modern financial bubbles into several types. Namely:

- Speculative (traditional). An investor purchases a product because he expects the price to rise for a more profitable resale. Moreover, his forecasts are based not on objective analytical indicators, but on a one-time initial jump in value.

- Rational. These are bubbles that can be measured in specific value terms. That is, we are talking about the difference between the actual market value of an asset and its fair price, which is based on objective fundamental indicators.

- Commission. These financial bubbles, pyramid schemes and crises are caused by discrepancies in the information held by clients and portfolio managers. Thus, the latter have the opportunity to conduct a large number of transactions to increase their commission.

The impact of economic bubbles on the economy

On the one hand, when the financial bubble in the field of investment inflates, the amount of cash flows also increases. But this usually does not last long. Only those who invested at the initial stage will benefit. The vast majority of buyers invested money during the growth stage of the bubble. That is, they were already paying an inflated price, therefore, when the bubble bursts, these people will lose their money.

Accordingly, the economy will lose part of its cash flows: if people do not have money, they cannot invest in other products. What about investments? Purchasing power will also decrease.

The negative consequences of the collapse of the bubble may spread to the economies of other countries in the world. The volume of exports will decrease due to a fall in demand for goods abroad and imports due to a lack of money in the domestic market.

#3 Mississippi Bubble (1715)

Despite the name, the Mississippi Bubble actually originated in France and occurred around the same time as the South Sea Bubble.

In financial ruins from the previous civil war, France sought help from Scottish economist John Law, who proposed the creation of a national bank with paper assets, backed by deposits of gold and silver.

This led to an inflationary boom that appeared to be smoothing over the cracks of the country's previous problems. However, the inflation bubble burst and the national bank's paper money fell in value. This meant that France entered a period of economic crisis even worse than before the bubble.

Ways to recognize economic bubbles

Experts believe that recognizing an economic bubble is quite difficult. But not impossible. The main sign should be considered a rapid rise in prices, which is not supported by anything. At the same time, it is also important to pay attention to the increase in loans: people are buying assets with borrowed funds. Here are two factors that strongly indicate that we are dealing with an economic bubble.

The main problem with spotting bubbles is that it is not easy to calculate the fundamental value of an instrument. It is impossible to know for sure how much this asset will be worth in a year and what income can be received from it. Calculations based only on forecasts cannot be considered 100% reliable. But they cannot be discarded either.

Here are the main signs of an economic bubble:

- A sharp increase in the value of an asset.

- Large gap between fundamental value and market price.

- Easing credit policy combined with an increase in marginal debt (the share of borrowed funds involved in the acquisition of an asset increases).

How to sell $20 for $200?

Economists have long puzzled over the causes of bubbles. Whatever harmonious hypotheses they put forward, the heartless reality breaks them down one by one. Practice shows that bubbles can occur even when market participants CORRECTLY evaluate assets and, moreover, even when speculation in itself is impossible.

Every year, Professor Max Bazerman of Harvard Business School sells a twenty-dollar bill to MBA students at a price well above the face value. His record is selling $20 for $204. And this is how he does it.

He shows the class the bill and tells the rules: he will hold an auction and give it to the person who bids the most money. But at the same time, the person who was immediately behind the winner will also give the professor the amount he offered to pay.

For example, one student offers $17 per bill, and another offers $18. The second person gets the bill, but they BOTH give their bets to the professor. These are the conditions.

Typically, bidding starts at one dollar and by the time the bids reach $12-16, most participants stop competing. When the bidding approaches $20, it becomes obvious that winning is impossible, but no one wants to lose, because he will have to pay the professor the entire amount of his bet.

The situation quickly becomes ridiculous: MBA students compete to see who can spend the most on a twenty-dollar bill. But the laughter of the audience does not stop anyone. The auction goes up to 50, then 100 dollars. The professor's record for his teaching career is $204 for one twenty-dollar bill. He gives this money to charity.

Why do people always pay more money for twenty dollars? It's all about psychology. They are driven to do this by the fear of irreversible losses. We have a separate article about this.

What are sunk costs and how do they affect our wallet?

But the stock market is not a class with a professor, clear rules and one bill. Everything is more complicated here, there are a lot of bidders and new ones appear all the time.

How a financial bubble bursts

The collapse of a bubble usually happens quickly, which is why many investors suffer losses - they simply do not have time to get rid of the overvalued asset. Initially, the tool is sold by the most far-sighted (they are the ones who end up in the black). Then the number of investors wanting to sell assets increases: many hope to get at least something before they become completely worthless. And then panic arises. There are many examples of this. Remember the same 2008, when the S&P 500 index fell by 17% after Lehman Brothers declared bankruptcy, which pulled several mortgage companies with it.

Often the collapse of a bubble is followed by an economic crisis that spreads to other countries.

Dow Jones bubble

Many financial analysts claim the constant growth of long-term financial markets, paying insufficient attention to the inflation factor. Studying the performance of the Dow Jones index leads to quite interesting conclusions. So, from 1900 to 1982 it is zero. That is, in almost a hundred years the US stock market has not budged. Over the 130-year history of its existence, the index has been repeatedly subjected to recombinations and rotations, but during long-term analysis it remained unchanged.

In the last century, the US stock market witnessed two Dow Jones financial bubbles. The first was inflated from 1924 to 1929. During this time, the index soared 4 times, after which a sharp decline in the market began, which stopped only by 1932, which was accompanied by a decline in the index by 85%. The recovery period continued until 1937, when the index again quadrupled (but fell short of its previous high). For the next 16 years, the market was in a state of stagnation, from which it began to emerge only in 1953.

The second bubble dates back to 1994. Until 2000, the market almost tripled, after which it collapsed by 40%. From 2003 to 2007 there was a recovery, which, however, could not be consolidated due to the onset of a new crisis in 2008.

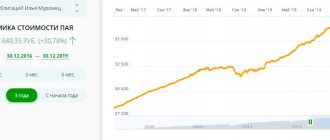

Is it worth investing in financial bubbles?

Predictions about the lifespan of a bubble are just that, predictions that are based on nothing: neither statistics nor historical facts.

If you notice the signs of a financial bubble described above, investing is certainly an option. But be careful.

First of all, you should look at the chart: how long ago the price increase occurred. Secondly, answer the question: how much am I willing to lose and what will I do if the bubble bursts.

In simple words, when investing in a financial bubble, you cannot spend all your funds. Portfolio diversification and rebalancing are tools that will help mitigate the unpleasant consequences of the collapse of the bubble.

And a couple more points that are worth paying attention to. As trivial as it may seem, try to control your emotions, do not succumb to euphoria and panic, and, if possible, do not use borrowed funds.

The Greater Fool Theory

There is also a theory (this is its very official name) that explains the growth of the bubble by the presence of buyers for overvalued securities. She assumes that buyers enter the bubble consciously, hoping to buy paper and then sell it at a higher price to an even more optimistic and naive fool than them. As long as there are such people, the bubble grows. And it bursts when the last remaining fool can no longer find anyone who would buy the paper at an even higher price.

This behavior well describes the MMM pyramid, especially its second wave: all investors knew perfectly well that they were bringing money into the financial pyramid, and yet they carried it in the hope of being able to take it back before the pyramid collapsed.

Examples of economic bubbles in history

In addition to the crisis of 2007-2008, several more examples of economic bubbles that arose at different times should be given.

Tulip mania in Holland

At the end of the 16th century, tulips were brought to Europe. This happened around 1560, when the Austrian ambassador to Turkey brought several bulbs to Austria, which were planted in the emperor's garden. In 1593, the botanist who looked after the imperial garden got a job at the botanical garden of the university in the Dutch city of Leiden and brought with him bulbs of strange flowers. The first flower bloomed in the spring of 1594.

At the beginning of the 17th century, Dutch gardeners mastered the selection of tulips and began trading in bulbs. It should be noted that the Netherlands had already entered the Golden Age: the country was growing richer and there were people who could afford flowers that were exotic at that time. Tulips took root well in the European climate, new varieties appeared that cost several times more than the already known ones. Trade brought good income. The cost of one bulb of some varieties, for example, Semper Augustus (“Eternal August”), was several times higher than the annual income of the artisan.

By 1630, the tulip trade had gained momentum, and the real boom came in 1633, when tulip bulbs began to be exchanged for real estate.

But flower trade is not possible all year round, since bulbs are planted in late autumn and tulips bloom in spring. Thus, it was possible to buy bulbs only from the beginning of summer to October. In order not to suffer losses, traders began to sell the bulbs in the ground with the obligation to transfer them to the buyer after flowering. This is how the first futures contracts in history appeared.

#6 Black Monday (1987)

Black Monday is the name given to the stock market crash on Monday, October 19, 1987, which remains the largest one-day crash in history. The Dow lost 22.6% of its value on the day, which came after a number of strong years of stock market gains in the 1980s.

The exact reasons for this plunge have never been fully understood, but it was most likely due to a combination of various factors, including software sales, illiquidity, overvaluation, and market psychology.

Examples of financial bubbles today

As examples of modern economic bubbles, the first thing that comes to mind is Bitcoin, the cost of which has reached 1,500,000 rubles. ($20,000 or UAH 580,000) in 2021. This happened only based on the expectations of investors. In 2021 there was a decline, and in November Bitcoin fell to 300,000 rubles. ($4,000 or 116,000 UAH). This was facilitated by several factors: a drop in interest in cryptocurrency, checks on Chinese bitcoin exchanges, as well as statements from world-famous investors. Thus, Warren Buffett said that Bitcoin does not meet his investment criteria and is a bubble similar to the dot-com bubble. “Bitcoin produces nothing and has no material value,” Buffett said.

Bill Gates, in turn, expressed the opinion that cryptocurrencies are dangerous because they are characterized by complete anonymity, and the state should monitor cash flows in order to combat terrorism and drug trafficking.— Bill Gates

Another example is US Treasury bonds. The US national debt is inflated to enormous proportions, and yet debt obligations continue to be in demand. The yield on these securities is low - about 2% per year. Thus, the US spends little money on servicing the national debt. But if credit policy changes and payments increase to a trillion dollars a year, this threatens a global world crisis.

“What a scam!”: the whole truth about economic bubbles

A financial bubble is a market obscurity created by government, financiers and industry, a general hallucination followed by collapse and depression. Once upon a time, bubbles occurred rarely—about once every hundred years—but this was enough for politicians to take measures to prevent this from happening in the future. Now we don’t even give ourselves the trouble to catch our breath before falling into a new attack of madness. The collapse of the Internet market in the early 2000s should have left us in deep thought for decades. Before the old bubble had properly burst, however, a new mania began, fueled by the belief that increased homeownership would lead to social harmony and economic prosperity. Encouraged by the Federal Reserve, financed by exotic derivatives and debt securitization, the real estate sales system has expanded to include even the poor and defenseless, adding to their woes.

Just ten years spanned the creation of two bubbles, each of which created trillions of dollars of imaginary wealth, and this is just the beginning. There are many bubbles awaiting us, without them the economy can no longer exist. The bubble cycle has replaced the economic cycle.

Such changes do not happen overnight. After World War I, Wall Street financed companies trying to adapt wartime inventions such as refrigerators and radios for civilian use. Consumers were eager to buy it all, but they didn't have the funds, so banks gave them more affordable loans. After the recession of 1921, the government took special measures to keep lending rates within inflation limits. A “new era” of prosperity had already arrived, but then October 20, 1929 happened.

The Great Depression and World War II were harsh lessons for government, scientists, the press, and corporate America. That American generation learned to distrust false hopes and bad loans. But John Maynard Keynes led a new school of economists who promised growth until the end of time. Keynes taught that when the economic cycle begins to move downward, it is necessary to increase government spending, reduce taxes and lower short-term lending rates. Demand stimulated by government spending and cheap money will prevent a recession. This set of economic measures was called reflation.

The first attempt at reflation according to Keynes failed. Banks continued to fail, fewer loans were given, GDP declined; the economy refused to respond to the measures taken. Healing came from World War II, which provided a massive increase in demand financed by debt. The war succeeded in doing what Keynes' poorly implemented ideas failed to do.

At the end of the war, the Allies gathered at Bretton Woods, New Hampshire, to determine the future of the international monetary system. The United States, which by that time had become the main economic and political force, convinced the allies to peg the currencies of the participating countries to the dollar, providing the dollar itself with American gold reserves.

By 1971, the United States faced its first trade deficit—$3.8 billion (adjusted for inflation). Participants in the Bretton Woods agreements, especially French President Charles de Gaulle, were worried that the United States would pay debts with a depreciated dollar. De Gaulle demanded payments in gold. The recently elected US President Richard Nixon assessed gold reserves and made an unconventional decision: to unilaterally abandon obligations on the gold backing of the dollar, that is, he declared a default.

Financial markets were in turmoil for another decade, when the dollar remained an international currency but had no fixed value. Inflation has increased not only in the United States, but throughout the world. The Federal Reserve pushed interest rates into double digits, causing two global recessions, and eventually floating exchange rates emerged to replace the gold standard. Since 1975, the US trade balance has never been positive. High-value productive industries such as steel and automobiles fell by the wayside. The new economy belonged to Finance, Insurance and Real Estate - FSN.

The FSN is a credit-financed inflation machine. The principle of its operation is that the price of assets, which previously fluctuated along with the industrial cycle and financial markets, now moves only upward, and any decrease is short-term. Guided by the FSN and freed from the yoke of the gold standard, the United States could now finance its deficits with its own dollars. External debt grew significantly as US partners, especially the oil countries and Japan, balanced their trade surpluses by purchasing US securities. Financing one's own deficit with foreign funds has become an irreversible process: if one of America's largest creditors sold part of the debt obligations, the dollar exchange rate, and with it the price of what remained with the creditor, would fall. Moreover, without selling enough securities, the US would be unable to finance its imports. The old rule is that if you owe a bank $3 billion, it owns you; if you owe a bank $10 trillion, the bank belongs to you.

The FSN sector gained strength as the old industrial economy declined. The bubble of the 1920s is believed to have arisen due to conflicts of interest between banks and stockbrokers, but in the 1990s, at the initiative of Alan Greenspan, the banking and brokerage markets were deregulated. In 1999, the Glass-Steagall banking act was repealed, and federal lending policy did the rest. With the rise of the FSN, a new generation of politicians, bankers and journalists emerged to justify both the system itself and the projects it financed, from the mortgage bubble to the Iraq War.

Bubbles often start with a promising discovery. The Mosaic browser, released in 1993, began to transform the Internet into a system of interconnected pages. Creating and using new websites has become surprisingly easy. Lobbyists immediately appeared calling for deregulating the market and introducing tax breaks. By 1995, it was possible to make money from the Internet; four years later, a moratorium on sales taxes appeared, opening up vast opportunities for e-commerce. Changes in legislation do not cause a bubble, but no bubble is possible without them.

I had a front-row seat to how the internet mania unfolded: I was managing director of a venture capital fund at the time and sat on the boards of several technology companies. I saw how seemingly reasonable men and women fell into the rapids of a rapid and, as it seemed then, safe flow of money. Logic and the lessons of history were forgotten.

Once deregulation has built a church, venture capital investment is required to attract a congregation. Each bubble has its own financing mechanism, but the system must be able to accumulate an astronomical influx of funds and create securities worth trillions of dollars. At first, Internet start-ups were only a small part of the industries where venture capitalists brought money. But then several start-ups, like Netscape, went public, bringing significant profits. The vicious circle was closed: profits from attracted investments flowed into new venture funds, from them into new start-ups that attracted new investments, many times greater than the original ones, and then again into venture funds.

Newspapers wrote with admiration about twenty-year-old prodigies who earned their first hundred million dollars, magazines bulged with advertising. Few people were interested in the weak links of the new theology. Congressmen with influence over regulatory agencies have never had anything against a hurricane of tax money.

My job was, in part, to maximize profits and protect the company from sudden losses when the bubble finally burst. In March 2000, we received our first warning signal. One of our companies went public in April 2000. One investment bank we consulted advised us—contrary to everything the bankers had told us for the previous five years—not to go public in April. For us, this was a clear sign that the market had reached its peak. Over the next few months, we divested ourselves of our stakes in other companies. Soon after, millions of investors who realized unrealized gains sold their shares to pay income taxes. The panic began. The bubble burst.

The fictitious value of a bubble disappears the moment market players become disillusioned with their religion—their false beliefs crumble as quickly as they were once formed. Although the direct participants in the events represented only a small part of the companies, the market collapse affected the economy as a whole and even caused a short recession in early 2001. This leaves us with an important question: how to make up for the loss of the $7 trillion in fictitious value created by the bubble.

The Internet boom was generated by intangible electrons - the price of shares rose along with the walls of castles in the air. The last boom, the mortgage boom, happened in castles on the ground, among nails, boards and granite blocks. But the reasons were the same: too much mortgage money and too little housing. At its peak, the bubble acquired $12 trillion in fictitious value.

We, of course, should have seen this coming. Historically, home prices in America have risen at the rate of inflation. About 3.3% per year from the 19th century to the present, excluding the post-World War II housing boom. Why then have housing prices risen so much? Changes in bank reserve requirements and the creation of checking interest accounts in 1994 allowed banks to make more loans. In anticipation of the dot-com crash, the Fed rate was lowered from 6% to 1.24%. As a result, mortgage rates in the United States fell sharply, and the monthly payments on a $500,000 home were reduced to the same as the monthly payments on a $250,000 home purchased two years earlier. Demand grew instantly; builders needed years to meet it. As loans became more affordable than homes, home prices predictably rose. All that was needed for a new bubble was an influx of capital. And it flowed from securitized debt.

To securitize is to issue new securities based on several existing ones in order to create something more predictable and less risky than the sum of its parts. The abundance of such mortgage-backed securities allowed banks to become de facto intermediaries - even if one of the debtors went bankrupt, but the rest continued to pay, the bank trading the securitized debt would not suffer, or would suffer less than if it directly issued the loans . In theory, risks previously borne solely by the bank would be distributed across the financial markets to sophisticated institutional investors.

Think back to the chemical industry in the 1960s, when pollutants like PCBs were released into the water and air completely freely. The main principle was that “the best way to fight pollution is through dilution.” It was assumed that by mixing the toxins with a huge amount of water, they could be neutralized. Decades later, as we look at mutant frogs, poisoned groundwater, and mysterious cases of cancer, we see how flawed that logic was. But bankers apply the same logic. The more questionable loans were issued, the higher the level of risk became throughout the global financial system.

Think of risk as economic poison. In theory, the toxins of risk were dissolved in the endless ocean of the world's credit markets. Thanks to the magic of securitization, they were neutralized. In reality, credit pollutants are as harmful to our economy as chemical toxins are to the environment. Like toxins, they gather in the most vulnerable parts of the financial system, where their harmful effects are most evident.

Open any business publication and you will see a huge bubbling swamp. Merrill Lynch lost $7.9 billion on its mortgage investments and posted quarterly losses for the first time since 2001, while Morgan Stanley, Bear Stearns, Citigroup and many other US banks suffered heavy losses. The Royal Bank of Scotland was forced to write down $3 billion, and Norinchukin Bank in Japan lost $357 million in six months. We'll see a lot more poison as house prices continue to fall.

As more and more toxic risks rise to the surface, credit becomes scarcer, and the FSN economy, built on the influx of credit money, will experience the first life-threatening shock in its history. With all overvalued assets reverting to their mean, we can expect home prices to fall by about 38% from their peak. If the decline stabilizes at 6-7% per year, the correction will take six years and will leave a $12 trillion hole in the FSN’s pocket. Where can I find that kind of money?

A bubble is for industry what deforestation is for a forest. After years of recession, the battered industry will rebound, but slowly—the NASDAQ, for example, is not half as high as its March 2000 peak of 5,048. When those trillions of dollars die and go to money heaven, the entire economy goes into mourning.

The mortgage crisis left us in a bad place, much worse than the IT crisis, when the refinance rate was 6%, the dollar was at a multi-year high, the budget was running in surplus, and taxes were relatively high - making reflation relatively painless. Now the refinancing rate is 4.5%, the dollar has reached its lowest level in decades, the budget is in deficit, and taxes have already been reduced. Chronic trade deficits, currency depreciation and a lack of foreign buyers for debt will require the US to print new money just to pay its 22 million government employees. The production and consumption sector and the FSN know that credit armageddon is just around the corner, and are only hoping for a miracle - another bubble that will keep the economy from depression.

We now know that the next bubble industry must support thousands of firms and accumulate trillions of dollars in securities that Wall Street will sell. Like the mortgage market in the 1990s, this sector of the economy should already be well developed by the time the previous bubble bursts. Legislative incentives to stimulate investment in this sector should also exist. Finally, this industry should be familiar to those who read newspapers and watch television.

There is only one industry that fully fits all parameters: alternative energy - the development of energy-efficient fuels and adequate alternatives to oil. You can already see the first signs of the next bubble. Wired magazine put ethanol on the cover of its October 2007 issue, telling readers to forget about oil, and NBC had a "green week" in November, with a slew of environmental shows and Al Gore guest starring on a sitcom. Gore, a freshly minted Nobel laureate, looks set to become the face of the new, new, new economy: he has begun collaborating with the legendary venture capital fund Kleiner Perkins Caufield & Byers, which participated in the creation of Amazon.com and Google, where he oversees the “climate change group.” . Other venture funds are funding a huge variety of startups in solar panels, biofuel production, “energy management” software, and more.

US presidential candidates in the 2008 campaign mention "energy security" in their speeches and on their websites. Previously, people preferred to talk about “energy independence,” and this terminological shift hints that part of the defense budget will be allocated to alternative energy.

Much more important, however, is not election rhetoric, but lawmaking. The Energy Policy Act of 2005 contains provisions that guarantee loans to alternative energy companies. The law allows $200 million a year to be spent on technologies to reduce emissions from coal plants and offers subsidies to alternative energy producers.

Along with the alternative energy bubble, there will also be a boom in infrastructure - transport, communications, water supply. In 2005, the American Society of Civil Engineers called for spending $1.6 trillion to improve the infrastructure, recognizing its condition as unsatisfactory. Within a week of the Minnesota bridge collapse last August, Hillary Clinton had already launched her multibillion-dollar Rebuild America plan.

Of course, alternative energy and investment in infrastructure are necessary for our prosperity, and this is the main danger: in the long term, hyperinflation is always destructive. Since the 1970s, US dependence on imported energy has become our main economic and political concern, and our aging roads are the nation's bloodstream. Without the uninterrupted movement of gasoline trucks loaded with goods, there will be no Wal-Mart, no neighborhood mall, no Fedex delivery in the morning. Without “energy security” and fixing our “crumbling infrastructure,” our very competitiveness is at risk. Luckily, Al Gore will be making smart venture capital investments on our behalf.

The next bubble will have to be big enough to cover the losses from the mortgage market collapse. How big? According to rough estimates, the total market value of all enterprises necessary for the development of hydropower, geothermal, nuclear, wind and solar power plants, as well as hydrogen technologies, will be somewhere between 2-4 trillion dollars, including infrastructure. Once the bubble begins to grow, the fictitious value could add another 12 trillion to this amount. In a time of hyperinflation, infrastructure will grow at an ever-faster pace, providing an opportunity for large government contractors to flee the weakening Iraqi market. That would create about eight trillion more in fictitious value, bringing our estimate to 20 trillion—and that money would most likely be used to boost stock prices rather than to ensure “energy security.” When the bubble finally bursts, we will only have to clean up the remains of another ruined industry. Meanwhile, the FSN will create the next bubble. Given the current state of our economy, the only thing worse than the next bubble is not having one.

Russia in global turbulence

During the first wave of the coronavirus crisis, the Russian economy demonstrated greater stability not only compared to developed countries, but also among its partners in the BRICS group of countries. Despite the sharp decline in world prices for carbon fuel - the main item of Russian export - Russia managed to maintain a more stable position in key macroeconomic indicators than the G7 countries. Thus, at the end of 2020, among the world's largest economies, the IMF predicts for Russia the lowest budget deficit (-4.8%) with a relatively low level of unemployed (4.9%).

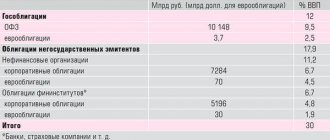

The Russian Federation, in a certain sense, is protected from the formation of financial bubbles, since (unlike the United States) it is more focused on the development of the real rather than the financial sector of the economy. At the same time, the main problem of Russia's integration into the world economy is the lack of stabilizing mechanisms to counter the volatile and difficult to predict elements of the global financial market. We are talking about Russia’s lack of a reserve currency, the issue of which allows issuing countries to withstand external shocks, especially during periods of global crises, when the demand for reserve assets increases sharply. Consider the following example. Russia has been a net creditor to the global financial system for many years. Thus, at the end of 2021, the external financial assets of the Russian Federation exceeded external financial liabilities by $358 billion, while the balance of investment income was negative and amounted to -$50 billion. This asymmetry is formed mainly due to the placement of international reserves in low-yielding foreign assets while simultaneously servicing their foreign financial obligations at higher interest rates. Thus, for many years, the Russian Federation has been subsidizing countries issuing reserve currencies, not always receiving adequate compensation, and in recent years, even being subjected to economic isolation in the form of sanctions restrictions. In this regard, the issue of creating your own reserve liquidity, the role of which, for example, in the period 1964–1990, becomes relevant. in trade with the CMEA countries, it was carried out by the transferable ruble, created long before the emergence of other collective currencies - SDR, ECU and euro. This mechanism resolved at the regional level a number of contradictions (in particular, the problem of imbalances) that arise today in connection with the use of the US national currency as a global means of international payments, loans and investments.

According to the well-known forecast of Goldman Sachs, by 2050, among the five largest economies in the world, four will be represented by BRIC countries, for none of which the stock market is the main source of accumulation of financial resources. On the contrary, the common problem of the BRIC economies is the need to develop the enormous potential of domestic markets through the implementation of large-scale infrastructure projects. Such development could occur on the basis of the creation of an innovative double-circuit monetary circulation system, in which foreign trade would be serviced in conventional monetary units. Such a model would make it possible to separate the internal value of money (purchasing power) from the external value (exchange rate). This separation is necessary to prevent the flow of newly created value (through the financial market) from regions with low productivity to regions with high productivity, as is currently happening in the Eurozone, which deepens the structural imbalances of the single European market. In addition, this system would resolve the issue of creating international liquidity without the need to remove national money from circulation to form unproductive international reserves or conduct speculative operations.

Technology and politics

Historically, the formation of financial bubbles was associated with the emergence of new revolutionary technologies, be it the invention of railways, electricity or cars. Technologies of the fourth industrial revolution offer a range of new inventions (from smartphones and 3D printers to distributed ledger technologies and artificial intelligence), leading to mass automation of business processes and, as a result, the release of a significant part of the workforce, which significantly reduces production and operational costs .

At the same time, a feature of the current global crisis is the absence of galloping inflation as a natural reaction of the market (all other things being equal) to the cheap money policy that has been ongoing for a decade. On the one hand, the moderation of price growth is explained by the effect of the pandemic, which increased the desire of households and firms to accumulate savings and hampered consumption due to the partial lockdown of the economy. On the other hand, in the current conditions, a significant part of the newly created liquidity is immediately absorbed by the stock market - mainly the United States, which is developing due to advanced financing of new technologies emerging one after another. The duration of the viability of this model depends on at least three factors: 1) the continuation of the Central Banks' soft monetary policy with near-zero or negative interest rates; 2) the market’s ability to adapt to new technological transformations; 3) uninterrupted functioning of the world monetary system based on the American dollar.

As for the latter, its functionality largely depends on the political situation in the United States and, in particular, on the results of the upcoming presidential elections in November. Based on the results of their implementation, three main scenarios are possible: 1) maintaining the current configuration of the global financial system with minor changes; 2) radical reform of the existing system; 3) the collapse of the global financial system and the establishment of its new model.

In the first option, most likely, the world economy will continue to function in an unchanged institutional format. In the second option - in the context of a radical reform of the current system of global institutions - RIC countries (Russia, India, China) could insist on more favorable conditions for integration into the world economy (for example, by further moving away from the use of the US dollar in international transactions, more active internationalization of national currencies, revision of participation in the IMF and the World Bank in order to obtain, together with partners in the group of BRICS countries, a blocking package of votes, etc.). In the third option, it becomes possible to form regional monetary and financial systems (as equal independent financial structures of the emerging multipolar world) on the basis of already existing various regional financial institutions with a strengthening of the role of national currencies in mutual settlements and the nomination of international financial instruments (or through the creation of new international liquidity in form of supranational collective units of account).

Andrey Kortunov: Eight principles of the Greater Eurasian Partnership