Greetings to all newbies and old-timers.

Any trader uses borrowed funds in one way or another to increase the potential return on investment. Investors often use margin accounts when they want to invest in stocks or currencies, using money "borrowed" from a broker to control a large position while starting with minimal capital.

So they can risk a relatively small deposit, but buy a lot that under other conditions they would not be able to afford. What is margin on Forex is a burning topic for the domestic novice investor, who is mostly not burdened with money. Therefore, I propose to delve into Forex and find out everything in detail.

What is margin in Forex

Margin is not only found in trading. Initially, this is an accounting concept meaning the difference between the cost of a product and its final price.

But in Forex this word has a slightly different meaning and, in short, it can be translated as “collateral”.

Let's start with the basics.

Forex trading is carried out in lots. The cost of one lot is one hundred thousand dollars.

A huge amount for most traders, so brokerage companies use leverage to attract clients.

Read more about what leverage is here.

This is a kind of loan that gives a trader the opportunity to trade on Forex without having a multi-thousand-dollar deposit, and collateral is used to ensure the liquidity of transactions. The same margin.

Each time you open a transaction, a certain amount is frozen on the deposit, which serves as collateral while the transaction is open.

Why is margin needed?

It should be understood that no matter how kindly a broker treats his clients, he is primarily a commercial organization and is not involved in charity.

Margin is another way for a broker to protect himself from losses.

The broker gives the trader a loan in the form of leverage, but it is impossible to lose this loan, since margin acts as insurance.

In principle, such cooperation is beneficial to both parties: the broker attracts clients, and the trader gets the opportunity to trade without investing or risking huge sums.

Trading nuances you need to know about margin on Forex

The main aspect that needs to be understood is that margin is a broker’s tool to stimulate a trader to trade.

There is no talk of any charity, and if the trade is unsuccessful, the broker will not lose anything, and the trader will lose the amount of the deposit.

There are a few more factors to remember:

- Margin is not the property of the trader. This money, in fact, already belongs to the broker until all transactions are closed and the collateral is returned to the deposit.

- Margin is affected not only by lot size, but also by leverage. The higher the leverage, the less collateral is required to secure it.

- If several transactions are opened at once, the margin is summed up, as is its level, which allows you to track risks not for individual positions, but for all transactions simultaneously.

The problem is that many novice traders do not fully understand the meaning of margin and increase the lot size without thinking about the consequences.

Disadvantages of Margin Trading

The main disadvantage of margin trading is its high risk. If a trader has a small starting capital, then it will not be easy for him to rise to a high trading level, because he will have to cover the spread, commission, and so on. This, of course, complicates the work; you will have to take on a lot of leverage and take risks. But before you start, determine your real capabilities, carefully consider the available options and select the appropriate tools. Currently, margin trading using “dealing leverage” (leverage) is the most popular way of trading for Forex currency market traders. Expanding your trading capabilities through leveraged funds and smartly chosen strategies greatly increases your potential for good returns.

Why can’t you open a deal for the entire deposit amount?

The mistake of many novice traders is not knowing how to calculate margin on Forex.

Typically, this results in opening contracts that are too large.

If the forecast comes true, the deposit will begin to increase rapidly, but in the opposite scenario it will also quickly evaporate.

Let's consider the situation with maximum entry into the market, that is, when all deposit funds are used.

The introductory ones are as follows : $1000 on the account and leverage 1:100. Converting borrowed funds into real figures, we get 100 thousand dollars. As you know, one lot on Forex costs 100 thousand.

1 lot = 100,000 units of base currency

We open a deal of one lot in size, and to secure it, the broker blocks the margin, which is exactly 1000 of our real funds.

That is, the entire deposit is blocked!

Now, a price fluctuation of one point in the opposite direction to the forecast leads to the fact that there are not enough funds in the account to provide collateral, and the broker automatically closes the transaction, since we remind you that he will not lose his money under any circumstances.

Of course, if the price moves in the right direction, this will quickly accelerate the deposit, but the risks from such trading are prohibitively high and the likelihood of an unfavorable scenario occurring is much greater.

Trading pairs

Margin trading does not have any special preferences. For beginners, the best option would be the main currency pairs, which have a lot of information on them. This:

- EUR/USD;

- USD/JPY;

- GBP/USD;

- AUD/USD;

- USD/CHF;

- USD/CAD.

When choosing a currency pair, you need to take into account that as its volatility increases, the risk of a losing trade also increases. Among these, the GBP/USD pair is the most volatile.

But the list of currency pairs “convenient” for trading is not limited to those listed. For a beginner, it is better to start with the pair: USD/the currency of your own country (provided it is sufficiently volatile). It is easier for a beginner to track important economic events at home and assess the degree of their impact on the “native” currency than to analyze the behavior of a foreign currency.

Calculation for USD/CHF

The USDCHF currency pair is included in the list of major ones and enjoys stable popularity among traders. The peculiarity of trading in CHF is that since January 15, 2015, the franc is not officially pegged to the euro exchange rate.

According to some studies, the average volatility of this pair is about 70 pips per day. Moreover, during the trading week it increases from Monday to Friday, which is traditionally considered the most volatile for USDCHF.

Read more: What is a spread on Forex and can it be returned?

In the above example, the base currency is the US dollar, so only the amount of leverage is important for the calculation. If the ratio is 1:100, you will need a margin of $1000. If you increase it to 1:200, you need $500, and if you increase it to 1:500, you need $200.

Calculation for EUR/USD

If the deposit currency and the base currency are different, then you first need to eliminate this discrepancy, and then proceed with the calculation. For example, when trading EURUSD, the base currency will be the Euro. For a dollar deposit, you need to convert it into dollars.

They do this using current quotes for the euro and dollar. For example, the quotes for this pair are 1.1313. The calculation formula is simple: the current euro quote is multiplied by the trading volume and divided by the amount of leverage. In the above example, with a leverage of 1:100, to purchase 1 lot you will need a deposit: 1.1313x100000:100 = $1131.30.

Using the same scheme, the margin amount is calculated if the selected pair does not contain the American dollar. First, the base currency is converted into dollars at the current rate, and then the margin is calculated.

How to calculate margin

Before you calculate the margin, you need to understand that all calculations are made in the base currency.

Each currency asset consists of two positions, for example, the EUR/USD pair. Here the base currency is the euro, so one lot costs 100 thousand euros.

In the AUD/USD pair, the base currency is the Australian dollar and so on.

In addition, it is necessary to take into account the currency in which the deposit is opened. Most often these are American dollars, but if your account is opened in euros, you will have to additionally take into account the ratio of the euro price to the base currency of the selected asset.

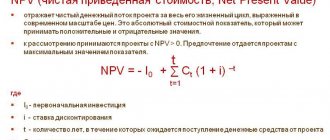

Formula for calculating free margin on Forex

When opening a transaction in the trading terminal, the system automatically makes calculations and displays all the data on the screen, but you must calculate the margin before entering the market.

A simple formula is used here: the size of the lot that is planned to be entered is multiplied by 100 thousand, then by the value of the base currency of the asset in relation to the deposit currency, and divided by the size of the leverage.

Below we will look at a specific example.

Required data for margin calculation

The formula looks complicated only at first glance. In a specific example, everything is much simpler. First, let's define the introductory information:

- Deposit currency is US dollars,

- Asset EUR/USD,

- Leverage 1:100,

- Euro to US dollar exchange rate (at the time of writing) 1.1370,

- Trading lot 0.01,

- Deposit size is 1000 US dollars.

Now let's move directly to the numbers.

Margin calculation example

Substituting the necessary values, we get the equation:

0.01(Lot)*100000(Contract Size)*1.1370(quote)/100(leverage) = 11.37(margin)

That is, by opening a transaction in accordance with all the conditions listed above, a margin of $11.37 will be blocked on the deposit.

Margin level

Screenshot 1. Margin level

Another important indicator is the margin level.

In the trading terminal it is indicated as a percentage and displays the ratio of deposit to margin.

When an open transaction, this indicator always floats, since calculations are made based on the current price of the asset.

The margin level is obtained by dividing funds by margin.

Using the above input data, it turns out: 1000/11.37*100=8795%

As in previous examples, the calculations are relative, since price fluctuations during an open transaction change the amount of funds and the level of margin, but the initial data when entering the market will be exactly the same.

Margin calculator

Margin calculator from Investing.com Russia.

Using margin in trading

For an investor, margin trading is an opportunity to trade outside of your existing capital. And this works with all assets.

Trading Tips

Here are a couple of tips from me on how to trade Forex with borrowed funds more effectively:

- Use margin where possible. Especially if you are an active trader. Only our investment goals decide whether margin trading is suitable for us and under what conditions.

- Be selective about what you buy. Not all tools are safe. Forex and cryptocurrencies are profitable, but very volatile and unpredictable instruments. These parameters must be taken into account before opening a trade.

- The longer the leverage, the shorter the timeframe. A smart investment professional will usually recommend opening trades on margin only for short periods of time. One or two months maximum. Otherwise, the risk of unexpected market behavior leading to a decrease in net profit from investments (or their complete loss) is too high.

- Avoid margin calls. One unsuccessful trade can ruin a bunch of potentially profitable ones. Monitor the situation. Calculate the minimum account requirements in advance - to secure your money, you need 30% more than the required margin.

- Take it for a test drive first. The best way to start trading Forex with leverage is to try it out in a simulator. This way we will experience all its delights and inconveniences without risking real money.

Example of margin trading

Let's say a trader opens an account with a broker with a leverage of 1:100. He decides to trade the EUR/USD currency pair, that is, he buys in euros for the US dollar. The price is 1.1000 and the standard lot is €100,000. In normal trading, he would have to deposit his 100,000 into his account to open the trade. But when trading with a leverage of 1:100, he deposits only $1000 into the account.

Predicting a rise or fall in price, he opens a long or short trade. If the price goes where it should, the trader will make a profit. If not, the drawdown will cover the thousand on deposit, the deal will be closed, and the trader will lose money.

How to use margin as a trader

Now, having figured out what the margin level is in Forex, we need to talk about how to use it in trading.

The level of margin determines the degree of risk. The lower the percentage received in the calculations, the higher the risk from open positions.

In the above example we got 8795%. Since, according to the conditions, we have only one position open, we can say that the size of our deposit is more than 87 times the deposit.

According to the rules of money management, the total percentage of all open transactions should not exceed five percent, that is, the margin level should not fall below 500%

General concept of margin

In the semantic context of the Forex market, the concept of “margin” usually means a certain amount of money on a speculator’s trading deposit, which is deposited by a Forex broker as insurance coverage (coverage) each time the speculator is allocated leverage to complete a transaction with a standard lot.

What is margin in Forex? Margin is considered to be a certain part of the trading capital of a currency speculator, which he must deposit on his trading deposit as a kind of collateral for the brokerage loan received as part of Forex trading. Without such a brokerage loan, as is known, a “remote” private speculator will not be able to carry out any currency transactions on Forex.

Any speculative online transaction with a foreign exchange contract necessarily involves the implementation of two interdependent procedures:

- if there is a “buy game” - purchasing (buy) currency at the most favorable ASK rate (opening a transaction), and then selling it (sell) at the most favorable BID rate (closing a transaction);

- acquisition (buy) at the most favorable ASK rate (closing the transaction).

Regardless of the direction of the “game” (up or down), the price at which a trader sells a currency must be higher than the price at which he purchases the same currency (meaning, within the framework of one specific transaction). If a trader uses large leverage, then it is extremely important to be able to correctly distribute funds in the account, and for this it is necessary to correctly calculate the amount of margin. Many brokers' websites contain margin calculators, but it is better to know how to calculate margin on Forex and be able to do it yourself.

Maximum lot calculation

Margin is also used as a means of calculating the maximum lot.

Using the above conditions and setting the maximum risk at 5%, we obtain the following formula:

percentage of the deposit in monetary terms, multiplied by leverage. This is the numerator of the formula. Next, we multiply the base currency rate by 100 thousand. This is the denominator. And now we divide the numerator by the denominator.

In numbers it looks like this:

(50$*100)/(1,1370*100000)=0,04

That is, the maximum lot with which we can enter the market in compliance with the rules of money management is 0.04.

The margin will be $45.5, and its level will be approximately 2197%.

Accordingly, by increasing the lot size, we automatically increase trading risks.

Practical example of calculation

The margin amounts are set by the broker. The trader chooses the optimal size based on his goals.

Margin calculation for USD/CHF

Let's assume that in our currency pair the US dollar is the base currency (as in the USD/CHF ratio). To open a deal with a standard lot and a leverage of 1:300, we will calculate using the formula 100000/300=333, where 100000 is the lot and 300 is the leverage length. The resulting $333 is the required margin for the currency pair.

Margin calculation for EUR/USD

For other currency pairs where the base currency is not the dollar, it is necessary to relate the rate of the base currency to USD. For example, if EUR/USD costs 1.1469 and leverage is 1:300, a one-lot trade requires 100,000/300×1.1469=$382.3 of margin.

Displaying margin values in the MT4 terminal

Screenshot 2. Where the amount of free margin is indicated in the MetaTrader terminal.

In the MetaTrader terminal, all margin data is displayed on the “trading” tab. With no open positions, the data will be displayed in three categories:

- Balance,

- Facilities,

- And free margin.

The digital values will be the same everywhere, since at the moment we are not using collateral, that is, margin.

Screenshot 3. Trading tab in the MetaTrader 4 terminal

Once the market is entered, two more categories are added: margin and level.

MT4 independently calculates all indicators, which is very convenient, especially if you have several open positions at once.

How leverage and margin are related

Since the margin is, in fact, a guarantee for the use of the broker’s credit funds, its size is influenced by two factors:

- Shoulder size

- And lot size.

Leverage increases the amount of funds on deposit.

For example, a trader opens an account with $1,000 and agrees to a leverage of 1:100. The broker will allow him to open transactions up to (1000*100) 100 thousand.

But by opening an order with a mini lot that costs 10 thousand initially, the company will reserve $100 on deposit.

Accordingly, the higher the leverage, the lower the margin level.

There is an inverse relationship with the lot size.

For example, the deposit is the same 1000, and the leverage is 1:100. We open a trade with a micro lot (0.01) and receive a margin of $10. A mini lot (0.1) will require a deposit of $100, and therefore the entire 1 lot will require a deposit of the full amount of $1000.

It is also necessary to understand that all the above calculations are conditional and are given for convenient reference, since in addition to these factors, swaps, spreads and broker commissions affect the free margin.

The most convenient way to calculate Forex margin is using a special calculator, which almost all brokers have.

Margin calculation for cross rates

M = SS/KP x KV

- M – margin;

- СС – transaction amount;

- KP – leverage;

- KV – exchange rate (base) to the dollar.

Although, in principle, there is no need to remember and study all these formulas, because today there are many calculators designed specifically for calculating margin. The broker will provide you with calculators or you can find them on the Internet, choosing the option that is most convenient for you. Such programs already contain all the necessary formulas that take into account data such as: transaction volume, price of one point, CP size, type of quote. A quick, rational calculation of margin greatly facilitates the trader’s work.

Video

What is free margin on Forex in Metatrader 4 and 5

So, free margin in Forex, what is it? In simple terms, these are the funds available for opening subsequent trades.

Without open positions, this indicator will be equal to the deposit amount, but after entering the market, the margin amount is subtracted from it.

Essentially, the free margin indicator reflects the amount a trader can trade at a given moment.

The value is not static, and depending on the state of transactions, it changes in one direction or another.

So, if the price goes in the right direction, that is, in the direction in which the transaction was concluded, the free margin indicator grows, and vice versa.

What is regular and free margin?

Free margin is the account equity (free funds) minus the margin deposit.

For example, after opening a position, we have a margin of 100 dollars, and funds on deposit of 1000. 1000-100 = 900 dollars. This is free margin, that is, money available for trading.

But you shouldn’t go to great lengths and open deals with all your money. Free margin is used not only for trading, but also for insurance against unsuccessful transactions.

Another example of calculations

Let's take an initial deposit of $10,000, let the leverage be 1:200. Then we open an order with one lot at the rate of 1.25302 (GBP/USD). The margin level exceeds the exchange rate by 250 times. Free margin is the value between margin and balance. Free margin is not a constant value as it constantly changes due to loss or profit.

If one lot is equal to $250.6, then the free margin will be approximately $9,740, we can open a total of 38 lots. This will be the limit. If the price moves in the direction predicted by the trader, then the free margin will increase. But this is not the way to trade. Because you can get caught in a rollback and lose your entire deposit at once.

What is Margin Call?

What is Margin Call on Forex

As I said above, the broker does not intend to lose his money from the trader’s unsuccessful trading.

He provides collateral in the form of margin, but constantly monitors it using special tools.

One of these tools is called Margin Call.

Before the advent of the Internet, transactions were made via telephone. The trader called his broker and gave a trading order, and he, in turn, reported on the state of affairs on the market.

In cases where the trader's account is in drawdown, but the transaction is not closed, sooner or later there comes a time when the free funds necessary to maintain the position are approaching the end.

Screenshot 4. Negative margin

At this moment, the broker must notify the client (Margin Call) about the impossibility of further trading and the need to make a decision. There can be two of them:

- Close the most unprofitable positions or leave the market completely,

- Or increase the deposit, thereby providing a margin deposit.

In online trading there is also a margin call - in English, margin call.

As soon as funds run out, the information line in the “trade” tab turns red.

As a rule, this happens when the margin threshold level reaches 20% - 100%; this indicator differs from one broker to another, and also depends on the type of account.

Be sure to look at the description of your trading account on the broker's website!

Margin level

It is important to remember two key limits on margin levels - Margin Call and Stop Out

.

Margin Call

level , you will no longer be able to open new positions, since there will not be enough available funds to cover one more margin. Typically, brokers set this value at 100%.

If the margin level drops even lower and reaches the Stop Out

, the broker will begin to forcefully close your positions, starting with the most unprofitable one. This is where the danger of trading with collateral comes into play. The broker does not intend to lose his funds, and will close your positions before you have time to go into negative territory.

As a rule, with proper money management this should not happen. A typical mistake of novice traders is opening too large a lot with high leverage. Because of this, even a slight change in the rate almost immediately leads to a Margin Call

.

Also, beginners often forget to set stops, which is why positions that are far into the minus have a chance to close using Stop Out

.

What is Stop Out?

What is Stop Out on Forex

Another broker protection tool is the Stop Out order.

This is a last resort measure following a margin call.

If the margin level falls below a safe value and the funds on the deposit are not replenished, and transactions remain open, the broker begins to automatically close them.

If there are several positions, the one with the largest drawdown is closed first.

If, after it is reset, the margin level has increased to normal values, trading continues. Otherwise, the next contract is closed.

This tool does not allow the trader to go into the red. Only those funds that were originally in the account are lost, and no debt obligations appear.

Hopes deferred. Or where do pending orders go?

Traders often scold brokers for not fulfilling such a long-awaited “return”. In such cases, the dealing center will get the worst of it, he is irresponsible, and he has no money, and in general, there are probably scammers there. True, in reality it is much simpler. The broker does not execute pending orders (or even closes them independently) if your free margin level has reached Stop Out or Margin Call. And there is no need to convince the soulless automation with arguments that the pending order was winning and the profit would cover all losses. In the world of money, as in the oldest profession, one law is unshakable: No money - No honey, dear :-)

This is where we can actually end today’s conversation. It turned out to be capacious, and I am sincerely grateful to everyone who read the article to the end. Let me remind you that on the pages of this blog I share real practical and theoretical knowledge about Forex, which I have accumulated in my head over the years of practical trading on FX.

Subscribe to my blog, receive gifts, leave your comments, to which I will be happy to answer. And of course, the most important secret is not to forget to practice as much as possible. See you again and good luck!

You can learn this and much more by taking one or more courses presented below. I myself studied such a course at one time. This is the most win-win investment, an investment in knowledge. The courses are actually very interesting and, most importantly, structured. All in one place. After studying, you will have an accurate understanding and practice of how to trade and, most importantly, you will have a trading strategy that is suitable for you. And when you have a trading strategy, you immediately become a professional Trader who knows and knows how to make money in the market, be it the Forex market or any other.

Well, the most delicious thing is for last. If you want to start trading now, then this offer is for you. Click “Buy” or “Sell” and after a short registration you will be greeted by a friendly, clear, uncluttered terminal of the venerable broker Plus500. I started with it myself, but I still don’t forget it. First love so to speak :)

Why trade Forex using margin at all?

So, we have figured out what margin is in Forex trading and it’s time to talk about the advisability of using it.

It is worth noting that no one forces a trader to use margin. You can easily trade without leverage, and there will be no collateral requirements.

But here we need to remember a few interesting numbers:

- One lot – 100,000,

- Mini lot (0.1) 10000,

- Micro lot (0.01) 1000.

If we allow a maximum risk of even 10%, and open trades with the smallest lot, the deposit size should definitely exceed 100 thousand dollars.

The amount is huge for most traders, and if margin trading did not exist, trading would remain the prerogative of a narrow circle of people, as it was not so long ago.

Trading Tips

With the help of margin trading, you can either quickly increase your deposit or quickly lose it. When the market is calm, there is a greater chance of making a profit, and as volatility increases, the risk of losing trades increases. When volatility is high, it is preferable to use minimal leverage, or even better, avoid margin trading.

Beginners in trading should not immediately start trading with real money using margin. Most brokers provide their clients with the opportunity to test their skills on a demo account, where they can safely try trading with different amounts of leverage and choose the most suitable option.

For margin trading, the “Don’t be greedy” rule is relevant. The desire to make a profit faster and more is inherent in any trader, but when using a credit plus, it must be kept in check. Seeing that the price is moving against you, it is better to close a losing position rather than stall for time in the hope of a quick reversal. Otherwise, you can wait for forced closure and lose the entire deposit instead of part. You can also use a margin call (automatic closing of the transaction).

Margin trading makes it possible to get more profit from a small deposit. And this is the reason for its popularity. But with a relatively small drawdown it can lead to the loss of the entire amount on the deposit. When starting margin trading, you should always remember this and not take excessive risks.