Every person thinks about the possibility of receiving passive income by investing savings. Ideally, a situation is considered in which the amount of money received will be enough to live on. People who live off interest from bank deposits and other means of investing are called rentiers.

For many citizens of our country, this is a dream. However, how realistic is it to implement it? Is it possible to live on interest from a bank deposit? What difficulties and obstacles stand in the way of achieving your goal?

Advantages and disadvantages of living on bank interest

At first glance, the advantages are immeasurably greater. Indeed, the rentier has no need to earn money, and therefore not to work; passive income provided by the bank does not require any additional participation; If you choose the right bank, as well as if you follow security rules, you can save your funds with almost one hundred percent probability.

There are also disadvantages to this method of investing. The most important thing is that you will need a really large initial capital; part of the income will be lost due to inflation, and over time this part will become more and more; even with a solid starting capital, the rentier will be forced to give up luxurious and expensive purchases in order to keep it intact.

The conclusion is this: this lifestyle is not suitable for everyone, but, nevertheless, it is quite effective as an additional income.

How to check how much money is on the card through the office

If there is an office of a servicing bank nearby, you can go there too. But, of course, if the branch is far away, it is better to use other methods: remote or through an ATM.

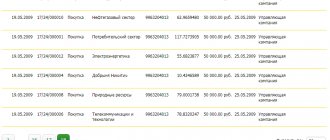

To find out how much money is left on the card, you need to go to the branch during opening hours. You need to have your passport with you and preferably the card itself. In the electronic or standard queue, approach the operator, talk about the reason for your visit, and provide your passport. You are immediately given information about your balance. If necessary, you can ask for a statement of transactions performed with the card.

Information about the addresses and opening hours of the bank's offices is always available on its website.

What are the advantages of bank deposits over other investment methods?

A rentier as such can receive passive income not only from bank deposits, but also from securities, deposits in mutual funds, the use of copyrights or real estate.

However, deposits have a key advantage due to their high liquidity. Why is that? If the owner of the deposit needs funds, he can get them almost instantly by going to the bank and closing the deposit there. Of course, he will lose some part of the interest, but he will lose the large amount invested entirely. With real estate, this option is generally not realistic, since the search for buyers in any case will not be quick, and an attempt to speed up the process can lead to a significant reduction in price. Difficulties may also arise with securities and shares in a mutual fund, ranging from simple non-receipt of profit to loss of funds, partial or complete.

As for copyright and other rights, only a few percent of people have them, while anyone can make a deposit in a bank.

PAMM accounts

What is this way of earning money? In this case, the user will need to open an account with a brokerage firm that specializes in trading operations carried out on currency exchanges.

Deposits are used by the trader. He uses them as investments in any highly profitable projects. The income received is divided between the broker, the intermediary site and the client, based on a pre-concluded agreement. A significant advantage of this direction is the absence of the need to bargain on your own.

How to make money on deposits on the Internet, receiving as large sums as possible? To do this, it is recommended to register simultaneously on different sites by creating several PAMM accounts. The return on investment in this case occurs quickly. The profitability is quite high.

It is worth keeping in mind that not all traders can be considered bona fide participants in this market. There are also scammers among them. There is a chance that the broker will disappear, taking the investor's money with him. An honest trader can also “burn out” if he invests the amount given to him in unprofitable projects. In this regard, such investments are considered unstable and risky.

Where to start a rentier career

First you need to decide on the level of income that will be sufficient to live on. For some, in this case, 40-50 thousand rubles will be enough, while others will consider 200 thousand rubles as the necessary amount. Based on this amount, you can determine the total amount of initial capital. Let’s say a person needs at least 70 thousand rubles per month. Then, if the interest rate, for example, is 8% per annum, and this is a real and very high rate offered by banks, the initial capital should be equal to 10.5 million rubles.

Which bank should I deposit money into?

You should use the services of large, trusted banks with a good reputation. It is necessary to remember about the deposit insurance program, so it makes sense to distribute funds between several of the most reliable banks so that the deposit amount in each of them is no more than 1.4 million rubles, this is the amount that is insured by the state. In any case, what monthly amount of passive income the rentier will receive will depend on the amount of starting capital, the chosen bank, and the characteristics of the deposit. It is advisable to choose banks with a predominance of state capital, such as Rosselkhozbank, VTB, Sberbank, they are considered the most reliable.

The most interesting and profitable deposits for a period of 5 years with an initial capital of 1 million rubles.

1. Deposit “Savings account” at VTB Bank. Annual yield - 8.5%. Interest is paid monthly, income is 7,083 rubles/month.

Capitalization is not provided, it can be replenished, there is an option for partial withdrawal.

2. “Term” deposit in Eurofinance Mosnarbank. The annual yield is 7.5%, for the entire term of the deposit the yield will be 37%. Interest is paid exclusively at the end of the term, income is 6,458 rubles/month. Capitalization is not provided, it cannot be replenished and it cannot be partially withdrawn.

3. “Term” deposit in Spetsstroybank. The annual return is 7.4%. Interest will be paid at the end of the term, income is 6,166 rubles/month.

You cannot top up and you cannot withdraw. Funds can be deposited in rubles, or in another currency of your choice.

4. “Profitable” deposit in Stolichny Credit Bank. Annual yield - 7.3%. Interest is paid monthly, income is 6,083 rubles/month.

Capitalization is not provided. You cannot top up or partially withdraw.

5. “Term” deposit in NK Bank. The annual yield is 7.25%, for the entire term of the deposit the yield will be 36.25%. Interest will be paid at the end of the term, income is 6,041 rubles/month.

Cannot be replenished, capitalization is not provided.

Option 1. Simple

It's simple. Determine for yourself how long you want to live after retirement. We divide the required capital into equal parts. The quantity is equal to the survival period. And every year we withdraw 1 part for living.

We get that for 5 years of life we need to have 3 million rubles (50,000 x 12 months x 5 years).

10 years - 6 million, And so on.

With this scheme we have several problems at once.

- Unclear. How many years will you live in retirement? There is always a risk of having time to eat up all your capital during your lifetime. And not die. Is it good or bad?

- The sooner you retire (rest, not what you thought), the more money you need for your future long life. Leave at 40 or 60. The difference in the required capital is more than ten million.

How to choose optimal conditions

Each bank has a line of deposits, each of which has its own characteristics. They differ in terms of validity, the size of the minimum possible deposit, and the interest rate.

Let’s say a client wants to regularly increase the amount in the bank, which means that a deposit with replenishment is suitable for him. If you plan to withdraw not only interest, but also part of the main deposit, it makes sense to choose a deposit with the possibility of partial withdrawal.

A deposit, the program of which provides for monthly payments, is suitable for those clients who want to receive monthly income.

The return on investment will consist of the following components: the reliability of the bank, the selected program and the bank’s interest rate: based on these criteria, the amount of accrued interest is determined.

But the determining role, nevertheless, is played by the amount of starting capital. It is possible to live on interest from a deposit and not have other sources of income only if the deposit is at least several million rubles. It is desirable that the program provides for the capitalization of interest, as well as the ability to replenish the account.

Taking into account the drop in rates

The rate on bank deposits is a fickle thing. It may decrease over time. Yesterday it was 10%, today it is 8, and tomorrow it will be 5 or 6% or even just a couple of percent(((.

So what do we get?

Full ZO... Just yesterday I received 30 thousand in interest. And now it’s 10-15 thousand. And how to live on this money?

To be fair, it can be noted that rates may increase.

But this is usually a temporary phenomenon. When setting interest on deposits, banks rely on the Central Bank rate.

And a high size is disadvantageous for the country. And whenever possible, they strive to keep it (the rate) at the lowest possible levels.

There are periods of sharp growth (usually during times of crisis). But just as quickly it begins to decline.

The problem is that when opening a deposit, the bank allows you to fix the rate for a short time (a year, two or three). Nobody knows what will happen next. And your deposit will be extended under new (possibly less favorable for you) conditions.

Where does interest on deposit come from?

When concluding an agreement on opening a deposit, the depositor transfers to the bank a certain amount of money either for a period agreed upon and specified in the agreement, or indefinitely, which is also indicated in the agreement. The bank disposes of the amount as it sees fit in accordance with its policy. Most often, the bank purchases shares and bonds of profitable enterprises, or these funds are issued to other bank clients in the form of loans. Since money is in circulation, the capital placed on deposit brings a certain income to the financial institution. The bank transfers part of its income to the depositor in the form of a certain interest rate.

Brief summary

The investor is able to earn money on the deposit. You just need to collect information on the products of the maximum number of financial institutions and compare the conditions. Don't hesitate to spend a few days on these steps. Your efforts will pay off handsomely.

Most bank websites contain deposit calculators. With their help, the process of calculating the profitability of a deposit is simplified and accelerated as much as possible. The client needs to select starting conditions and the program will calculate the final income.

Invest profitably!

Impact of inflation

The phenomenon of inflation constantly and significantly affects the amount of deposits, which leads to a gradual depreciation of money. Despite the fact that the amount in the account remains unchanged, or even increases due to accumulating interest, the purchasing power of the money in the bank gradually decreases.

Based on this fact, two concepts should be distinguished: nominal and actual interest rates.

Nominal - the one specified in the contract. The actual one is adjusted for inflation. The real income from investing the amount on deposit in a bank is always lower than the nominal one. The actual rate reflects the purchasing power of the capital after the end of the period for which the money was deposited. It often happens that the level of inflation often reduces the income from the deposit to almost zero. Since banks do not operate at a loss, the interest rate is always offered at the level of the annual inflation rate predicted by experts.

Is it possible to increase income from a deposit?

A successful solution would be to convert rubles into world currencies - euro or dollar. For now, these currencies are much less susceptible to inflation, and the change in the ruble exchange rate itself is calculated in relation to these two currencies. Interest rates on deposits in dollars and euros are much lower than in rubles. But taking into account inflation, the benefit will be noticeable. And the actual interest rate in this case will exactly correspond to the nominal one. Thus, today dollar (or euro) deposits can be considered a more profitable investment.

Will the interest on the deposit be enough to live on?

The answer to this question is not as simple as it might seem. On the one hand, if you put a really large amount on deposit, it will seem that living on interest is very realistic. However, the financial situation today is subject to various influences and does not remain unchanged. Even in a good situation, the interest rate only allows you to keep the purchasing power of the invested amount at a constant level. If you start taking interest from the deposit, the purchasing power of the deposit will decrease over time. Thus, a bank deposit should be considered as one of many tools to achieve financial independence.