Methods of investment calculations can be classified according to a number of criteria. According to the method of taking into account the time factor in investment calculations, the methods are divided into the following groups:

- static, in which cash receipts and payments arising at different points in time are assessed as equivalent;

- dynamic, in which cash receipts and payments arising at different points in time are reduced to a single point in time using discounting, ensuring their comparability.

Based on the type of general indicator that serves as a criterion for the economic efficiency of investments, investment calculation methods can be divided into the following groups:

- absolute, in which the difference indicators between cash receipts from an investment project and the corresponding payments are used as a criterion;

- relative, in which generalizing indicators are defined as the ratio of cost estimates of the financial results of a project to the total costs of obtaining them;

- temporary, in which the return period (payback period) of investments is estimated.

In addition, all methods of investment calculations can be divided into two groups:

- Methods for substantiating investment projects under conditions of uncertainty and risk.

- Methods for determining the feasibility of implementing an investment project in conditions of complete certainty regarding the result obtained.

The choice of method for assessing the effectiveness of investments largely depends on the goals of the investor, on the characteristics of the investment projects under consideration and on the conditions for their implementation.

Statistical methods for evaluating investment projects

Static methods of investment calculations include those that are used in the case of short-term investment projects. If investment costs are incurred at the beginning of the period, the results of the project are determined at the end of the period.

Static methods for assessing the economic efficiency of investments are simple methods that are used mainly for a rough and quick assessment of the attractiveness of projects and are recommended for use in the early stages of examination of investment projects.

The following indicators (annual or average annual) are used as a criterion for choosing an investment alternative:

- profit;

- costs (cost price);

- profitability.

Static methods of investment calculations are based on comparative calculations of profits, costs or profitability and the selection of an investment project based on the optimal value of one of these indicators, which in this case act as the short-term goal of the investor.

For the reliable application of these methods, all proposed projects or investment alternatives must be brought into a comparable form.

Of the simple methods, the most commonly used are methods for calculating reduced costs, analyzing the break-even point of the project, calculating the return on investment indicator and the payback period (return period) of investments.

Net present value

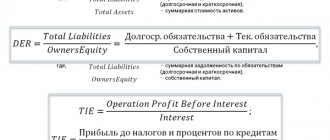

Net present value (NPV) or net present value is a set of future expected financial flows that the project generates, reduced to the current period of time. Gives the investor an idea of what he will get out of his investment in the investment. The calculation takes into account how much will be spent on initial costs, as well as during the production process. The economic sense is to tell the investor what the risk and total return will be. The calculation formula looks like this:

Fig.7 Formula for calculating NPV

Where:

- n, t – number of periods;

- CF (cash flow) – cash flow;

- C – initial investments;

- R (rate) – discount rate.

Conclusion on the project:

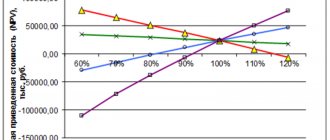

- NPV > 0 ⇒ the project is profitable and feasible for implementation.

- NPV

- NPV = 0 ⇒ zero payback (break-even level), the project loses its feasibility. Required actions: a) winding down the project; b) developing a plan to increase its profitability.

- NPV1>NPV2 Comparison of the NPV of one project with the NPV of another indicates the greater attractiveness of the first.

Dynamic methods for evaluating investment projects

In the economic activities of business entities, the problem of measuring funds paid or received at different points in time constantly arises. For example, commercial organizations, having free funds, have alternative opportunities for using them either by investing them in production in order to expand sales volumes and generate additional profits, or by investing these funds in a deposit account with a bank and receiving income in the form of bank interest, or by purchasing income-generating securities. In many ways, similar opportunities exist for households (the population).

Having a number of alternative options for using funds, a potential investor naturally decides to choose the best of the available alternatives, and the one that will bring the greatest income in the future. However, in many cases the situation is more complex. To solve this problem, some scale or scale of measurement is required by which cash flows can be measured over time.

In economic measurements, comparison of cash flows at different times is carried out by discounting - a procedure for bringing cash receipts and payments at different times to a single point in time. Discounting consists of calculating the current equivalent of cash paid and/or received at various points in time in the future.

Dynamic methods of investment calculations are used to justify investment projects when we are talking about long-term projects that are characterized by income and expenses changing over time. The use of dynamic calculations is based on certain prerequisites, the fulfillment of which ensures the implementation of calculations with obtaining sufficiently reliable results.

For the purposes of analyzing investment projects, the following dynamic methods for assessing the economic efficiency of investments can be used:

- assessment of the absolute efficiency of capital investments, based on finding the difference in the financial values of the results and costs associated with the implementation of the investment project (current value method);

- assessment of the relative efficiency of capital investments, based on finding the relationship between the financial values of results and costs associated with the implementation of an investment project (return index method, internal rate of return method);

- assessment of the return on investment period, during which the initial investment costs are fully recouped by the income received from the implementation of the project (payback period method).

Internal rate of return

The internal rate of return (IRR) is a certain level of the discount rate at which the net present value equals zero. Formula for calculating internal rate of return:

Fig.8 Formula for calculating IRR

Where:

- CF (CashFlow) – cash flow generated by the investment object;

- IRR – internal rate of return;

- CF0 – cash flow during the investment phase.

If we take WACC as the discount rate. The conclusion of the project will be as follows:

- IRR > WACC – capital invested in an investment project will create a return higher than the cost of invested capital. Such a project is subject to implementation;

- IRR = WACC - the project will not bring either losses or income in the future period and such a project should be postponed or the parameters should be revised;

- IRR

Investment return index

The Investment Profitability Index (PI) is used to evaluate investments and the effectiveness of investments by assessing the relative profitability of various investments. The profitability index is calculated as the ratio of discounted income to invested capital, indicating how much profit each ruble we invested brought us. Profitability index calculation form:

Fig.10 Formula for calculating PI

Where:

- NPV – the value of discounted incoming investment flows;

- I – set of capital investments.

Interpretation of the results:

- P.I.

- PI = 1 ⇒ profit from the project is equal to financial flows; to launch business processes, serious revision of the project is required.

- PI > 1 ⇒ the project is promising.

Order a consultation on automation of investment activities

If you give a comparative assessment of several projects, then it is advisable to implement the one with a higher PI, since this means a higher profitability potential.

Don't look at others

Sometimes, to estimate the cost, you want to look at several similar works on the Internet and name the same price that other designers asked. But doing so is not the best option. There is no average market price for the project. A designer from the stock exchange will draw a website layout for a thousand rubles, a good designer will charge 20 thousand, and a studio will charge even more.

Formally, all these guys will complete the task - the layout will be ready. But will a thousand-ruble model solve the client’s problems? Most likely not, because the designer has no motivation to look for answers, he will draw as the client said.

How to evaluate a job in 4 seconds

Above I presented several algorithms for evaluating work; they require time to think about. But there is another way that helps to evaluate the project right away. Conventionally, it is called RAP (rate-add-price)

1. Rate

First, mentally evaluate the project according to your feelings - any comfortable amount.

2.Add

Add another 20% to this amount.

3. Price (Total cost)

Give the final cost to the customer.

Discounted payback period

Discounted payback period (DPP) is the period during which the project is at the self-sufficiency stage. Formula for calculating the payback period:

Fig.9 DPP calculation formula

Where:

- IC (InvestCapital) – capital investments of participants;

- CF (CashFlow) – financial flow;

- r – discount rate;

- t – period.

The advantage of this coefficient is the ability to take into account the time value of money in the calculation due to inflationary processes, which seriously increases the reliability of the assessment of the payback time of invested capital.

The disadvantages of the criterion include the predictive nature of determining future cash flows and the inaccurate assessment of the discount rate. The rate is subject to change at all stages of the project due to the influence of various economic, political, and production factors.

How to tell the customer the price without blushing

Often the conversation about payment feels awkward. Whenever I am asked to evaluate my work, I become shy and am ready to agree to the very minimum amount or take on the project for free.

To simplify the entire project estimating process, I stopped discussing the amount in person.

Now at the meeting I collect information about the task, ask questions, find out about the limitations. But I do not announce the deadlines and cost of the work.

After the meeting, I think about all the conditions of the task and estimate how much time it will take me to complete this project. And then I send an email to the client. In it I tell you how I understood the problem, how I plan to solve it, how long it will take and how much it will cost.

Thanks to this approach, I have time to think about the decision and soberly assess my capabilities - whether I can do it or not. When I write a letter, I don’t see a client in front of me, I’m not embarrassed, and therefore I can name the adequate cost of the project.

Evaluate a piece of work

The easiest way is to evaluate work in specific units. For example, a designer can set the cost of one drawn page. If the customer needs ten pages, then it’s easy to imagine the total amount. The designer drew it and handed it over - the customer paid.

However, this model has its drawbacks. The designer looks at the work as the number of pages rendered. Therefore, he is not interested in solving the customer's problems.

Investment rules

To roughly assess the need for an investment, you can rely on the basic rules:

- Investments are mostly real - these are long-term projects, the payback period of which is 10-30 years. When investing in securities, the investment period may be shorter, especially if the investor plays on price increases and decreases, but if we discard the speculative strategy, then investments in the same shares are also recommended for a period of 5 years. Therefore, remember: you need to invest long-term funds in long-term projects. If the project is for 10 years, then you need to invest an amount that will not be needed for 10 years. Usually it will not be possible to return the money earlier or it will be possible, but with large losses;

- Balancing risks. Projects can be high-risk and low-risk, but their profitability must correspond to the level of risk. There is no point in taking great risks with your savings when the bank deposit is profitable. Analyze how much you can earn and what is the probability of losing everything, take risks - only if the profitability is also high.

Important: invest only your own funds in high-risk investment projects. You can't risk borrowed money here!

- Return on investment. One of the basic concepts when calculating the return on investment. When choosing a project, calculate the profitability of each and choose the one with the maximum.

Educational program: Profitability is an economic indicator for determining efficiency. It is calculated as the ratio of revenue and costs.

- Taking into account market needs - the project must be in the market, the product or service of such a project must be in demand, otherwise it may not pay off;

- Solvency - when investing funds, the solvency of the organization should not be affected. If we talk about private investments, then, accordingly, you need to take into account your own dependence on the money invested: how much you can afford to live without these savings.

Educational program: Solvency is the ability of an entity to fulfill its financial obligations in a timely manner and in full.