______

______

Plan:

— What is the Impermanence Index? — How is Volatility Value (VIX) calculated — How to trade volatility index? — How to read the index value?

Volatility index - English. The Volatility Index (VIX) was created by the Chicago Board Options Exchange in 1993 and trades under the ticker symbol VIX. It measures the market's expectation of short-term volatility based on changes in the prices of options on the S&P 500 stock index.

The VIX Volatility Index is a measure of investors' beliefs about the volatility or magnitude of stock market movements. Simply put, the index value reflects the level of fear investors have about the dynamics of market prices and helps to assess the panic or excessive optimism of the crowd regarding the stock market.

Figuratively, the VIX volatility index can be represented as insurance - the stronger the fear of traders, the more they are willing to pay for insurance (which means VIX will rise in price). If market participants have virtually no fear about future price movements, then the indicator will become cheaper.

Implied volatility is an estimate of how much the price of a security will change over a specified period of time. The VIX Volatility Index is constructed by using the Black-Scholes option pricing model to calculate implied volatility for a range of stock index options.

These data are combined to provide a comprehensive assessment of the market's expectations for near-term volatility. The VIX was originally constructed from the S&P 100 Index, but in 2004, CBOE switched to the S&P 500 Index to capture a broader segment of the overall market. To maintain continuity, older calculations (based on the S&P 100 Index) continue to be published under the name VXO.

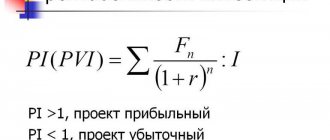

Calculation formula

Below is the formula for calculating the index:

Take our proprietary course on choosing stocks on the stock market → training course

DSI = (Y+G)/14

Where:

Y is the number of years during 7 years when the company paid dividends during the year. Maximum value 7;

G – the number of years within 7 years when dividends were greater than the maximum amount for previous periods.

*the period of 7 years was taken due to the fact that Russian companies began to pay dividends irregularly and fairly recently. The formula was proposed by UK INCOME.

| Business valuation | Financial analysis according to IFRS | Financial analysis according to RAS |

| Calculation of NPV, IRR in Excel | Valuation of stocks and bonds |

Stock indices

To determine what the MSCI Russia index is, let’s first understand the concept of “index”.

Stock index is an indicator calculated based on quotes of selected stocks. Securities are selected based on a variety of criteria: territory, sector, etc. For example, the Moscow Exchange index (iMOEX) includes shares of the 50 largest companies represented on the trading platform of the same name.

The initial value of the index is taken as a conditional number, for example, 100 or 1000. To ensure that the prices of shares included in the index are comparable, they are multiplied by a special coefficient, for example, calculated on the basis of capitalization, so the company with the largest capitalization will have a greater influence on the change the entire index.

Exchange or stock indices allow you to evaluate the general direction of movement of the prices of shares included in the index, so the absolute values of the index are not particularly important, but the dynamics of change are what is important. Indexes can be useful, for example, as a guide (benchmark).

Application of DSI

The table below discusses the standard values for assessing the dividend stability index.

| DSI value | Explanation |

| DSI = 1 | The company pays regular (annual) dividends with constant growth for 7 years. High probability of continuation of this trend |

| DSI > 0.6 | The company has been paying dividends for more than 6 years in a row, with an upward trend. The probability of payments is high. |

| 0,4 < 0,6 | The company has paid dividends for more than 4 years in a row. The likelihood of further payments is moderate |

| DSI<0.4 | The company paid dividends inconsistently or without increases. |

| DSI = 0 | It is impossible to assess the regularity of payments and growth of dividends |

Taxation

When investing through a brokerage account, the broker will take care of all tax-related issues. The investor will receive the amount of dividend payments already cleared of tax costs into his account.

If the shares were purchased without the participation of a financial intermediary, then the tax return will have to be completed independently. NFDL is accrued on dividends; its amount is equal to 13% of the payment amount.

TOP 10 Russian companies with stable dividends

The table below selects those companies that pay dividends regularly and with constant increase ↓

| Name | Industry | Profitability* | Capitalization | DSI |

| NLMK | Metals and mining | 9.57% | 14213.84 | 1 |

| MTS | Telecoms | 8.86% | 7956.61 | 1 |

| NOVATEK | Oil Gas | 3.03% | 39257.63 | 1 |

| LUKOIL | Oil Gas | 7.56% | 36339.79 | 0.93 |

| Norilsk Nickel | Metals and mining | 15.11% | 38555.31 | 0.64 |

| Polymetal | Metals and mining | 6.9% | 10315.71 | 0.64 |

| Rosneft | Oil Gas | 6.51% | 47973.20 | 0.64 |

| Tatneft-p | Oil Gas | 11.14% | 12264.49 | 0.57 |

| Tatneft-AO | Oil Gas | 10.75% | 12264.49 | 0.57 |

*data in the table may change, current data can be viewed in the analytical summary → dividend stability index

MSCI Russia Index

The MSCI Russia index is calculated by the American analytical company MSCI Inc. (Morgan Stanley Capital International), which is one of the world's largest providers of stock indices for various funds and large investors. In addition to MSCI Russia, the company calculates more than 225,000 different indices.

MSCI Russia is a market capitalization-weighted, free-float index designed to track the performance of the Russian stock market.

The index value is available in Bloomberg exchange terminals under the ticker MXRU and Reuters under the ticker .MIRU00000PUS.

Composition and structure of the index

As of 02/17/2021, the composition of the MSCI Russia index is as follows:

Source: https://app2.msci.com/eqb/custom_indexes/russia_performance.html

The composition of the index is small: only 23 securities, and almost half are occupied by such heavyweights as Sberbank, Gazprom and Lukoil. The weight is influenced by such parameters as capitalization, free-float and the possibility of purchase by foreign investors.

The index is calculated in US dollars, some securities are included in the form of GDR (Novatek, Magnit, Phosagro) and ADR (MTS), and for all others - in rubles. It was decided to use depositary receipts due to greater liquidity on foreign exchanges.

The structure of the index by sector as of 02/17/2021 is presented in the diagram:

Source: https://app2.msci.com/eqb/custom_indexes/russia_performance.html

Industry diversification is quite meager and is a clear reflection of the realities of the Russian economy. 82% are made up of 3 sectors: energy (46%), raw materials (19%) and banks (17%). The energy sector includes Lukoil, Novatek, Tatneft, Rosneft, and Surgutneftegaz. Raw materials companies - Norilsk Nickel, Polyus, Polymetal, Severstal, Alrosa, NLMK and Phosagro. The banking sector is represented mainly by Sberbank, with VTB making up a small share.

Conditions for including a paper in the index

MSCI Russia is calculated at trading time with an interval of 15 seconds and is based on the MSCI Global Investable Market Indexes methodology.

According to this methodology, the minimum requirements for shares to be included in the index are:

- Company value (full capitalization) > $1.4 billion;

- Free-float capitalization > $0.7 billion;

- Liquidity ratio ATVR (Annualized Traded Value Ratio) is more than 15% (ratio of annual turnover to free-float).

The selection principle is as follows: first, the total capitalization of the Russian stock market is assessed, as well as the capitalization of free-float shares. Next, companies are sorted by capitalization size and the largest are selected until the market capitalization reaches 85%.

Since the Russian market is highly concentrated among large companies, the conditions for entering the index become a little stricter and the required level of free-float capitalization becomes no lower than $1.5 billion.

MSCI reviews the index for changes in composition, as well as revises the weights every quarter in 2 stages: the announcement of changes and the entry into force of the changes when the index funds make actual transactions to buy/sell securities.

Calendar of upcoming revisions of the MSCI Russia index:

- February 2021 quarterly rebalancing (02/09/2021 - announcement, 03/01/2021 - entry into force);

- May 2021 semi-annual rebalancing (05/11/2021 - announcement, 05/28/2021 - entry into force);

- August 2021 quarterly rebalancing (08/11/2021 - announcement, 09/01/2021 - entry into force);

- November 2021 semi-annual rebalancing (11.11.2021 - announcement, 01.12.2021 - entry into force);

- February 2022 quarterly rebalancing (02/09/2022 - announcement, 03/01/2022 - entry into force);

- May 2022 semi-annual rebalancing (05/12/2022 - announcement, 06/01/2022 - entry into force);

- August 2022 quarterly rebalancing (08/11/2022 - announcement, 09/01/2022 - entry into force);

- November 2022 semi-annual rebalancing (11/10/2022 - announcement, 12/01/2022 - entry into force);

- February 2023 quarterly rebalancing (02/09/2023 - announcement, 03/01/2023 - entry into force).

Why is the index interesting for trading?

You, of course, can rely on the MSCI Russia index in your own trading, but your results will be very different from the reference ones, because Monitoring index changes every second and rebalancing in a timely manner is quite problematic. In this case, it would be better to simply purchase the iShares MSCI Russia ETF from Blackrock. But this is not what makes the MSCI Russia index remarkable.

The fact is that the MSCI Russia index is used by many different funds (index, pension, hedge), large foreign investors interested in Russian assets. Some funds strictly follow the index, and some develop their new products based on it. For example, funds focused on the MSCI Emerging Markets index, which actually includes the MSCI Russia index, have more than $1.3 trillion under management, of course, only a small part is in Russia, as one of 26 developing countries, in the already mentioned iShares ETF fund MSCI Russia (ERUS) has $470 million under management. There are several such funds and in total they manage billions of dollars.

When a stock is included in the index, fund demand for it increases and liquidity increases significantly, and vice versa, if the security is excluded. Let's look at the impact that news about inclusion/exclusion from the MSCI Russia index has on stock quotes using illustrative examples.

The red dots on the charts show the moments of announcement of changes in the MSCI Russia index and actual rebalancing by funds.

TCS Group (Tinkoff)

Source: https://www.tradingview.com/

On February 9, 2021, MSCI announced the inclusion of GRD TCS Group in the MSCI Russia index based on the results of the quarterly review. Index funds will begin rebalancing and purchasing securities on March 1, 2021.

Yandex

Source: https://www.tradingview.com/

The announcement of the inclusion of Yandex shares in the MSCI Russia index took place on August 13, 2020, and direct purchases by index funds took place on September 1.

Mail.Ru Group

Source: https://www.tradingview.com/

The inclusion of Mail.Ru Group depository receipts was announced on November 10, 2021, and the purchases took place on December 1, 2021.

What can you notice in common among the stocks included in the MSCI Russia index? News of inclusion is not unexpected for a market participant; usually large players buy shares of candidates in advance, which leads to growth on expectations. At the time of actual quarterly rebalancing by funds, there is a significant increase in trading volumes, which is clearly visible on the charts and is an excellent opportunity for large shareholders to sell without significant pressure on the market.

Therefore, as a unique trading idea, you can use the growth of quotes on expectations of the inclusion of shares in the MSCI Russia index. Also, on the days of announcement and actual rebalancing, there is high volatility and an increase in trading volumes.

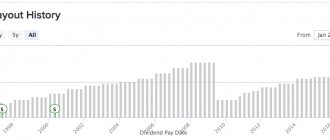

American companies regularly paying dividends

Many American companies regularly pay dividends and some are even larger than domestic ones (for example: ABBV yield 5.6%, PBCT 4.48%, XOM 5.25% payout for over 37 years). Such - they have been making constant payments for more than 25 years with a constant increase in the size of the dividend. For more information about dividend aristocrats, read the article: → TOP US dividend aristocrats with yield.

Conclusion

Using DSI allows you to quickly select those companies that pay dividends consistently and with increase. Focusing on dividend-paying companies that promise maximum dividends in future periods may not be repeated. Therefore, it is recommended to invest in those companies whose policy is aimed at growth and regularity (see → types and types of dividend policy).

| Business valuation | Financial analysis according to IFRS | Financial analysis according to RAS |

| Calculation of NPV, IRR in Excel | Valuation of stocks and bonds |

What are dividends?

Dividends are part of a company's profits that are distributed among its shareholders. This can be either the net profit of the current period or undistributed earnings from previous years. But in simple terms, these are fixed payments that are accrued on the company’s shares in equal proportions.

I'll give you an example right away. The issuer has 10 shares in circulation. The company decides to pay 10 rubles. This means that for each security there will be 10/10 = 1 ruble of dividends.

How much can you earn from them?

Dividend yields may vary. Now, for example, the average return on the Russian stock market is about 6.9% per annum.

When assessing dividend yield, it is important to take into account several parameters:

- the amount of funds allocated for dividends;

- total number of shares outstanding;

- market value of securities.

Let's expand the initial example a little, using all the presented metrics.

The company has 10 shares outstanding. The issuer wants to pay 10 rubles. On the market, securities are valued at 10 rubles. a piece. From past data, I know that 1 ruble is paid per share, which means the dividend yield will be 1/10 = 0.1, or 10%.

Now I’ll change the situation a little and assume that the instrument is trading at 20 rubles on the market, then the dividend yield will be 1/20 = 0.05, or 5%.

Is it possible to live on them?

To understand this, we must again turn to the queen of sciences and play a little with the numbers. Let's say I chose good stocks with stable dividends of 10% of my purchase price. I think that the minimum I need per month is about 30 thousand rubles. This means that my annual income should be around 30 * 12 = 360 thousand rubles.

Accordingly, in order to receive such dividends, it is assumed that my initial investment amount will be 360 / 0.1 = 3.6 million rubles. Then everyone can answer the question for themselves.

Comparative analysis of the state of crops at the same time using NDVI

At the beginning of the growing season, the increasing index shows how friendly the seedlings were, and if the crop is winter, then the degree of favorableness of its overwintering:

- if the value is below 0.15, then the seedlings are sparse or died. This figure corresponds to black steam;

- 0.15-0.2 – plants went into winter underdeveloped, that is, without forming a tillering node;

- 0.2-0.5 – the plant has gone “under the snow” into the tillering phase.

- from 0.5 – an abnormally high indicator after leaving the winter hut. The site needs to be checked for other parameters.

In the middle of the growing season, the NDVI index can be 0.5-0.8. A value in this range indicates that everything is fine on the field or a separate section of it. However, this may indicate the presence of weeds. But this is a separate topic for consideration.

In general, based on the index data, a fairly accurate yield forecast can be made. Thus, the potential maximum yield is assumed if the peak NDVI value reaches 0.8 (during the heading phase or ear/head formation).

This means that biomass affects yield by default. At the end of ripening, the index decreases and the lower its value, the sooner you can start harvesting. During this period it does not exceed 0.35.

Dividend yield and policy

I have already talked about how profitability is calculated in economics. Let me remind you: the size of the payment and the market value of the shares are taken into account.

Many companies, as part of their corporate culture, establish a dividend policy in their charter. It may look different. Some set a percentage of profit for the period, some fix a specific value, others use valuation multipliers.

Examples

Now I will show several examples of different corporate policies regarding the payment of dividends:

- The dividend policy assumes the allocation of at least 20% of net profit under IFRS to its preferred shares.

- MMC Norilsk Nickel establishes a progressive payment line, which calculates the dividend as a certain percentage of the issuer's EBITDA, which, in turn, depends on the net debt/EBITDA multiplier.

- The dividend policy of the Sistema holding previously assumed a fixed payment of 1.19 rubles. per share with the caveat that the dividend yield rate for the year should be higher than 6%.

How to make money on stock dividends?

Strategies may vary, depending on investors' risk appetite and desired return.

If the investment profile is sufficiently conservative, then one can choose reliable stocks with reasonable dividends that are highly likely to be reproduced or increased in the future.

There are strategies when dividends are not the final goal, but a driver for revaluation of stock prices. And again, a little simple mathematics. Let us assume that the rate of return on the market is conditionally at the level of 10%. Those. a promotion that brings 10 rubles. dividends, will cost 100 rubles.

But if the dividend in this share rises to 20 rubles, then how much, presumably, could the asset be worth after adjusting its value to 10% yield? Of course, this is just an example, but this is the principle here.

What an investor definitely shouldn’t do is buy one-time dividend stories. For example, preferred shares of Surgutneftegaz provide high returns only in those years when there is a strong devaluation of the ruble.

This is due to the fact that the company has a lot of cash, which is consolidated in dollar deposits. Therefore, the yield on such securities can reach up to 20% in some years, but the stock will not be overvalued, and after a gap it may even decline.

What equipment is used for surface surveying?

To conduct a qualitative study, the following equipment is used (which is installed on the drone):

- RGB cameras (allow you to shoot in the visible light range and can be installed on most drones);

- Thermal imaging cameras (capable of capturing thermal radiation from a surface). Thermal imaging cameras can detect diseases at relatively early stages. You will be able to see very moist or fairly dry areas.

- Multispectral cameras (allow you to work in both visible and non-visible ranges). Filming with this camera allows you to see the chlorophyll and nitrogen content in plant tissues.

Drones are used as a carrier of equipment to collect data and calculate NDVI maps for agriculture; different models are suitable for data collection, but there are also ready-made solutions, one of which is the DJI Phantom 4 Multispectral. You can read more about it here.

- MicaSense RedEdge-MX Dual dual multispectral camera

1,075,000.00 ₽

Add to cart

- Multispectral camera MicaSense Altum

990,000.00 ₽

Pre-order (Aeromotus)

- Parrot SEQUOIA+ Multispectral sensor

379,000.00 ₽

Add to cart

- DJI Phantom 4 Multispectral

604,920.00 ₽

Add to cart

How can an individual buy shares and receive dividends?

If these are exchange-traded shares, then it is best to use the services of a brokerage company. In this case, an account will be opened and a trading terminal will be provided, in which the investor will be able to buy and sell securities.

You can use the services of the investment department at the bank. A brokerage account will also be opened here, but employees of the credit institution will take care of most of the technical issues.

Another way to purchase financial instruments involves direct transactions. To do this, transaction participants must fill out an agreement and contact the registration authorities.

Which company shares provide the highest dividends?

In 2021, the top dividend stories include the following issuers:

- NKNKh;

- Surgutneftegaz (preferred shares);

- NCSP;

- NLMK;

- Severstal.

However, the fact that these stocks have high returns today does not mean they will continue to do so in the future.

Harvest and NDVI

The NDVI indicator is a comprehensive and qualitative indicator . It allows you to estimate the potential yield on the field, but does not explain at all the reasons why it may decrease.

This is a general picture of what is happening, on the basis of which specialists solve a number of problems that arise before them.

NDVI analysis is relevant in any phase of plant development, and you need to be aware of the patterns of changes in index values:

- at the beginning of the growing season, when the plants gain weight, it grows,

- at the moment of flowering/grain formation – suspended

- decreases as the crop matures

Therefore, using NDVI, it is possible to make a comparative analysis of the state of crops at the same time.

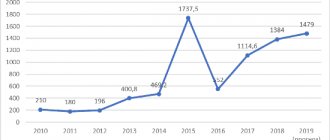

Let's take a closer look at these dependencies:

Key benefits of using the NDVI index

Let's look at the main advantages of this yield forecasting method:

- Allows you to identify plant diseases at an early stage (while there is still a chance to save the crop):

- The ability to explore large areas in the shortest possible time;

- The ability to obtain the most detailed data in high resolution;

- Allows you to work in any weather (if you use a drone with a high IP index);

- Allows you to determine the threshold of plant development in the fields;

- The ability to find waterlogged or, conversely, very dry areas;

- Farmers can calculate the exact amount of fertilizer to be applied;

- Ability to determine the volume of precipitation;

- Accurate forecasting of crop yields, biodiversity;

- Ability to determine the extent of damage;

- Ease of obtaining data;

- The data from this index is used to calculate LAI (leaf area index) and FPAR (photosynthetic active radiation index).

Material taken from the website www.rus-aero.com

What is the Hirsch index and how is it calculated?

The Hirsch index (h-index, h-index, or simply “Hirsch” in common parlance) was proposed in 2005 by American professor Jorge Hirsch as an index for quantifying the publication productivity of a scientist.

This index simultaneously combines both the number of articles published by a given scientist and the number of citations of these articles, and has recently become a popular scientometric indicator, information about which is requested and taken into account when applying for grants and awards, and passing competitions for scientific positions etc.

The index can also be applied to assess the activities of not only an individual scientist, but also a group of scientists (institute, university), as well as an entire country.

The higher the H-index, the more highly qualified the scientist (research fellow) is considered.