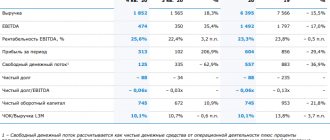

Main financial indicators

| 4 sq. | 3 sq. | ∆, % | 12 months | ∆, % | ||

| 2020 | 2020 | 2020 | 2019 | |||

| 550 046 | 536 741 | 2,5 | Revenue (million rubles) | 1 999 620 | 2 485 308 | (19,5) |

| 138 923 | 128 521 | 8,1 | EBITDA (million rubles) | 415 375 | 711 846 | (41,6) |

| 155 971 | 147 252 | 5,9 | Adjusted EBITDA (RUB million) | 485 203 | 795 129 | (39,0) |

| 11,55 | 11,52 | 0,3 | USD/bbl n. e. | 9,48 | 17,31 | (45,2) |

| 81 506 | 27 961 | 191,5 | Profit attributable to shareholders of Gazprom Neft PJSC (RUB million) | 117 699 | 400 201 | (70,6) |

| 207 788 | 136 902 | 51,8 | Operating cash flow (RUB million) | 517 057 | 609 076 | (15,1) |

| 85 109 | 91 218 | (6,7) | Free cash flow (RUB million)** | 117 416 | 173 834 | (32,5) |

| 1,32 | 1,50 | (12,1) | Net debt / EBITDA | 1,32 | 0,70 | 88,6 |

Gazprom's reporting under International Financial Reporting Standards (IFRS) for 2020

Release

April 29, 2021, 10:00

IR releasesReporting

IFRS reporting for 2021

PJSC Gazprom today presented its audited consolidated financial statements for the year ended December 31, 2021, prepared in accordance with International Financial Reporting Standards.

The table below sets forth the highlights of the IFRS consolidated statement of comprehensive income for the years ended December 31, 2021 and December 31, 2021. All amounts in the table are presented in millions of Russian rubles.

| For the year ended 31 December | ||

| 2020 | 2019 | |

| Sales revenue | 6 321 559 | 7 659 623 |

| Net income (expense) from trading operations in commodities on liquid trading platforms in Europe | 31 349 | (24 957) |

| Operating expenses | (5 665 762) | (6 387 071) |

| Loss from impairment of financial assets | (72 295) | (127 738) |

| Revenue from sales | 614 851 | 1 119 857 |

| Financial income | 747 400 | 654 916 |

| Financial expenses | (1 365 518) | (354 835) |

| Share in profits of associated organizations and joint ventures | 136 736 | 207 127 |

| Profit before tax | 133 469 | 1 627 065 |

| Current income tax expenses | (75 606) | (327 618) |

| Income (expense) on deferred income tax | 104 544 | (29 930) |

| Income tax | 28 938 | (357 548) |

| Profit for the year attributable to: | ||

| To shareholders of PJSC Gazprom | 135 341 | 1 202 887 |

| Non-controlling interest | 27 066 | 66 630 |

| 162 407 | 1 269 517 | |

Below is more detailed information regarding the main indicators characterizing the structure of sales revenue.

| in million rubles (unless otherwise specified) | For the year ended 31 December | |

| 2020 | 2019 | |

| Gas sales revenue | ||

| Europe and other countries | ||

| Net sales revenue (less excise and customs duties) | 1 811 636 | 2 490 372 |

| Volumes in billion cubic meters. m | 219,0 | 232,4 |

| Average price, rub. / thousand cubic meters m (including excise tax and customs duties) | 10 355,9 | 13 613,0 |

| Countries of the former Soviet Union | ||

| Net sales revenue (less customs duties) | 295 254 | 356 102 |

| Volumes in billion cubic meters. m | 31,2 | 38,7 |

| Average price, rub. / thousand cubic meters m (including customs duties) | 9 899,8 | 10 175,9 |

| Russian Federation | ||

| Net sales revenue (excluding VAT) | 940 155 | 970 913 |

| Volumes in billion cubic meters. m | 225,1 | 235,8 |

| Average price, rub. / thousand cubic meters m (excluding VAT) | 4 176,9 | 4 118,2 |

| Total revenue from gas sales | ||

| Retroactive gas price adjustments | 2 294 | (16 657) |

| Net sales revenue (less excise tax, VAT and customs duties) | 3 049 339 | 3 800 730 |

| Volumes in billion cubic meters. m | 475,3 | 506,9 |

| Net proceeds from the sale of oil and gas products (less excise tax, VAT and customs duties) | 1 798 396 | 2 111 181 |

| Net proceeds from the sale of crude oil and gas condensate (less VAT and customs duties) | 487 349 | 752 790 |

| Net proceeds from the sale of electrical and thermal energy (net of VAT) | 499 469 | 518 373 |

| Net revenue from sales of gas transportation services (net of VAT) | 223 824 | 215 335 |

| Other revenue (net of VAT) | 263 182 | 261 214 |

| Total sales revenue (less excise tax, VAT and customs duties) | 6 321 559 | 7 659 623 |

Net revenue from gas sales decreased by RUB 751,391 million, or 20%, for the year ended December 31, 2021 compared to the year ended December 31, 2021, and amounted to RUB 3,049,339 million, primarily was caused by a decrease in average prices and volumes of gas sold in the Europe and other countries segment.

Net revenue from gas sales to Europe and other countries decreased by RUB 678,736 million, or 27%, for the year ended December 31, 2021 compared to the year ended December 31, 2021, and amounted to RUB 1,811,636 million . This is mainly due to a 24% decrease in average prices (including excise taxes and customs duties) denominated in rubles and a 6% decrease in gas sales volumes in physical terms, or 13.4 billion cubic meters. m. At the same time, average prices expressed in US dollars decreased by 32%.

Net revenue from gas sales to the former Soviet Union decreased by RUB 60,848 million, or 17%, for the year ended December 31, 2021 compared to the year ended December 31, 2021, to RUB 295,254 million. The change was due to a decrease in gas sales volumes in physical terms by 19%, or 7.5 billion cubic meters. m, and a reduction in average prices (including customs duties) expressed in rubles by 3%. At the same time, average prices expressed in US dollars decreased by 13%.

Operating expenses decreased by RUB 721,309 million. for the year ended December 31, 2021, compared to the previous year and amounted to RUB 5,665,762 million.

The main impact on the decrease in operating expenses was a decrease in expenses under the item “Purchased gas and oil” by RUB 441,644 million, or 31%, for the year ended December 31, 2021, compared to the previous year, caused by a decrease in average gas prices and oil and a reduction in gas and oil purchases.

Foreign exchange gain on operating items for the year ended December 31, 2021 amounted to RUB 164,128 million. compared to a loss on exchange differences in the amount of RUB 78,287 million. for the last year. This change is primarily due to the revaluation of receivables from foreign customers and loans issued, which was affected by an increase in the exchange rates of the US dollar and euro against the Russian ruble by 19% and 31%, respectively, for the year ended December 31, 2021, compared to a decrease in exchange rates US dollar and euro against the Russian ruble by 11% and 13%, respectively, over the past year.

The decrease in the item “Taxes other than income tax” by RUB 173,426 million, or 12%, for the year ended December 31, 2021, compared to the previous year, was mainly due to a decrease in mineral extraction tax expenses, due primarily to lower oil prices and lower gas production volumes.

For the year ended December 31, 2021, the balance of exchange rate differences reflected in “Net financial (expense) income” generated a loss in the amount of RUB 604,810 million. compared to a profit of RUB 285,581 million. for the last year. This fact had a major impact on the financial results of the Gazprom Group.

For the year ended December 31, 2021, the profit attributable to shareholders of PJSC Gazprom amounted to RUB 135,341 million.

Adjusted EBITDA (calculated as the sum of operating profit, depreciation, impairment loss or reversal of impairment loss on financial and non-financial assets, less the allowance for expected credit losses on accounts receivable and the allowance for impairment of advances issued and prepayments) decreased by 393,138 million rubles, or 21%, for the year ended December 31, 2021, compared to the year ended December 31, 2021, and amounted to 1,466,541 million rubles. This change is mainly due to a decrease in sales revenue.

Net debt (defined as the sum of short-term loans and borrowings and the current portion of long-term debt on loans and borrowings, short-term bills payable, long-term loans and borrowings, long-term bills payable minus cash and cash equivalents) increased by RUB 704,848 million. , or by 22%, from RUB 3,167,847 million. as of December 31, 2019 up to RUB 3,872,695 million. as of December 31, 2020. This change is mainly due to an increase in the amount of long-term loans and borrowings in ruble equivalent due to the increase in the exchange rates of the US dollar and euro against the Russian ruble.

More detailed information on the consolidated financial statements under IFRS for the year ended December 31, 2021 can be found here.

Information Department of PJSC Gazprom

| Media contact information +7 +7 +7 | Contact information for investment companies +7 | Gazprom on social networks |

Latest news on the topic

Main production indicators

| 4 sq. | 3 sq. | ∆, % | 12 months | ∆, % | ||

| 2020 | 2020 | 2020 | 2019 | |||

| 177,16 | 173,73 | 2,0 | Hydrocarbon production including share in joint ventures (million barrels of oil equivalent) | 709,74 | 709,67 | — |

| 23,97 | 23,51 | 2,0 | Hydrocarbon production including share in joint ventures (million tons of oil equivalent) | 96,06 | 96,10 | — |

| 10,22 | 10,67 | (4,2) | Refining volume at own refineries and refineries of joint ventures (million tons) | 40,39 | 41,47 | (2,6) |

| 2,12 | 2,39 | (11,3) | Volume of gasoline production at own refineries and refineries of joint ventures (million tons) | 8,43 | 8,02 | 5,1 |

| 3,06 | 3,34 | (8,4) | Volume of diesel fuel production at own refineries and refineries of joint ventures (million tons) | 12,55 | 11,87 | 5,7 |

| 5,96 | 6,22 | (4,2) | Sales volume through premium channels (million tons) | 23,06 | 26,46 | (12,8) |

| 2,64 | 2,68 | (1,5) | Sales volume through gas stations (million tons) | 9,77 | 10,49 | (6,9) |

*Adjusted EBITDA includes the share of EBITDA of associates and jointly controlled entities accounted for using the equity method

**For 12 months of 2021, free cash flow takes into account net investment flow, including acquisitions and sales of shares, fixed assets, licenses and intangible assets in the amount of RUB 399.6 million.

Nord Stream 2 attracted Fortuna

To be or not to be in Europe the new powerful Russian gas pipeline “Nord Stream 2”? In 2021, the fate of the Gazprom project and five European financier firms should be finally decided. In an environment of sharply escalated political discussions in the EU, the pipe-laying vessel Fortuna in early February resumed laying pipes in the Baltic waters of Denmark, which had been interrupted for more than a year due to US sanctions.

European gas market 2021: Gazprom and its competitors

Eugal: gas will not be delayed in Germany

The task of Nord Stream 2 is to provide gas not so much to Germany, but to those countries in the center and south of Europe, including Italy, which were previously supplied through Ukraine. This is evidenced by its continuation from Lubmin to the Czech Republic - Eugal. In the picture, this gas pipeline, also with a capacity of 55 billion cubic meters per year, is being laid through the Elbe. The end of construction of the second line was postponed from January to April 2021.

European gas market 2021: Gazprom and its competitors

"Eastern route"

Construction of the Power of Siberia gas pipeline is in full swing. Gas from Eastern Siberia (the Chayadinskoye field in Yakutia and the Kovytkinskoye field in the Irkutsk region) will be transported for the needs of the Russian domestic market, as well as exported to China, whose gas market is considered the most promising in the world.

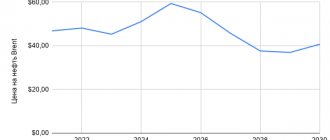

“Even when we observed a strong drop in oil prices a year and a half ago - to about $45 per barrel, under these conditions we saw that the contract (for gas supplies to China) under the Power of Siberia was profitable for Gazprom,” also noted Andrey Kruglov.

In 2021, Gazprom plans to invest 217.988 billion rubles in the Power of Siberia project. Russian gas supplies to China will begin in December 2021.

Investments

The total volume of development of Gazprom Group's investments in gas, oil, electricity and heat generating assets will amount to 2.094 trillion rubles in accordance with the profile program for 2021.

In the investment program for 2021, the group included investments at the level of 1.92 trillion rubles. Thus, the volume of investments this year will increase by 9.04%.

Initially, the Gazprom board of directors increased the investment program for 2021 by 17% - to 1.496 trillion rubles.

In particular, in the last year’s program, 984.263 billion rubles were allocated for capital construction projects (an increase of 185.835 billion rubles), and for the acquisition of non-current assets by Gazprom - 84.806 billion rubles (an increase of 43.823 billion rubles). The volume of long-term financial investments will amount to 427.259 billion rubles. (decrease by 12.16 billion rubles).

Gazprom reported that the adjustment to the parameters of the investment program for 2021 was associated, in particular, with an increase in the volume of investments in Gazprom’s priority projects in the field of transportation and liquefaction of natural gas (LNG). Among them are the development of the gas transportation system in the North-West region of Russia and the construction of a complex for the production, storage and shipment of LNG in the area of the Portovaya compressor station.

TAP: Azerbaijan supplies southern Europe

In three important countries for Gazprom in southern Europe - Greece, Bulgaria and especially Italy - Azerbaijani gas will henceforth compete with Russian gas: in 2021, the TAP Trans-Adriatic gas pipeline began operating. Together with TANAP, it forms the Southern Gas Corridor to supply 10 billion cubic meters to the EU, bypassing Russia, from the shores of the Caspian Sea. In the photo: a compressor station near the Greek village of Kipoi.

European gas market 2021: Gazprom and its competitors

Lubmin expects supplies from Russia to double

The terminal for receiving 55 billion cubic meters per year along two lines of Nord Stream 2 (in the center of the picture near the coast) in Lubmin, Germany near Greifswald, was generally ready by the end of 2021. On the left, on the other side of the water area of the small port, is the receiving terminal of the first Nord Stream, operating since 2011, of the same capacity. Behind, a closed nuclear power plant from the GDR era is being dismantled and nuclear waste is being stored.

European gas market 2021: Gazprom and its competitors

Ukrainian transit: download or pay

Regardless of the possible completion of Nord Stream 2, Gazprom has committed to annually export 40 billion cubic meters through Ukraine by the end of 2024 or pay for this reserved volume. But in 2021, demand in Europe may be higher due to a cold winter and empty gas storage facilities. However, Gazprom will have to pay especially high transit tariffs for pumping additional volumes.

European gas market 2021: Gazprom and its competitors

Baltic Pipe: Poland will change supplier

By the end of 2022, another large gas pipeline should go into operation in the Baltic: Baltic Pipe with a capacity of 10 billion cubic meters per year. It is being built with EU support and will supply Norwegian gas through Denmark to Poland, which intends to completely stop purchasing from Gazprom by then. Pictured: pipes being laid between the Danish mainland and the island of Funen.

European gas market 2021: Gazprom and its competitors

Top management income

The income of members of the management board and the board of directors of Gazprom in 2018 decreased by 4.96% compared to the previous year and amounted to 4.312 billion rubles.

In 2021, remuneration to top management amounted to 4.537 billion rubles.

The report notes that government officials on the board of directors of Gazprom do not receive remuneration.

The board of directors of Gazprom includes the following government representatives: Chairman of the Board of Gazprombank Andrey Akimov, Special Presidential Representative for Cooperation with the Gas Exporting Countries Forum (GECF) Viktor Zubkov, Minister of Industry and Trade Denis Manturov, Chairman of the Board of Gazprom Alexey Miller, Minister Energy Alexander Novak and Minister of Agriculture Dmitry Patrushev.

As independent directors, the board includes: Chairman of the Kazakhstan Association of Oil and Gas and Energy Complex Organizations Kazenergy Timur Kulibayev, Rector of the Russian State University of Oil and Gas named after. THEM. Gubkin Viktor Martynov and the rector of the Russian Academy of National Economy under the President of the Russian Federation Vladimir Mau.

Also on the board are Deputy Chairman of the Board of Gazprom Vitaly Markelov and Deputy Chairman of the Board - Chief of Staff of the Board of Gazprom Mikhail Sereda.

In 2021, the Gazprom board included 16 people. These are Alexey Miller (chairman), Elena Vasilyeva, Valery Golubev, Andrey Kruglov, Vitaly Markelov, Alexander Medvedev, Sergey Khomyakov, Oleg Aksyutin, Vladimir Markov, Elena Mikhailova, Vyacheslav Mikhalenko, Sergey Prozorov, Kirill Seleznev, Igor Fedorov, Vsevolod Cherepanov, and also Deputy Chairman of the Board of Sogaz Mikhail Putin.

"Akademik Chersky" was prepared for a whole year

At the beginning of April, the Akademik Chersky began work in the deeper waters of Denmark. This pipelayer left the Far Eastern port of Nakhodka towards the Baltic back in February 2021. But it took him almost a whole year to undergo modernization in German ports while sailing between Germany and Russia and test new equipment several times off the coast of the Kaliningrad region (pictured).