Photo: chaslaupiastsiuk.com

Ratmir Belov

Journalist-writer

Investment market participants are known as a holding company that owns shares of many well-known companies around the world. For those who are far from the world of investments, it may be indirectly known through the name of its founder and one of the richest people on the planet, Warren Buffett.

What Berkshire Hathaway is today, how the company has developed and what assets it has, we share in the article.

Numbers that make your head spin

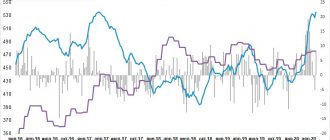

1. Thanks to the management talent of Buffett (and his partner Charlie Munger), BRK grew faster than other companies over the years. Between 1960 and 2021, Berkshire posted an average annual growth rate of 20.3%. The S&P 500 rose 10.3% over the same period.

2. Berkshire Hathaway has been a textile mill since 1839. It was only under Buffett's leadership that it became an insurance and investment company. Now it is the 9th company by capitalization in the world and 6th in the USA.

3. Owns many large American corporations: Bank of America (11.5%), Apple (5.4%), Kraft Heinz Company (26.7%), American Express (17.6%), Wells Fargo (9. 9%) The Coca-Cola Company (9.32%). Berkshire also fully owns insurance company Geico, which accounts for 8% of revenue.

4. The capitalization of BRK.B is $518 billion, and it owns publicly traded shares worth $244 billion (of which 71% is concentrated in just four securities: APPL, KO, BAC, AXP). That is, half of the holding's capitalization is explained by the presence of shares in its portfolio, and half - by operating business.

5. BRK is the largest recipient of dividends. For 2021, $3.8 billion was received in the form of dividends from 10 top companies. Buffett has repeatedly said that Berkshire has not paid and does not intend to pay dividends to its shareholders. First of all, because Buffett believes that he can manage finances more rationally than most investors.

There is a second reason - taxation. Efficiency is significantly reduced by taxes and compound interest.

6. BRK is a conglomerate that has brought together dozens of subsidiaries (at least 60) under its leadership.

7. There are two types of shares traded: BRK.A and BRK.B. Class B shares with an affordable price tag, Buffett brought to the market in 1996 so that anyone could purchase them without paying extra to intermediaries. Today the cost of one share is $217.

8. Buffett sold all airline shares (American Airlines, Delta, Southwest, United Airlines).

9. The Fed is actively printing money, which reduces the value of Berkshire's cash cushion, which is $130 billion. The more currency, the weaker a single $1.

Buffett has repeatedly said that it is increasingly difficult for him to buy “giants” at reasonable prices. Politics undermines the investment philosophy of an influential investor.

Berkshire Hathaway - brand history

Berkshire Hathaway is an American holding company headquartered in Omaha, Nebraska. She is a manager for a large number of companies in various industries. The average annual growth in book value over the past 44 years has been 20.3% with minimal debt. Berkshire Hathaway shares rose a total of 76% from 2000 to 2010, compared with a total decline of 11.3% for the S&P 500.

The company is known for its longtime chairman Warren Buffett, who used profits from Berkshire Hathaway's insurance operations to finance investments. In the early periods of the company's activity, it specialized in long-term investments in listed shares, while more recently it has switched to purchasing entire companies. According to the Forbes Global 2000 List, the company is ranked eighth among the largest publicly traded companies.

The history of Berkshire Hathaway is, first of all, the success story of its founder, one of the richest people in the world, Warren Buffett.

Warren Edward Buffett was born on August 30, 1930, in Omaha. His father is Howard Buffett, a stockbroker and Republican congressman. The Buffetts had four children in total, and Warren was the only boy among them. Warren's grandfather ran a grocery store in Omaha where Buffett's current partner, Charlie Munger, worked. As a boy, Warren discovered an excellent memory for numbers, surprising his friends. He easily remembered the population of many American cities.

Young Buffett made his first trade at the age of six. At his grandfather's store, he bought six cans of Coca-Cola for 25 cents each with his pocket money and sold them for 50 cents to members of his family. And at the age of 11, Warren Buffett began to show interest in his father's field of activity. That same year, the future great investor teamed up with his older sister Doris, borrowed money from his father, and bought his first three shares of Cities Service Preferred worth $38 each. After the purchase, their price immediately dropped to $27, but after a couple of days it settled at the $40 mark. Young Buffett decided not to take risks and sold the shares, earning the first $5 on the operation. Imagine his disappointment when the shares of the same company soared to $200 per share within a week! This was Buffett's first lesson in patience.

At age 13, young Warren began delivering newspapers for the Washington Post. Having developed his own strategy, he optimized the route, which allowed him to visit many more addresses in a morning, and therefore earn more money. Eventually his monthly income equaled and then doubled the post office director's salary. A year later, according to Buffett’s recollections, his savings amounted to almost 1.5 thousand dollars, which he immediately spent by purchasing a plot of land to rent to local farmers.

Then his interests shifted towards the gambling business. Buying broken and out of order slot machines on the cheap, Warren handed them over for repairs and then installed them in the most popular places - stores, hairdressers, etc. He honestly shared his profits with the owners of these establishments, and $600 was added to his piggy bank every month.

When it was time to get a higher education, Buffett, at the insistence of his parents, went to the University of Pennsylvania. However, he quickly became bored with his studies: the enterprising young man knew much more about business than the theoretic professors. A year later, he left his studies and returned to Nebraska, where he again went into the newspaper business, only now with the rank of head of the delivery department, and then co-owner of the office. Business was going well, and gradually the young entrepreneur's eyes turned again to the stock market. In addition to the fact that Buffett had his own savings, by that time he had already received his father’s money at his disposal and immediately began to increase the family capital. At the same time, he graduated from the University of Nebraska.

But after graduating from university, Buffett decided to continue his education. “I understood that I knew a lot and could do it at the level of personal abilities, but I also understood that additional knowledge would make me a superman,” he recalls ironically. In 1950, he tried to enroll at Harvard, but the university's admissions committee rejected his candidacy because he was "too young." Then Buffett decided to enroll at Columbia University in Washington, where Benjamin Graham, who had a reputation as a shark in the investment business, lectured. He became a famous stockbroker already in the 1920s, buying up undervalued stocks that no one else was interested in, but suddenly, some time after Graham bought them, began to rise sharply in price. While all stock market players viewed the stock market as a game of roulette, Graham considered it a science and diligently studied the balance sheets of the companies in which he planned to invest.

Mr. Graham taught students to carefully analyze the financial statements of companies, regardless of the direction of their activities, and based on the information obtained to make decisions about buying or selling shares. Graham, drawing on his own experience, argued that funds should be invested not in those companies that are popular on the stock exchange today, but in those whose shares are sold cheaper than their real assets. Graham called them “cigar butts”: the butt has already been thrown away, but you can still take a few puffs.

However, after listening to the entire course, young Buffett came to the conclusion that it was necessary to do exactly the opposite: “Why should I care about the company’s reporting when I know that its assets are worth more than they are selling for? It’s not the shares you should buy, but the business behind them!” Using this principle, in the future Warren was able to earn several times more than Mr. Graham’s entire fund.

Buffett was the only person to receive a perfect grade of A from Graham. However, he did not recommend that the student work in the financial sector. They did not get along in character: the upstart Buffett openly argued with Graham at lectures, and on the sidelines he even ridiculed some of the teacher’s theories. However, after graduating from university, not wanting to part with his mentor, Warren told Graham that he was ready to work for him for free, but he rejected the offer. Buffett gave up, returned home, got married, began teaching at a local university, and then a miracle happened - a phone call from Graham. The financial guru changed his mind and invited Warren to work. Over six years at his company, Warren amassed a fortune of $140 thousand and decided to open his own business. Buffett realized that he was ready for independent “swimming”, and in 1957, returning to his native Omaha, he created his first investment partnership, Buffett Associates. He had to convince a number of entrepreneurs who, believing in his talents, appointed Buffett as general manager and handed him 25 thousand dollars. The initial capital of the company was 105 thousand dollars, after six months it tripled.

Buffett's main principle is to invest money in shares of only those companies that are well managed. Unlike his teacher Graham, he studied not only the balance sheets of companies, but also their corporate structure and the biographies of top managers. Unlike another famous investor, George Soros, Buffett was not interested in short-term speculation. He invested only in those companies that, in his opinion, would remain on the market for a very, very long time. “Our favorite time to sell a stock is never,” he often says. This simple strategy has brought and continues to bring amazing results. Over the five years of Buffett's company's existence, the company's shares rose 251%, while the Dow Jones Industrial Average rose. by only 74%. Five years later, Buffett's shares were already worth 1156% more expensive, while the Dow Jones was only able to grow by 122% during this time.

This was Buffett's first takeoff. The launching pad for a second, much larger one, was laid in 1969, when the value of Buffett Associates reached $102 million. Buffett unexpectedly dissolved the fund and sold all its assets, but acquired a small textile company, The Berkshire Hathaway (BH), which was in deep crisis at the time. Its shares were selling at $8 per share, while its net asset value allowed them to be sold at $20. Only Buffett, who bought half of VN in three years, could appreciate this. However, contrary to the expectations of the other shareholders, he did not develop textile production, and directed all the company’s income to the purchase of securities. Just at this time, American insurance companies received huge tax breaks from legislators. Quickly assessing the future profitability of this business, Buffett gradually acquired ownership of the five largest insurance firms in America and hit the nail on the head.

At that time, insurance companies were better invested than others. Insurance premiums are payments in advance, which means that a cash flow was ensured for the further creation of various funds. The mechanism worked, and it turned out to be the biggest news since the country's swoon since 1930. Buffett did not rest and was always in search of other values, continuing to make purchases, filling his portfolio with shares of solid companies that rose in value once they regained their footing. As a result, when he was barely over forty, he became the owner of a 28 billion dollar fortune.

When choosing investment objects, Warren Buffett adheres exclusively to fundamental analysis; he selects stocks based on the financial and operational indicators of companies. He buys not just shares, but a successful business that stands behind these securities. At the same time, Buffett prefers those assets that, in his opinion, are undervalued at the time of purchase.

Following his principle, he gradually acquired large blocks of shares in “good companies.” According to Business Week magazine, the value of Coca-Cola shares, purchased by Buffett for $1.3 billion, is now $13.4 billion, and the Gillette stake, owned by VN, has risen in price from 600 million to $4.6 billion. And the $11 million spent on The Washington Post has now turned into $1 billion.

No one can explain how Buffett managed to guess correctly in each specific case. But the main principle that underlay his success is known - Buffett never speculated in stocks. He, as analysts put it, “invested them firmly.”

Buffett's name, like the names of all rich people, is shrouded in myths and legends. Countless magazine articles have been written about him, and many books have been devoted to Warren Buffett’s success story.

The annual reports and letters to shareholders that Warren Buffett writes about Berkshire Heathaway's performance are recognized far beyond the investment community. In February 2005, the National Commission on Writing for America's Families, Schools and Colleges recognized Buffett's contributions to writing. In its 2005 award comments, the panel cited the "clarity, insight and wit" of Buffett's reporting and its profound impact on business America.

Buffett is eccentric, jokes a lot in public, and is known for his many sayings. The world press loves to publish his quotes. Consider the sarcastic phrase he once uttered after another deal criticized by the financial community: “If you are all so smart, then why am I so rich?” However, his speeches are not only food for journalists, but also a topic for thought for stock speculators around the world. His every word and action is carefully studied and analyzed. Even the slightest hint from an investment guru about someone's financial insolvency can bring down the stock market. For example, while delivering a message to the shareholders of his company, Buffett mentioned the possible bankruptcy of a certain large organization operating in the reinsurance market. According to his information, this company owes fabulous amounts amounting to billions of dollars to primary insurers, and has practically stopped paying money under insurance contracts. Alarmed analysts quickly concluded that Buffett was referring to Germany's Gerling Global Re, the seventh-largest reinsurer in the world. Experts seriously feared for its solvency, because after Buffett’s statement, the influx of clients to Gerling Global abruptly dried up.

However, Buffett can not only bring down the shares of a company, but also significantly increase their value. To do this, he just needs to buy them. This happened with the advertising company Omnicom. To the news that Warren Buffett himself had acquired its shares, the stock market reacted with a significant increase in the prices of all American advertising giants.

Buffett's eccentricity also shows in his investment strategy. And this is a kind of conservative eccentricity. For example, Buffett invests money only in those companies whose products he himself prefers. As already noted, his portfolio includes large stakes in Coca-Cola, Gillette, The Washington Post, American Express, McDonald's and even Walt Disney. And this is no coincidence: according to journalists, the 80-year-old businessman starts his day with a glass of Coca-Cola, prefers to eat hamburgers, shaves with Gillette blades, reads The Washington Post at breakfast and pays for all this with an American Express card.

Buffett explains the strange absence of shares in high-tech companies in the present time very simply: “I don’t use their products, because I don’t even have a computer.” By the way, Buffett doesn’t use a calculator either. He is able to calculate the most complex mathematical combinations in his mind and manipulate multi-digit numbers. Perhaps it is precisely this ability of his that allows him to avoid those mistakes that make stock speculators burn.

In 2006, Buffett predicted the collapse of the American real estate market, which he calls a soap bubble. “When the price of something rises faster than the costs associated with it, it can have very serious consequences,” he argues. During 2007–2008, there was a sharp drop in prices, construction rates and sales volumes. Mass alienation of real estate for mortgage debts began. At the beginning of 2009, the drop in prices for residential real estate compared to January 2008 was 19%, and with the peak figures of 2006 - 29%. The Guru was right once again.

In February 2010 Berkshire Hathaway holding bought the American railway company Burlington Northern Santa Fe for $26.4 billion.

On March 14, 2011, Berkshire Hathaway makes a major purchase, acquiring the third largest chemical concern in the United States, Lubrizol Corp., for $9.7 billion. Under the terms of the deal, Berkshire paid $135 for each share of the chemical giant.

On August 25, 2011, it was agreed that Berkshire Hathaway would invest $5 billion in Bank of America. As part of the agreement, Berkshire Hathaway would acquire 50 thousand BoA preferred shares at a selling price of $100 thousand per share.

In November 2012, the Berkshire Hathaway conglomerate signed an agreement to purchase Oriental Trading, a company engaged in the distance selling of children's toys, school supplies and party supplies. According to American business media reports, the deal is worth about $500 million.

On February 14, 2013, it became known that a consortium consisting of billionaire Warren Buffett's Berkshire Hathaway and 3G Capital signed a legally binding agreement to purchase the American sauce and ketchup manufacturer HJ Heinz Co for $28 billion in cash, including Heinz debt . The acquisition of the sauce giant was the largest in the history of the food industry. Heinz owners will receive $72.5 per share. According to W. Buffett, 3G Capital approached him with a proposal to jointly purchase Heinz in December 2012.

William Buffett told American television that his company would spend $12-13 billion on the purchase of Heinz.

Berkshire Hathaway vs 2021: who wins

After underperforming the market by about 20% in 2021, the stock is still behind. However, investors are optimistic thanks to active share buybacks. For the second quarter, the redemption amount amounted to $5.1 billion, which is more than for the entire 2021. In July, the pace did not fall - about $2 billion.

The second point is the sharp increase in Apple shares, up to $122 billion in investments, which is almost half of all BRK.B assets (44.4%). Investors are beginning to envision a post-Buffett era and are predicting the likelihood of the company falling apart.

But in May, Buffett said at the annual meeting that a breakup was unlikely. There are enough shares held by family and friends to keep Berkshire intact, even if Buffett wants his shares to be donated to charities after his death.

However, there are other opinions. Investor David Rolfe of Wedgewood Partners, who sold shares of BRK last year, believes that "the culture and structure of the Berkshire conglomerate will not survive Buffett for long..." Investors also speculate that after Buffett's departure, the company may begin paying a dividend (around 2%) and effective management will become a challenge.

Start trading CFDs on Berkshire Hathaway shares

Buffett's first successes

Buffett's investment partnerships ran from 1957 to 1969. During this time, the average return for those who invested money was 29.5% per annum (24.5% minus Buffett's remuneration). Those. if you invested $1,000 in 1957, 13 years later it had increased 17 times! This is the power of compound interest that Buffett himself likes to talk about.

The operations in which this money was earned were of the following type - the purchase of undervalued securities, special corporate situations (reorganizations, mergers and acquisitions, etc.) and control situations (purchase of a controlling stake in order to influence corporate decisions).

The practice of annual letters to shareholders originates from investment partnerships. Letters that are now famous throughout the world (letters to Berkshire Hathaway shareholders), which talked about how the current year went, what Buffett’s current views on investments, business, the market, etc.

What’s interesting is that if you read the very first letters, they have a lot in common with letters written 10, 20 and even 50 years later. Of course, one person had a hand in them, and we don’t change as much over the years as we ourselves think. But what is more striking is the illusion of ease of what Buffett does.

Everything is very straightforward and simple - buy quality assets for less than their real value. This in itself implies that you (as the buyer of the security) consider yourself smarter than others (smarter than the stock market in which you make the purchase).

Of course, this is an illusion. It is very difficult. And even Buffett himself makes mistakes from time to time. One of the last very big mistakes was the purchase of a very large block of shares (more than 10 billion dollars) of IBM. A few years after the purchase, Buffett admitted that it was a mistake and began selling shares.

Fundamental Analysis

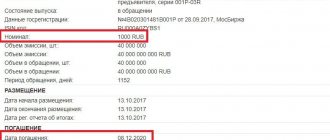

Quotes are at 2021 levels, book value is at a historical low for 8 years. The average price for 52 weeks is 203.37. The portfolio includes 46 companies from 5 sectors:

- Technological 47%.

- Healthcare 2%.

- Grocery retail 7%.

- Financial 33%.

- Industrial 11%.

Financial indicators

- Capitalization - $518.82 billion.

- ROA - 3.8%. One of the best profitability indicators in the industry. Average - 1.20%. BRK.B outperforms 87% of its industry peers.

- lirofit Margin of 11.49% is one of the best in the industry. BRK.B outperforms 84% of its peers. The average level of liM is 4.92%.

- ROE - 7.47%. Comparable to the industry average - 8.15%.

- liiotroski-F rating - 6.00. Indicates average financial condition and profitability.

- When comparing enterprise value to EBITDA, BRK.B is valued cheaper than its peers: 6.97 versus the industry average of 10.31.

- A li/E of 22.87 indicates a fairly expensive current valuation (industry average of 14.33).

- li/B 1.34, industry average - 0.9.

- EliS for the second quarter - $10.8 (89.52% more than for the same period in 2019).

- Revenue for the quarter is $56.840 billion, which is 10.63% less than in the second quarter of 2021. Over 5 years, revenue has grown by 28%.

Risks

- The value approach has been losing out to growth stocks lately. Oil and gas and industrial companies are no longer up to date and are growing slower than the market, which prevented Berkshire from outperforming the S&P 500 in 2010–2020.

- Buffett prefers significant stakes in companies, which distinguishes him from famous investors. Currently, 45.4% of all investments are in Apple shares. Therefore, the BRK.B portfolio cannot be considered diversified.

- One of the main businesses is insurance. Buffett warns that insurance premiums will rise much faster than general inflation, meaning Berkshire's earnings prospects are at risk.

Warren Buffett Net Worth 2021

Warren Buffett turns 87 in 2021.

He is still cheerful, wise and active.

Warren Buffett's net worth can only be estimated. First, because we can only value his stake in Berkshire Hathaway. But this is not his only asset, as he has repeatedly said. Secondly, the price of Berkshire Hathaway shares is constantly changing.

As of early-end May 2021, Warren Buffett's net worth is approximately $82 billion (based on his 17.9% stake in Berkshire Hathaway).

Results

Compared to 69 insurance industry peers, BRK.B has an excellent overall picture. The company is showing strong earnings per share growth. EPS grew 28.52% over the last year, which is quite impressive.

INTERESTING TO KNOW!

With a zero D/E (debt-to-equity ratio), Berkshire Hathaway is one of the best companies in its industry. Conservative historical company based on real economics.

It makes sense to invest in BRK.B if you are convinced of Buffett's genius and that he will somehow catch up on the backlog of the last decade. This is quite possible given the latest investments.

But it is worth considering the uncertainty of Berkshire Hathaway's policy after Buffett's imminent departure.

Open an account and start making money on Berkshire Hathaway stocks right now

Biography of Warren Buffett

This story begins almost 90 years ago.

On August 30, 1930, one of the richest people in the world, Warren Buffett, was born. Buffett was born in a relatively large city in the American Midwest - Omaha (Nebraska).

Berkshire Hathaway office in Omaha

About 500 thousand people live in Omaha today and the city is located almost in the center of the United States. Buffett, by the way, still spends a relatively large amount of time in Omaha, and the famous annual meetings of Berkshire Hathaway shareholders are held here.

Warren's father worked for a time as a securities broker, but always aspired to politics and was eventually elected to the US Congress. This required the whole family to move to Washington, and Buffett finished school there.

Warren's relationship with his mother was tense and the likely reason for this was her mental disorders. Warren had a very warm relationship with his father and his photograph is in the most prominent place in his office.

Buffett made his first more or less serious money by delivering the Washington Post newspaper in the morning. [An investment in this newspaper many years later during the recession and subsequent acquaintance with the editor-in-chief and main owner of the newspaper, Katharine Graham, would begin a lifelong story. And the value of a stake in the Washington Post will increase by more than 100 times in a few decades!]